Unravel the complexities of Value Added Tax with our guide. Learn how Whop simplifies VAT for businesses and enhances global customer experience.

Key takeaways

- VAT is a consumption-based tax tracked throughout the supply chain, used by over 160 countries for government revenue.

- Whop serves as Merchant of Record, automatically handling VAT collection and remittance so sellers can focus on their products.

- Sellers and customers can enter VAT IDs at checkout through Whop, simplifying compliance with international tax obligations.

Business administration is a vast and complex field, and whether you’re running a sole proprietorship or have your eyes on managing a large corporation you’re probably already aware of the many challenges that need to be overcome. Taxation is one of these, but even tax has to be broken down into smaller but no less important parts such as Value Added Tax (VAT).

This guide will take you through what VAT is and why it’s important, along with the features Whop provides you in order to make handling VAT a lot easier for both you and your customers.

Understanding VAT

Value Added Tax is a consumption-based tax applied to goods and services at various stages of production and distribution. Essentially, you can look at a supply chain as a series of stages at which a raw material is refined and value is added to it before it moves to the next step. VAT is assessed throughout this chain, making it different to sales tax which is levied solely at the point of sale.

A glance at the VAT component on a bill might reveal that it can be considerable. This is an indicator of its importance, and VAT is in fact a primary source of revenue for many countries’ governments. This money then goes back into the country’s economy in the form of infrastructure and healthcare, so VAT can do a lot of good.

Different countries have different rates and regulations when it comes to VAT, and the European Union is extremely stringent when it comes to enforcing VAT. Some goods and services can qualify for a reduced rate of 5% in the EU, but most face a minimum VAT of 15%.

As a seller on Whop and therefore a business, VAT compliance can be crucial because while some countries including the U.S. don’t charge any, over 160 countries do use VAT. Staying up to date with respect to VAT and acknowledging that some of your customers need to deal with it will help you in the long run and definitely enhance the way your brand is perceived by international customers.

How VAT works

To better understand how VAT is actually levied and why your customers may have to keep track of it, let’s use an example with an assumption of a national VAT of 10%:

- A fabric mill sells a roll of fabric to a clothing manufacturer for $100. VAT is applied here, meaning that the clothing manufacturer pays $110, with $100 going to the fabric mill and $10 in VAT sent by the mill to the government.

- The clothing manufacturer then cuts the fabric and sews clothing, which it then sells to a retailer. The same amount of fabric might be able to produce $300 worth of clothing, so the retailer pays $330. At this step, the clothing manufacturer sends $20 VAT to the government, with the other $10 already having been paid by the fabric mill previously.

- The retailer then adds their branding and printing to the clothing and sells it to customers. Assuming that the initial fabric roll’s worth of clothing is sold in bulk to a college sports team for $1000, the college pays $1100, of which the retailer sends $70 to the government.

The end result here is that the government receives $100 on the final $1000 sale, but the exact tax paid by each component of the supply chain is easily tracked. A sales tax would have the same end result, but it would be much harder to identify and track what’s paid at each step of the supply chain.

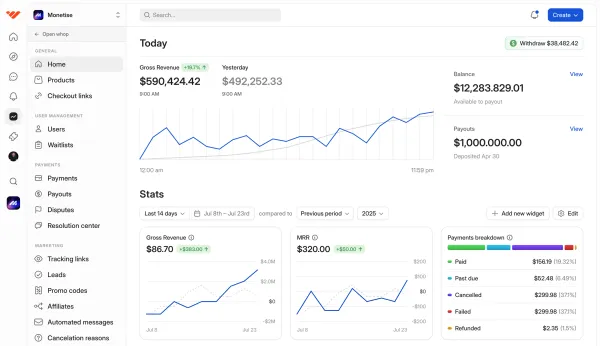

Whop as a Merchant of Record

Whop’s status as a Merchant of Record (MoR) has several implications in the areas of VAT and sales tax, all of them positive for you. For one thing, Whop handles VAT and sales tax, incurring payment liability for all digital products sold on the Whop marketplace.

If you connect Whop as your Merchant of Record, EU and UK based customers will pay sales tax but Whop will remit those same taxes on behalf of your business, helping you remain compliant.

By taking care of operational intricacies as an MoR on your behalf such as collecting sales tax, processing refunds, and honoring chargebacks, Whop can free you up to focus on your products and delighting your customers!

If you haven’t connected Whop as your MoR but are interested in doing so, check out Whop’s MoR documentation here.

What else Whop can do for you

Depending on your location and the nature of your business, VAT could be more or less important for you. However, as a seller on Whop, it’d be a mistake to underestimate the potential importance of VAT to your customers.

Luckily, Whop allows you to let customers enter their VAT ID at checkout. That can help both you and your customer stay compliant when it comes to VAT obligations and local regulations.

As a seller, you can also enter your VAT ID, tax information, or any other legal ID for your company on Whop, irrespective of what business structure you’re using. Thanks to these two features, Whop allows you to stay in total control of your situation with regard to VAT.

Simplify your sales tax at Whop

VAT is a prevalent system of consumption-based tax that’s used in most major economies outside of the U.S. It’s a system that many countries rely on for revenue so staying on top of VAT obligations is crucial for businesses in these areas or those that serve customers in VAT-paying nations.

Whop allows sellers to enter the VAT ID of their own business to their account but also let customers input VAT ID at checkout to make compliance far easier and more convenient. Whop also serves as a Merchant of Record, remitting sales tax on your behalf wherever your customers are located.

👉 Anyone can create a business and start selling products or services on Whop in minutes, so if you’ve got digital products or services to sell, get in touch with the team at Whop for any help or support you require. Visit Whop.com/sell/ to get started with just a few clicks!