The best international payment options are cards, digital wallets, bank transfers, real-time networks, local methods, and global solutions like Whop. Here’s how to choose the right mix for 2026.

Key takeaways

- Local payment methods like iDEAL and Bancontact deliver the highest conversion rates in their home markets.

- A minimum viable payment stack combines cards, one-two digital wallets, and key local methods for your target regions.

- All-in-one platforms eliminate the complexity of managing currencies, fraud, compliance, and multiple integrations yourself.

It goes without saying that businesses today need to be able to accept international payments alongside domestic. That’s what lets platforms sell subscriptions globally and marketplaces onboard buyers from day one, without adding checkout friction.

Credit and debit cards, digital wallets, bank transfers local payment methods, and all-in-one global payment platforms are the best ways to get paid internationally.

But it isn't one-size-fits-all; each option has different fees, conversion rates, and levels of global coverage. The methods you'll need depend on where your customers live and how they prefer to pay.

I'll break down how each method works, where to use it, and how to create a payments stack that gives you the highest conversion at the lowest cost.

Why it's crucial to offer both international and domestic payments

Domestic payments are straightforward. The buyer and seller are in the same country, using the same currency, and the money moves through a single banking system. Settlement is fast, fees stay predictable, and there's not much that can go wrong.

That simplicity is great, but it doesn't help your business scale into new markets or unlock global demand. For that, you need cross-border payments.

International payments can introduce extra layers of complexity, though. Customers may be paying from another country, in another currency, or through a different payment network altogether.

That means foreign exchange, additional fees, stricter fraud checks, and banking systems that don’t always communicate cleanly. This is why a lot of the older international transfer services feel expensive and slow these days (check out our Western Union review for a breakdown).

And from the customer’s side, tolerance is low. If the payment methods they expect aren’t available (or don’t look familiar or trustworthy) they drop off instantly.

That’s why accepting international payments takes more planning than domestic ones. It’s not harder; it just requires the right setup, with the right methods, in the right markets.

International payment methods for your online store

Selling internationally is about more than showing prices in another currency and accepting foreign transactions in any way possible. It's about meeting your customers where they are, with payment methods they want, recognize, and trust.

Checkouts that feel unfamiliar introduce hesitation. "Is this a scam? What if I can't get a refund? Where are they storing my details?" These are the kinds of questions you don't want your buyer having – purchasing should require little thought.

Different regions prefer different ways to pay; so while relying on a single option can work domestically, selling across borders is another story.

Most businesses build a payments stack that suits their buyer needs, growth goals, and customer journey. The goal isn't to offer everything, but offer the right mix.

Here are the top ways to get paid online, no matter where your customers are:

Credit and debit cards (Visa, Mastercard, Amex)

Credit and debit cards are still the default way people pay online, even as alternative methods grow.

If you’re selling internationally, cards give you near-instant access to global customers because almost everyone has one, and almost every checkout supports them.

They’re simple, familiar, and fast. They're trustworthy and secure. But they also come with higher fees and a higher chance of chargebacks, especially when you start selling outside your home market.

The tradeoff: Broad reach in exchange for higher operating costs.

Digital wallets (Apple Pay, Google Pay, Venmo)

Digital wallets are fast becoming the default payment option because they remove friction. Who wants to type out card numbers? Personally, I want to tap, verify, and be done. The built-in fraud protection with digital wallets give buyers a lot of peace of mind.

Wallets convert, especially in markets where phones are the primary shopping device. Nothing stops a purchase like having to go find your physical card details (I've abandoned plenty of carts at this point).

The tradeoff: Not every wallet dominates everywhere. Apple Pay and Venmo rule the US and Europe. Alipay and WeChat Pay run China. You need to offer the right mix depending on who you're selling to.

Bank transfers and real-time payments (SEPA, ACH, PIX, Faster Payments)

Bank transfers used to be slow and annoying. Back in my day (yes, I'm that old) I would need to visit the bank in-person to send a transfer. Not anymore.

Real-time payment networks like PIX in Brazil or Faster Payments in the UK have made bank transfers simple. These methods are cheap (sometimes free), secure, and increasingly instantaneous. They’re perfect for high-value transactions and markets where trust in cards is low.

The tradeoff: Bank transfers don’t fit every business, because customers typically need to leave checkout to approve the payment (again, if it takes an extra step will you actually checkout?), and adoption varies by country.

Local payment methods (iDEAL, PayPal, Bancontact, Boleto, GrabPay)

If you want the highest conversion in international markets, you need local payment methods.

"When we route a payment through a local entity, everything improves — approval rates, fees, even chargeback outcomes. It just looks ‘right’ to the customer’s bank." - Derek Wilmer, Whop

Customers in the Netherlands don’t want cards; they want iDEAL. Germans love PayPal. Brazilians love Boleto. Southeast Asia is all about GrabPay and GCash. Local payment methods have high conversion rates in their home markets, and often lower fees than cards.

The tradeoff: You have to choose to support the right local methods for your customers, which can be tricky without an all-in-one solution (like Whop). Integrations can also be complex unless you're using a global platform to manage your payment methods.

All-in-one global payment platforms (Stripe, Adyen, Shopify Payments, Whop)

These platforms exist because managing international payments yourself is a nightmare. One API or one dashboard gives you cards, wallets, local methods, fraud protection, FX handling, and compliance.

Plus, according to recent findings from Airwallex? 72% of small businesses agree these all-in-one solutions are the best system to support their payments.

Through thousands of conversations, we’ve learned our customers really only care about two things: getting paid and paying out. Our mission is to be the best in the world at solving those problems.

— Hunter Dickinson, Head of Partnerships at Whop

If you want to scale globally, this is usually where you start. Some of the top choices include:

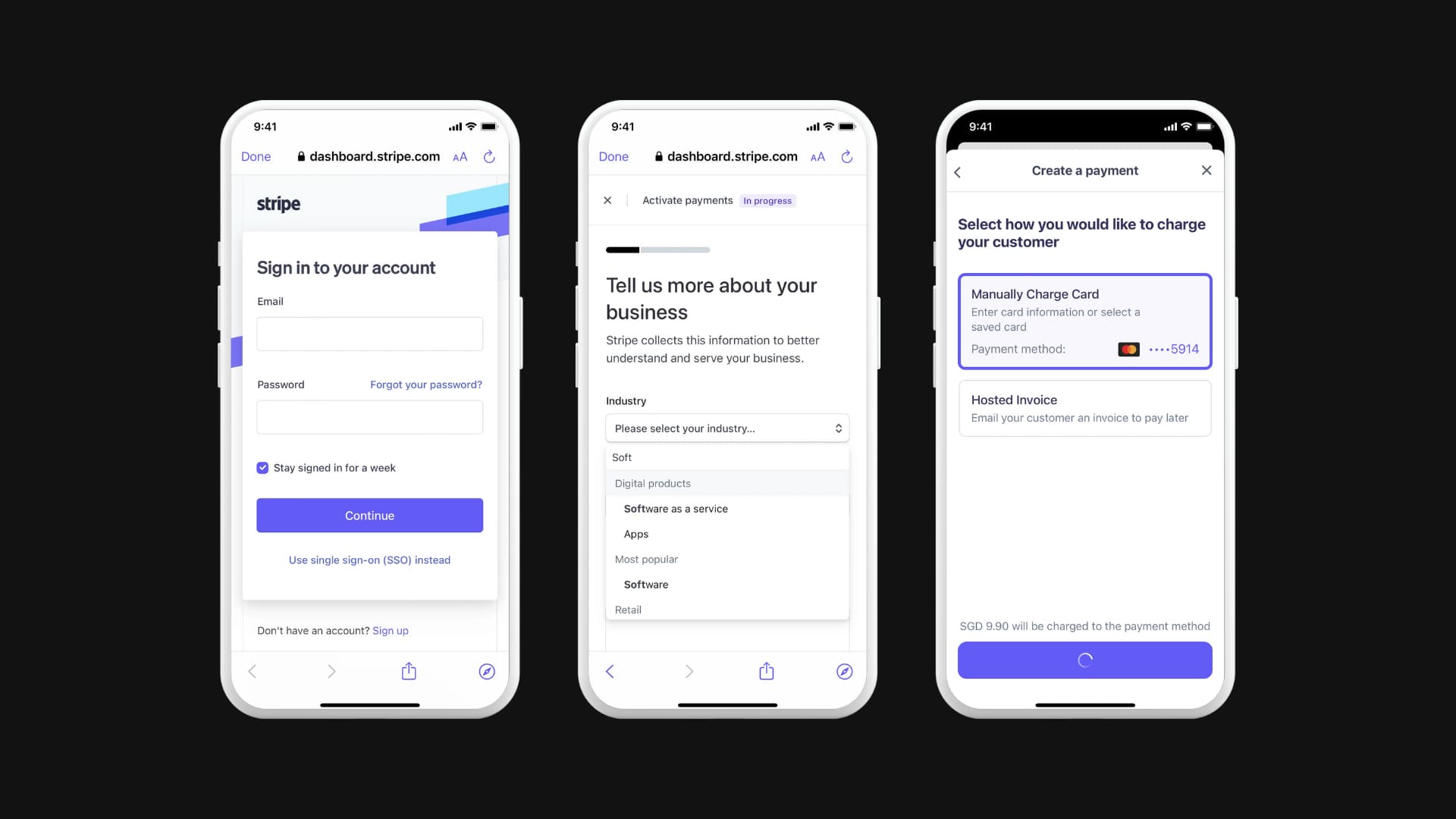

Stripe

Stripe is one of the most widely used payment processors globally. It allows businesses to accept payments in 135+ currencies, supports a wide range of local payment methods, and offers other products alongside, like Stripe Tax and Stripe Radar (fraud protection).

The trade-off? It can get expensive at scale, and managing multiple payment methods, fraud settings, and cross-border fees requires active configuration.

TL;DR: Great for global currency support, local methods, and strong fraud tools. Developer-friendly and widely supported.

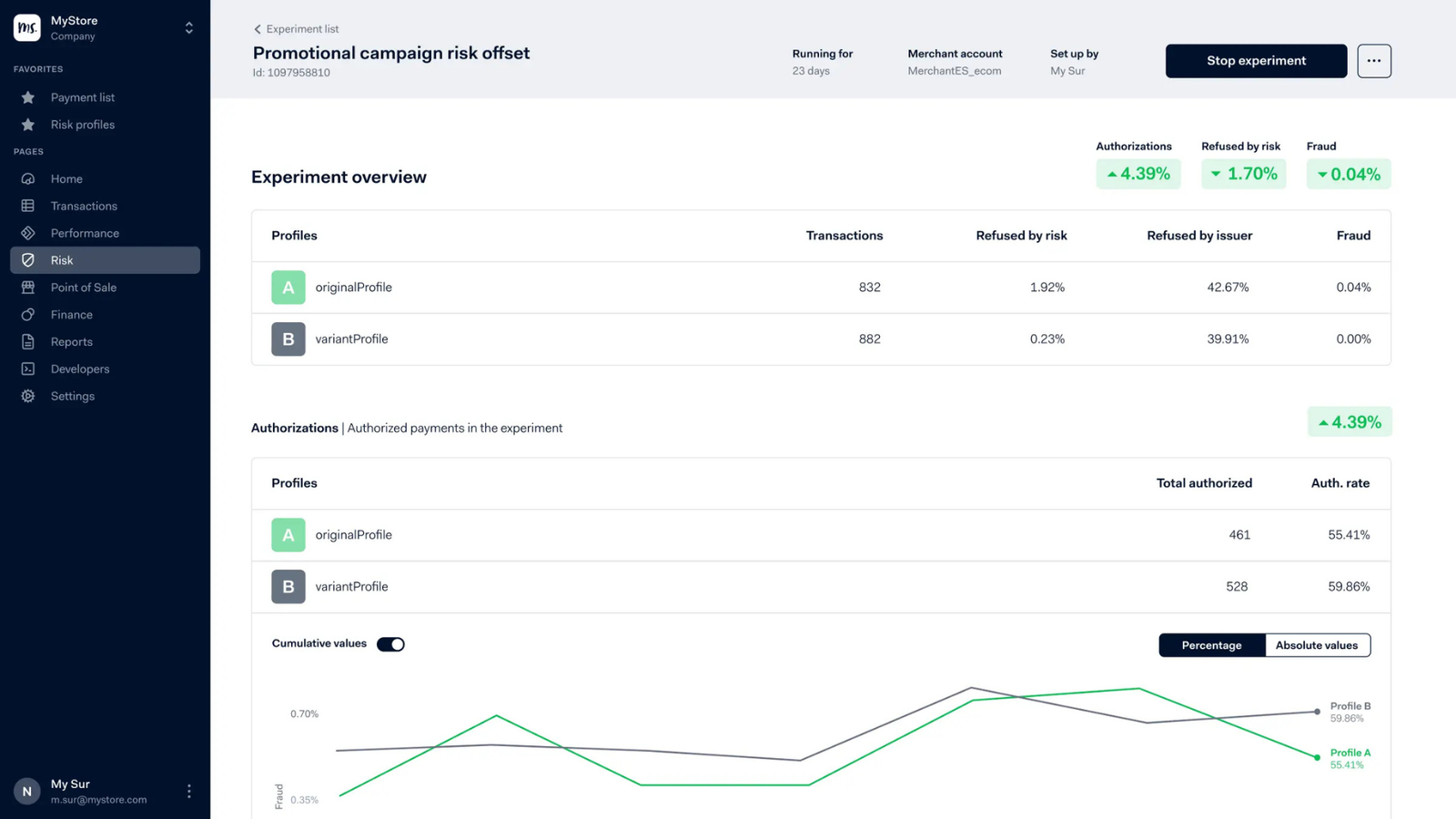

Adyen

Adyen is mainly aimed toward enterprise-level merchants. It offers direct acquiring in dozens of markets, unified commerce (online, in-store, and mobile in one backend), advanced routing, and highly sophisticated risk and fraud tools.

It’s powerful, deeply configurable, and capable of handling serious volume, but it’s not plug-and-play.

Integration can be complex, pricing is custom, and it’s typically better suited to established enterprises than early-stage or SMB sellers.

TL;DR: Built for enterprises. Huge global coverage, deep risk tools, unified commerce. Powerful, but complex.

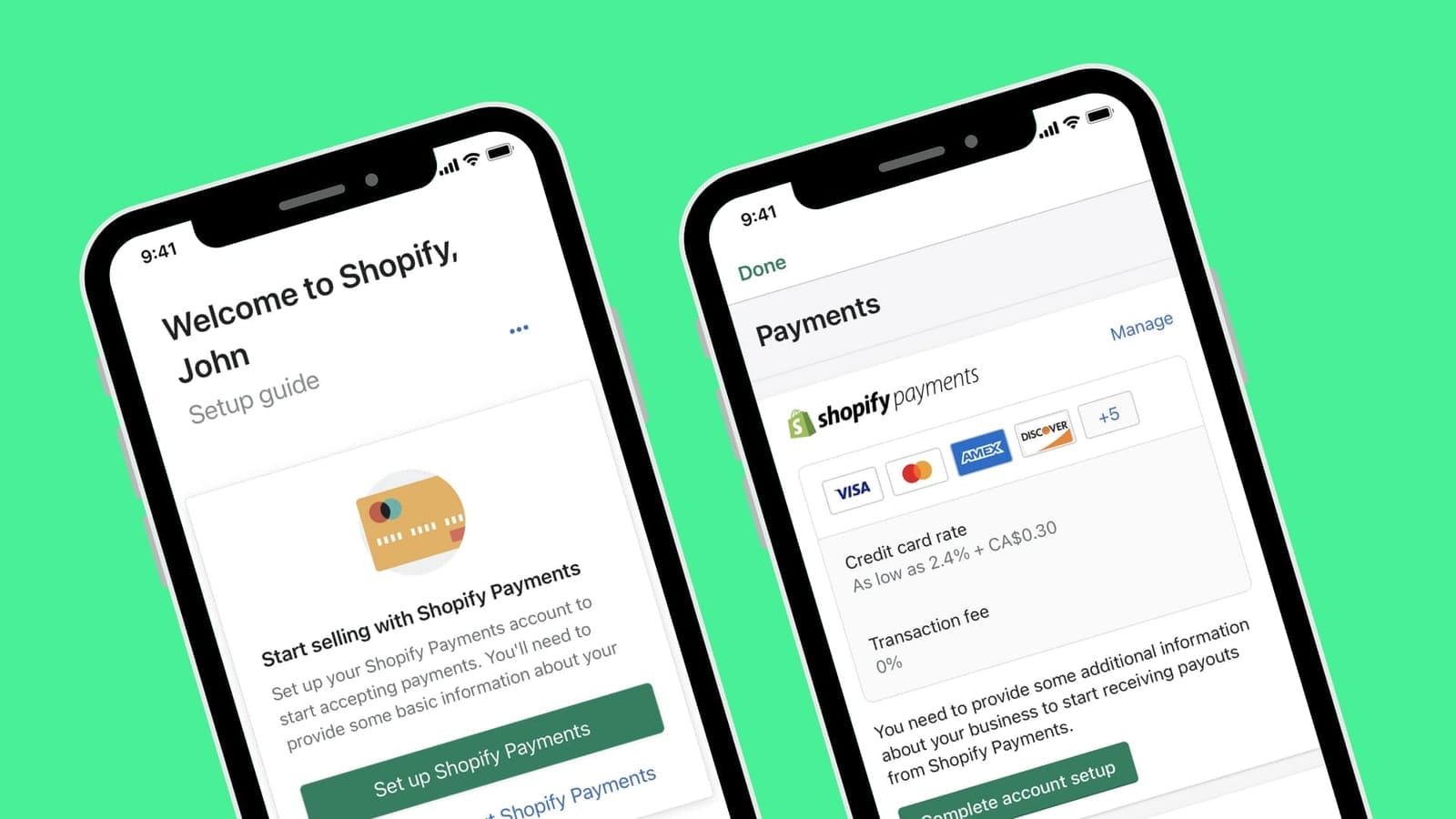

Shopify Payments

Shopify Payments is Shopify’s built-in processor, designed to work seamlessly inside its ecosystem. If you’re running a Shopify store, it removes the need for third-party gateways and simplifies payouts, reporting, and checkout.

Multiple currencies, subscription add-ons, and a range of wallets and local methods are available, depending on region.

The limitation is that it’s tightly tied to Shopify: if you’re selling outside that environment (memberships, communities, off-platform services, digital access products), you’ll need additional infrastructure.

TL;DR: Seamless if you’re on Shopify. Limited outside the Shopify ecosystem, but solid inside it.

Whop

Whop Payments is the platform layer that handles international payments for you.

Instead of stitching together Stripe, PayPal, subscription software, access control tools, and fraud systems yourself, Whop bundles everything into one stack.

Get global payment acceptance, multi-currency checkout, recurring billing, customer management, fraud protection, and automated access control in one system.

Accept payments in 100+ currencies (including crypto), create checkout links, embed a Whop checkout into your existing site, or use our store builder and marketplace.

We’ve obsessed over designing easy-to-use APIs that allow your team to build what you need, all on one platform.

TL;DR: Low fees, seamless onboarding, smart routing, and stackable infrastructure.

How to choose the right international payment methods for your business

Choosing the right mix isn’t about picking the 'best' payment method overall, it’s about picking the best method for the people buying from you.

Here’s the simplest way to get it right without overthinking it:

Start with where your customers live

Every country has a preferred way to pay. If you ignore that, your conversion rate tanks - even if your product is great.

Here's a simple table with popular regions and their preferred payment methods:

| Country / region | Commonly preferred payment methods |

|---|---|

| Netherlands | iDEAL |

| Brazil | PIX, Boleto |

| Germany | PayPal |

| China | Alipay, WeChat Pay |

| US / UK / Australia | Credit & debit cards, digital wallets |

Layer in the methods that boost conversion

Cards are a must, but they’re not enough. When creating your payment stack, layering methods can feel confusing. But a basic guide is to include 1-2 major digital wallets, the top local payment method in your target region(s), and a platform that can tie it all together.

This makes your minimum viable global stack.

Compare total cost, not just the transaction fee

All payment methods come with fees, but cross-border payments come with hidden costs like FX markup, cross-border fees, chargebacks, and wallet or local surcharges.

Sometimes a method with higher fees converts way better, which means it’s cheaper overall.

Check settlement speed (it matters more than you think)

International payments can take anywhere from seconds (PIX) to days (some bank transfers) to a week (certain card settlements).

Think about it: the longer money sits in transit, the longer it takes to reinvest, pay operating costs, or scale what’s already working.

PYMNTS found that 61% of small-to-medium sized business have turned their back on banks and moved to fintech platforms in order to access instant payments. 88% are willing to pay to access instant clearing.

Truth is, most businesses rely on fast reinvestment, so prioritize methods that pay out quickly.

Use a platform that makes global payments easier

If you try to manage every payment method manually, you’ll drown in integrations and compliance headaches. Most stores use:

- Stripe for maximum global coverage

- Adyen for enterprise-level international volume

- Whop if you want to sell globally and let the platform handle payments, access control, fraud, and recurring revenue for you (though you can use Whop just for payments too)

Yes, you can duct tape together 10 tools… or use one platform that has packaged it all up for you.

Don’t aim for everything. Aim for the methods that actually matter.

When businesses first start selling internationally, the instinct is to add every payment option possible. More buttons must mean more conversions, right? Wrong.

You don’t need 15 payment options. Ironically, your customers could actually be put off buying when they're faced with an overly crowded checkout. Instead, only use the methods your customers trust.

If you support cards and wallets and the right local method, you’re already ahead of 90% of online stores trying to sell globally.

Accept more international payments and pay less fees with Whop

Accepting international payments isn’t hard, but it can get messy when you’re managing currencies, local methods, FX fees, fraud rules, and banking networks that don’t always cooperate.

When you use Whop, you don’t need to integrate Stripe, PayPal, Apple Pay, or any local method manually.

Forget about configuring FX settings, or worrying about whether customers in Brazil or Germany can actually pay you.

Turn on Whop Payments, and instantly accept customers from around the world with multi-currency checkout, recurring billing, access control, fraud protection, cross-border orchestration all handled behind the scenes.

Want the simplest way to sell globally? Sick of thinking about payment rails? Power your payments with Whop.

International payment FAQs

What is the most popular international payment method?

Cards are still the default globally, but digital wallets now outperform them in many markets. In some countries, local methods dominate, like iDEAL in the Netherlands or PayPal in Germany.

Which payment method gives the best conversion rate?

Local payment methods almost always win. If customers can pay the way they’re used to, conversion rates jump immediately.

Are international payments safe?

Yes, as long as you use trusted providers with fraud protection. Wallets (Apple Pay, PayPal) and major solutions (Stripe, Adyen, Whop) all include strong security features by default.

How fast do international payments settle?

It depends on the method:

- Real-time networks: seconds

- Wallets: usually instant

- Cards: 1–3 days

- Bank transfers: 2–5 days

Settlement speed directly affects your cash flow, so pick methods that match your growth pace.

Do I need to offer every payment method?

No. You only need:

- Cards

- One or two major wallets

- The main local method for any region you serve

Can Whop handle international payments for me?

Yes. Whop handles global payments, FX, recurring billing, fraud tools, and customer access in one place. You don’t need to set up or manage individual gateways yourself.