With ecommerce becoming the norm for businesses, understanding the medium through which the payment flows from the customer to the business is a crucial aspect for effectively running a thriving business.

Global ecommerce is expected to grow at a rate of 9.4% in 2024, and during this year, it is projected to have the largest percentage increase within the four year period leading up until 2027.

Ecommerce store owners, particularly those selling digital products, are poised to capture a potentially substantial piece of this growing pie, and they’ll be using various ecommerce payment solutions during the process of building and running a business. Choosing the right one can have significant impact on your bottom line.

Here’s what you’ll learn in this article:

- A brief explanation of ecommerce payments

- A list of ecommerce payment providers

- Different types of online payment methods

- What makes a good ecommerce payment solution

- How ecommerce payment solutions work

- Why and how to choose a payment processor that is ideal for your business

Ecommerce Payments Explained

During the dawn of the internet, people found it incredibly strange to enter sensitive personal information related to payments online, including credit card details, name and shipping addresses. Today, virtually everyone enters or even stores personal information online in their web browser and mobile apps or device itself.

One of the biggest reasons for this shift in trust is the SSL protocol, which was introduced as a solution to transmitting secure information like payments online. SSL and its issued certificates establish authenticated and encrypted links between networked computers, allowing customers to make secure payments.

Thanks to this layer of security, companies were able to build productized payment gateways to collect customer payment in for payment processing. These are convenient as they can be used by businesses so that the owners wouldn't have to create one from scratch.

With the payment processor running in the background, the customer interacts with the payment gateway to submit information to make their online purchase.

Today, there are several options for ecommerce payment gateways, and their quality varies depending on their features and functionality.

Here’s a list of some of the top payment gateways:

🏆 Top Ecommerce Payment Providers

🥇 Whop

For those dealing with digital products of any kind, it will be hard to pass up on Whop, which has become the go-to marketplace for products ranging from memberships, courses, and various types of SaaS.

Whop Payments is a payment gateway that is a fusion of Stripe’s robust security and seamless payment API with Whop’s extensive ecosystem.

Sellers can choose how often and when they want to be paid, with the option to receive payments via ACH direct deposit in your chosen currency. Additionally, there is the option to accept and also be paid out in cryptocurrency.

Whop’s own API makes it easy to integrate payments with your existing website or service.

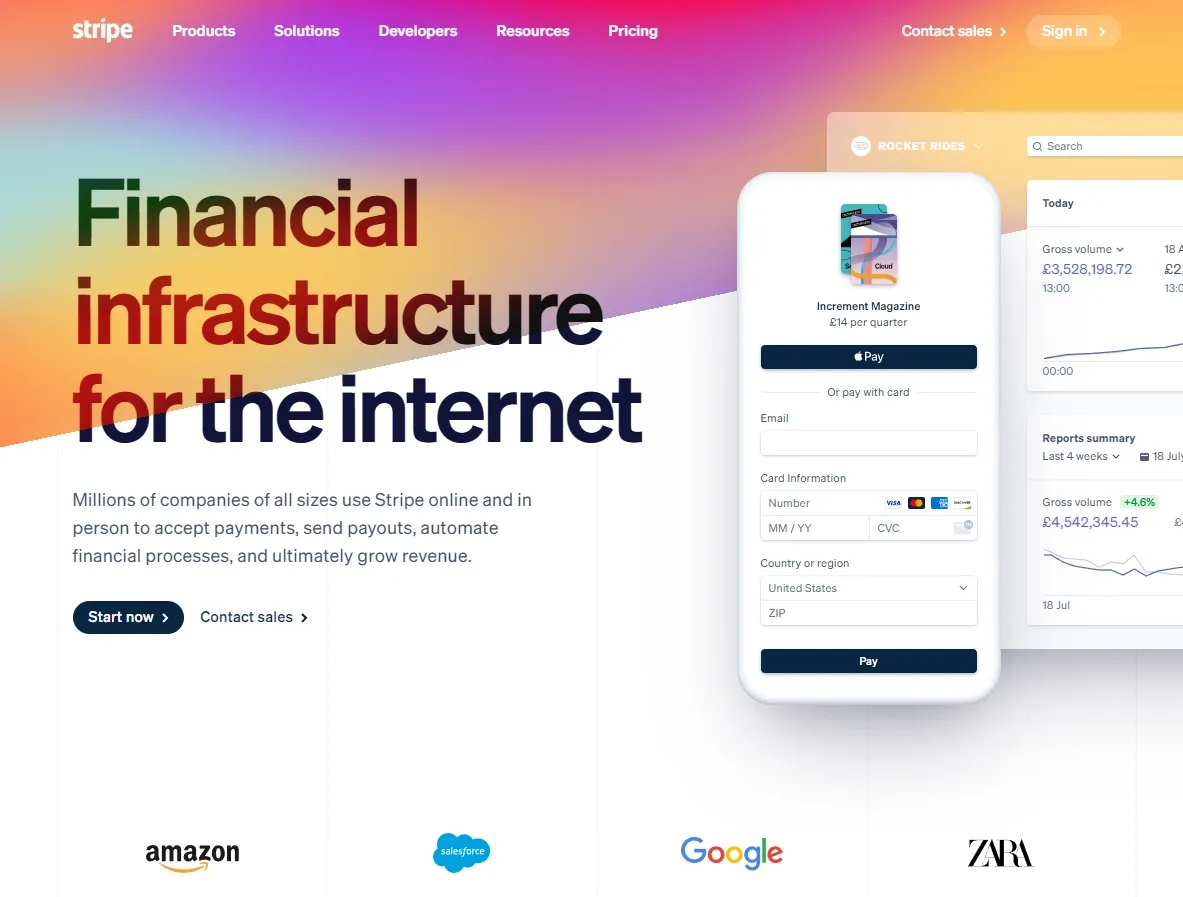

Stripe

One of the most comprehensive and omnipresent financial infrastructures of the internet today is Stripe, which has been around since 2010 and has constantly innovated and adapted to be a go-to solution for payment processing and a payment gateway.

Businesses of all sizes use Stripe due to its easy to use dashboard and quick setup, which allows for both online and in-person payment processing, simple creation of invoices and management of customers including subscriptions.

A suite of APIs and no-code tools make it easy for both developers and non-developers to feel empowered to use the best of what Stripe has to offer, simplifying setup for both businesses and platforms.

Stripe has a high standard for security for both the vendors that use them and the customers that buy through them.

PayPal

One of the earliest payment gateways to show up on the internet is PayPal, which launched in 1998 with the intention of being a low-cost, effortless solution for digital payments meant to be both consumer and business friendly.

Its main selling point was and remains to be the convenience of not needing to enter credit card information repetitively on each site they are visiting by storing tokenized payment methods ranging from customer credit cards to bank accounts that the customer can easily choose during checkout along with other options like PayPal credit.

However, the payment gateway has had issues throughout the years regarding fraud and chargeback abuse which affected vendors more heavily than consumers, which caused some users to be banned from using the platform unjustly. Additionally, holds are sometimes put on merchant accounts for inconvenient periods of time.

Its convenience and publicity continues to hold a group of loyal customers despite its shortfalls compared to other more secure payment gateways.

Braintree

Bryan Johnson’s Braintree was founded in 2007 and has since been acquired by PayPal in 2013. Its software development kit (SDK) now powers PayPal amongst other payment solutions including Venmo and Apple Pay, meaning that the consumer facing gateway can accept all of these methods seamlessly as they are native to the platform.

It is often posed as a main competitor to Stripe. Differences between the two include Braintree’s Marketplace which offers a more integrated solution with built in capability for split payments, and Stripe Connect which provides increased flexibility for customization of payment flows.

Overall, Braintree is lagging in adoption compared to Stripe despite having lower per-transaction fee than Stripe, particularly for big-ticket purchases, mostly because of the lackluster customer service and similar vulnerability to fraud that PayPal shares.

Apple Pay

Apple Pay’s main selling point is its convenience for iPhone users, who can use the payment system to securely store various forms of payment information, allowing for nearly instantaneous payment both in person and online through a double-click and a tap. Braintree’s SDK powers its magic.

Apple Pay also allows for peer-to-peer payment between Apple users, without the need to enter payment information, log in, or even leave areas such as iMessage which makes the experience truly seamless.

In 2023, it has now become one of the most popular mobile digital payment services in the US.

Its unique tokenization keeps customer data and payments secure, and it is becoming increasingly common as a checkout option for ecommerce websites.

Google Pay

For the many who prefer to use the Chrome browser or Android over iOS, Google Pay, formerly known as Android pay, was developed as a competing payment service which also offers quick and easy online and in-person purchases from stored payment methods.

Authentication of the transactions can be done through a passcode, PIN, or biometrics like touch and facial recognition.

Users can view transaction history, easily manage payment methods, and even integrate with loyalty cards.

The digital wallet payment solution is also increasing in adoption for ecommerce stores, and it has a heavy emphasis on security for both users and vendors alike.

Amazon Pay

Amazon leaves nearly every corner in the realm consumerism untouched, so it’s no surprise that the monopoly offers a payment solution that utilizes its extensive consumer and merchant userbase.

Amazon Pay is its online payment service which is continuing to offer support for payments in more areas throughout the globe. Its range of features include one-time and recurring payments, and beyond being simply a payment gateway, it is also a comprehensive online payment processing service that merchants can use to create an account to run payments and payouts through.

Integration with Amazon accounts is fast and easy, and offers perks for users that remain loyal within its ecosystem.

Square

One of the most popular payment solutions for physical stores is Square, which has developed POS hardware for accepting credit card and contactless payments that businesses of all sizes use today. It’s not technically a payment gateway, nor is it actually a true card payment processor, but more of a facilitator or virtual terminal so to speak. Thus, it is not a standalone payment gateway solution, but comes as part of a broader payment solution.

It offers a free online store feature which automatically connects to Square payments, and has a partnership with Weebly in which it powers payment methods made through that platform.

Additionally, it offers a default buy now, pay later (BNPL) solution which is becoming increasingly adopted by consumers, particularly those who want to make larger purchases.

Klarna

A payment gateway that was launched with BNPL as its main selling point is Klarna, which, for better or for worse, is showing up in a growing number of ecommerce stores worldwide as a payment option that consumers can use.

Although it offers a pay now option, most users opt for the Pay in 30 days, Pay in 3 Installments, or other financing options.

Klarna can be accepted with any kind of Stripe integration as it works with Stripe Checkout and Stripe Connect. However, customers will need to be redirected to Klarna in the same way that customers are taken to a new window for PayPal purchase, adding an additional step to the customer journey which may hurt conversion rate.

Elements of a Good Ecommerce Payment Solution

Not every payment gateway or processor is created equally, but every one of them that is good will include all of the following traits:

Trust

As mentioned earlier, submitting details online that could make one vulnerable to exploitation is a sensitive process that requires trust from the consumer. Since not everyone understands how security protocols work or how data is transmitted and stored securely online, often the trust is in the form of brand reputation, whether it’s with the online store that the consumer is shopping on, or if it’s with the payment processor if the customer is familiar with it.

Security

A business owner should know how secure a payment processor or payment gateway is as this is one of the most important considerations not just for customer trust but to remain compliant with any rules that may be in place.

Data encryption, which obfuscates valuable customer information is standard amongst ecommerce payment solutions, may vary between processors and gateways in terms of strength and updates.

In recent years, tokenization has become common to incorporate security with convenience, the most widely used example being the process of concealing credit card numbers while storing them as a tokenized set of codes.

Can Deal With Complexity

Encryption and tokenization are fairly complex, and they’re just part of the intricate process of an online transaction. Payment processing also involves multiple points of communication between the customer, their bank and the merchant and their bank. Only the most robust ecommerce payment solutions are able to perform and excel in these areas, and additionally, the landscape is dynamic as technology and the capability of hackers evolve, so payment gateways and processors must always be innovating.

Reasonable Transaction Fees

Payment gateways and processors need to produce revenue to fund continued functionality and innovation, so it is standard to incorporate a fee for both customer payments and sales payouts to merchants. This fee is known as a transaction fee. The fee can come in the form of a percentage, a flat rate, or both. Depending on the payment gateway that is being used, it is often possible to get a volume discount for businesses producing revenue over a certain threshold.

Acceptance of Various Payment Methods

Consumers have preferences and loyalty towards different payment methods for various reasons, and this allegiance with their choice can be so strong that they might opt not to buy a product simply because it is impossible to use their favorite method.

In order to avoid this and to increase conversion rate, your ecommerce payment solution should offer acceptance for as many payment methods as possible, ranging from acceptance of stored payment methods through digital wallets all the way to cryptocurrency.

Different Online Payment Methods

When interacting with payment gateways, customers will use a variety of payment methods. Each of these have varying degrees of compatibility with payment processors and gateways.

Here are the broad categories for different online payment methods:

Traditional

The earliest and most straightforward payment method is simply entering credit or debit card information to complete an online purchase, and this is now known as a traditional payment method because of how many solutions have innovated since the inception of transacting online.

Crypto

Cryptocurrency based payments, although controversial to some, remain a choice for users who prefer true peer-to-peer transactions without any extra intermediaries involved, and the option for true security. Merchants might like crypto as well as it is impossible to create a chargeback as transactions are irreversible and verified as a permanent and easily confirmed record on the blockchain.

Digital wallets

Digital wallets such as Apple Pay, Amazon Pay and Google Pay are now widely adopted particularly by users that are loyal to the brand of their choice in their other offerings. These take advantage of tokenization to securely store payment methods, and make for peer-to-peer payments between users within the ecosystem of one of these digital wallets truly seamless. More and more ecommerce stores are choosing to add digital wallets as a checkout option.

Mobile payments

With a growing majority of online browsing, including shopping, done on a mobile device, digital wallets like Apple Pay for iPhone and Google Pay for Android and Google devices tie digital wallets directly to the user’s phone, allowing for authentication via the method used for the device itself. Ecommerce stores can benefit from adding mobile payment options to increase the conversion rate of users who are browsing their stores on their mobile devices.

How Ecommerce Payment Solutions Work

While it is typically a seamless process, especially on the consumer end, there can be intricate process behind the scenes when an item is sold on an online store.

First, let’s look at the different components that play a role in an online transaction:

Payment Processors

A payment processor facilitates the transfer of funds. To do so, it communicates between the merchant, issuing bank, and acquiring bank so that funds can be moved from the customer bank to the merchant account. Payment processors are necessary for every transaction involving a credit card. Payment processors can have APIs so developers can integrate payments seamlessly and directly with existing software.

Payment Gateways

A payment gateway is used in conjunction with a payment processor, and is what the customer interacts with when making a purchase. It collects, encrypts, and verifies customer payment information, ensuring card validity and sufficient funds. Several different forms of payment gateways exist, with each supporting different customer payment methods.

Customer Payment Method

The customer payment method is normally a credit or debit card, but this information can be tokenized and saved on either a web browser or in a digital wallet. Some customers may choose crypto as their payment method, in which case the payment gateway needs to facilitate communication between their wallet and the merchant wallet. It is important to offer a variety of payment methods as customers have varying personal preferences.

Merchant Account

The merchant account is a business bank account where customer transactions are processed and the funds are credited so that you can get paid. It is an intermediary between your business account and the customer’s bank or card issuers, and makes payouts to your primary business account.

Here is a brief summary of what happens to make the ecommerce payment work so that the merchant gets paid with the customer’s funds, and the transaction is recorded:

- The user enters their payment information at the checkout stage. Previously saved and tokenized information can be transmitted directly or via a digital wallet

- The information is encrypted and sent securely to a payment processor via a payment gateway

- The bank associated with the customer’s payment method is told by the payment processor the amount of the transaction, and it lets the processor know whether or not there are sufficient funds

- The processor will either authorize or decline the transaction based on funds, which is sent to the payment gateway so that the customer can see the status of their purchase

- Funds from the purchase are deducted from the customer’s bank or credit card

- Customer funds are transmitted to the merchant account

- A settlement period must be endured until a merchant gets the money into their bank account, and the timeframes and payout terms vary depending on the payment processor and gateway

- Even after the money is in the merchant’s bank, the merchant still needs to worry about the potential of a customer chargeback, which often immediately deducts available funds from the merchant

How Ecommerce Payment Solutions Impact Your Business

Choosing the correct payment solution can impact your business in a number of areas, including:

Conversion rate

One of the simplest and most important product adoption metrics that a business owner should be measuring is the conversion rate, which can be affected greatly by the checkout experience that is mostly designed on your chosen ecommerce platform, but the speed, security and convenience of your chosen payment solution will affect the rate as well. Another factor that will affect the conversion rate is the variety of payment methods that you accept on your online store.

Customer satisfaction and User experience

The customer's experience during the checkout process while using your chosen payment solution will determine how satisfied they are with the experience, and the easier and more pleasurable the user experience was during the journey will determine whether or not a customer will be motivated or excited to come back and shop on an online store again. Customers should also feel secure, familiar, and empowered in their payment, so utilizing payment solutions that have qualities that provide these feelings will greatly increase your effectiveness in pleasing the customer in these areas.

Payout access and management

Vendors want to be able to be ensured that they will be paid, and on a schedule and in a currency that is most convenient to them. The best payment solutions will have an intuitive dashboard that allows users to view previous and pending payouts, and might offer options for getting paid faster in addition to being paid on a reasonable timeframe, without any unreasonable restrictions or holds for accessing funds inside of the merchant account.

Ecommerce Payment Processing with Whop

Every seller on Whop will be able to utilize Whop Payments, which is built on the tried-and-true payment infrastructure of Stripe and provides access to Whop’s diverse and powerful ecosystem, which includes an intuitive dashboard that contains various helpful metrics including MRR, Churn Rate, and more.

Inside of the dashboard, business owners are empowered to manage and create payouts at timeframes and in currencies that are convenient to them.

With Whop, sellers can offer a broad array of payment methods for their customers to use including crypto, and can even accept payments on a recurring basis complete with the ability to grant or rescind access to private communities on platforms like Discord and Telegram. Thanks to its easy to integrate and thoroughly documented API, sellers can use Whop as their payment solution on their own website in addition to being listed on Whop’s thriving marketplace.

📚 If you have any questions regarding payments with Whop, you can ask our customer support which responds quickly with a real person 24/7 in our chat, or you can refer to our documentation.

Ecommerce Payment FAQs

How does payment processing work with ecommerce?

Payment processing on ecommerce works through complex and secure communication between all of the parties involved in the sale of an item online, including the merchant account, the merchant bank, the customer bank, and the customer card issuer. To put it simply, it takes of the payment related process behind the scenes when someone makes a purchase online.

How are ecommerce payments made secure?

Thanks to the SSL protocol of the internet, sensitive data is transacted with inherent security on every website (i.e. nearly everyone, and everyone with an ecommerce store is basically required to have SSL as a prerequisite) that has an SSL certificate installed. Additionally, many payment solutions utilize secure tokenization to store and obfuscate sensitive payment information like credit card numbers and details, which adds convenience on top of security.

What is the difference between a payment gateway and a payment processor?

A payment gateway is what the paying customer interacts with when making a purchase, so it is associated with the front end and user interface during the checkout process, while a payment processor works behind the scenes and handles the communication between the merchant account and customer bank to verify and settle funds.

Do I need a payment processor for my ecommerce store?

It is necessary to have a payment processor for your ecommerce store so that you can securely accept and handle payments between your merchant account and the customer’s chosen payment methods and accounts. In terms of a more specific payment solution such as a payment gateway working in conjunction with a payment processor, the merchant has more choice when it comes to choosing one depending on their needs.

What are transaction fees?

Every payment processor and just about every payment gateway will charge a fee, typically in the form of a percentage and a nominal flat rate per transaction. These associated costs per transaction are known as the transaction fee, and although there is some variance between different payment solutions, the fee is fairly standard, typically set at around 2.9% + $0.30.

What is tokenization?

Tokenization refers to the process in which sensitive and easily readable information such as a credit card is obfuscated in the form of encrypted tokens that only the payment solutions can understand. This allows for increased convenience of stored payment methods along with security, and generally speaking, final confirmation such as a CCV are not tokenized and must be manually entered each time for further safety.

Does a payment processor or gateway collect taxes?

Although some payment solutions will offer the option to collect taxes such as VAT or other regional taxes associated with digital or physical products, generally speaking, the onus is on the merchant to take care of all tax collection and liability. With Whop Payments you will automatically use Whop as your Merchant of Record.

📚 Read next: Profitable Ecommerce Business Ideas