Interested in selling on Etsy, but confused by their fees? Read this guide for a full rundown on the fees and costs associated with selling on Etsy.

Key takeaways

- Etsy's mandatory fees total approximately 12.2% per sale, so price your products with enough margin to stay profitable.

- Etsy's creator-friendly ecosystem and lower competition make it ideal for handmade, vintage, or unique products over mass-produced goods.

- Anyone can start selling on Etsy without a business license, with just a $15 setup fee and $0.20 per listing.

Etsy is the go-to place to sell handmade and vintage goods online. For shoppers, you get access to arts and crafts from all around the world, all from the comfort of your own home. And for vendors, you get access to almost 100 million customers without having to set up a booth at a local market.

While it has a wide number of advantages, there are costs with selling on Etsy. In this guide we’ll be covering what expenses are associated with making money on the platform. But first, let's start with a brief overview of the platform.

Already know what you're looking for? Jump ahead to:

- What is Etsy?

- Why should I sell on Etsy?

- Etsy fees: How much does Etsy take?

- Etsy payments: Getting paid by Etsy

- Is selling on Etsy worth it?

- Learn how to be successful on Etsy with Whop

- Etsy FAQs

What is Etsy?

Etsy is the world’s largest marketplace for buying and selling unique products like handmade jewelry, custom apparel, and home goods. Etsy is very similar to both Amazon and eBay. In fact, it’s essentially a blend of both platforms’ features.

Like eBay, any individual person can sell on Etsy—you don’t necessarily have to have an official business license. But there are no auctions, so like Amazon, you set a fixed price and you usually have a quantity higher than one for sale.

Etsy is the best place to sell unique items online.

Making money online with Etsy is a great place to start an ecommerce business. While you don’t have access to as many categories or customers as you do with Amazon, the competition is a bit lower.

Additionally, selling your products organically (without ads) is a bit more feasible on Etsy because of its creator-friendly ecosystem. They have guidelines set up that encourage handmade goods over mass-produced products.

Why should I sell on Etsy?

Selling on Etsy isn’t for everyone, but if you fit within the group of people that should consider Etsy, then you stand to rake in heavy profits. So, why should you consider selling on Etsy?

There are two main reasons: Category and competition.

Category

Because Etsy is primarily focused on handmade items, vintage goods, custom products, and overall uniqueness, if what you’re selling falls into those categories you should sell on Etsy.

Because Etsy has such a well-known brand as being a marketplace for artists, the quality of customer you’ll attract is a lot higher. They’re ready to buy, which means they’re ready to pay more for better quality or designs.

It’s not like Amazon or eBay where people are typically looking for the cheapest or fastest option.

Competition

Unlike Amazon or eBay, Etsy isn’t dominated by a ton of sophisticated sellers who buy from manufacturers overseas and compete on price. That’s a race to the bottom that you don’t want to compete in as a beginner.

Your competition is other artists or budding entrepreneurs who have a knack for making things with their hands. Their first instinct isn’t to figure out how to sell the cheapest product.

This makes it just a bit easier to find customers who are looking for the type of thing that you’re selling. Would you rather be a big fish in a small pond or a small fish in a big pond?

Etsy fees: How much does Etsy take?

Now, let's get down to business - how much does it actually cost to run a business on Etsy? Well, there are many types of fees that you should be aware of when getting started on Etsy, from compulsory fees to optional add-ons. Also keep in mind that any service fees that you get charged are non-refundable.

Let's take a look.

Compulsory Etsy fees

These fees are mandatory when selling on Etsy. There is no way around these and no option to not pay them.

Etsy setup fees: $15

Etsy charges a $15 one-time fee to get your store set up and ready to take orders. This will be charged during your onboarding and processed after your store is live.

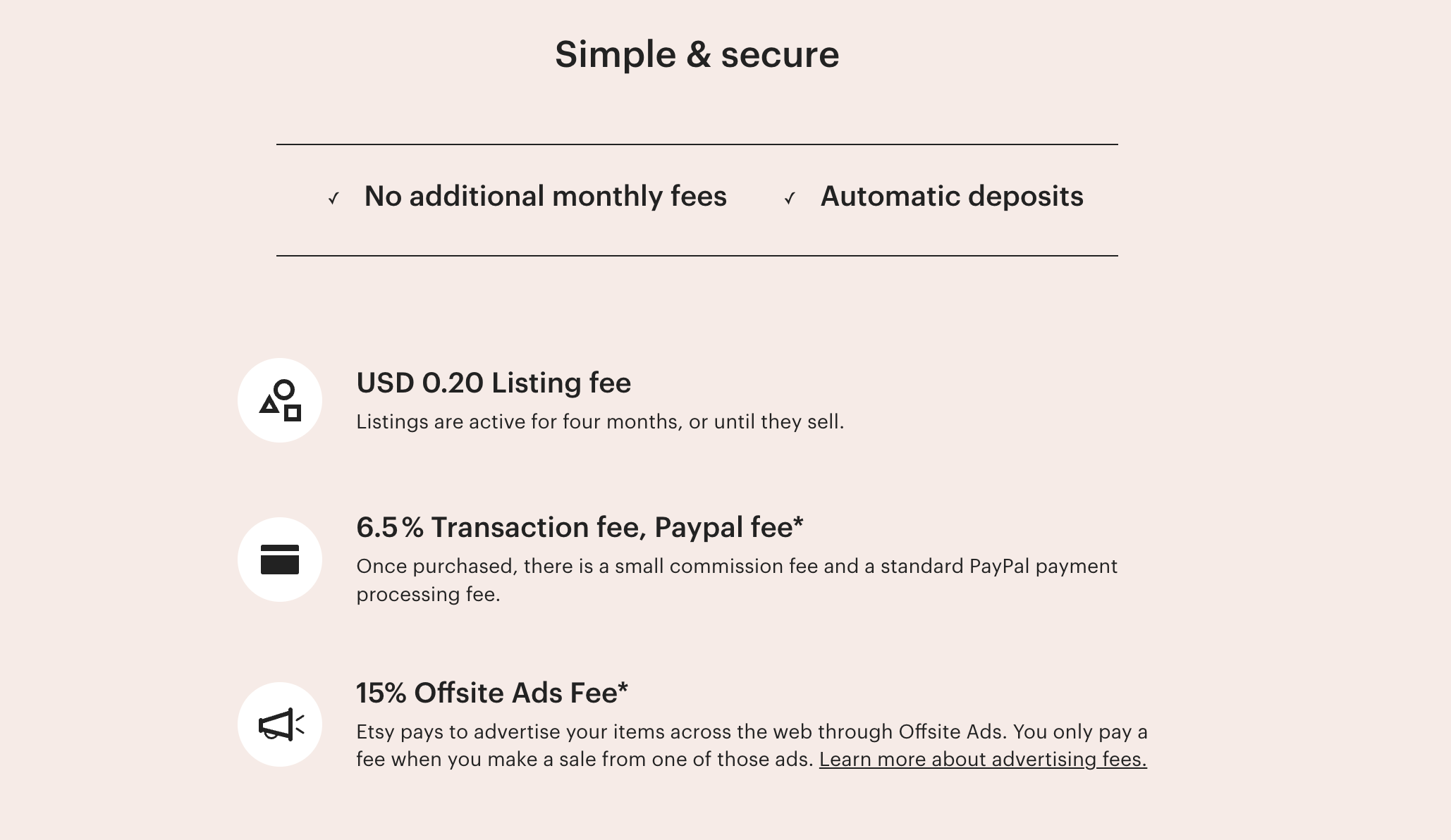

Etsy listing fees: $0.20

Every time you put a product up for sale on Etsy you will be charged $0.20. Your listing will stay live until the product sells or for four months, whichever comes first. Please note that even if you don’t get a sale, you’re still charged the fee.

It may be wise to set your listing to “auto renew.” This means that once the four-month period is over, your listing will automatically stay live for another four months and you’ll be charged an additional $0.20.

Multi-quantity listing fees: $0.20 x (x)

If your listing has a quantity higher than one, you also get charged for additional sales of that product. For example, if a customer buys three of the same product in the listing, you’ll get charged for two additional listings (2 x $0.20).

So, the original $0.20 listing fee always applies, then if you sell more products you’ll get charged an additional $0.20 per unit sold.

Etsy transaction fees: 6.5%

Now the big one. Aside from the listing fee, Etsy charges a 6.5% of the total cost fee. This also applies to shipping and gift wrapping options if the customer has to pay for it.

Say that you sell a product for $85 and shipping is $15, so the total that the shopper has to pay is $100. Etsy will charge 6.5% of that, or $6.50. These fees are calculated based on your local currency.

The transaction fee is also different from the payment processing fees. Think of the transaction fee as a commission that Etsy takes for giving you access to its shoppers.

Payment-processing fees: 3% + $0.25

When you set up a shop, you’ll want to get enrolled in Etsy Payments. Etsy Payments is like Stripe: it allows you to collect credit cards, debit cards, and more.

Processing fees are a flat rate plus a percentage of the total sale. It varies depending on your country, but in the United States it is 3% plus $0.25. View the full chart by country here.

As you can see, the transaction and payment-processing fee gets close to 10% of your sale. Keep this in mind when you’re considering selling on Etsy. For reference, eBay selling fees are around 15%.

Location-based Etsy fees

The following fees are additional mandatory fees based on the Etsy store's currency, taxes, and Etsy's operations. These vary depending on the seller's location.

VAT fees

VAT fees are most common in the EU and UK, so depending on your location you may be charged. Learn more about VAT here.

Sales tax

Etsy collects monthly sales tax rates in most of the US territories, in order to hand over sales tax to government authorities. Tax remits are calculated in your Etsy Payments account, however, you can also opt-out of this and do your own tax.

Sales tax fees depend on whether you sell physical or digital items.

Regulatory operating fee

Some countries have specific regulatory standards for digital transactions. As a result, sellers are charged a percentage of the total cost of their product. These operating fees currently apply for the following countries:

- United Kingdom – 0.25%

- France – 0.40%

- Italy – 0.25%

- Spain – 0.40%

- Turkey – 1.1%

Optional Etsy fees

These fees are completely optional, but can offer you an advantage when selling on Etsy.

Advertising fees: $1-$25

If you want to accelerate your store’s growth and visibility, you have the option to run ads. Etsy ads are broken down into Offsite Ads and Etsy Ads. Generally, you’re automatically enrolled into Offsite Ads. Etsy manages where the ads are placed, but they will be on places like Google and content publications and if a customer purchases from you through an ad, you get charged 15% of the total order. If your store does over $10,000 in revenue, that fee drops to 12%.

Etsy Ads are those that are live on the site and they are optional. Fees will vary depending on your budget.

Private listing fees: $0.20

Say you want to offer a product to just one person and use Etsy to facilitate the transaction. That’s possible and it’s $0.20 if the buyer ends up making the purchase.

Etsy payments: Getting paid by Etsy

When it comes to getting paid, you can accept payments from a whole range of methods. Etsy accepts:

- Credit and debit cards

- PayPal

- Google Wallet

- Apple Pay

- Etsy Gift cards

Your sales funds are directly deposited into your bank account in your currency. Etsy fees are processed through Etsy Payments, so if you are an Etsy Payments user then all fees will be automatically deducted from this account.

Is selling on Etsy worth it?

It can absolutely be worth it to sell your products on Etsy if you have a unique product and factor in the fees associated with the platform.

However, the fees can add up. Let's say you're just looking at the mandatory Etsy fees as a US-based user. You would have to pay a $15 setup fee, but as this is a one-time payment, we won't include this in the calculation.

Imagine that you're selling a product for $10, with free shipping. To sell this product, you incur fees of:

- $0.20 listing fee

- 6.5% transaction fee ($0.65)

- 3% + $0.25 payment processing fee ($0.30)

This means that of the $10, you make $8.85. Etsy has taken a 12.2% cut of your sale - this is before you get into paying your tax obligation. So, make sure to have a high enough margin so that the listing fee, transaction fee, and payment processing fees still allow you to be profitable.

However, if you are selling digital products, then Etsy may not be the right choice for you. Due to the nature of the platform and the fees associated with selling, there are other, better options out there. Read this guide to selling digital products on Etsy to know more.

Learn how to be successful on Etsy with Whop

Selling on Etsy can be a powerful way to get your physical, handmade products in front of a ready-to-buy, devoted audience. But as you can see, there are a lot of fees and factors to think about when you’re getting set up.

You shouldn’t go at it alone! At Whop, we have courses, communities, and expert Etsy sellers ready to help you in your journey on the marketplace.

Take The Etsy Empire for example. This free course and community has over 40 videos showing you how to sell on Etsy step by step, case studies of successful stores, an active Discord community where you can connect with other sellers, and more.

However, if you want to start selling things online and making more money, but you don't have a handmade product to market, then digital products could be a great place to start. With digital products, you don't need to worry about shipping, logistics, or physical returns. And, while you can sell digital products on Etsy, it is not what the marketplace was designed for.

The best place to sell digital products is Whop. Whop only takes a 2.7% + $0.30 transaction team and has pre-made store templates, a team of experts ready to help, and a thriving marketplace.

Why you should trust us

Joe Niehaus is an ecommerce specialist and content writer at Whop. He has extensive experience selling products online, from selling Jordans on eBay growing up to working in affiliate marketing for top nine-figure ecommerce brands. His work is the result of years of hands-on experience

Etsy FAQs

What is the downside on Etsy?

The main disadvantage to selling on Etsy is the traffic, or number of customers. Since Etsy is so targeted in who it sells to, that means the amount of buyers you have for your products is less than other marketplaces like Amazon or eBay.

Do I need a tax ID to sell on Etsy?

No, you do not need a tax ID or business license to sell on Etsy. Individuals can use the platform to market their goods!