Rocket Money simplifies your finances by canceling unwanted subscriptions, negotiating bills, and tracking spending. But will it really work for your budget?

Key takeaways

- Rocket Money consolidates all your financial accounts into one dashboard, helping you spot and cancel forgotten subscriptions automatically.

- Bill negotiation services take 30-60% of first-year savings, making DIY negotiations often the smarter financial choice.

- Premium features require annual payment ($48-144/year), but the free tier offers limited functionality for serious budgeting needs.

During tough financial times, every cent counts, making strict budgeting a necessity for many. However, with monthly subscriptions coming out of your ears, the cost of living increasing, and more things vying for our attention than ever, it can feel almost impossible to keep on top of your finances.

That’s where Rocket Money comes in.

With this digital budgeting app, you can display all your outgoings, cancel unwanted subscriptions, and save yourself sleepless nights worrying about money.

This review of Rocket Money takes a deep dive into its features. Could this all-in-one set of finance tools match your high expectations? Let’s find out.

What is Rocket Money?

Rocket Money is an app that makes it easier to simplify your finances. It does this in a number of ways, including managing your transactions and subscription fees and helping you budget.

You can also set financial goals, giving you something to aim for going forward, as budgeting can be tricky without incentives.

The app has a relatively short but eventful history, having initially been founded in 2015 under the name Truebill. Within a year it was acquired by Y Combinator, a technology startup accelerator, before being sold to Rocket Companies in 2021 for over $1 billion.

At a glance: Rocket Money pros and cons

| Pros ✅ | Cons ❌ |

| Cancels unwanted subscriptions for you | Bill negotiations are unreliable |

| Connects to multiple bank accounts | Only accepts annual payments |

| Pay-what-you-want pricing model | Limited features on the free plan |

| Easy to navigate the app | Poor customer support |

| Not available outside of the US |

How does Rocket Money work?

Rocket Money works by connecting your bank accounts to the app and providing you with relevant information about your spending activity. You can view graphs, statistics, and a variety of other data formats.

These will give you a greater understanding of your saving success, highlighting where you’re doing well and where you need to improve.

Your bank accounts are integrated with Rocket Money using Plaid, a third-party financial service. This might make some people feel slightly vulnerable, however, it shouldn't.

That’s because Plaid acts as a middleman between Rocket Money and your bank. Plaid authorizes Rocket Money to use your online banking credentials but not to store them on its own servers.

Rocket Money uses a number of measures to keep your details and data safe, including:

- End-to-end 256-bit encryption

- Servers hosted on Amazon Web Services (cloud computing)

- Partnership with Plaid

You can also delete your Rocket Money account at any time if you are convinced your data is at risk of being compromised.

What can Rocket Money do?

Rocket Money aims to both streamline your current finances and save you money in the long run. It does so by offering a range of features, including some that take care of bill negotiations to secure you better deals.

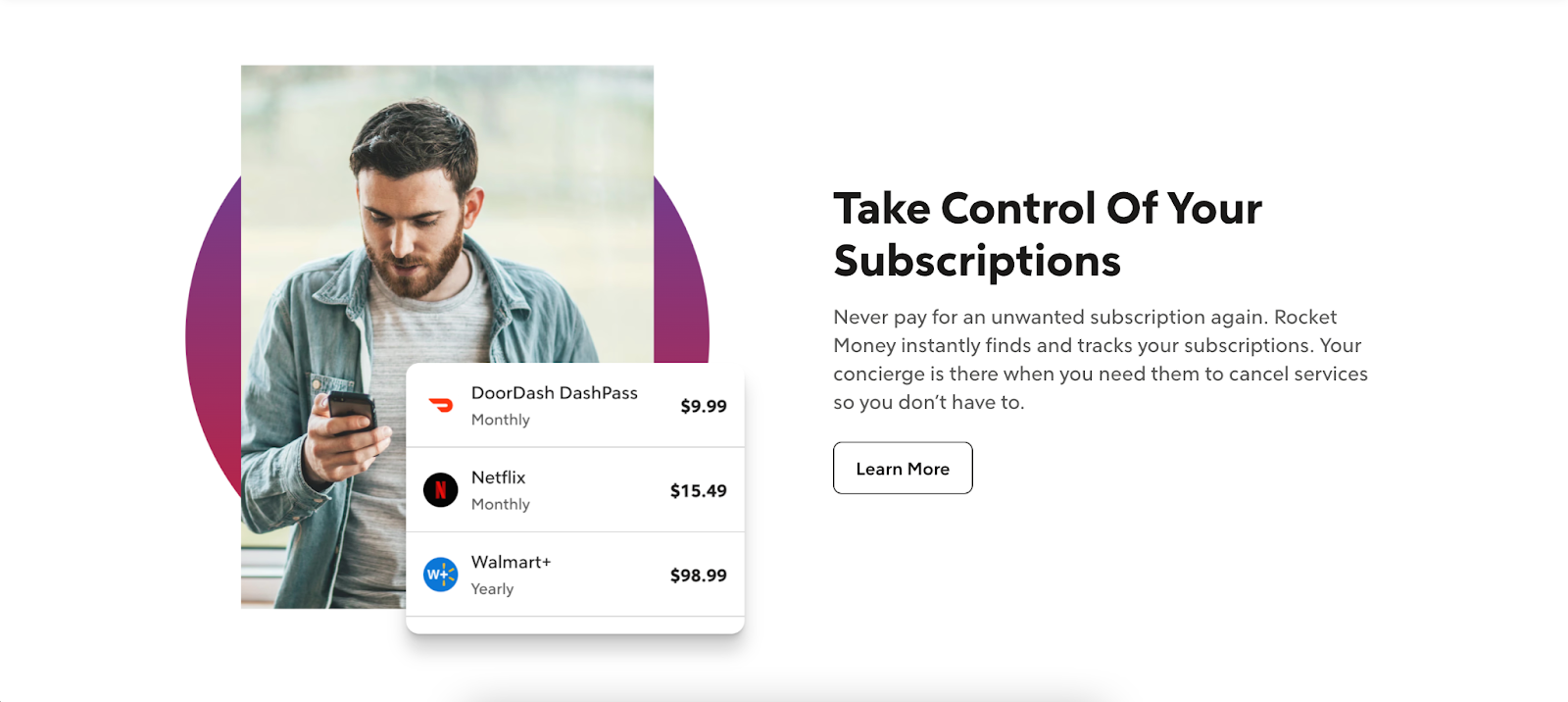

Track and cancel subscriptions

Many people happily pay for monthly subscriptions to stream the latest TV shows, consult reliable sources of news, or use certain apps.

However, you can too easily forget to end subscriptions you no longer want or need, so monthly costs can pile up.

Rocket Money finds and tracks your subscriptions, allowing you to cancel them within the app. You could find yourself saving money you didn’t even know you were spending!

Monitor your credit score

Having a good credit score can benefit you when you’re looking to open credit cards or take out loans. Your credit score lets the lender know how likely you are to be able to pay back your debts, helping them to decide whether to accept your request.

This can also affect the interest rates the lender is willing to offer you. Rocket Money will provide you with tracking tools enabling you to keep a close eye on your credit score.

Track spending

Rocket Money will track every cent that leaves your bank account, allowing you to work out where the majority of your money is being spent. The app will also send you alerts whenever your bank account details are used to make large or uncommon purchases. That way, you can watch out for suspicious activity.

Bill negotiations

Not only will Rocket Money alert you about the bills you are currently paying, it will also identify which bills could potentially be lowered. Rocket Money has a team of expert negotiators capable of negotiating with service providers on your behalf.

This sounds great, but unfortunately, there’s a slight catch if these negotiators actually succeed in arranging a better deal for you. In this situation, Rocket Money could charge you 30-60% of the savings you consequently make in your first year on the app.

You’ll likely put at least 40% of these savings back in your pocket while still losing a substantial chunk of them. This is made even more frustrating as these bill negotiations could more often than not be done by the user themselves rather than the app.

Net worth tracking

Tracking your net worth will give you a greater understanding of your financial well-being, helping you to plan for the future and meet your goals. Rocket Money allows you to do this with ease, giving you peace of mind about your finances.

Are you interested in getting back on top of your personal finances? Explore some of the best personal finance courses available on Whop.

How to use Rocket Money

Now you know what Rocket Money offers, let’s look at how you actually use it. Overall, the app is fairly straightforward to use, provided you have all the relevant details on hand. This includes various bank details that are needed to get started.

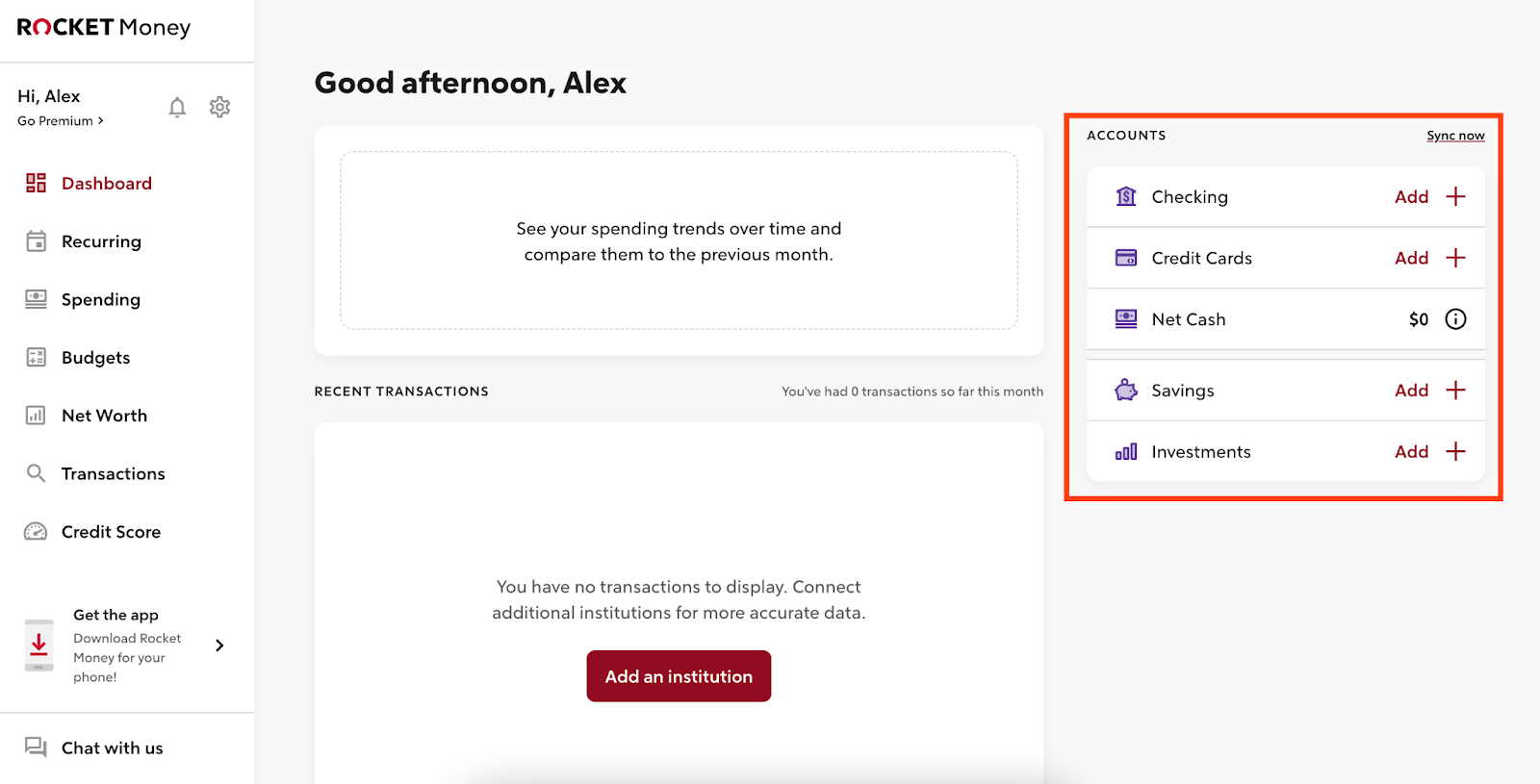

Add bank accounts

Expect this Rocket Money review to repeatedly emphasize the platform’s ease of use, made possible by a slick, simple-to-navigate user interface and dashboard.

The first thing you’ll want to do after signing up is add your bank accounts, as highlighted on the right of the above picture. You can add bank accounts, credit cards, savings accounts, and investments.

You’ll also be able to see your net cash to easily understand how much money you have to your name.

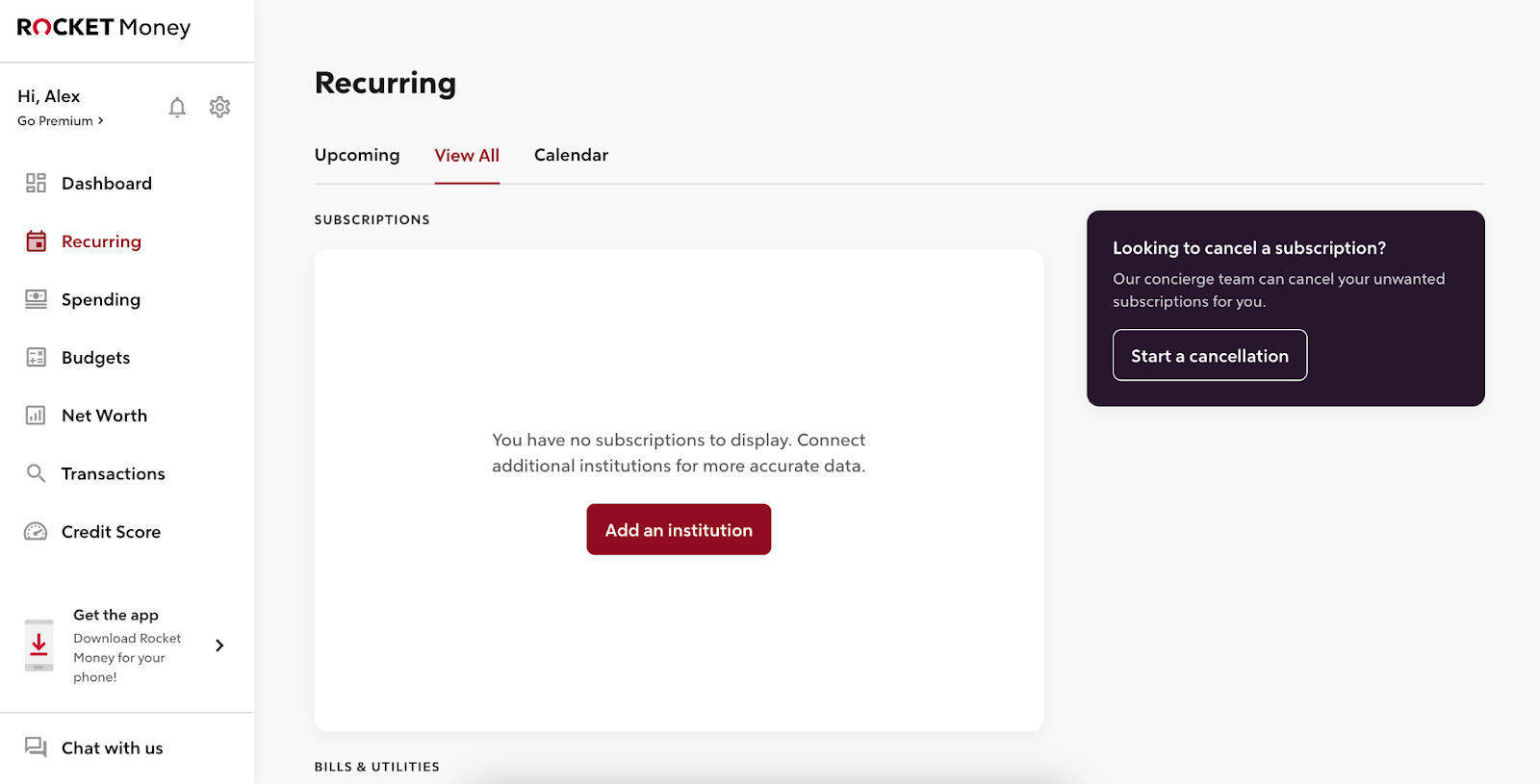

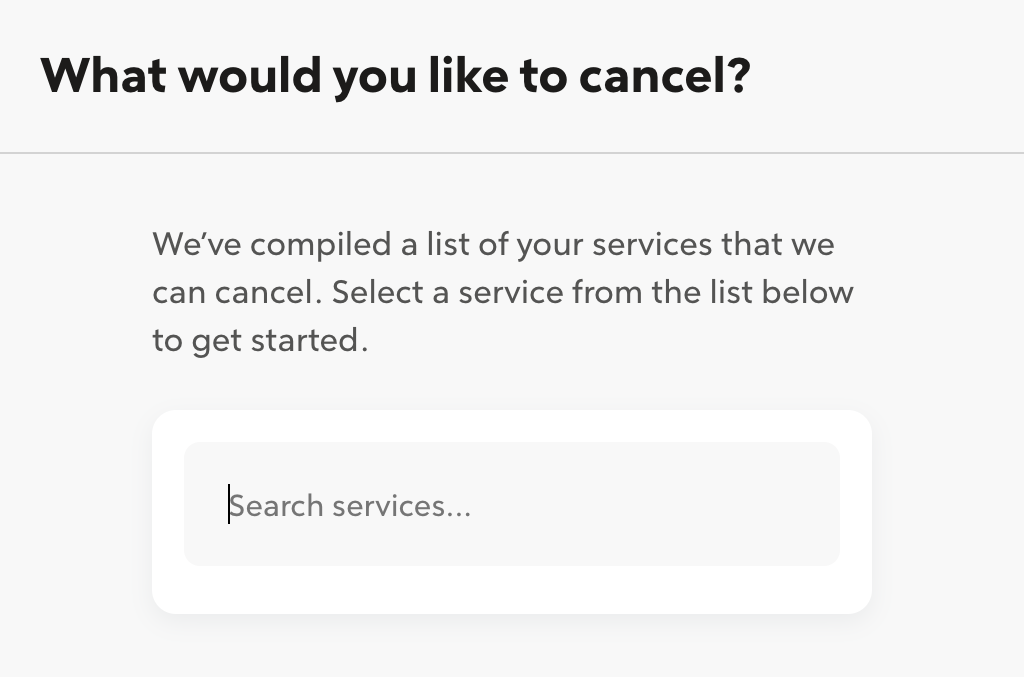

Canceling subscriptions

The next option down from your Dashboard is the Recurring section. This is where you can manage all of your monthly subscriptions and cancel any of those now surplus to requirements.

The Recurring page is another example of the Rocket Money interface’s charming simplicity, with limited distractions surrounding the main Subscription area.

To cancel a subscription, click on the Start a Cancellation button on the right-hand side of the screen.

From here, look up the subscription you want to cancel and click on it. Rocket Money does the rest for you.

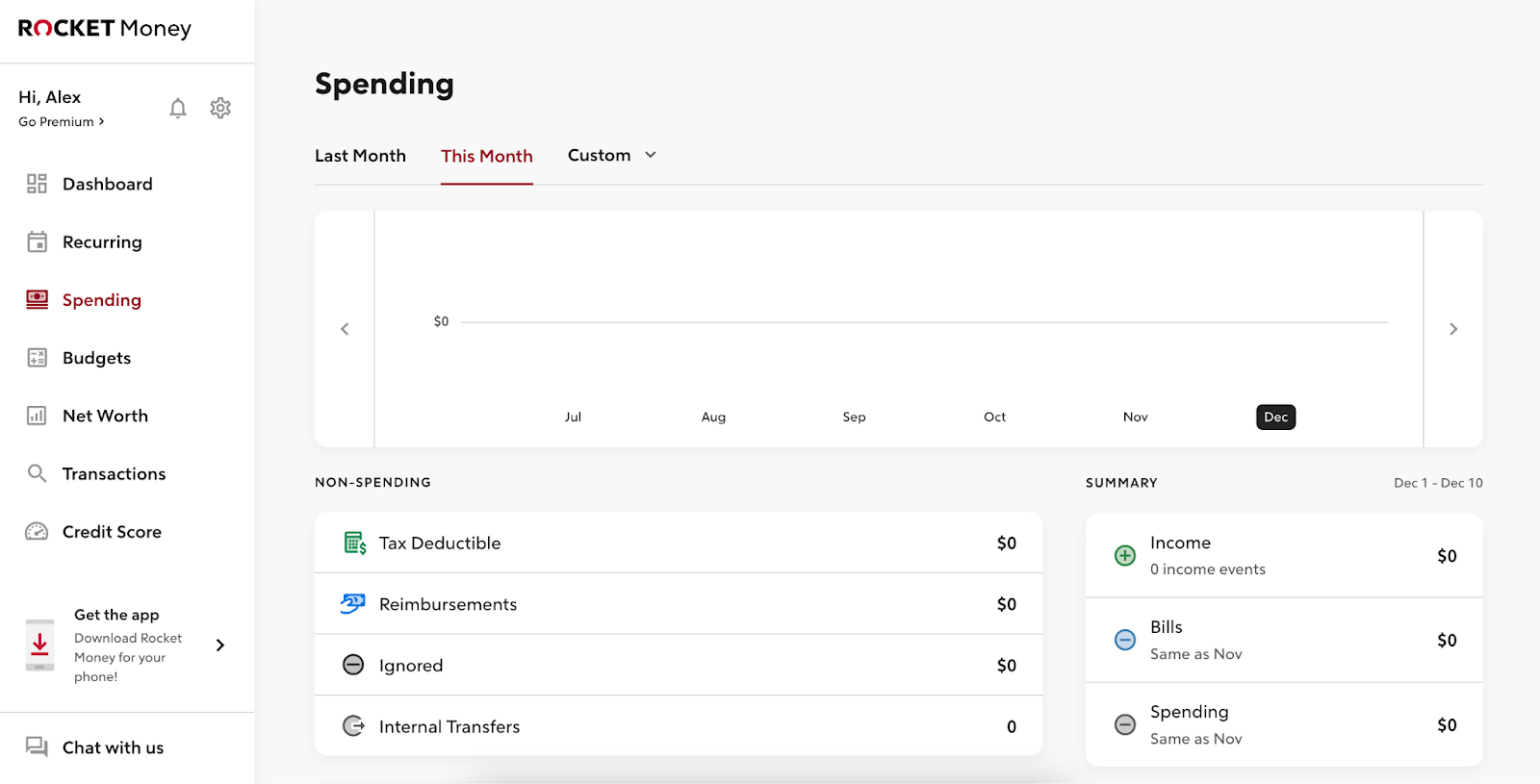

Spending

The Spending page will track your income and outgoings, presenting them to you in the form of a graph.

The platform will also calculate your non-spending income and outgoings for you, such as tax and reimbursements. This will aid you when you’re working out your budgets for the week, month, and year.

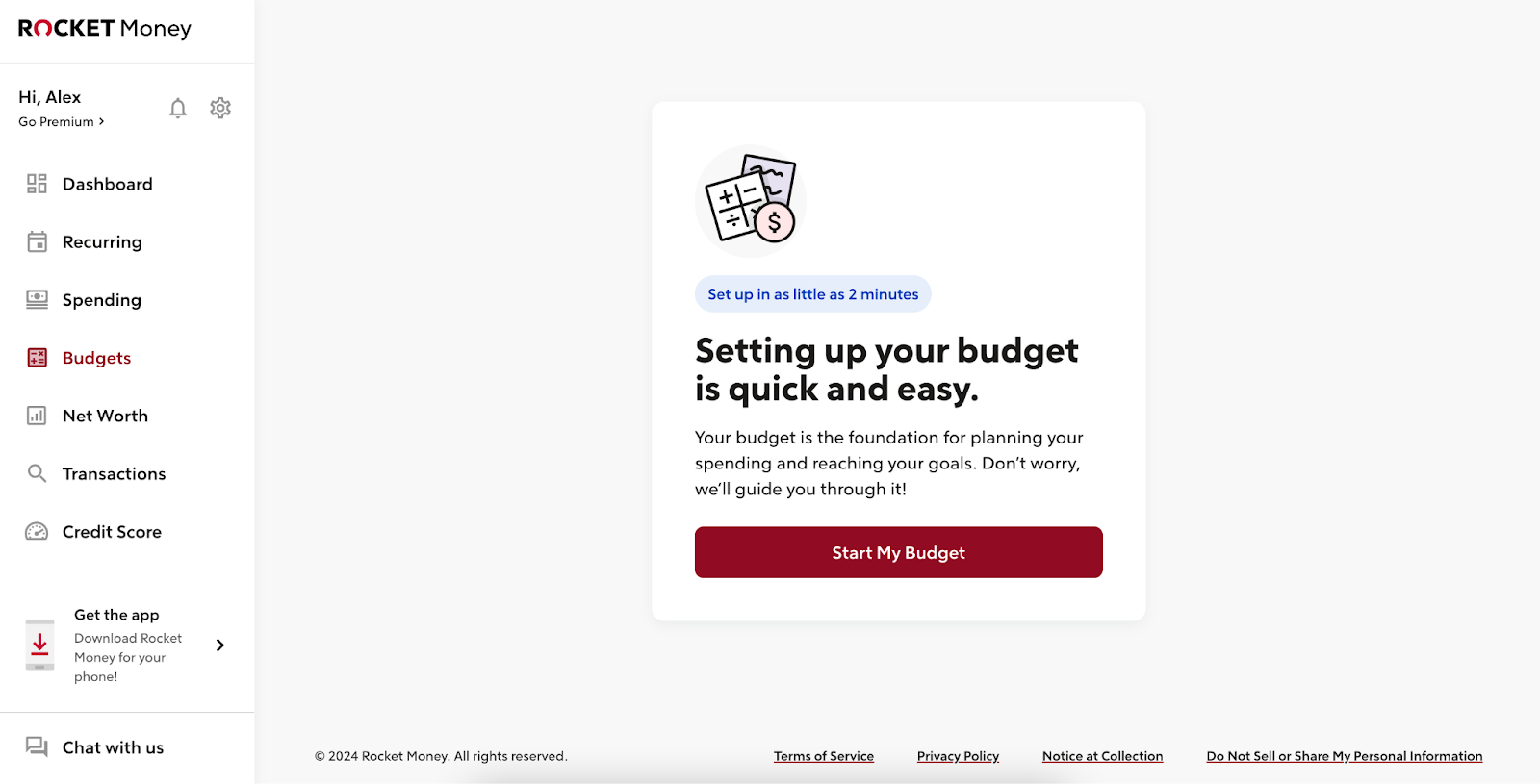

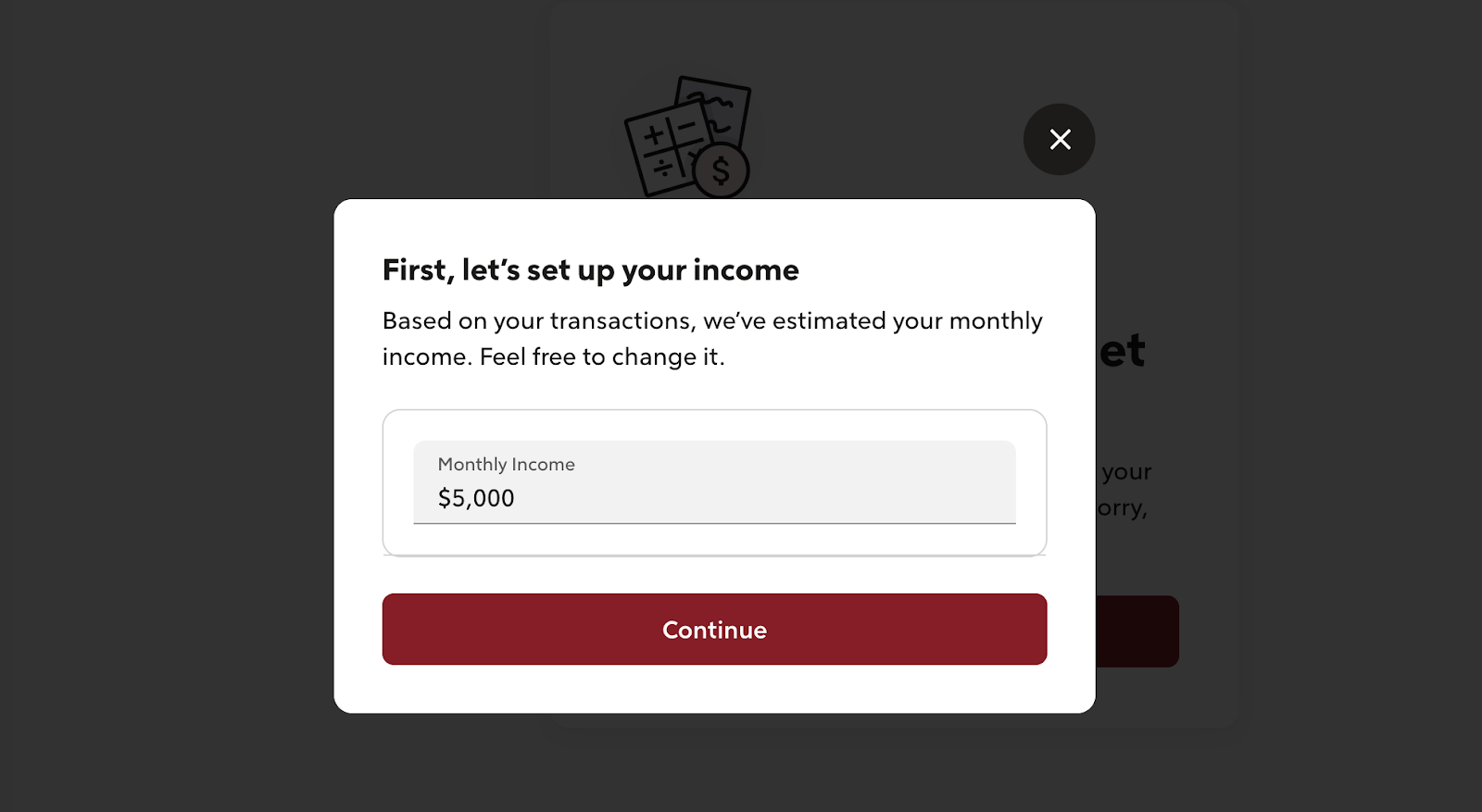

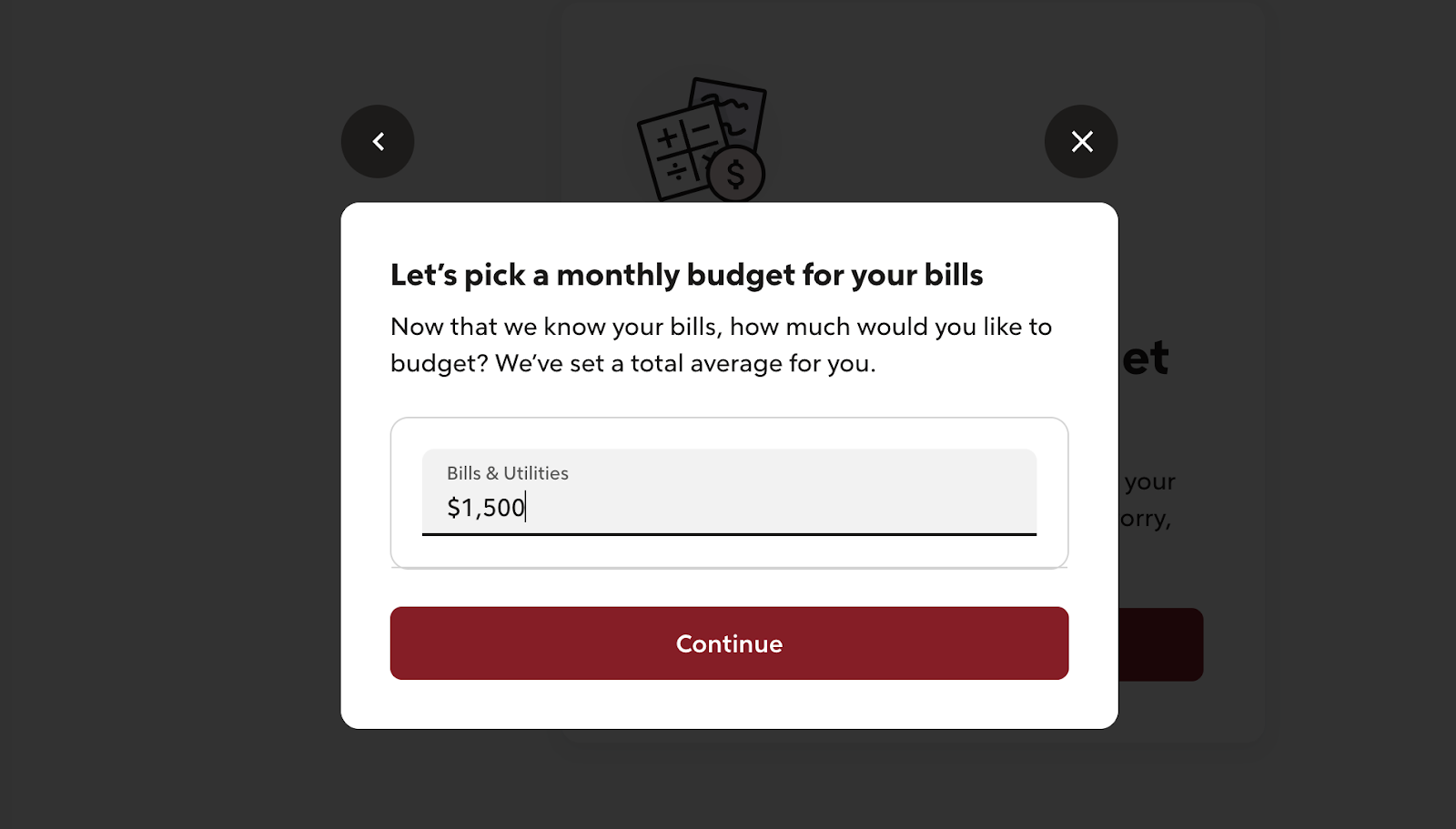

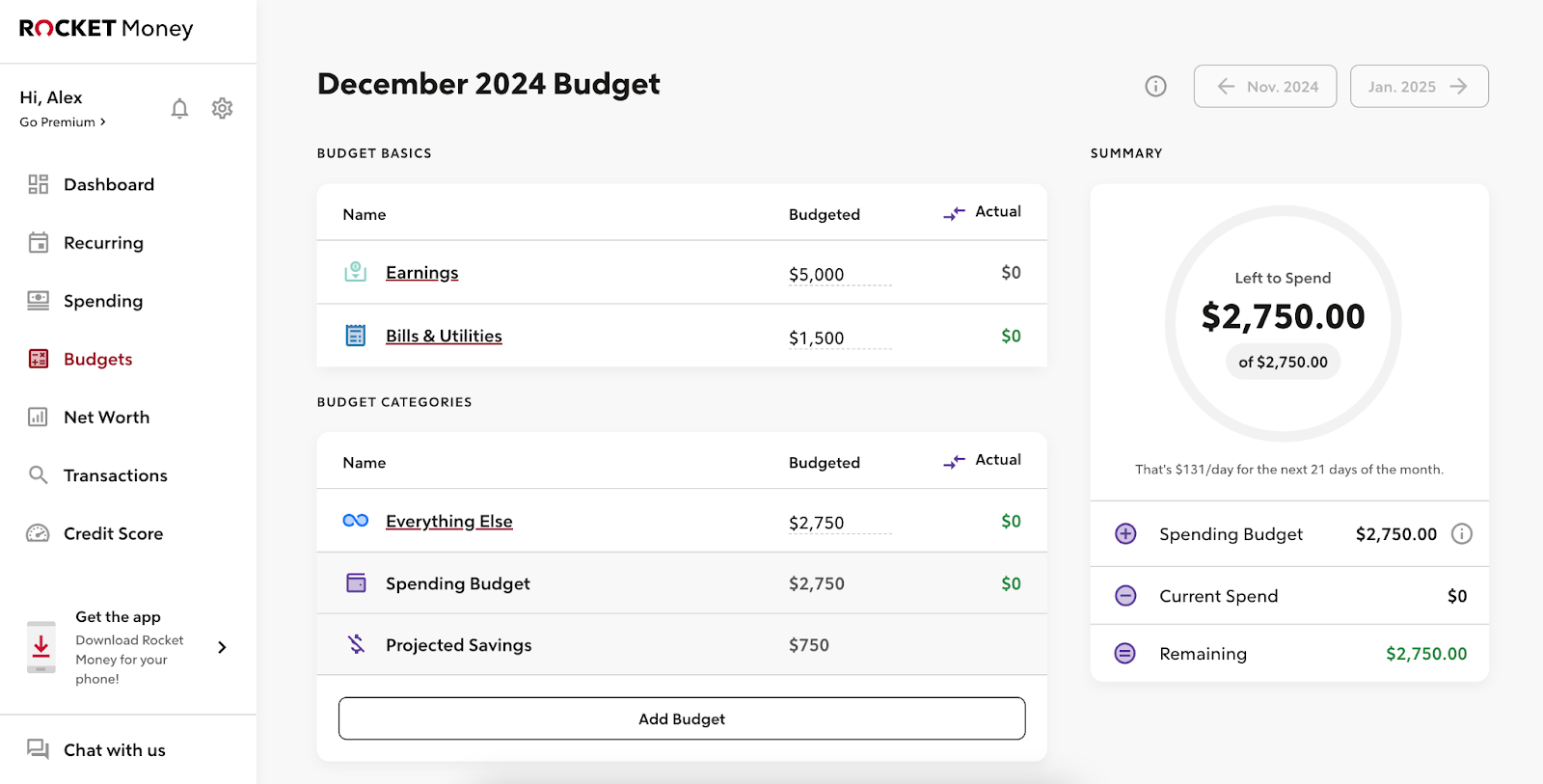

Budgets

Rocket Money’s budgeting features attract many people to the platform. Setting up your budget here just entails entering your monthly income and your monthly outgoings.

Once you’ve entered these numbers, the money you have left to spend will be instantly displayed on your budget dashboard. From here, you can adapt and evolve this number, factoring in bills and taxes for ultimate accuracy.

The Budgets section, as you’d expect, follows the clean, easy-to-understand model of the rest of the site. Unfortunately, the tidiness of the page also reveals Rocket Money’s budgeting features to be surprisingly basic.

With alternative platforms such as Monarch Money and Copilot offering graphs, in-depth projections, and more, Rocket Money’s budgeting does feel a little underwhelming.

Premium features

Of course, Rocket Money can’t keep handing out freebies to its unpaid users, which is why most of its interesting features are behind a paywall. Here is a selection of features only paying members are permitted to use:

🛑 Subscription cancellations: Only paid members can harness Rocket Money’s subscription cancellation features.

🏠 Net worth tracking: This allows you to track your assets and liabilities, giving you an overview of how well-off you are.

💬 Bill negotiation: If the Rocket Money team believes you could get a better deal on a tariff, whether it’s your phone or electricity bill, they will negotiate for you.

🏦 Savings accounts: With this feature, Rocket Money will transfer money from your checking account to savings accounts, helping you to set your cash aside.

👨👩👧👦 Sharing accounts: As a paid Rocket Money member, you can share your account with people you trust.

⏱ Real-time figures: Paid members are entitled to real-time viewing of their account balances. So, you would be able to see what’s coming and going as it happens.

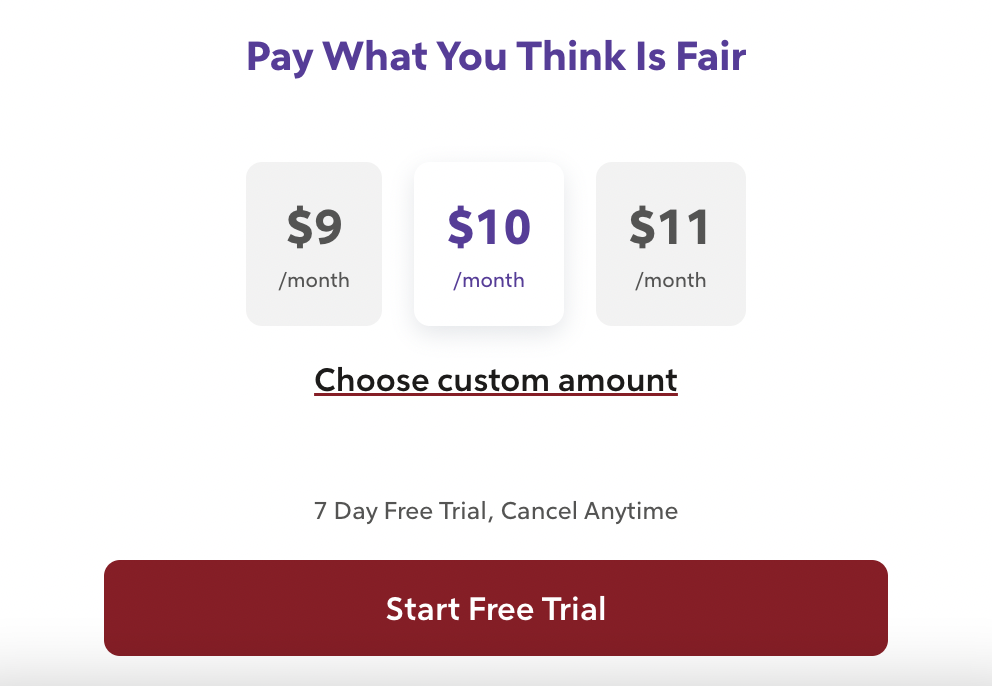

How much does Rocket Money cost?

The app is completely free to download.

However, if you want the very best the platform has to offer, you’ll have to pay a subscription fee. This fee can be anywhere from $4 to $12 a month, with the platform running a rather unique pay-what-you-wish scheme.

The platform recommends you pay $10 a month, but $4 a month will still grant you access to the site’s best features. Rocket Money charges annually, with no monthly option, so you’ll be paying a minimum of $48 in one hit.

On the whole, Rocket Money is cheap for a budgeting app.

Unsure whether paying for its premium features is right for you? Consider taking advantage of the 7-day free trial available.

Side note: Are you a freelancer or business owner?

If you are, don't skip this. There are other things you could do on top of using an app like Rocket Money to make your money goes further.

Why not reach out to people who already know how to thrive in these areas? On Whop, there are dozens of professionals who teach courses and have awesome groups that discuss how to maximize earnings as a freelancer or business owner, some of them running 6 figure businesses themselves!

Groups like Freelance Lab may be exactly what you're looking for.

One tip its members might give you is not to use your personal bank account for business purposes.

It’s a sobering statistic, but almost half of new businesses fail within five years. Should your company file for bankruptcy, you could be somewhat shielded financially if you have separate personal and business bank accounts.

Of course, one drawback of this arrangement is that it gives you an extra bank account you have to keep an eye on. So, you could benefit immensely from Rocket Money giving you a single unified dashboard through which you would be able to monitor multiple accounts simultaneously.

Rocket Money pros and cons

👍 Pros:

Useful planning features: Rocket Money has a great selection of features designed to ease your financial planning. You can set goals to work toward and create budgets to keep yourself on track.

Connect to multiple accounts: If you have multiple finance accounts, you can connect each of them to Rocket Money. This includes credit cards and investment accounts as well as standard bank accounts.

Lots of visuals: If endless rows of numbers aren’t your thing, Rocket Money provides you with graphs and charts for easy reading. This will simplify your user experience and help you monitor how your finances are doing.

Cancel subscriptions: How many subscriptions are you signed up for? You might have lost track, especially with auto-renewing being so common. Rocket Money will scour your subscription outgoings, letting you quickly identify (and cancel) subscriptions you don’t need.

👎 Cons:

Problems with bill negotiation: On paper, Rocket Money’s bill negotiation should be one of its best features, saving you paying unnecessary money each month. Sadly, though, there have been reported issues of the platform canceling bills rather than negotiating a cheaper price, leaving users without the services they need.

Tough to cancel Rocket Money subscription: Given the platform’s specialism in canceling subscriptions, it’s ironically pretty tough to cancel your Rocket Money subscription. This is often the case with subscription companies determined to deter their paying customers from leaving.

Limited features on the free plan: It’s entirely free to sign up to Rocket Money, although unpaid users will be barred from using most of the platform’s key features. To unlock them, you must pay a subscription fee in the region of $48 to $144 a year (remember, you choose the exact payment amount).

Limited customer support: As Rocket Money deals with your personal finances, you’d want to know that a reliable customer support service is in place if anything goes wrong. Sadly, this isn’t the case, with the platform found to be lacking in this area.

Alternatives to Rocket Money

1. Monarch Money

Monarch Money might lack some of Rocket Money’s features, but as far as budgeting goes, it’s hard to top. Monarch Money’s graphs and charts are more detailed than Rocket Money’s, highlighting exactly what’s coming in and going out of your account each month.

However, Monarch Money is also more expensive than Rocket Money, costing either $14.99 a month or $99.99 annually.

Ultimately, the decision between the two platforms comes down to whether your interest lies in budgeting or having a general overview of your monthly finances.

2. Copilot

Copilot (not to be confused with Microsoft’s AI chatbot of the same name) shows impressive, often unrivaled attention to detail. Copilot offers users more data about their budgeting than most apps.

In addition to this extra data, the app is satisfying — at a push, even fun — to use. This is because you can almost compete with your past self to improve your budgeting, seeing progress in real-time.

Price-wise, it’s a fraction cheaper than Monarch Money, but more expensive than Rocket Money, at $13 a month or $95 a year.

Got an iPhone, iPad, or Mac? Fetch the Copilot app from your device’s App Store. If you're an Android user, I'm afraid we have bad news...Copilot is not available in the Play Store.

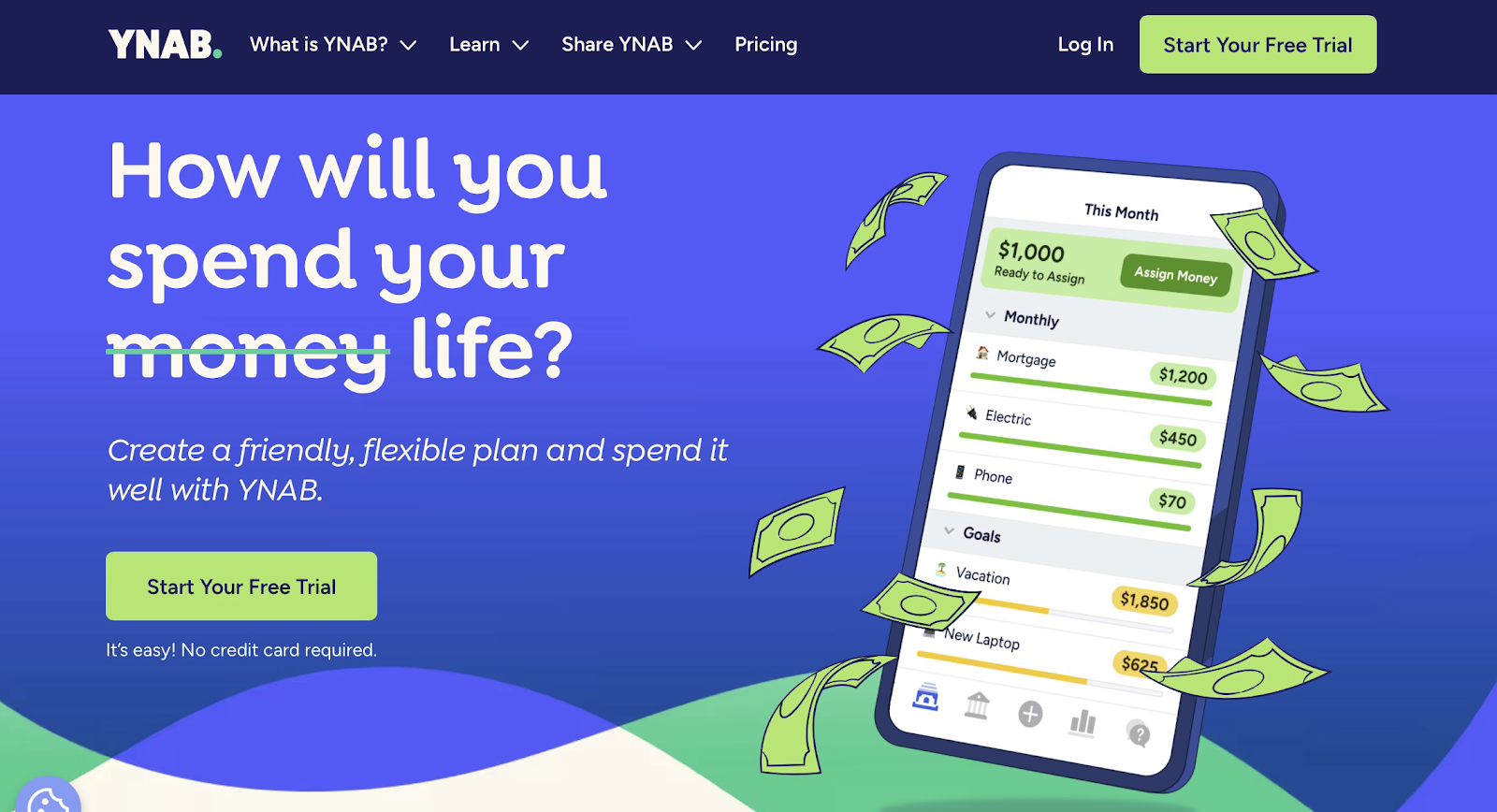

3. You Need a Budget (YNAB)

You Need a Budget (YNAB) requires users to allocate every single cent of their income to something, whether it be groceries, entertainment, general savings, etc. In this way, YNAB encourages a strong sense of accomplishment, as it leads you to feel like you’re taking an active approach to budgeting.

Are you an aspiring entrepreneur? With YNAB’s help, you can test the principles of ‘zero-based budgeting’ in your personal life before applying them to your business activities. Learn why zero-based budgeting is important for business owners.

YNAB is the most expensive option out of these three selections, coming in at $14.99 a month or $109 annually. On the plus side, new users are offered a healthy, 34-day free trial, with no credit card required.

Maximize your budgeting with Whop 🙌

Budgeting isn’t easy. Sometimes you can feel overwhelmed, out of your depth, and in need of some helpful financial advice. That’s where Whop comes in.

Whop is home to hundreds of courses built to teach students how to budget better and save money. Whop also hosts supportive communities ready to offer you support and encouragement as you chase your money-saving goals.

If you’re eager to accelerate this pursuit, why not start a whop — your own online space — right here, today? You can create courses, sell digital products, and form your own monetized community. And guess what, it’s totally free to join!

Depending on how people find your whop, you can pay as little as 2.7% + $0.30 in commission on sales you make through the platform.

Don’t hesitate — get started with Whop today and begin your journey toward total financial freedom.

FAQs

Is Rocket Money safe?

Rocket Money is safe. It stores data with 256-bit encryption and is partnered with the third-party integration app Plaid. The app also won’t make any changes to your bank accounts without your approval.

Can I pay monthly for Rocket Money?

While Rocket Money advertises a monthly price of between $4-$12, it will charge you annually. This means you will have to pay between $48-$144 in one single payment.

Can I use Rocket Money outside the US?

Rocket Money is only available to US residents using US-based banks. There are currently no plans to roll the app out in any other countries or continents.

Can I link more than one bank account to Rocket Money?

Yes, you can link more than one bank account, credit card, or savings account to Rocket Money. Linking all relevant accounts will help you to develop a greater picture of your overall financial health.