Starting any new business venture is an all-encompassing task, and you will often find that your attention is being pulled in many directions, from product development to marketing, sales, customer service, and more. Therefore, with so many competing priorities, the last thing you want to spend your time on is creating a merchant account and handling all the payment processing yourself.

That is why so many sellers turn to a full-stack payment service provider (PSP) that can be integrated easily within their website. The payment service provider takes care of the checkout process so that you can focus on other aspects of your business. And a stand-out name in the PSP game is Stripe!

In this article we’ll take a deep dive into what Stripe is, everything it offers for online businesses, and whether it’s the right option for your ecommerce store. Plus, we’ll check out how it ranks up against other PSPs like PayPal and Whop Payments.

What is Stripe?

Stripe is an online payment services provider that lets merchants accept debit and credit cards. It is a payment gateway and processor that provides top-notch security, convenience, and a suite of related services for your business. Stripe is considered to be the best option for digital-based stores as it eliminates the need to create a merchant account and handle payments, all for a reasonable fee.

There’s much more to the platform than that, as it is a Merchant of Records (MoR). You can get access to tax services, invoices, and billing, as well as issue your business’s very own cards. Plus, Stripe has its own unified commerce platform, Stripe Terminal, for in-person transactions.

However, we’ll primarily focus on the payment side of things and the platform’s solution, Stripe Payments. But before we go on to talk about how accounts and transactions work, it’s worth noting the developer-centric nature of Stripe. While you can use no-code solutions, like payment links and invoices, to get paid through the platform, the real fun lies in its API.

Stripe is, in general, very customizable. Many developer tools and custom integrations are available, all of which are well-documented on the platform itself. Plus, Stripe partners with third-party developers who can help you if you’re not tech-savvy.

How Does Stripe Work?

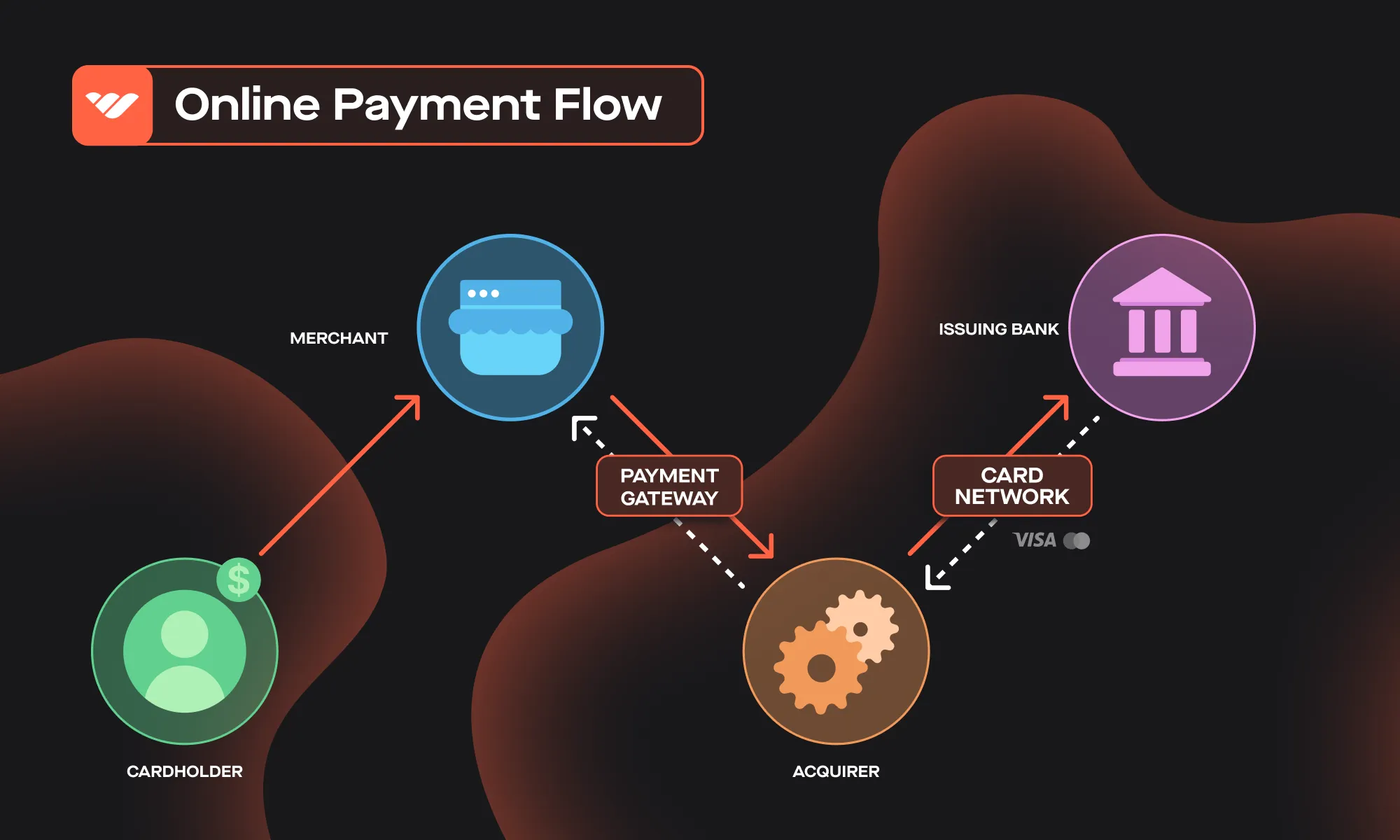

As a payment service provider, Stripe simplifies the checkout process. Customers provide their payment data securely through Stripe’s payment gateway. Then, within seconds, the merchant’s bank receives that data, communicates with the customer’s bank, and sends a positive (or negative) signal back to the customer, if sufficient funds are (or aren’t) available.

Let’s take a deeper look into the entire process, from the moment your customer goes to checkout to the point you receive the payment in your bank account.

- The customer provides their card data, either through a one-time or a recurring payment.

- Stripe’s payment gateway receives and encrypts the details, storing them on a separate server for extra security.

- This data is sent to the acquirer, a bank with which Stripe has a merchant account.

- The acquirer processes the card details through the card’s network (Visa, Mastercard, etc), and the payment signal is sent to the issuer, the bank with which your customer has an account

- This issuing bank approves or denies the transaction based on your customer’s balance

- The signal sent from the issuer goes back to the acquirer through the card network, which then passes through Stripe’s payment gateway and reaches the customer with a receipt (if the payment was approved) or a message to use a different card (if it was denied)

This rather complex process takes mere seconds. And, if the payment is approved, it’ll take a few days for Stripe to verify and process it, at which point it’ll reach your account.

Is Stripe Safe For Businesses and Customers?

Knowing how sensitive handling all this customer and business data is, it’s no wonder you want to ensure that Stripe is secure. Thankfully, the platform is considered one of the safest payment service providers to use, and for good reason.

For one, Stripe is certified as a PCI compliance Level 1 service provider and is audited yearly to maintain this certificate. Simply put, Stripe passes all of the Data Security Standards (DSS) set by the Payment Card Industry (PCI). Besides that, the platform is subject to regular security checks, so it’s safe to say that they take your business’s security very seriously.

Also, from the customer’s viewpoint, Stripe encrypts their data and stores it on separate servers to avoid leaks. Plus, every transaction through its gateway must occur within the HTTPS network, adding an extra layer of security.

So, it’s safe to say that the platform is amongst the most secure PSPs on the market. But that also comes with a cost in the form of Stripe’s transaction fees.

What Businesses Can Use Stripe?

Thanks to its strong security and brand reputation, many types of businesses use Stripe. The platform has a pay-as-you-go format, so everything from small businesses, like a brand-new ecommerce store, to huge enterprises, like Shopify and Lyft use Stripe. In fact, Stripe says that almost 90% of all personal credit cards have been processed through Stripe’s software - so you have probably used Stripe for your own purchases!

That said, most of its features primarily target digital-only businesses. Still, all kinds of businesses can use Stripe - here are some of the business models that Stripe supports:

- Ecommerce and Online Retail Stores

- B2B and B2C Platforms and Marketplaces

- Software as a Service (SaaS) Providers

What are the Stripe Fees and Payment Methods?

Stripe has different fees according to the payment method your customer chooses. The baseline for most card transactions is set at 2.9% + 30¢. However, if you were to get paid by an international customer using their local currency, the fees would go up to 5.4% + 30¢.

As for its payment methods, Stripe has a huge selection, from wallets and cards to bank transfers and international options.

Here’s a table with the most popular payment methods on Stripe, as well as their accompanying transaction fees:

| Payment Method | Transaction Fees |

|---|---|

| Cards (e.g. Visa, Mastercard, American Express) | 2.9% + 30¢ for online payments 2.7% + 5¢ for in-person transactions |

| Wallets (incl. Apple Pay, Google Pay, Alipay WeChat Pay) | 2.9% + 30¢ |

| Bank Debits and Transfers (ACH Direct Debit, USD Bank Transfer) | 0.5%-1.2%, capped at $5.00 |

| International Payment Methods (SEPA Direct Debit, Sofort, iDEAL, EPS, Multibanco) | 1.4%-1.6% + 30¢ 2.95% + 30¢ (Multibanco) 0.8% + 30¢ capped at $6.00 (SEPA Direct Debit) All transactions include an additional 1.5% fee (international payment methods) + 1% fee for currency conversion |

| Buy Now, Pay Later (Affirm, Afterpay) | 6% + 30¢ (Pay in 4 & Monthly) |

Is Stripe the Best Option For Your Business?

Now, you might have already decided that Stripe is the right option for you. It’s convenient, it’s safe, and it’s one of the most widely used PSPs. Even big names like Shopify, Lyft, Amazon, and Google are using Stripe.

That being said, there are some clear factors that make the platform the best choice for you:

- You use popular ecommerce platforms:

Stripe has direct integrations with the most popular ecom platforms and website builders, like Whop, Shopify, and WooCommerce. So, integrating Stripe with them will be effortless. - You are a developer (or have a developer on your team):

Stripe is developer-centric and offers tons of tools to customize your customer’s checkout process. - You have an international business:

Stripe supports 135+ currencies and is available in more than 45 countries worldwide. Thus, it’s going to be your best bet if you cater to an international customer base. - You have security concerns:

Stripe offers top-notch security measures. The platform is certified as a PCI compliance Level 1 service provider and encrypts all customer data (which is stored on separate servers) throughout the payment process.

Prohibited Industries on Stripe

Of course, there’s a chance that your business won’t be allowed on Stripe. The platform is clear on the industries that they don’t work with. Here’s a quick list of all the business types Stripe prohibits on its platform:

- Illegal Products and Services

- Adult Content and Services

- Content Creation Misuse

- Debt Relief Companies

- Gambling and Betting

- Government and Identity Services Misuse

- Intellectual Property Rights Infringement

- Lending and Credit Misuse

- Marijuana and Related Products

- Nutraceuticals and Pseudo Pharmaceuticals

- Non-Fiat Currency Operations

- Travel Industry

- Unfair, Deceptive, or Abusive Acts or Practices

- Weapons, Firearms, and Dangerous Materials

Setting Up an Account on Stripe

Signing up is pretty straightforward and is required so that you can accept payments. That’s because Stripe acts as the merchant while your business is a sub-merchant. Basically, every Stripe business account is part of one big merchant account, with the platform being the aggregator.

Here are the steps to sign up and accept payments on Stripe:

- Create an Account

Simply visit Stripe’s website, sign up, and provide all the business details required, like your full business name, card statements, etc. If you’re an individual, you can still sign up as a sole proprietorship. - Provide your Bank Details

Accepting payments through Stripe requires you to have a business bank account. Once you’ve input the details, you’ll have to wait 1-3 business days to receive money in your account.

Now, you’re ready to get your first payout. However, receiving your first payment will take some time (1-2 weeks). That’s because the platform holds your payment to fully verify your business.

With that said, it’s time to see how Stripe processes each payment within seconds!

Integrating Stripe With Your Ecommerce Platform

As we mentioned above, Stripe has some pre-built integrations with the most popular ecommerce platforms. So, the whole process only takes a few clicks, and you don’t need any coding skills for it.

However, things get slightly complicated when it’s time to test it out. Running a test transaction is pretty much essential to see if everything’s running smoothly.

If you know your way around your ecom platform’s CMS, you’ll need to enable test mode and process a test transaction that way. Otherwise, simply try the API out with an actual transaction using your details and refund it afterward.

How to Integrate Stripe with Whop

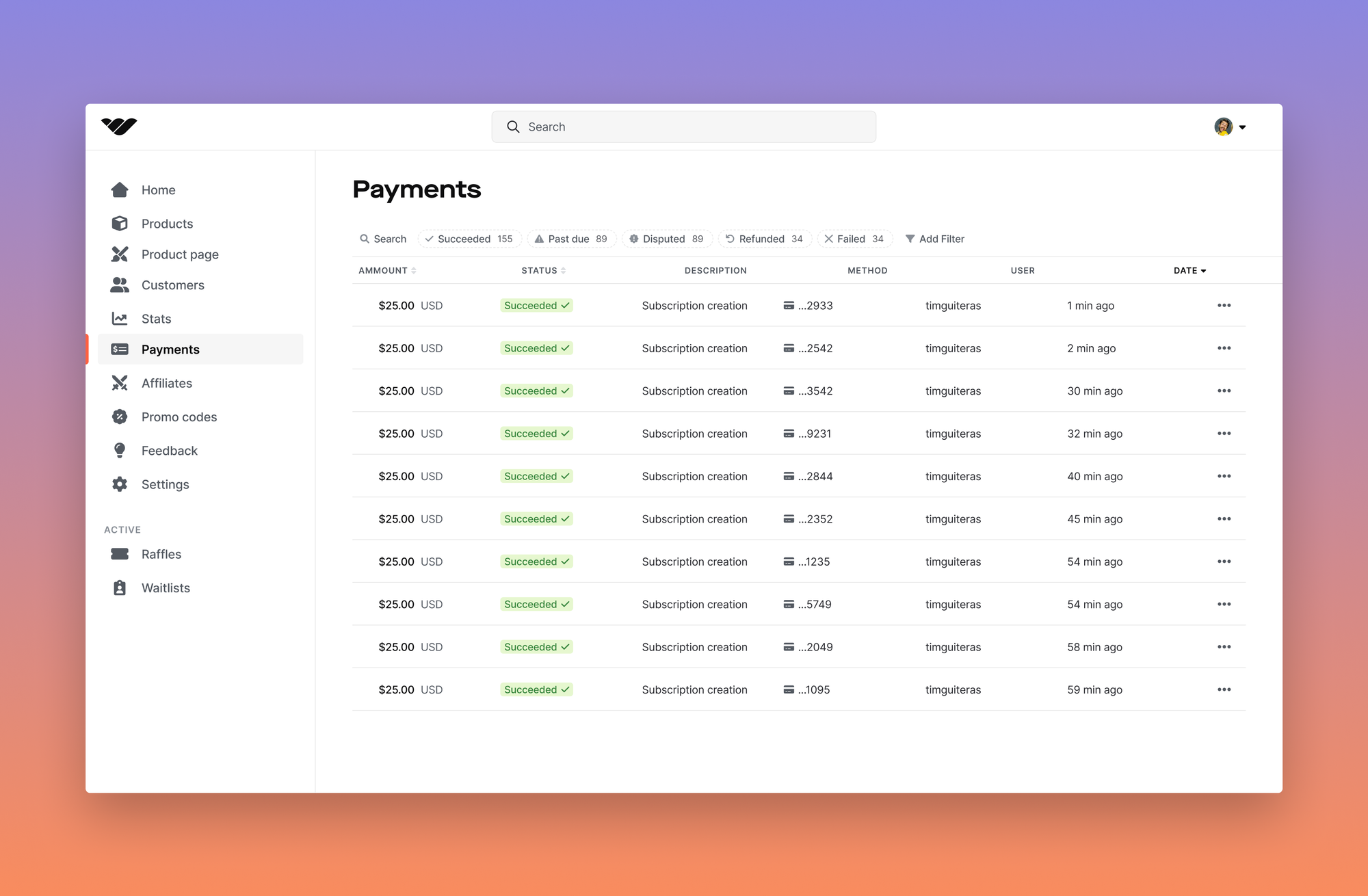

At Whop, we’ve been using Stripe from the get-go. Thus, integrating your Stripe account with Whop is very simple. All you need to get started is to sign up for an account on both platforms and set up a subscription plan on Stripe.

Once you’ve done so, you’ll need to generate a set of API keys from Stripe and input these on your dashboard on Whop to connect the two platforms. From there, you’ll be able to manage the subscription plans you offer directly through Whop, with Stripe powering the back-end side of things.

Advantages and Disadvantages of Using Stripe as Your PSP

Now, there’s no doubt that Stripe is a great payment service provider. However, it does have some disadvantages compared to some other PSPs on the market. Let’s check out the pros and cons of the platform.

Stripe Pros:

- Top-notch security measures on the business and customer side

- Well-established in over 45 countries, with 135+ currencies

- Plenty of payment methods available

- Developer-friendly with tons of customization options

Stripe Cons:

- The fees can get expensive when extra features are added/for international transactions

- You won’t get the full benefits of the platform if you’re not a developer

- It’s not the best option for physical stores

The Top Alternative Payment Processors

Now, Stripe might not be the best option for your business. For example, if you’re in the crypto space, or are paid primarily through cryptocurrencies, Stripe is a no-go. Or, if you sell sports betting tips, your business falls within Stripe’s prohibited industries.

So, here are a few payment service providers that could fit your online store better.

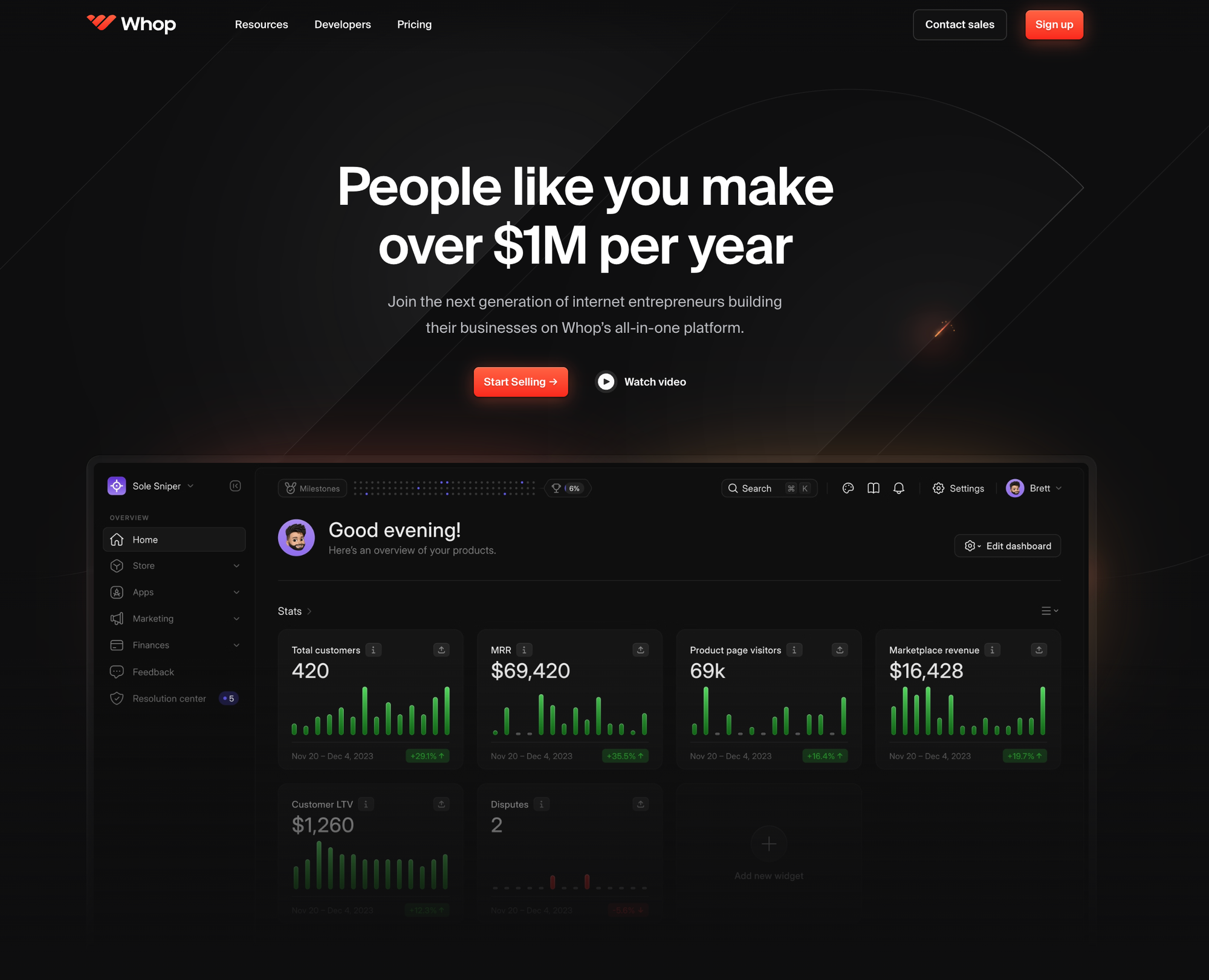

Whop Payments

Whop Payments combines the security and convenience Stripe provides with a couple of features that overcome some of the latter’s shortcomings. Whop Payments allows you to get paid through crypto by creating an ETH gateway and connecting your Whop account with your crypto wallet.

Also, even though the ACH payouts are made through Stripe, Whop Payments enables you to get paid with the help of a Tipalti integration if Stripe isn’t available in your country.

PayPal

Stripe vs. PayPal is the most common comparison in the ecommerce payment processing space. Both platforms have been around for a long time, but PayPal does one-up Stripe in some areas. For one, it supports 200 countries, a big jump from Stripe’s 135.

Also, PayPal has an incredibly simple setup process compared to Stripe, making it a better option for smaller businesses that have no developer onboard.

Square

Square can be considered the best alternative for physical stores. Square and Stripe are pretty equal in terms of their fees… but that’s where their similarities end. Instead of focusing on an international online market, Square has taken over the US in-person transaction market.

Sure, they still have the option for digital-only payments, but their product suite clearly targets physical stores.

Using Whop as Your Payment Service Provider

There’s no doubt that Stripe is at the top of the payment service provider market. While the platform is best utilized by developers and can get pricey at scale, it enables you to reach a global customer base and helps you keep a cool head when it comes to security.

That being said, Whop and its payment processor, Whop Payments, are your best bet for subscription-based products and recurring payments. With Whop’s competitive 3% transaction fees and a plethora of payout alternatives, as well as the support of Stripe’s security, your new payment service provider awaits.

Join the thousands of entrepreneurs who have sold $250+ million worth of products. Sign up as a seller with Whop today!

Stripe FAQs

Is Stripe free to use?

Stripe is 100% free to sign up. Getting paid through Stripe will set you back a base rate of 2.9% + 30¢ for online payments in transaction fees. A 1.5% fee is added in the case of international payments, and an additional 1% will be added as a currency conversion fee.

Does Stripe transfer to a bank account?

Stripe offers automatic daily payouts to every account. The frequency of these (daily, weekly, monthly, or manual) can be changed within your dashboard.

![Top 23 best dropshipping Discord Servers [July 2025]](/blog/content/images/size/w600/2024/02/Top-Dropshipping-Discord-Servers--1-.webp)

![Top 16 best ecommerce Discord servers [July 2025]](/blog/content/images/size/w600/2023/09/ecommerce-groups.webp)