Creators are ditching slow banking systems for fast, global, automated payments. See why the modern entrepreneur’s money flows through payment tools.

Key takeaways

- Gen Z creators build their own financial stacks using multiple payment tools because traditional banks can't keep up with online business needs.

- Using multiple payment rails and processors protects creators from catastrophic account freezes that can destroy entire businesses overnight.

- Payment automation eliminates manual invoicing, failed charges, and currency conversion—letting creators focus on their work instead of chasing payments.

Allie is a brand photographer in Australia. She hasn’t stepped inside a bank in three years. Her invoices go out through Pixieset, her payouts arrive through Stripe and Square, and she pays her clients on her phone.

My bank is basically an app store. I don’t even think about branches or wire transfers anymore. Everything just moves.

- Allie Dodds, Photographer

It’s not that we are rejecting banks - it’s that banks can’t keep up. So creators turned to the tools that could, and those tools became their real financial layer.

The bank of mum and dad (literally)

When I was a kid, money moved in ways that feel almost fictional now. I remember standing in shops while my parents paid by cheque, literally handing over a piece of paper that said, “I promise I’ll pay you later,” with no real guarantee behind it.

If you've seen Catch Me If You Can, then you know the danger I'm talking about here. The system ran on trust, paper, and the desperate hope that everything would clear.

And if it wasn't? Too bad. Good luck getting your cash.

I remember signing receipts after paying on a debit card, too. The little machine would spit out a slip, and you had to manually approve the transaction with a signature that nobody ever checked. Then at seventeen, I got my first chip-and-pin card, and it felt like the future (Ok, wow, I’m showing my age now.)

Now we have tap-and-pay, text-to-pay, banking apps and AI banking chatbots. But even with these advancements, traditional banks haven’t evolved at the speed that the rest of the world has.

The banking system we inherited isn’t the one we need today

Traditional banks weren’t designed for people who run businesses online, sell across borders, or need money to move in seconds.

- They close on weekends and public holidays -which, in the UK, are literally called “bank holidays” because the bank gets a day off.

- They freeze “suspicious” transactions over the smallest things. (I once got a fraud alert for spending $2 in a shop two hours from my house. Congrats guys, you could have cracked open a huge case with that one.)

- They leave you stranded in emergencies. Like when I solo-traveled South America, had my card frozen, and couldn’t speak to anyone because it was the weekend - and my bank, apparently, doesn’t participate in weekends.

Their open hours match 9-5 work hours, and their onboarding is paperwork on paperwork.

Every process takes too long, every step is too complex, and every system feels like it was built for a generation that did business face-to-face, not phone-to-phone.

Why creators are building their own financial stacks

When a system isn’t built for you, you eventually stop relying on it.

Derek Wilmer learned that long before he ever worked at Whop. Back in 2019, he was running his own ecommerce brand when PayPal froze $264,000 of his money without warning.

Yep. A huge quarter of a milly, for a generic “elevated risk” label. This was standard for PayPal, but business-destroying for Derek.

That moment showed me how little power small businesses actually have. One processor makes a decision and your entire livelihood is on hold — you don’t get a say, and you don’t get a human to talk to.

– Derek Wilmer, Whop

And guess what? They never gave the cash back.

That experience isn’t rare in the creator world. Almost every online entrepreneur has lived some version of this - the bank or processor decides you’re a problem, and suddenly you’re locked out of your own revenue.

And there’s no one to call, no human to escalate to. Most account freezes or bans are triggered by AI systems that don't care about your business at all.

As Derek puts it: Creators think they’re being targeted when something goes wrong. They’re not. The whole system was built long before online business existed.

So creators did what creators do best - they built their own workaround.

Instead of relying on old-school banking systems, online entrepreneur use a mix of invoicing platforms, payment apps, and tools that let them work with clients all over the world.

The new entrepreneur payment stack

Here’s what today’s default money flow really looks like, without the bank teller.

1. Invoicing that moves money instantly via payment links

Invoices are no longer a PDF that you attach to an email — now, an invoice is a link that gets you paid.

The old flow looked like this:

The new flow is closer to this:

Payment links work much better than traditional invoices because they get rid of time-consuming tasks (like downloading pdfs and logging into a bank), work on mobile by default, and plug straight into cards, wallets, and sometimes local rails.

Plus, they are much harder for a client to “lose” in their inbox.

2. Multiple payment rails

Having one single payment method means that you have a singular point of failure.

So, instead of relying on just one method, creators use whatever rail gets the money through fastest with the fewest issues.

Here’s what that looks like in practice:

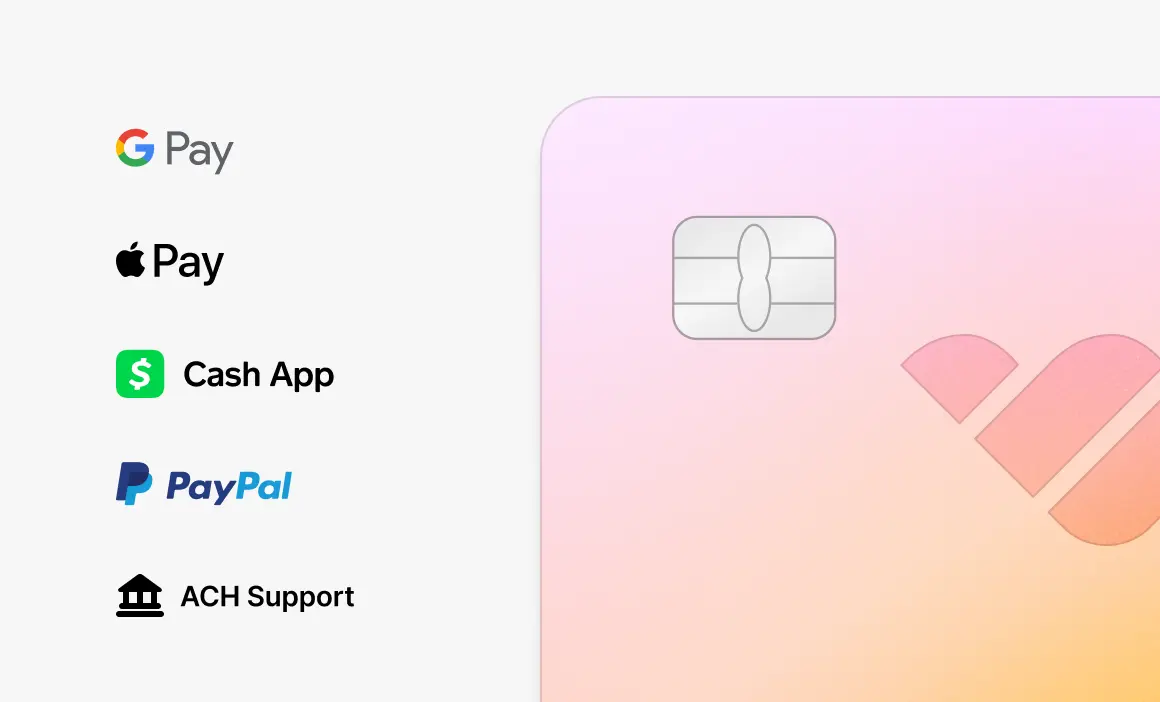

Cards (the default rail)

Still the most common way clients pay, especially US, UK, and EU clients. Creators use credit card processors like Stripe, Square and Apple Pay (via their processor) to get instant approvals easily for clients all around the world.

But, credit card processing typically comes with higher fees than other methods, and is the most sensitive to fraud/AI flags.

ACH & Bank Transfers (the low-fee rail)

ACH and direct bank transfers are popular for agencies, long-term clients, and retainer billing. Creators use ACH through payment partners Whop or Stripe, or account-to-account transfers through Wise or GoCardless.

But, while fees are low, these payments clear slowly (3–5 days), and some clients hesitate to connect their bank accounts.

Digital Wallets (the 1-click rail)

Wallet payments like Venmo, Cash App, Apple Pay, and Google Pay convert extremely well because the buyer’s card is already saved. They’re fast, mobile-friendly, and ideal for global customers who want a frictionless checkout.

But, they’re not always ideal for recurring billing, and fees can be slightly higher depending on the provider.

Local Payment Methods (the global rail)

For international clients, local rails like SEPA (EU), iDEAL (Netherlands), PIX (Brazil), UPI (India), and Interac (Canada) dramatically reduce declines and FX fees.

They also make your checkout feel native to buyers in that region, meaning that they trust your business.

But supporting these methods usually requires a payment platform with multi-currency and local acquiring built in - like Whop.

"Local acquiring matters. A UK customer paying a UK business gets approved faster, costs less, and wins chargebacks more often" says Derek, "That’s why we built multi-entity acquiring across regions."

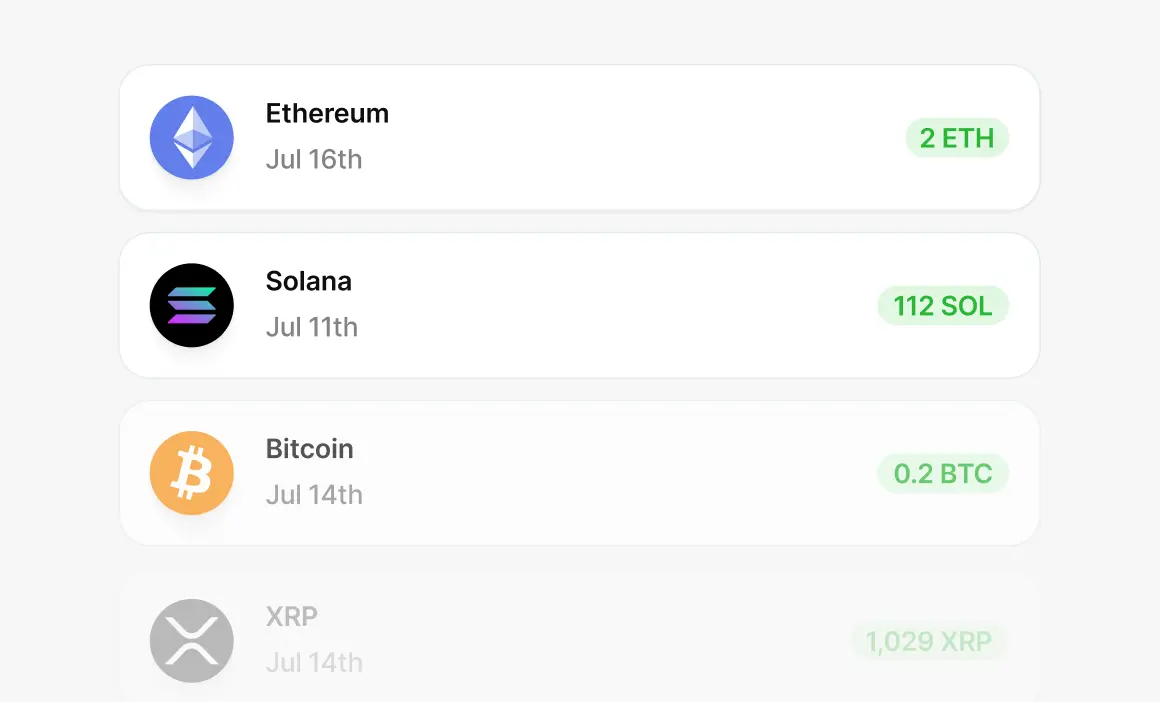

Crypto (the backup rail)

USDC and USDT have become the go-to option when traditional rails fail - especially for cross-border payments, contractor payouts, and clients in places where banking is unreliable.

Why? Because they’re instant, global, and don’t require bank approvals.

But not every client is comfortable with crypto payments yet, and using wallets requires a small learning curve.

3. Global payouts

Most creators and online entrepreneurs work with clients across multiple countries, so their payout system needs to actually support that. Traditional banks slow things down with FX fees, transfer delays, and “suspicious activity” flags.

Today's payout tools skip all of that, with creators using tools like Wise, Payoneer, Whop, and stablecoins to get paid faster, with lower fees, and on their own timeframe.

I've already touched on this, but it's worth saying again - this is where local acquiring becomes a real advantage. When the payment and payout happen within the buyer’s region, everything gets easier: fewer declines, lower fees, and higher trust.

"When we route a payment through a local entity, everything improves — approval rates, fees, even chargeback outcomes. It just looks ‘right’ to the customer’s bank." - Derek Wilmer

4. Automation as financial infrastructure

It's not just what is stacked, but how the stack works. With automation, payments run themselves - it removes the missed invoices, the failed charges, and the “hey! just bumping this to the top of your inbox!!!” messages every creator hates sending (I've sent more of these than I can count).

Through thousands of conversations, we’ve learned our customers really only care about two things: getting paid and paying out. Our mission is to be the best in the world at solving those problems.

– Hunter Dickinson, Head of Partnerships at Whop

Payment automation today looks like:

- Auto-billing: invoices generate and send themselves on a schedule

- Saved payment methods: the system charges the client automatically on the due date

- Auto-retries: if a payment fails, it retries on its own

- Smart routing: transactions get sent to the bank most likely to approve them

- Auto-currency: no more manual FX calculations

- Automatic access control: payment clears → access granted; payment fails → access paused

For a creator running a global business, this removes hours of manual admin every month.

5. Fail-safes (what banks get wrong)

At the start of this article I mentioned getting stranded in South America when my bank froze my card on a weekend, with no human to call and no way to fix it.

That’s the old system defined - one bank, one processor, one point of failure.

And that was just me trying to access the (very limited) cash in my own personal account - imagine if this happened for your entire business?

Creators can’t operate like that anymore. So the modern payment stack builds in something banks never bothered with: redundancy.

If one bank blocks a transaction or a processor glitches, the payment shouldn’t die - it should instantly route somewhere else. Platforms like Whop do this under the hood by using multiple processors and banking partners at the same time.

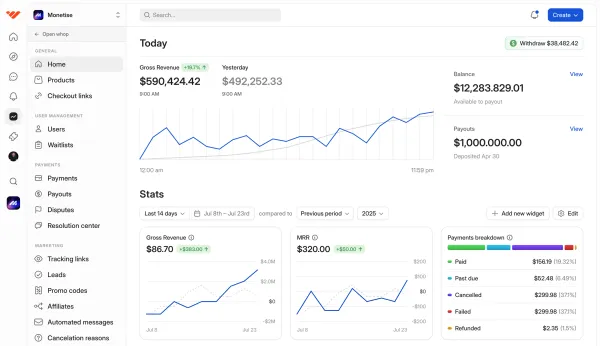

Why Whop is building the future of creator payments

The way money moves has changed, and modern businesses don’t have time for slow payouts, blocked transactions, or payment fails. Every delay is a lost sale, and every freeze is a lost customer.

That’s why we built Whop Payments - so your entire stack lives in one place. It’s why creators like Allie are leaving three different tools behind and running everything through Whop instead. One platform, one payment system, money that moves at the speed of your business.

Whatever you're selling, sell it with Whop.