If you’re running a business, you’ve probably got a lot on your mind. The problem is that a lot of the moving parts of any business take a lot of time to put in place and maintain, meaning that you’re taking time away from what truly matters—working on your product, and delighting your customers.

Payments fall right into that category, but if you get it wrong, you can stand to lose out big time. From transaction failures to decline cards, you can lose out on lots of sales—and who knows how many entire markets you’re closed off to if your payment processor can’t take payments from countries?

Understanding payment processors and picking the right one, therefore, is key to optimizing your business. So, what do you need to know about payment processors, how do they work, and which one should you pick? We’ll answer all of these questions and more.

If you want to jump ahead to a specific section, click here to go to:

- What is a Payment Processor?

- How do Payment Processors Work?

- How to Choose a Payment Processor

- Top 5 Payment Processors

- What’s the Difference Between a Payment Processor and a Merchant of Record?

- Process Your Payments with Whop

What is a Payment Processor?

A payment processor is a company that facilitates transactions, making it possible for merchants to accept instantaneous payments from customers. They manage the transfer of data between all of the different financial institutions and networks involved in the transaction.

How do Payment Processors Work?

Payment processors work behind the scenes, but they’re the primary actor ensuring that money moves from A to B, and they’re also responsible for securing the transaction. This means that they perform the checks required to ensure that the customer either has enough funds or sufficient credit, and they also protect the customer’s financial information.

They can also provide an essential service for businesses by means of reporting and analytics, furnishing merchants with a variety of data that can be used to create detailed reports. The insights gleaned from these analytics can help businesses in a number of ways, from tracking and optimizing sales to identifying and acting on trends.

The best payment processors also support payments across a variety of currencies and geographical regions, facilitating ecommerce across borders, and they continuously monitor payments for signs of fraudulent activity in order to help you as a merchant minimize your exposure to illegal activity.

Now that we’ve clarified what a payment processor does, let’s look at the nuts and bolts of how a payment processor typically works, dividing a basic transaction into a number of steps:

Step #1: Customer Makes a Purchase

A payment processor’s services are engaged when a customer makes a purchase. At checkout, they provide their payment information to the merchant, whether it’s online through a website or app or via a point-of-sale (POS) machine. In either case, the customer’s credit or debit card information is the primary input, alongside additional data such as transaction amount and merchant account.

Step #2: Transaction Data is Encrypted

All of this transaction data is now encrypted in order to ensure secure transmission and eliminate the risk of customer information being misused by bad actors or fraudulent third parties.

Step #3. Transaction Data is Transmitted

Now safely encrypted, the transaction data can be transmitted from the merchant to the payment processor via a payment gateway, and the payment processor sends the information to the acquiring bank (this is where you maintain your merchant account, although in some cases the payment processor also acts as the acquirer.)

Step #4. Transaction is Underway

Now the ball’s formally rolling, and the acquiring bank sends the transaction details to the issuing bank (your customer’s bank) via either the bank network in case of debit or one of the major card networks like AMEX, Visa, or Mastercard if it’s credit.

Step #5. Issuer Reviews Transaction

Your customer’s bank now reviews and verifies transaction details, confirming the authenticity of the payment method as well as the customer’s identity. Some issuers put an extra step in place here with online transactions, asking customers to manually authorize transactions too. The bank also checks whether the customer has enough funds or credit for the transaction to complete.

Step #6. Transaction is Authorized (or Declined)

If it’s all systems go in the above step, the issuer will then send an authorization code back to the acquirer via the network. The issuer may also decline the transaction, and in that case will also send a decline code in response.

Step #7. Processor Confirms the Transaction

The final word on the transaction is now sent to the payment processor, who can finalize things on the merchant end. All of this usually happens in a matter of a second or two, and the payment gateway or POS terminal will confirm either that the transaction went through or was declined. If it was declined, the merchant will usually prompt the customer for an alternate means of payment or, if it’s an online transaction, to try another card or payment option.

Step #8. Transaction is Completed

Now the transaction is complete as far as the merchant and customer are concerned, and the merchant can hand over the goods or initiate fulfillment. However, what some people don’t realize is that even though the transaction and sale of goods is complete, no funds have actually been transferred. The banking system is clunky and complex, and one of the benefits of service providers like payment processors is that you can have instant sales rather than having to wait days.

Step #9. Capture and Settlement

The payment processor will batch all of the merchant’s authorized transactions, typically at the end of the business day, then will send these batches to acquiring banks. The banks then initiate the process of actually moving funds across from issuing banks to specific merchant accounts, and settlement can take up to a few business days. This eventual transfer of funds from the customer’s account to that of the merchant is called “capture”.

How to Choose a Payment Processor

Picking the right payment processor can be a big deal for any business, and some payment processors can open up a variety of opportunities and even markets that others simply don’t. Here’s what to look for when you make your choice!

#1. Payment Methods

One of the most important things to look for when it comes to a payment processor is the choice of payment options they enable for your customers. Each customer may have their own preferences when it comes to making payments, and on top of that, your own products may be more suitable to one type of payment or the other—particularly expensive products, for example, might have a broader market if your payment processor can offer “buy now pay later” options or installments. Payment via debit or credit card is usually the bare minimum, but each additional option will help you sell to more customers.

#2. International Support and Currencies

Ecommerce is global, but the limiting factor is often the ability of a payment processor or a logistics company. Digital products don’t need physical fulfillment, so the only thing in the way of having truly global sales is your payment processor! For this reason, it’s wise to work with a payment processor that covers as many countries and offers as many currencies as possible.

#3. Pricing Structure

The next thing to look at when it comes to choosing a payment processor is pricing. While there are other things (like security) that can be deal-breakers too, picking a payment processor with the right pricing structure for your business is key.

Many payment processors offer flat fees, others do percentages of transactions, some have tiers. What you need to do is weigh up your business model and see if the payment processor’s pricing structure makes sense for you. For instance, if all of your products are under $10, just about any sort of flat fee will hurt.

#4. Security

There are a lot of industry standards in place for payment processors to follow, and it’s worth doing a little background research to know what sort of measures are used by the processor you’re interested in. Make sure that they’re in full compliance, how they handle things like encryption, and where they are in terms of fraud detection and prevention.

#5. Integrations

This is another big one to think about, especially if you’re already running a business and have certain elements of infrastructure in place. You might be using a particular ecommerce platform or POS system, so the payment processor you choose will have to integrate easily with what you’ve already got. The best ones ensure that you get simple APIs, plugins or SDKs that allow easy integration, so that’s something to look for in order to avoid the hassle of migrating or replacing things.

#6. Analytics and Reporting

This one isn’t quite as important as a lot of the previous entries, but if you want to get serious about your business, you need to take analytics seriously. The best payment processors know this, and provide plenty of analytics and reporting tools geared toward the optimization of your business and allowing you to make data-driven decisions.

#7. Scalability

The business landscape is always changing, and you can expect that your business will change too as time passes. You’re likely to evolve your operations, cut down on some aspects and grow others, and ideally grow your company to match your business ambitions. Your payment processor should be able to scale with you, so when you’re thinking about things like pricing structure, consider where your company might be in a year, or two, or five. The best payment processors will give you room to grow.

#8. Contract Terms

As with any deal or partnership, make sure that you go through the payment processor’s terms with a fine-tooth comb. Keep an eye out for things like minimum requirements or other thresholds, termination fees, and make sure that the processor you choose is transparent and clear in the way they communicate their T&C’s.

#9. Customer Support

Last but very much not least, dig up as much information as you can on your chosen payment processor’s customer support. See what the internet says about them, and make sure that they offer prompt support across the channels (such as phone or email) that you prefer.

Top 5 Payment Processors

#1. Whop

Whop is one of the hottest internet marketplaces for just about any kind of digital product and service, and it also functions as an extremely robust, versatile, and responsive payment processor and Merchant of Record for ecommerce.

Whop’s payment gateway is built atop Stripe, allowing it to take advantage of Stripe’s security and powerful platform while also offering a ton of extended features that other payment processors simply can’t match.

You can take payments in more countries than you can with Stripe if you sign up with Whop thanks to integrations such as Tipalti, and your customers can even pay you in cryptocurrency thanks to an ETH gateway and the ability to link your Whop account with a blockchain wallet.

With Whop you’re only looking at paying 3% plus processing fees but getting lots of extras such as 24/7 web-based customer support, tools to combat disputes, and free graphic design! You can also get in touch with Whop’s sales team for features that turn the dial all the way up to 11.

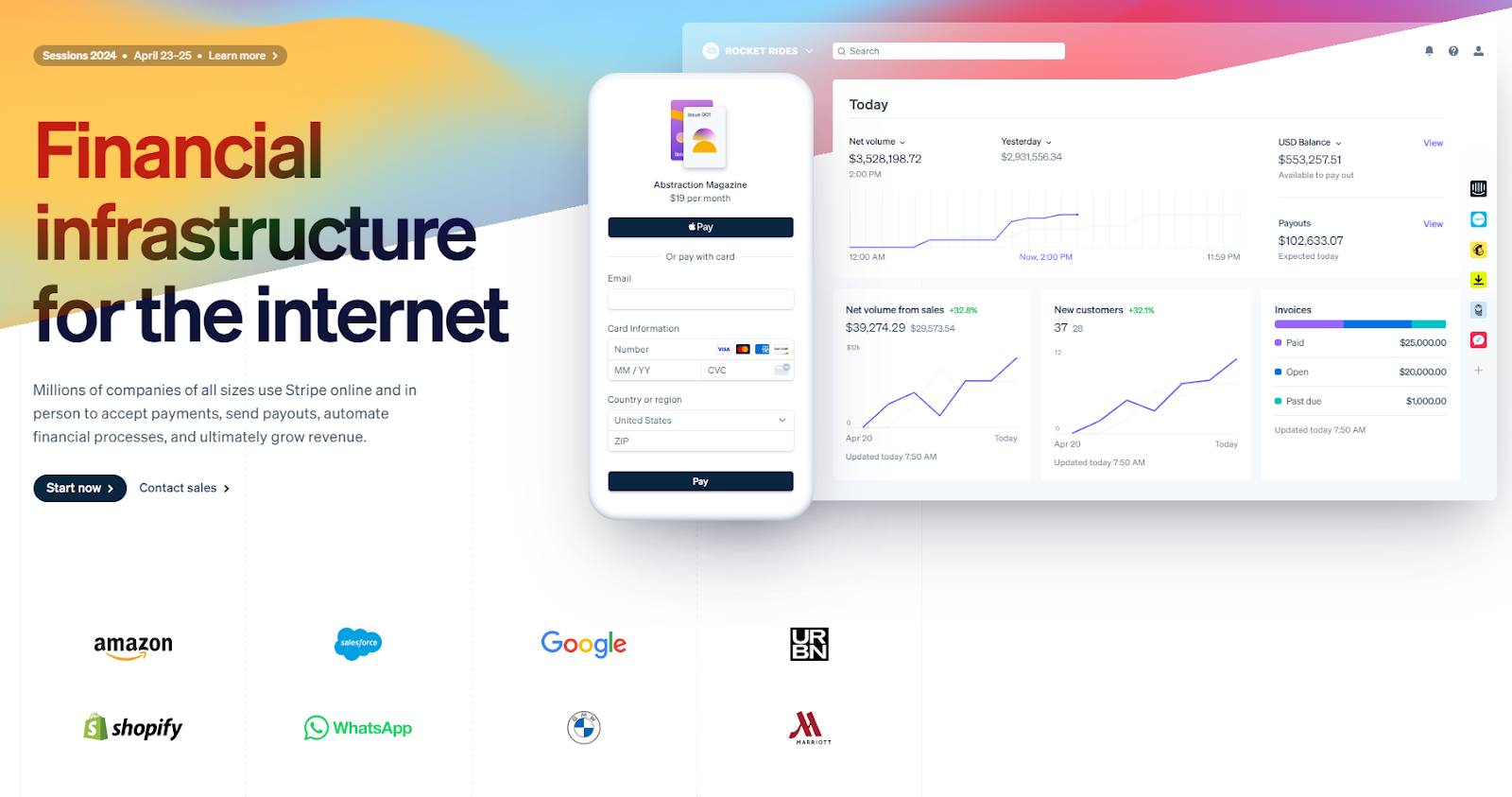

#2. Stripe Payments

Stripe is a payment gateway and processor widely considered one of the best options for digital stores since it eliminates the need to create a merchant account. It has its own platform called Stripe Terminal to handle in-person transactions, and also serves as a Merchant of Record.

It’s an extremely customizable option meaning that integration with your existing tech stack should be very easy via the Stripe API, and it’s also considered one of the safest processors out there. Stripe is a certified PCI Level 1 provider, and all data is heavily encrypted and stored on separate servers.

All of Stripe’s benefits do come with a certain cost, with the standard payments package coming in at 2.9% + $0.30 per successful charge for domestic (US) cards. You can also contact Stripe sales for a custom package if your business handles a large payment volume.

#3. PayPal

PayPal is an extremely well-known payment processor, and it should be no surprise that it makes this list. The company’s core competence has always been the easy facilitation of money transfer, and this extends to ecommerce—customers can pay you easily and instantly in a number of ways, including in installments.

PayPal also integrates easily with other platforms, from various sorts of enterprise software all the way to ecommerce platforms, and you’ll get a solid suite of reporting tools too. Like the previous entries on this list, PayPal has no monthly or startup fee.

The pricing model is a little bit more complicated, though—online card payment comes to 2.59% + $0.49 per transaction, and you can choose to add 0.4% or 0.6% for chargeback protection options. PayPal Zettle POS transactions are cheaper, priced at 2.29% + $0.09 per transaction.

QR code payments cost the same as POS, but PayPal’s own native digital payment system is available too at 3.49% + $0.49.

#4. Square

Square is a payment processor that’s slick, modern, and covers all sorts of businesses although they specialize in restaurants, retail, and beauty. It’s a great option for growing businesses, and has a track record of helping entrepreneurs grow, adding new streams, and track powerful analytics.

It’s easy to integrate Square into your tech stack, and they offer extras as and when you need them—and this extends to pricing, with a basic plan just charging processing fees, a more advanced option for retailers or appointment-based businesses, or bespoke pricing upon inquiry.

On the processing fee side of things, you’re looking at 2.6% + $0.10 for in-person transactions where a card is tapped or swiped. Usage of a card on file or manual entry costs a little more thanks to the fraud prevention aspect at 3.5% + $0.15, while online purchases come in at 2.9% + $0.30 and invoices are charged 3.3% + $0.30.

#5. Payment Depot

Payment Depot provides merchant services for all sorts of businesses, offering various different kinds of payment terminals (including virtual ones) and handling ecommerce as well as mobile payments.

Payment Depot advertises transparent payments but you’ll have to contact their sales team to get a personalized quote. There aren’t any setup or cancellation fees and you get full access to their software, but subscription prices are determined by processing volume.

What that means is, you’re looking at transactions that aren’t marked up and range between 0.2%-1.95%. However, you’re also going to have to pay a monthly fee in the region of $79 to use Payment Depot’s services.

What’s the Difference Between a Payment Processor and a Merchant of Record?

We’ve mentioned the term Merchant of Record (MoR) and the fact that both Stripe and Whop are MoRs, but how does that differ from an ordinary payment processor or payment service provider?

Essentially, a merchant of record assumes liability for the transactions it processors, which a payment processor doesn’t do. The payment processor simply enables transactions, but a merchant of record manages the various complexities that arise, tracks payments, and manages compliance on your behalf.

Here’s a detailed guide to what a merchant of record is, and why you might consider linking up with a payment processor who also acts as your MoR.

Process Your Payments with Whop

If you sign up with Whop as a seller, you can use Whop Payments at no cost or charge. This will allow you to take advantage of Whop’s merchant of record services, extremely easy-to-use API, and platform based on the solidity and security of Stripe.

By running your business on Whop, you can open up a whole new world of revenue streams including recurring revenue, and even leverage a variety of marketing tactics such as deploying affiliates and coupons to your advantage. You can sell to customers from even more countries than before, making your business a truly global endeavor.

Even if you’d prefer to stick with your own website or online store, you can simply use a Whop checkout link to let Whop take over all of your payment processing needs. So don’t wait, check out Whop today!