You may have seen a house-flipping series on TV that has piqued your curiosity as you watch people cash in while going through the exciting process of flipping a house. However, like most things on TV, the exercise is made to look easier on the screen than it is in real life.

The reality is that house flipping is a business, and in order to be profitably flipping houses, you’ll have to get a realistic assessment of the overall process, including how it works, how much you need to get started, potential risks, and alternatives. This guide reveals all that for you and more, starting with the basics of house flipping, all the way to how to find profitable properties.

Know what you're looking for? Jump ahead to:

- What is House Flipping?

- How Does House Flipping Work?

- How to Get Into Flipping Houses for Profit

- How to Flip a House in 9 Steps

- Where to Find Profitable Property Deals

- House Flipping Risks

- Wholesaling vs. House Flipping: What's the Difference?

- Join a Real Estate Community on Whop!

- House Flipping FAQs

What is House Flipping?

House flipping is the process of buying a home, holding it for a short timeframe, and selling it again on the market for a profit. It often involves undervalued homes that require renovations and repairs to increase the value and appeal to fairly fetch a higher price.

While it’s simple in theory and can be very profitable, flipping houses is one of the most advanced forms of reselling in any realm, and in addition to relevant skills, you’ll need a healthy budget and very likely a team to back you up.

It can be considered both an art form and a science, as you will have to systematically find undervalued properties while maximizing the price you can fetch for them by making them appealing to new buyers with marketing and renovations that require taste and a homeowner’s perspective.

How Does House Flipping Work?

At its core, house flipping is just a form of real estate investing, and as with any investing, it requires subject matter expertise. The real estate market is subject to changes and ebbs and flows based on macroeconomic factors, most notably interest rates and the overall health of a country’s economy.

The process of flipping houses hinges on buying an undervalued property, renovating it in a cost-effective manner to increase its appeal and thus its market value. Ideally, the house will be sold quickly and for an amount that is healthily above all of the associated investments that the process requires.

In order to flip a house, you’ll first need to own it. You’ll have to buy it and secure the property under contract just as any other buyer would. Then you’ll continue to the renovation phase, and wrap up by listing it and cashing out to a new owner. We’ll explain this more in-depth with a step-by-step process later in this guide.

How to Get Into Flipping Houses for Profit

Before considering flipping a house, you’ll have to get up to speed with the current real estate market, and determine that flipping the house is the best thing to do based on the state of the market and your financial goals. Although the idea of cashing out a big deal sounds appealing, sometimes it’s better to consider an alternative such as renting it out to either short or long-term tenants, allowing you to benefit from positive cash flow while paying down the mortgage.

You’ll also need a budget that allows for substantial wiggle room, as house flipping often requires a paid team and other fees in addition to the money that it will take to own a property outright. If you don’t have the cash to start on your own, you can assemble a team of investors to help you.

If you’re ready to start flipping houses, here’s a 9-step guide that will paint a realistic picture of what it takes to successfully flip a house for profit while minimizing the inherent risk:

How to Flip a House in 9 Steps

1- Educate yourself on the current housing market

In the United States, houses have historically appreciated at a faster pace than almost any other asset, particularly in recent years following the COVID-19 pandemic, where significant increases in value in short timeframes became the norm. However, in 2024, with a recent increase in interest rates and overall economic uncertainty, the housing market has changed as it always does, making for a different house-flipping environment than a few years back.

You can’t win today with yesterday’s strategies, and this is particularly true with flipping houses. Make sure you get a good assessment of how hot real estate is in your intended area of flipping, including how active buyers and sellers are and how fairly houses have been priced in recent sales. While there is some degree of intuition when it comes to finding a good home to flip, for the most part, data is your friend, so your best decisions are those that have the numbers to back them.

2- Define your budget and investment strategy

One of the most important things you’ll need to do before buying a house to flip is to have a clearly defined budget and investment strategy.

Determine an exact dollar amount in terms of capital you’ll be able to allocate for all forecasted expenses, including the purchase price, the overall cost of renovations, and the fees and taxes you’ll need to pay. Always buy a property that is well within the projected costs as many times projects go over budget and can take longer than expected to finish and sell.

One popular investment strategy is the 70% rule. The 70% rule states that you should not buy a property for more than 70% of its after-repair value (ARV). ARV is the estimated value of the home after renovation and repairs.

Let's imagine that you are buying a property that needs a brand-new kitchen, new flooring throughout, and new lighting. You have estimated this cost at $40,000. The property is expected to sell for $250,000 after repairs.

The ARV is $250,000- $40,000, which equals $210,000. Using the 79% rule, you should not pay more than $147,000 ($210,000 x 0.7) to buy the property and make a profit. If the property sells for $250,000 you won't keep the entire 30% profit, but it will be a good buffer for any fees and taxes and still net you profit.

3- Gather a skilled team

Just about every profitable house flip is a strategic operation run by a team of professionals, including tradespeople, real estate agents or mentors, investors, contractors and lawyers. While you can take on some repairs yourself to minimize costs, carefully consider what you need to leave up to the professionals.

Building a reliable network of experts who work together towards the same goal and are each incentivized by their fair share in a piece of the profit pie will ensure that all aspects of each flip are handled properly.

4- Secure financing

It is best to secure your financing before attempting to purchase a property, as getting financed can sometimes be a length process. Get all of your paperwork and documents in order and secure your funds so that when you find the right house to flip you can secure it before anyone else. When it comes to flipping houses, speed is of the essence.

Even if you’re dealing with a cheap property that you can buy cash, you should always explore financing options so that you can keep a liquid bankroll for repairs, fees, taxes and other expenses or potentially picking up other properties.

Consider using a network of private investors, perhaps friends and family, but be sure to make all of the terms clear regarding how they will benefit from their financial commitments. You can go the traditional mortgage route for potentially better interest rates, but this typically limits the number of deals that you can pursue simultaneously.

Be sure to calculate and compare fees including interest rates, repayment terms, and potential prepayment penalties as you’ll be paying off the house whenever you flip it.

5- Research and find a property

Finance secured it's now time to find a property that fits your price range and goals. Not just any old fixer-upper will do–successful house flippers use research to buy the right property, in a good location, at a profitable price point that is well positioned to sell in their market. Conduct thorough due diligence on different neighborhoods, pricing trends, local schools, taxes and safety to determine what a good deal looks like in each area. While some areas may be more favorable to deal with than others, if you find a really good deal, it’s worth getting in any area so long as the numbers make sense.

Some flippers even target undesirable neighborhoods as they often present better price points, less competition, and potentially higher profit potential as you can often get a good deal more easily in these situations. You're not looking for your dream house here - you're looking for the best money-maker.

No matter which area you target, your goal should be to identify an undervalued property with great unrealized potential. This means that sometimes, the more unappealing the house is to the public, the more likely it is that you should consider it–given that the issues are surface-level and you feel confident you have the skills to turn the property around.

5- Assess the property

Once you’ve identified a good potential candidate for flipping, don’t rush in to close without doing your due diligence. We did say that speed is of the essence, but you’ll want to conduct thorough inspections and assessments for anything initially hidden that might derail your plans.

Be sure to hire professional, reputable inspectors to examine all structural elements, including the flooring, insulation, essential appliances like a heater and water tank, and the structure of the house. While you will pay more up front to work with a professional inspector, it will save you a huge headache if they help to uncover a costly fix that puts your deal over budget. A few hundred dollars now could save you thousands in the long run.

Consider partnering with a local inspector so that you have someone trustworthy and reliable every time you find a potential flip.

If issues arise during inspections, get multiple quotes from different contractors regarding repair costs and timeframes so that you can work this into your profitability and projected flip date. Remember to not fall victim to sunk cost fallacy, and realize that even if you sink time and money into inspection, it’s all part of the overall cost of doing business as a house flipper, and walking away from a bad deal to make room for a good one is always the best move.

7- Invest in smart renovations

After you’ve found a good property, run the numbers, and the house is officially yours, it’s time to renovate and improve all aspects of the house that will allow you to get top dollar for it.

This is the most critical stage of flipping houses, as this is where you’re adding value to the house that will be worth more than the time and money you’re putting into it.

Work with a lean and loyal team, and prioritize renovations that provide the highest ROI, including bathroom and kitchen upgrades and an overall better look to the house, which might be as simple as fresh paint and better staging when you take pictures to market the property. Remember to keep decor neutral - while you may love bright colors and extravagant features, most buyers are looking for a blank canvas that they can make their own.

Be sure to track expenses meticulously during the renovation process so that you get a good idea of how long things take compared to how long you projected them to take, as things typically won’t run as scheduled, especially in the beginning.

8- Put your property on the market

One tactic that makes for a good flip is to find a property that flew under the radar simply because it was poorly marketed, so that when it’s time for you to flip the house, simply marketing it well will already increase the value of the house.

Start with good photography and staging to showcase the house in its best light, showing off any particularly appealing details or features. Consider investing in professional staging services for open houses, pictures and videos so that buyers can easily see themselves comfortably living inside of the property.

You can run advertising campaigns online on sites like Zillow, realtor.com, or even social media and attractive open house events if you are selling a higher end property with a specific target audience in mind.

9- Flip for profit!

While ideally you want to flip your house as fast as possible, you’ll be subject to the demand of the market and the timeframe of the buyer. This means that patience is a big part of flipping houses, as you need to wait until you get the price you aimed for, which you should have an exact figure for since the beginning of your project.

Be sure to have realistic prices in mind while listing the home: remember also that your purchase price is on public record, so you want the buyer to feel like they are getting a good deal for the work you put in if you want to maintain a good reputation–a good house flip should be a win-win for both you and the buyer.

House flippers generally aim for a 20-30% profit margin on the overall cost of a house, meaning that if you bought a house for $150,000 and had $50,000 total in associated costs, you can aim to make $40,000-$60,000 in the time it takes to make a sale after purchasing the house.

Where to Find Profitable Property Deals

Flipping houses is a treasure hunt, and as we mentioned earlier, the best houses are those that are poorly marketed, meaning that it will take manual work and sifting to find a diamond in the rough.

Here are some good places to find a profitable property for a potential flip:

House flipping communities

There are online communities dedicated solely to the art of flipping houses, from house flipping forums to private real estate flipping communities. Joining an online community gives you a chance to learn from experienced flippers, and some of the more exclusive communities can teach you everything you need to know about finding deals, getting financed, and ultimately making a profit. If you're looking for properties to flip, joining a group dedicated to just that is a good idea.

Online platforms like Zillow, Redfin and Realtor.com

The first place you can look is on a public online marketplaces. However, due to their convenience and transparency, this means that you’ll have tons of company from competing investors and other buyers. The key to succeeding on these platforms is to stay organized and to have criteria for listings so you can systematically and efficiently scour only the best candidates. You can filter by neighborhood and price range on top of more specific criteria such as distressed properties and those sold by the owner.

Speed is of the essence when using an online platform, so be sure to have email notifications set up for new listings and contact sellers quickly if you see a deal that checks all your boxes.

Networking with agents

Most real estate agents are open to working with home flippers, and many are already doing so as they know that they can be serious buyers who are professional and easy to deal with. By developing a relationship with a connected and experienced real estate agent, you could get access to off-market listings before they get exposure. Agents are on the pulse of the market, and are the first to hear about special cases such as personal life events or impending foreclosures that can motivate a seller to accept a below-market offer for a cash-ready buyer.

You’ll likely have to offer the agent financial incentive to work with you to get the best deals, but having a good one on your team can be your secret sauce in scooping up the best deals.

Finding deals in person

Sometimes finding an under-the-radar deal is best done the old fashioned way, which means looking by yourself in person. Look for any properties that appear like they’ve been neglected or vacant for a long time, estate sales, or other signs that might point to a seller who is willing to accept a direct deal from a buyer.

You can even post signs or advertisements saying that you buy houses in any condition quickly and are cash-ready, which can bring some sellers to you who don’t want to deal with the lengthy process of listing and marketing their property, particularly if it isn’t yet ready to showcase to the public.

House Flipping Risks

While house flipping can be incredibly lucrative and rewarding, it isn’t without its risks, some of which can be substantial.

Being aware of the potential risks and doing your best to hedge against them so that you don’t lose financially (or even legally) will allow you to approach the house flipping game with respectful caution. Here are some of the biggest risks to consider:

Market Fluctuation

Real estate markets can be volatile, and since they can be hard to predict and the process of getting a house ready to flip takes time, conditions can change during the course of your renovation. Sometimes your previous calculations are no longer relevant, so you’ll be forced to either wait for a better market that may not come, or you might have to settle for a less than ideal price.

Renovation Risks

Even the most detailed inspections can miss issues that arise only after time and work, like uncovering poorly done previous structural renovations, hidden pest infestations, or dangerous mold. These unforeseen problems will cause delay and can push your budget past the point of profitability.

Renovation issues might also arise from working with unreliable or dishonest contractors, which is why setting up a reliable relationship with a trustworthy contractor is an essential part of getting yourself ready to be a home flipper.

Financing Issues

Getting the money to the seller quickly is of the essence when it comes to home flippers, as often a good price is contingent upon a cash deal within a short timeframe. Being cash-ready by either having the funds outright or having investors willing to finance immediately will allow you to get the money quickly to close the deal, without having to wait for bank bureaucracy, lengthy paperwork, or potentially unfavorable financing terms.

Competition

House flipping has increased in popularity in recent years, and with an additional rise of buyers of fixer-upper properties from short-term rental investors, the market is perhaps more competitive than ever. If too many eyes are on a property, this can create a bidding war on available properties, or an excess of renovated homes that is beyond market demand, ruining chances for flipping a house within a reasonable timeframe. Remember to keep your budget in mind before entering a bidding war.

Legal and regulatory concerns

As a house flipper, in addition to potential financial issues, you’ll have to navigate the legal landscape of real estate, which can sometimes be restrictive. Be sure to familiarize yourself with any local requirements, including permitting requirements, building codes, fair housing laws and other regulations that can delay your work or put you in the position of violation where you’ll have to worry about legal fees or the inability to complete a project altogether.

Wholesaling vs. House Flipping: What's the Difference?

Some people who want to get involved in the real estate game have considered the alternative of wholesaling in place of flipping, which is attractive for a number of reasons.

Wholesaling as it applies to real estate is a strategy in which one obtains a contract on a property with its seller that they can then sell another buyer, ideally with a profitable spread. It requires less upfront capital and can even be done without any investment at all. Wholesale deals often happen quickly as they don’t require any renovations, financing, or listing–all that is needed to make the deal happen is the connection between the property’s contract and the investor. The wholesaler benefits as the intermediary of the deal–think of their pay as a finder’s fee.

With the opportunity to make money with no investment and without any ownership, some people who want to get involved in the real estate game are attracted to wholesaling as opposed to flipping, but as with the latter, it’s much more complicated in practice than it is in theory and has its pitfalls as well.

Join a Real Estate Community on Whop!

Statistics show that a significant percentage of self-made millionaires–some sources say 80%--have made their first million in real estate.

While real estate is often a long game that requires years or even decades to realize substantial profits, flipping houses greatly shortens that timeframe and allows you to profit in the historically proven market of real estate at a high volume. However, flipping real estate is a multifaceted process that requires a thorough strategy and has the potential for seriously costly mistakes or even legal issues.

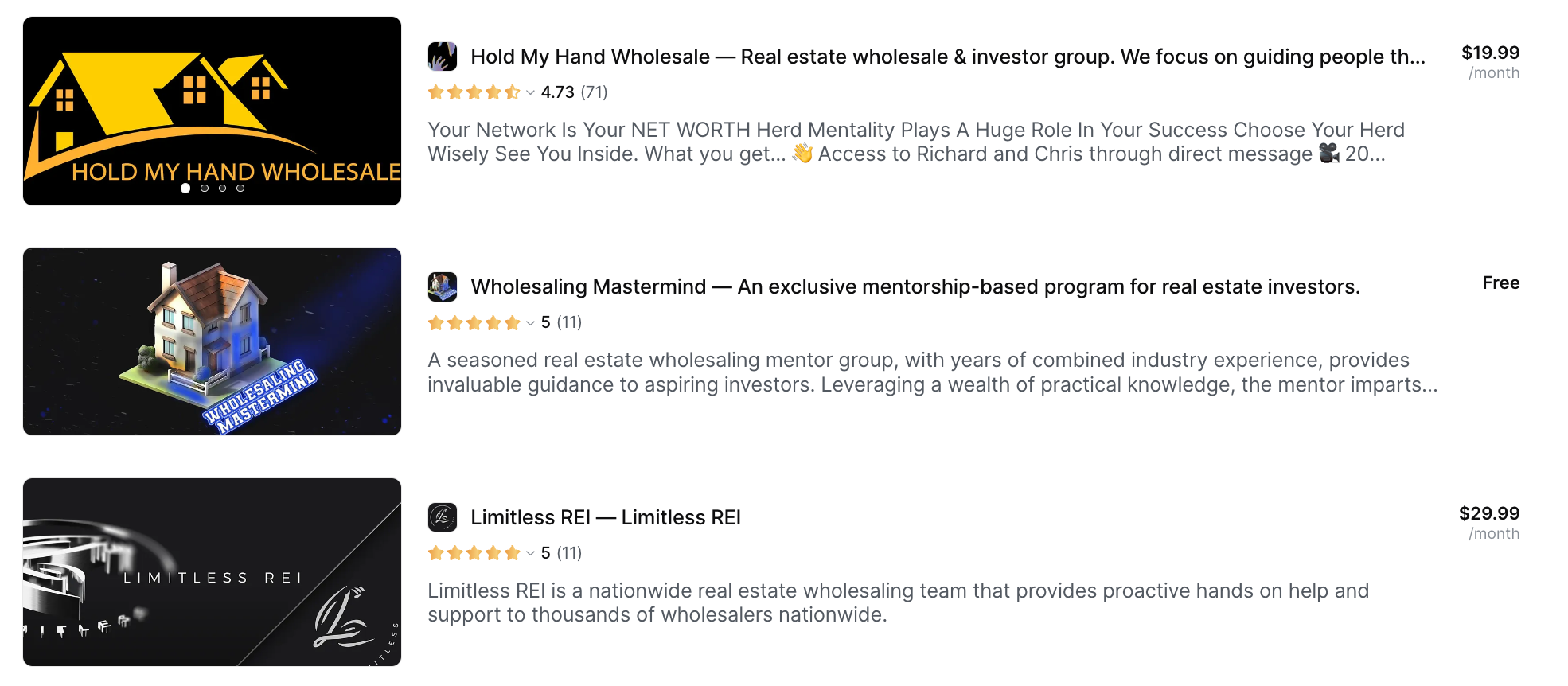

In order to have the best chance for success as a prospective home flipper, you’ll need to build a knowledgeable network, and although that can be hard to find, Whop is home to many vetted private communities that are led by real estate veterans.

As a member of one of these exclusive groups, you’ll gain access to an inside network of real estate professionals that will simplify all aspects of this highly lucrative game, providing guidance, mentorship and even cutting-edge tools to give you an edge over the competition.

So, if you want to join a private group of current and potential future real estate millionaires, head over to Whop’s real estate section right today to find a group for you –you’ll find advice on flipping houses, wholesaling, investing in short term rentals, and more.

House Flipping FAQs

How much money do I need to flip a house?

The exact dollar amount will vary depending on your intended market, but generally speaking, you should only get involved in flipping houses if you have access to significant capital, either personally or through a network of trustworthy investors. As an example, if you’re financing a home to flip on your own, if you don’t have the cash outright, you’ll want to have around 20% of the home price as a down payment and an additional 20-30% as budget for renovations and other associated costs.

How long does it take to flip a house?

The length of time it takes to flip a house can vary considerably and is based on factors like the complexity of the renovation, the experience of the contractors, dealing with any necessary permits or other regulations, and the market conditions when the house is listed for sale. You should aim to flip your house in less than a year after buying it, ideally between 3-6 months so that you can run a healthy business that generates steady cashflow.

Can I flip a house with no money down?

Flipping a house with no money down is possible, although it’s difficult to do so and carries risk and less return for you to pocket personally as you will be relying on external investors. This will make it more difficult for you to negotiate terms and you’ll also lose control when it comes to budgeting and other decisions that will affect your profitability, so it’s better to flip houses with a good bit of money in the bank.

Is real estate wholesaling a good alternative to house flipping?

If you don’t have the money to flip houses, you can consider real estate wholesaling, which can be done with little to no investment, and less risk and liability. By simply securing a property under contract and then assigning the contract to another investor, you can make money as a wholesaler without needing to renovate or take on ownership of a home. Keep in mind that wholesaling can be difficult and can take a good bit of luck or connections in order to find a profitable deal. Read this review and see how Hold My Hand Wholesale helps people to get started with real estate wholesaling.

![Top 18 Best Sneaker Reselling Discord Servers [2024]](/blog/content/images/size/w600/2024/01/sneaker-reselling-discord.webp)