Freetrade is a freemium trading app for UK-based traders, but is it right for you? Find out in this review.

Key takeaways

- Freetrade is an ideal beginner-friendly platform for UK investors wanting to start investing with zero upfront costs.

- The free Basic plan limits order types and charges higher FX fees, making paid tiers worthwhile for active traders.

- FCA regulation and FSCS protection ensure your investments are secure on this well-regarded UK platform.

Sometimes, the name says it all—and Freetrade is particularly apt, given that it offers customers the opportunity to start building their wealth or trying out trading for free. Officially, 'freemium' is the word that’s used on the tin, and it’s not one that you often come across in the world of stockbrokers or online trading platforms.

So, how does Freetrade work, and could it be a platform worth trying for your own specific set of wealth-building needs?

In this review, we’ll take a look at all the angles and try to figure out if Freetrade is for you.

What is Freetrade?

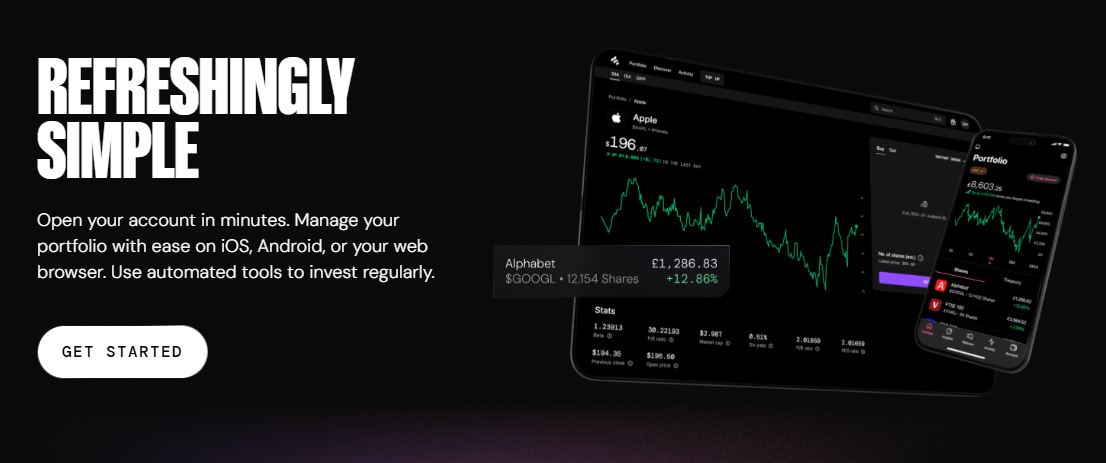

Freetrade is a UK-based fintech that offers a freemium online stockbroking service. It was founded back in 2016 with the launch of its web platform, then added iOS and Android app versions before the turn of the decade.

In 2021, Freetrade was able to reach 1 million users and a billion GBP in both quarterly trading volumes and assets under administration, and have since reached the subsequent milestone of a million and a half users.

Why investors choose Freetrade

Freetrade is today a UK-only mobile-first trading platform that focuses on convenience, letting you invest your money as quickly and easily as possible. Its interface is extremely easy to use, designed specifically to provide the best possible experience for mobile traders wanting a way to buy shares on the go.

The platform gives users access to over 6000 stocks and ETFs, and while there are quite a few fees to look out for, a lot of customers enjoy the free General Investment Account for the access it provides to solid investment products.

The platform doesn’t give beginners access to anything too risky, and very much encourages a responsible attitude to investing.

How to use Freetrade

What you need to get started

The very first thing you need to get started with Freetrade is to be a resident of the United Kingdom. More European countries are reportedly on the docket, but Freetrade only serves UK residents for now, not including Channel Islands and Isle of Man residents. They, too, are on the ‘coming soon’ list as of 2025.

It’s also worth noting that there may be restrictions on use even if you are a legal resident of the UK. EU nationals need to provide different sets of identification documents, a list of which you’ll find on the Freetrade website.

It’s worth checking, because the requirements can be quite specific, such as the 10-digit personal identity code for Danes, fiscal code for Italians, and no additional requirements for nationalities such as German, French, and Irish.

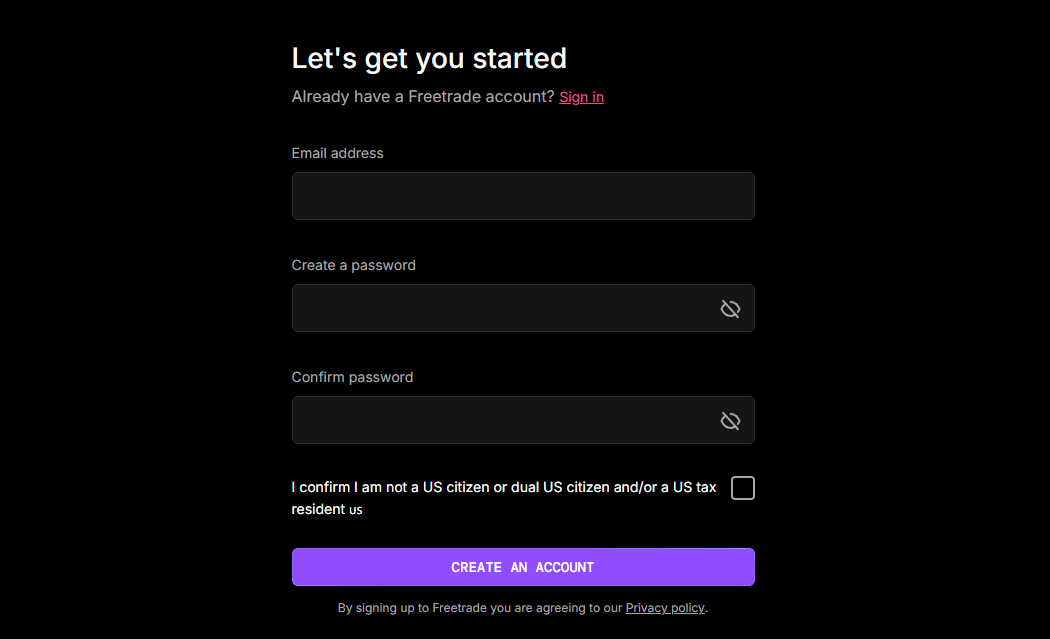

If you’re a US national, you’ll have to look elsewhere for a free trading platform. Freetrade doesn’t offer services to US citizens or even dual US nationals thanks to stricter US taxation laws.

All you’ll really need to provide Freetrade with are your name, date of birth, address, and nationality. Those details can all be automatically verified by the platform during the selfie verification check, but if there’s a problem you can provide a proof of ID and proof of address via email and you should be good to go within 2-3 working days.

Creating your Freetrade account

Creating your Freetrade account is very easy to do, and it starts with downloading the Freetrade mobile app from your app store of choice.

Once you do, you can get verified quickly with the documentation we detailed in the previous step, and you’re essentially all clear. Your Freetrade account will be tied to your email address, so make sure you use one that’s current.

Once you create your Freetrade account on mobile, you can use it to log in from a desktop and use the Freetrade web platform as well if you want to.

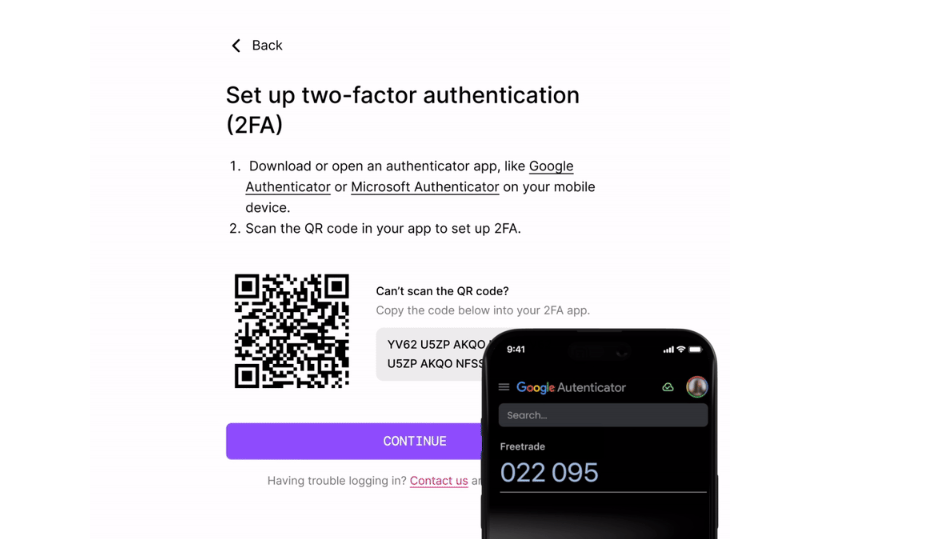

The only thing you’ll need to do is set up 2FA using any recognized authenticator app and then use it when logging in via desktop.

The Freetrade web platform works with most major browsers as long as you keep them up to date, including Chrome, Firefox, Safari, and Opera.

The web platform can do just about everything the mobile app can, with the advantage of a bigger screen meaning clearer charts as well as click-and-drag performance analysis.

Buying stocks and ETFs on Freetrade

The first thing you need to know when it comes to investing on Freetrade is the fact that the available selection of assets depends on what plan you’re on. This model differentiates Freetrade from most major online brokerage platforms, especially since with Freetrade your stock selection is limited on lower-end plans while brokers might only gate advanced trading strategies like options behind permission levels.

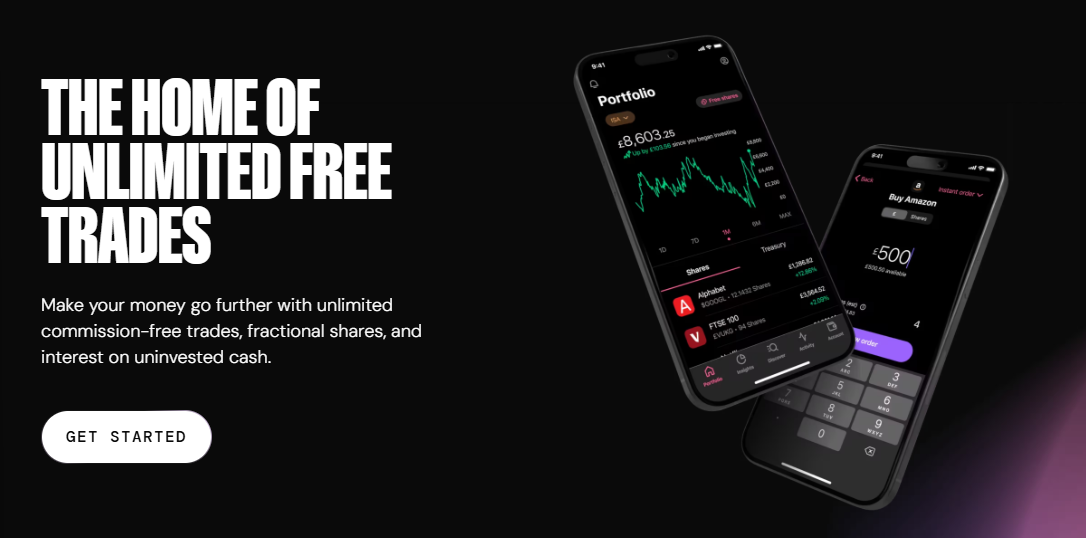

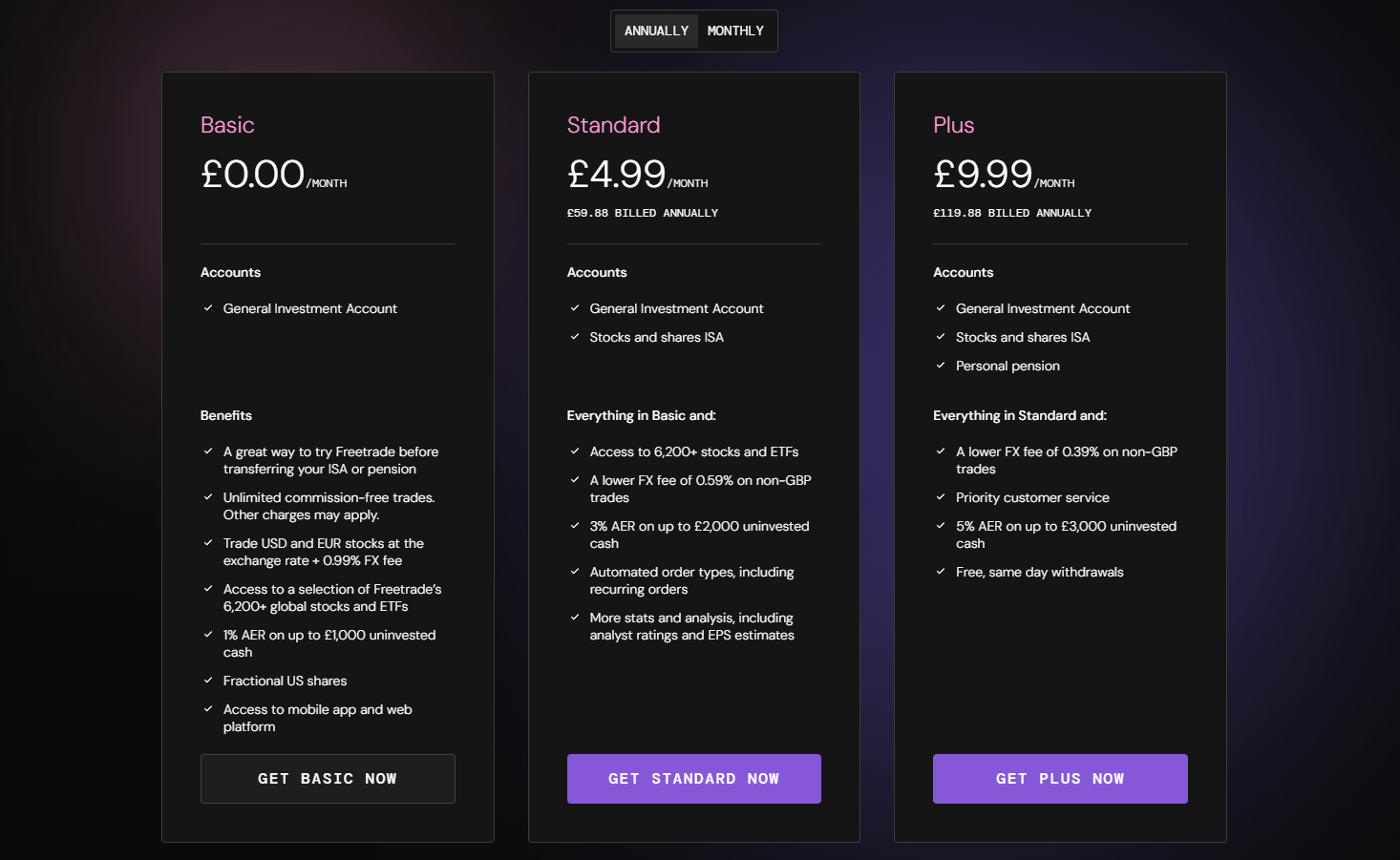

The Basic plan gives you a choice from over 4800 stocks, while going to the paid Standard or Plus plans ups that number to 6200. All plans give you access to fractionals, but you don’t get access to automated order types on the free Basic plan, nor do you get access to advanced stock fundamentals.

Basic is where almost all Freetrade users start off since it gives you a chance to check the platform out for free. It includes the General Investment Account (GIA) as well as the Treasury Bill account, and you’ll also get 1% AER interest on uninvested cash up to 1000 GBP.

We’ll go into the different plans in detail later, but while the selection of stocks on offer differs between them, buying them works the same way.

Freetrade’s interface is easy to use, and you can enter as well as exit positions with a single button press. It’s possible to create recurring orders just as easily, although pulling up advanced charting and other information requires a tap or two more.

As mentioned, certain order types are restricted depending on your plan type, and even basic automated orders like limits and stops are going to need a Standard account. In Basic, you’ll have to manage with just market orders.

Lastly, buying US fractionals on Freetrade is very much an option on all of the different plans, but you’ll have to do so by specifying a GBP amount with which to purchase them. Freetrade will then calculate the optimal number of shares to fill that amount, and go ahead with the trade. EU and UK stocks aren’t available for fractional share trading.

Withdrawing your money from Freetrade

As a rule, withdrawing your money from Freetrade is a breeze, although whether you can get free, same-day withdrawal depends on your account tier. The Plus payment option features this as one its key benefits, while Basic and Standard users will have to bide their time before their cash lands.

Same-day withdrawals need to be requested before 1400 on a working day, and they require a UK bank account to be linked and verified. The payment rails your bank uses also play a part here, with participants in Pay.UK’s retail payment network enjoying the benefits of same-day processing.

How much does Freetrade cost?

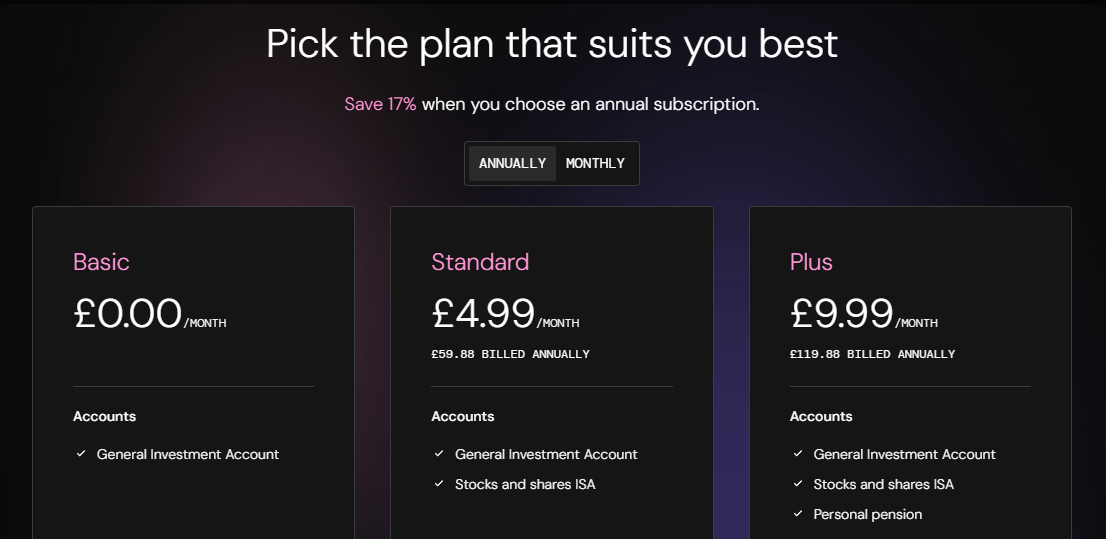

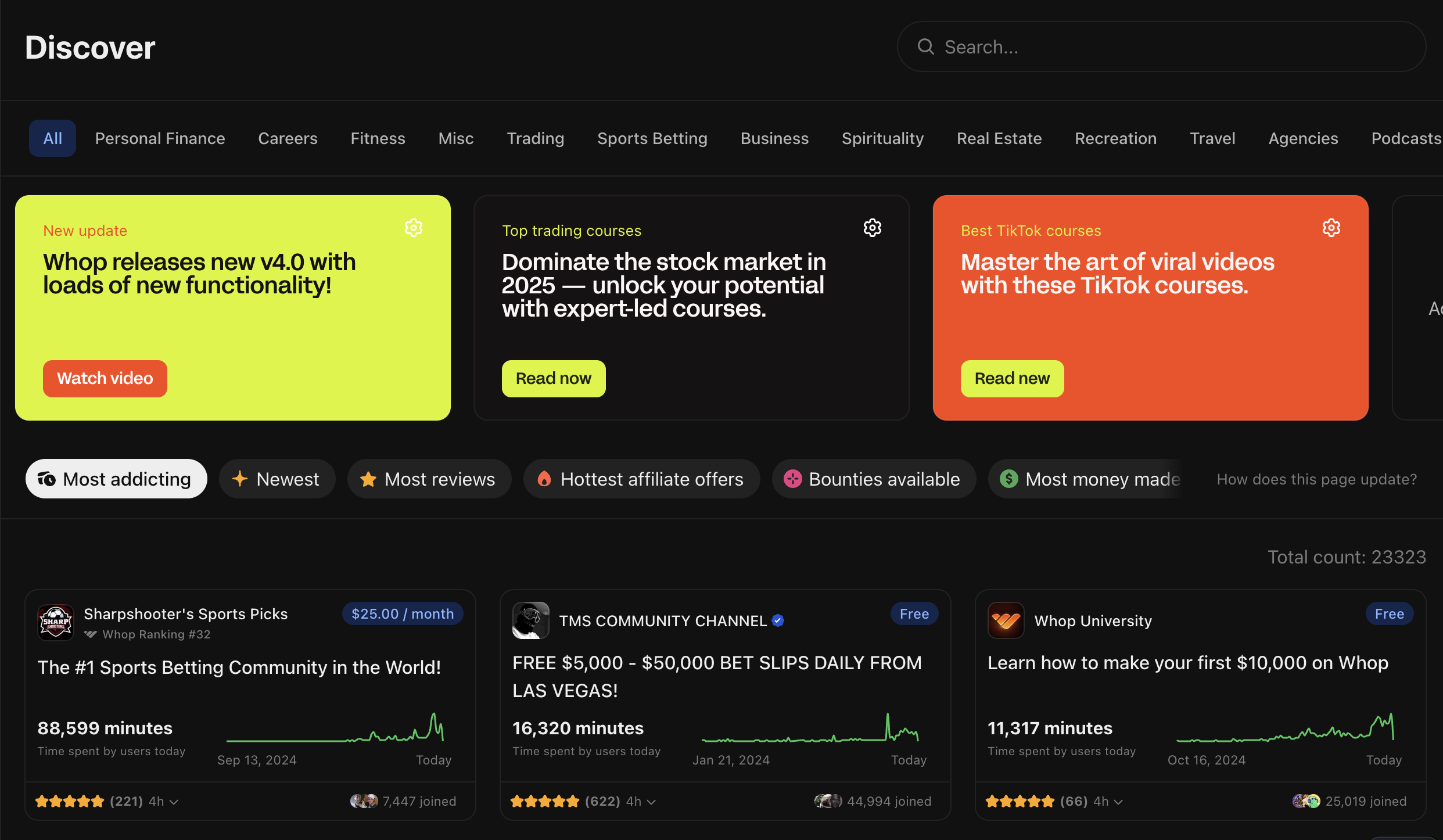

We’ve referenced the different plan tiers several times already, and you can see what they cost in the image above—as with many freemium platforms, you’ll get a slightly discounted rate if you choose to pay your dues annually, and that’s what the image reflects.

The simple rule of thumb to follow here is that Basic users are going to pay the most in fees, while Plus users get the platform’s full feature set and Standard offers a middle ground between the two.

Standard users get 3% on up to 2000 GBP of your uninvested cash, with Basic only netting 1% on up to 1000 GBP. With Plus, you’ll get a quite significant 5%, but only on up to 3000 GBP of uninvested cash.

Plus plan users are the only tier who can take advantage of free, same-day cash withdrawals, while they also enjoy the lowest FX fee at 0.39% on non-GBP trades. Standard plan members pay 0.59%, while the fee goes up to 0.99% for the Basic plan.

Ultimately, Plus is probably going to be the best choice to pick if you’re going to be doing a decent amount of investing or trading on the platform since those FX fees will add up, and even though you can’t escape them completely, you’re better than halving them.

You’re also getting access to all of the platform’s available resources, including stats, analyst ratings, EPS estimates, and even priority customer service.

There’s no harm in starting off in Basic, checking the platform out, and then upgrading if you like it. To do so, simply navigate to your Profile in-app and find the ‘Upgrade your plan’ option to proceed.

Is Freetrade safe?

Freetrade is an FCA (Financial Conduct Authority of the UK) authorized firm and complies with all of Britain’s regulatory standards and requirements, and client funds are held in segregated assets as well as being protected under the FSCS (Financial Services Compensation Scheme).

The FCA protects consumers and regulates financial services firms, aiming to make sure that financial markets work properly and give consumers a fair deal—but importantly, it also operates independently of the UK government. FSCS kicks in if and when FCA authorized firms fail, paying customers compensation for the assets held under the failing firm.

The UK’s financial Ombudsman service gives UK residents even more protection, settling complaints between consumers and businesses which provide financial services—so if you ever have issues with Freetrade or other similar financial services firm, this is the service to contact.

Freetrade specifically is a highly-rated company in the world of finance, and customers tend to be happier than even their 4.0 on Trustpilot may show. The waters of public opinion has been muddied a little bit thanks to their crowdfunded launch, with many smaller backers unhappy with the sale of the business to IG and the valuations that deal entailed.

From a usage and safety standpoint customers tend to be extremely satisfied with the Freetrade platform, which even allows the outbound transfer of any US (for a 17 GBP fee) or UK securities (free) as well as cash. This is one small litmus test that they pass, since many platforms with less-than-stellar reputations either disallow position transfer or charge an extremely high fee.

Is Freetrade worth it?

Freetrade pros

- Uncomplicated product. Freetrade is very easy to get started with and to use, and it’s an excellent platform with which to get started on your investment journey and learn the basics. It doesn’t overload you with features, offering a small set of functions but doing so well.

- Simple interface. Along those same lines, Freetrade’s interface makes its features perfectly accessible. Just about everything you need can be reached with a couple of taps or less, and there’s hardly any complexity to navigate.

- Stock selection. Freetrade has a very decent selection of stocks for you to buy, with well over 4000 available on the basic free plan and 6000+ on the premium tiers. This doesn’t match up to major brokers, but it does give investors access to most of the top US and UK stocks.

- UK Treasury bills. Treasury bills are an asset class that aren’t terribly common when it comes to modern brokers and online trading platforms, so being given access to them on Freetrade is definitely a point in its favor.

Freetrade cons

- Gated assets. Most broking platforms don’t restrict some stocks and offer access to others. Certain advanced trading instruments can be locked away, especially behind certain permission levels, but not allowing free users access to some stocks can feel like an artificial restraint—especially since they have to pay a high FX fee in any case.

- Can get expensive. Those FX fees, in fact, could add up depending on what sort of trading or investing strategy you follow. It’s 0.99% on the Basic plan, and that applies to all US stock purchases.

- Limited features. Freetrade’s feature set is limited, and while that can be a plus, restrictions aren’t good. The Basic tier can’t even use stock standard order types, meaning you have to pay to be able to use a limit order. All told, you just can’t do that much with the platform beyond buying shares and ETFs.

Freetrade alternatives

Freetrade is one of many free trading apps out there, so here’s a shortlist of apps that may also catch your interest depending on which aspects of what Freetrade you’re interested in or what other features you need.

1. Trading 212

Trading 212 tends to be the alternative of choice for users who decide not to go with Freetrade for whatever reason, primarily because it’s also UK-based and serves British residents. In fact, Trading 212 goes a few steps further than just that, offering its services to over 100 countries, encompassing all of Europe as well as Australia.

It’s also one of the most downloaded trading apps out there, and gives customers unfettered access to over 10,000 stocks and ETFs alongside a very handy box of tools. Trading 212’s charting and trading indicators definitely go above and beyond, helping advanced traders do the research and analysis they need to without needing to go off-platform.

It’s worth noting that Trading 212 is much more of a trading platform than Freetrade is. Both platforms are up-front about the risks involved, but Freetrade’s focus is on buying stocks while Trading 212 does put a lot of emphasis on CFD trading.

These are high-risk instruments that aren’t terribly different from gambling, but the good news is that you don’t need to get involved with them at all if you don’t want to on Trading 212.

2. Interactive Brokers

Interactive Brokers is one of the top global trading platforms, offering services in just about every country and giving users access to stocks and ETFs from all over the world. If you’re a UK resident and want a boundless selection of assets, IBKR is where it’s at—and that includes all of the derivatives and instruments that Freetrade doesn’t offer as well, such as options and futures.

Interactive Brokers has an option called IBKR Lite for US users that offers completely commission-free trading, but no matter where you are, you’re getting a powerful, professional-grade investing and trading platform when you sign up with this firm.

However, complete beginners to the world of trading may find IBKR intimidating because of just how many assets and features are available. Granted, certain things are locked away behind different permission levels, but the interface as a whole does take a little bit of getting used to.

That said, having more features is better than none, and Interactive Brokers’ paper trading feature lets you try out the entire platform and get used to it before making a deposit.

3. Vanguard

Vanguard is another of the top names in the world of finance, and while it doesn’t offer services in as wide a range of countries as IBKR does, the US and UK are definitely both on the list. It’s also a low-cost option despite its standing, and you’ll find few brokerages able to compete with this juggernaut on the cost front.

One of the reasons Vanguard is able to keep costs low is the fact that it’s essentially owned by its customers–people who buy into Vanguard funds, to be precise–and that means that users are going to be right up at the top of the list of stakeholders that the platform caters to, absent traditional shareholders.

As a pioneering name in the world of passive and fund investing, Vanguard is definitely worth checking out if you need a low-cost, online trading platform to fulfill your investing needs.

There are better places, such as Trading 212 and IBKR, if you want to be an active trader, but for long-term investing Vanguard is hard to beat.

Make the most of trading apps like Freetrade with Whop

Freetrade is a great online trading app to start your trading journey on if you’re a UK-based investor, and its simple interface, streamlined feature set, and selection of popular stocks and ETFs can really help beginner traders catch the bug. Putting some skin in the game with an app like Freetrade definitely helps the learning experience, but it’s always wise to supplement that in other ways.

But how do you know what trades to make?

Here on Whop, where you’ll find trading courses to help you learn the basics of trading as well as more advanced concepts and strategies, allowing you to make full use of what Freetrade has to offer—and beyond that, Whop is also home to some of the internet’s premier expert-led trading communities where you can get personalized instruction, workshops, and mentorships designed to unlock the expert trader in you.

Check out trading on Whop today and find out how you can become a better trader.