If you’re after a free stock trading app, go no further. This is the definitive guide to picking an app, and our best free stock trading apps in 2026.

Key takeaways

- Zero-commission trading has become the industry standard since 2015, making investing accessible to everyone.

- Different free trading apps excel in different areas—choose based on your specific needs like options, global markets, or mutual funds.

- Traditional brokers like Fidelity and Vanguard now offer free trading with added security and stability benefits.

Stock trading and investing has never been easier to get into, but with so many options out there, guess what?

It’s never been harder to pick the right broker or trading platform.

Luckily, we’ve put together this guide to the best free stock trading apps of 2026 in order to help you make the right decision.

Choosing a free stock trading app can be tricky thanks to the variables involved, with different assets, commission structures, and account types going around.

We’ll deep dive into all of that and show you some of the top options on offer, as well as what exactly to look for when you’re comparing this year’s top trading apps.

Why use a free trading app?

Free stock trading sounds like a no-brainer these days, but it hasn’t been free for that long.

Prior to 2015, just about every stockbroker or trading app charged some sort of fee, whether flat or percentage-based.

Some brokers also had minimum deposit policies in the thousands or even tens of thousands.

Trading and investing just wasn’t open to everyone back then.

Fortunately, things are very different now. Once the first free trading app hit the market, the rest of the industry simply had to take note.

Low or no-cost trading has become the rule rather than the exception, and stocks (along with other asset classes) are now much easier to access.

Picking a free trading app, just like with anything else, will depend on your circumstances, behavior, and risk tolerance.

If you’re just looking to learn how trading works and would like to start off with some $5 trades, for example, a broker that charges $1 per trade would be a bad idea.

So, let’s take a look at some of the best free trading apps that let you trade the way you want to.

14 best free stock trading apps in 2026

1. Fidelity

Fidelity is best known as a traditional stock broker, and has been one of the giants of the field for a long time.

And as a market leader, they’ve kept up with trends and do offer a free trading app of their own.

Plus, signing up with a traditional powerhouse like Fidelity can help you bypass some of the major risks that smaller free trading apps might pose.

Fidelity administers trillions of dollars in assets, so it’s unlikely to run into any problems where stability or safety are concerned.

Stock and ETF transactions are free on the Fidelity app, and the mobile experience is user-friendly - as far as UI goes, it’s slick and super intuitive.

You also don’t have to deal with any account minimums, and there are plenty of zero expense ratio index and mutual funds to choose from.

However, Fidelity does have its drawbacks despite the many plus points.

First among those is that options contract fees can be more expensive than with competing brokers.

This isn’t a problem if you’re just starting your investing journey, so it’s not really a big deal.

If however you just want to make high-risk options trades and have fun with a few YOLOs every so often, there are better platforms out there for you.

Regardless, Fidelity offers a top all-round experience and zero fee operations across the board.

That, along with the security of knowing your assets are in safe hands, makes Fidelity the undisputed number one free stock trading app.

Check out our in-depth Fidelity review

2. Interactive Brokers & IBKR Lite

If you’re looking to trade or invest on a truly global scale, then it’s very hard to beat Interactive Brokers.

On the one hand, they offer access to stocks and ETFs from a variety of foreign markets in addition to a comprehensive selection of US-listed assets.

And on the other, they’ve got their doors open to customers from all over the world - we’re talking customers in 200 countries and territories.

Let’s get real here: if you aren’t a US customer, then it’s highly likely that Interactive Brokers is going to be one of your top choices.

And if you are a US resident, even better, because you can sign up for IBKR Lite.

Rather than downshifting on features, IBKR Lite actually provides several extra benefits, including zero commission trading.

Interactive Brokers is a platform that plenty of pro traders use, and beyond its global selection of assets, you’ve also got access to every asset class imaginable.

Stocks, ETFs, funds, options, futures, forex, and even crypto can all be traded under one IBKR account.

One of the main criticisms levelled against IBKR is the fact that it isn’t beginner friendly.

In fact, that’s a necessary compromise in order to give you as many tools and trading instruments as possible, so take your pick.

Still, IBKR offsets this drawback with how they combine their free trial package with paper trading.

So, if you’re a beginner, you can get used to IBKR in your own time and engage in a little trial and error without having any real funds on the line.

Don’t miss our comprehensive IBKR review

3. SoFi Invest

SoFi is a stock trading app targeting beginner investors, but don’t let that fool you if you’ve got a little experience in the trading game.

SoFi is actually an excellent option for users of every knowledge and experience level, and we’ll tell you why.

It features low commissions across all assets and completely free stock and options trading.

You heard that right - free options trading.

SoFi may well become your top pick if options are your thing given that just about every other platform charges options contract fees.

You can also invest in fractional shares with a minimum of just $5, so it's a great place to start building your long-term portfolio too.

SoFi Invest's only practical down-side is the fact that it charges multiple layers of fees on mutual funds.

There are also a few other fees, such as an inactivity fee, that could cut into your balance if you've not taken a close look at their fee schedule.

If mutual funds are not on your radar, however, SoFi is an incredible option.

Make sure to read our SoFi Invest review for more

4. Vanguard

Vanguard is often mentioned in the same breath as Fidelity, and is known as the pioneer of passive index fund investing.

So, if index and mutual funds are going to be a big part of your strategy, you can’t go wrong with Vanguard given how many they offer for low or no cost.

You also don’t need to worry about account minimums or commissions on stocks, ETFs, or even mutual funds.

Watch out for fees on assets like options, though. These can still have a contract fee while being free of commission, so don’t get caught out there.

What about the flip side, then?

Well, Vanguard’s interface isn’t as smooth as you might want from a stock trading app, and they do lack some of the shiny extra features that competitors offer.

Still, Vanguard is massively capitalized and their safe, steady reputation ought to count for a lot.

The firm's ownership structure also merits a mention here since it isn't owned by shareholders but rather the folks who invest in the Vanguard funds.

This is a great formula for ensuring top-notch customer service, and you can be assured that your user experience isn't going to be compromised in service of shareholder profits.

Take a look at our comprehensive Vanguard review

5. Webull

Webull is one of the newest stock trading platforms on this list, but it’s definitely one of the better ones.

Not just that, Webull is quite capable of competing with the sort of trading platforms that are generally way ahead of neo-brokers.

Very much a mobile-first platform, Webull has built a reputation around offering deposit incentives.

Let’s take nothing away from this strategy, though.

There are some very expensive stocks on the market, and as long as you meet the required initial deposit threshold, Webull gives you a chance to get your portfolio off to a running start.

Fortunately though, Webull doesn’t rely on too much gamification beyond that.

Quite the opposite, in fact. Webull is well ahead of most of its competitors in several areas including charting and technical indicators, which means it also attracts more skilled traders than competing stock apps.

It must be noted that Webull is in fact owned by a Chinese company, but it’s fully regulated in the US and has a solid track record as far as safety and security goes.

For more, check our our full Webull review

6. Ally Invest

Ally Invest takes things a step further from just trading: it offers an all-in-one financial suite that lets you manage your finances efficiently in one place.

Whether it’s your checking account, savings, or stock portfolio, you can manage all of it in one place with the Ally Invest app.

This does mean that it’s a little light on options as a sophisticated trading platform, but if you’re just looking to start building a portfolio it’ll do just fine.

Ally also brings low commissions when it comes to mutual funds, but it doesn’t actually offer no-transaction-fee mutual funds.

Find out all about Ally Invest in our review

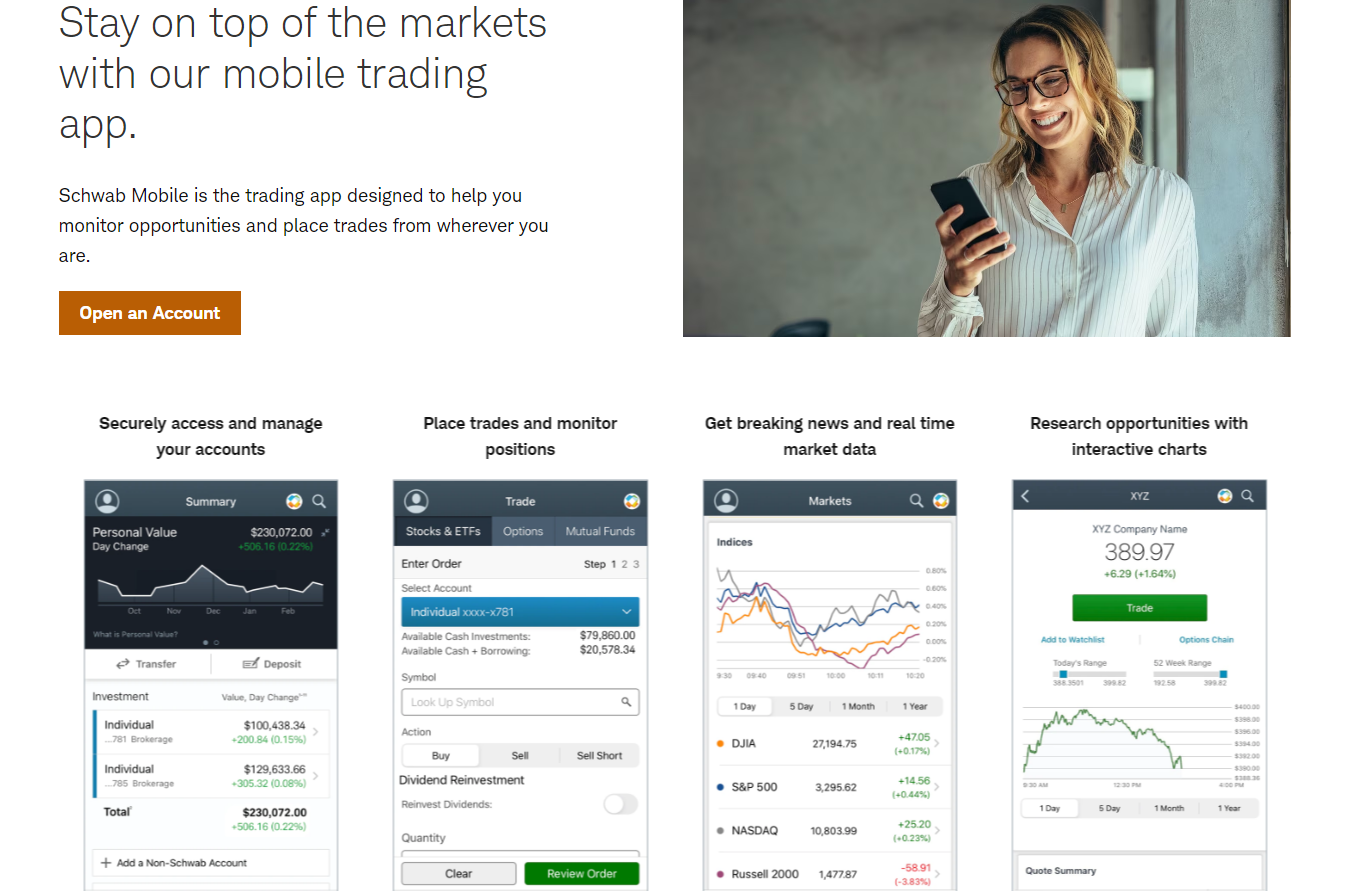

7. Charles Schwab

You might have spotted a bit of a trend, here: Charles Schwab is yet another specialist, “traditional” broker to make this list.

There’s a good reason for that, of course.

Schwab has a vast selection of assets such as stocks and options for you to invest in. They also offer fractional share trading, which is a big benefit for retail investors who don’t always have thousands of dollars to invest every month.

The platform also has several account types based on your profile as a customer, which can really help you get the most out of Schwab’s services.

So, does Schwab have any down-sides?

Well, the mobile app isn’t quite as slick and refined as it could be, but that isn’t the focus of this particular platform.

In fact, it’s easy to forgive a slightly dated app when you’ve got Charles Schwab’s wealth of resources, top customer service, and sterling reputation.

8. Trading 212

Trading 212 is a low-cost stock trading app that’s extremely easy to use, and a great option if you’re not in the US.

Actually, Trading212 isn’t an option at all if you’re stateside, focusing instead on markets like the UK, Australia, and the European Union.

Trading 212 serves over 100 countries and was the first platform to offer zero-commission trading to many of these.

This has made them very popular, ranked number one in trading for the UK and Germany since 2016 and 2017 respectively.

If stocks are your thing, then Trading 212 is a solid choice, with a vast selection of shares as well as ETFs to pick from.

The platform has over 10,000 shares for you to purchase, and you can also get your research done with a selection of charting tools and indicators on the app.

Trading 212 also notably offers CFDs (contracts for difference), a trading instrument that is available in many markets but banned in the US.

Be warned: CFDs are extremely high risk, and can cause you to lose a lot more money than you gamble.

Gamble? Yes, I said it — derivatives can be super risky, but CFDs are straight up gambling. However, if that’s the sort of thing you’re looking for, then this is the platform for you.

Read our full Trading 212 review

9. eToro

Originally known as RetailFX when it was founded back in 2007, eToro has come a long way from its Forex-focused roots.

So much so, in fact, that it is now considered one of the top social investing platforms and is a bit of a household name.

Much of the credit for that paradigm shift goes to its flagship CopyTrader feature, which allows users to follow top traders and copy their exact trading strategies in a single click.

This feature made a lot of sense, especially in the last decade when post-recession gains elevated many professional traders to superstardom - take the much-followed Cathie Wood, for example.

eToro is much more than that, though, and its ease of use and simple UI has kept it relevant in the time since.

However, it’s important to note that using CopyTrader requires a minimum of $200, and there are other cash-based social features in play as well.

One of them is the eToro Club, where traders are organized into tiers based on portfolio (cash plus assets) value, from Silver at $5k all the way to Diamond at $250k+.

These tiers automatically unlock different rewards, such as zero-fee withdrawals, live webinars, and VIP events.

Just like the other entries on this list, eToro offers zero-commission trading of US stocks and ETFs, but there’s 1% charge on crypto trades and a few other fees to look out for depending on your region.

Read our full eToro review for more details

10. Robinhood

Robinhood is one of the biggest names in trading, and while it receives a lot less press these days than it once enjoyed, it’s still a very relevant app.

A pioneer of free stock trading in the US, this app was once on every phone and could be seen on screens in practically every coffee shop.

The simple, effective charts it generates are still super popular, and while not as many people actively trade on it anymore, they certainly still track their stocks using the RH app.

Some would argue that it makes trading too simple and easy, and they could be right.

But how’s that a bad thing?

Well, Robinhood lets you play with instruments like options without jumping through hoops like trading permissions and other restrictions.

The app also features quite a bit of gamification, and these literal bells and whistles can help to make trading fun, especially for novices.

These features encourage trading, even if users don’t necessarily know what they’re doing. All of those pesky trading restrictions other apps have? They’re there for a reason.

Thing is, while Robinhood is technically free to use, more users trading actively means more revenue for them — you can read our full review of Robinhood if you want to know more.

Robinhood also stands out by offering options and crypto trading free of any fees in addition to stocks and ETFs, and that’s not something that many other stock trading apps are willing to match.

However, all Robinhood offering all of these features for free means that users pay a price - evidenced by RH having significantly more regulatory issues in their brief history than the average trading app.

11. Moomoo

Moomoo is a powerful trading app built for traders who want professional-level tools without paying professional-level fees.

This platform stands out for offering commission-free trading on US stocks and ETFs while providing advanced features that are typically reserved for premium platforms.

The app includes real-time market data, Level 2 quotes, advanced charting tools, and comprehensive technical indicators - all completely free.

Moomoo's interface is designed for data-driven traders who want to analyze markets in depth before making their moves.

You'll find heat maps, financial news feeds, and detailed company fundamentals all built into the platform.

The app also offers paper trading, so you can test your strategies without risking real money.

One of Moomoo's biggest strengths is its educational resources and market analysis tools, making it a solid choice for intermediate traders looking to level up their game.

However, the platform does have a bit of a learning curve compared to simpler apps like Robinhood.

If you're willing to invest time in learning the platform, Moomoo rewards you with precision, depth, and professional-grade analytics at zero cost.

12. Public.com

Public.com takes a unique approach to investing by combining commission-free trading with a social community experience.

This platform lets you invest in fractional shares of stocks and ETFs, making expensive companies accessible even if you're working with a small budget.

What sets Public apart is its social media-inspired interface where you can follow other investors, see what they're buying, and discuss investment ideas in a community forum.

Public offers commission-free trading on stocks and ETFs, and also gives you access to US Treasury bonds - a feature that's relatively rare among free trading apps.

The platform is transparent about its revenue model and notably does not accept payment for order flow, instead making money through optional premium features.

Public is ideal for new investors who want to learn from others and feel part of a community while building their portfolio.

The app's interface is clean, intuitive, and makes investing feel more interactive and less intimidating.

However, if you're looking for advanced charting tools or complex trading features, Public might feel limited compared to more technical platforms.

13. E*TRADE

E*TRADE is one of the original online brokers, and after more than 40 years in the business, they've refined their offering into an excellent free trading platform.

Now owned by Morgan Stanley, E*TRADE combines the reliability of a traditional broker with modern commission-free trading on stocks and ETFs.

The platform offers a well-designed mobile app and web interface that strikes a good balance between powerful tools and ease of use.

E*TRADE provides extensive educational resources, market analysis, and research tools - perfect for beginners who want to learn while they trade.

You'll get access to Morgan Stanley research, which is a significant advantage over many competing platforms.

The app also offers fractional shares, options trading (with contract fees), and a wide selection of mutual funds.

E*TRADE's customer service is top-notch, with 24/7 phone support and access to financial consultants if you need guidance.

While the platform may not be as flashy as newer apps, it offers a comprehensive, reliable trading experience backed by one of the biggest names in finance.

If you value stability, extensive resources, and excellent support alongside your free trading, E*TRADE is a strong choice.

14. J.P. Morgan Self-Directed Investing

J.P. Morgan Self-Directed Investing is one of the few platforms that offers commission-free trading on both stocks and mutual funds.

This makes it an excellent choice if mutual funds are going to be a significant part of your investment strategy.

The platform is backed by JPMorgan Chase, one of the largest and most stable financial institutions in the world, so you can trade with confidence knowing your assets are secure.

J.P. Morgan's app features an intuitive interface that's perfect for newer investors, with no minimum balance requirements to get started.

You'll get commission-free trading on stocks, ETFs, and over 4,000 mutual funds, which is a rare combination in the free trading space.

The platform also offers robust research tools, market insights, and educational resources to help you make informed investment decisions.

One of the biggest advantages is the integration with other J.P. Morgan Chase banking services if you're already a customer.

You can manage your investments, checking, savings, and credit cards all in one place.

While J.P. Morgan Self-Directed Investing may not have the advanced charting tools that active traders want, it's an excellent all-around platform for long-term investors who value simplicity, security, and access to mutual funds.

How to choose a free stock trading app

If you’re on the fence about which free stock trading app to try out, here are some of the factors you might want to consider when making your decision:

Free stock and ETF trading

By definition, this is the main thing you’re looking for in a free stock trading app since, without the ability to buy stocks and ETF shares without any extra charge, the broker wouldn’t be free!

That being said, it may still be worth checking out brokers who charge low rather than no fees.

The additional benefits may be worth it, and some free brokers could actually end up being more expensive thanks to how they price mundane things, for example sending paper documents your way.

No, we’re not kidding. Robinhood charges $20 for domestic overnight mail or check delivery. That could be the price of 20 trades on a premium platform.

Minimal fees and commissions

Check your app’s fee schedule, and keep an eye out for what sort of fees brokers charge outside of stock and ETF transactions.

It’s unlikely that every product offered by the broker will be free, so make sure you know what you can do and how much you’re going to pay for each action or trading asset.

Speaking of which, many derivatives (such as options) tend to have a small fee attached to them, so again, make sure you check the broker's commission schedule so you know exactly what you're getting into.

Access to different assets

If you’re on a stock trading app, you’re either looking to invest or trade. And to do either of these, you need access to different investment or trading options.

Whether you’re thinking about stocks and ETFs or derivatives and even cryptocurrencies, make sure that the stock trading app gives you access to everything you may want now or in the future.

So, the bigger the selection of assets or trading instruments, the better the broker.

The best brokers know that their customers want to diversify, which means a big selection of assets on the menu.

Options and margin

This is a big one, because you might either discard these completely or be very interested in them.

Stock trading apps know this, so keep an eye out for what sorts of fees and charges apply to options and margin trading on your chosen app.

If you do indeed want to trade on margin and use high-risk instruments like options, make sure you check on whether the trading app has different levels of trading permission.

Many brokers deny access to things like margin and options unless you're able to prove you have the wealth and the skill to handle them.

And remember to consider the risks: margin trading means borrowing money and then using it to trade, so if your trade goes back you’ll owe your trading app money.

Fractional shares

One of the benefits offered by newer stock trading apps is that, unlike traditional brokers, they give you the option to buy fractional shares.

What does this mean?

Well, stocks can be expensive, going into price ranges upward of four figures. So, to ensure that people can still buy into them, brokers will now sell small fractions of those shares.

It’s like buying just a slice of pizza for a taste rather than being forced to buy the entire pie. Maybe you just want to try a little bit of this and a little bit of that - essentially, a diversified portfolio…

…of pizza. But you get the idea, right?

So, if you only have a small amount of money to invest at a time but want access to very pricey stocks, you’ll need a stock trading app that allows you to buy fractionals.

This way, you can build the portfolio of your dreams brick by brick, and even dollar cost average (DCA) your way into a highly diversified portfolio despite having low starting capital.

Direct Registration System (DRS)

You may not have heard of the Direct Registration System, but it’s the only way to take full ownership of your stocks outside of requesting physical certificates.

Checking if your stock trading app allows you to directly register your shares is a great litmus test of how legit they are.

That way, you know with absolute certainty that they’re actually buying your shares rather than just taking your money and changing a number in their UI.

Not that we’re saying any broker would dream of doing something like that, but Fails-to-Deliver (FTDs) are a thing and Wall Street’s financial plumbing is very, very opaque.

If a broker or trading platform lets you DRS your shares, it's a good bet that they're rock solid in other aspects of operation, too.

Customer service

Aside from a slick, comfortable, bug-free user experience, this might be the most important thing outside of proper, low-cost access to financial options and services.

Good customer service can be fantastic to have when things go wrong - especially given that it's your wealth that's at stake here.

How can a trading app be free?

Different stock trading apps have different revenue models, but the general rule of thumb at play here is very simple:

If the app’s completely free, then you’re the product.

This is mostly true when it comes to stock trading apps thanks to a practice called Payment For Order Flow that is still legal in the U.S.

And… given the number of billion-dollar companies making money off it, it’s probably not going anywhere despite being banned in most other major markets.

So, what does PFOF do, in a nutshell?

Well, it lets free stock trading apps get compensation for directing your stock and option orders to third parties for execution.

Basically, market makers like Virtu Financial and Citadel Securities are the real customers of the free stock trading apps, and, as we pointed out, you and other users are the product.

Proponents of this practice (generally the brokers themselves and market makers who benefit from this) argue that it results in faster trade execution and better prices, but this isn’t always the case.

It’s also viewed by many commentators as a blatant conflict of interest.

Almost every free stock trading app accepts PFOF, with the notable exceptions of Fidelity, Merrill Edge, and Public.com.

For a full list, you can look up the U.S. Securities and Exchange Commission’s Rule 606 reports since brokers are mandated to disclose their participation in PFOF.

Let Whop help you pick the right trading app

Choosing a free stock trading app comes down to what you’re really looking for.

If you just want to buy a few dollars’ worth of stocks or ETF shares on a regular basis then a simpler, more convenient app might be for you.

But if you’re looking to trade options? Then you need to have a hard look at contract fees and the research tools apps are offering.

Neo-brokers pioneered the concept of free stock trading, but all of that gamification is geared toward making you trade as frequently as possible.

This ensures that they have more orders to sell to market makers for execution via PFOF.

That’s why our top recommendations include more traditional brokers who can offer free trading without resorting to these practices.

Whatever you’re after when it comes to finance and whichever app you like the look of, remember to check out Whop's trading communities.

You can compare stock trading apps with other investors or traders and see what others just like you say about the different options on offer.

FAQs

Can I really trade stocks for free with no hidden costs?

Yes, most modern stock trading apps offer commission-free trading on stocks and ETFs. However, "free" doesn't always mean zero costs. Watch out for other fees like options contract fees (typically $0.50-$0.65 per contract), margin interest rates, transfer fees, or account inactivity fees. Some brokers also profit from Payment For Order Flow (PFOF), which can result in slightly worse execution prices. Always review the fee schedule carefully before signing up, and remember that truly free stock and ETF trading is now the industry standard.

Do I need a lot of money to start using a free stock trading app?

No, you don't need much money at all. Most free stock trading apps have eliminated account minimums, meaning you can start with as little as $1-$5. Many platforms now offer fractional shares, allowing you to buy portions of expensive stocks like Amazon or Google with just a few dollars. This makes it easy to start building a diversified portfolio even if you're investing small amounts regularly. However, some advanced features like margin trading or certain account types may require minimum balances, typically ranging from $2,000 to $25,000 depending on the platform and feature.

Are free stock trading apps safe and regulated?

Yes, reputable free stock trading apps in the US are regulated by the Securities and Exchange Commission (SEC) and are members of the Financial Industry Regulatory Authority (FINRA). Your investments are also protected by the Securities Investor Protection Corporation (SIPC), which insures accounts up to $500,000 (including $250,000 in cash) if the broker fails. However, SIPC doesn't protect against market losses or poor investment decisions. Always verify that your chosen app is properly regulated and check their security measures like two-factor authentication, encryption, and insurance coverage before depositing funds.

What's the difference between a stock trading app and a traditional broker?

The main differences are accessibility and user experience. Stock trading apps are designed for mobile-first investing with simplified interfaces, making them ideal for beginners and casual investors. They typically offer commission-free trading and lower (or no) account minimums. Traditional brokers often provide more comprehensive research tools, advanced trading platforms, dedicated financial advisors, and a wider range of investment products like bonds and mutual funds. Many traditional brokers now offer their own mobile apps that combine the best of both worlds. Your choice depends on your experience level, investment goals, and whether you value convenience or comprehensive features.