Discover exactly what CrowdStreet is, how you can start investing in real estate today and whether the platform is right for you.

Key takeaways

- CrowdStreet simplifies commercial real estate syndication for accredited investors, connecting them directly with vetted project sponsors.

- Investments require $25,000 minimum with 2-5 year holding periods, making thorough due diligence essential before committing capital.

- Despite CrowdStreet's vetting process, investors must conduct their own research as past incidents show sponsor fraud risks remain.

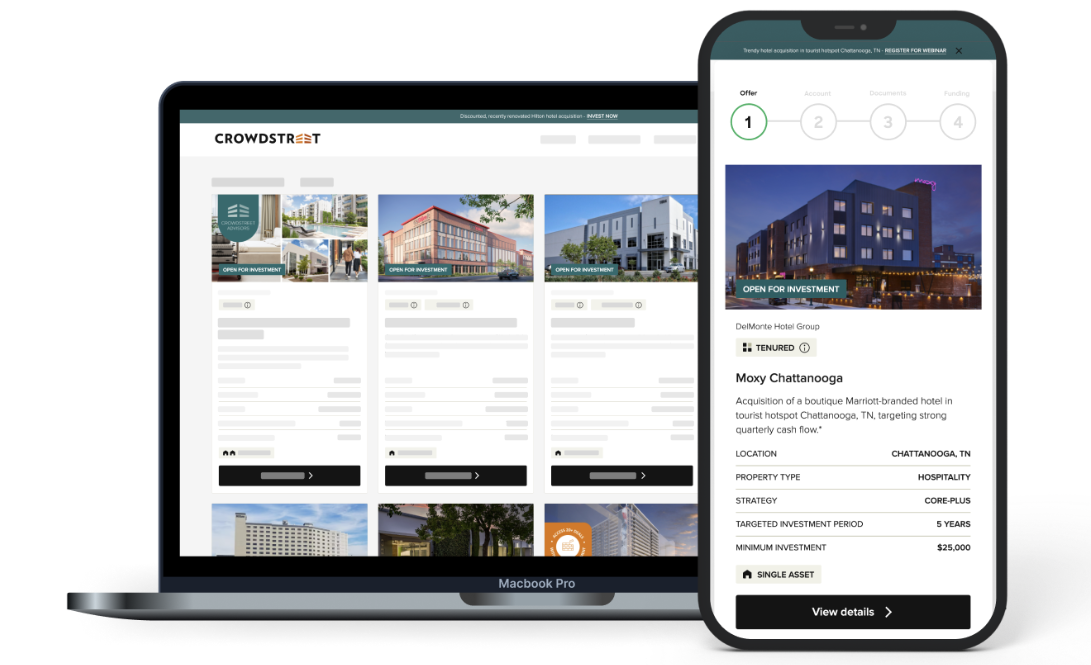

CrowdStreet is a name that’s probably come up if you’ve been looking for a way to invest, and for good reason—it brings the ease of online investing to the often-offline world of real estate, and connects you directly to the project developers involved with the properties you’ll be investing in.

So, what else does CrowdStreet bring to the party, how can you start investing on the platform, and who is it best for?

Let’s find out.

What is CrowdStreet?

CrowdStreet is a syndicated real estate investment platform and a FINRA/SIPC registered broker-dealer with over 300,000 sign-ups totaling $4.4 billion in investments made since 2012.

It’s collected a number of gongs in the world of fintech over the last couple of years especially, and advertises a realized rate of return in the region of 12.2%.

As an investor, what CrowdStreet offers you is the opportunity to get in on the ground floor of promising commercial real estate projects that they vet painstakingly before ever presenting to investing members.

The sponsors of these projects then host a webinar for investors to participate in and ask any questions they have, and if satisfied, you can go ahead and buy in and grow your portfolio.

Since its founding, CrowdStreet have launched 790 deals from 344 project sponsors across 17 property types in almost all states of the US, so there ought to be something for you if there’s a specific type of real estate you’re in or a region you want to focus on for your real estate portfolio.

How does CrowdStreet work?

CrowdStreet only accepts accredited investors. Confirming your accreditation is the first thing you need to do to sign up and login to the CrowdStreet platform, and to gain this status you need a pre-tax income of $200k ($300k for a joint application), net worth of $1 million excluding primary residence, or a Series 7, Series 82, or Series 65 that is active and in good standing.

If you don’t meet these criteria but still want to invest in real estate, you could visit Whop’s real estate groups to get some first-hand intel on other platforms people are using.

You can also check out our review of Fundrise, a real estate investment platform that allows the general public to microinvest in certain types of properties.

Once you prove your accredited investor status, you can create an investing account with CrowdStreet. This is a relatively simple process, and as you complete it you’ll also be prompted to watch the company’s new investor orientation.

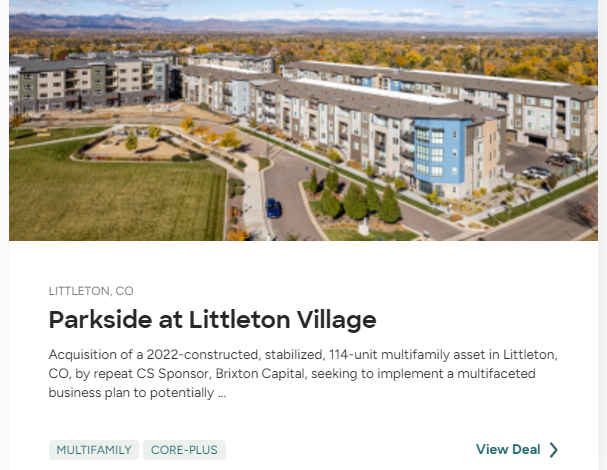

However, the meat and drink of the CrowdStreet platform is the access you’re given to deals like this one:

CrowdStreet has over 300 real estate operators who identify investment opportunities like these and bring them to the platform. CrowdStreet’s team then undertakes a two-pronged review process: sponsor screening and deal screening.

- In the sponsor screening process, CrowdStreet evaluates sponsor firms (such as Brixton Capital in the above image) themselves, running background checks on the company and its principals before reviewing a sample quarterly report to check that all requirements will be met.

They ask for sponsors to provide two years’ worth of financial statements, and assess their track record in executing similar business plans to the proposed project in the past. As an investor, you can access a Sponsor Screening Checklist from CrowdStreet to review all of this due diligence yourself. - Then, CrowdStreet screens the deal itself by evaluating the property in question, gaining an understanding of the business plan, and financial model, offering memorandum, rent roll, and other relevant documents to outline the potential risks and rewards of investing in the deal.

The resulting Deal Screening Checklist can also be downloaded by investors.

For you, at the end of the day, CrowdStreet is a vehicle toward building an investment portfolio of diversified real estate in a far easier manner than before.

As an accredited investor, the doors were never closed to begin with, but CrowdStreet takes almost all of the hassle out of the process while also letting you invest with lower sums than you might otherwise need to put in.

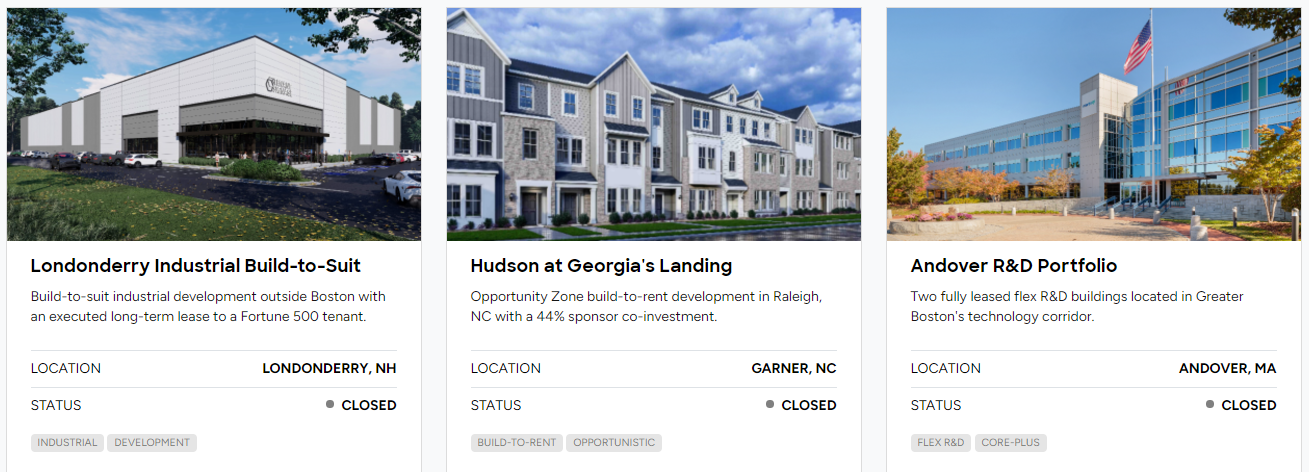

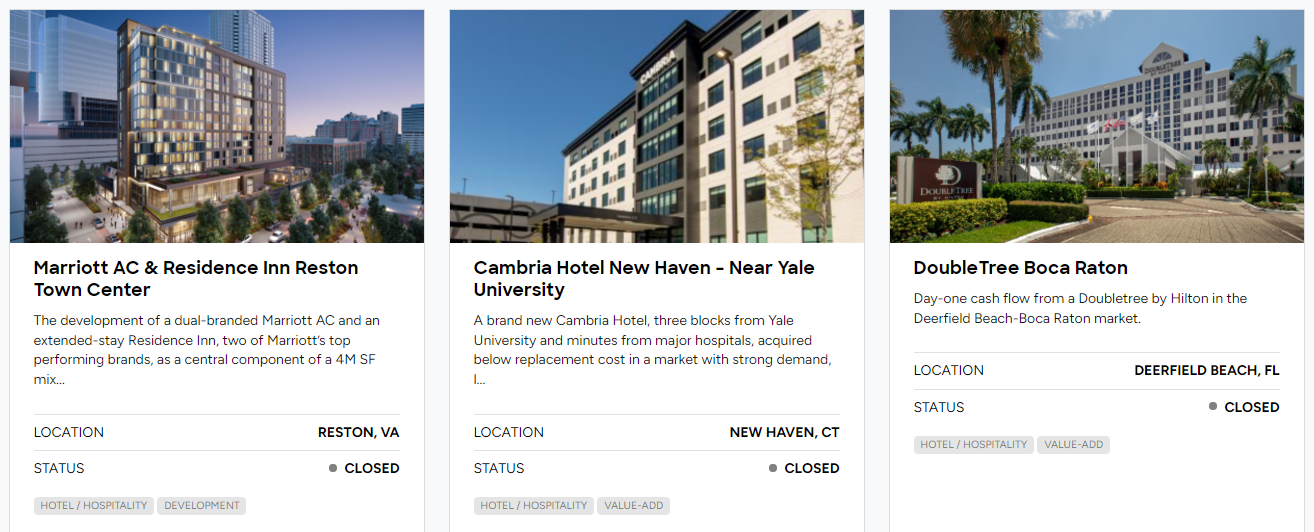

These are some examples of properties you can invest in with CrowdStreet, and as the images show the selection is quite smart—it’s not all city-center highrise office blocks that nobody’s actually using.

CrowdStreet lets you invest in different types of industrial developments, conveniently located R&D properties, build-to-rents, luxury multifamily, self-storage, and even medical facilities, school sites, and hotel properties.

CrowdStreet’s investing categories

CrowdStreet has four main categories for deals like the ones above. They are:

Opportunistic

These are the highest risk category of investments that CrowdStreet allows onto its marketplace, and they come with issues such as vacancies or even structural issues and foreclosed assets. Proper due diligence is required on these, with the investment thesis being that of a total turnaround led by experts.

Value-Added

These deals have moderate issues such as requiring renovation, and investors should look out for the specific business plans laid out to improve the asset.

Core

These properties pose the least risk according to CrowdStreet thanks to favorable location in major metropolitan areas, with stable core assets and a promise of steady, low-leverage returns.

Core-Plus

These are very similar to core assets but ratchet up the risk to offer higher, but limited, leverage returns.

Rather than invest in individual deals, CrowdStreet also lets you use its selection of funds that cover different properties. You can pick these vehicles by region, property type, risk category, and other criteria.

CrowdStreet provides plenty of information on each fund within its platform, including the underlying properties, the fund manager and their performance history, investment strategy, and return structure.

CrowdStreet’s minimums, fees, and charges

CrowdStreet usually requires a minimum investment of $25,000, although this figure can change for some projects. This is somewhat higher than other fintechs in a similar niche, but it’s worth re-stating that CrowdStreet only deals with accredited investors—and if you are one, this sort of minimum will still allow you to diversify your investments on the platform quite quickly.

There’s no fee for registering with CrowdStreet, but you’ll find there’s a standard fee on each project that varies from deal to deal.

Additionally, there’s a 0.5% to 2.5% management fee levied on CrowdStreet funds, with some charging an additional servicing fee, acquisition fee, marketing fee, or performance fee—so it’s worth reading up thoroughly on each product offered on the platform before buying in.

Liquidity at CrowdStreet

Real estate development isn’t an area you should expect to see immediate results. As a rule, investments in CrowdStreet tend to take a few years to realize—the holding period can vary from project to project, but your funds will usually be locked up for anywhere between two to five years although there may be exceptions that take even longer.

It’s possible that some projects may start paying returns early, but it’s just as possible that you lose money on individual deals. Many Reddit users have posted in detail about their experiences with the platform, there’s invariably a small percentage of investments where money is reported lost.

It’s also possible that projects fail to fund, but in that instance, you’ll have your money returned to you.

CrowdStreet compliance

As previously mentioned, CrowdStreet is a broker-dealer and a member of FINRA as CrowdStreet Capital LLC. The firm also offers advisory services via CrowdStreet Advisors LLC, which is a federally registered investment advisor.

CrowdStreet has an A+ rating from the Better Business Bureau, but it’s worth noting that CrowdStreet has been involved in one high-profile incident with Nightingale Properties, a sponsor which was attempting to acquire the Atlanta Financial Center by raising $54 million from 654 CrowdStreet investors.

Nightingale CEO Elie Schwarz allegedly misappropriated a significant amount of these funds, and following a settlement, Schwartz reportedly entered into a repayment plan to CrowdStreet investors. News outlet Bisnow (which first broke the story) reported that Schwartz missed a critical repayment deadline in April 2024, leading to renewed legal action as well as an arbitration claim against CrowdStreet with FINRA.

CrowdStreet pros & cons

CrowdStreet pros

- Online convenience

One of CrowdStreet’s main selling points is how easy it is to take part in syndicated real estate investing, an area that usually requires a lot of connections and legwork. - Sponsor connections

CrowdStreet pairs individual accredited investors with vetted project developers, reducing the amount of time and effort required to get involved in real estate projects. - Diversification

The ability to pick and choose different real estate projects on CrowdStreet’s platform can really help investors build the diversified portfolio they want.

CrowdStreet cons

- Lack of liquidity

It’s a given for a platform that deals with this sort of asset class, but investing with CrowdStreet is illiquid, and there’s no provision for redemption. - Risk

Unless you are extremely thorough with your due diligence and are educated in the world of real estate investing, it could be a complicated and risky way to manage your money. - Accredited investors only

The fact that CrowdStreet requires members to be accredited investors means it’s not for everyone, and the high minimums play a part in that.

Who is CrowdStreet best for?

CrowdStreet is a platform that gives accredited investors easier access to syndicated commercial real estate investments, which means that it’s suitable for you if you are indeed an accredited investor. You’ll have to look elsewhere if not, but if you do qualify, the platform can be a convenient option when it comes to managing and diversifying your investment portfolio.

Real estate is one of those areas that never goes away, and space is always at a premium—but it’s also wise to be aware of the risks of investing in the asset class, as well as by employing an intermediary like CrowdStreet.

The onus remains on the investor to do their due diligence on the different project sponsors, because while CrowdStreet does vet the offerings allowed onto the marketplace, the case of Nightingale (now known as NPG) and its CEO Elie Schwartz should remain a cautionary tale for prospective users.

Given the amount of capital that needs to be deposited into the platform to fulfill minimum requirements and the nature of some of the properties as well as the fact that investors need to do their own due diligence, CrowdStreet is also best for investors with a healthy appetite for risk.

This goes for the entire area of commercial real estate in any case given the prevailing market as well as the fact that a potential capitulation of commercial mortgage-backed securities (CMBS) could drag even solid real estate investments down with them.

Learn more about real estate investing with Whop

Ready to start investing in real estate? Check out Whop today and connect with like-minded investors who share their experiences, strategies, and insights. Whether you're exploring platforms like CrowdStreet or seeking expert advice, Whop's personal finance communities are your go-to resource for mastering real estate investing.

There’s no better way to learn the ins and outs of real estate investing than finding a community of other like-minded individuals to guide you through the process.

Whether it’s experts who have been there and done that or those still learning the ropes, you can find the perfect real estate community right here on Whop!