In this guide, we’ll go over everything you need to know about Fidelity, including its different investment plans and if it’s a good fit for you depending on your current situation.

Key takeaways

- Fidelity offers commission-free trading on stocks, ETFs, and thousands of mutual funds with no minimum balance requirements.

- Account holders gain free access to institutional-grade research tools and educational courses typically unavailable to retail investors.

- The platform provides comprehensive retirement planning with multiple account types including Traditional and Roth IRAs and 401(k) options.

If you’ve been exploring ways to invest or manage your retirement, Fidelity is a name that’s likely come up - and for good reason. Fidelity has become a dominant force in retail investing, taking up a sizeable market share as a user-favorite.

In this guide, we’ll go over everything you need to know about Fidelity, including its different investment plans and if it’s a good fit for you depending on your current situation.

Let’s start with a brief overview of what Fidelity is.

What is Fidelity?

Founded in 1946 by Edward C. Johnson II, Fidelity is a platform that has evolved from a single mutual fund to a comprehensive investment solution within a user-friendly online platform.

It’s one of America’s largest self-directed investment platforms, meaning that it empowers individual retail investors with the tools and resources to personalize and manage their own portfolios.

Through the platform, you can be sure all of your investments are secure: Fidelity fully protects your funds with SIPC coverage, which safeguards your securities up to $500,000 (including $250,000 for cash claims) if the brokerage faces financial difficulties.

Additionally, Fidelity operates under the oversight of FINRA, the financial industry’s regulatory authority, ensuring they maintain strict standards surrounding consumer protection and fairness. This means you can expect transparency in addition to a reasonable fee structure and fair trading practices.

It’s important to know that Fidelity only serves the US market and only offers services for domestic investment vehicles, so if you’re not based in the country, you’ll need to consider another option.

- eToro review: Everything you need to know about the social investing platform

- Robinhood review: Should you use this investing platform?

Fidelity investments overview

Fidelity’s investment platform is known to empower individuals with institutional-grade tools that aren’t otherwise available to retail investors. Here’s a brief overview of what exactly this looks like:

Commission-free trading

Fidelity offers commission-free trading with access to the whole stock market and thousands of unique ETFs covering every imaginable market including mid-cap, large-cap, crypto, and more. In addition to the vast diversity that Fidelity offers for its investors, being able to trade without commission means you can build a diversified portfolio at your own pace without worrying about transaction fees.

Options trading

For traders who want to dabble in the potentially lucrative high-risk, high-reward realm of trading options, Fidelity allows you to do so with industry-low fees. Options trading is available at $0.65 per contract and comes with a suite of handy tools including a probability calculator, a profit/loss calculator, and advanced screening tools that can help find options that match specific criteria based on risk tolerance and strategy.

Mutual funds

Fidelity is known in particular for its mutual fund offerings which provide access to thousands of no-load (sales load fee-free) mutual funds. Their custom-crafted Fidelity funds feature some of the lowest-cost index funds in the industry, with competitive expense ratios compared to other major brokers.

Investors can choose from index funds compiled of major market indices, speciality funds focusing on specific markets or strategies, and actively managed funds in various sectors. Fidelity provides full transparency on all fund fees and expenses through their fund screener and comparison tools, allowing you to make an informed decision on which fund is best for you.

Research and analysis tools

One of the greatest perks that Fidelity provides is its comprehensive suite of research tools that are considered by many to be institutional-grade.

This suite includes real-time feeds that cover live market data and news, stock screening and filtering capabilities, and third-party research reports from respected providers. This allows you to quickly identify the best picks among thousands and act as your own analyst, saving you the potential cost of a service or individual that offers similar insights and capabilities.

We’ll get in-depth with more details about their specific tools later in this guide.

Retirement planning

Fidelity is well known to be excellent in terms of retirement planning. The platform offers comprehensive solutions with various retirement vehicles including traditional and Roth IRAs, retirement accounts for business owners, and 401(k)s.

These tools will allow you to get prepared and started with realistic goals based on your current situation and create a custom schedule and plan accordingly. We’ll dive into more of the 401(k) specifics in particular later.

Getting started with Fidelity in just 3 steps

Getting started with Fidelity is straightforward. Here’s exactly what you need to know to get started and make the most of your account.

1. Choose your account type

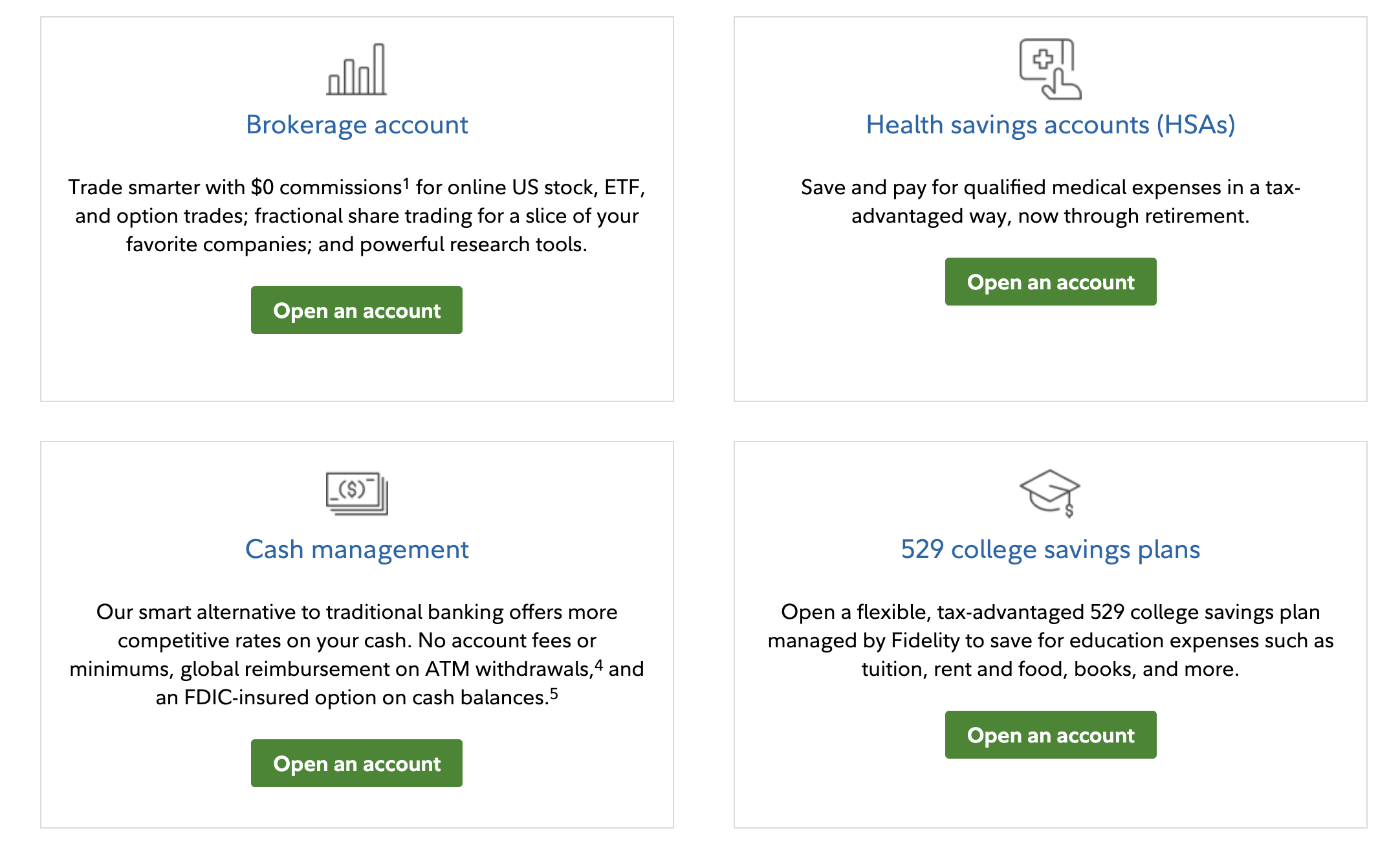

Once you have logged in, you’ll be presented with the different Fidelity account types, which are as follows:

Individual Brokerage Account

This is the most common starting point for most retail investors. The individual brokerage account allows you the flexibility to trade stocks, options, ETFs, and mutual and index funds all with little to no fees and the ability to manage everything fully and independently.

Joint Account

A joint account has the same capabilities as an individual brokerage account but allows two or more individuals to invest and manage funds together in the convenience of a single account. This is common not just for couples but also for business managers or family members who have a long-term agreement to co-manage funds.

529 College Savings Plan

Fidelity’s 529 college savings plans allow you to have a dedicated account for saving for future education expenses that you can grow tax-free if it is used for qualified educational expenses. You can open the 529 as soon as a child is born, and you can even change beneficiaries if needed. After opening this account with Fidelity, you’ll be presented with a variety of investment strategies that you can adjust accordingly based on risk depending on how soon your child needs the money.

Retirement Account

Fidelity’s retirement accounts are meant to be an approachable way to manage long-term savings goals while taking advantage of tax benefits, most notably in the Traditional and Roth IRAs.

The Fidelity Traditional IRA allows you to make tax-deductible contributions and grow your investments with taxes deferred until retirement. Its Roth IRA offers tax-free growth potential which is especially handy for those who expect to eventually end up in a higher tax bracket.

Fidelity also offers a Rollover IRA which helps you consolidate all of your previous retirement funds into a single account that you have full management over. They also offer specific plans for self-employed and business owners.

2. Set up your account

After picking your preferred account type, you’ll need to gather the necessary documentation for approval and onboarding, which includes your government-issued ID, your Social Security number or Tax Identification number, and the information of the bank account you want to link to your Fidelity account. For the sake of security, you’ll also want to set up two-factor authentication which can include biometric login options such as fingerprint or Face ID.

The online application will then walk you through each step, and once your account is approved and live, you can start funding it with your bank account to buy or trade whatever assets you want.

In addition to your investment accounts, you’ll also gain access to Fidelity Bank, which can act as either a checking or a high-yield savings account so you can have all of your finances in one place.

The Fidelity Cash Management Account comes with other perks such as free ATM withdrawals nationwide, no monthly fees, and standard FDIC insurance coverage.

Setting up an account Fidelity can be done regardless of how much money you’re starting with: the platform has no account minimums for most account types, and there’s no cost to open or maintain an account.

Some investments and services may have associated fees, such as options contracts or certain mutual funds. We’ll break down the fee structure in greater detail later in this guide.

3. Platform access and management

Once your account is active, Fidelity lets you access the platform to monitor your investments and make trades both on desktop and mobile on their official app which is available for both Apple and Android users.

It’s incredibly convenient to have the mobile app to check in on your accounts on the go, and you will have full ability to trade, deposit checks, and manage your entire portfolio no matter where you are as long as you have your phone and internet connection. You can also set up custom alerts for price movements that you can get as push notifications on your phone.

While the mobile app provides nearly all the functionality of the desktop platform, accessing the full suite of tools including the Active Trader Pro platform and other advanced analysis features and full dashboards, you’ll want to access the platform on desktop.

Fidelity on-demand courses

Another perk of your Fidelity account once it’s set up is access to a variety of courses and webinars to help you get educated enough to make professional investment decisions on your own. These courses are totally free, but only exclusive to account holders. They include general courses on trading, wealth management, options and even digital marketing and mergers and acquisitions which can help broaden your career horizons.

Check out the best trading courses and communities on Whop.

Fidelity 401(k)

Fidelity is the largest 401(k) provider in the US, with an estimated market share of up to 25% and trillions of dollars in assets under management from over 20 million individuals and roughly 24,000 corporate-defined 401(k) contribution plans.

Here are the features and options that make the platform’s 401(k) so popular for retirement savings:

Traditional 401(k) plans

One of the platform’s most popular offerings for retirement savings is its traditional 401(k) plan. This standard plan lets you contribute money directly from your paycheck before taxes are taken out, lowering your taxable income in addition to helping you save for retirement. Most employers match a percentage of what you put in, which is basically free money added to your retirement savings. Taxes are only paid if and when you take the money out in retirement.

Fidelity’s platform makes managing your traditional 401(k)’s straightforward with their automatic contribution system that can be set up with either a percentage of your salary or a fixed dollar amount that can be adjusted at any time.

Roth 401(k) options

If your employer offers it, you can choose a Roth 401(k) alongside or instead of a traditional plan. While you’ll pay taxes on contributions now with your Roth, your money will grow tax-free and can be withdrawn tax-free in retirement.

Fidelity makes it simple to split contributions between traditional and Roth options, with clear tracking of each type. You can configure your automatic contribution to increase to shifting more money towards your Roth over time based on how close you are to retirement.

The platform makes it clear exactly when you can access your Roth funds by clearly displaying both the contribution amount and earnings separately. This is particularly important since Roth accounts have strict rules which require you to hold them for at least 5 years and be at least 59½ years old before withdrawing, otherwise, you will be submitted to taxes and penalties.

Rollover options

In case you need to consolidate retirement accounts due to either a job change or multiple retirement accounts, Fidelity offers rollover specialists who can help guide you through each step of this process.

For example, you can move your old 401(k) into a new employer’s plan, convert it to an IRA, or consolidate multiple accounts within the platform while clarifying and sticking to your investment strategy.

Most of the rollover process can be handled completely online, saving you time and money compared to other options that might include paperwork, planning and consulting with financial advisors, and having to manage accounts in different places.

Other Fidelity features

Let's take a look at some of the extra features you can get with Fidelity.

Customizable investment options

Another reason for the popularity of Fidelity and the high retention rate for its customers is its customizable investment offers. The level of flexibility that they offer rivals that of working with a traditional financial advisor, but without the typically high management fees and commissions that come with such services. The self-directed platform allows you to access virtually every investment vehicle you want, from ordinary stocks to options and different types of funds in every imaginable market sector, which recently includes crypto.

The customization is possible through Fidelity’s robust trading platform, which lets you choose when and how much you want to invest with resources that will help you make decisions that are best for you and your risk tolerance and strategy.

The majority of these assets and investment types can be traded commission-free, and for those that do have fees, they’re typically on par with or lower than industry averages. Whether you’re looking to invest in individual stocks, ETFs, mutual funds, or options, Fidelity’s platform provides all the tools and research you need to make sound investments.

Planning tools and resources

As a Fidelity account user of any level, you’ll be empowered with a fully-stacked suite of comprehensive planning tools that extend well beyond what might be expected from a service that is essentially free.

You can get started in their dedicated sections for investment planning which are complete with advice and goal setting, and from there, you’ll gain access to their suite of tools designed for all stages of your journey.

Active Trader Pro

Active investors who like picking their own stocks will get access to real-time market research and screening tools complete with technical analysis capabilities. This includes access to customizable dashboards within their Active Trader Pro tool that can help you evaluate and identify potential new investments in addition to effective management of current holdings.

Fidelity Go

Fidelity also offers a robo-advisor, Fidelity Go, which uses technology to automate investing with its smart algorithm based on current and historic market data and your current financial goals.

Once your portfolio is set up, you can have Fidelity Go automatically rebalance your investments so you can stay on track based on your pre-determined risk tolerance, investment strategy, and time horizon.

While there’s no minimum account balance to use Fidelity Go, if you have a balance of over $25,000, you’ll gain access to perks such as unlimited 30-minute coaching calls with Fidelity advisors who can help you manage your account.

Retirement tools

In terms of retirement savings, you’ll get tools that range from basic contribution calculators to advanced retirement planning features. Their calculators will apply to whichever account type you have and will help you make projections that can help you see if you’re on track by analyzing your current savings, projected Social Security benefits, and expected return based on your planned retirement date.

Educational resources

Fidelity also offers an entire section of free educational resources in courses that you can enroll in on your own schedule to increase your overall ability to make good investment decisions while fine-tuning a strategy that works for you.

24/7 assistance

If at any point you need help navigating the tools and resources or if you have any questions surrounding the platform or your investment strategy, Fidelity also provides 24/7 support completely for free through multiple channels. Representatives can be reached through phone, 24/7 chat, or email. You can even set up virtual coaching sessions with a representative who will walk you through any tool or feature on the platform through a screenshare.

Fidelity Netbenefits Platform

For employers using the platform, Fidelity offers a Netbenefits program which allows companies to manage company workplace benefits. So, if your employer uses Fidelity as their benefits provider, the platform will be your main portal for managing everything from your 401(k) to your health savings account and stock compensation plans.

The Netbenefits Platform will give you access to a unified dashboard where you can view and adjust all of your company-backed benefits and investments with the added convenience of checking exact vesting schedules or making changes to your elections if needed.

You’ll be able to conveniently access your Netbenefits with all of your other Fidelity accounts so you can have a complete picture of your entire financial situation in a single place.

Fee structure and other costs

Here’s a summary of Fidelity’s fees and other associated costs:

Account fees

- Account opening: $0

- Account closing: $0

- Account maintenance: $0

- Account transfer: $0 for partial transfers, $75 for full account transfers to another broker

Trading costs

- Stocks and ETFs: $0 commission

- Options: $0.65 per contract, no base fee

- Mutual Funds: No transaction fee for Fidelity funds, variable but mostly free for third-party funds

- Bonds: $1 per bond for secondary market trades with $10 minimum, $250 maximum

Wire transfer fees

- Incoming domestic: $0

- Outgoing domestic: $30 online, $32 if done with a representative

- International: Varies by country

Investment management services

- Personalized planning and advice: 0.50% annual fee for balances over $25,000

- Fidelity Go robo-advisor: Free for balances under $25,000, 0.35% annual fee for balances above including free access to personal advisors

- Wealth Management: Variable depending on account size and service

Fidelity: pros and cons

Here’s a brief summary of the pros and cons of the financial services platform:

Pros:

- No account opening fees

- No fees for basic account management

- No minimum balance requirements for most accounts

- Commission-free trading for stocks and ETFs

- Extensive resources, tools, and support for 401(k)s and overall retirement planning

- Integrated banking features with no-fee ATM withdrawals

- Tools and education for self-directed trading

- Clear fee structure for paid services and features with no hidden costs

- 24/7 customer support through multiple channels

Cons:

- Advanced features can be overwhelming for beginners

- Some third-party mutual funds have expensive fees

- Limited international trading options

- Wealth management services require higher balances for full features and come with fees

- Customer service wait times can be long, especially during market opening hours

- Closing or transferring your account, while free, is difficult

Who is Fidelity best for?

Fidelity is an excellent choice for US-based individual investors who want to take the reins with their financial investments in both the present and the future without needing to pay high management fees or consult potentially pricey advisors.

The platform is particularly well known for its extensive features that help to make it an all-in-one go-to financial resource, including the ability to open up a convenient checking and high-yield savings account in addition to several options for retirement planning and access to advanced trading tools which include a robo-advisor.

However, Fidelity isn’t for everyone. The financial services platform might not be the best fit if you’re easily overwhelmed by options or don’t have enough time or confidence to pick your own investments. Full control comes with a sense of responsibility that might be too much for individuals who prefer a more hands-off approach, in which case working with a traditional financial planner might be well worth the fee.

Level up your financial game with Whop

Getting your finances straight is a full-time responsibility for anyone who wants a comfortable future, and Fidelity is a great option for individuals who have the confidence and ability to take advantage of the platform’s full suite of tools and services, many of which come with low to no fees.

However, you can never be too educated when it comes to finances, especially when it comes to investing. Head over to Whop to read more free guides that will help you become a better trader and investor, and consider joining a dedicated trading community that can help you take control of your finances for an abundant future, no matter where you might be right now.