Chargebacks happen when a customer disputes a transaction and requests a refund from their bank or card issuer. Learn what chargebacks are, why they occur, and proven strategies to prevent them for your business.

Key takeaways

- Prevent chargebacks proactively using clear billing descriptors, transparent policies, and fraud detection tools.

- Dispute chargebacks quickly with strong evidence, though merchants only win 20-40% of cases.

- Keep chargeback ratios below 1% to avoid payment processor penalties or account termination.

For online sellers, few things are more costly - or more misunderstood - than a chargeback.

Picture this: a course creator gets a notification that a customer has disputed a $297 charge. The creator remembers the sale, remembers the customer downloading the first module. According to the bank, none of that happened. The money is gone, a $15 fee added on top, and there are just three weeks to prove that the transaction was, in fact, legitimate.

That's a chargeback, and the scale of the problem in 2026 is staggering. Global volume is projected to hit 337 million transactions this year - a 42% increase from 2023 - with fraud costing merchants $28.1 billion. For U.S. merchants, every dollar lost ultimately costs $4.61 in fees, labor, and fallout, a 32% increase since 2022 (LexisNexis, 2025).

What makes it especially maddening is that up to 75% aren't fraud in any traditional sense. They're friendly fraud - customers who got exactly what they paid for, and disputed the charge anyway.

The good news is that most of it is preventable, if you know how the system works.

What is a chargeback?

A chargeback is a forced payment reversal initiated by a customer's bank - funds pulled from your account, no input required. Unlike a refund, which is your decision, a chargeback is made for you. The money leaves first; you argue after.

Designed to protect consumers from fraud and billing errors, the system works as intended. The problem: it's equally available to someone who simply changed their mind. According to Chargebacks911's 2025 Cardholder Dispute Index, 76% of consumers prefer resolving disputes through their bank, and nearly half bypass the merchant entirely.

That asymmetry of effort - easy for the customer, costly for the merchant - is at the heart of why chargebacks have become such a significant and growing threat.

A note on partial chargebacks

Not every dispute covers the full transaction. A partial chargeback happens when a customer challenges only a portion of a charge, perhaps for an incorrect amount or a service they claim was partially undelivered. Importantly, even partial chargebacks incur the full chargeback fee for the business.

Debit cards vs. credit cards: does it matter?

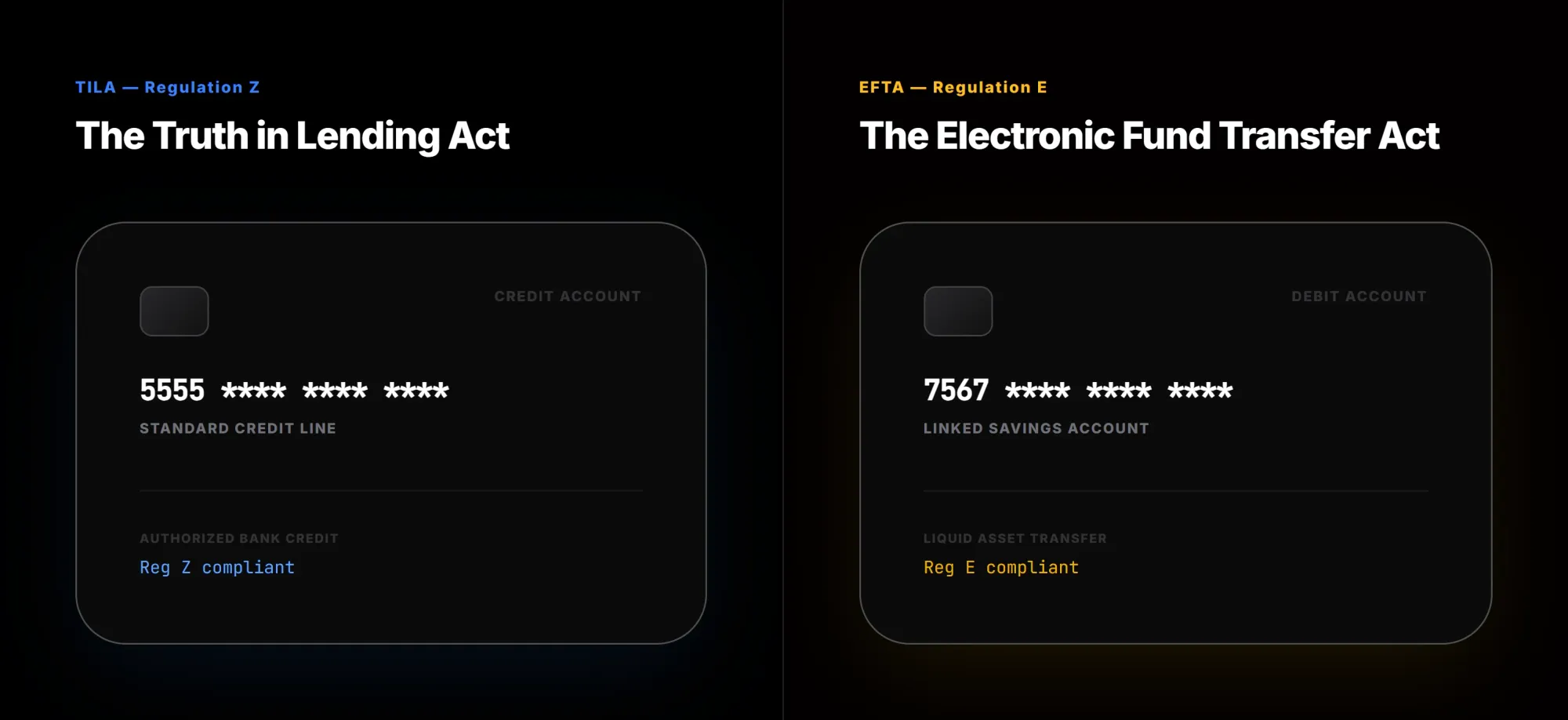

Chargebacks apply to both credit and debit cards, but the rules aren't identical, and the differences can matter to merchants.

Credit cards operate under Regulation Z (the Truth in Lending Act), which provides broad consumer protections, including the right to dispute charges for quality-of-service issues. Debit cards fall under Regulation E (the Electronic Fund Transfer Act), which is narrower in scope, primarily covering unauthorized transactions and processing errors.

In practical terms, credit cards tend to carry stronger consumer protections, which means credit card chargebacks can be harder for merchants to fight. Both types follow card network rules (Visa, Mastercard, Amex, Discover), but the specific deadlines and processes differ.

Merchants dealing with high volumes of debit card transactions may face slightly different dynamics than those who operate primarily on credit.

However, payment processors may impose other deadlines.

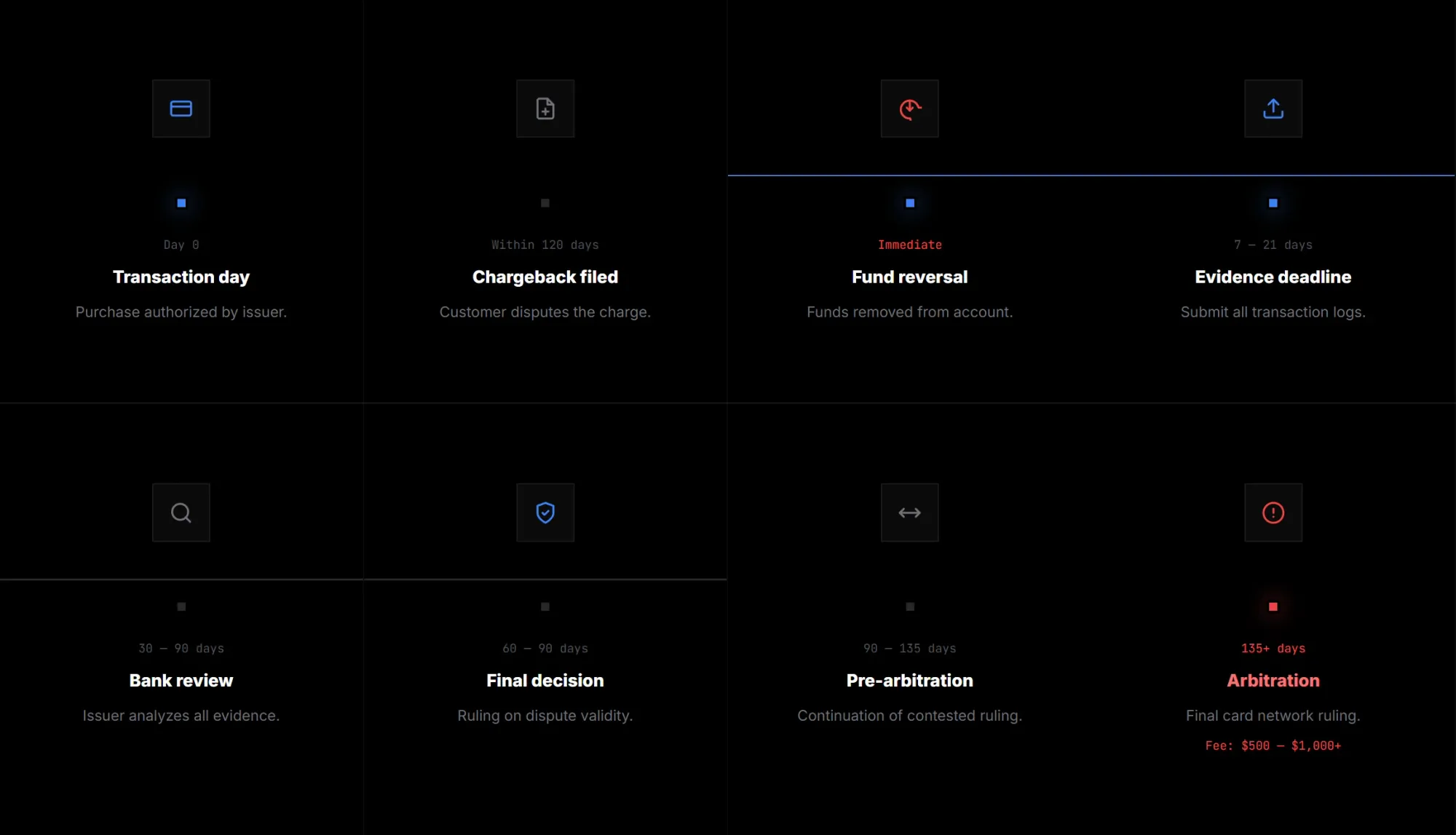

What happens when a chargeback is filed, step-by-step

A chargeback happens after a payment is processed and the funds have already landed in your account. Essentially, it’s a customer forcing their bank to reverse a transaction they believe is unauthorized, incorrect, or fraudulent.

Here’s how it typically unfolds:

Customer disputes the charge

The cardholder spots a transaction on their statement that seems wrong or suspicious and contacts their issuing bank to challenge it. Notably, 48% of people who file a chargeback do this without ever contacting the merchant first.

Issuing bank opens the chargeback

The bank reviews the claim and formally initiates the chargeback process with the merchant's bank. Funds are withdrawn from your account immediately, before any investigation ends.

You get notified

You see a notification about the chargeback in your email or payment platform. After this, you have around three weeks to respond, though your processor's internal deadline is usually shorter than the network deadline, so act fast.

Decide if you want to dispute

You get a chance to fight back by providing evidence that the charge was legitimate: receipts, delivery confirmation, customer communication, or any proof that supports the transaction. If the transaction value is low and your evidence is thin, accepting the loss may cost less than the fight.

Bank reviews both sides

The issuing bank evaluates the customer’s claim and your evidence, then decides whether to reverse the charge.

- If the bank rules for the business: The funds stay in your account (or are returned if the customer’s account was temporarily credited).

- If the bank rules for the customer: The disputed amount is removed from your account and returned to the customer.

Arbitration if needed

If the bank sides with you but the customer contests further, the dispute first enters pre-arbitration - a second review stage that typically resolves within 30 to 45 days. If that still doesn't resolve it, the case escalates to the card network, which makes the final call. This adds weeks and $500 to $1,000+ in costs - most merchants only go this route for high-value transactions with airtight evidence.

How long does a chargeback take?

Response deadlines vary by network, and customers can file up to 120 days after the original transaction, so keep detailed records for at least that long.

| Network | Response deadline | Processor deadline |

|---|---|---|

| Visa | 20 days | 7 to 10 days |

| Mastercard | 45 days | 10 to 21 days |

| American Express | 20 days | 7 to 10 days |

| Discover | 30 days | 10 to 20 days |

Chargebacks are more dangerous than refunds as they’re a formal dispute that can hit your revenue, incur fees, and eat up time. And unfortunately, chargebacks are getting worse - retail eCommerce rates climbed 233% through 2025, driven largely by friendly fraud, which now accounts for up to 75% of all disputes.

Plus, social media "refund hack" tutorials and the sheer convenience of disputing through a bank rather than a merchant have normalized what was once considered abuse.

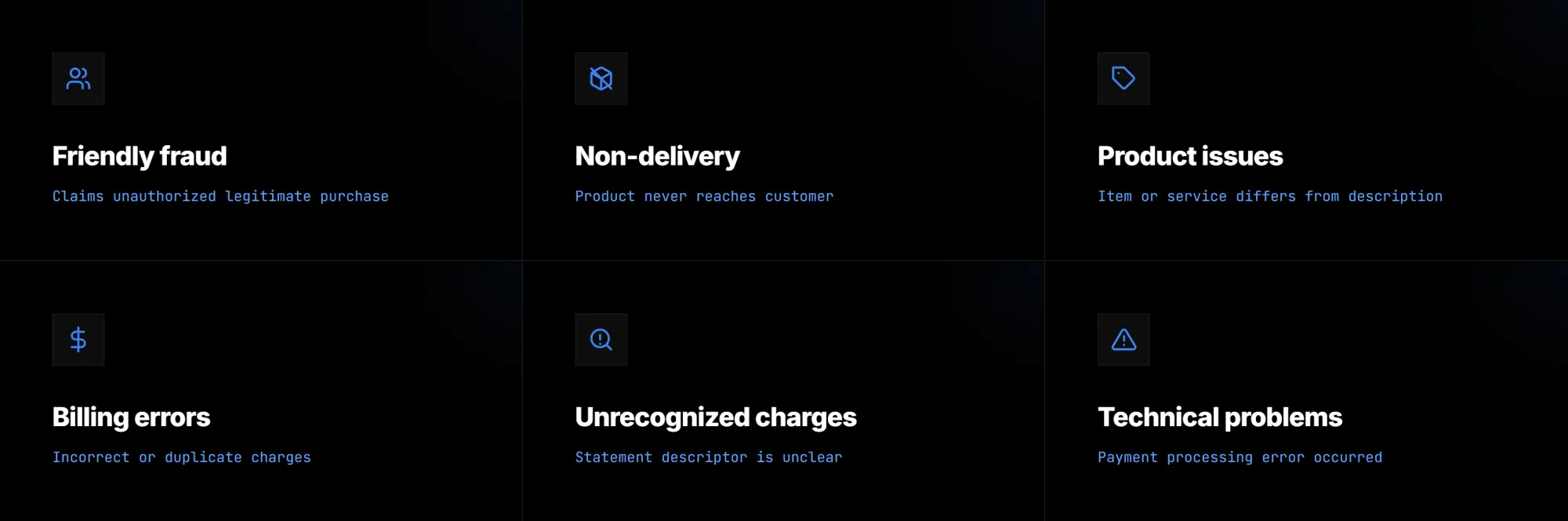

The six most common reasons customers file chargebacks

Understanding why chargebacks happen is the first step to preventing them. The reasons tend to fall into the same familiar categories, each with its own risk profile and tell-tale signs.

Friendly fraud

Friendly fraud sits at the top. As covered above, this is the disputed-legitimate-transaction scenario: either deliberate abuse of the chargeback system or a customer who genuinely doesn't recognize a charge or forgot about a purchase. According to a fraud report from Cybersource in 2024, friendly fraud is the second most common fraud attack source.

How to protect yourself from friendly fraud

- Keep detailed records of all customer actions

- Send detailed confirmation emails to your customers

- Make the billing descriptions recognizable

- Make sure customers can easily contact your customer service

- Implement secure payment to your system (3D Secure, address verification, etc.)

Unrecognized charges

Unrecognized charge disputes are technically a subset of friendly fraud, but they're significant enough to deserve separate attention.

When "ACME HOLDINGS LLC" shows up on a statement instead of the name your customer knows you by, the dispute that follows isn't malicious, it's just a confused customer who doesn't recognize the transaction.

Luckily for you, this is one of the most easily preventable chargeback reasons.

How to protect yourself from unrecognized charge chargebacks

- Make sure your billing description and name is recognizable

- Always mention how your details will look like in the bank description in your payment emails

Non-delivery

Non-delivery disputes happen when the customer doesn’t receive the product they bought from the business or never got access to the digital products/platforms they were promised.

While the dispute might be genuine, there are a lot of examples of people abusing the system by claiming they never got the product.

How to protect yourself from non-delivery chargebacks

- Take detailed logs of customer actions if you’re selling digital products

- Send detailed confirmation emails for all purchases

- Use shipping with tracking features if you’re selling physical products

- Require signature for order pick ups

Product issues

Chargeback due to product issues usually happens when the item customer receives is significantly different from the description, images, or expectations.

These disputes can be both legitimate (customer did receive the wrong product) and open for discussion (customer’s expectations were unrealistic).

How to protect yourself from product issue chargebacks

- Use accurate product listings. This includes images, descriptions, reviews, and specifications

- Clearly define what the product is in description fields

- Offer free previews or trials if you’re selling digital products

Billing errors

Billing error chargebacks happen due to double charges, incorrect amounts, or misapplied discounts. Chargebacks with billing error as the reason is rare, and the issue can be easily solved by you (the business) before the customer even feels the need to dispute the charge.

How to protect yourself from billing error chargebacks

- Regularly check your sales logs and audit your transactions

- Make sure promo codes apply the discount you claim they do

- Be very fast when it comes to billing issue reports from your customers so they don’t feel the need to dispute

Technical problems

Technical problem chargebacks happen due to checkout or payment processing errors that cause confusion or failed transactions, like when a customer makes the same purchase twice because the system was giving out errors or the success messaging wasn’t clear.

This chargeback reason has a legitimacy rate higher than most others.

How to protect yourself from technical problem chargebacks

- Test your checkout and payment systems regularly to spot issues

- Make sure the after-payment redirects and successful payment messaging is clear on your platform

- Send out easy to understand success emails to your customers

- Look out for duplicate payments and get in contact with the customer before they dispute the charges

How to fight a chargeback

Many merchants assume chargebacks are unwinnable, and that banks are structurally biased toward cardholders so the effort isn't worth it.

That belief isn't entirely unfounded: on average, merchants win fewer than half the chargebacks they dispute. But win rates are significantly shaped by how merchants approach the process.

Bowen Xue, Head of Payments Product at Whop, puts it plainly:

“I think a huge misconception is that you can't win chargebacks. People believe that. And it's completely false. They just don't know what evidence the banks expect in order for them to win.

Visa, Mastercard have guides for merchants on how to and what evidence to upload, depending on the reason of the dispute. If you follow that as a merchant very closely, you will win a lot of your disputes.”

Chargeback reason codes and supporting evidence

Winning starts with understanding the reason code - the label the issuing bank assigns to the dispute that tells you why the customer said they filed it.

Every chargeback across Visa, Mastercard, Amex, and Discover falls into one of four categories:

- Fraud: unauthorized transactions, stolen cards, card-not-present fraud. Requires proof the cardholder authorized the purchase: device fingerprinting, IP logs, prior transaction history.

- Authorization errors: transaction processed without proper authorization. Requires authorization records showing the transaction was approved.

- Processing errors: duplicate charges, incorrect amounts, wrong currency. Requires transaction records showing the correct amount was charged once.

- Customer disputes: goods not received, item not as described, canceled recurring billing. Requires delivery confirmation, access logs, product descriptions, or cancellation policy documentation.

Here all the reason codes across Visa, Mastercard, Amex and Discover 0 and their response window:

Visa reason codes

| Code | Name | Response window |

|---|---|---|

| 10.4 | Other fraud – card-absent environment | 30 days |

| 10.5 | Visa fraud monitoring program | 30 days |

| 11.1 | Card recovery bulletin | 30 days |

| 12.5 | Incorrect amount | 30 days |

| 12.6 | Duplicate processing | 30 days |

| 13.1 | Merchandise/services not received | 30 days |

| 13.2 | Cancelled recurring transaction | 30 days |

| 13.3 | Not as described or defective | 30 days |

| 13.5 | Misrepresentation | 30 days |

| 13.6 | Credit not processed | 30 days |

| 13.7 | Cancelled merchandise/services | 30 days |

Mastercard reason codes

| Code | Name | Response window |

|---|---|---|

| 4837 | No cardholder authorization | 45 days |

| 4808 | Authorization-related chargebacks | 45 days |

| 4831 | Transaction amount differs | 45 days |

| 4841-4853 | Canceled recurring transaction | 45 days |

| 4853 | Cardholder disputes | 45 days |

| 4854 | Cardholder dispute not elsewhere classified | 45 days |

| 4855-4853 | Items or services not provided | 45 days |

| 4860-4853 | Credit not processed | 45 days |

| 4863 | Cardholder does not recognize | 45 days |

American Express reason codes

| Code | Name | Response window |

|---|---|---|

| F14 | Missing signature | 20 days |

| F24 | No cardmember authorization (known merchant) | 20 days |

| F29 | Card not present | 20 days |

| A02 | No valid authorization | 20 days |

| P08 | Duplicate charge | 20 days |

| C02 | Credit not processed | 20 days |

| C08 | Goods/services not received | 20 days |

| C28 | Canceled recurring billing | 20 days |

| C31 | Goods/services not as described | 20 days |

Discover reason codes

| Code | Name | Response window |

|---|---|---|

| UA02 | Fraud – card not present | 30 days |

| AA | Does not recognize | 30 days |

| DP | Duplicate processing | 30 days |

| AP | Canceled recurring (automatic payment) | 30 days |

| RG | Non-receipt of goods or services | 30 days |

| RM | Quality of goods or services | 30 days |

| RN | Credit not issued | 30 days |

| IN | Invalid card number | 30 days |

Submitting strong evidence against the wrong code is one of the most common ways merchants lose disputes they should win. Once you know your code, write a concise professional letter tying your evidence directly to it.

Chargeback deadlines

The mechanics of this chargeback appeal process - called representment - follow set deadlines at each stage (initial representment, pre-arbitration, and arbitration). Missing any deadline means automatic loss.

| Card network | Representment deadline | Notes |

|---|---|---|

| Visa | 30 days | Generally 30 days at each representment stage. Deadlines may change based on processor/acquirers |

| Mastercard | 45 days | Some requests may have shorter reply deadlines |

| American Express | 20 days | Around 20 days at each representment stage |

| Discover | 30 days (for chargeback representment) | Some appeals may slightly change the deadlines |

Given that the payment processor deadline is almost always shorter than the network deadline, treat your processor's timeline as the real one.

How to stop chargebacks before they start

Winning chargebacks is possible. But the merchants who struggle least with chargebacks aren't the ones who dispute well - they're the ones who stop disputes from happening in the first place.

Make your billing descriptor instantly recognizable

If you run your business under a different legal entity name than your brand name, make sure your payment processor is configured to display your brand name (or at minimum, include it alongside the entity name). Include a reminder in every post-purchase email: "This charge will appear as [X] on your statement."

Create a clear path back to you

According to Madeline Cohen, Head of Trust at Whop:

"When someone goes the route of formally disputing the payment or asking the bank to issue a chargeback, it's because there are no clear paths to get a refund or resolve a case with the merchant directly. If your return or refund policy isn't clear, or if there's not a clear point of contact that you can reach out to at the business, sometimes it's easier to just go and ask the bank to give your money back."

Every customer who files a chargeback through their bank instead of asking you directly is a customer who couldn't find - or didn't trust - the path to resolution on your side. A visible, responsive support channel and a straightforward refund policy don't just reduce chargebacks - they're the difference between a $0 refund you control and a $297 reversal you don't.

Use 3D Secure authentication

3DS is a real-time risk assessment protocol that adds a verification step to checkout. Its most important feature for merchants: when a 3DS-verified transaction is disputed, liability shifts to the card issuer, not you. It's one of the most effective structural protections available.

Set up chargeback prevention alerts

Many payment platforms offer early warning systems that flag potential disputes before they become formal chargebacks, giving you a window to resolve the issue directly.

Capture evidence in advance, not after

By the time you receive a chargeback notification, the window to gather evidence is already closing. For digital products especially, access logs, login records, and usage data should be captured automatically as part of your platform architecture, not assembled retroactively when a dispute lands.

Send renewal reminders

Subscription chargebacks are among the most preventable. A well-timed reminder before a billing cycle, especially for annual plans, gives customers the opportunity to cancel rather than dispute, and signals that you're a transparent business that respects their autonomy.

Use dedicated fraud prevention tools

For higher-volume operations, purpose-built fraud tools like Sift, Signifyd, SEON, and Riskified go beyond what payment processors offer natively. They use device fingerprinting, real-time risk scoring, and identity verification to flag suspicious transactions before they process.

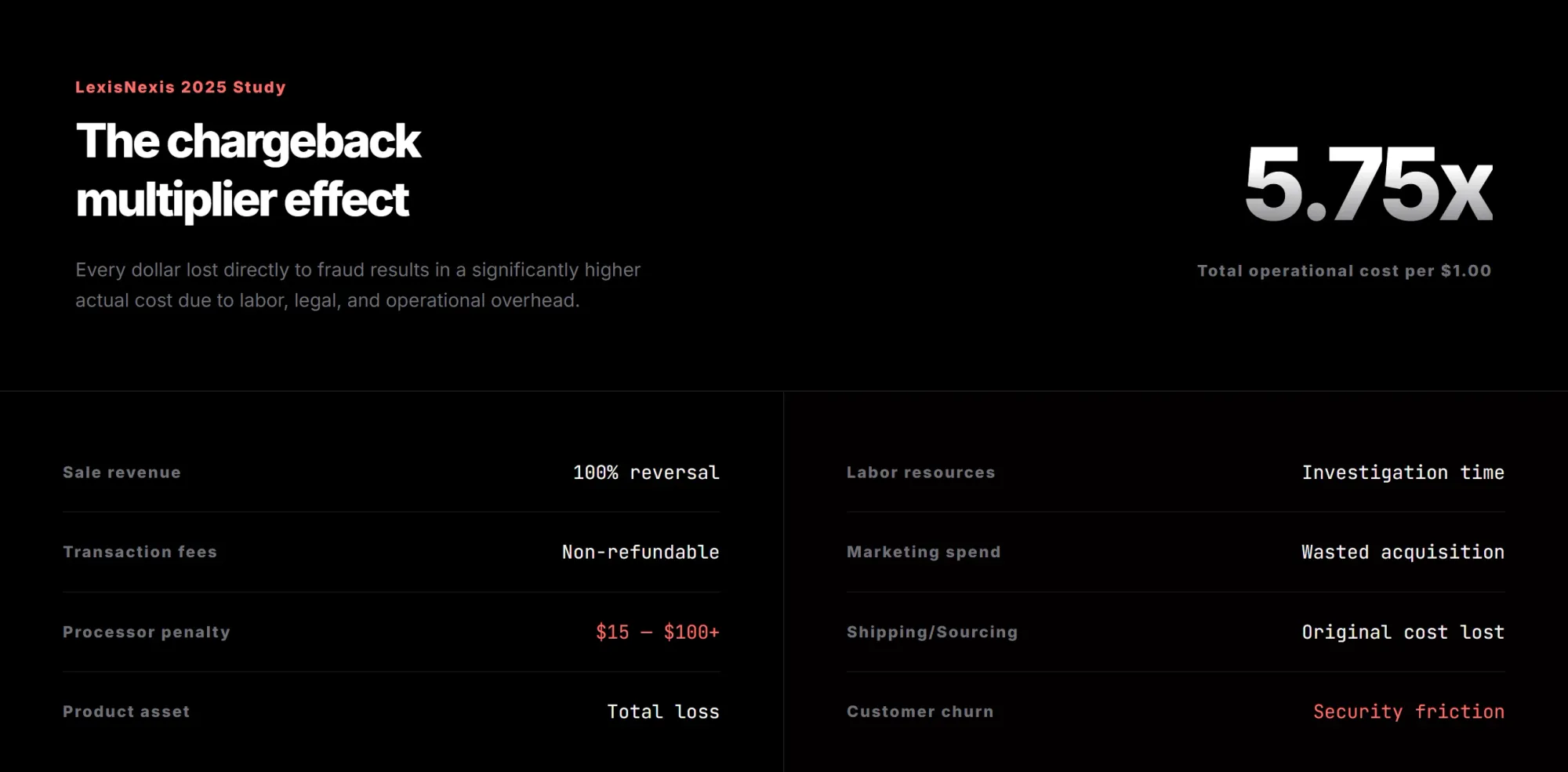

The true cost of a chargeback

The sticker price of a chargeback is straightforward: you lose the transaction amount, plus a dispute fee of $15 to $100 depending on the processor and your risk profile. But the real cost is significantly higher.

According to LexisNexis Risk Solutions' 2025 True Cost of Fraud study, U.S. merchants lose $4.61 for every $1 of fraud - a figure that accounts for the chargeback fee, labor spent gathering and submitting evidence, marketing costs on the original acquisition, and operational overhead.

For digital product sellers, add the loss of the product itself: unlike physical goods, there's no returned inventory to resell.

| Payment Service | Standard Fee | High Volume Fee | Refund if You Win? |

|---|---|---|---|

| Whop | $15 | None | Yes |

| Stripe | $15 + $15 if disputed | None | Yes (counter fee only) |

| PayPal | $15 | $30 (at 1.5%+ rate) | No |

| Authorize.net | $25 | None | No |

| Braintree | $15 ($30 for EU) | None | No |

| Shopify Payments | $15 | Network fees after 300/month | Yes |

And if fees aren't enough to worry about, here's what happens when volume gets high:

- Visa's VAMP flags merchants who exceed a 1.5% ratio with more than 1,500 monthly disputes

- Mastercard flags merchants who exceed 1.5% with more than 100 disputes for two consecutive months, with fines starting at $1,000 per month

Most processors act before you hit those thresholds, with reserve holds typically kicking in around 0.75–1%, and termination risk rising sharply above 2%. Losing your payment processor is a business-ending event for most online merchants.

How Whop handles chargebacks

Maddie Cohen tells us that chargebacks typically happen when customers can't find a clear path to resolve issues directly with merchants. Whop addresses this with a defense system:

- The Resolution Center prevents chargebacks before they reach banks

- Dispute Fighter automates your response if a chargeback does occur

The Resolution Center is an intermediary channel where customers contact you, the business, directly instead of going to their bank. If a dispute escalates to a formal chargeback, Dispute Fighter automatically gathers evidence, uploads supporting proof, and submits your response to the card issuer.

What happens when a chargeback is filed on Whop?

When a customer files a chargeback through their bank, Whop's Dispute Fighter activates immediately.

- You receive instant notification via your Whop dashboard and email.

- The notification includes the dispute reason code, the disputed amount, and your deadline to respond.

- The disputed amount is immediately debited from your Whop balance, along with a $15 dispute fee.

- These funds are held in reserve to ensure you can cover the cost if you lose the dispute.

Whop's system automatically begins gathering evidence when the dispute is filed. Then, the Dispute Fighter uploads customer access logs, policy disclosures, transaction data, and proof of service delivery to your dispute case file.

You can then access the dispute in your dashboard, review what Whop has already uploaded, and add any additional supporting evidence before the deadline. You can see the dispute status, outcome, and timeline in your Whop dashboard.

The automatic evidence and what you can add to it

Dispute Fighter automatically uploads customer details (email, name, billing address), transaction records, access activity logs showing product usage, and your Terms of Service and refund policy disclosures.

This proves the customer authorized the purchase, received the product, and agreed to your policies.

You can then strengthen your case by adding customer communications (chat logs, emails showing satisfaction or product use), screenshots of community engagement or course progress, and refund request documentation.

You should upload additional evidence before the deadline shown under the Dispute Fighter tool. Missing deadlines mean you'll automatically lose.

They also have the option to require terms and conditions acceptance on checkout.

A note on regulations and compliance

Chargebacks exist because the law requires them.

Credit cards fall under the Truth in Lending Act, which gives cardholders the right to dispute charges within 60 days of their statement - with liability for unauthorized charges capped at $50, and most issuers offering full zero-liability protection.

Debit cards fall under the Electronic Fund Transfer Act, which covers unauthorized transactions but offers narrower protections and shorter timelines. Card networks like Visa and Mastercard layer their own rules on top, which is where the real teeth are for merchants.

Sell with Whop for the ultimate in chargeback protection

Chargebacks are an unavoidable part of selling online - but their frequency, cost, and outcome are largely within your control. The merchants who manage them best aren't just better at disputing, they've built systems that make most disputes unnecessary in the first place.

Whop's Payments Network routes every transaction through an intelligent orchestration engine that increases approval rates by up to 11% and filters suspicious transactions before they reach your account.

The Resolution Center intercepts disputes before they become chargebacks.

And when a chargeback does land, Dispute Fighter handles the response automatically - collecting evidence, submitting on your behalf, and tracking outcomes in real time.

If you're serious about protecting your revenue, start selling on Whop.

Chargeback FAQs

What are chargeback regulations?

Chargebacks are regulated by both card network rules (like Visa and Mastercard) and federal laws that protect consumers. Two key regulations apply:

- Regulation E (Electronic Fund Transfer Act): Covers debit cards and electronic transfers, protecting consumers from unauthorized or erroneous transactions.

- Regulation Z (Truth in Lending Act): Applies to credit cards, ensuring fair billing practices and dispute rights.

These laws define how consumers can dispute charges — and what merchants must do to respond within set timeframes.

How long do chargebacks take to resolve?

Most chargebacks are resolved within 30 to 90 days, depending on the card network and complexity of the case. Some disputes, especially those that move to arbitration, can stretch to 120 days or more. Acting fast and submitting complete evidence gives you the best chance to shorten the timeline and win.

Can merchants win chargebacks?

Yes, if they can prove the transaction was valid. Merchants win roughly 20–40% of disputes, but success depends on how strong and organized the evidence is.

What happens if a business gets too many chargebacks?

High chargeback ratios (typically above 1%) trigger penalties from payment processors or card networks. Merchants might face higher transaction fees, stricter monitoring programs like Visa’s Chargeback Monitoring Program, or even account termination.

How can Whop help reduce chargebacks?

Whop merchants can use Dispute Fighter to automatically handle chargeback responses with pre-filled evidence and faster submissions. Plus, the Whop Resolution Center flags high-risk transactions and customer disputes before they become chargebacks, helping merchants prevent revenue loss before it starts.