Wondering if day trading is for you? Delve into the essentials, from defining day trading, strategies, risks, and alternatives like scalping and swing trading. Get started on your trading journey today! 🌟

Key takeaways

- Day trading requires technical analysis skills to identify patterns like opening gaps, trends, and momentum shifts within single sessions.

- The $25,000 FINRA minimum and competition from high-frequency trading firms create significant barriers for retail day traders.

- Most retail day traders lose money, making discipline, risk management, and realistic expectations essential for anyone attempting this strategy.

If you’ve got at least a passing interest in trading or want to put a little money to work in the markets, odds are you’ve heard of day trading and how it can be a lucrative source of income. It’s a divisive topic, and for every story of success with day trading you’ve probably been treated to many a tale of failure.

But what is day trading, and how can you actually be successful doing it? This guide will take you through the basics along with our picks for the best day trading strategies that you can put to immediate use!

What is Day Trading?

Day trading is a trading style that focuses on trading during a single market session without allowing positions to stay open overnight. Once purely the province of professionals, day trading has become increasingly common among retail or household investors who have access to online trading platforms and time to monitor the markets through the day.

While day traders often can’t take advantage of longer runs in stocks since they close their positions within the session, there’s a certain wisdom to this tactic. Not only does after-hours trading exist, but some research suggests that this is when true price movement happens.

Retail investors aren’t completely locked out of after-hours trading, but it does tend to be illiquid and dominated by institutional investors. This makes it a tricky time frame to day trade in, and the risk of leaving a position exposed to after-hours movement is evident.

As such, day traders prefer to stick to regular market hours, and close their positions before that final bell.

Best Day Trading Strategies

Now that you know that day trading just means buying and selling within the scope of a single session, it’s time we look at some strategies. The basic idea is clear—develop a hypothesis over a short term of minutes or hours, and trade on it.

Ideally, a day trader uses either leverage or large volume to make a profit. Price movement of thirty or forty cents may not sound like much, but with volume (or leverage) of thousands of shares, the gains can multiply fast.

You’re also not going to be making lots of trades—you might let a single position ride from morning until afternoon, or just make two or three moves and call it a day. So, with the basics in place, here are our picks for the top day trading strategies you can use:

Market Opening Gaps

We’ve mentioned after-hours trading already, and there’s another time frame called pre-market where Wall Street can continue to trade stocks. All of this trading activity following the previous day’s close means that, by the time the market actually opens again, a stock can start the session significantly higher or lower than the previous closing price.

This difference is called a gap, specifically a market opening gap since it’s observed on the stock chart right at market open. Many traders believe that all gaps are eventually filled, and just as many also believe that smaller opening gaps tend to be filled during the day.

If you subscribe to this school of thought, you could take a position that represents your view. If the stock “gaps down” at open (starts the day below the previous close) you could buy in with the idea of exiting when the stock moves back up through the price range of the gap, thereby filling it.

Technical Trading

It’s not exactly a strategy in itself, but the majority of day traders try to learn the basics of technical analysis in order to become better at their craft. Whatever your opinions on “TA”, the reason for this is that day trading is done across just a day—the fundamentals of the asset don’t really matter as much.

Technical trading isn’t rocket science, neither is it mumbo-jumbo. It simply attempts to make sense of how price and volume interacts on a given day, and traders learn various patterns, indicators, and signals that could suggest that a stock may move in one way or the other.

This can become a self-fulfilling prophecy, though, with plenty of other traders anticipating the same sort of movements and likely making the same bets, thereby causing the movement to happen through all of that collective volume.

Trade the News

You might have to leave fundamental analysis at the door if you want to become a day trader, but there’s an exception when the fundamentals are about to shift. Just prior to the release of news or financial reports, trading can settle into certain patterns. These patterns can be identified, and then the actual news causes a breakout that you can anticipate and trade on.

That said, a lot of news is timed for market close or after-hours. This helps to keep volatility off the charts, but at the same time means it’s institutions who make hay during after-hours trading. Yet another reason to close positions at the end of the day, since bad news at close could demolish your positions overnight.

Trend-based Trading

Also known as momentum trading, this strategy focuses on hitching yourself to the coattails of a stock that’s moving in either direction, generally in response to earnings reports or some sort of news. These trends can continue over a long period of time (relatively speaking, since it’s still intraday) so following them but exiting quickly when the trend loses steam can be highly lucrative.

There’s another strategy called contrarian trading that approaches trends in the opposite manner. With the hypothesis that all moves need to end and reverse a little to find a new normal, a contrarian trader bets that momentum will come to an end and the stock will move in the opposite direction, shorting a rising stock or buying a dropping one.

You can use both strategies to good effect, riding a trend and then “fading” or short-selling it when it looks like the buying side is out of steam. It often takes a little experience and knowledge to be able to time trends like this, but an understanding of technical analysis can help since it’s this sort of thing all of those patterns attempt to identify.

Risks of Day Trading

It’s often said that 95% of retail day traders lose money. Whether or not that’s true, even professional day traders will tell you that it’s not an easy style of trading to get good at.

It certainly doesn’t help that the odds are stacked against you in several ways. For one thing, high-frequency trading (HFT) houses have billions to play with and are hooked up to exchanges as closely as possible, making sure that they have every advantage over you when it comes to speed and leverage. They’ve also got algorithms devised by entire teams of Ivy League mathematicians and psychologists.

If this weren’t enough, they’ve also got the edge when it comes to personal connections. While illegal, insider trading often seems to be more norm than exception. Certain politicians’ trading activities have practically become a meme, and when Wall Street firms do it and get caught, their billionaire bosses still walk away clean.

All of that being said, day trading can still be profitable if you have the time to dedicate to it, along with the capital to leverage and the discipline to stick to your strategy! It’s all too easy to hold onto positions for too long when riding a trend, or succumb to the temptation of overleveraging.

Alternatives to Day Trading

If at this point you think day trading isn’t really for you, here are a couple of alternate trading styles that might fit you better:

Scalping

Often confused with day trading, scalping is actually a style that focuses on even shorter time frames and larger volumes. Rather than hoping for a few dollars or tens of cents of movement on a stock throughout a day and making a handful of trades, scalpers are looking for extremely small profits many, many times during a day.

Scalping might be for you if you have a good amount of capital to play with, a fast connection, good access to the market, and a willingness to learn about things like spreads and bots. On the downside, it’s very difficult to compete with billion dollar HFT firms playing the same game.

Swing Trading

If scalping narrows the trading time frame compared to day trading, swing trading moves it the other way. Unlike a day trader, a swing trader is happy to keep a position open overnight, and looks to trade on time frames of days or weeks, even a month or two. If you’ve ever bought a stock and then sold it a couple of weeks later, that’s basically a swing trade.

Many swing traders rely heavily on technical analysis, but fundamentals are as or even more important. A stock is unlikely to crash within a single day, but a couple of weeks is plenty of time for a 99% loss in value—intraday trading halts can come to the defense of a day trader, but a swing trader has no such protection.

❓ Day Trading FAQs

How is day trading different from swing trading or long-term investing?

Day trading involves making trades within a single trading day. Swing trading spans several days to weeks, while long-term investing can last for months to years.

Do I need a special account or license to day trade?

While you don't need a license to day trade, in the U.S. the Financial Industry Regulatory Authority (FINRA) requires Pattern Day Traders (PDTs) keep a minimum of $25,000 in a brokerage account if making four or more day trades in a five-day period.

Is day trading risky?

Yes, day trading can be risky and is not suitable for everyone. It requires a deep understanding of the markets, quick decision-making, and a robust risk management strategy.

How much capital do I need to start day trading?

While regulatory bodies might have minimum account requirements (like the $25,000 rule by FINRA), beginners can start with smaller amounts to practice but should be aware of regulations and broker requirements.

How do day traders analyze the market?

Many day traders use technical analysis, which involves studying price charts and using statistical measures to predict future price movements. Some also incorporate news or economic events into their strategies.

What are the most common day trading strategies?

Common strategies include trading market opening gaps, trend-based trading, contrarian trading, and trading the news.

Do day traders need to monitor the market all day?

Not necessarily, but it's essential to be vigilant when positions are open. Some traders might trade only during specific hours when volatility is high, while others might be active throughout the trading session.

How do day traders manage risk?

Day traders often use tools like stop-loss orders, which automatically sell a security when it reaches a certain price. They also determine in advance how much of their portfolio they're willing to risk on a single trade.

Can I engage in day trading using a mobile platform or app?

Yes, many modern trading platforms offer mobile apps that allow traders to execute trades and monitor the markets on the go.

Are profits from day trading taxed differently?

Tax treatment for day trading profits can vary by country. In some places, frequent trading can lead to profits being taxed as income rather than capital gains. It's essential to consult with a tax professional specific to your region.

Is after-hours trading the same as day trading?

No, after-hours trading occurs outside the regular trading hours. While day traders primarily trade within the standard trading session, some might also participate in after-hours trading, though it's often riskier due to lower liquidity.

📖 Day Trading Glossary

Day Trading: A trading style where positions are opened and closed within a single market session, ensuring no positions remain open overnight.

Retail Investors: Non-professional investors who buy and sell securities, mutual funds, or ETFs through a brokerage account or savings account.

After-Hours Trading: Trading that occurs after the official trading hours of a stock exchange, often marked by less liquidity and wider bid-ask spreads.

Leverage: Using borrowed money to amplify potential returns from an investment. In the context of trading, it allows traders to buy or sell more than they'd be able to with their own money.

Market Opening Gaps: The difference between the opening price of a security and its closing price from the previous trading session, often due to after-hours news or events.

Technical Analysis (TA): A trading discipline that evaluates investments and identifies trading opportunities by analyzing statistical trends from trading activity, such as price movement and volume.

Trade the News: A strategy where traders make decisions based on news releases that might influence stock prices.

Trend-based Trading: A strategy that involves following the momentum of a stock, either by buying into a rising trend or selling into a falling one.

Contrarian Trading: A trading strategy where the trader goes against prevailing market trends, anticipating that the trend will reverse.

High-Frequency Trading (HFT): A type of algorithmic trading characterized by high speeds, high turnover rates, and high order-to-trade ratios.

Scalping: A trading strategy that attempts to profit from small price changes, making numerous trades throughout the day to seize these small price gaps.

Swing Trading: A style of trading where positions are held for several days to weeks, aiming to profit from short- to medium-term price moves.

Intraday Trading Halts: Temporary suspensions in the trading of a particular security within a single trading session, usually due to pending news or extreme volatility.

Technical Indicators: Mathematical calculations based on historic price, volume, or open interest information that aims to forecast financial market direction.

Spread: The difference between the bid and the ask price of a security or asset.

Key Takeaways

Day trading is a trading style based on entering and exiting positions within the course of a trading day, and ideally ending the session without anything at risk overnight. A day trader relies on a decent amount of capital to make a few trades during the day, ideally using the effects of news and trends to their advantage while harnessing the knowledge of technical analysis.

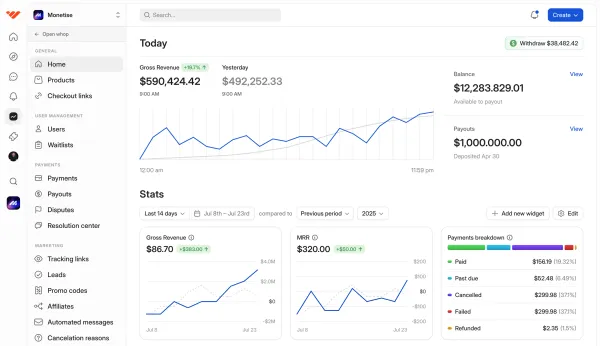

If you want to learn more about technical analysis or get hooked up for the best signals and trading indicators in the business, we’ve got just the thing for you!

👉 Head over to Whop.com’s trading page for all of the top trading communities and Discord servers to take your day trading game to the next level.

🏆 Check out: Whop's Top Best Trading Discord Servers

🏆 Check out: Whop's Best Day Trading Courses