Looking for the best Buy Now, Pay Later solution for your store? We’ve rounded up the top BNPL providers in 2026 that help businesses boost sales, improve checkout conversion, and keep customers coming back.

Key takeaways

- BNPL providers pay merchants upfront and assume customer debt, keeping business cash flow steady while reducing cart abandonment.

- Choosing the right BNPL provider depends on your audience, platform integrations, and fee structures ranging from 1.5% to 6.5%.

- BNPL converts high-friction purchase decisions into smaller, manageable installments that boost average order values and conversions.

With over 580 million Buy Now, Pay Later users worldwide (and global transactions projected to exceed $565 billion in 2026), flexible payments are shaping the future of ecommerce.

Using BNPL isn't just a sales trend; it's actually proven to boost conversions and customer loyalty. When you let shoppers spread payments over time, your business will likely see both a reduction in cart abandonment and an increase in average order value. Win win.

But remember, BNPL providers don't replace your payment processor; they work alongside it to give shoppers flexible financing options right at checkout.

This guide breaks down the best BNPL providers to help you pick the right one for your needs.

Give your customers more reason to click 'buy'

The concept of Buy Now, Pay Later is really about psychology.

In 2026, shoppers are more price-aware than ever, but they still want flexibility. Financing bridges that gap.

BNPL services turn single, high-friction decisions into a series of smaller, manageable ones (without forcing customers into traditional credit loans).

Basically? Incorporating BNPL at checkout gives your customers a flexible, low-friction alternative to traditional credit cards. Most BNPL providers run soft credit checks, making them more accessible than bank-issued cards.

There's no real downside for businesses, either. When a shopper uses financing to make a purchase, the provider pays you immediately and takes on the customer's debt.

This means your cash flow stays steady, while your customer pays over time (usually with an initial down payment).

BNPL benefits your business in more ways than one

One of the biggest benefits of offering BNPL to your customers is the instant gratification. Think about it, someone hesitant at a $50 price tag probably finds it easier to commit to $12 today, and spread the rest over a few weeks.

And trust us, the facts back this up:

- 25%(+) of U.S. consumers report having used BNPL (2025 survey, Morgan Stanley)

- In 2024, BNPL accounted for ~5% of global ecommerce transaction volume, up from ~2% in 2020 (Morgan Stanley)

- Globally, the BNPL transaction market is active and growing — 2024 saw ~$340 billion in BNPL volume, with forecasts pointing to ~$565 billion by 2026 (GlobeNewswire) (FinTech Futures)

- Among users, many cite spreading payments, convenience, and affordability as their top reasons for choosing BNPL (The Motley Fool) (DemandSage)

It's pretty clear BNPL isn't just popular; it's fast becoming a mainstream way of paying for purchases. The current trend is improving the customer experience by offering flexible options to pay.

The best BNPL providers

So now you get why you should add BNPL; let's explore the top Buy Now, Pay Later providers you can add to your store:

1. Klarna

Klarna is one of the most established BNPL providers and remains a dominant force despite recent valuation challenges. The company continues to process millions of transactions daily and serves a large global customer base across 26 countries.

It also integrates with close to one million merchants, giving shoppers familiarity and businesses a high-trust option.

Payment options with Klarna (U.S):

For U.S. shoppers, Klarna offers a "Pay Now" option, as well as three credit-based options:

- Pay in 4: Four biweekly, interest-free installments

- Pay in 30 days: Full payment due after 30 days

- Financing / Pay over time: For purchases $150+, up to 24 months

Klarna costs and fees:

- For customers: Plans are interest-free, but Klarna charges late payment fees if payments aren't made on time

- For merchants: Klarna doesn't publicly list merchant pricing, but most U.S. merchants can expect to pay ~5.99% + $0.30 per transaction.

Klarna pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ High name recognition and trust in multiple markets | ❌ Late fees can frustrate customers if they miss installments |

| ✅ Multiple checkout options (Pay in 4, Pay in 30, longer financing) | ❌ Customer support and ID checks can be a pain point |

| ✅ Familiar UX that reduces checkout hesitation | ❌ Merchant pricing can be on the higher side vs some rivals |

| ✅ Strong ecommerce integrations and broad merchant adoption | ❌ Longer-term plans may include interest (varies by customer) |

| ✅ Good fit for cross-border ecommerce |

2. Affirm

Affirm is another major player in the BNPL space and has built a strong reputation since launching in 2012 under Max Levchin, co-founder of Confinity (which later became PayPal).

It positions itself as a transparent BNPL option, standing out from competitors by not charging late fees, a feature many shoppers appreciate. Instead, Affirm focuses on clear repayment terms and responsible lending.

The company partners with thousands of U.S. merchants (including Shopify) and continues to expand its reach across ecommerce. For businesses, Affirm's brand recognition and customer-friendly policies can make it an attractive checkout option.

Payment options with Affirm for shoppers:

- Pay in 2: Two equal installments

- Pay in 4: Four biweekly installments

- Pay in 30: Full payment due after 30 days

- Monthly installments: Spread purchases over 3–60 months (interest may apply)

Minimum purchase amounts apply, and for larger transactions (up to $30,000), Affirm may require a down payment.

Affirm costs and fees:

- For customers: shorter-term plans are typically interest-free, while longer-term financing can carry interest rates from 0% to 36% APR depending on credit.

- For merchants: Affirm charges a fixed transaction fee plus a variable percentage, averaging around 6% + $0.30 per sale.

Affirm pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ No late fees for customers | ❌ Merchant fees are relatively high (~6% + $0.30) |

| ✅ Transparent repayment terms | ❌ Interest on long-term plans can reach 36% APR |

| ✅ Wide range of installment lengths (up to 60 months) | ❌ Not all shoppers qualify for 0% plans |

| ✅ Strong US brand credibility |

3. Cash App Afterpay

Afterpay's integration with Cash App has expanded its reach, especially among younger, mobile-first shoppers.

Data shows Cash App Afterpay customers tend to spend more per transaction and shop more frequently than traditional customers, making it an appealing option for retailers.

The service is heavily app-based, encouraging customers to manage purchases and payments through Cash App. For retailers, Afterpay is marketed as a way to capture millennial and Gen Z buyers with a seamless checkout experience.

Payment options with Afterpay (U.S):

- Pay in 4: Four equal installments over six weeks, interest-free

- Pay Monthly: 6 or 12 month plans, with APRs ranging from 6.99% to 35.99%

- Eligible customers may also qualify for "no down payment" offers

Cash App Afterpay Card: Customers can use a digital Afterpay Card for in-store purchases where Apple Pay, Google Pay, and Samsung Pay are accepted. A paid Afterpay Card Plus tier ($9.99/month) allows broader usage with the Pay in 4 plan.

Cash App Afterpay costs and fees (U.S):

- For customers: Pay in 4 is interest-free, Pay Monthly plans carry variable APRs. Late fees apply.

- For merchants: Fees are typically a $0.30 transaction fee plus 4-6% of the sale, though exact terms depend on the agreement.

Cash App Afterpay pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ Strong appeal to Gen Z and millennial shoppers | ❌ Late fees apply on missed payments |

| ✅ Interest-free Pay in 4 option | ❌ Merchant fees typically 4–6% |

| ✅ Integrated with Cash App ecosystem | ❌ Monthly plans can carry high APRs |

| ✅ In-store usage via Afterpay Card |

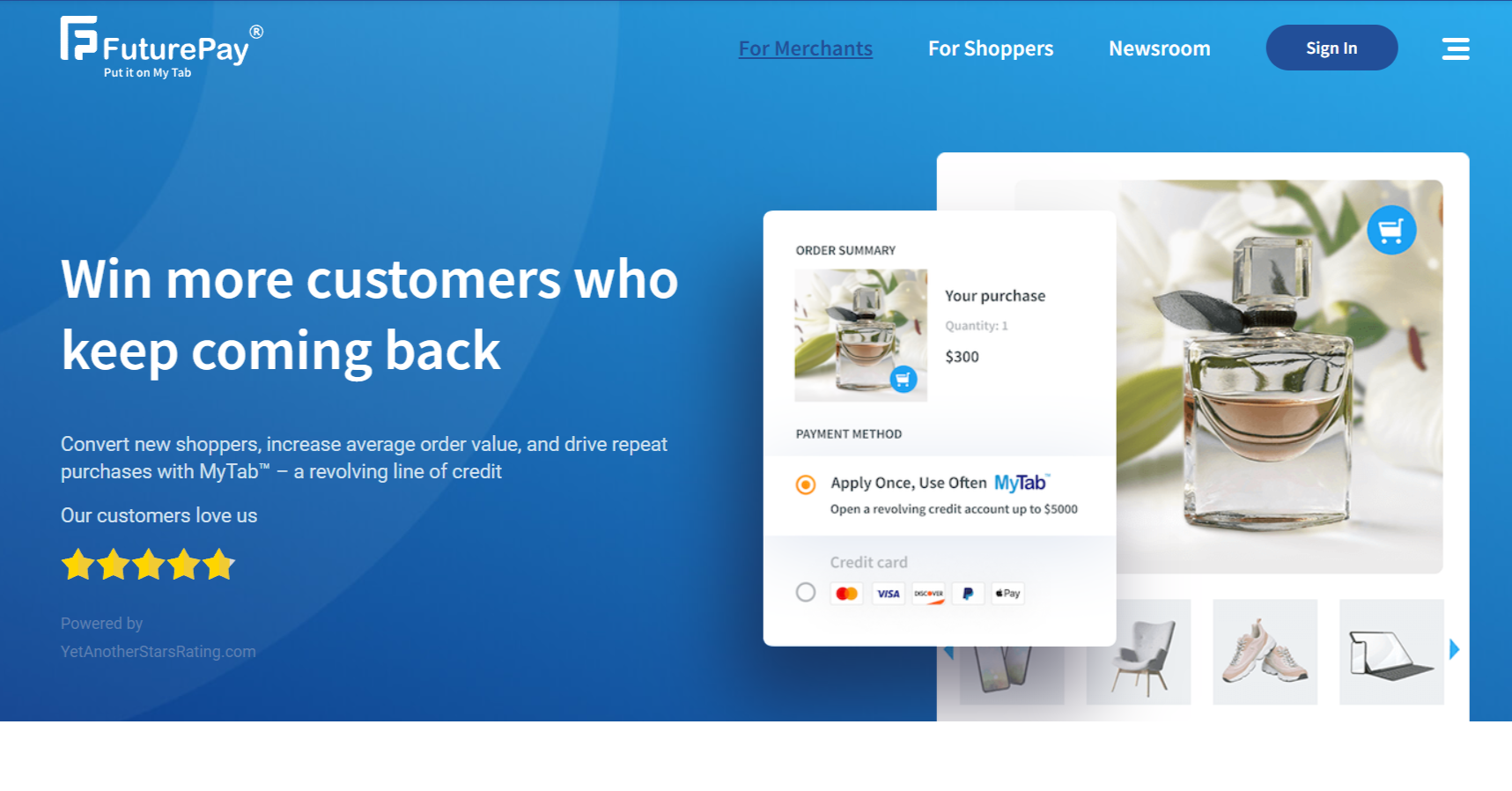

4. FuturePay

FuturePay takes a different approach to BNPL with its MyTab digital revolving credit platform.

Instead of fixed installment plans, shoppers receive a revolving line of credit (kind of like a store card), and pay it off in monthly installments.

This gives customers flexibility, but it lacks the predictability of structured "Pay in 4" or "Pay Monthly" plans.

The MyTab Virtual Store Card offers credit lines between $1,000 and $5,000, and customers can keep accounts open long-term (some report 7+ years).

For retailers, FuturePay integrates with major ecommerce platforms including Shopify, Magento, Shift4Shop, and PrestaShop, and it claims merchants see up to 37% more first-time purchasers when MyTab is available.

Payment options with FuturePay:

Just a line of credit, meaning customers can make purchases and pay them off monthly like a credit card. FuturePay's minimum payments are $20 a month.

FuturePay costs and fees:

- For customers: $1.25 fee (per $50) carried over each month, a $25 annual membership fee, and late/returned payment fees up to $38.

- For merchants: 3% merchant fee on order values, with no extra platform fees.

FuturePay pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ Revolving credit model encourages repeat purchases | ❌ No fixed installment structure |

| ✅ Lower merchant fee (~3%) | ❌ Less familiar to consumers than major BNPL brands |

| ✅ Good ecommerce integrations | ❌ Annual and carryover fees for customers |

| ✅ Strong for loyalty-driven brands |

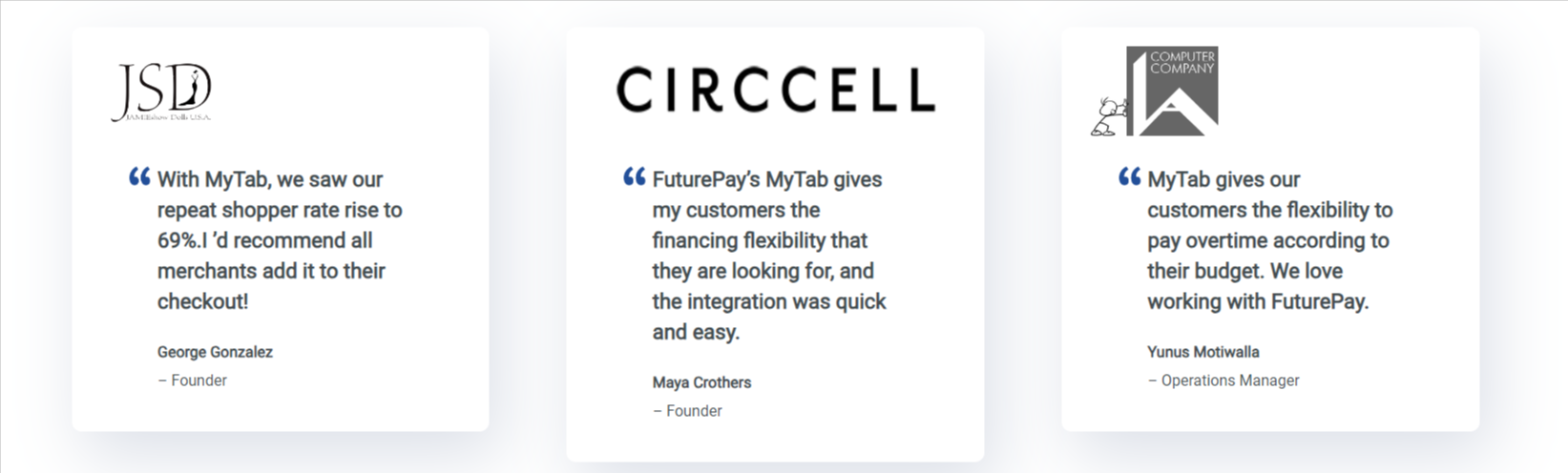

5. Pay Later by PayPal

PayPal has also carved out a strong position in the BNPL market. With millions of merchants already using PayPal for online checkout, adding BNPL is seamless and comes with high shopper recognition and trust.

PayPal's BNPL offering is built into its platform and works much like its competitors, though eligibility depends on the purchase type, value, and merchant.

As with others, merchants are paid upfront while PayPal manages repayment from customers. In addition, PayPal Credit provides a revolving credit line for larger purchases.

Payment options (U.S):

PayPal offers U.S. customers three credit-based payment options:

- Pay in 4: four equal, interest-free installments over six weeks (for purchases $30–$1,500)

- Pay Monthly: spread $199–$10,000 over 6, 12, or 24 months (APR ranges 9.99%–35.99%)

- PayPal Credit: revolving line for purchases $99+, with promotional zero interest if paid in full within six months

PayPal costs and fees (U.S):

- For customers: Pay in 4 is interest-free, and Pay Monthly carries variable interest. PayPal does not charge late fees on installment plans. For PayPal Credit, unpaid balances incur interest (29.24% APR) and late fees up to $41.

- For merchants: Standard PayPal processing fees apply — 4.99% + $0.49 per BNPL transaction (as of January 2025). These apply whether or not customers use BNPL, since it's tied to PayPal's checkout system.

PayPal pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ Massive global brand recognition | ❌ BNPL eligibility varies by purchase type |

| ✅ Seamless for existing PayPal merchants | ❌ Merchant fees apply even if BNPL isn’t used |

| ✅ No late fees on Pay in 4 | ❌ Interest rates can be high on Pay Monthly |

| ✅ Multiple financing options |

6. Sezzle

Sezzle has grown into a popular BNPL provider with millions of users and a rapidly expanding merchant network.

It stands out as a Public Benefit Corporation, highlighting its commitment to social and environmental standards.

Customers appreciate Sezzle's flexibility, including the ability to reschedule a payment for up to two extra weeks (something most rivals don't allow).

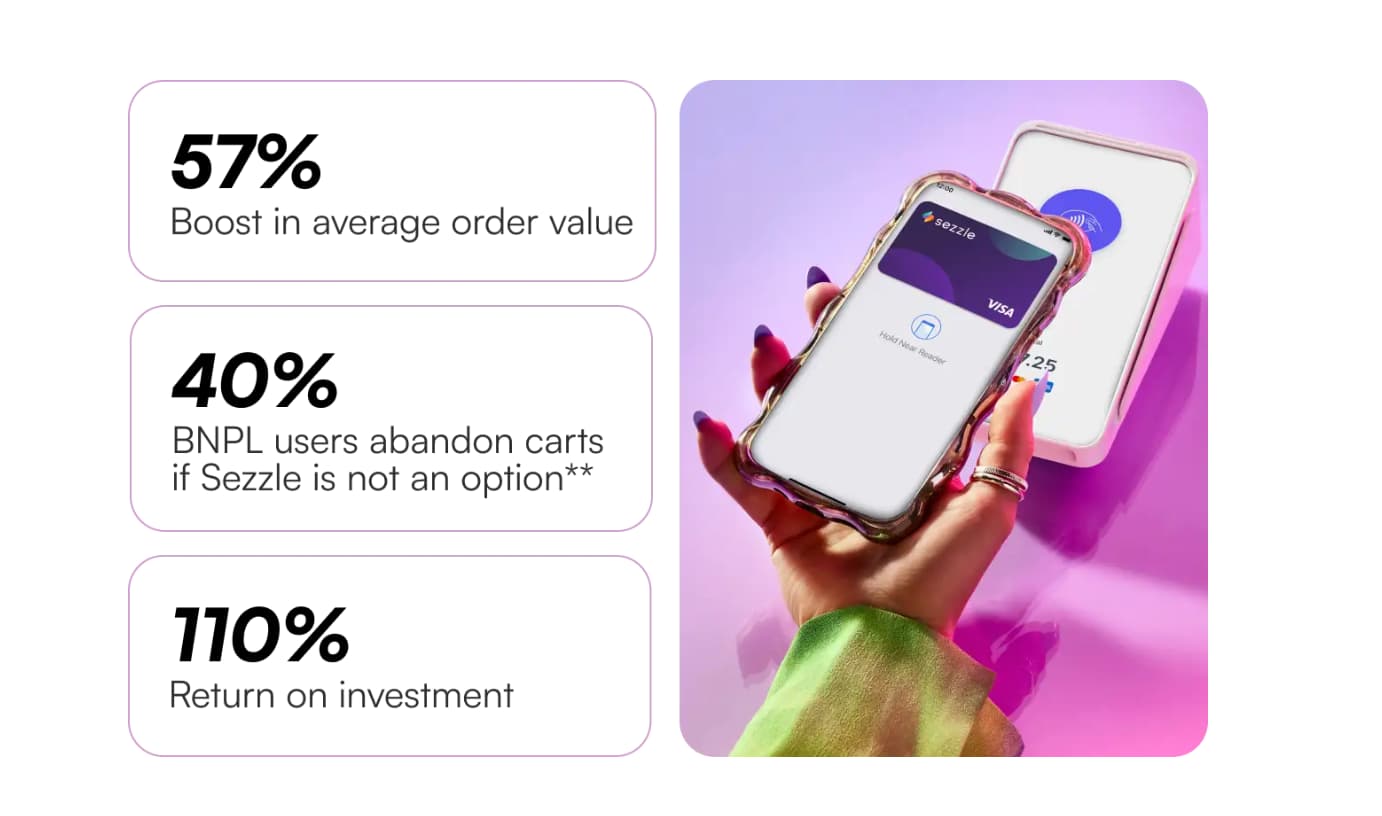

Sezzle integrates with major ecommerce platforms like Shopify, WooCommerce, and BigCommerce. According to their recent study, merchants offering Sezzle see an average order value increase of 57%.

The company also offers Sezzle Up, a feature that lets users build credit by reporting on-time payments to credit bureaus.

Payment options with Sezzle (U.S):

- Pay in 2: 50% upfront and 50% two weeks later

- Pay in 4: 4 equal installments over six weeks (25% down at checkout)

- Pay Monthly: Long-term financing for up to 48 months, depending on eligibility

Extras: Sezzle also offers a Virtual Card for online and in-store purchases, plus Sezzle Premium, which rewards users with discounts and perks.

Sezzle costs and fees (U.S):

- For customers: Pay in 2 and Pay in 4 are interest-free, while monthly repayments carry interest ranging from 5.99% to 34.99%. Late fees, rescheduling fees, failed payment fees, convenience fees, and service fees can apply (though one free reschedule is permitted).

- For merchants: Fees typically run about $0.30 per transaction + 6% of order value, with no setup costs. Merchants processing less than $300 in a 30-day period are charged a $15 monthly fee.

Sezzle pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ Flexible rescheduling options | ❌ Higher merchant fees (~6%) |

| ✅ Credit-building feature (Sezzle Up) | ❌ Multiple potential customer fees |

| ✅ Interest-free short-term plans | ❌ Smaller global footprint |

| ✅ Strong ecommerce integrations |

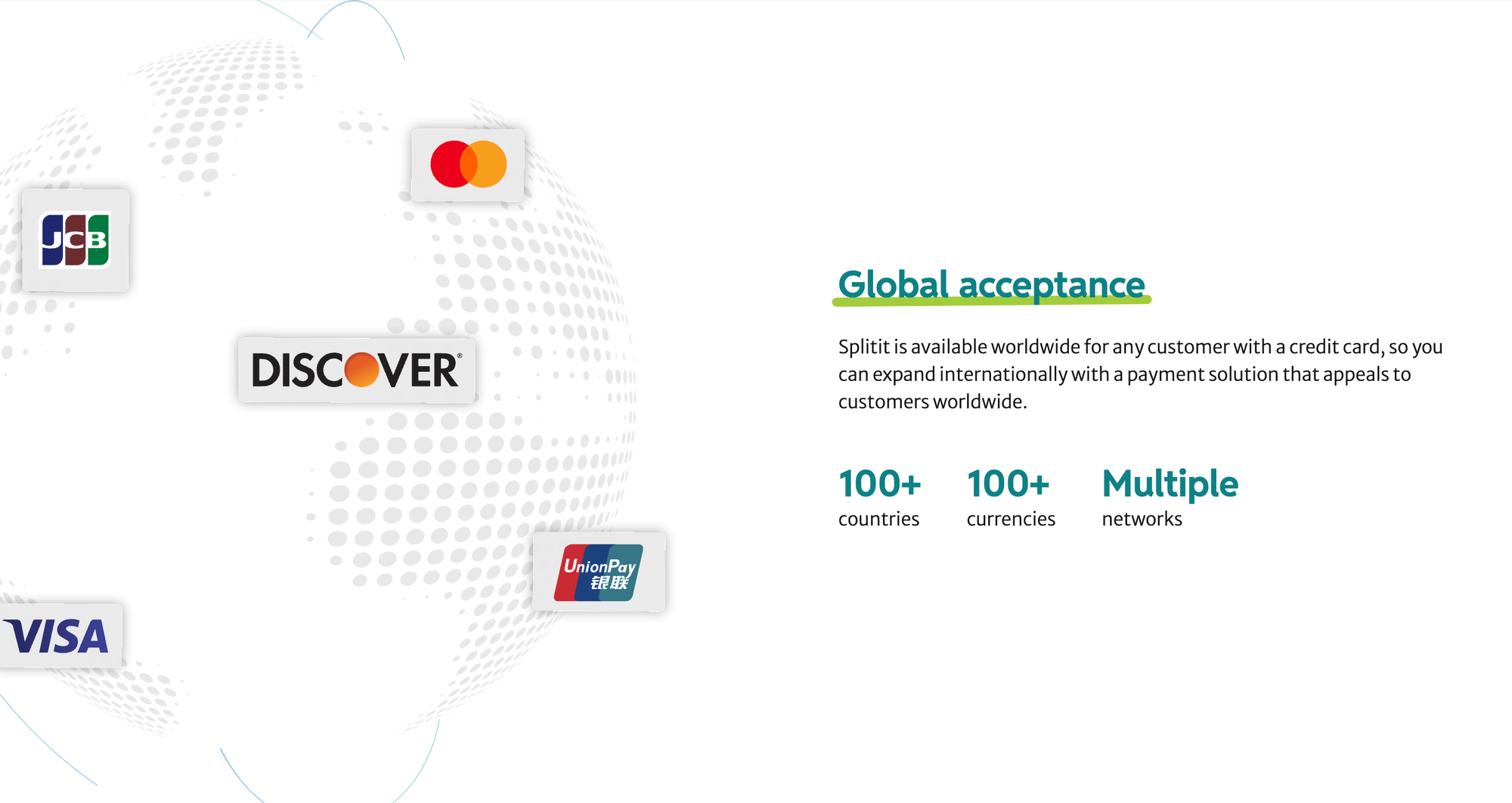

7. Splitit

Splitit takes a unique approach to BNPL by working with a shopper's existing credit card instead of issuing a separate loan or line of credit.

At checkout, Splitit pre-authorizes the full purchase amount on the card, then automatically charges installments until the balance is paid off.

Shoppers don't undergo additional credit checks, they just use their current credit card limit (but in a more budget-friendly, installment-based way).

Splitit integrates with major ecommerce platforms like Whop, Shopify, WooCommerce, and Magento, and reports approval rates of over 85%.

Merchants also note higher order values, with an average purchase exceeding $1,000.

Payment options with Splitit:

- Installment payments using an existing credit card (up to 36 months)

- Subscription-based installment plans

- Interest-free loan structures for eligible purchases

- Works with Visa, Mastercard, American Express, Discover, and UnionPay (merchant-dependent)

Retailers can also offer a "Pay after delivery" feature, allowing trusted customers to receive their order before the first payment is processed.

Splitit costs and fees:

- For customers: No added interest or late fees from Splitit (only subject to the credit card provider's terms if payments fail). Customers must have the total purchase balance available on their card.

- For merchants: Fees range from 1.5% to 6.5% per transaction plus a flat fee, depending on whether the merchant wants full upfront settlement or is willing to accept installment payouts.

Splitit pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ No new credit application required | ❌ Requires full purchase amount available on card |

| ✅ No interest or late fees from Splitit | ❌ Credit card required |

| ✅ High approval rates | ❌ Lower consumer awareness |

| ✅ Strong for high-AOV purchases |

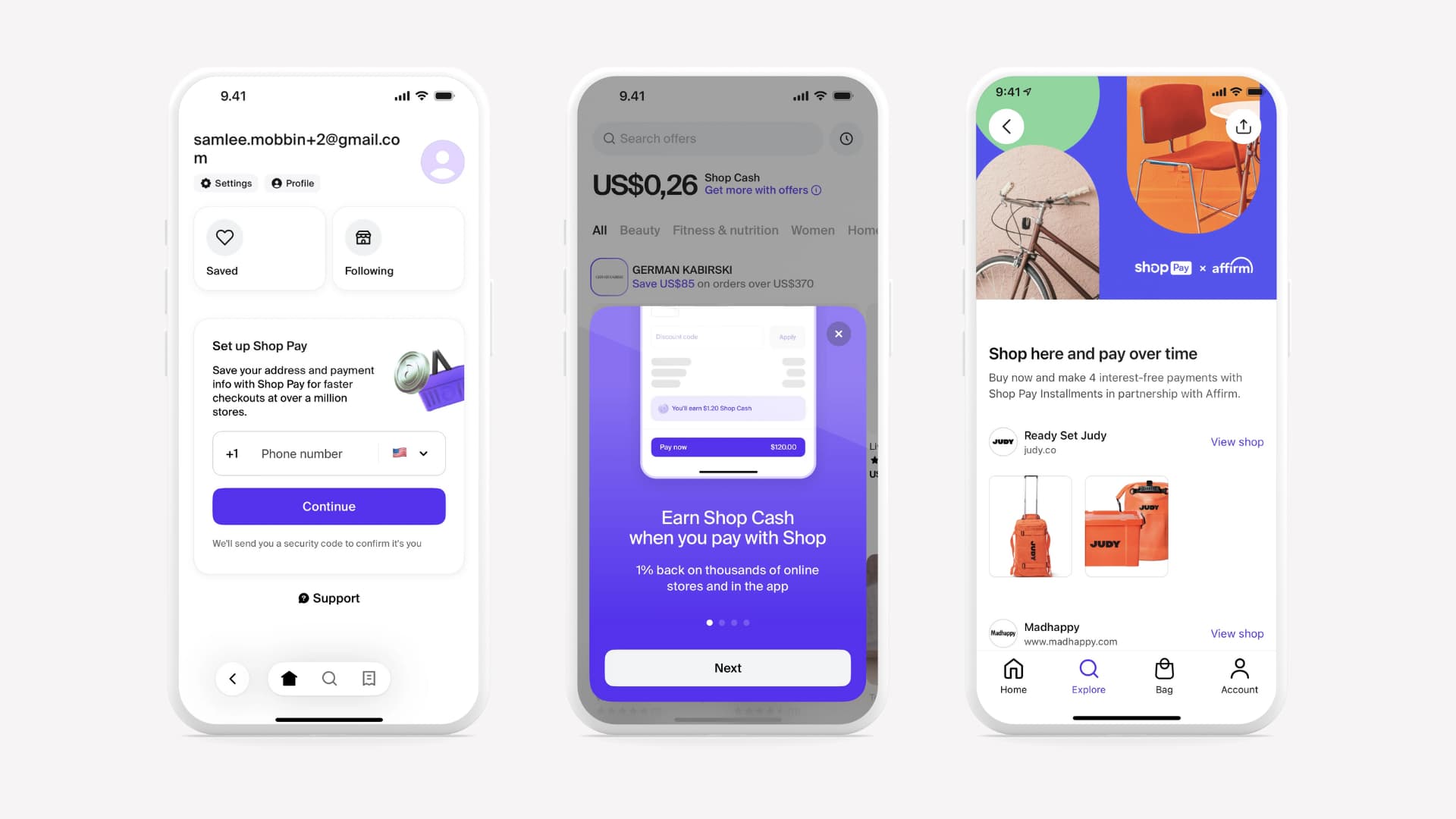

8. Shop Pay

Shop is a mobile shopping app designed by Shopify with a native BNPL solution included in its payments product, Shop Pay.

It allows customers to split purchases into smaller payments directly through the Shop Pay checkout flow — no need to integrate a third-party provider.

Because it's powered by Affirm in the U.S., merchants get the trust of an established BNPL partner while keeping the checkout process branded under Shop Pay.

Shop Pay Installments is best suited for Shopify merchants who want a BNPL option built into their existing checkout, with no extra integrations. It's not as flexible as standalone BNPL providers, but its native integration and customer familiarity make it a convenient, high-trust choice.

Payment options (U.S.):

- Pay in 4: 4 interest-free installments for orders between $50 and $999

- Monthly installments: Spread purchases from $150 to $17,500 over 3–12 months (interest may apply depending on eligibility)

Costs & fees:

- For customers: Pay in 4 is interest-free, while monthly installment plans carry APRs from 10%-36% depending on creditworthiness. No late fees are charged.

- For merchants: Shopify deducts a processing fee of 5.9% + $0.30 per BNPL transaction. These fees are higher than Shopify's standard payment rates, so retailers need to factor them into pricing.

Shop Pay pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ Native Shopify integration | ❌ Only available to Shopify merchants |

| ✅ Trusted checkout experience | ❌ Higher BNPL processing fees (5.9% + $0.30) |

| ✅ Interest-free Pay in 4 | ❌ Limited flexibility vs standalone BNPL providers |

| ✅ Powered by Affirm |

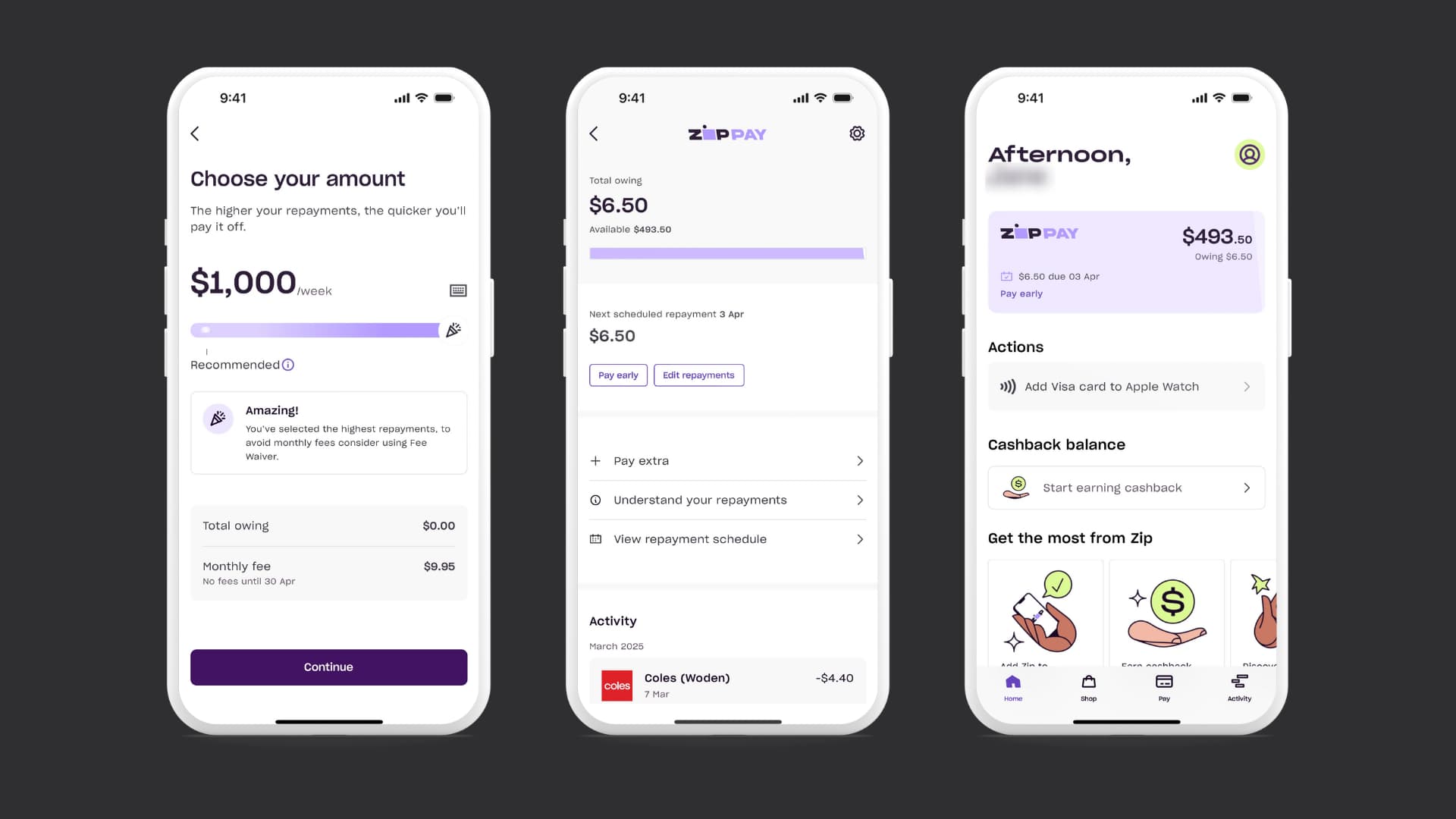

9. Zip Pay

Zip Pay is a Buy Now, Pay Later provider that lets U.S. customers split purchases into four interest-free payments over six weeks.

Unlike platform-native BNPL options, Zip works across thousands of online stores and most major ecommerce platforms, including Whop, Shopify, BigCommerce, WooCommerce, and custom sites via its API and payment widget.

Zip is best suited for merchants that want a flexible, widely adopted Pay-in-4 option without switching processors or migrating their checkout.

It's not as feature-rich as enterprise BNPL tools, but it offers broad retail coverage, strong brand recognition, and simple implementation.

Payment options (U.S.):

- Pay in 4: Four interest-free payments in weekly, twice monthly, or monthly instalments.

Costs & fees:

- For customers: Pay-in-4 is interest-free. Monthly account fees waived for timely repayments, but account and late fees apply if repayments aren't made on time.

- For merchants: Merchant fees vary by industry and risk profile (Zip generally charges a percentage of the transaction plus a fixed fee, higher than standard card processing rates).

Zip Pay pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ Widely accepted online and in-store | ❌ Late fees apply if payments are missed |

| ✅ Interest-free Pay in 4 | ❌ Lower initial spending limits for new users |

| ✅ Works across many platforms | ❌ Merchant fees higher than card processing |

| ✅ Simple setup |

10. Bread Pay

Bread Pay, owned by Bread Financial, is a Buy Now, Pay Later and installment financing solution aimed towards enterprise level business.

Unlike the usual Pay in 4 suspects, Bread Pay gives broader financing options to merchants and their customers, including short-term and longer payment plans. It's a strong choice for merchants selling large-ticket items.

Bread is a 'gray-label' solution, in that your brand stays front and center at checkout while Bread handles underwriting and risk (through their subsidiary, Comenity Capital Bank).

Payment options (U.S.):

- Installments: Fixed, monthly, traditional-style loans paid over months. Fast approval decisions (often seconds), for high-ticket purchases and structured financing.

- Bread Pay SplitPay: Four equal, interest-free payments over six weeks.

Costs & fees:

- For customers: SplitPay is interest free, installment plans can carry APR depending on credit profile and merchant terms. Late fees and terms governed by Comenity Capital Bank.

- For merchants: Custom fees negotiated based on industry, volume, and which payment option(s) you choose to go with.

Bread Pay pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ Supports long-term financing for high-ticket items | ❌ Slower launch than plug-and-play BNPL |

| ✅ Gray-label checkout experience | ❌ Best suited to mid-market and enterprise |

| ✅ Bank-backed underwriting | ❌ Fees are custom and |

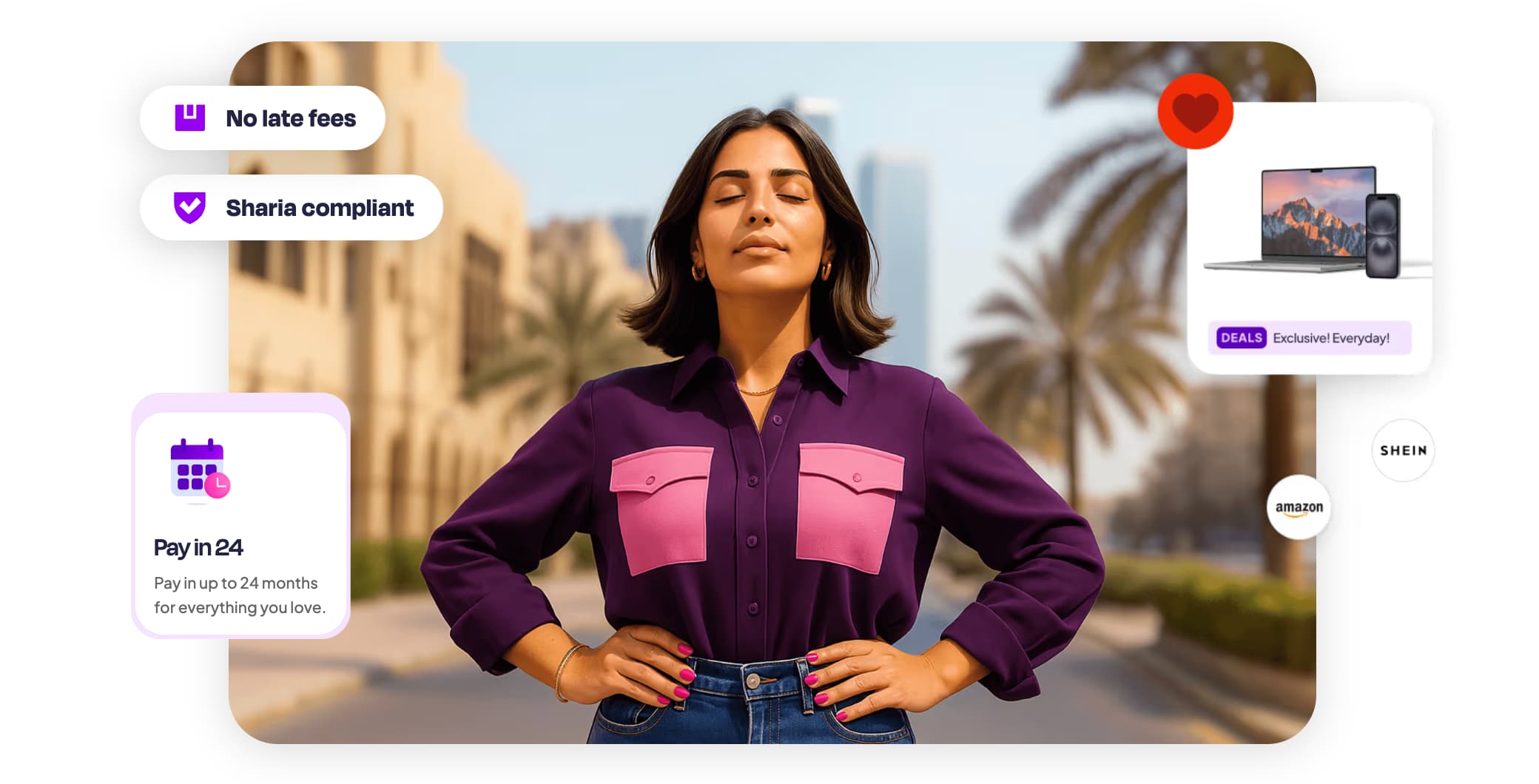

11. Tamara

Tamara is a Sharia-compliant BNPL provider, and one of the fastest growing fintechs in the GCC. It's been built specifically for markets where conventional interest-based products aren't suitable (so it can immediately open up your checkout to a massively underserved audience).

Tamara follows Islamic finance principles, meaning no interest, no hidden fees, and transparent repayment structures. Instead of charging interest, Tamara earns through merchant fees.

Millions of active users are reported and adoption is wide among global merchants. Tamara is now available on Whop for all eligible customers in the UAE and Saudi Arabia.

Payment options (UAE & Saudi Arabia):

- Pay in 3 or 4

- Deferred payment options (availability depends on merchant and customer eligibility)

Costs & fees:

- For customers: Interest free installments with no compounding fees. Late fees may apply depending on local regulations.

- For merchants: Percentage-based transaction fees. Rates vary based on country, volume, and merchant agreement

Tamara pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ Sharia-compliant (no interest) | ❌ Limited to GCC markets |

| ✅ Strong adoption in Saudi Arabia and UAE | ❌ Fewer payment structures than Western BNPL apps |

| ✅ Expands access to underserved audiences | ❌ Merchant pricing varies by region |

| ✅ Transparent repayment terms |

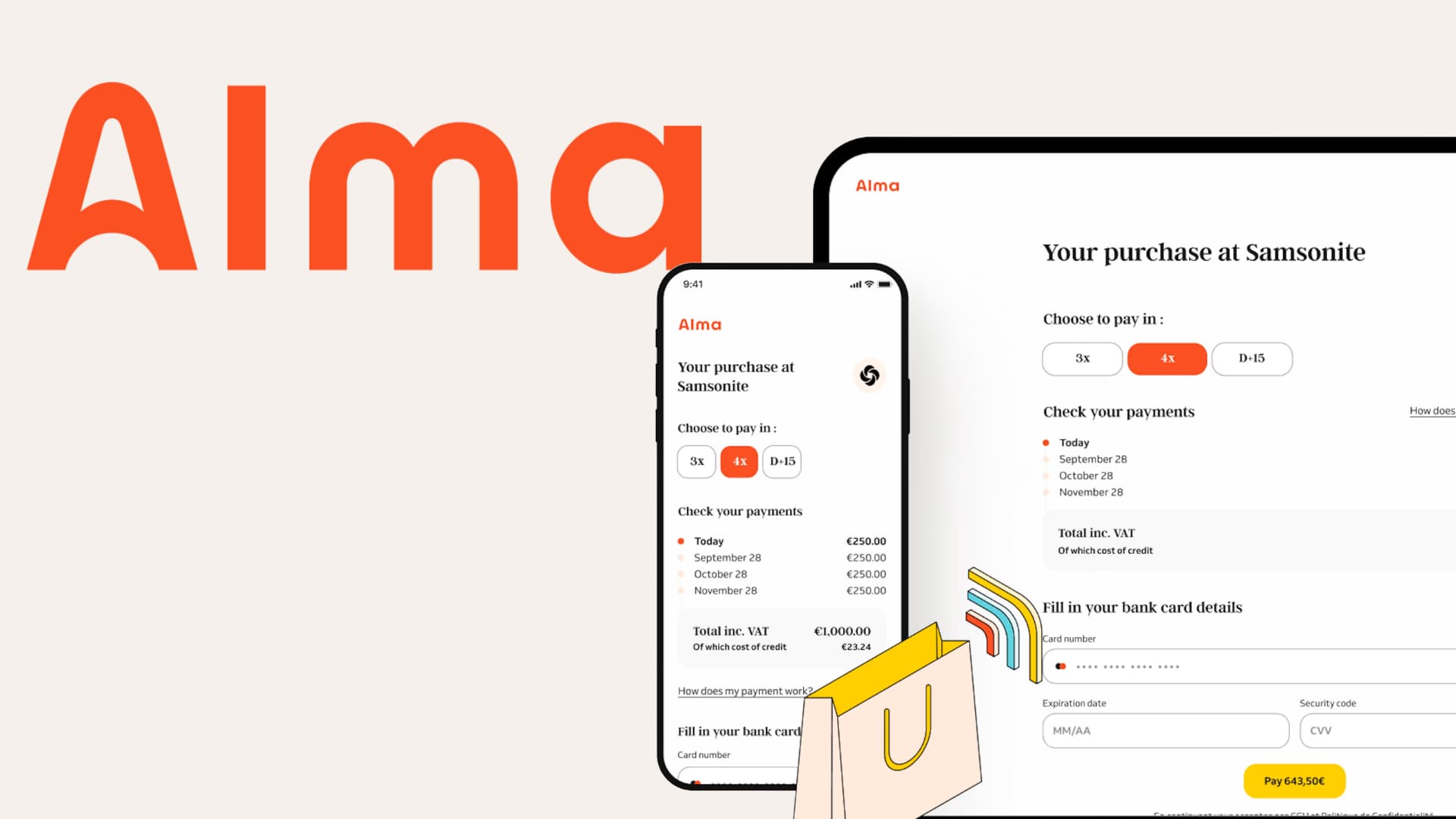

12. Alma

Alma is a European-focused BNPL provider with strong adoption across France (and growing coverage in Southern and Western Europe).

It's especially popular with higher-value goods and merchants seeking an alternative to typical Pay-in-4 apps. That's because Alma positions itself as a bank-grade BNPL, with fast yet conservative approval that helps reduce chargebacks and disputes.

Alma is most widely used in France, where it's one of the leading payment options. But it's also rapidly expanding across Spain, Italy, Belgium, and the Netherlands.

Payment options (Europe):

- Pay in 2, 3, or 4

- Monthly installments: Longer repayment plans for higher-value purchases (availability depends on merchant setup and customer eligibility)

Costs & fees:

- For customers: Short-term installment plans are interest-free, no compounding interest, possible late fees.

- For merchants: Percentage-based transaction fee, typically ~3-5%, no setup fees for most merchants.

Alma pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ Strong adoption in France and Western Europe | ❌ Limited availability outside Europe |

| ✅ Bank-grade risk controls | ❌ Less flexible than long-term financing tools |

| ✅ Interest-free short-term plans | ❌ Lower brand awareness globally |

| ✅ Lower dispute rates |

13. Scalapay

Scalapay is a European Buy Now, Pay Later service headquartered in Milan. It allows customers to split purchases into 3 or 4 fixed monthly installments, and operates across multiple EU markets.

After working in the payments sector in Australia and seeing the success of models like Afterpay, its cofounders set out to build a European-focussed BNPL solution. Scalapay is built around short-term installments only, so it doesn't offer revolving credit or long term financing options like Zip and other providers.

As with most BNPL solutions, customers receive their purchase immediately while Scalapay manages repayment on your behalf.

Payment options (Europe):

- Pay in 3 or 4

Costs & fees:

- For customers: Pay in 3 is interest free (when paid on time), Pay in 4 includes a service fee shown clearly at checkout. Late fees may apply.

- For merchants: Percentage-based transaction fee and no setup fees for most integrations.

Scalapay pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ Simple Pay in 3 or 4 structure | ❌ No long-term financing options |

| ✅ Strong EU presence | ❌ Late fees may apply |

| ✅ Clear repayment schedules | ❌ Limited outside Europe |

| ✅ Easy for first-time BNPL users |

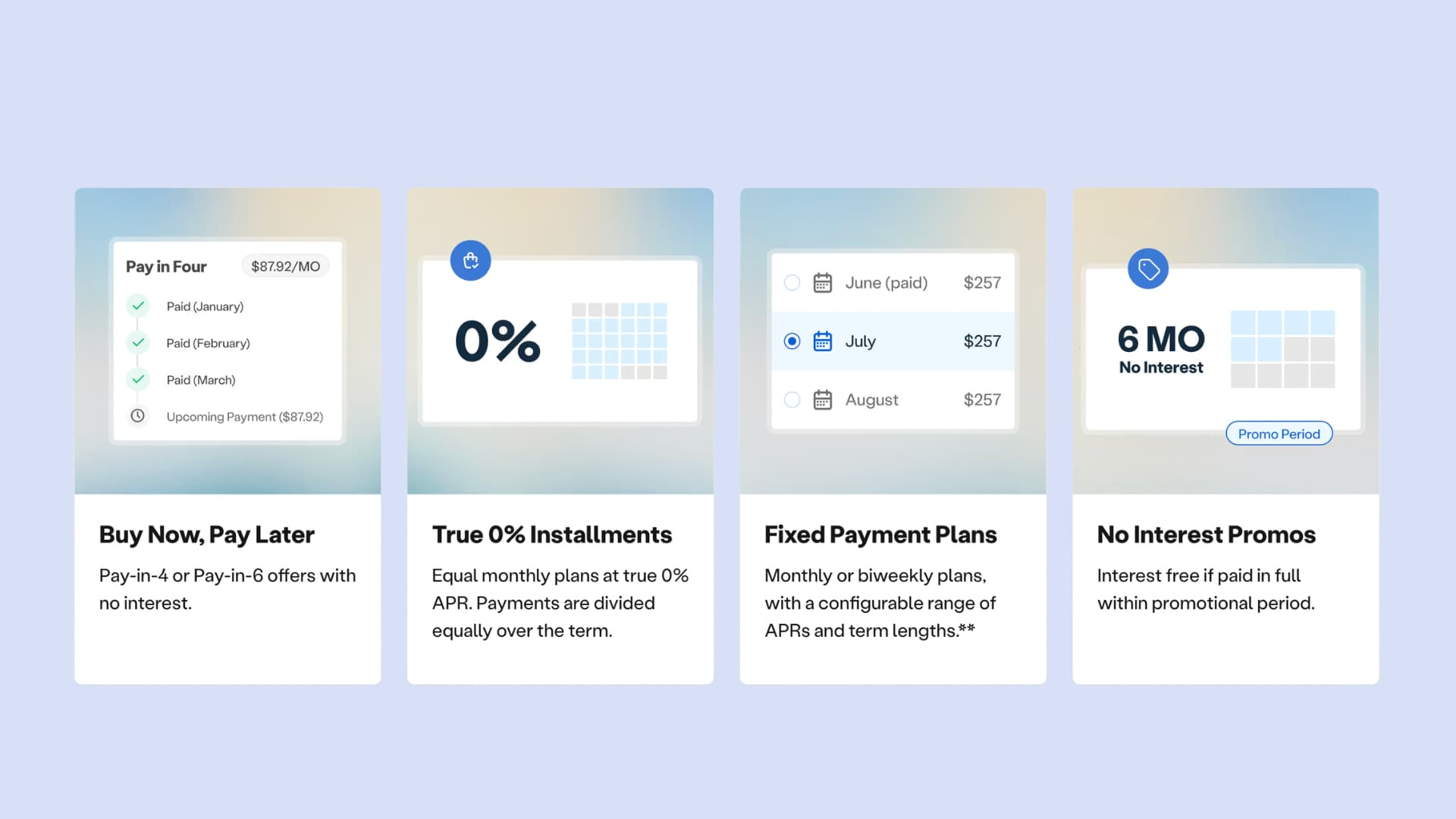

14. Claritypay

ClarityPay is a US-based financing platform built for higher-consideration purchases, not impulse checkout.

Unlike lightweight BNPL apps, ClarityPay supports a range of financing structures at checkout, from short-term instalments to longer repayment plans. These offers are delivered through a bank-issued credit model, meaning customers are entering a formal lending agreement rather than a simple split payment.

From the merchant side, ClarityPay handles underwriting, compliance, servicing, and repayment (while the business is paid upfront).

Payment options (US):

- Pay in 4 or 6 installments: No interest

- Fixed payment plans: Monthly or biweekly repayment plans with variable APRs and term lengths depending on credit profile

Costs & fees:

- For customers: Loan APRs range from 0% to 36%, depending on credit profile, state, and plan.

- For merchants: Pricing is custom and negotiated based on vertical, volume, and enabled products.

Claritypay pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ Supports higher-ticket purchases | ❌ Not a pure BNPL experience |

| ✅ Multiple financing structures | ❌ Longer approval flow than Pay in 4 |

| ✅ Bank-issued credit with regulatory coverage | ❌ APRs can reach 36% on long plans |

| ✅ Paid upfront to merchants |

15. SeQura

SeQura is a Barcelona-based pay-over-time provider focused on flexible instalments and deferred payment, with particularly strong adoption across Southern Europe.

Unlike simpler BNPL tools, SeQura is designed around conversion optimisation and acceptance rates. It uses its own risk and scoring models to approve more shoppers at checkout, including first-time buyers who might be declined by more rigid BNPL providers.

SeQura also supports "Pay after delivery" flows, letting customers receive the product first and pay 7 or 30 days later. This kind of model is especially effective for categories where trust and product inspection matter.

Payment options (Europe):

- Part payments: 3 to 24 instalments, interest-free or interest-bearing (merchant chooses whether fees are absorbed or passed to the shopper)

- Pay later: Pay 7 or 30 days after delivery, no credit card or document upload required for first-time purchases

- Split into 3: 3 equal monthly payments, first payment at checkout, remaining payments monthly

SeQura also supports combinations of these options within the same checkout to optimise conversion.

Costs & fees:

- For customers: Interest-free options available on shorter plans; longer instalment plans may include shopper fees or APR (clearly shown at checkout).

- For merchants: Fees vary based on instalment length, sector, and whether financing costs are subsidised or passed to the shopper.

SeQura pros and cons:

| Advantages | Disadvantages |

|---|---|

| ✅ Very flexible installment lengths (3–24) | ❌ More complex setup than basic BNPL |

| ✅ Pay-after-delivery option | ❌ Limited adoption outside Southern Europe |

| ✅ Strong acceptance rates | ❌ Fees vary widely by configuration |

| ✅ Paid upfront to merchants |

Apply for multi-provider BNPL financing with Whop

BNPL is available to eligible businesses using Whop Payments.

The simplest way to apply is through the Checkout links page of your dashboard:

- Click + Create checkout link

- Select One-time as your pricing type

- Under Payment methods, click Apply for financing

- Complete the application form

If your application is successful, we'll let you know via email, Whop DM, and on your Payouts page. All active financing options will automatically show up at customer checkout, and you can choose which financing options to enable on each checkout link.

Supported providers and limits

Whop partners with ten major BNPL services. Each has its own transaction limits and coverage regions:

- Sezzle: Up to $2,500 (Max term length 24 months)

- Afterpay/Clearpay: Up to $4,000 (Max term length 12 months)

- Klarna: Up to $10,000 (Max term length 24 months)

- Zip Pay: Up to $1,500 (Max term length 4 months)

- Splitit: Up to $20,000 (Max term length 6 months)

- Scalapay: Up to $3,000 (Max term length 4 months)

- Climb: Up to $42,750 (Max term length 5 years)

- Claritypay: Up to $30,000 (Max term length 12 months)

- Tamara: Up to $6,000 (Max term length 4 months)

- SeQura: Up to €5,000 (Max term length 12 months)

Whop currently supports BNPL for one-time payments only (not subscriptions or recurring memberships).

Find out more about each financing option, including limits, supported regions, approvals and terms in our documentation.

Sell more, get paid faster, and offer BNPL with Whop

BNPL lets you confidently sell more high-ticket offers like masterminds, live coaching, or premium programs while letting buyers spread the cost, and Whop gives you access to the best providers.

No monthly fees, low transaction fees, payouts in 241+ territories, smart routing to boost payment acceptance, and of course, the top global BNPL options (including Klarna, Sezzle, Splitit, and Afterpay).

More accessibility for customers, higher conversions for you.

Use Whop Payments to power more sales and scale your business.

BNPL FAQs

What should I look for in a BNPL company?

As a retailer, the most important factor is the approval (or acceptance) rate — the percentage of shoppers who actually get approved for financing. Low approval rates mean frustrated customers and abandoned carts.

While exact numbers are rarely shared, younger shoppers tend to have lower approval odds than older groups. Look for a provider known for high approval rates and broad accessibility.

Other key factors to consider:

- Ease of integration with your ecommerce platform

- Variety of payment options (Pay in 4, monthly financing, revolving credit, etc.)

- Merchant fees (transaction percentages and flat fees)

- Risk management (fraud prevention, credit checks, repayment strategies)

- Customer experience (support, reviews, reputation)

What happens if a BNPL customer misses a payment?

You don’t take on the risk. As the merchant, you’re paid upfront in full. Missed payments are between the customer and the BNPL provider. Consequences depend on the provider — usually late fees, account freezes, or restrictions on future purchases.

In some cases, long-term nonpayment may result in debt being sent to a collection agency.

Can customers still make returns if they used BNPL?

Yes. The process works just like a normal return. You issue a refund to the BNPL provider, and they update the customer’s repayment plan or credit line. This ensures the shopper’s account reflects the return correctly.

Are BNPL providers regulated?

Regulation is catching up. For years, BNPL operated in a gray area outside of traditional financial oversight. Now, regulators in the U.S. and abroad are tightening rules to protect consumers and ensure ethical practices.

For you, this is good news: working with a regulated provider builds trust and reduces reputational risk if customers complain about their experience.

![15 best BNPL providers for your business [2026]](/blog/content/images/size/w2000/2026/02/BNPL.webp)