SoFi is one of the most recognizable brand names in the US, and SoFi Invest is the brand's investment product. Read all about it in this review.

Key takeaways

- SoFi Invest offers truly commission-free stock, ETF, and options trading with no contract fees, making it cost-effective for active traders.

- Fractional shares starting at $5 enable dollar-cost averaging and portfolio building even with minimal capital investment.

- The robo advisor charges just 0.25% annually and provides BlackRock-managed portfolios with automated rebalancing for hands-off investors.

“Social” is a word that has collided with just about every sphere of endeavor, and finance is no different. SoFi is one of the most recognizable brand names in the US today when it comes to banking and loans, and its zero commission, low fee trading platform has been making bigger and bigger waves in recent years.

In this review of SoFi’s investment arm, SoFi Invest, we’re going to look at the platform as a whole and examine what benefits it gives you if you’re a trader or investor.

We’re also going to dig deep into those low fees as advertised, and show you how best to use the app and what pitfalls, if any, you’ll need to look out for if you do decide to sign up with SoFi Invest.

What is SoFi?

SoFi, previously known as Social Finance, Inc. and now as SoFi Technologies, Inc., is an online personal finance company and fintech that operates as a direct bank and brokerage while also supporting other financial institutions via its technology platform.

It’s home to over 10 million customers, referred to as members, and delivers services through the three main platforms of banking, investments, and student loans.

Why investors choose SoFi

SoFi was founded in 2011 by Stanford Graduate School of Business students Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady. Like many start-ups, it focused on problems close to its founders’ hearts—and in this case, the initial aim of the company was to provide more affordable options for students needing to take on debt to fund their education.

To kick things off, SoFi ran a pilot program at Stanford where 40 alumni loaned a total of $2 million to around 100 students. The success of this pilot program led to over $77 million dollars in funding in 2012, and then the acquisition of credit lines with major banks in order to help provide student loans.

The company has since gone from strength to strength, starting up personal loans in 2015, and despite the resignation of CEO Mike Cagney in 2017 have become one of the biggest names in personal finance. Part of this came by inking sponsorship deals with the Los Angeles Rams and Los Angeles Chargers as well as acquiring naming rights to the SoFi Stadium in Inglewood in a record deal.

SoFi were also backed by celebrity investor Chamath Palihapitiya when they decided to go public via a SPAC, raising $2.4 billion dollars at a $9 billion valuation in 2021. They also made several strategic acquisitions, including the Galileo payments platform, investment app 8 Securities, and Golden Pacific Bank in order to obtain the OCC bank charter and the ability to hold loans for investment.

In the years since, SoFi has been widely recognized as one of the top platforms for student and personal loans, lauded for competitive rates and high loan amounts, as well as lending in many cases on the same day as approval of loan applications. In fact, a 2023 report estimated that SoFi had 60% of the US student loan refinancing market.

SoFi Invest, the focus of this review, was introduced as Sofi Wealth in 2018, taking the form of a low cost, commission-free brokerage focusing on stock and ETF trading that you can use actively as well as via their Robo Investing option.

How to use SoFi Invest

What you need to get started

As with every brokerage platform both online and off, SoFi’s first requirement is that you be at least 18 years old in order to sign up. SoFi is also only for US residents, which includes US citizens as well as permanent residents with a supported US visa.

Your physical US address will need to be within the 50 states including the District of Columbia and military addresses, and be recognizable in the US Postal Service database. SoFi doesn’t serve customers outside of the US, including US citizens living abroad, due to regulatory reasons. As a US citizen, all you need to have ready to open your account is your Social Security number or ITIN, and proof of address.

It’s worth noting that non-permanent US residents can also open a SoFi Invest account, although beyond the initial verification you’ll need to keep verifying your visa status every 6 months to continue using SoFi. As a non-permanent resident, you need to furnish one of the following visa documents in order to get started:

- E-1

- E-2

- E-3

- F-1

- G-4

- H-1B

- L-1

- O-1

- TN-1

Creating your SoFi Invest account

Creating an account with SoFi is extremely easy. All you need to do is enter your name, the US state where you live, enter an email address, and choose a password to use.

The next step is to provide all of the verification information we detailed in the previous section, and you should be good to go.

To get your SoFi Invest account off the ground, you’ll also have to make an initial deposit in order to start investing. There are several ways of doing this, including by linking your SoFi Money account if you’re an existing SoFi customer. You can also link your personal checking or savings account, initiate an ACAT account transfer, rollover, check, or wire.

Making this initial funding to your account also gives you a chance of picking up SoFi’s advertised initial bonus. Putting in a deposit of at least $50 within 30 days of opening the account will qualify, although according to SoFi themselves the probability of receiving $1000 is just 0.028%.

Buying stocks and ETFs on SoFi

SoFi’s standard self-directed investing platform is called SoFi Active Invest, and it offers you the opportunity to manage your own portfolio without paying any sort of fees or commissions. As with any zero commission platform, exchange fees do apply—but SoFi deals in US stocks, and exchange and SEC fees aren’t going to impact your trades much at all.

The name of this account says it all, and it’s an excellent option for anyone looking to build a portfolio given the absence of any fees. Furthermore, getting a SoFi Invest account means that you automatically become a SoFi member, making you eligible for a variety of benefits including product discounts and various community events.

As a SoFi member, you can also dip your toes into commodities, private credit, real estate, and a selection of other alternative investments alongside the ability to accumulate individual stocks and ETFs. The SoFi selection may not be as wide as competing platforms because it only offers US assets, but the platform’s a solid choice if you’re good with that.

SoFi also offers fractional share trading with a minimum of $5, which opens up a wide variety of portfolio-building strategies even if you’re just getting started or want to accumulate small quantities at a high frequency—in other words, dollar cost averaging.

It’s worth noting that you need to be careful when carrying out a lot of fractional share trades in a short window of time, because there’s a chance that you may be classified as a “pattern day trader”. This is a designation that’ll require you to maintain a minimum account balance of $25,000. However, it shouldn't be a problem if you’re just making purchases of shares at a high frequency, because there need to be sales as well to be identified as day trades.

You absolutely can sell your fractionals, too, and it works exactly the same as buying them in that you can simply hit the relevant buy or sell button and then enter the amount. Unlike the $5 purchase minimum, sales have no amount minimum but need to be at 5 decimal places or bigger in terms of denomination.

Robo investing with SoFi

If you’d rather take a more hands-off or strategic approach to investing by working out your goals and approach and automate the implementation of it, then SoFi’s robo advisor is worth checking out.

This sort of option is becoming more and more common nowadays because it requires a lot of time and effort to work out a detailed investing plan, and then even more to actually put it into action. The robo advisor works by first of all asking you to provide a certain amount of information with regard to your investment goals and risk tolerances, then providing you with pre-curated ETFs and portfolios to invest in.

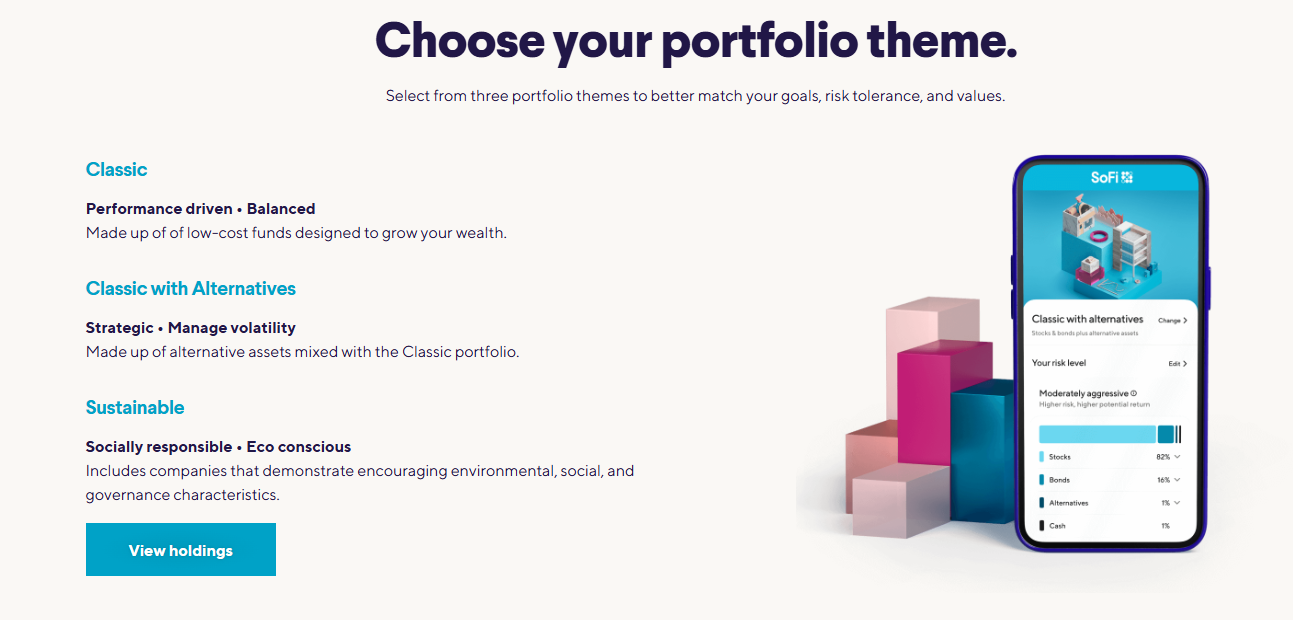

All you’ll need is to choose your contribution amount (minimum $50), whether it’s a lump sum or regular deposit, then it’s just a matter of picking through the portfolio themes you’ll be presented with. There are three themes of portfolio to pick from—sustainability is one of them, so it’s possible to use the robo advisor even if you want to take a more eco-friendly or green approach with your portfolio.

The other two main portfolio themes boil down to whether or not you want to include alternative investments such as real estate-backed funds. Whichever portfolio theme you pick, your choices with regard to time horizon and risk will dictate which specific assets the robo advisor picks out for you.

SoFi does charge a 0.25% annual advisory fee since a lot of work is put into curating these options, and automating your investments this way including rebalancing of portfolios is worth the small charge given the amount of time you’d have to spend if you tried to do so manually.

In fact, the robo advisor portfolios are managed by SoFi’s own investment committee in partnership with experts from BlackRock, one of the world’s premier investment firms.

Trading options on SoFi

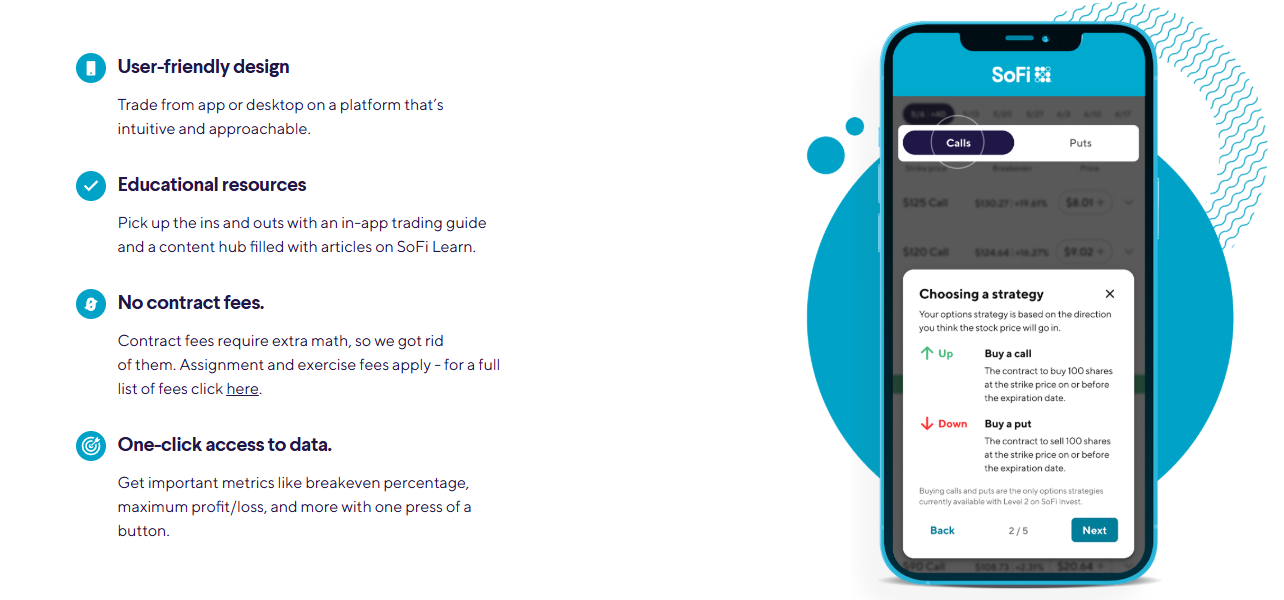

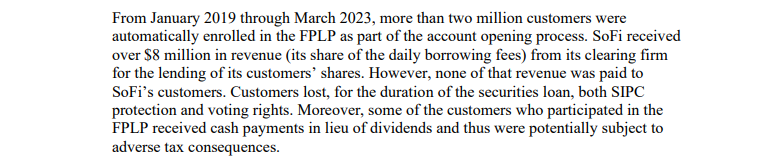

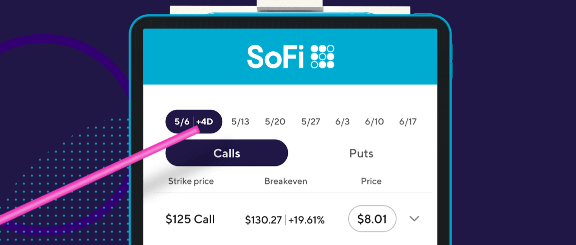

SoFi is a compelling platform when it comes to options, and a big reason why might jump out at you from among the points listed above—no contract fees. Most trading platforms charge these, so by allowing you to avoid them SoFi is definitely able to stick its nose out in front of the pack.

It also makes options, an extremely complicated derivative asset class, simple to trade. There are also educational resources on hand to provide you with basic explanations as to what you’re looking at in your SoFi interface. More importantly, information like break-evens and maximum P/L are also available, just a click away from the options trading screen.

Importantly, SoFi conducts an approval process to evaluate every user and see whether they should be granted options trading permission. You can view and apply to change your status from within your individual active investing account settings, and SoFi keeps it simple by only offering level 2 options execution which includes the basics such as calls and puts.

How much does SoFi cost?

One of SoFi Invest’s biggest draws is the absence of commissions, and while that’s true to perhaps an even greater extent than the majority of zero commission brokerage platforms, there are a few fees to watch out for.

The first one you’re likely to encounter is the 0.25% advisory fee that applies to any automated investing options or use of the robo advisor. An advisory fee is understandable given the services you’re availing yourself of, and could be a whole lot higher if, for example, you were to get your money managed in a similar way by a bank.

Then there’s the margin rate. Not everyone trades on margin, and you won’t even need to know what this is if you’re just interested in buying and selling a few shares or slowly building a portfolio. However, leverage traders, short sellers, and sometimes option traders all need to use margin, and SoFi’s margin interest rate for debit balances in margin accounts is 11%, calculated on the daily debit balance and charged monthly.

Mutual funds on SoFi have some fees you need to look out for, and can differ from fund to fund. Make sure you read each fund’s tearsheet before investing, and look out for any Front-End Load fees (fee when you buy the fund), Back-End Load fees (fees when you sell or redeem your fund shares), and annual expenses or the fund’s expense ratio (essentially, fund management and other administration fees).

SoFi also charges a $30 fee for returned checks, ACH, or Wire & Recall, and a $25 fee for outgoing wire transfers. Again, these shouldn’t affect you too much, but it’s good to know that they’re in play.

What could (and does) affect the majority of investors is SoFi’s inactivity fee, which was instituted in 2024. If you don’t log into a SoFi Invest account for 6 months, you’ll incur a $25 fee—so this one could be tricky, especially if you have multiple SoFi Invest accounts. It’s also one to plan ahead for in case of an accident, bereavement, or other circumstances.

SoFi’s $50 fee for participation in voluntary corporate action is also worth remembering. These aren’t that frequent, but such a hefty tax being levied on them doesn’t sit well given how much they could affect an investment—things like tenders are a big deal for a company, as are optional dividends and rights offers, and a $50 fee to have your voice heard can be a tough pill to swallow.

Along the same lines, SoFi charges $100 for Outgoing ACATs, or transfers of your assets such as stocks to another broker. This is very much on the higher end, with SoFi employing a similar strategy to neo-brokers like Robinhood and Webull in making it expensive to transfer out.

Oh, and you’ll also want to make sure that the email address you provide to SoFi is in good working order, with some free storage space. If email confirmations or statements get returned, they’ll send you paper versions instead and charge you $2 and $5 per document, respectively.

Is SoFi safe?

As a fully regulated personal finance company and fintech, SoFi is considered safe and offers federal insurance via the FDIC covering $250,000 per person on bank accounts. However, investments are neither FDIC insured nor bank guaranteed, and the company has had its share of regulatory and safety issues as well as some controversy at the top.

Shortly before the launch of SoFi’s Invest brokerage platform in 2018, company CEO Mike Cagney announced his retirement due to allegations of sexual harassment and skirting risk and compliance controls. The former Wells Fargo trader departed but immediately went on to found Figure Technologies, which reached a valuation of over $1 billion in 2019.

Following Cagney’s departure, SoFi settled Federal Trade Commission (FTC) charges alleging that SoFi had been making false claims about student loan refinancing dating back to 2016. As a part of this settlement, SoFi was prohibited from misrepresenting to consumers how much they will save or have saved using its products.

Then in 2023, SoFi got into hot water with FINRA for its securities lending system. Between January 2019 and March 2023, customers opening a new SoFi Invest account were required to consent to a Master Securities Lending Agreement drafted by its clearing firm, Apex Clearing Corp.

Thanks to this agreement, said clearing firm could borrow SoFi customers’ fully paid or excess margin securities, and lend them out to a third party in exchange for a daily borrowing fee.

Here’s the kicker. Anyone who lends their shares out loses (for the duration of the loan) SIPC protection as well as voting rights for their shares, handing said rights over to the borrower, who is a short seller profiting from dips in price and therefore would almost certainly vote against the company’s interests.

In layman’s terms, let’s say for example that you spend money and buy an Apple share. Apex has an agreement with SoFi to grab your share and lend it to a third party, who in turn votes against Apple using your voting ID, and makes money when Apple drops in price. Apex gets a borrowing fee, and passes part of it to SoFi, who keeps the rest. So, not only did you lose your vote at the Apple AGM, but all the three other parties make money when your investment loses value.

This systemic failure in corporate governance aside, any dividends paid by the company during the period of the share loan are also supposed to be paid to the original owner by the borrower.

These payments are taxed as regular income, possibly at a higher rate than qualified dividends, if indeed the borrower stumps the cash up at all.

In all, 2 million SoFi customers had to agree to this practice and were enrolled in the program, which earned SoFi a total of $8 million in daily borrowing fees from its clearing firm—and it handed over none of this revenue to its customers, who (often unknowingly) lost their SIPC protections and voting rights, and may also have been subject to adverse tax consequences.

SoFi paid just $500,000 to settle these FINRA charges without admitting fault (far less than ten percent of their $8 million gain), and during the settlement proceedings compiled a list of over 3000 customers to whom less than $200,000 in total restitution was proposed. According to SoFi, customers enrolled in this program started receiving a portion of the generated fees in March 2023.

More recently in 2024, SoFi was targeted in a breach of sorts—people were able to use stolen identities or fake identification to open 800 accounts, which were then used to transfer $8.6 million in funds from other customers’ accounts. SoFi was found to have failed to set up proper safeguards to prevent instances like this, and fined $1.1 million.

Is SoFi worth it?

SoFi pros

- Low fees. One of SoFi’s central benefits is the fact that trading and investing doesn’t cost a cent, and if you’re just looking to start building a portfolio of US assets you can do so without losing any money to fees and commissions.

- No options contract fee. The lack of any options contract fee is worth highlighting even though it’s part of the previous point, since many other competing brokers offer zero commission stocks and ETFs but not options.

- Robo investing. SoFi’s robo investing option can be appealing if you want to build wealth but don’t have the time or expertise to sit down and build your own portfolio or strategy.

SoFi cons

- Hidden fees. You need to be aware of fees SoFi charges that aren’t trading related, because getting hit by something like their inactivity fee can wipe out all of the benefits of commission-free trading. Make sure to check their fee schedule so you know what to look out for.

- Track record. SoFi’s 2024 breach due to lax controls on identity verification sets a dangerous precedent, as does the fact that they forced new customers into their share lending program for years without even passing down some of the gains.

SoFi alternatives

For a full list of great alternatives to SoFi, make sure you check out our guide to the internet’s top free stock trading apps. Before getting to that, here are three options we think offer an excellent alternative to SoFi for different reasons:

1. Vanguard

Vanguard is well known as the pioneer of fund investing, so if your investment strategy needs to involve mutual funds but you’re put off by SoFi’s fees, then this is where you need to go.

You’ll also get zero commission brokerage services on top of the low cost funds, with Vanguard able to cut down on almost all charges thanks to their unique ownership model—rather than having shareholders, it’s fund owners that own a part of this financial titan.

This also means excellent customer service since you’re among the company’s top stakeholders, and you can do everything you might expect from a top-notch traditional brokerage here.

Your Vanguard brokerage account is also extremely light on fees, to the point that the only thing they even charge for is delivery of things like paper statements. Choose email delivery, and you’ve got a free brokerage at your hands offering an unparalleled selection of funds, and one of the most trusted names in the business.

2. Fidelity

Staying at the very top of the stock trading pyramid, Fidelity enjoys as powerful of a brand as Vanguard does while also giving you a brokerage platform that scores highly on just about every metric.

It’s only usable in the US, but beyond that has a spotless safety record, offers zero commission share and ETF trades, and has a vast selection of assets—including plenty of zero expense funds to consider.

Options trading might be the only area where Fidelity lags behind given its contract fees, but if you want a slick, stable app experience while you build a lasting portfolio, then Fidelity’s worth looking at. It’s the first choice for a lot of investors, and for good reason too.

3. Interactive Brokers

Interactive Brokers is one of the first online trading apps you should look at if you want the broadest possible selection of assets. Its IBKR Lite platform offers zero commission trades for US customers, but maintains one of the company’s key advantages—truly global reach.

IBKR is available in more countries than practically any other broker, meaning the majority of its clients are outside the US, and its presence on so many different markets means that it has access to more exchanges than most.

So, if you want to pick international stocks and build a portfolio that truly knows no borders while also delving deep into derivatives like options and futures, and even grab a cryptocurrency or two, IBKR is truly where it’s at. It’s a professional, sophisticated platform, and while it can take some time to learn how to use, Interactive Brokers will be high up on any list of trading apps.

Make the most of SoFi’s low fees with Whop

SoFi is a brand that’s widely known in the US, with significant reach into sectors of finance that you’ve probably already dealt with before ever thinking about opening a trading or investing account.

If you’ve taken a loan from SoFi or use it as your bank, then opening an investment account with them makes sense—why not stay with the same trusted platform, especially given that they come well recommended and feature almost no fees across the board?

Starting off with SoFi Invest presents you with an opportunity worth considering, but there’s another side to the story—you’ve got to nail down the basics of trading, whether it’s by making more frequent trades and trying to build up profits like a day trader, actively building a solid, long-term retirement portfolio, or making quick money with zero-fee options on SoFi.

We think Whop is the best place to do that, with expert groups and communities providing you with the resources you need to master the different sides of trading—whether you want to take a crash course, be mentored, attend workshops, watch experts trade in real time or in on-demand videos, or just share your journey with other like-minded traders, Whop’s trading communities have it all.