Stripe is a payment processing platform that lets businesses accept online payments, manage subscriptions, and handle transactions securely. Learn how it works, key features, and whether it’s the right fit for your business

Key takeaways

- Stripe combines payment gateway and processor functions with developer-friendly APIs, enabling custom checkout flows without building from scratch.

- As Merchant of Record, businesses using Stripe remain responsible for disputes, chargebacks, and tax compliance despite strong security features.

- Stripe restricts high-risk industries including gambling, cannabis, and crypto, so businesses should verify eligibility before committing.

Stripe is a global payment processor that lets businesses accept cards, wallets, and bank payments online and in-person.

It handles everything from one-time purchases to recurring billing, without you needing to build a payment system from scratch.

In this guide, we'll break down how Stripe works, its key features, pricing, and whether it's the right fit for your business.

We’ll also compare it to other options like PayPal, Square, and Whop Payments so you can choose the smartest setup for your business.

What is Stripe?

Stripe combines payment gateway and processor functions into one platform.

It's PCI Level 1 certified (the highest security standard), trusted by companies like Shopify, Lyft, and Amazon, and known for its developer-friendly APIs that let you build custom checkout flows and subscriptions.

Unlike traditional merchant accounts that require lengthy bank approvals, Stripe uses aggregated accounts to simplify onboarding (most businesses can start accepting payments within minutes).

Its product suite includes:

- Billing for subscriptions and recurring revenue

- Connect for marketplace and platform payouts

- Issuing for creating virtual and physical cards

- Atlas for company incorporation

- Terminal for in-person sales

Merchants remain the Merchant of Record unless using Stripe Managed Payments; meaning you're responsible for disputes, chargebacks, and tax compliance.

Stripe Managed Payments

Stripe's real strength is its developer-friendly APIs, offering flexible, customizable payment flows that can be tailored to your exact business needs.

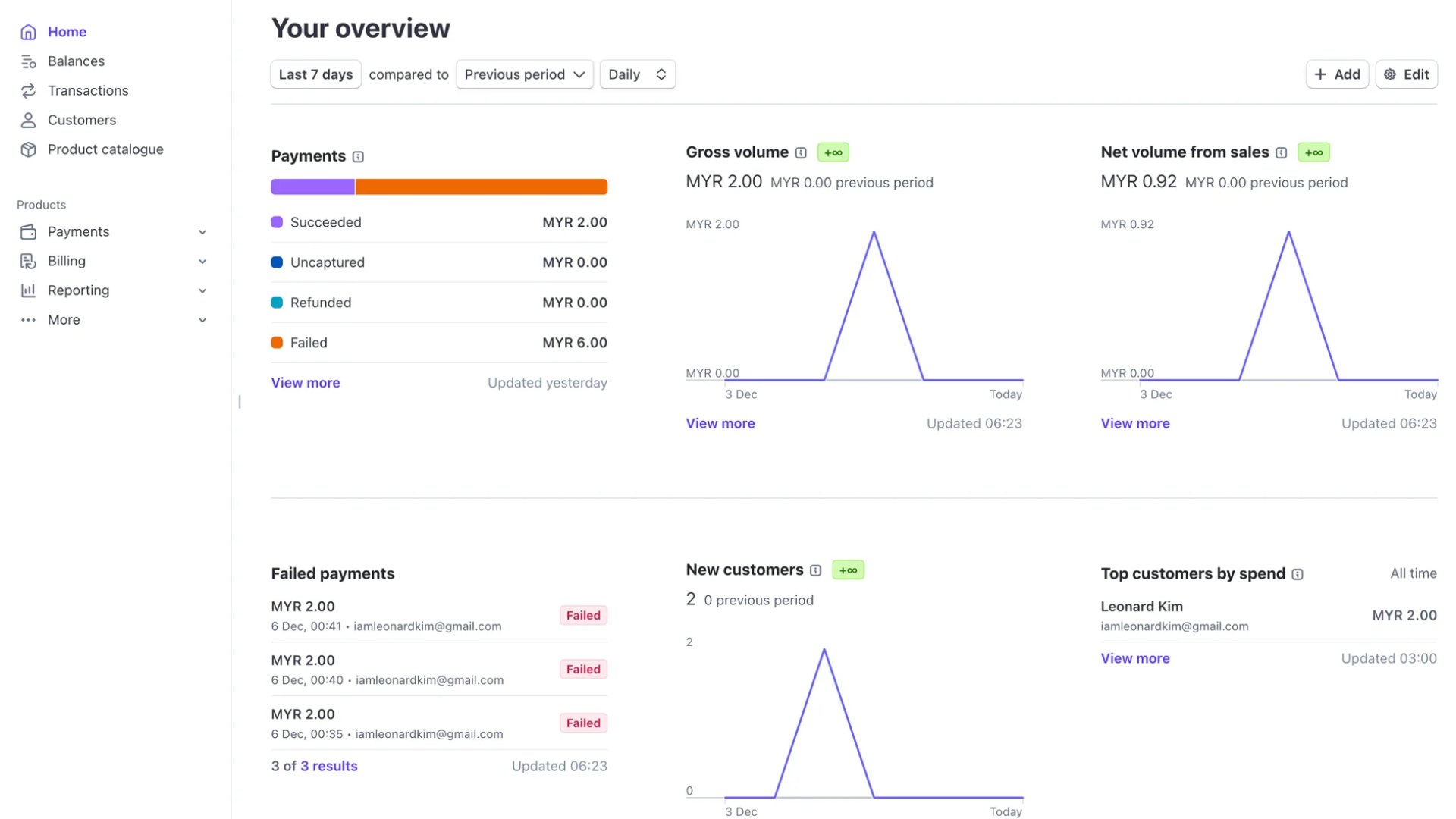

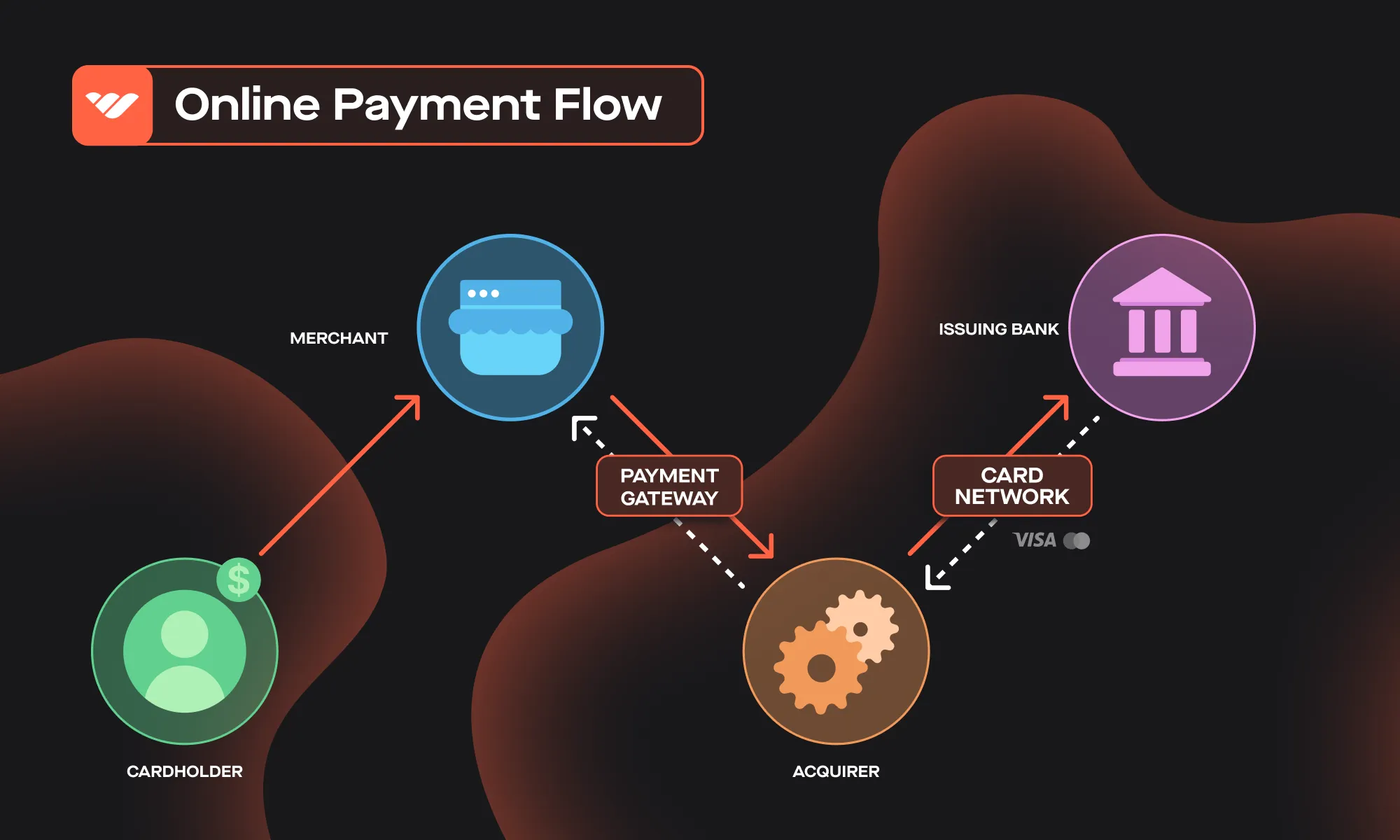

How does Stripe work?

Stripe simplifies the flow of money between your customers and your business.

When a customer checks out, Stripe securely transmits their payment details, validates the transaction with their bank, and ensures funds reach your account, usually within 2 business days (timelines vary by country).

Here’s the process broken down step by step:

- Customer enters payment details: This could be a card payment, bank debit, or other supported method.

- Stripe encrypts and transmits the data: Information is sent through Stripe’s PCI Level 1 compliant gateway over HTTPS.

- Acquiring bank and networks: Stripe’s acquiring partner submits the payment to the relevant card network (Visa, Mastercard, AmEx, etc.).

- Issuer authorization: The customer’s bank (issuer) approves or declines the transaction based on available funds and fraud checks.

- Response back through Stripe: The approval or decline is sent back to Stripe, which instantly shows the result at checkout.

- Funds settlement: If approved, the transaction clears and funds are deposited into your Stripe balance. From there, Stripe transfers payouts to your bank account, typically in 2 days (faster in some countries, slower for high-risk industries or first payouts).

This entire authorization process happens in seconds, giving your customer a smooth checkout experience. Stripe then handles settlement and payout behind the scenes.

For recurring payments, invoicing, and subscriptions, Stripe can also securely store customer details using its customer object system—removing the burden of PCI compliance from the merchant.

Is Stripe safe for businesses and customers?

Stripe is widely regarded as a safe and secure payment platform. It’s certified as a PCI DSS Level 1 provider — the highest level available — and goes through independent audits, security scans, and compliance checks each year.

From a business perspective:

- PCI compliance is handled, so you don’t need to store sensitive card data yourself.

- Fraud tools like Radar and 3D Secure help reduce risk, though they can require extra setup and add cost.

- Stripe offers reporting and dispute management tools, but chargebacks still fall on you to resolve.

From a customer perspective:

- Transactions are encrypted, tokenized, and run through HTTPS/TLS.

- Card data never touches your servers, which reduces exposure.

- Stripe’s global infrastructure meets compliance standards like GDPR and PSD2, though regional requirements can sometimes add friction at checkout.

Stripe delivers strong, enterprise-level security. The trade-off is that many of the protections come with complexity, extra fees, or responsibilities that still sit with the business owner.

What are the Stripe fees and payment methods?

Stripe charges transaction fees based on the payment method, location, and whether the payment is domestic or cross-border.

As of 2026, the standard fee structure in the U.S. is:

- Card payments (domestic): 2.9% + $0.30

- Manually entered/card not present: 3.4% + 30¢

- International payments: +1.5%

- Currency conversion: +1%

- In-person payments: 2.7% + $0.05

These are standard rates, custom pricing may be available for high-volume businesses.

Who can use Stripe?

Stripe is one of the most widely used payment platforms worldwide. It’s trusted by businesses from startups to global brands like Shopify, Lyft, Amazon, and Google.

But Stripe isn’t a one-size-fits-all solution; it works best for certain types of businesses:

1. Ecommerce platforms

Stripe integrates directly with major ecommerce builders like Shopify, WooCommerce, BigCommerce, and Squarespace. Setup can be quick if you’re already using one of these platforms.

That said, fees can stack up, and flexibility may be limited if you’re locked into their ecosystem.

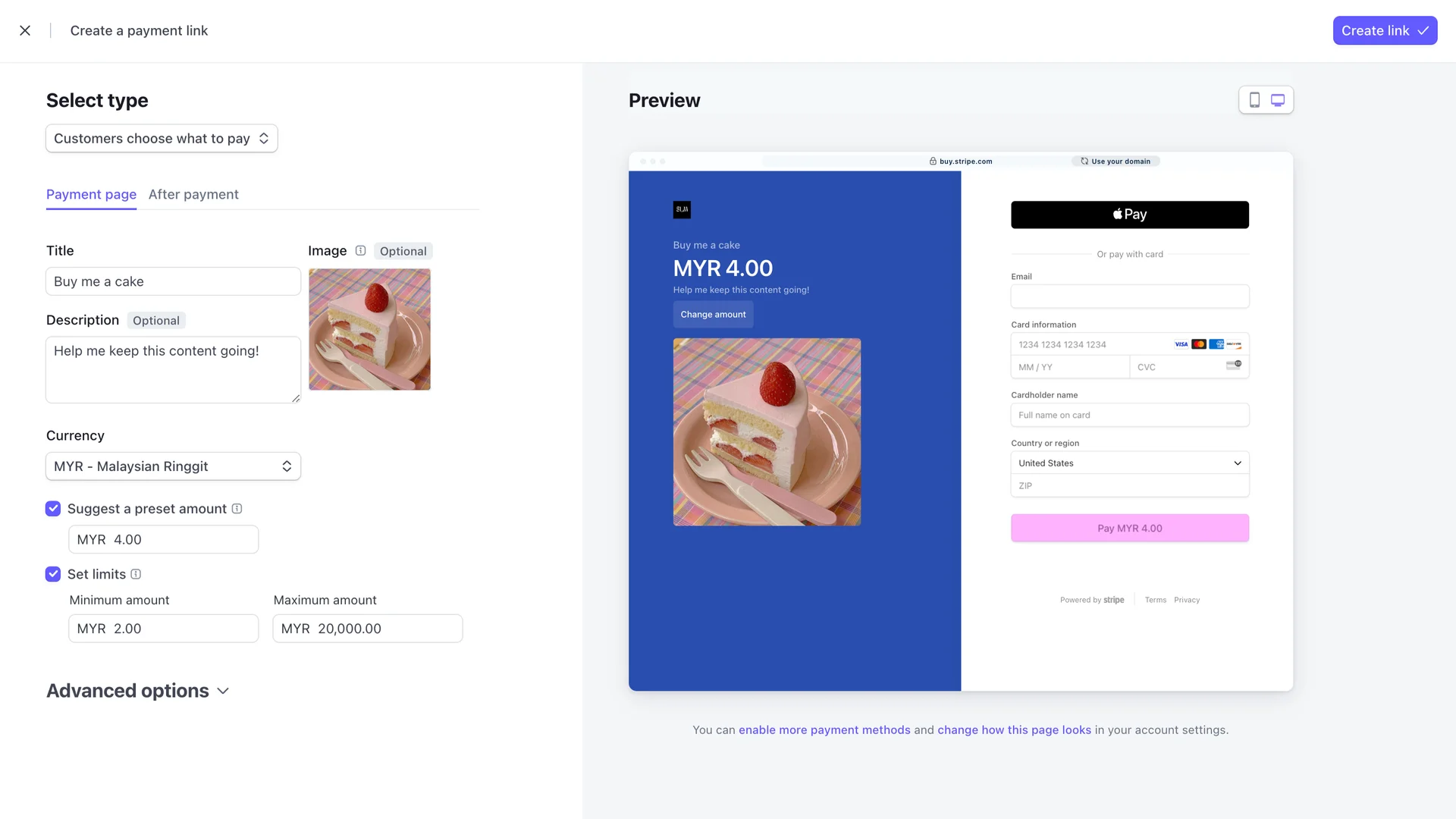

2. Developer-heavy businesses

Stripe is known for its developer-friendly APIs. If you have technical support, you can build custom checkout flows, subscriptions, and marketplace payouts. For non-technical teams, Stripe does offer no-code tools like Payment Links, but deeper customization often requires coding resources.

3. International sellers

Stripe supports 135+ currencies and localized payment methods such as iDEAL (Netherlands), Bancontact (Belgium), and SEPA Direct Debit (EU). This makes it strong for global commerce.

The trade-off: Stripe isn’t available in every region, and onboarding can be stricter for certain countries.

4. Businesses with strict security needs

Stripe is PCI DSS Level 1 certified and includes fraud prevention (Radar), 3D Secure, and compliance with laws like GDPR and PSD2.

Security is strong — but you’re still the Merchant of Record, meaning you carry the weight of disputes, taxes, and chargebacks.

Whop Payments was built for that.

Prohibited and restricted industries on Stripe

Stripe clearly outlines a range of business types it does not support, categorizing them as either prohibited (always disallowed) or restricted (which require additional due diligence or preapproval).

The list below reflects the most current version of Stripe's policy and is not exhaustive.

Stripe reviews all applications and may request further documentation if your business falls into these categories :

- Illegal products or services (e.g. narcotics, equipment for drug production, unlawful activities)

- Adult content and services (e.g. pornography, escorts, strip clubs, adult live chat, adult-themed dating)

- Debt relief companies, including debt settlement and debt consolidation

- Certain financial services like payday lenders, debt collection agencies, peer-to-peer money transmission, crowdfunding, bearer shares, shell banks, money orders, traveler's checks

- Gambling and betting activities (e.g. casinos, sweepstakes, fantasy leagues, lotteries, skill contests with prizes, sports betting)

- Travel-related services such as airlines, cruises, timeshares, travel reservations and clubs

- Identity and government services misuse (e.g. unauthorized legal advisory, identity theft protection, misleading government offerings)

- Intellectual property violations (e.g. counterfeit goods, unauthorized distribution of copyrighted media, violation of trademarks or trade secrets)

- Legal services not limited to fee-only models like bankruptcy lawyers or bail bonds operations collecting funds beyond lawful fees

- Marijuana and related products (e.g. cannabis, dispensary services, cultivation paraphernalia, high-THC or majority-CBD products, cultivation courses)

- Nutraceuticals or pseudo-pharmaceuticals making harmful or unverified claims

- Non‑fiat currency operations including cryptocurrency mining, staking, ICOs, NFTs (secondary sales)

- Unfair or deceptive business practices including MLMs, pyramid schemes, "get rich quick" schemes, deceptive testimonials, unrealistic rewards, telemarketing scams

- Weapons, firearms, and dangerous materials (e.g. guns, explosives, ammunition, fireworks, pepper spray, swords)

- Content creation platforms that distribute third-party content—those must have strong content moderation and require preapproval

Also, Stripe prohibits servicing high-risk jurisdictions and individuals, such as sanctioned countries (e.g. Cuba, Iran, North Korea, Syria, Crimea, Donetsk, Luhansk) or persons flagged by international sanction.

Advantages and disadvantages of using Stripe as your PSP

Stripe is a popular and well-established PSP, but like any platform, it has strengths and weaknesses. Here’s the breakdown:

| Advantages | Disadvantages |

|---|---|

| ✅ Strong security (PCI DSS Level 1 + built-in fraud tools) | ❌ Costs can add up with add-ons and international transactions |

| ✅ Global reach (135+ currencies, broad country support) | ❌ Requires developer resources to unlock full functionality |

| ✅ Flexible payment options (cards, wallets, local methods) | ❌ Not ideal for physical retail compared to POS-focused providers |

| ✅ Powerful APIs for custom checkout, subscriptions, and marketplaces | ❌ Strict industry restrictions (adult, gambling, payday lending, crypto ICOs/mining, etc.) |

| ✅ Scalable for startups through enterprise businesses | ❌ Blocks high-risk regions and sanctioned entities |

Stripe is powerful, secure, and global, but it’s not designed for every business model.

If you fall into a restricted category or don’t have developer resources, you may find the platform limiting.

The best payment alternatives to Stripe

Stripe won't be the right fit for every business. If you're selling in a restricted industry (like sports betting or medical cannabis) or you want to accept crypto payments, Stripe probably won't work.

Below, we've listed Stripe's top competitors and why they might be a better fit for your business.

1. Whop Payments

Whop Payments is an all-in-one payments stack built for digital businesses, combining payment acceptance, global payouts, marketplace distribution, affiliate management, orchestration, fraud tooling, tax handling, and embedded checkout into one system.

Unlike Stripe, Whop acts as the Merchant of Record (MoR), meaning it handles tax compliance, chargebacks, global settlement, and currency conversion on your behalf.

You don't need to manage separate processors, tax tooling, or international payout setups.

Accept card payments, digital wallets, global payment methods, ACH, BNPL, and crypto; across 195 countries and 135+ currencies.

Whop powers 27,000+ businesses and has paid out billions to sellers across coaching, SaaS, marketplaces, paid communities, events, and digital products.

Whop fees:

- Cards & wallets: 2.7% + $0.30 (domestic)

- International: +1.5% (+1% FX if currency conversion applies)

- ACH: 1.5% (max $5)

- Buy Now, Pay Later: 15%

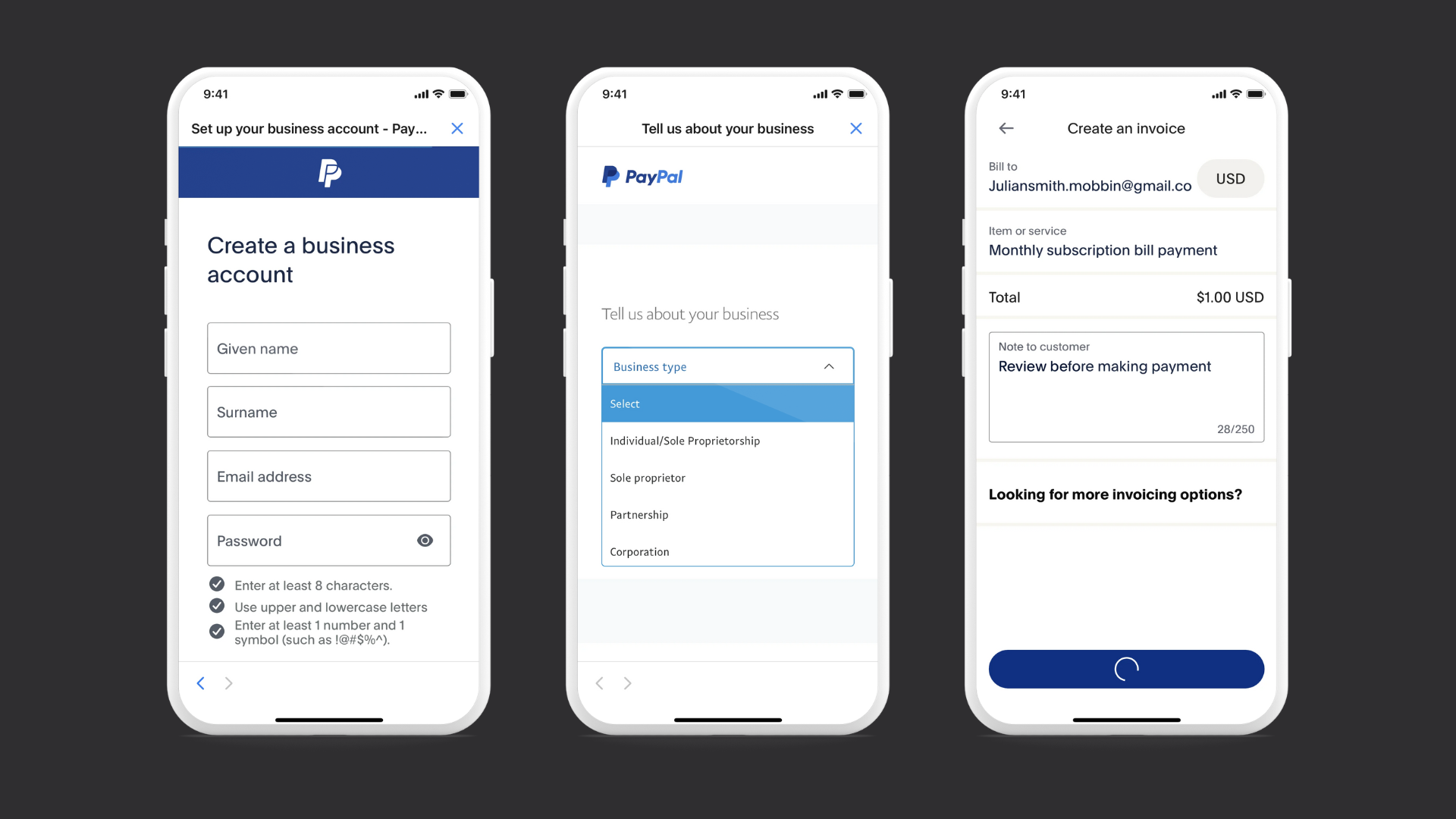

2. PayPal

PayPal remains one of the most accessible payment platforms globally. It is available in over 200 countries and regions, supporting 25 currencies, making it broader in geographic coverage than Stripe's operational footprint.

PayPal allows businesses to accept cards, PayPal balances, Venmo (in the U.S.), bank transfers, and BNPL (through PayPal Pay Later) through a familiar checkout experience.

PayPal stands out for its straightforward, non-technical setup, ideal for small businesses and solopreneurs looking to start receiving payments quickly.

PayPal fees (U.S.)

- Cards & wallets: 2.99% + fixed fee (domestic)

- International: +1.50%

- Currency conversion: FX rate + margin

- PayPal Checkout (wallet & balance): 3.49% + $0.49

- Buy Now, Pay Later: 4.99% + $0.49

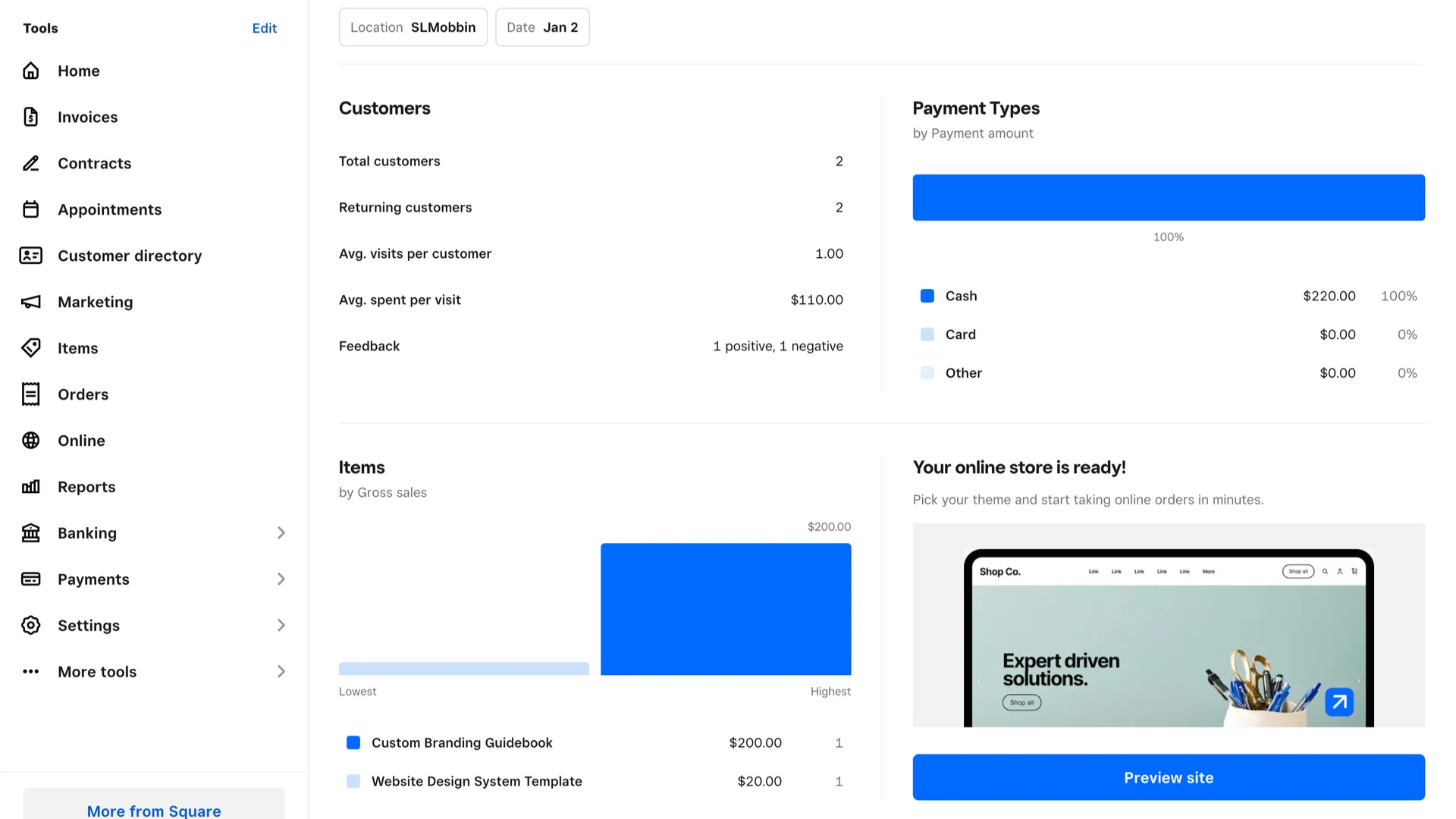

3. Square

Square is a payments and point-of-sale platform built primarily for in-person and hybrid businesses. It combines hardware, POS software, online checkout, invoicing, payroll, and banking into one ecosystem.

If you sell in a physical location, Square is one of the most integrated systems available. Hardware, payments, inventory, staff management, and reporting all sync automatically.

But while Square supports ecommerce and online payments, it doesn't offer multi-PSP routing or orchestration across multiple payment providers.

Businesses needing cross-border acquiring, multi-currency settlement in a single account, or advanced authorization optimization may require additional infrastructure.

Square fees (Plus plan, U.S.)

- Cards & wallets (online): 2.9% + $0.30

- Manual entry/card on file: 3.5% + $0.15

- ACH/bank transfer (invoices): 1% (min $1, $10 cap)

- ACH/bank transfer (via API): 1% (min $1, $5 cap)

- Buy Now, Pay Later (via Afterpay): 6% + $0.30

4. Adyen

Adyen is an enterprise-grade financial and payments platform. It combines payment processing, local acquiring, fraud management, issuing, and financial infrastructure into one system.

Companies like Uber, Spotify, eBay, and McDonald's use Adyen for its direct acquiring model, unified commerce setup, and global data visibility.

Unlike flat-rate processors, Adyen uses an Interchange++ pricing model, meaning you pay the actual interchange fee + scheme fees + Adyen's markup.

This provides transparency at the transaction level but results in variable pricing depending on card type, region, and payment method.

Adyen is powerful but typically suited to high-volume or international merchants.

Adyen fees (U.S., at a glance)

- Cards (domestic and international): Interchange++ + 0.60% + $0.13 processing fee

- ACH / bank payments (U.S.): $0.27 + $0.13 processing fee

- Currency conversion: FX rate + applied network margin (varies by currency pair)

- Buy Now, Pay Later: Pricing varies by provider

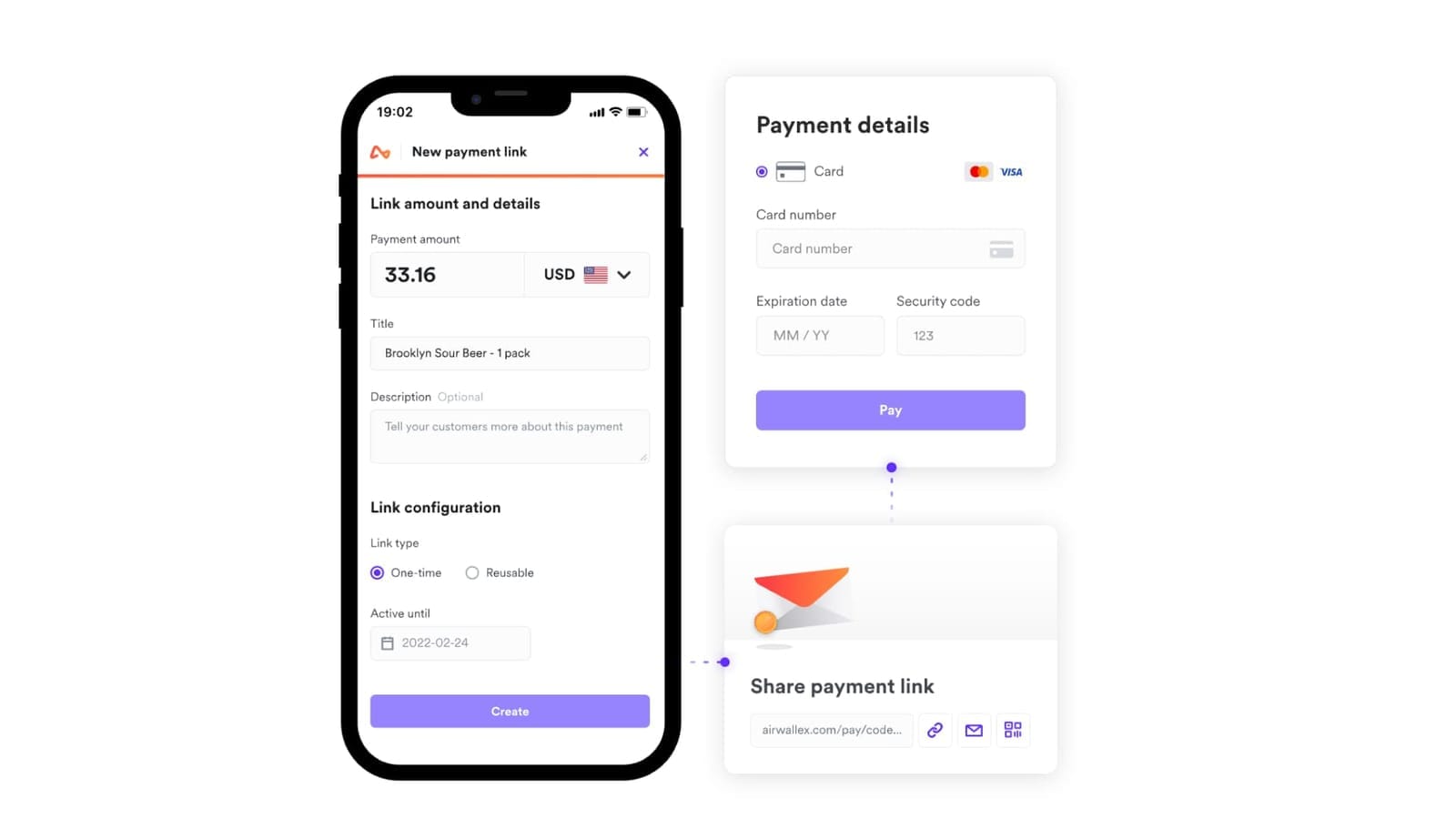

5. Airwallex

Airwallex is a global fintech platform designed to simplify cross-border payments, multi-currency acceptance, and business banking for merchants and platforms.

It combines processing, FX conversion, bank transfers, subscription billing, and more under one roof.

Airwallex lets businesses accept payments and settle funds in different currencies, while managing foreign exchange at competitive rates.

This makes it strong for international sellers, marketplaces, and SaaS businesses that need predictable FX pricing and global payout capabilities.

You get a lot, but the fees reflect the features. Below, we've had a look at the Explore Plan (free to get started).

Fees (US, Explore plan):

- Cards & wallets (domestic): 2.8% + $0.30¢

- International cards: 4.30% + $0.30¢

- ACH/local transfer: 0.4% (max $5)

- Conversion: 0.5% above interbank rates for major currencies

- Local payment methods: $0.30 + payment method fees

- Buy Now, Pay Later: varies by provider

Use Whop Payments as your PSP and MoR

Stripe works for some, but if you want purchases to actually drive growth?

You need Whop Payments.

We've developed a global, adaptive system that reaches customers in 241+ territories, supports local bank transfers and crypto (bitcoin + stablecoins), and pays you out fast.

With built-in KYC, you can start transacting in minutes, and transparent, flat fees keep costs predictable.

You can embed checkout on your site, share standalone links, or run your whole business on Whop – it's the same seamless experience either way.

We're routing every single payment to a number of different service providers to max out authorization rate via local rails, bitcoin, and stablecoin.

- Whop Co-Founder, Steven Schwartz

Ready for a full-stack payments engine? We can make every payment count.

Stripe FAQs

Is Stripe secure?

Yes. Stripe is PCI DSS Level 1 certified, which is the highest standard in the industry. It uses tokenization, TLS encryption, and fraud tools like Radar. That said, merchants are still on the hook for disputes, chargebacks, and compliance.

What businesses can’t use Stripe?

Stripe has a long list of prohibited and restricted industries. These include adult content, gambling, payday lending, debt collection, marijuana, firearms, nutraceuticals, and many crypto-related services (like ICOs and mining). If you’re in one of these spaces, you’ll need an alternative PSP.

How fast are Stripe payouts?

Stripe typically pays out in 2–7 business days depending on your country. In some regions, payouts can take even longer for new accounts.

What are Stripe’s biggest downsides?

Stripe’s main friction points are: fees that add up (especially for international transactions when compared to solutions like Wise), reliance on developer resources for advanced customization, and its limited support for certain industries and regions.

What makes Whop Payments different from Stripe?

Whop Payments is built for modern entrepreneurs. Whop powers payouts in 241+ territories, supports local bank transfers and crypto (Bitcoin and stablecoins), and routes every transaction through the provider most likely to approve it. This reduces declines, increases revenue, and gets sellers paid faster.

Does Whop Payments support crypto?

Yes. Whop Payments supports payouts in Bitcoin and stablecoins in addition to local banking rails. Sellers can also set up an ETH gateway to accept crypto directly from customers.

How long does it take to get started with Whop Payments?

With built-in KYC, most sellers can start transacting within minutes. There’s no lengthy bank onboarding process or complex account setup.

What’s the pricing for Whop Payments?

Whop Payments offers flat, transparent fees with no hidden add-ons for features like fraud protection or routing. This makes it easier to forecast costs compared to traditional PSPs.

Is Whop Payments available worldwide?

Yes. Whop now powers payouts in over 241 territories, making it one of the most globally accessible payment solutions available.