You can start accepting crypto payments as a business by choosing which coins to accept, setting up a wallet, connecting crypto payments to your checkout, deciding if you want to auto-convert, and promoting the new payment option.

Key takeaways

- Crypto payments cost significantly less than credit cards, letting businesses keep more revenue per transaction.

- Stablecoins eliminate price volatility risk while still offering crypto payment benefits to customers.

- Crypto transactions are final with no chargebacks, so businesses must establish clear refund policies upfront.

You can get crypto payments up and running in just a few steps. First choose the coins you’ll accept, set up a wallet, and connect crypto to your checkout. Then decide whether you’ll hold or auto-convert the payments you receive, and finally, let your customers know the new option is live.

Simple, right?

Now let’s break down how each step works, why more businesses are adding crypto to checkout, what risks to be aware of, real examples from brands doing it well.

Accepting crypto payments for your business: step by step

1. Choose your crypto coins

The first step is choosing which crypto coins you want to accept. Look at recognition, transaction fees, and price stability to make the right choice for your business.

Most businesses start with Bitcoin and Ethereum, and many are now adding stablecoins like Tether (USDT) or USD Coin (USDC) to the mix.

- Bitcoin is the most recognizable cryptocurrency with a very strong foundation and huge audience. Just keep in mind its price can swing a lot.

- Ethereum has a very flexible ecosystem (the smart contract protocol) and the second most biggest audience in the crypto world. If you’re selling digital or crypto-related products, accepting Ethereum is a solid choice

- Stablecoins are tied to the U.S. dollar, so these coins protect you from overnight price drops while still letting customers pay in crypto

2. Set up your wallet (securely)

Once you’ve decided on your coins, you need to set up a wallet. A wallet is essential for storing and accepting crypto.

Some of the most popular ones are MetaMask, Phantom Wallet, Coinbase, Kraken – and there are even physical hardware wallets like Ledger.

Reputable wallets have strong security track records and do their best to keep their users’ wallets safe. On the other hand, hardware wallets are not connected to the internet and its private keys are offline, so others cannot access your wallet - so they’re more secure than digital wallets.

If you’re a beginner, you can easily get a crypto wallet by creating an account on Coinbase.com. This gives you a wallet with simple storage and trading capabilities, and that's enough for accepting crypto payments on platforms like Whop.

How to get a MetaMask wallet

- Go to MetaMask.io and click Get Metamask, this will redirect you to the extension store of the browser you’re using. There, install the browser extension. This will open a window on your browser (click the extension icon if the window doesn’t open).

- Open the extension you just installed and click Create a new wallet and either create an account with Google or Apple or use a secret recovery phrase. If you’re using a secret recovery phrase, you’ll be asked to set a strong password.

- Once you create the account, you’ll be given a secret recovery phrase - write it down somewhere safe, don’t lose it, and don’t share it, it’s the key to your wallet. There is no retrieving this once it's lost.

- After saving your secret recovery phrase, you now have a crypto wallet of your own - you’ll be able to see your account and your wallet address in the extension.

3. Integrate crypto payment into your checkout

There are a few ways you can integrate crypto into your checkout:

- Using plugins in ecommerce platforms like Shopify or WooCommerce

- Using the API systems of crypto payment processors

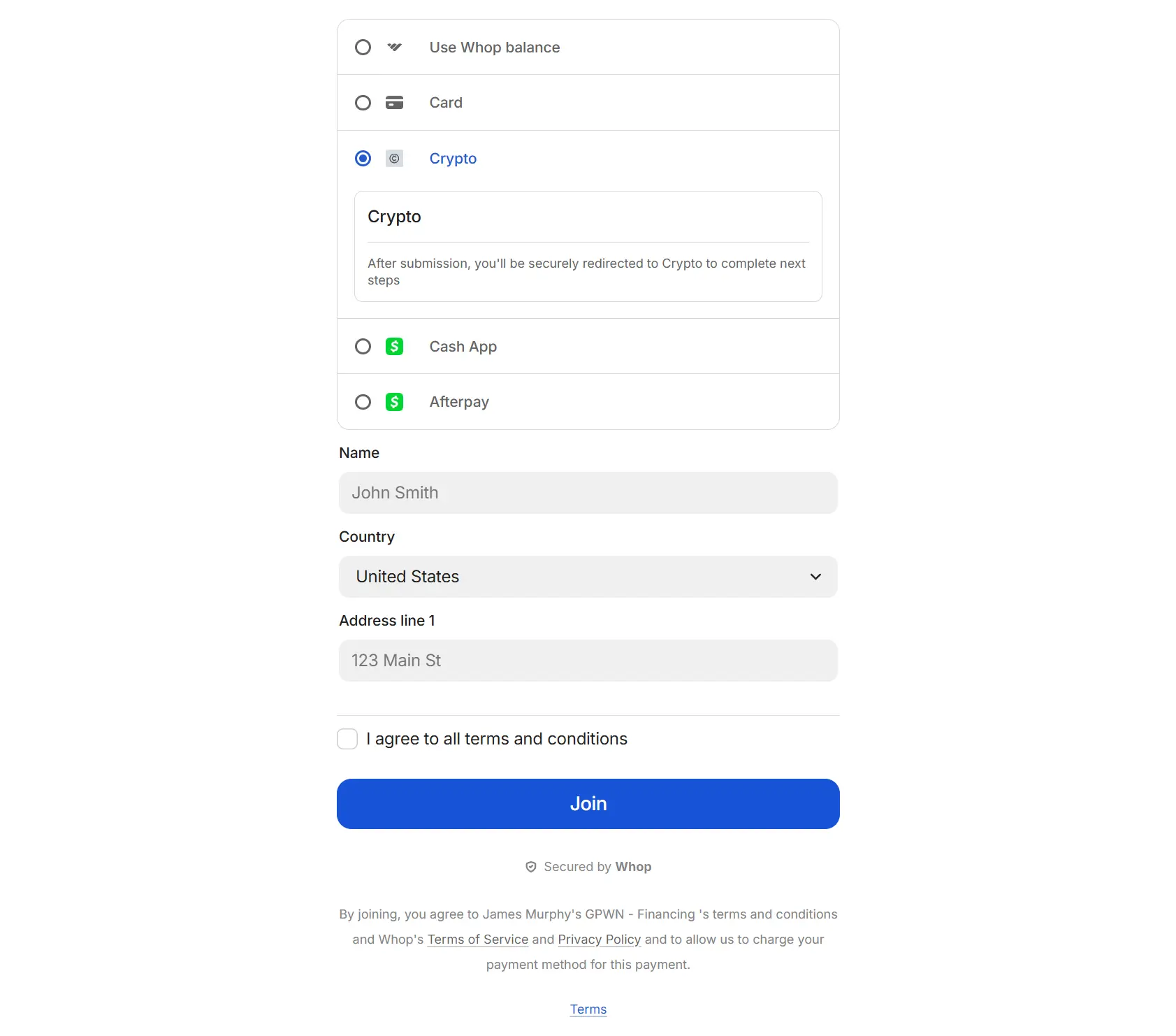

Some platforms like Whop allow you to easily connect crypto platforms like Coinbase with your account using API key and webhook URLs.

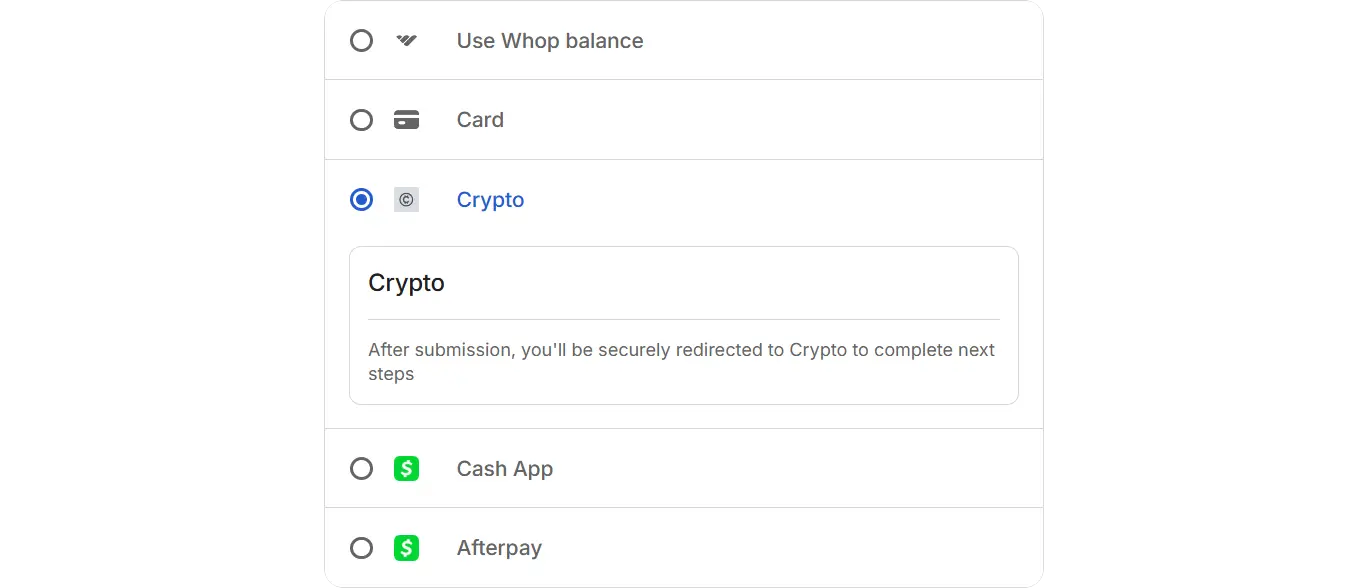

This means that customers can select crypto as a payment option at checkout, just as easily as they would select ‘credit card’ or ‘BNPL’. allowing customers to select the crypto payment option while making a purchase.

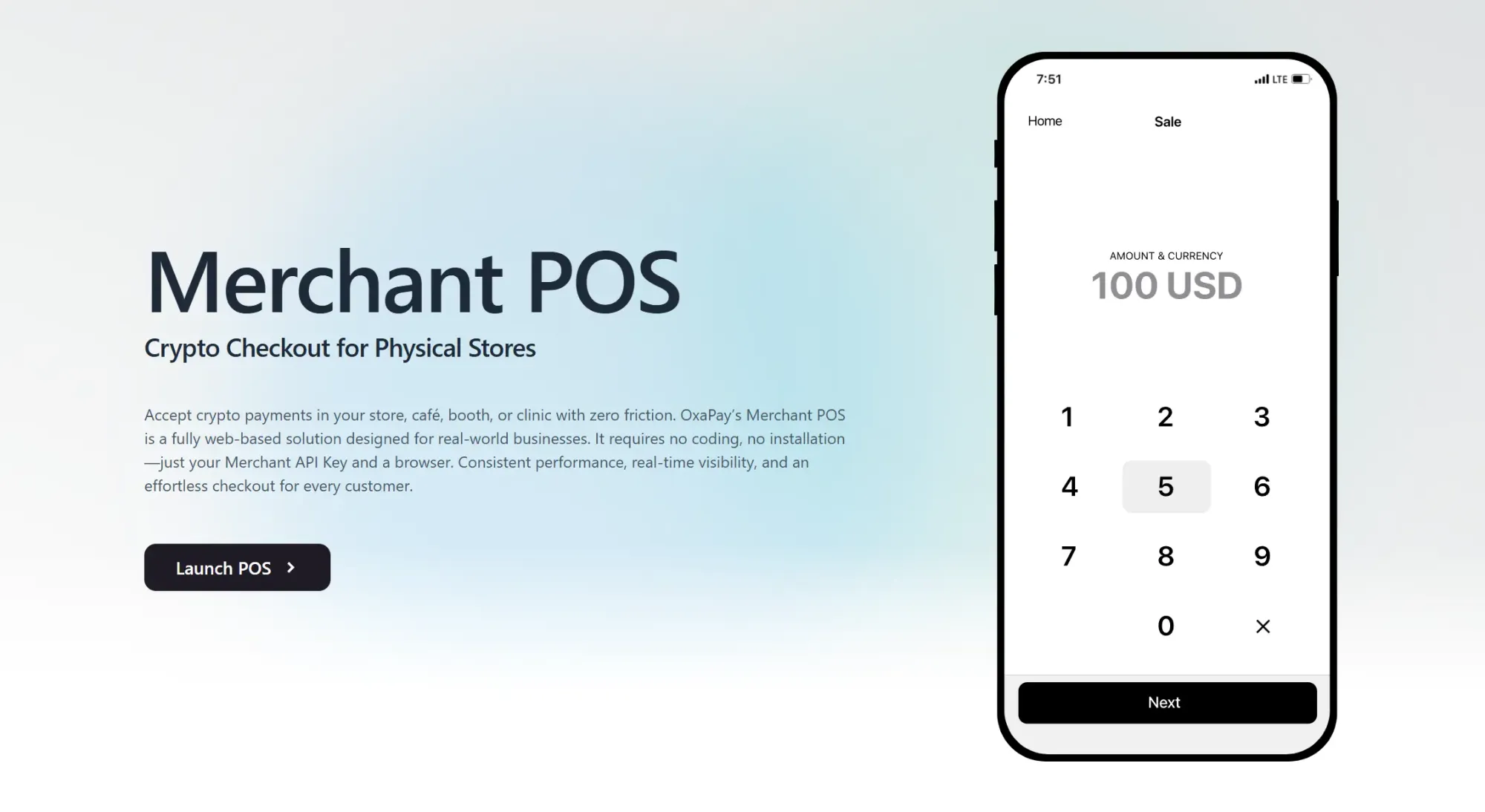

Running a physical business where your customers pay you in-person? You can still accept crypto payments by using a POS solution. POS systems that support crypto payments - like OxaPay - are simple to use.

The system simply generates a QR code for your customers to scan with their wallet and authorize the payment.

4. Decide on wether you keep your crypto or convert it to cash

Now that you’ve set up how you will get paid, it’s time to decide what to do with the crypto you receive. You can either keep it as crypto, or, convert it to a fiat (traditional) currency.

If you believe in long-term growth of the non-stablecoins you receive, you might want to keep them. Accepting stablecoins like Tether or USD Coin can keep your money stable, as they’re grounded to the U.S. Dollar and so carry a lower risk of price changes.

But, accepting non-stablecoins like Bitcoin and Ethereum could result in overnight drops in value. It can happen in an instant - Bitcoin dropped 22% overnight during the FTX crash.

So, if you want to avoid the risk of losing (but also gaining) value, you should consider auto-converting crypto payments you receive to USD, EUR, or your local currency.

Do your own research to understand the risks, tax implications, and financial considerations of choosing whether you keep your crypto or convert to cash.

5. Let your customers know

Now that you’re starting to accept crypto payments, now it’s time to let your customers know! You’ve gained a whole new audience of people who want to use cryptocurrencies to pay online or in-person.

Here are a few ways to spread the word:

Update your checkout page

Adding clear buttons and options for crypto payment to your checkout pages is crucial. For example, Whop lists the crypto payment option directly next to other options like credit card, cash app, and BNPL.

Add clear messaging to your homepage

One of the best ways to let everyone know is adding clear messaging to your homepage or other high-traffic pages - that’s what Tesla, AT&T, and Travala did.

Share the news on social media

Post a tweet, an Instagram story, or a TikTok - that’s enough to let your customers know you’re now accepting crypto payments. One of the most popular examples of this is Elon Musk announcing that Tesla now accepts Bitcoin payments:

Let your customers know by email

Send simple announcement emails to your customers, saying they can now pay with crypto and list the cryptocurrencies you accept. Talk about the benefits, lower fees, and add a clear call to action.

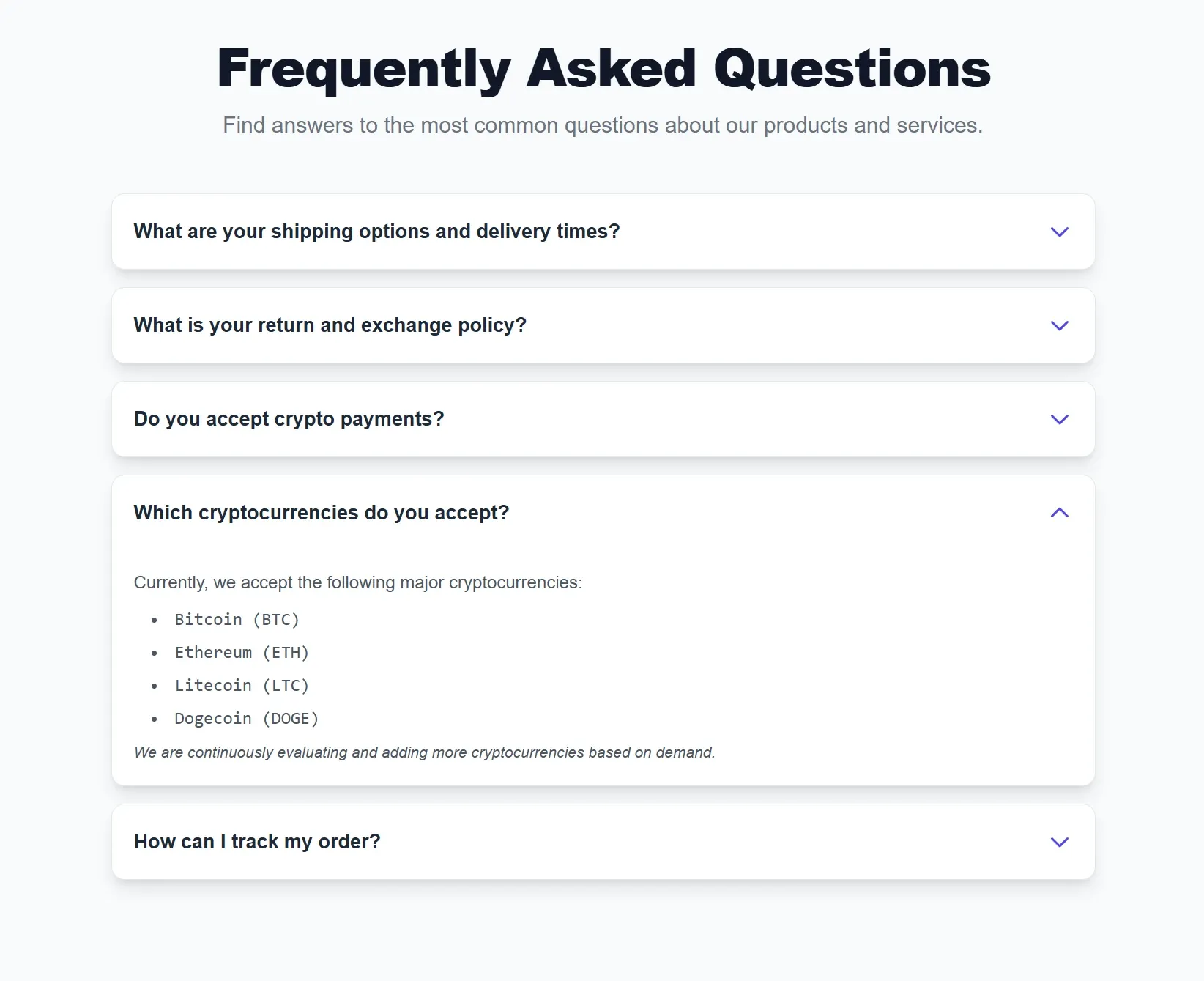

Update your FAQ lists

Adding questions like “Do you accept crypto payments?” and “Which cryptocurrencies do you accept?” is a great way to let your customers, search engines, and AI models know that you accept crypto payments.

How to make accepting crypto payments seamless

If you’re ready to start accepting crypto payments for your business, here are some tips to make the whole process seamless:

- Pick the right crypto payment processor for your business

- Set policies about crypto

- Keep track of accounting, tax reporting, and risk management

- Keep track of your results and iterate

Pick the right processor

Picking the right processor for crypto payments is one of the most important decisions you will make when it comes to accepting crypto payments. Here are the things you should look out for:

- The number of cryptocurrencies it supports, and if it supports the ones you’re planning to accept

- If it has auto-conversion to other currencies

- If it can be easily integrated into your business with APIs or basic integrations

- Clear documentation to help you fix problems

- Acceptable fees

Some of the most popular processors are:

- BitPay

- Coinbase Commerce

- CoinGate

- Swapin

Set policies

Unlike traditional payment methods, crypto transactions are final - there are no chargebacks. That alone makes it essential to set clear policies before you start accepting crypto. You’ll also want to account for things like price volatility and how it impacts your pricing or billing systems.

You’ll need two kinds of policies: customer-facing and internal.

- Customer-facing policies cover things like refunds, pricing rules, and how you handle conversion rates.

- Internal policies cover tax compliance, private key management, and other behind-the-scenes processes.

Both can be drafted, proofread, and packaged into clean documents or web pages.

Keep track of accounting, tax reporting and risk management

In countries like the U.S., Canada, UK, and Australia, crypto is treated as property, meaning that most transactions are subject to taxes - whether you’re selling crypto, trading it, or even buying something with it. This is why you should keep detailed records of your crypto activities.

Platforms like Koinly and CoinTracker are some of the most popular platforms that can help you with it, allowing you to import transactions, calculate taxes, generate reports, etc.

Monitor results and iterate

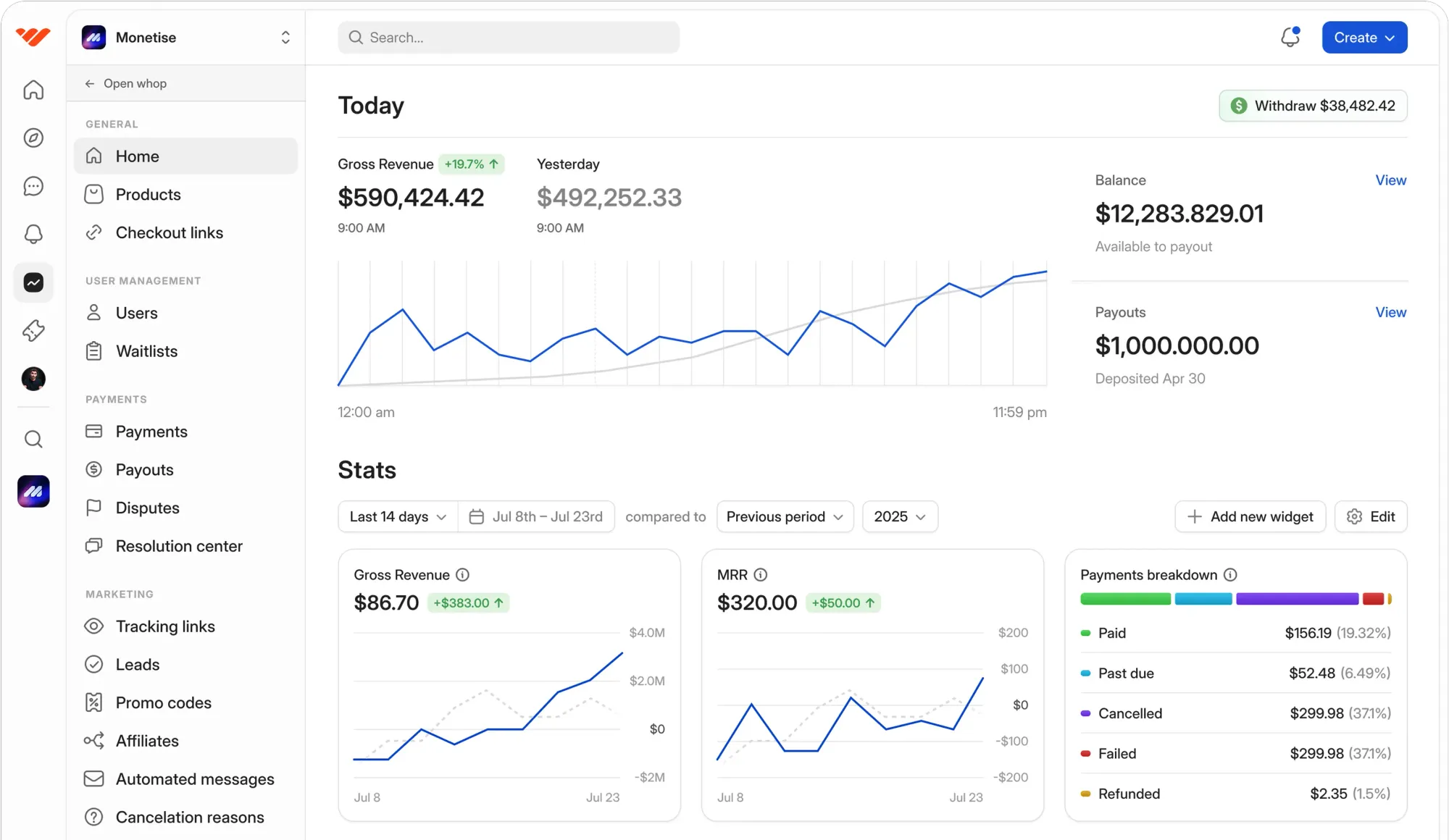

As your customers pay with crypto, you should monitor how it affects your business by looking at how many of your customers are paying with crypto, what’s the average transaction size, how it impacts user conversion, what it costs you, and more.

As you get more and more data on the impact of accepting crypto payments for your business, iterate.

Decide if you should promote it even further or start accepting other cryptocurrencies if you’re seeing good results, or, if not, think if it’s a sustainable venture you should keep going with.

Why more businesses are choosing to accept crypto payments

More businesses are adding crypto at checkout because it unlocks something traditional payments can’t: access to a high-spending, global audience with far lower processing costs.

Crypto users are an attractive customer base on their own. Around 60% are between 24 and 44, and 36% earn over $100,000 a year.

So it comes as no surprise that brands like Gucci, Hublot, Off-White, and Ferrari already accept crypto. Crypto connects them to buyers who are young, tech-forward, and ready to spend.

And then there’s the cost difference. Credit cards quietly take 1.7–2.5% of every sale, plus another 0.15–0.25% in network fees. But with crypto, payments can cost as little as $0.01 plus 0.5–1% processing, which means you keep significantly more of your revenue over time.

And because crypto is global by default, businesses don’t run into the usual international payment blockages. Even when certain card providers or countries decline transactions, crypto still goes through, letting you reach customers anywhere without the friction.

The risks of accepting cryptocurrency payments for your business

It’s clear that there are many benefits of accepting crypto payments, but it also comes with risks, like price volatility, regulatory and tax-related complexities, and more.

Let’s break them down.

Price changes

If you’re accepting non-stablecoin crypto payments, like Bitcoin and Ethereum - and you’re not auto-converting them to a currency like the U.S. Dollar or Euro - you’ll be facing the risk of price volatility.

What does this mean? Put simply, the crypto payment you got that’s worth $1,000 can go down to $900 the next day, losing you money.

Complicated tax and regulations

Countries have different regulations and tax appliances when it comes to cryptocurrencies, and it can be hard to keep up with all the rules.

If you’re living in the U.S., you should know that the IRS treats cryptocurrencies as properties, so, general tax principles apply to cryptocurrency transactions.

The same applies to Canada, UK, and Australia - so, you should track every transaction and keep detailed records. If you want to improve your regulatory and tax-related operations, consider working with an accountant who’s familiar with crypto regulations in your country.

To make sure you’re following your country’s crypto regulations and related taxes, refer to your national tax authority.

Smaller customer base

According to Capital One, cryptocurrency payments have a market share of 2% - that’s really low. This results in an overwhelmingly low number of crypto payments compared to other methods like credit card payments.

That's why crypto should never be your only payment method, but instead offered alongside more widely accepted methods like credit card, BNPL, and even cash, so you have something for every type of customer.

Keep in mind that according to a report from PYMNTS Intelligence, availability of their preferred payment method heavily influences 70% of customers.

Wallet management

Crypto wallets are generally very secure, but they have risks, too. For example, losing your private keys means losing your entire wallet, with everything in it - and there’s no way to get them back (just ask James Howells, a Welsh engineer who lost a hard drive containing the only copy of his private keys to access his 8000 Bitcoin).

On top of this, you should be very careful of what kind of information you’re sharing. Someone else getting access to your wallet can result in losing all your cryptocurrencies.

To minimize the risks regarding your crypto wallet, use trusted crypto wallets like Ledger, Coinbase, and MetaMask.

5 businesses who accept cryptocurrency payments

Miles High Club

Miles High Club is a crypto community that offers exclusive altcoin alpha, airdrop alerts, and trade ideas. With their strong team, they organize private weekly livestreams and share their expertise and insight with their members on their private Discord server.

With an annual membership option for $1,850, Miles High Club accepts crypto payments on Whop via Coinbase.

Microsoft

Microsoft is one of the biggest and most popular companies in the world, and it allows users to top up their account credits with Bitcoin.

These top ups can be used in stores like Xbox and Windows Store where users can pay for games and software.

Wealth Group

Wealth Group is a Whop community that offers a private community full of active crypto and trading experts. Its users collaborate with each other, share ideas, access expert market analysis, coin breakdowns, exclusive trading tools, and even personalized 1-on-1 mentorships.

Wealth Group accepts crypto payments for $225 per month, $1,275 per six months, or $2,400 annually.

Gucci

Gucci is one of the most popular luxury brands in the world, founded in 1921. While most people think crypto payments are for online stores only, Gucci is a great example of physical stores taking crypto payments.

While not all Gucci stores accept cryptocurrencies, some select ones allow customers to pay using BitPay, a popular crypto payment processor.

Kaizen

Kaizen is one of the biggest crypto communities on Whop, offering reliable trading signals, real-time market analysis and strategies, a private community of traders, and exclusive courses. The beginner friendly community provides step-by-step onboarding, beginner guides, and even live support to help beginner crypto traders learn the basics.

Kaizen offers membership to their exclusive community with crypto payment options for $199 per month, $1,075 per six months, or $2,000 annually.

Start accepting crypto payments with Whop

By now, you know why businesses are adding crypto at checkout - it helps you reach new customers, lower processing costs, and get paid on your own terms. Whop makes the entire setup simple.

Whop is an all-in-one platform you can use to run your business or just handle payments. You choose which methods to offer - card, crypto, BNPL, and more.

To accept crypto on Whop, just:

- Create a whop

- Create a product and enable crypto payment method

- Set up crypto payments by signing up to Coinbase and connecting Whop and Coinbase account

Whether you’re running a community, selling services, or managing bookings, Whop removes the hassle of payment setup. You get a clean checkout, flexible options, and a streamlined way to accept crypto without extra tools or technical work.

Accepting crypto payments as a business FAQs

What are the most widely accepted cryptocurrencies?

The most widely accepted cryptocurrencies are Bitcoin, Ethereum, Dogecoin, and stablecoins like Tether (USDT) and USD Coin (USDC).

Do I need a crypto wallet to start getting crypto payments?

Yes, you need a crypto wallet to store the funds you receive from payments.

Which crypto wallet should I get?

You can get either a digital or a hardware wallet. Digital wallets can be created on platforms like MetaMask, Phantom, and Coinbase - hardware wallets, like Ledger, can be bought online.

If you're going to take crypto payments online, it makes sense to get a digital wallet - which you can easily do even with just creating a Coinbase Commerce account.

Can crypto transactions be reverted?

No, crypto transactions cannot be reverted.

Can in-person businesses accept crypto payments?

Yes, you can accept crypto payments in-person by using a POS solution like OxaPay.

Can I accept crypto payments with a phone?

Most crypto wallets allow you to quickly generate QR codes to direct others to payment links where they make the payment and you receive the crypto funds.

Should my business accept only crypto payments?

No, accepting crypto only will hurt your sales - if possible, you should always offer crypto alongside more traditional ways to pay, like credit card.