Trading 212 is a popular trading app for anyone outside of the US - read this review to find out why.

Key takeaways

- Trading 212 offers zero-commission stock and ETF trading with fractional shares, making it accessible for micro-investors outside North America.

- Avoid the 0.7% deposit fee by using bank transfers instead of card payments after reaching 2,000 GBP/EUR in deposits.

- CFDs are extremely risky with 80% of retail accounts losing money, so stick to the Invest account for traditional trading.

If you’re not in the US and want to download a stock trading app, Trading 212 is probably going to be the name that shows up first on your app store of choice. That top ranking, millions of downloads, and a very good rating are all excellent signs, and the platform’s got lots to offer.

This review is going to peel back the layers and look at Trading 212 as both a company and a trading platform, and look at what you can buy, how to create an account, and what services the app does and does not offer.

If you want to know whether Trading 212 is the stock trading app for you, you’ve come to the right place.

What is Trading 212?

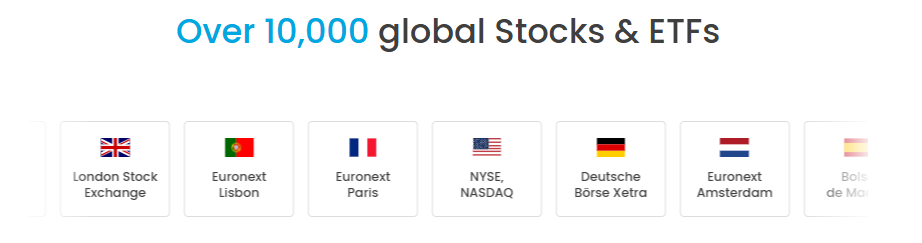

Trading 212 is a London-based stock broking platform that offers its services to over 100 countries, and was the first zero-commission broker for customers in the UK and Europe. It has been the top rated trading app in the UK since 2016 and has had the equivalent crown for Germany since 2017 with over 15 million downloads from all over the world.

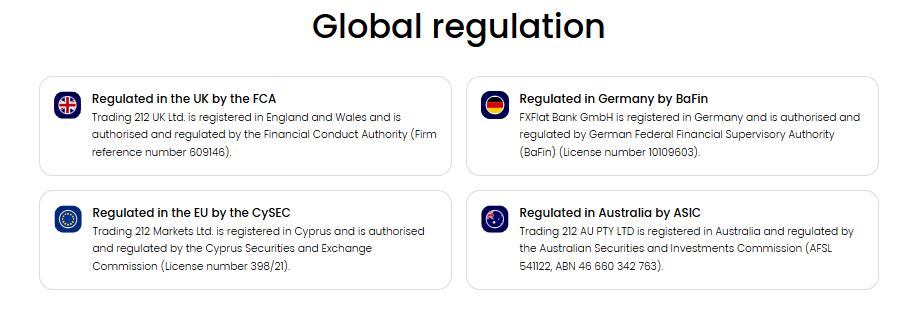

The company is registered in England and Wales, Bulgaria, Cyprus, Germany, and Australia, and regulated by relevant authorities such as the Financial Conduct Authority in the UK, BaFin in Germany, and ASIC in Australia - although it’s worth noting that its EU regulation falls under CySEC, the Cyprus Securities and Exchange commission.

Why investors choose Trading 212

Trading 212 is a well regulated trading platform with a significant international presence, and importantly, it provides a whole suite of low-cost investing and trading options for investors who aren’t based in North America. It’s extremely convenient thanks to its app-based platform, and opening an account is a simple, streamlined experience.

There are no commissions on Trading 212’s stocks and ETFs, and it also offers CFD trading as well as more traditional assets like Forex. It also allows investors to purchase fractional shares, allowing even the most expensive stocks to be part of micro portfolios, and cash parked on the side is allowed to earn a very competitive amount of interest paid out daily.

How to use Trading 212

What you need to get started

Whatever trading platform you use, anywhere in the world, there’s invariably one key rule in force - to use said platform without restriction, you need to be at least 18 years of age. This holds true for Trading 212 as well, and the platform will need a selfie along with a valid government-issued photo ID to prove your age as well as who you say you are, for compliance and anti-money laundering reasons.

So, before you get started with Trading 212, you’re going to need to have your ID documents ready.

An identity card tends to do the trick, but a driving license or passport will work just as well, just make sure you’re in a well-lit environment and have a decent WiFi connection for the upload and verification process to go off without a hitch.

Address verification is also required for compliance, so you’ll need to have a valid proof of address document ready to go. The format doesn’t really matter, so a PDF or even a screenshot would be fine as long as they’re issued in your name, show your address, are dated within an acceptable period, and show all details (meaning, no cropping or folding).

If you’re submitting a bank statement in order to prove your address or link a bank account, you’ll also need to make sure that your account number or IBAN are clearly displayed on the document. And for non-EEA residents, the bank statement needs to show a few transactions to prove activity.

Finally, you’ll also need to provide Trading 212 with your Tax Identification Number (TIN). This could take different forms, such as the NIN or National Insurance Number in the UK, Codice Fiscale in Italy, Bulgarian Personal Number in Bulgaria, and so on.

Creating your Trading 212 account

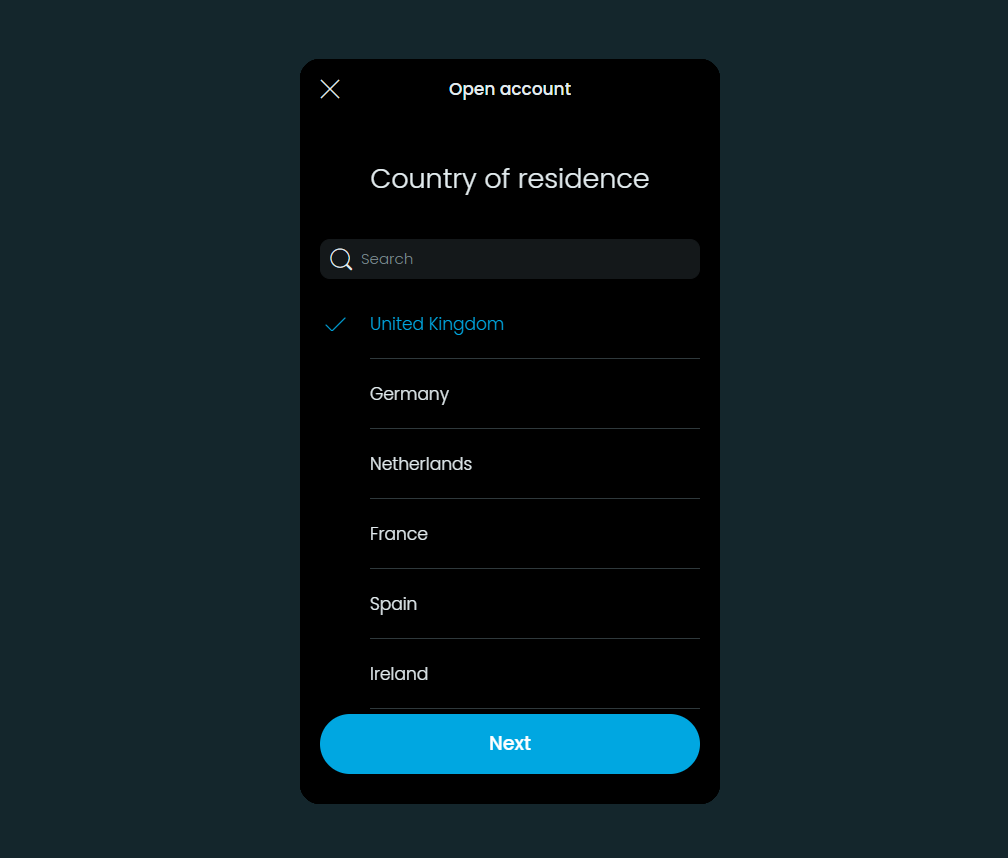

Creating an account on Trading 212 is extremely easy, and as an international broker, region selection is the first big step after downloading the Trading 212 app or visiting the web portal.

This defines a lot of things, so make sure you choose the country that matches your own official residence status. You can have been born somewhere else, but what matters is residence rather than country of origin.

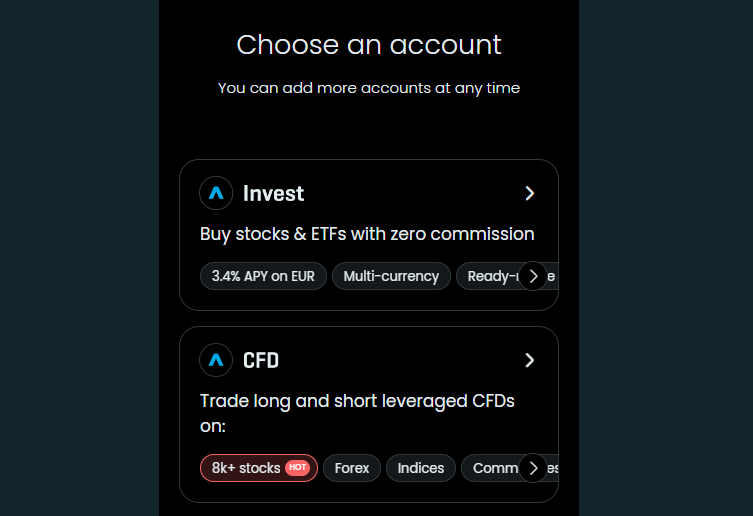

Then, you need to choose an account. As the above image indicates, traditional investing needs to be done via an Invest account, whereas if you want to speculate on CFDs you can go with the other option.

More accounts can be added later on down the line, so this choice doesn’t lock you in one particular account type. Once you’ve completed this account selection step, all that remains is to input your email address and set a password for your new Trading 212 account.

Regardless of whether you’re using the app or the web, once you’ve signed up you can then proceed to verify your identity and residence via the documentation we went over in the previous section.

Of course, you’ll need money in your account to purchase stocks or ETFs on Trading 212, so you’ll also need to fund it. This is possible in different ways, including by card as well as Apple and Google Pay.

There aren’t any fees on these deposits to begin with, but once you’ve deposited 2,000 GBP or EUR, you’ll have to start coughing up 0.7% from that point forward.

Buying stocks and ETFs on Trading 212

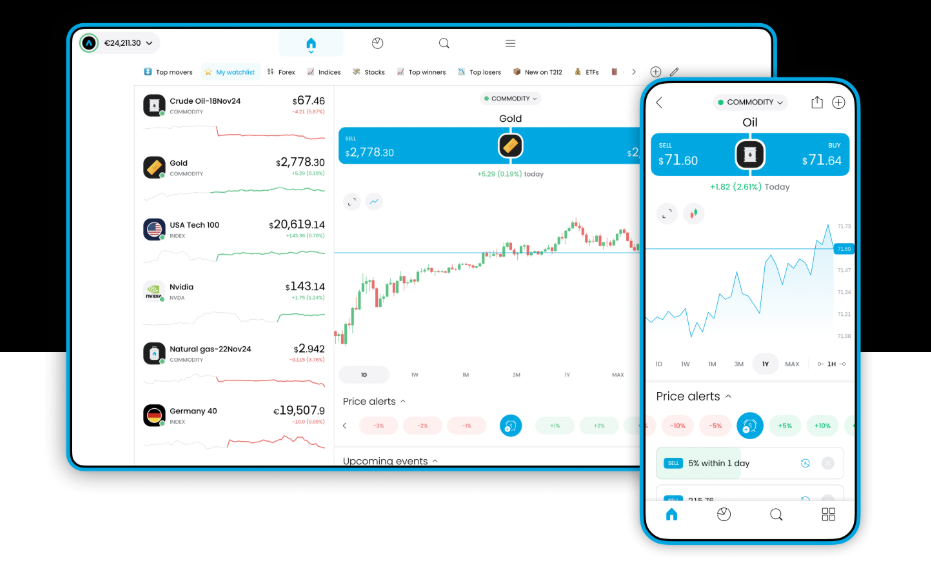

Buying stocks and ETFs on Trading 212 is extremely easy, and the platform has a selection of tools to help you build and monitor your portfolio.

Purchasing a stock or ETF starts with searching for it, and when you view an asset you can view things like market sentiment (the number of buyers and sellers of the asset) that can help you refine your trading strategy.

There’s also a tool called the ‘upcoming earnings watchlist’ which can ensure that your eyes are open for any possible moves in the near future—earnings, after all, are big events in the trading calendar for just about any company, from the analyst estimates all the way to the earnings call itself.

You can buy Trading 212’s different assets using a variety of orders, including the standard market and limit orders as well as more advanced options such as stop losses and OCO (one cancels the other) orders that can help you get your trades just right.

Trading 212, like many neo brokers, allows you to buy fractional shares. That means micro-investing strategies are easy to pull off. Say you’ve only got $100 a month to invest with, but you’d like to accumulate some blue chip stocks. $100 hasn’t been enough to buy a single Apple share for a long time, but with fractionals, you can, for example, put $10 into 10 different blue chip stocks and own a fraction of each.

Those fractions can grow if you keep accumulating, and this way you can allocate your funds exactly how you want to without worrying how much a full share costs.

Lastly, Trading 212’s links with TradingView ensure that they’ve got plenty to offer from a charting perspective as well to aid in buying and selling those stocks. There are a significant amount of trading indicators to choose from, along with a number of drawing tools to make use of on both web and mobile platforms.

How to auto-invest with Trading 212

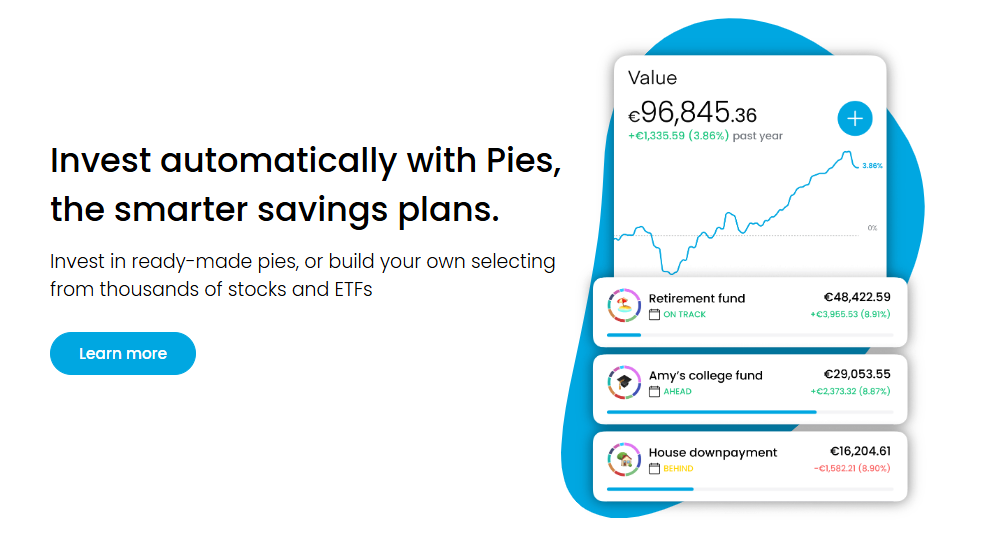

One of Trading 212’s most interesting features are called “pies” which essentially allow you to set a goal and dollar cost average your way toward it via a diversified portfolio selected for you. This sort of robo-investing isn’t groundbreaking, but it is an effective way of building wealth since it relies on a proven strategy and emphasizes consistency, requiring you to execute a scheduled deposit.

The frequency of these deposits are up to you, and they could come every day, week, or month, with a minimum of just 1 GBP. The pies are composed of different ETFs, and they’re suggestions rather than hard options—the customer is responsible for all investment and rebalancing decisions made on the account.

In fact, it’s possible to also build your own custom pie from Trading 212’s over 13,000 global stocks and ETFs. This means that you have lots of options when it comes to diversification, and you’re not locked into a small and very specific selection of options like you might be with a bank or traditional broker.

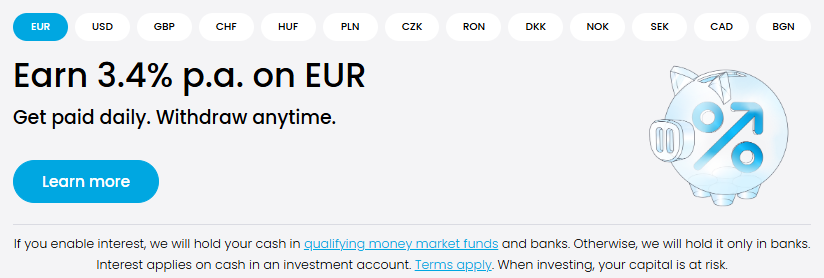

It’s also worth noting that using Trading 212 as a platform doesn’t mean needing to dump all of your money into pies or other investments and stay invested all of the time.

One of the platform’s big draws is the fact that it offers an extremely high interest rate on uninvested cash, usually staying a few points above the competition.

How much does Trading 212 cost?

As we’ve already mentioned, one of the first fees that’ll kick in when you use Trading 212 is the deposit fee, which comes to 0.7% beyond deposits amounting to 2,000 EUR or GBP. The fee doesn’t start applying until you put a significant amount of money into your account, which is a saving grace, and it only applies to card payments and other providers such as Google Pay and Apple Pay.

So, if you want to keep depositing money into Trading 212 and avoid any fees, simply do so via bank transfers or instant bank transfers. Assuming your bank doesn’t have any fees on these, you’re good to go. Withdrawals are also completely free on Trading 212 regardless of the payment method you choose to use.

If you decide to open an Invest account or have an ISA, the only fee that’ll apply is the forex fee, which comes to 0.15%. There are no trading commissions or custody fees, but you’ll have to be aware of fees that are imposed by the relevant exchanges. On the London Stock Exchange, for instance, a Stamp Duty Reserve Tax of 0.5% is applied to share purchases, and a PTM Levy applies for both purchases and sales to the tune of 1.5 GBP per trade of over 10,000 GBP.

NYSE-listed stocks are free to purchase, and an extremely small fee is applied by both FINRA and the SEC on sales of stocks.

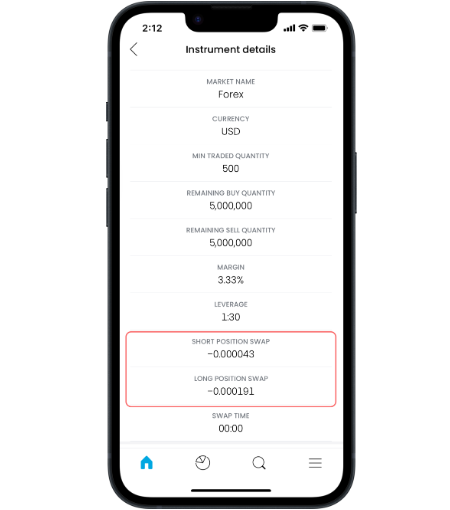

The Trading 212 CFD account has a few more fees to think about, however. Again, trading commissions and custody is free, but the forex fee goes up to 0.5%. Spreads are dynamic and can change depending on market conditions, and there’s overnight interest that could apply if you hold beyond the trading session.

Is Trading 212 safe?

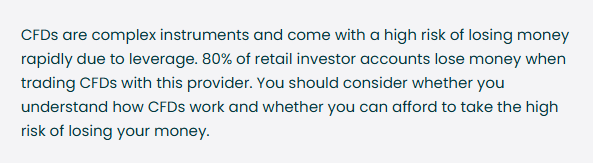

Even before analysing Trading 212 itself for safety, it’s important to turn the spotlight onto the elephant in the room - CFDs. This stands for Contract for Difference, and as we’ve already mentioned, you can choose to create a Trading 212 account primarily to trade these, meaning that it’s one of the platform’s primary products. And here’s why:

This disclaimer can be found all over Trading 212’s own website, and it underlines just what sort of a proposition these are. Many liken CFDs to a coinflip, since assets usually go up or down, but 80% of accounts losing money on a coinflip reveals the fallacy. It should also say a lot that the US, a country not known for overly stringent financial regulation, prohibits CFD trading.

Put simply, a CFD is a financial instrument that allows a trader to bet on whether the price of a given asset is going to go up or down. They take no ownership of said asset when they enter into the contract, but they do have to pay out the difference from their own account if their bet goes bad—and as we mentioned in the previous section, you’ve also got the spread to think about even though commissions are free. That means profiting from CFDs is even harder.

CFDs can be profitable since they provide higher leverage, but that means maintaining margin and thinking about liquidity risks. Altogether, CFDs are not something beginner investors should even think about, and even advanced traders are best advised to think twice before even considering CFD trading.

Beyond the risks of gambling on instruments like CFDs, Trading 212 has a generally clean track record and no real history of any hacks or breaches. They also feature financial compensation in case of default based on which local entity you trade with—that means 85,000 GBP in cash coverage in the UK and 20,000 EUR in the EU.

The platform is fully compliant across multiple regions, and furthermore is very transparent about the risks of trading, especially with instruments like CFDs. Shares purchased by customers are held by Interactive Brokers and Bank of New York Mellon, and customer funds are held primarily with J.P. Morgan as well as the German bank Sparkasse.

Is Trading 212 worth it?

Trading 212 pros

- 24/5 trading. Trading 212 offers non-stop market access to US stocks covering pre-market, after hours, and overnight trading which ensures international clients are catered to at all times, and all traders can react to breaking news and earnings calls in real time.

- Fractional shares. Fractionals allow retail investors to gain exposure to even the most expensive stocks by purchasing them in small quantities. This allows you to sink small amounts of money into any sort of portfolio as frequently as possible. Want to DCA into Nvidia or Netflix for just a single dollar every day? That’s possible thanks to fractional share trading.

- Charting tools. Trading 212 offers a selection of trading indicators and drawing tools that exceeds what most other broking platforms offer. This means that research and trading is that much more convenient since you don’t have to leave the platform for anything but the most complex tools.

Trading 212 cons

- Focus on CFDs. The fact that Trading 212 gives access to CFDs could be considered a plus point, given that not many others do, but they’re an extremely risky proposition and should be avoided by most if not all but the most risk-tolerant speculators.

- Share lending. Share lending tends to be on by default on Trading 212, and while this isn’t an alien practice when it comes to the broking industry, you may not be aware that lending out your share means that you are in fact surrendering your voting rights to borrowers—and these borrowers are short sellers, who actively want the company to fail.

If that wasn’t already double jeopardy, it’s these borrowers who would have to pay you dividends if the company announces them. And, in the world of finance, short sellers sometimes dodge their obligations by simply not picking up the phone. - No mutual funds or options. Trading 212’s focus on CFDs is put into even starter light by the fact that their asset selection is quite thin. They offer a huge number of stocks and ETFs, but no traditional derivatives like options or futures, and definitely no mutual funds.

Trading 212 alternatives

If what you’ve read so far about Trading 212 doesn’t quite float your boat, check out our list of the best free trading apps for you to try. To save you a click, though, here are three great options to check out:

1. Interactive Brokers

We’ve already mentioned Interactive Brokers (IBKR) in this review, and if you missed it, they’re one of the two firms that Trading 212 uses to hold the assets that customers purchase. So, if a company like Trading 212 trusts Interactive Brokers, why shouldn’t you? It’s one of the biggest names in finance, and a pioneer in the world of electronic trading.

However, perhaps the biggest reason why Interactive Brokers features as a top alternative to Trading 212 is the fact that it covers a similar, and in fact even larger set of locations. You can use Interactive Brokers from just about anywhere in the world including the US, and the platform offers a truly global selection of stocks and ETFs.

It also provides users with a vast selection of other asset classes, including funds, options, futures, and even cryptocurrencies. It doesn’t bother with CFDs, though zero commissions are an option too if you’re in the US via the IBKR Lite platform. All told, Interactive Brokers is a rock-solid global trading platform and a great choice for investors, traders, and professionals alike.

2. Vanguard

Trading 212 doesn’t offer funds, and if that’s a dealbreaker, then who better than the fund OGs themselves? Vanguard is the number one name in mutual funds and ETFs, and their investment platform offers top brokerage services as well as discount access to a truly vast selection of investment funds.

There are few financial services names bigger than Vanguard, and its founder John C. Bogle is known for popularizing the time-honored strategy of index fund investing. This strategy and a whole slew more are easily executed on the Vanguard platform, and its unique ownership structure helps—the company is owned by its fund investors, so customers are essentially the top stakeholder, unlike neobrokers where users are little more than products to be sold to their true customers, market makers who engage in Payment for Order Flow (PFOF).

Despite being such a big name in the financial services world, Vanguard is able to offer extremely low costs thanks to its unique ownership structure—and you can even dodge the small brokerage account fee by signing up for electronic documentation.

3. Webull

Webull shares a lot of similarities with Trading 212, especially in the area of charting and trading tools where the two platforms are very much at the head of the pack given the breadth of what they allow you to do.

So, if you’re in the US and want a platform just like Trading 212 (remember, Trading 212 can’t be used by US customers) then Webull might well be the answer. It’s a mobile-first platform too, and offers a very decent selection of US stocks and ETFs for you to explore. It’s also well known for deposit incentives that can net you free shares or fractional shares to get your portfolio started.

Webull is owned by a Chinese company, which can be a relevant factor today, but it’s fully licensed and regulated in the US.

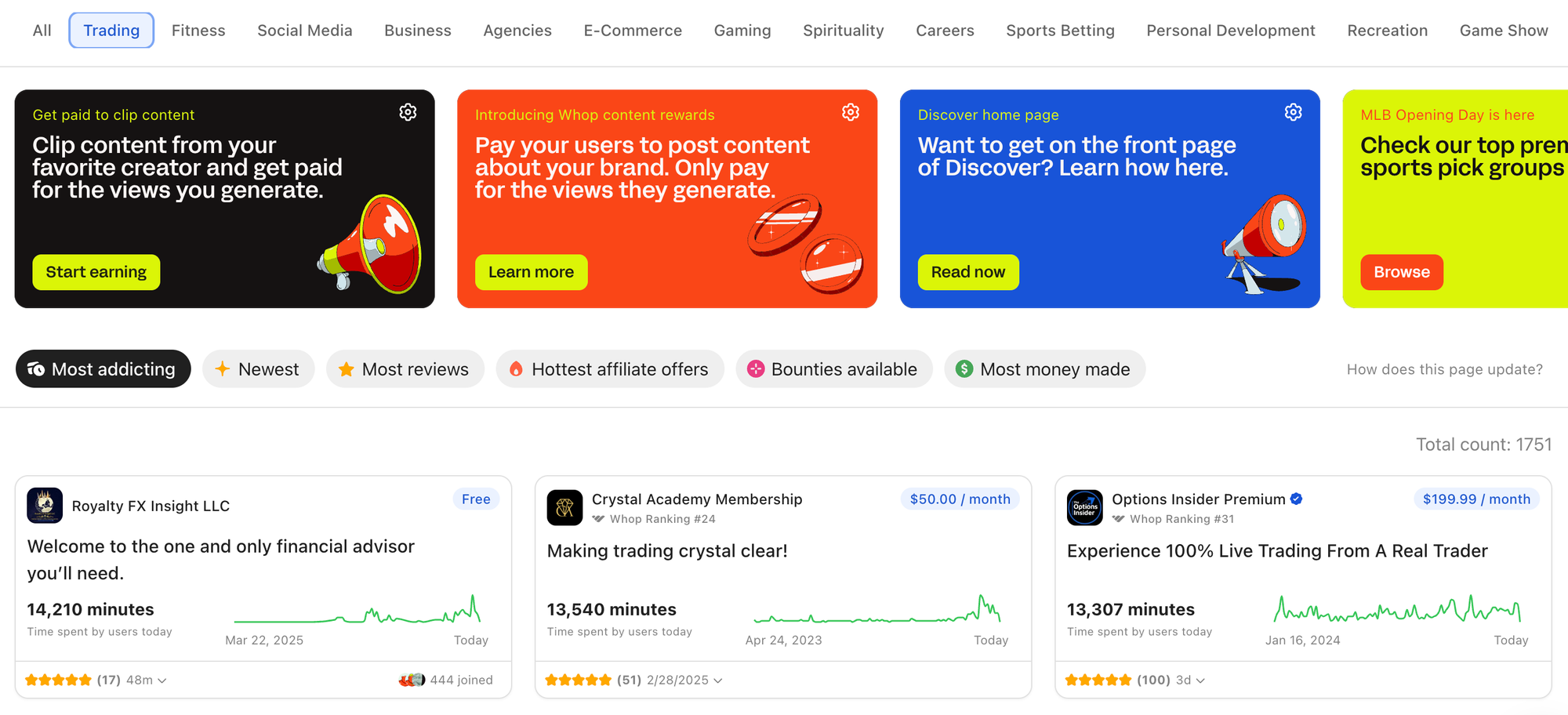

Make the most of Trading 212’s features with Whop

Trading 212 is one of the most popular trading platforms out there for European and Australian customers, and for good reason - it’s got a vast selection of stocks and ETFs for you to buy, some great charting and trading tools, and features like fractional shares, auto-investing, and 24/5 trading can be very powerful if used right.

In order to make the most of all of these features, make sure you check out Whop’s top trading courses. There, you can learn the ins and outs of charting as well as how to use advanced trading orders, different trading strategies, the significance of earnings, and so, so much more.

Platforms like Trading 212 give you all the tools and market access you need, but trading courses and communities like Whop’s trading groups are a piece of the puzzle that you really shouldn’t miss.