It’s a fact. Technology has changed how we spend, save, and invest for the future. Since Amazon first opened its (virtual) doors in 1996, the Internet has fundamentally reshaped our relationship with money — and it shows no signs of stopping.

For millions, weekly trips to the mall have now been replaced with Amazon vans speeding down suburban highways, and bulging orange bags filled with goodies ordered from Temu. Once, most left their investments in the hands of a trusted financial adviser. Today, countless people are taking control of their financial future, buying stocks and cryptocurrencies through mobile apps.

It’s a quiet revolution in consumer habits, and it shows no sign of ending — or, for that matter, changing. But is this revolution a universal one, or is it influenced by age, gender, and household wealth?

To find the answer to this question, Whop surveyed over 1,100 Americans about how they spend, save, and discover new products and services. The survey also dove into their relationship with social media platforms, their openness to influencers, and their attitudes toward entrepreneurship.

Here’s what we learned.

Details of the Survey:

The study aimed to represent each age group equally, with sample groups built around their respective generations.

- 28% of respondents were aged between 18-29 (referred to as “Gen-Z”). A further 24% were aged between 30-44 (described as “Millennials”). Those aged between 45-60 accounted for 25% of all survey respondents, with 23% aged over 60.

- 677 (or 61%) of respondents identified as female, with 441 (39%) identifying as male.

Ecommerce Through the Ages: Key Takeaways

Social Platform Preferences:

- Instagram and TikTok have significant sway on the purchasing decisions of Gen-Z, with over 29% of the cohort selecting TikTok as their most-used social networking platform, closely followed by Instagram at nearly 28%.

- Millennials are the first demographic group where Facebook is the dominant social network, with 37% saying it’s the platform they used most. Instagram and TikTok followed, with 26% and 13% respectively.

- Facebook’s commanding lead as the preferred social networking site continues to grow as our age groups skew older, with 49% describing it as the platform they used most. Just 20% selected Instagram — the second-most popular network.

- Facebook was the most popular social networking site among the over-60 group, and it wasn’t even close. 69% described it as the social network they used most of all. Its closest named rival, Instagram, was preferred by just 9%.

Online Shopping Trends:

- Gen-Z prefers Target over Walmart for online shopping, if only by a small margin, with almost 53% of the demographic choosing Target and nearly 52% choosing Walmart.

- As the demographics skew older, the number of consumers preferring Walmart to Target increases. This trend begins in the millennial cohort, with 59% having purchased goods from Walmart in the previous six months, compared to 56% for Target.

- As our samples grow older, Walmart’s lead over Target lengthens, with 62% of those aged 45-60 having made an online purchase with the Arkansas-based supermarket chain, and just 39% having bought from Target. The 45-60 group was also the most likely of all age segments to have shopped at Temu — the China-based online discount retailer — with 24% claiming to have made at least one purchase in the past six months.

- The over-60 group reported shopping at Amazon at higher rates than any other demographic group, with over 94% claiming to have bought something from Amazon in the previous six months (compared to 87% of those aged 45-60, 82% of millennials, and 89% of Gen-Z).

- When compared to every age group mentioned in the study, the 45-60 cohort used mobile devices (defined as a smartphone or tablet) for the largest percentage of their online activity, with desktops. Nearly three-quarters of all internet use (73%) occurred on a mobile device, with traditional laptops used for just 27%.

Attitudes Toward Investing:

- We asked each group how they would invest a hypothetical $50,000 windfall. Of all the groups surveyed, Gen-Z was the most likely to say they would invest in their education (11%).

- Millennials were half as likely to say they would invest an unexpected $50,000 windfall into their education as Gen-Z (5 compared to 11%). They were also modestly less enthusiastic about novel or risky investment strategies compared to Gen-Z, with fewer saying they would invest the windfall into cryptocurrencies (9% compared to 10%) or collectibles (5% versus 8%).

- The 45-60 segment were vastly more likely to say they’d save for retirement than the other younger age groups, with 17% of millennials and 15% of Gen-Z choosing this option. Although traditional investment approaches were highly popular with this group (like buying real estate or investing in the stock market), the 45-60 segment expressed high levels of enthusiasm for novel or risky investment approaches. 14% said they would buy cryptocurrencies or digital assets. This was the most of any age group, and close to the percentage of those who said they would buy stocks (14%).

- Over-60s were more likely than any group to say they would invest an unexpected $50,000 windfall into their retirement savings, with 39%. The second-most popular option, purchasing real estate, was selected by 22%. This segment expressed the lowest levels of enthusiasm for novel or risky investment strategies of any age group, with just 0.39% saying they would use the $50,000 to purchase cryptocurrencies and 1% saying they would buy collectibles.

Gen-Z: The Power of the Algorithm

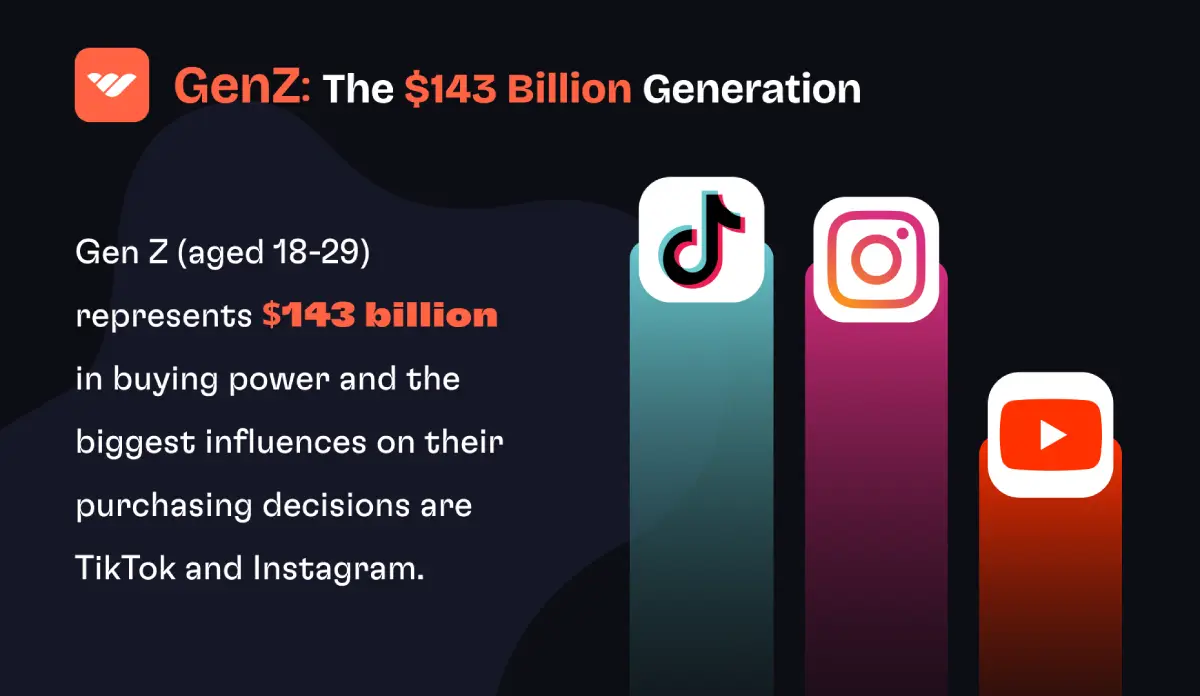

For marketers, Gen-Z represents a valuable demographic. While it’s hardly the most affluent, as demonstrated by Whop’s survey, with roughly 58 percent reporting household incomes below the US median of $74,480, it remains a force to be reckoned with. Aged between 18-29, this youthful cohort represents $143 billion in buying power. Gen-Z has the power to influence family purchasing decisions, and the spending habits (and brand affinity) they build now will linger throughout the rest of their lives.

So, it’s fair to ask: Who’s influencing Gen-Z? If you know any twenty-somethings, the answer shouldn’t come as a surprise. The two social networks with the biggest sway on their purchasing decisions are Instagram and TikTok, which are trailed narrowly by YouTube.

Gen-Z was the sole demographic segment where Facebook wasn’t the dominant social network. When asked which social networking websites they used most often, approximately 29% of Gen-Z selected TikTok, with Instagram chosen by almost 28%. Legacy social networking sites fared poorly in this group, with less than 19% of Gen-Z choosing Facebook and around 15% percent choosing Twitter.

While this finding could be interpreted as younger consumers preferring highly visual content, it’s also a reflection of the power of timelines and recommendation algorithms. Gen-Z prefers to swipe up through a never-ending feed of their friends’ photos or watch algorithmically-curated short form videos on TikTok or YouTube. These platforms (and the creators that use them) know their audience, and so, they’re in a position to influence.

Attitudes to Entrepreneurship Vary With Age

We asked each respondent the following question: Would you rather make $200,000 a year working for a company or $100,000 a year working for yourself? One answer represents stability and routine. The other represents freedom, risk, and — perhaps — opportunity.

If you assumed that Gen-Z would be the generation most open to entrepreneurship, think again. That cohort was the most likely to say they’d prefer to work for a company, with 61.01% choosing that answer.

Every other demographic showed a strong preference towards self-employment, with 52.03% of millennials and 54.01% of those aged between 45-69 choosing the $100,000 option.

How Age Influences Investing

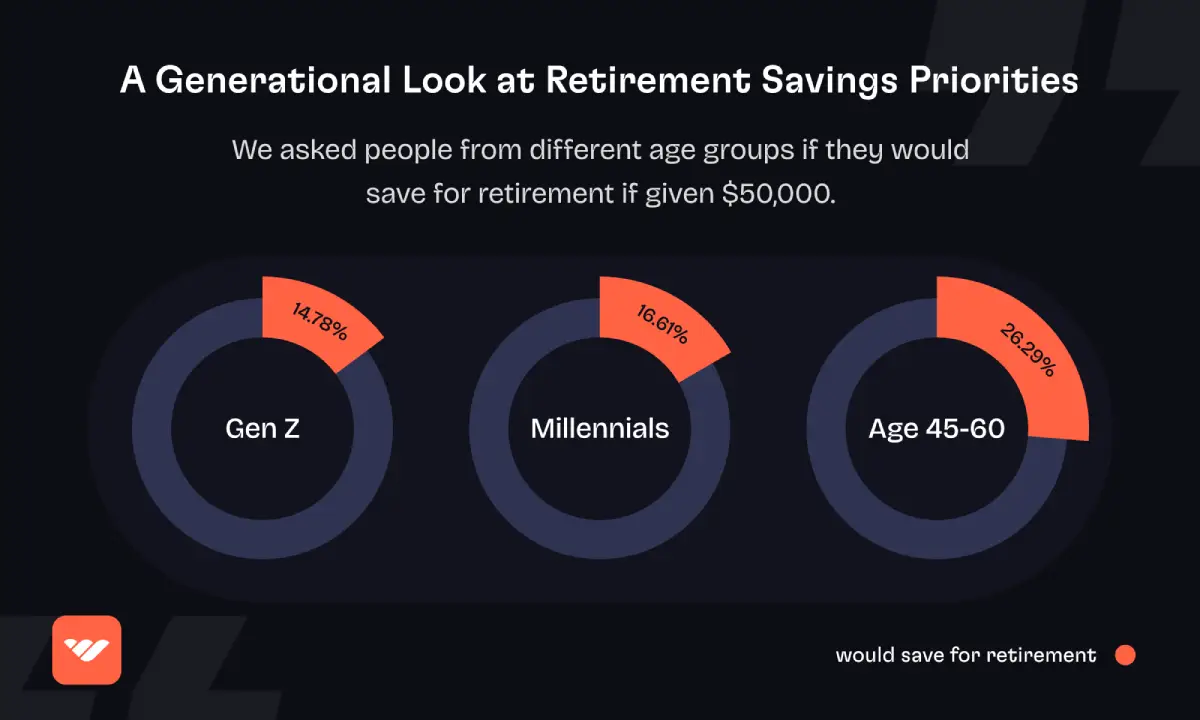

We posed our audience another question: If you were given $50,000 to invest, what would you do with it? When we break down the responses according to age group, we see several striking differences.

Each group showed a high affinity for conventional investment strategies — the stock market, real estate, and launching a new business. But the group most likely to say they’d save it towards retirement was — perhaps unsurprisingly — those aged between 45-60, with 26.29% selecting this option, compared to just 16.61% of millennials and 14.78% of Gen-Z.

Gen-Z expressed a slightly higher preference for riskier investment strategies than the older cohorts and was most likely to state they’d use the $50,000 to purchase cryptocurrencies or collectibles. Perhaps reflecting the spiraling cost of college tuition, they were also nearly twice as likely as millennials (and more than three times as likely as those aged between 45-60) to say they’d use the money towards their education.

Thrift is Universal

We asked our audience to name the online retailers they used over the past twelve months. Unsurprisingly, the three most popular options for all age groups were Amazon, Walmart, and Target, with Amazon taking the top position by a significant margin.

Gen-Z, however, was the only demographic group to prefer Target over Walmart, albeit by the narrowest of margins (52.83% to 51.89%).

And yet, despite the comparatively stronger purchasing power of our older respondents (and vastly higher household incomes), we saw similar levels of enthusiasm for discount and second-hand retailers across every age cohort. Temu, Shein, Craigslist, and Facebook Marketplace demonstrated strong (and strikingly similar) levels of popularity across the ages.

The only surprise was Temu, with nearly a quarter (24.09%) of those aged between 45-60 reporting having purchased from the ascendant Chinese online retailer, compared to 21.03% of millennials and 16.04% of Gen-Z.

Of Influence and Affluence

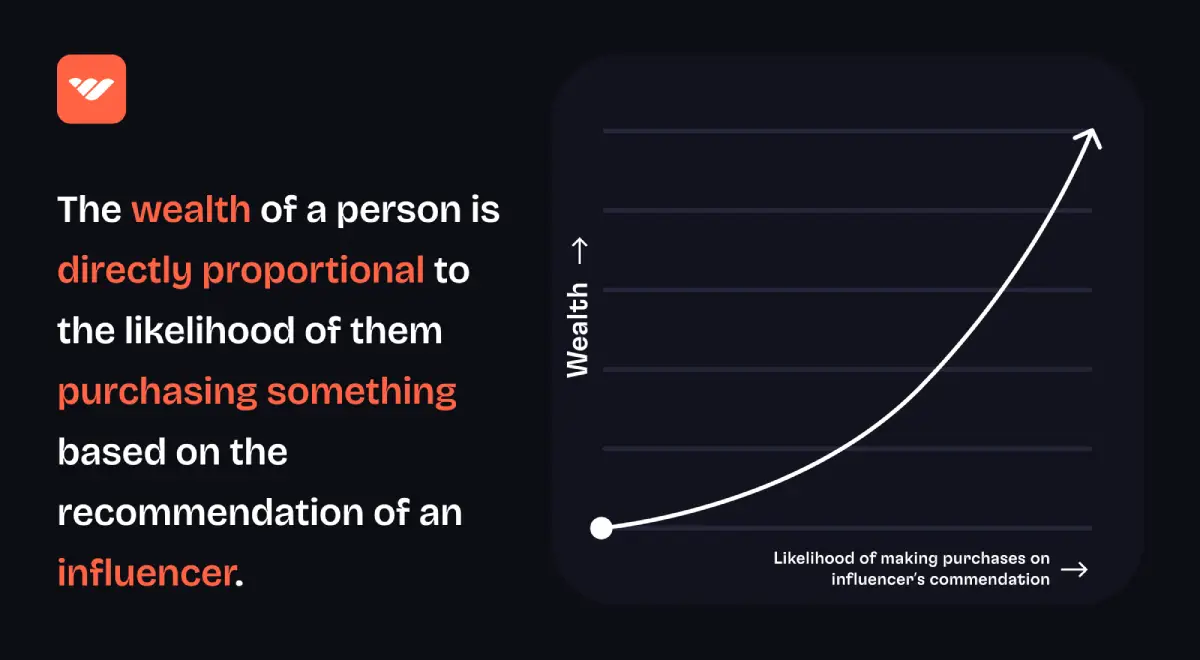

When we divided the data into those earning more than $100,000 and those earning below that figure, we noticed several striking trends. Perhaps the most surprising was that wealthier consumers were more likely to purchase something based on the recommendation of an influencer.

We asked our panel: “How likely are you to buy something if an influencer recommends it?” One-fifth (19.57%) of those earning over $100,000 said they were “very likely” to buy an influencer-recommended product, compared to just 5.93% for everyone else.

Wealthier respondents also, on aggregate, expressed a greater sensitivity to influencer recommendations, with almost half (49.07%) saying choosing the “very likely,” “likely,” or “somewhat likely” options. For those in the sub-$100,000 group, that figure was significantly lower at 37.1%.

The Future of Ecommerce Lies With Gen-Z

There you have it. The impact of technology on our financial behaviors is undeniable, and whether through social media, online retailers, or influencers, the digital age is reshaping how we spend, save, and invest. The cohort with the lowest median income (Gen-Z) also represents a surprising amount of buying power, and spending habits that are heavily influenced by social media, algorithms, and online creators.

As technology evolves, it is crucial that we understand and harness these market shifts. The spending habits of Gen-Z will shape the market in coming years. Even now, we see a surprising amount of buyers age 45-60 purchasing from online retailers like Temu. For product owners, marketers, and ecommerce entrepreneurs, it is crucial that they not only understand but harness the buying preferences of the younger generations, as Gen-Z ushers in a new age of online spending.

If you want to harness the power of the growing landscape of online shopping, then sign up as a seller on Whop. Gen-Z are ready to spend - make sure that you put your product on Whop's thriving digital marketplace.