Ally Invest can help you become a more savvy trader - find out how in this review.

Key takeaways

- Ally Invest offers zero-commission trading on US stocks, ETFs, and no-load mutual funds for self-directed investors.

- Three investment tiers exist: self-directed trading (no minimum), Robo Portfolios ($100 minimum), and Personal Advice ($100,000 minimum).

- Watch for hidden fees including $50 ACAT transfers, $115 DRS fees, and $50 charges for foreign stock trades.

Ally is an extremely recognizable name in the world of finance and banking, especially when it comes to auto loans, and it should come as no surprise that they’ve got a stock broking arm that plenty of Ally Bank customers use.

Called Ally Invest, it offers zero-commission trading that’s just about par for the course these days when it comes to US stocks and ETFs.

So, what else does Ally Invest offer, and is it the right place to invest your hard-earned cash?

We’ll look at this online trading app from the eyes of both investors and traders, and examine what it can do for you—and what it can’t.

What is Ally Invest?

Ally Invest is a low-cost broker that provides newer as well as intermediate investors with a strong, stable trading platform, banking integration, and a generally competitive package when it comes to wealth-building.

It’s also a great way to move between self-directed investing and automation, and once your portfolio is large enough, to hand the burdens of trading over to your own dedicated portfolio manager.

Why investors choose Ally Invest

Ally Invest is part of Ally Financial, and is a brand that, for many consumers, goes hand-in-hand with four wheels—Ally has been the league-wide sponsor and official consumer bank of NASCAR since 2023. It’s also the primary sponsor of Alex Bowman at Hendrick Motorsports, but outside of NASCAR is also a firm backer of the Miami International Auto Show as well as the Rocket League Championship Series.

All of this is for good reason, since Ally is one of the biggest car finance companies in the US with over 4 million customers in car financing and leasing. It also sold over half a million vehicles in 2023 via its SmartAuction online marketplace, making it a top car dealer as well.

Ally’s story with cars goes all the way back to its founding in 1919 by none other than General Motors, and for the better part of a century (until 2009 in fact) Ally was known as the General Motors Acceptance Corporation—although majority ownership of the company moved away from GM in 2006 when a 51% stake of GMAC was sold to Cerberus Capital Management.

Ally Financial today is an NYSE-listed firm that’s part of the S&P Midcap 400, with Ally Bank being a fully regulated FDIC member while Ally Invest is overseen by FINRA and has SIPC protections. As a comprehensive investment and banking platform, Ally offers customers the option of opening both automated and self-directed investment accounts to fulfill their needs.

As a more traditional brokerage platform, Ally is also known for providing personalized financial planning services and advisor-managed accounts—in an age of automation and chatbots, Ally makes a point of offering real, human support from a dedicated personal advisor.

How to use Ally Invest

What you need to get started

When you open an Ally Invest account, there are three different ways in which you might decide to use it. First of all, there’s Ally Invest’s self-directed trading account, where you’ll pick and choose your own stocks and ETFs and decide how much money goes where.

Then, there’s the option of picking a Robo portfolio, where you’ll choose from a few different portfolio templates, customize them, and then figure out how much money you want to put in and at what frequency—although there’s a minimum of $100 to get started here, unlike the previous option where there isn’t a minimum starting sum.

And, finally, there’s Personal Advice. Here, an Ally Invest investment advisor will handle your investments for you based on your goals and preferences, but you’ll need to be an existing Ally Invest or Ally Bank customer with at least $100,000 in investable assets (cash, stocks, and retirement accounts) to get started.

So, depending on which way you actually want to invest, what you’ll need to get started may differ. In all cases, though, you’ll need to have all of your documentation ready—and central to this is your Social Security Number. You don’t need to be a US citizen to register with Ally as long as you have a SSN as well as proof of your being a US resident.

Active military personnel stationed abroad may be an exception to this rule, and if that’s you, you’ll need to get in touch with Ally and see if things can be worked out in your case.

Creating your Ally Invest account

When you’re ready to open your Ally Invest account, the first step is to visit Ally’s website or download the Ally Invest app. Then, you need to navigate slightly differently depending on which of the three different services you want to use.

For self-directed trading and hands-on management of your own account, visit the Self-Directed Trading section of the site and give Ally your name and email address to get started. The next form will collect your other particulars, and you can upload your identity and residence verification documents as part of this process.

If you’d rather leave wealth-building to the experts and choose Ally’s Robo Portfolios option, navigate to the relevant section of the website and click on the Create Your Plan button. Here, you’ll configure your portfolio before opening the account, but ultimately the documentation and such that you’ll have to furnish are the same.

Lastly with Ally’s Personal Advice option, you’ll have to create either an Ally Bank or Ally Invest account first. Then, visit the Personal Advice section and Select a Call—this is a traditional service, and it’s handled in a traditional manner without needing to fiddle around with any sort of online configuration or account setup.

Buying stocks and ETFs on Ally Invest

If you’re knowledgeable about trading or simply want to learn more about the financial markets while building your own wealth, self-directed trading is the Ally Invest section you’re looking for.

As the last step in creating your account, you’ll need to choose an account type to match your investing needs—and with a self-directing account, you can go with an individual, joint, custodial, or coverdell account as well as a traditional, Roth, or rollover IRA.

You’ll then need to fund your account before you can actually start trading, so don’t expect to be knee-deep in the markets within seconds of account creation. Your funded cash needs to settle, and that can take up to a couple of days.

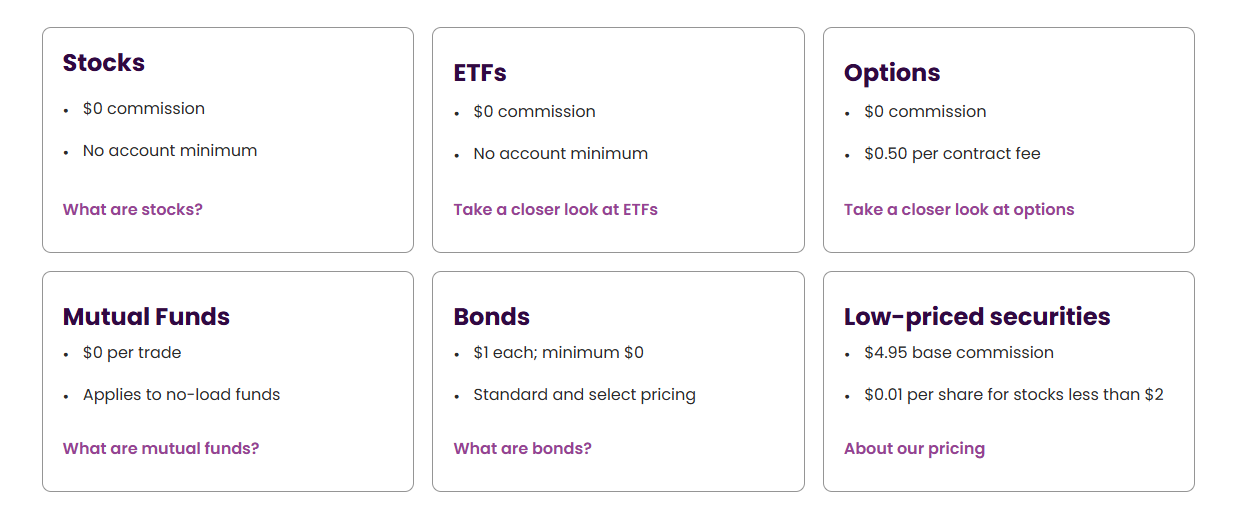

However, once your account is greenlit and your cash is settled, you’re good to go! There’s a whole world of stocks and ETFs out there to look at, all of them available with $0 commission and no account minimum.

In fact, Ally Invest also offers free trading on no-load Mutual Funds, as well as zero commission options although there’s a $0.50 fee on contracts that you do trade. That’s a very affordable package, all told, and it’s only on low-priced securities that Ally Invest actually charges a notable commission, specifically $4.95 base plus $0.01 per share for stocks cheaper than $2.

These low-priced securities aren’t penny stocks, but rather over the counter securities and pink sheet stocks that do not report to the Securities and Exchange Commission. As a result of these firms’ unwillingness to adhere to SEC requirements as well as the reduced disclosure requirements on the OTC market, these securities can be extremely volatile and risky.

Automated investing with Ally Invest

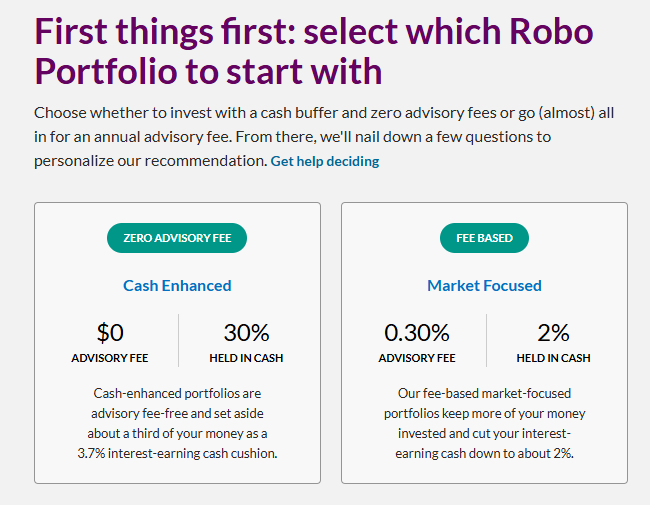

Ally Invest’s Robo Portfolio allows you to pick from one of Ally’s diversified portfolios to start building wealth, and the first thing to know about this option is that you’ll need a $100 minimum to get started. Then, you’ll have to choose between these two portfolio options:

Whether you choose the cash enhanced or market focused option is totally up to you, but what Ally gets out of it is clear—you’ll be paying a 0.30% advisory fee on the latter option, while in the former you’re essentially lending Ally 30% of your investment’s value in cash, much like with a savings account at a bank.

One of the biggest advantages of the Robo Portfolio is the fact that rebalancing is done on your behalf in order to maintain the same market-to-cash allocation. This is done for no extra fee on a daily basis, and you can update or change your goals at any point in just a few clicks.

Once you’ve chosen between one of the allocation options, you still have to pick a category of portfolio that matches your own set of goals. First among these is the Core portfolio, which is diversified across domestic as well as international assets, and it’s up to you to pick your risk tolerance level.

There’s also an Income category that focuses on dividend yields, which can be an excellent choice for retirees, and the Tax Optimized portfolio is a good one if you’re making after-tax contributions to your investment account.

Finally, the Socially Responsible option is similar to Core, with greater weight given to companies that show strong environmental, social, or governance qualities.

Using Ally Invest’s trading tools

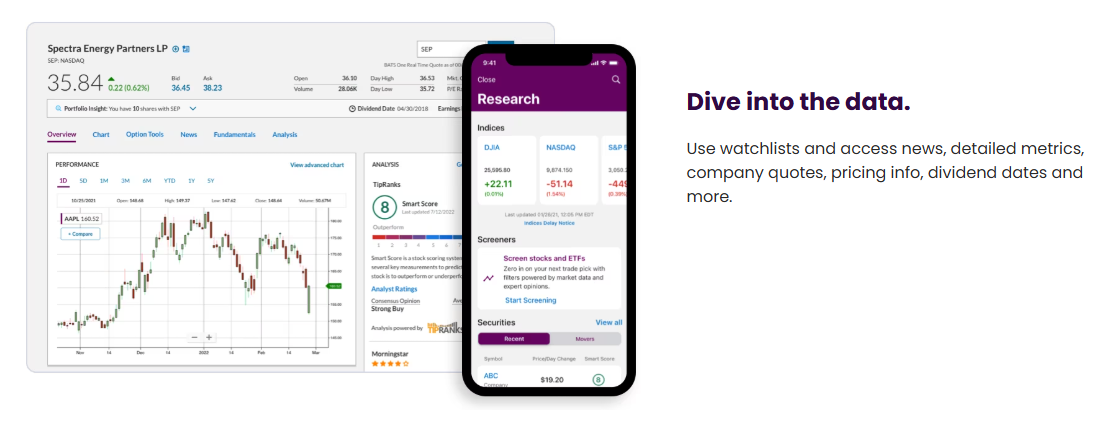

Ally Invest features a selection of tools tied to their self-directed investing account intended to help you make better decisions in relation to trading and wealth accumulation. The first of these is TipRanks Smart Score, which can give you a stock’s overall rating from 1-10 according to a set of selected criteria.

This kind of tool probably won’t help too much if you’ve got anything more than basic knowledge of investing, but for newer investors, Smart Score can give a useful ‘at a glance’ indication of how fundamentally sound a given stock might be.

You can also analyze and compare performance and price data for thousands of ETFs using Ally Invest’s screeners, while you can also access detailed research including various metrics, pricing info, company quotes, dividend dates, and much more without leaving the Ally Invest app.

How much does Ally Invest cost?

If all you’re looking to do is buy a selection of stocks and ETFs via its self-directed trading account, then Ally Invest gets the job done without a single fee or charge. As we’ve already mentioned, there are no commissions on options beyond a $0.50 contract fee, and no load mutual funds are free to trade as well.

Bonds and Treasuries are part of what Ally Invest offers given its nature as a more traditional investment firm, but there’s a $1 fee per Bond you do trade along with a $10 minimum and $250 maximum for any transactions in this asset class. Certificates of Deposit also carry a fee, and it’s a touch on the higher end at $24.95 per transaction.

You should also check Ally Invest’s fee schedule for other account fees, such as the $4 per paper statement on both self-directed trading and robo accounts that can add up if you’re not careful. There’s also a $60 annual Vault Fee levied on all account types, while Voluntary Reorganization costs $50 and any Tax Document requests by snail mail or fax also go for $50 a pop.

Ally Invest may also not be a good choice for trading foreign stocks as there’s a steep $50 plus regular commission to think about. If you need to ring them up and place an order by phone for whatever reason, you’ll be charged $20 plus regular commission, and option expiration sellouts cost $40 plus regular commission—although exercising options is free.

Outbound ACAT transfers (if you want to move some or all of your stocks to another broker, for example) will cost $50 for self-directed or robo portfolios, while directly registering (DRS) your stocks to get them listed under your name rather than your broker’s is also extremely expensive at $115 per position.

Ally Invest’s cashiering fees and IRA fees are also worth looking at, so make sure you take a look at their entire fee schedule—not everything’s going to apply to you or your account, but it’s good to know the lay of the land rather than risking a surprise charge for something.

Is Ally Invest safe?

Ally Invest is an offshoot of Ally Bank, which means that the company as a whole offers customers a level of safety and security that many brokers can’t match. Cash deposits are covered by FDIC insurance up to $250,000 while SIPC insurance protects brokerage accounts up to $500,000 although that doesn’t apply to investment losses or price fluctuations.

Ally Invest is also in full compliance with SEC regulations, and is a FINRA member—FINRA, of course, being the SRO that regulates broker-dealers in the United States.

In terms of their actual safety record, Ally Invest was subject to one notable data breach in early 2024 where users’ personal information, including Social Security Numbers, were exposed. Ally informed customers about the breach the following month, but customers filed two class action lawsuits later in the year arguing that Ally failed to protect sensitive information adequately.

Ally Financial and Ally Bank have also been subject to a variety of regulatory actions, including an order from the Consumer Financial Protection Bureau to pay $80 million in damages to minority communities in relation to discriminatory auto loan pricing. In all, prominent violation trackers have Ally at over $700 million in penalties since 2000, with the majority of those coming in the realm of consumer protection.

Is Ally Invest worth it?

Ally Invest pros

- Zero commission trading. Ally Invest is as good a broker as any for fee-free trading if all you want to do is buy stocks and ETFs. A self-directed trading account gives you the ability to do that without worrying about too much else, but the moment you move into robo trading or other assets, fees start to become a factor.

- Low cost options. Options are also commission-free with Ally Invest, and the contract fee is lower than what most other brokers charge. There are brokers who don’t take a contract fee either, but these are decidedly in the minority.

- Personal advice. Ally Invest’s Personal Advice account category equates essentially to having your own financial advisor or portfolio manager, and it’s the opposite of a revolutionary concept—in fact, it’s a throwback to how things used to be done, and can be a great way to go about building wealth in a stress-free, hands-off manner if you meet the minimums for it.

- Banking integration. Ally makes it easy to manage your wealth by seamlessly integrating their banking and investing platforms, meaning no more hassle when it comes to deposits and withdrawals of funds.

Ally Invest cons

- Various fees. Even though Ally Invest offers zero-commission US stock and ETF trading, this is a broker where you absolutely need to have a look at the fee schedule. There are a lot of fees at play behind the scenes, so make sure you’re not going to get caught out.

- Costly DRS fee. One of the fees that might take you by surprise is the $115 fee for DRS transfers. It’s easy to understand why brokers may disincentivize DRS since it makes it impossible to lend your securities out and profit off the borrowing fees, but there are several other brokers out there that either charge a nominal fee or no charge at all for DRS.

- Recent breach. Ally Invest experienced a data breach in 2024 that saw extremely sensitive customer information being exposed, and that has to be counted as a blemish on their copybook.

- Limited tools. Ally Invest is a platform that offers a selection of tools that helps the beginner investor but doesn’t provide the sort of utility that advanced traders need.

Ally Invest alternatives

If you’re looking for a top free stock trading platform, Ally Invest offers all of the basics and a compelling proposition, but there are plenty of fish in the sea. Here are three hand-picked alternatives that do certain things better:

1. Fidelity

Fidelity is not just an online broker or trading app but a true heavyweight as far as financial corporations go, and when it comes to safety and security it’s hard to find a better firm. They have a spotless record when it comes to safety, and you can alleviate almost every broker-side risk imaginable if you sign up with a broker with these sorts of credentials.

US stocks and ETFs can be purchased without any sort of commission, much like with Ally Invest, and you’ll have access to a similar breadth of assets on both platforms including bonds and mutual funds.

Fidelity charges a slightly higher contract fee if you want to trade options, but it goes the extra mile when it comes to index funds. Importantly, Fidelity is also one of the most trustworthy trading platforms when it comes to corporate governance—you’re not even going to have to pay a cent to DRS your shares, and outbound ACAT transfers are free too, as clear a sign of confidence in their own service as you’ll need.

2. Interactive Brokers

Interactive Brokers is a broker with almost unparalleled global reach, and not only is it usable as a resident of two hundred countries–as opposed to Ally Invest which is just for US residents–but it also provides a huge selection of assets from many of these different markets, allowing you to take a truly global strategy toward wealth-building without having to resort just to ETFs.

The contrast with Ally Invest is stark given Ally’s fees on foreign stocks, but on the flip side Interactive Brokers matches up on the zero-commission side of things via its IBKR Lite platform for US residents, thus offering the best of both worlds.

Interactive Brokers is also an extremely powerful platform, meaning that it gives you all of the different tools and order types that you need. The complex interface can sometimes be intimidating, especially to newer traders, but IBKR has an answer for that too—before signing up properly, you can start paper trading on the platform with a significant amount of virtual cash, letting you explore the ins and outs of the interface and also go through the entire order process without actually needing to spend any real cash.

3. Webull

Webull is among a cohort of trading apps often described as “neo brokers” responsible for shaking up the investing landscape. Part of the reason for that was the introduction of zero-commission trading, and while Webull is a comparatively new entry in the competition, that in itself has its advantages.

One of the reasons Webull is so well known is that they’ve historically offered extremely attractive deposit incentives, and that’s a practice that continues today even though the exact terms may change from month to month. Usually, they revolve around getting free stocks or fractional shares that, if you get lucky, can be lucrative especially as a micro investor.

However, Webull isn’t just a run of the mill trading app that attracts newbies with a gamified bonus scheme. It’s got some of the best trading tools and charts in the industry, and as far as trading apps go, Webull tends to attract a much more advanced user base than other free trading apps because of how powerful it is.

Learn to become an expert investor with Whop

Ally Invest is a broker that mixes in banking services in a way that makes it really easy to manage your finances and plan for your future. It’s a platform that gets the job done if you’re looking to build wealth, whether that’s via self-directed investing and picking your own stocks and ETFs or adopting a more hands-off approach with their robo portfolios.

However, the secret to investing lies in knowledge, and while there’s no guarantee of ever being successful with any sort of investment, learning as much as you can is the best way to up your odds.

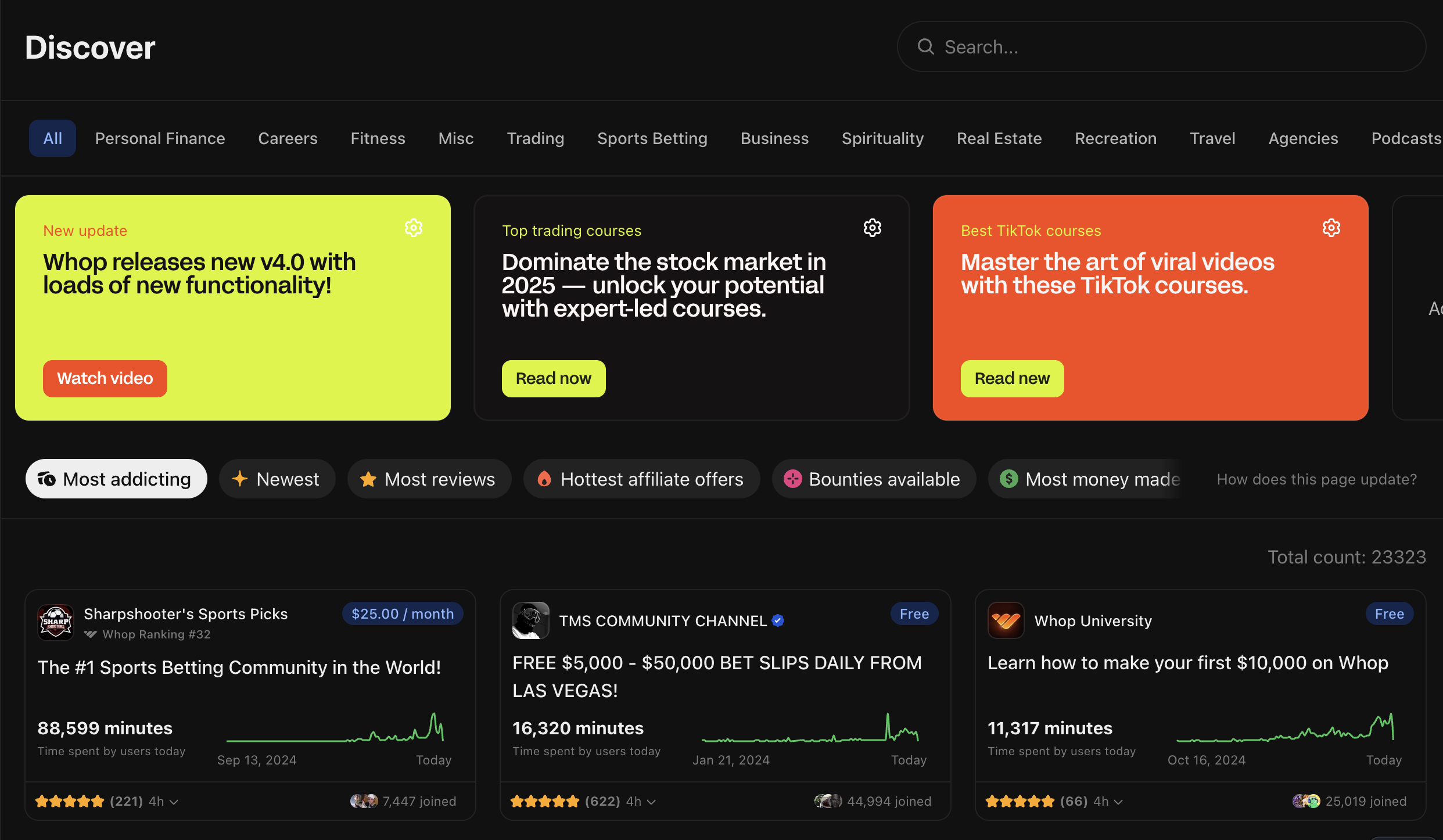

To that end, it’s well worth doing yourself a favor by checking out Whop’s top trading groups. Here, you’ll find the cream of the crop when it comes to communities including leading whops and Discord servers dedicated to all facets of trading, encompassing just about every style and asset class in the business.

If it’s workshops, masterminds, seminars, forums, or even mentorship you want, you’ll find it all on Whop—including a selection of the internet’s very best stock trading courses, designed to help you make the most of your chosen trading platform.