There are plenty of credit card hack ideas floating around the internet - but which are true, and which of these are myths? Read this guide to find out.

Key takeaways

- Strategically choose credit cards with sign-on bonuses and pay all bills through them to maximize rewards.

- Get multiple cards from the same issuer to earn optimal rewards across categories while transferring points between accounts.

- Request credit limit increases to lower your utilization ratio and boost your credit score without changing spending habits.

I’ve always been a big proponent of credit cards, whether you’re a consumer or a business owner. While I could yap on about the power of debt, I’ll keep things short and sweet. Credit cards can help you save money, and people have found many different hacks to “game” credit card issuers.

Now, is every hack out there going to work? Of course not. Many credit card hacks are myths and misconceptions. While I’ll go over these later below, I want to first highlight some of the best credit card hacks that can actually help you save money. That way, you won’t waste your time on hacks that don’t work.

Let’s get straight to it.

The 10 best credit card hacks to help you save money

You're likely already familiar with the fact that many credit cards offer some form of incentives like points, airline miles, or other rewards. Sure, it can be quite a challenge to understand which offers are genuinely helpful.

But that’s why I’m here. Instead of looking at how you can take advantage of individual cards, I’ll go over the hacks you can try for credit cards across all issuers and from anywhere in the world.

Of course, I have to point out that we’re talking about money here, so always, always do your due diligence. I’m no financial advisor, but I’ve tried and tested these tricks, and they worked out.

1. Take advantage of sign-on bonuses

Cards that offer sign-on bonuses are always a smart choice. I mean, that’s why pretty much every card has some form of bonus when you issue it. These can range from stuff like miles and cashback to reward points and so on.

Now, how do you take advantage of these as a consumer? Well, you’ll have to shop around. Check out different issuers, go through all of the cards they offer, and find the one that’ll really give you the most value.

If you don’t travel a lot, there’s no reason to go for a card that offers miles as a sign-on bonus. One that comes with a 50% cashback on your first purchases up to a total of $500 is going to be much more lucrative.

Same goes for businesses. If a card has purchasing inventory for a nice cashback as a sign-on bonus, but you run a service-based business at home, it’s a no-go. But if it gives you membership points for buying electronics, it’s a pretty good deal.

2. Pay your bills with your credit card

Now, this one goes for both consumers and business owners, and it’s something I do actively. Always pay your bills with your credit card if that’s an option. You’d have to pay your business or personal expenses either way, so why not make something out of it?

Even if paying your bills doesn’t net you cashback or even reward points (it’ll definitely have one of these, though), you’re still coming out with a nice boost to your credit score here.

Of course, the key to this hack is to make sure you pay off your balance each month to keep your available credit high and avoid interest.

3. Spend across two high-earning cards

I’m a big fan of having multiple cards, as I’ll cover below. But before that, let’s go over another quick hack you can do with multiple cards.

If you’re a business owner, you’re probably making frequent purchases across several categories. You might be buying inventory, online tools and services, business travel expenses, all of that. (Check out our guide to business credit if this is you!).

The thing is, your credit card might only offer you cashback or rewards on just business travel expenses. But you can always issue a second one, which might, for example, offer you rewards for online tools and services.

The same goes for consumers. Sure, it’ll be a bit of a hassle to manage these 2 at first, but you’ll be maximizing the rewards or cashback you earn with every buy.

Once you’ve gotten used to these, check out #9 below to truly maximize the amount of money you can save with multiple cards.

4. Stack your benefits

Now, while you can use 2 cards to get the most rewards, you can also stay with just one and do this thing called benefit stacking. Basically, instead of just one reward, your purchases can earn multiple benefits at once.

For example, your card may give you cashback bonuses, but that amount increases with higher purchase amounts. Or, you may get access to various subscriptions or services through your card usage.

This can be good for both regular consumers and businesses. If you’re spending a lot on groceries, for instance, choose a card that allows you to get more cashback when you spend over, say, $1000.

5. Explore points transfers

Points transfers are a huge plus to have with your credit card. I’ll even say that this can topple a good cashback, especially if you’re using multiple cards. Essentially, they allow you to move your points to a different reward.

So, for example, say you book a flight with your credit card and get some miles. With points transfers, you can add these miles to a different airline or even an entirely different rewards program.

If you’re a business traveler, this can help you save on many of your other business expenses, like hotels or services.

6. Take advantage of purchase protection

Every credit card out there has some form of purchase protection, but many consumers seem to forget that. Well, this is more of a tip than a hack to always remember to take advantage of purchase protection if you’ve bought something with your credit card.

This’ll basically allow you to get a replacement if the item you bought breaks or gets stolen within a specific timeframe. While the terms differ from card to card, you can be sure that you’ll get some form of reimbursement.

7. Ask for a limit increase

Again, this is probably more of a tip than a full-blown hack, but many credit card users don’t know about it. If you’ve been using your card for a while, consider asking for a limit increase.

Now, I’ll get into the technical, credit score-related stuff. There’s this thing called credit utilization ratio, which basically means the amount of credit you’ve used vs the amount you can use. If the limit is at $1k and you’ve used $300, that’s a 30% ratio.

As a general rule of thumb, anything under 30% gets your credit score up, as you’re deemed a trusted lender. And, that’s why you should ask for a credit card limit increase as soon as you can.

If you’re still going to spend $300, but the limit goes up to $2k, your ratio will be at a lower (and better) 15%. At the same time, you can take your spending up to $600 and still be at 30%. Just don’t go overboard with it, and remember to pay outstanding balances on time.

8. Use gift cards to hit minimum spending requirements

Now, this one is a hack. Many credit cards have minimum spending requirements to either remain free of charge or allow you to earn rewards. So, if you’re regularly using your credit card at, say, Walmart, you could buy a bunch of gift cards to hit the minimum spending requirements.

With this one, you’ll definitely need to not go berzerk. Spending hundreds or even thousands in gift cards can scrutinize your account, as it’s considered manufactured spending (basically buying something now that you’ll need way down the line).

Just purchase a gift card for places you enjoy, or for services you would need to pay for anyway and secure your rewards.

9. Get multiple cards from the same issuer

Here’s my favorite credit card hack of them all, and it’s very simple. This is primarily for business owners, but you can also do it as just a consumer.

Basically, you should get different cards from the same issuer. Ideally, try to go for 3. 1 for your business, 1 for your day-to-day stuff, and 1 for your travel expenses.

The great thing about this is that you can earn points, miles, rewards, or cashback at the best rates since you’ll be using 3 different cards. On top of that, since they’re all from the same issuer, you’ll most likely be able to transfer points from one card to the other.

So, if you travel a lot, you can also save up on your groceries or business expenses. It’s a win-win.

10. Pay off your card on time

This one isn’t a hack. It isn’t a tip. It’s something you have to do. Use your card responsibly. Make your payments on time and pay off your balance in full.

Remember, credit cards are small loans that are interest-free for the first month but come with very hefty interest rates afterward. Never buy more than you’d be able to afford with your regular debit card.

Basically, use your credit card as you would a debit one. But, instead of instantly spending your money, you’re spending credit and getting benefits from it. Plus, by keeping your credit utilization low and paying off your outstanding balances at the end of the month, your credit score will go way up.

The higher your score, the better terms you can get, like low interest rates on loans and home mortgages.

Looking to make more money? Check out these popular side-hustle guides:

- Highest-paid side hustles

- Side jobs you can work alongside your 9-5

- How to make 10k a month online

- Best online side hustles to earn money in your spare time

The 5 credit card hacks you should avoid

Now, these are some great hacks you can do with your credit cards. The thing is, there are just as many hacks that are misconceptions or pure myths.

Let’s go over some of these so-called hacks you should avoid.

1. Buying items and returning them

You may be tempted to build up your points by buying items to get the rewards and then returning them to avoid paying high balances. Don't fall for this hack!

Giving your credit card a workout in this way will just waste your time and possibly cost you money in return shipping or canceled orders. While it's true that you will get cashback or rewards for the purchase, your card will deduct these rewards for any returned items.

2. Cancelling before the annual fee

Many people are tempted to open new credit cards to take advantage of sign-on bonuses or short-term rewards but plan to cancel before paying the card's annual fee.

But this could actually hurt your credit by constantly opening and closing new accounts. Besides, most cards offer better benefits the longer you have the card, so it's often more beneficial to pick one or two cards and stick with those instead of an endlessly rotating line.

3. Sending money to your friends

Payments apps are a popular way to send money to your friends to split bills, pay for goods, or even give monetary gifts. These apps are fast and convenient, making them quite appealing.

However, when you use a connected credit card to send these payments, you get charged a fee for every transaction. You may even get hit with a flat fee for using the service plus a fee for a percentage of the transaction amount.

Some credit cards also consider these types of transactions as cash advances, which often come with fees from the credit company. Plus, cash advances don't earn you any rewards.

The same goes for withdrawing money using your credit card. If it’s not an emergency, never do that; otherwise, you’ll be hit with some extra interest on that.

4. Buying prepaid cards to meet monthly requirements

While it might be ok to buy some gift cards to hit a minimum threshold every now and then, you should stay away from doing the same with prepaid cards. Unlike gift cards, prepaid cards are usually considered cash advances.

So, for one, you won’t get any rewards for buying these. But you’ll also be hit with some extra interest and fees. Essentially, you’re buying a $25 Visa prepaid card for, say, $30.

I don’t really know why or how this hack got around, but it’s a total myth. You’re not going to save anything and are most likely going to waste money doing this.

5. 15/3 credit card hack

Now, this one is a bit more mild, as it’s really just a misconception. The 15/3 rule basically says that you should pay half your credit 15 days before the deadline for the account statement and the other half 3 days before.

The misconception here is that the credit issuers will note these as 2 payments and see you as a responsible lender, boosting your credit score. That’s simply not true.

Banks report just one payment every month, which basically debunks this hack immediately.

But, hey, if it helps you manage your finances better, feel free to do it. You just shouldn’t expect a credit score boost.

The good and the bad of using credit card hacks

As with most money-saving strategies, using credit card hacks has both pros and cons.

Pros

- Possibility of an enhanced credit score: You have to establish a credit history to build or improve your credit score. Paying your credit card bills on time is a pretty easy way to boost your credit score.

- Improved cash flow: Taking advantage of credit card hacks can give you access to monetary rewards and free up cash to use for other needs.

- Rewards, bonuses, and cashback: When you use your credit cards with care, you gain access to increased credit limits, more cashback, and further offers and bonuses. Also, the more you use your card, the more points and other rewards you earn.

Cons

- Risk of debt: If you aren't careful with your budgeting and financial planning, you can quickly accumulate credit card debt. Avoid racking up debt by only charging the amount you can afford to pay off quickly.

- Risk of high fees: Some cards come with high fees for regular use, cash advances, late payments, or other common transactions. These fees can quickly balloon your balance and make it more difficult to pay off. So, make sure you understand the terms of use of each card you plan to use.

- Possibility of damaging your credit score: Late payments, missed payments, and high balances can negatively impact your credit score. Drops in your score can take a long time to repair, affecting your ability to access other forms of credit or even your ability to rent an apartment or secure a job. Always stay within your budget and avoid falling behind in payments.

Now, you’ve got a pretty good idea of what credit card hacks there are out there. Some of them are myths, some are actually pretty good. The thing is, there’s so much more to personal finance than just credit cards…

Find personal finance advice on Whop

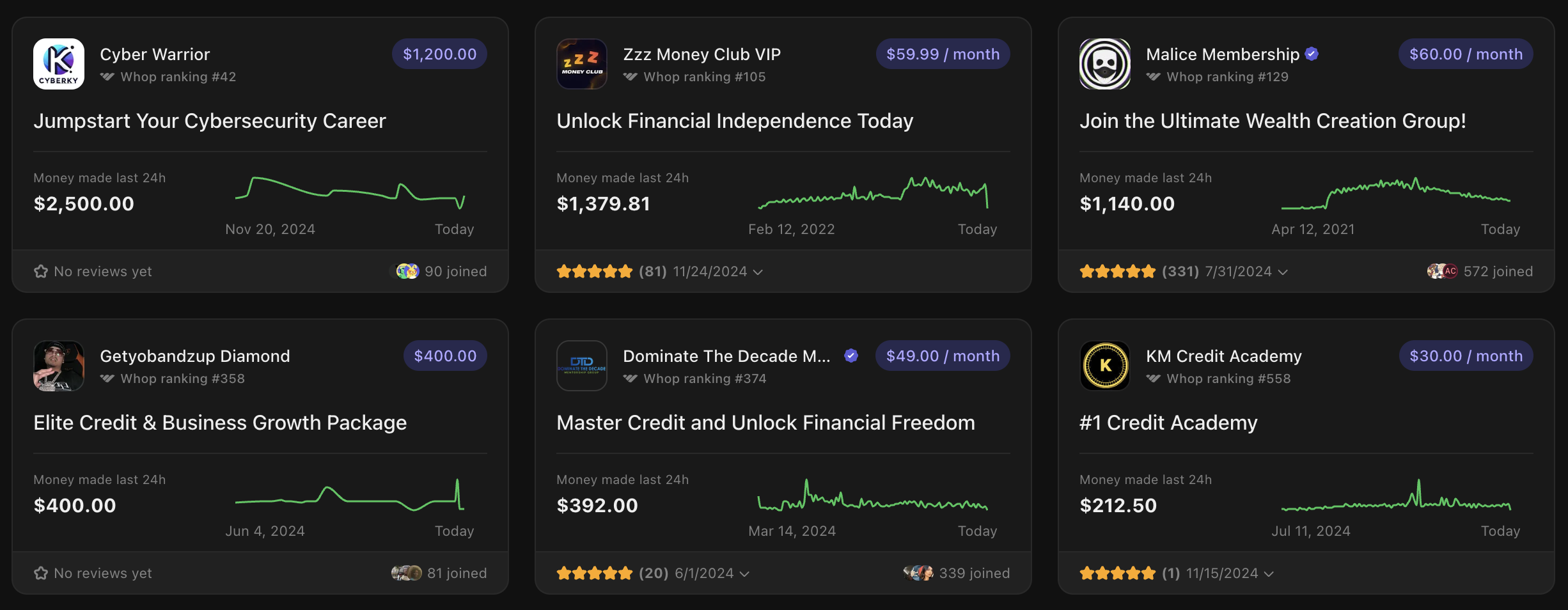

While credit cards are great for building your score, and the hacks I mentioned above can help you, they aren’t the only way to save money. If you really want to find ways to save some money, get personal finance tips, or simply want to speak with some finance experts for your specific situation, Whop is the place to be.

Whop has tons of personal finance communities, which are hosted by experts who want to help you get your finances in order and save as much as possible. On top of that, these communities are full of like-minded folks who will happily share their tips and tricks on more than just credit card hacks.

If you want to take your finances to the next level and take your next step to financial independence, check out Whop today.

Credit card hacks FAQs

How do credit card hacks work?

Every credit card hack works differently, but the basic premise is to incentivize you to get and use the card. Some give you immediate sign-on bonuses, while others let you accumulate points to trade in for cash or rewards.

Is it best to have one credit card or many?

Opening several credit cards can have its advantages. It gives you access to a higher credit limit and more rewards programs. Having 2-3 credit cards is usually the best way to balance the best rewards and keep up with payments without hurting your credit score.

Which credit card has the best rewards system?

The best credit card rewards system depends on your preferences. If you are a traveler, a card offering miles is an excellent choice. If you use your card frequently, getting cashback on purchases could be the best fit for you. Compare your options to select the right card for your needs.