No organization will succeed without tracking, calculating, and understanding its business metrics. These metrics can exist in nearly countless forms, and the types of metrics needed will vary for every business. What remains the same, however, is the need to track the performance of the company at every level.

To illustrate, the customer retention rate of a company would likely be calculated by the marketing department. The financial division would probably determine the net profit margin. These metrics will be directly contributing to analyzing the overall success of the business. These are the numbers that help a business grow. They gauge their current performance, predict future trends, and discover areas for improvement.

While you may have heard of customer retention rates, net profit margins and an assortment of other business metrics, there is another metric that is particularly important to the marketing department and businesses of every size. It is called Customer Acquisition Cost (CAC).

One vital metric for any SaaS business (or any business) is Customer Acquisition Cost. Companies with a good grasp of CAC make better decisions. It's that simple. You have to know what it costs to obtain a customer and the more accurate you are the better you can scale.

What is Customer Acquisition Cost (CAC)?

WARNING: Blinding flash of the obvious coming. Before typing in the formula, you should probably know what CAC really is. So, what is Customer Acquisition Cost? At its most basic level, CAC is the sum total of the costs associated with acquiring a new customer.

So, what is the formula for CAC?

SaaS Customer Acquisition Cost (CAC) = Cost of Sales and Marketing / by the Number of New Customers Acquired

That seems simple enough, right? Well, not quite. This calculation needs to include all of the money required to aquire (and keep) a customer. This includes marketing, advertising, sales, and customer service activities. Breaking down these costs into tangible amounts can be tricky but it is an essential step.

It's great practice to learn the in's and out's of CAC. Better knowledge of this metric means better understanding of the efficacy of your company’s marketing and sales efforts. CAC metrics help businesses see precisely how much they are spending to acquire each customer. With solid numbers you can make solid decisions. Focus the budget where it is actually working and remove the rest. Who doesn't want to make better revenue generating decisions?

Why is Calculating CAC Important?

Now, you’re probably wondering: “If my business is profitable, why bother calculating its CAC? Isn’t that for businesses that are spending more than they’re getting?” The answer is: not at all. Instead, calculating a business’s Customer Acquisition Cost is vital for every business. Even if your profitable, would you want to become MORE profitable? We all know the answer.

Here are several key reasons this metric is important.

#1 Understanding Growth

Customer Acquisition Cost analysis helps businesses understand what drives customer growth. Companies can use CAC data to determine where to market and sell their product. Better marketing decisions help businesses grow.

#2 Investment Decisions

Calculating CACs allows businesses to make informed decisions about investments in customer acquisition. By understanding their CAC, companies can determine if they are investing enough or too much in acquiring new customers. Focus on spending your money where it works and stop wasting it where it doesn't.

#3 Pricing Strategies

Customer Acquisition Cost metrics can inform pricing decisions. You may find a high demand marketing channel but aren't profitable and a price increase may be in order.

#4 Budgeting

CAC informs future budgeting decisions. CAC data tells companies how much it costs to acquire customers and allows them to see where they can adjust their plans for the best results. When you have a good understanding of how much each customer costs your budget becomes a weapon.

How Do You Calculate Customer Acquisition Cost?

We gave you the formula above but let's break it down. Exactly how do you calculate Customer Acquisition Cost? The formula itself is quite simple; it is the way you determine the numbers for the formula that is complex.

Again CAC = Total Marketing and Sales Costs / Total Number of New Customers Acquired.

For example, imagine if a business spent $50,000 on advertising and marketing efforts and gained 500 new paying customers. Using the formula the average Customer Acquisition Cost would be $100 per lead ($50,000 / 500 = $100).

The complexity of the calculation comes in when you realize that, in order to calculate your business’s CAC, you need to carefully track all costs associated with acquiring new customers. This includes both direct costs (such as paid search campaigns) and indirect costs (such as overhead expenses). These costs must consist of any funds that were used to find, convert, and retain customers–such as advertising, design fees, employee salaries, and commissions–as well as many other costs.

Once this data has been gathered, you can calculate your company’s average CAC with the formula above. Before calculating this, it is vital to ensure that the costs and number of customers acquired are for the same given period of time. In other words, both figures must be for the span of whatever length of time you choose, whether that is for the last calendar year or the last month.

Common Pitfalls and Mistakes

Thinking of closing down this tab and gathering your data to calculate your company’s CAC? Wait just a minute. You don’t want to make the same mistakes others are making. So, without further ado, here are some of the most common mistakes and pitfalls when calculating CAC.

#1 Failing to Account for Overhead Expenses

One of the most common mistakes people make is the failure to account for overhead expenses in their calculations. These expenses include employee salaries, office rent, equipment, tools, and more.

#2 Failing to Account for Indirect Costs

If a CAC calculation seems off, then it is fairly likely that you forgot to account for some indirect costs. Direct costs, such as paid search campaigns, will likely be part of your data-gathering efforts. Indirect costs like customer service or email campaigns may not be the first thing you think of. Nevertheless, these indirect costs can have an important impact on CAC.

#3 Failing to Account for Long-Term Effects

Failing to consider the long-term effects of investments on CAC is another common problem. Imagine a company that spent money on advertising but doesn't see immediate returns. Long acquisition cycles can artificially inflate CAC.

Strategies for Success

Ready to dominate the CAC game? Below are some tried and true strategies for optimizing your CAC.

#1 Focus on Quality Over Quantity

When it comes to attracting new customers, it is vital to focus not just on quantity but on quality. High-Quality content wins every time. People grow tired of the same old content spit back 100 ways. When you can truly relate to your customer eventually your CAC will lower as more and more people flock to you.

#2 Invest in Retention

It is cheaper and easier to retain existing customers than to acquire new ones. Investing in retention strategies, such as loyalty programs help reduce overall CAC. Do anything you can to make your customers happy and WANT to stay and keep coming back to you.

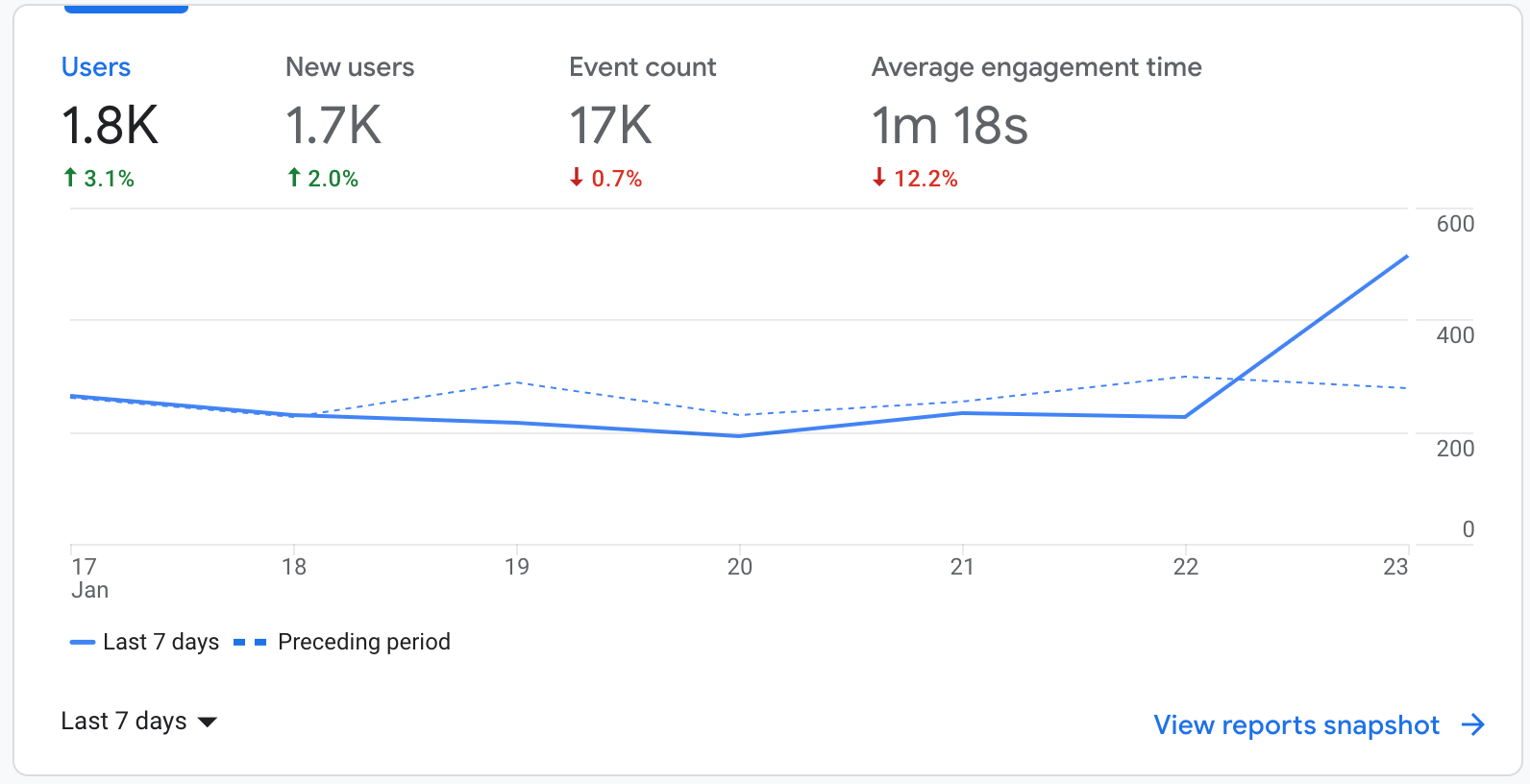

#3 Track & Analyze Your Data

As was mentioned earlier, track and optimize your marketing. If you are able to idenify areas that really work then stay there. If you can see they aren't working, it's time to move on. Over time, this will reduce your overall Customer Acquisition Cost. This is because you'll now be making informed marketing choices which in turn lower acquisition costs.

#4 Leverage Automation & AI

Artificial Intelligence (AI) has opened up many opportunities for businesses to lower their CAC. For instance, automation tools, such as ChatGPT, Jasper, and other AI-powered content writing tools, can be harnessed by companies to streamline processes. These tools can save a lot of time and effort and provide great ideas to get your content sharpened.

#5 Take Advantage of the Whop Marketplace

If your a SaaS company or if you sell digital products, you need to be using the Whop Marketplace. Whop is a digital marketplace for SaaS products with a monthly user base of over 700K. This large customer base means that businesses gain instant exposure. You'll also be listed against others that are already looking for similar products. Take advantage of the Whop marketplace and lower their CAC.

Conclusion

Now you know everything you need to know about Customer Acquisition Cost (CAC), what it is, how to calculate it, and how to optimize it.

![The Best SaaS Subscription Management Software [2024]](/blog/content/images/size/w600/2023/11/SaaS-management.webp)