Brothers Automated Premium

Swing Trading Strategy for Long-Term Success

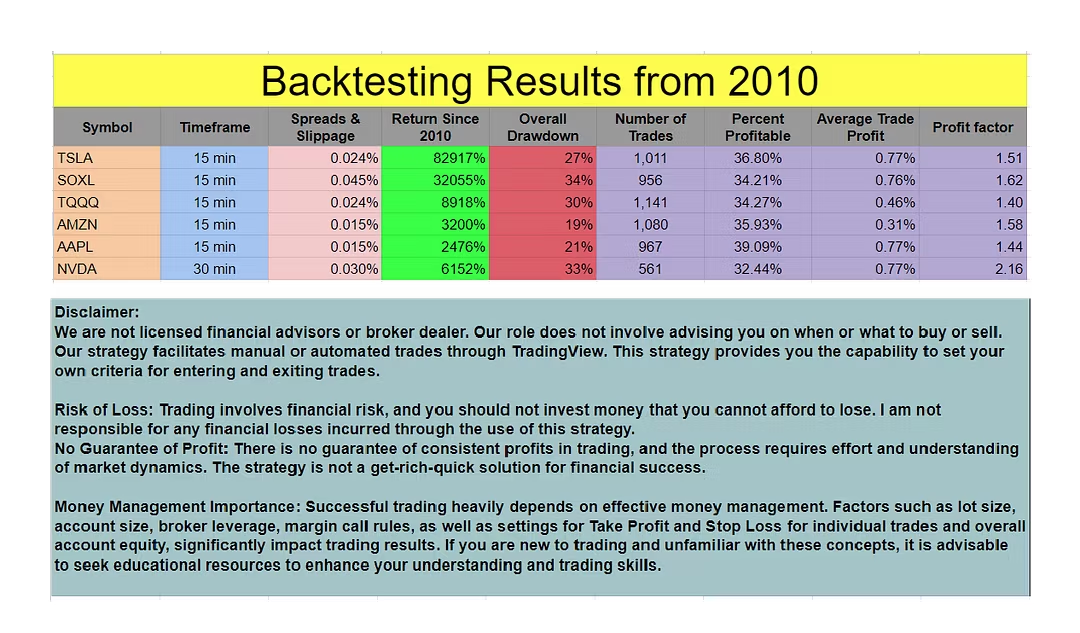

Try our Tradingview Strategy free for 30 days. It's designed for swing trading in 15-minute to 1-hour timeframes.

Products

- Brothers Automated TradingFree one-time purchase

- 30-day free trial of our Tradingview Strategy

- Easy step-by-step video tutorials for setup

- Access to our amazing support team for assistance

- 100% automated trading with full control over your account

- Brothers Automated PremiumSubscription$99.00 / month30 day trial

- 30-day free trial to explore automated trading strategies.

- Easy step-by-step setup tutorials for quick implementation.

- Access to a supportive team ready to assist with any questions.

- 100% automated trading with full control over your strategy.

Here's what you'll get

- Setup Instructions for Tradingview Strategy usersAccess step-by-step tutorials for quick strategy setup.

- Brothers V3.3 Strategy PremiumSell access to premium TradingView strategy indicators.

- Wealth Builder - Private AccessJoin exclusive Discord community with automatic role management.

Learn about me

As a seasoned trader, I've developed a passion for creating reliable strategies that focus on long-term growth. This swing trading strategy is designed for patient investors who value consistency over quick wins. Our strategy aims for 20%+ annual returns with controlled drawdowns, offering both automated and manual trading options for versatile application.

Who this is for

- Long-term InvestorsThose seeking consistency in their investment accounts and who appreciate patient trading for more than market returns.

- Exhausted Day TradersTraders tired of inconsistent systems seeking reliable growth without emotional trading pitfalls.

- Retirement Account HoldersIndividuals looking to maximize returns in IRAs or non-retirement accounts with a steady swing trading strategy.

Pricing

Join Brothers Automated Premium

$99.00 / month

30 day trial

- 30-day free trial to explore automated trading strategies.

- Easy step-by-step setup tutorials for quick implementation.

- Access to a supportive team ready to assist with any questions.

- 100% automated trading with full control over your strategy.

Frequently asked questions

Reviews

Become an affiliate

30% Reward

Earn money by bringing customers to Brothers Automated Premium. Every time a customer purchases using your link, you'll earn a commission.Brothers Automated Premium$99.00 / month