Up to 86% of small business and 94% of sole proprietorships rely on business credit. Here's how you can get business credit fast.

Key takeaways

- Building solid business credit takes about one year, with comprehensive profiles requiring three years of consistent financial activity.

- Keep credit utilization below 30% and pay bills early—a perfect PAYDEX score requires paying all bills 30 days before due.

- Choose the right business structure first, as sole proprietorships cannot build separate business credit due to no legal distinction from the owner.

According to the Consumer Financial Protection Bureau, up to 86% of small businesses and 94% of sole proprietorships rely on business credit. You can have the best idea in the world, but if you don't have the funds to set up, launch, run, and grow your business, then, well, you don't have a business.

That's why business loans and lines of credit are crucial for business owners.

Whether it's to get a line of credit from suppliers, take out a loan, or just get a business credit card, it's essential that businesses create a good credit score. Lenders look at business credit scores when determining whether a company is trustworthy and how likely repayment is.

But how quickly can you get business credit?

Consider this guide your crash course in business credit. From discovering how to structure your business correctly to actionable steps to build business credit quickly, we will point you in the right direction.

How long does it take to build business credit?

Generally speaking, businesses take around three years to build a comprehensive credit profile and about one year for solid business credit.

Legally speaking, you can start building business credit as soon as your business is established. However, keep in mind that, early on, your personal credit history heavily factors into your business profile. If you have less-than-stellar personal credit, you have a hurdle to get over, but it is doable.

As you can see, building business credit takes time and requires patience.

How do you build business credit?

A business credit portfolio considers several factors that all culminate in determining how financially trustworthy a company is.

If you understand how personal credit works, these factors likely look familiar:

- Payment history: This helps lenders judge whether you pay on time. Late payments can lead to a lower score.

- Credit utilization: Ideally, businesses shouldn't use more than 30% of their available credit. Low credit utilization tells lenders that your business can manage its cash flow.

- Diversity of accounts: Your business should have a mix of accounts, such as lines of credit, credit cards, and business loans. A diverse variety of credit types shows that your company can manage its finances responsibly.

- Liens and judgments: Legal actions can arise if you don't pay your debts in a timely manner. These can include liens, judgments for repayment, and bankruptcy filing. All of these negatively impact your business credit score.

- Inquiries: While you need to open accounts to build business credit, opening too many in a short period implies financial instability. Too many inquiries from seeking new credit lines can hurt your business credit score.

Your business credit is built primarily upon these factors. However, other factors can play a role, including industry risk and company size.

Unlike personal credit, which scales between 300 and 850, a business credit score typically falls between 1 and 100, with a few exceptions. The Equifax Small Business Credit Risk Score for Financial Services, for example, ranks business credit scores between 101 and 992. Meanwhile, the FICO SBSS uses a score of 0 to 300.

Important information to know before you start

If you're using the Dun & Bradstreet PAYDEX to measure your business's creditworthiness, keep in mind that a perfect score of 100 requires payments 30 days early.

To build your business credit, you need to register your business and get an EIN. The EIN acts similarly to your Social Security number when you apply for personal credit. An EIN is also typically necessary to operate a business bank account. Once you have an EIN, you can start applying for business credit.

Keep in mind that there are three main business credit bureaus: Equifax, Experian, and Dun & Bradstreet. Dun & Bradstreet requires you to have a D-U-N-S Number to start building business credit. This number is also necessary if you ever plan to apply for federal grants.

How to build business credit fast

Though a comprehensive credit score takes time, you can take some quick actions to start building business credit today. The first few steps set up the stage for your business to thrive, and you can get started right away.

1. Choose your business structure

It helps to establish a separate legal entity for your business before you start pulling business credit. You have several options, but most small businesses fall into one of these structures:

Sole Proprietorship

A sole proprietor owns an unincorporated business on their own. There is no legal distinction between the business and the owner, meaning the owner receives all profits, but must also cover losses, liabilities, and debts.

However, because there's no distinction between the business and owner, there's no business credit to build. You may be able to seek business credit lines, but your personal assets could be at risk if the company fails.

Partnership

A partnership operates like a sole proprietorship, except there are multiple owners who are liable for the business's debts.

Limited Liability Company (LLC)

A limited liability company establishes a legal difference between a business and its owner/operator. The Business becomes its own separate legal entity, protecting the owner from personal liability for debts.

However, you must file for LLC status, sometimes annually, depending on state regulations.

Corporation

Corporations are owned by shareholders, culminating in a board of directors who manage the business. Small businesses that incorporate are on the hook for corporate taxation, unlike an LLC. However, a corporation does provide protection against legal liability.

S Corp

This business structure allows taxable income, credits, deductions, and losses to pass to shareholders. It's an alternative to an LLC and only small businesses can take advantage of it.

If your company has 100 or fewer shareholders, this may be an option, but you'll have to confirm your business meets the Internal Revenue Service (IRS) requirements, including:

- Domestically incorporated in the US

- One class of stock

- No more than 100 shareholders

- The shareholders must be individual people, a specific trust or estate, or a qualifying tax-exempt organization.

If you're just starting out, read: How to start a business (the blueprint to success).

2. Check credit agency databases

Just as you should be checking your personal credit regularly through Experian, Equifax, and Transunion, you should keep up with your business credit.

If you've run your business for a while, it may already exist in the business credit agency databases. Check each major business credit agency (Experian, Equifax, and Dun & Bradstreet) for signs you already have business credit.

If your business is listed, take the time to review your credit history and make sure it's accurate and has reported active accounts in good standing. From there, keep making good financial decisions to build a more robust business credit profile.

If your company isn't listed, or if you find that you have no active business accounts, it's time to start building your business credit from the ground up. You can start by registering your business with Dun & Bradstreet to receive a D-U-N-S Number or start opening business credit cards or vendor accounts.

3. Get your business cards (credit and charge cards)

To get your business's credit history up and running, you need to engage with some sort of loan or line of credit. Credit and charge cards are just two ways to do so, and they're often easier to secure than loans.

Credit cards are among the simplest ways to start building business credit. If you don't have business credit or you need to improve it, start by qualifying for credit cards. If you have good personal credit, it may be factored into the decision and help you secure a credit card with a reasonable interest rate. However, if you don't, you may need to opt for a secured line of credit.

Alternatively, you may open up a business charge card. While this works similarly to a credit card, there are a few key differences. A charge card doesn't charge you interest. Instead, you must pay them off in full instead of making minimum payments on a revolving balance. However, this still helps you build credit as you continue to utilize and pay off your balance.

4. Make partnerships with vendors

Some vendors offer the ability to buy now and pay later. Fostering good relationships with these vendors can help you build business credit, especially if those vendors report to major credit reporting agencies. Some vendors even allow you to skip providing your Social Security number, so you know that your personal credit won't factor into their final decision to lend to you.

The key here is making sure that the vendors you've chosen will report credit history. Consider using net 30, 60, or 90 term accounts, which give you 30, 60, or 90 days to pay off the purchase without interest.

Interested in BNPL? Discover the best buy-now-pay-later providers for your business.

5. Pay on time (or early!)

At the bare minimum, you should make all payments on time. Your credit score reflects the risk lenders take if they provide you with a loan or line of credit. If you make late payments, they can do a lot of damage quickly. Because of that, paying your bills on time is an absolute must to avoid costly loan defaults that could result in liens and judgments down the line, as well as harm to your business credit score that can take years to undo.

Ideally, however, you'd pay off debts early. In fact, you have to if you want a perfect Dun & Bradstreet PAYDEX score. The only way to score a 100 on the PAYDEX is if you're paying all your bills at least 30 days before they're due.

If you're tempted to take out lines of credit and never actually use them to build credit, think again. Your business credit score benefits from you taking out loans and paying them off.

If you have accounts that go unused for long periods, they may be closed for inactivity by the lender, which can negatively affect your business credit score. By regularly and responsibly using available credit, you can help build a good credit score over time.

Just remember, under 30% utilization is the magic number. If at all possible, avoid leaning heavily on your credit lines.

Other ways to get business credit

Once you've completed the above steps, your business should be in a good position to start building credit. These methods will help your business continue its momentum and, with enough time, help set you up for success.

Become a financially independent business

While having a financially independent business doesn't directly impact your credit score, it can influence how lenders view your company and have a ripple effect.

A financially independent company is more attractive to lenders, which can result in access to better financing options and rates. Better access to funding makes it easier for you to build credit because you'll be able to get more manageable repayment terms and have more opportunities to prove your business's trustworthiness.

Establishing a financially independent business ensures that it has been separated from you from a legal perspective. This goes back to the first step in the business credit-building process—structuring your business.

If you've been operating as a sole proprietorship, you may be blocking yourself from extra funding because your business and your finances are intermingled. Choosing to instead structure your business as an independent legal and financial entity, like forming an LLC or S-corp, tells lenders that your company has an official business structure.

Be patient

Building excellent business credit is a marathon, not a sprint. As nice as it would be to establish an instant business credit score, it's just not possible. This process will take time, especially because it can take 1-3 months before any credit activity is reported to bureaus. Credit card activity, for example, takes between 30 and 60 days to report on average while your vendor activity can take upwards of 90 days.

Remember to be patient. Let your good financial choices work their magic and build your business credit score with time. Every timely payment you make and every loan you pay off all help you to build the excellent business credit you're striving for.

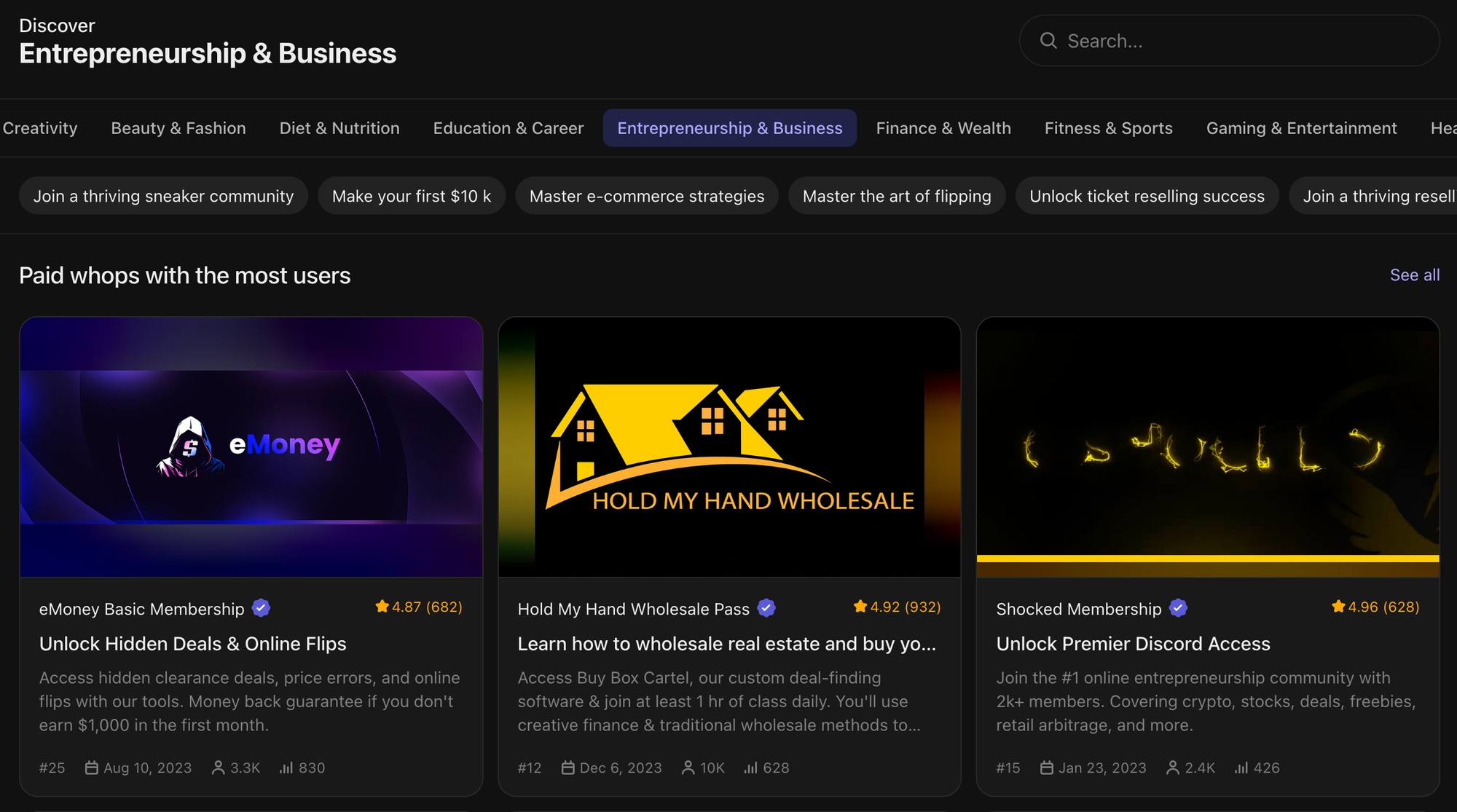

Find business advice and education on Whop

Your business education doesn't stop with this guide. With Whop, you can gain access to a ton of communities, tools, and courses to help boost your game and turn you into a savvy, successful business owner. You can gain a huge benefit from checking out some of the available resources designed to teach people how to build their businesses from the ground up.

Knowing what to do is a huge first step, but building a proper network of like-minded individuals is priceless. Using Whop, you can connect with other business owners, learn from them, and expand your professional network.

Why wait? Join a business community on Whop or take a course or two and discover just how much expert advice is waiting right at your fingertips.

Frequently Asked Questions

Have more questions about business credit? Browse through some of the most commonly asked questions to find your answers.

Can you build business credit with bad personal credit?

Yes, but it's often more difficult. You'll likely have limited options, but if you already have startup capital and you've established your company as a separate legal and financial entity from yourself, you can likely take out a secured business credit line to get started.

I don't plan on using business loans or lines of credit. Does my business still need credit?

Yes. Even if you don't plan on borrowing money, having a good business credit score can be advantageous. You'll know the funding is available if you ever need it during a tight period or if sudden expenses arise. Plus, your business credit score affects several other areas, including vendors' terms, real estate lease agreements, and business insurance premiums.

What are the main business credit bureaus?

The three main business credit bureaus are Equifax, Experian, and Dun & Bradstreet.

What is a D-U-N-S number and why does it matter?

A D-U-N-S Number is a unique, nine-digit identifier that is necessary to start building business credit with Dun & Bradstreet. Your company will not start building credit with Dun & Bradstreet until after this number is established, so doing so early on is a good idea, even if you don't intend to take out any lines of credit.

Many large companies and government entities require a D-U-N-S Number from all contractors they work with. Having a D-U-N-S Number can also expedite your loan approval process with some financial institutions.

Should I monitor my business credit?

Absolutely. Check your business credit profiles periodically to ensure all data reported is accurate. If it isn't, follow the credit agency's protocol for reporting discrepancies.

What is a good business credit score?

This depends on the credit reporting agency. However, generally speaking, a score of 75 is generally considered good. Scores under 50 can make it difficult to access funding.

How can I improve my business credit?

Be financially responsible. Make sure you pay your bills on time or early and in full and ensure you keep your credit utilization to under 30%. Keep in mind that you need to use your credit accounts from time to time to keep the credit active.