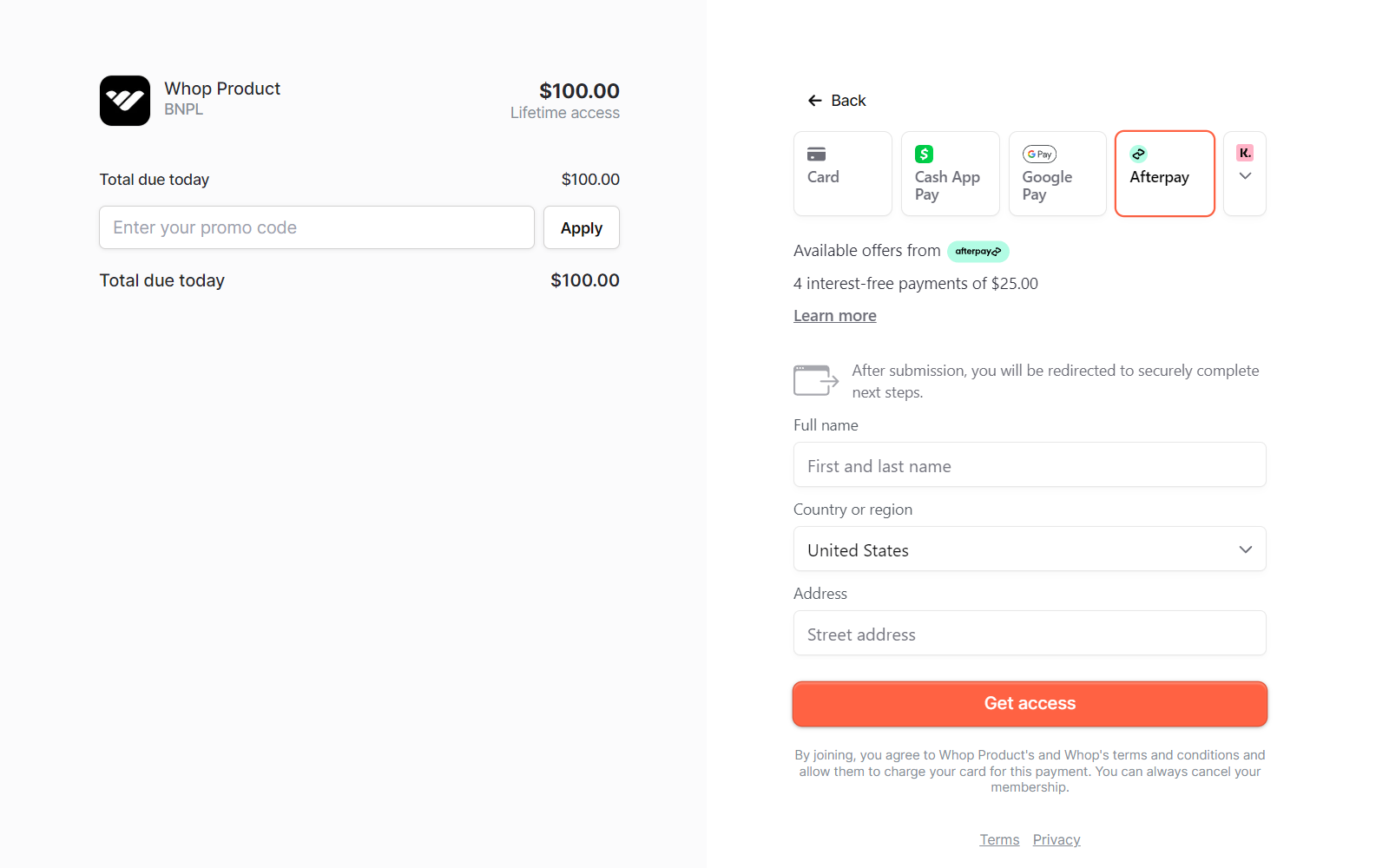

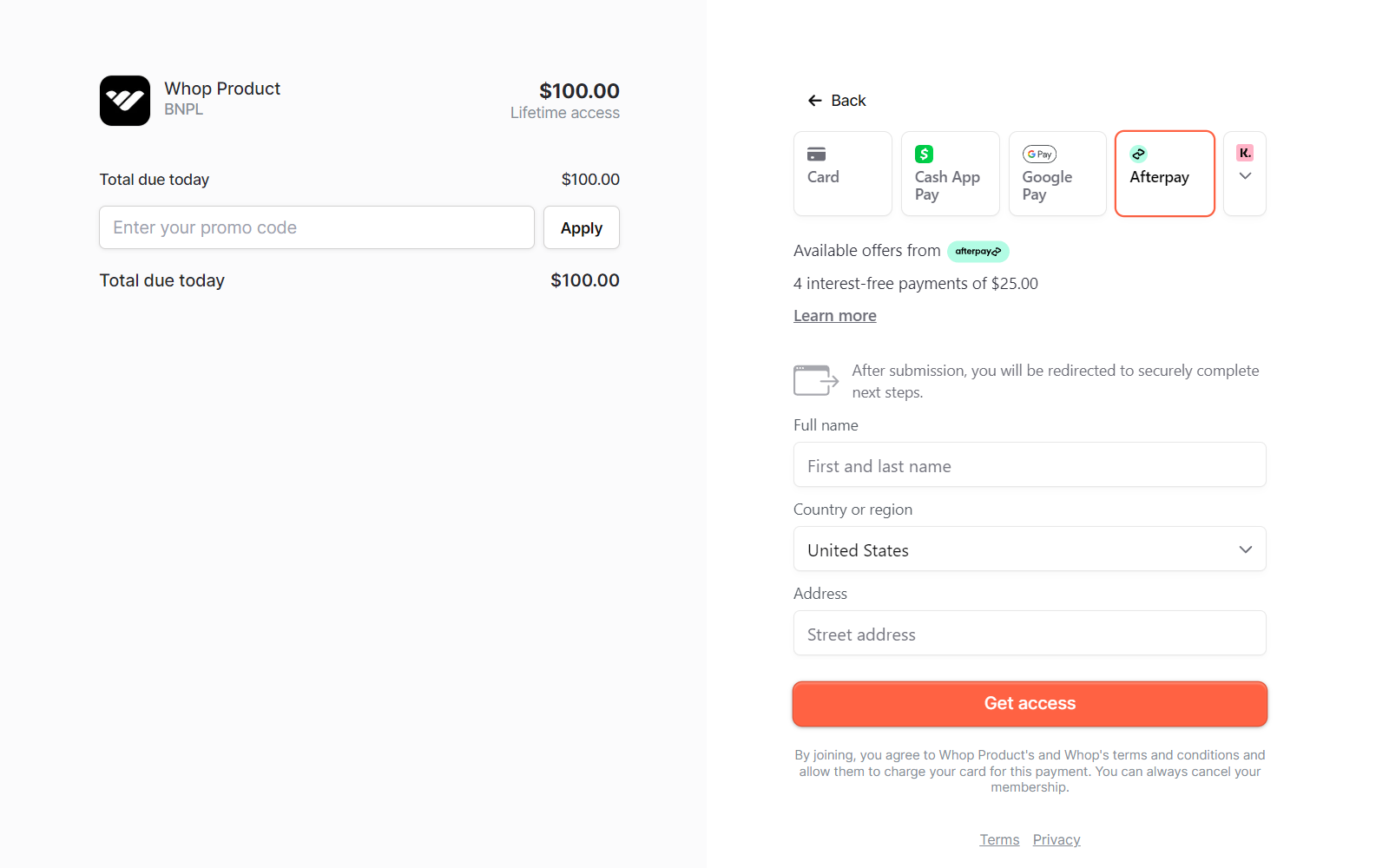

BNPL is an alternative payment method that allows customers to purchase without having to commit to the full payment amount up front. In doing so, customers have the ability to immediately finance purchases and pay them back in fixed installments over time. For example, a customer making a $100 purchase could pay for the item in four interest-free installments of $25.

Buy now, pay later services—such as Afterpay, and Klarna —are used by a wide variety of businesses to increase conversion, increase average order value, and reach new customers. Creators receive the full payment of the item up front, minus any fees (just like credit & debit cards payments), and don't have to manage the financing. The buy now, pay later providers take on the task of underwriting customers, managing the installments, and collecting payments.

Here's a streamlined version of the process:

- The customer selects a buy now, pay later (BNPL) option at checkout.

- They set up an account with the BNPL provider.

- The customer decides whether to accept the terms or decline.

- If accepted, the customer completes the checkout process.

- The creator receives the full payment upfront, minus processing fees.

💡If you didn't find the answer to your question, our support team is here for you 24/7.

- On Whop, buy now, pay later (BNPL) is available to a select few creators who use Whop Payments. If you don't already use Whop Payments, you'll need to set it up to give your customers the option to pay with BNPL.

- This program is currently in beta, so we're not accepting new creators at this time.

- The buy now, pay later (BNPL) fees are 6% + Whop's fees.

- Refunds for BNPL transactions are handled just like debit or credit card payments. As a creator, you can issue refunds directly from your dashboard.

- Disputes for BNPL work just like those for debit or credit card payments. As a creator, you'll see and manage any disputes through your dashboard.

- We don't receive alerts for BNPL disputes. Here's why: when a customer disputes a BNPL charge, their complaint typically goes directly to the BNPL provider, like Klarna, rather than their bank or card network. This means Whop isn't notified. To receive these alerts, we'd need to establish relationships with BNPL companies, which isn't currently part of our system. If a customer disputes through their credit card company and it contains an identifier we're subscribed to, we'd receive the alert as usual—but that's rare, as BNPL disputes are usually handled directly by the BNPL provider. Moreover, companies like Klarna don't have formal programs for monitoring disputes.

💡 Looking for more help? Reach-out to our 24/7 live chat support team here.