As an e-commerce merchant on Whop or elsewhere, ensuring a seamless shopping experience for customers is paramount to success. However, most if not all merchants encounter instances of chargebacks at one time or another. This may be a daunting term to newer merchants, so this guide will demystify the concepts of chargeback and fraud and provide all the tools required to deal with chargebacks in the easiest possible manner.

What is a Chargeback?

While it can be initiated by either party, a chargeback occurs when a payment made by a customer is reversed, sending funds back into the customer’s account and undoing the initial sale. While they can be frustrating for merchants, chargebacks are designed to be a form of consumer protection, giving them a safety net against unauthorized transactions, fraud, and merchant errors.

It’s also important to note that chargebacks can occur with both debit and credit card payments. In case of a debit card chargeback, funds are taken directly from the cardholder’s bank account while credit card chargebacks tend to involve reversing the transaction.

Chargebacks are different from refunds in that chargebacks are made through the issuing bank whereas a refund is a repayment arranged between customer and merchant. Chargebacks can be costlier than refunds due to the amount of processing required, and the merchant has far less control over how it works.

How does a Chargeback Work?

When a customer considers there to be an issue with a transaction, such as unauthorized account activity, non-delivery of goods, or even dissatisfaction with the product or service, they may choose to initiate a chargeback. They generally do so by contacting their bank, which then investigates the claim. If the claim is found to be valid, the bank reverses the transaction and credits the customer’s account.

Given the intricacies of global payment systems, it isn’t just one bank that’s involved. The customer and their issuing bank play a role, but card networks like Visa and Mastercard are also involved, along with the merchant’s acquiring bank and the payment processor used in the original transaction. Because of the many stakeholders involved, chargebacks can take several business days to be resolved.

A customer also isn’t required to initiate chargebacks immediately, so merchants may find themselves facing chargebacks months down the line. Different payment processors have different chargeback periods, typically ranging from a maximum of 60 to 120 days after the transaction in question.

Reasons for Chargebacks

As mentioned, customers may initiate chargebacks because of fraudulent transactions, non-delivery of goods, or dissatisfaction with product or service quality. They may also do so if they don’t recognize the charges on their bank statements, if they have technical problems during the transaction, or if they’re double-charged due to merchant error. It’s also common to have customers request chargebacks because the products they receive are different from the description they were given or images they were shown prior to the sale.

Regulations Governing Chargebacks

Chargebacks are subject to various regulations levied both by the major card networks as well as state and federal jurisdictions. Merchants should be familiar with two of these regulations in particular:

- Regulation E of the Electronic Fund Transfer Act which protects consumers when they use electronic fund and remittance transfers, including credit cards.

- Regulation Z of the Truth in Lending Act which protects people when they use consumer credit, including credit cards.

Chargeback Fees

While chargebacks can be frustrating for a merchant, one of the additional disadvantages they pose is the fact that merchants also tend to incur chargeback fees. Depending on the payment networks and banks involved this fee can even reach three figures, making chargebacks extremely expensive if frequent. A prompt, proper response to chargebacks can help to keep chargeback fees down.

Disputing Chargebacks

If a merchant believes a chargeback is unwarranted, they are well within their rights to dispute it. These are the main steps to take when disputing a chargeback:

- Gather Evidence: Collect all relevant transaction records, customer communications, proof of delivery, and other supporting documentation that may be relevant to the case.

- Craft Prompt Response: Merchants usually have a limited time and opportunity to file a response, so they have to make it count. Articulation of why they believe the chargeback is unwarranted along with attachment of relevant evidence can help to dispute the chargeback.

As a merchant on Whop, you can also leverage our Dispute Fighter tool to help you combat chargebacks. Dispute Fighter uploads the customer’s access logs, your unique TOS and refund policy, and any other relevant information in order to help you make your case.

All in all, Whop’s Dispute Fighter tends to give merchants significantly higher win rates when facing customer disputes and chargebacks.

Preventing Chargebacks

While it may be impossible to fully legislate against the possibility of chargebacks, here are some best practices merchants may employ in order to more easily dispute chargebacks:

Provide clear product/service descriptions and images.

Set accurate delivery expectations and provide track and trace information.

Provide good customer support and address customer concerns and queries promptly.

Use a clear, recognizable billing descriptor so that the customer recognizes the charge.

Implement advanced fraud detection tools and systems to prevent fraudulent transactions.

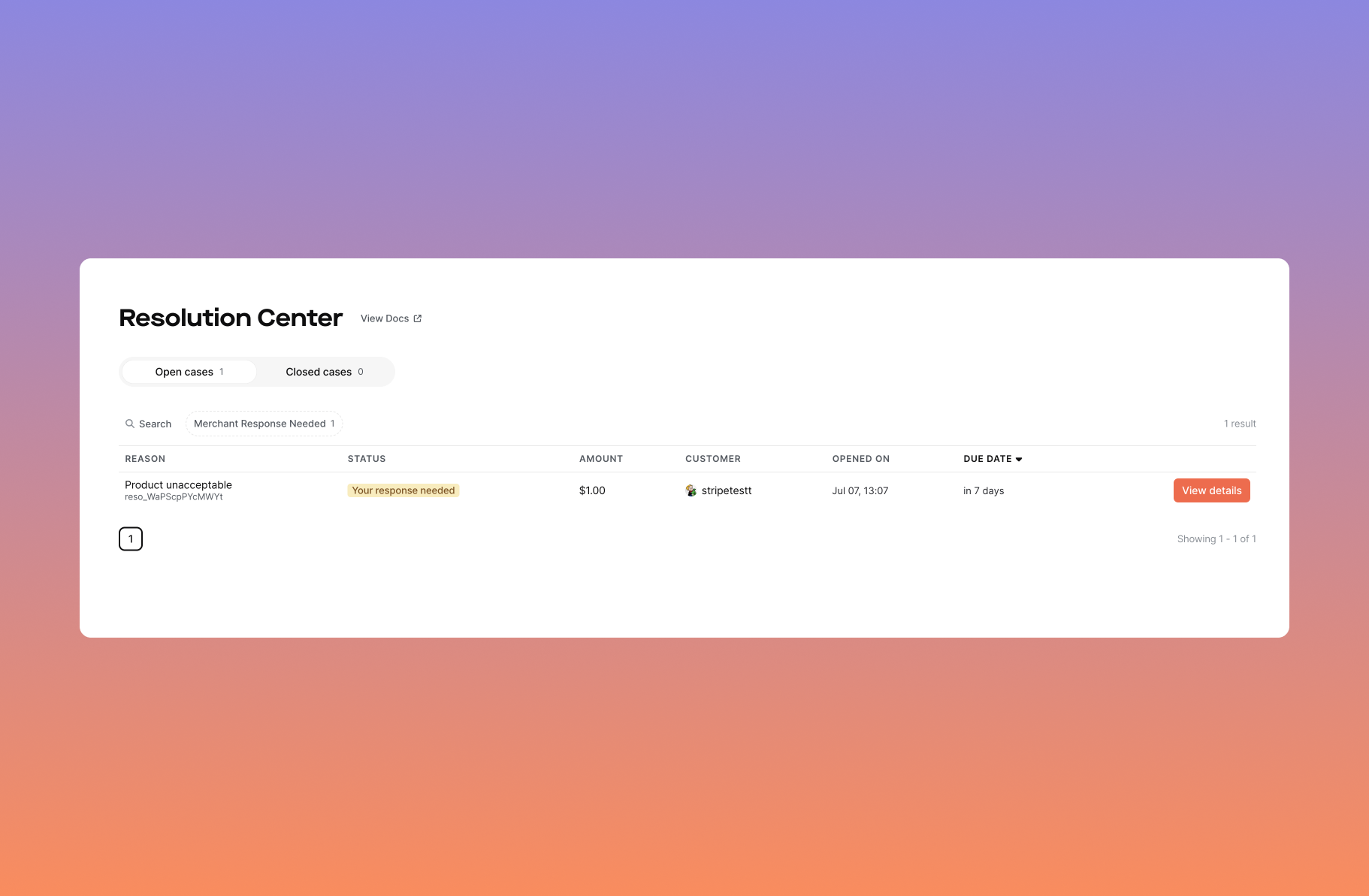

Whop also has a Resolution Center to resolve charge disagreements between the customer and the merchant. Solving cases through the Resolution Center will prevent chargebacks entirely!

Key Takeaways

Chargebacks are an integral and unavoidable aspect of e-commerce, but you can put yourself in the best possible position to deal with chargebacks when they come and prevent them entirely by informing yourself and your customers to the best of your ability.

👉 Along with the best practices outlined above, Whop’s Resolution Center and Dispute Fighter can also help you should the need arise. So, don’t forget to take a look at both tools and familiarize yourself with them in order to be prepared for every eventuality!