Western Union is one of the most well-known international money wire services, but is it the cheapest, most reliable, or fastest option for global transfers?

Key takeaways

- Western Union offers extensive global reach with cash pickup options, making it valuable for recipients without bank accounts.

- The service charges higher fees and less competitive exchange rates compared to modern digital money transfer alternatives.

- Western Union remains relevant for urgent cash transfers to remote locations despite being outpaced by newer fintech competitors.

Western Union became the first wire money transfer service in 1871 (yeah, really), and it’s still used in 200+ countries and territories today.

It used its existing network as a telegram company to configure international payments, and at the time, that was revolutionary.

But is it still the best option for worldwide P2P transactions?

I'll run you through how Western Union works for both sending and receiving international payments, and the fees associated. I'll go over some of Western Union’s key features, too, like Prepaid Visa Cards and in-person cash exchange.

After comparing Western Union to some of the alternatives listed below (and their costs), you’ll be able to see why other money transfer services might be better suited to your needs.

What is Western Union, and how does it work for international payments?

Western Union is the oldest global money transfer service, allowing you to send and receive domestic and cross-border payments; online or in-person.

Funds can be sent to bank accounts, mobile wallets, or for physical pickup in cash at Western Union locations.

Here’s a quick snapshot of the company, when it launched, and how it operates:

| Launched in | 1851 (first global wire transfer service launched in 1872) |

| Main service | International money transfers (P2P and business payments) |

| Key features | Cash pickup, bank transfers, mobile wallet payouts, prepaid Visa cards, in-person agent locations |

| Security | Encryption, fraud detection, identity verification, regulated in multiple jurisdictions |

| Send money via | Website, mobile app, in-person agent locations |

| Receive money via | Bank account, cash pickup, mobile wallet, prepaid Visa card |

| Supported currencies | 130+ currencies across 200+ countries and territories |

People use Western Union for its global reach, accessibility (cash pickups can be really handy for some people), and backed history as a secure way to send and receive money internationally.

While it is true that those strengths can be handy, newer and more advanced money transfer services often beat Western Union in terms of fees, user experience, and conversion rates.

Still, Western Union has been around for a long time. It’s a household name, has a proven track record, and an ‘Excellent’ rating on Trustpilot.

But does it makes sense for your needs? That's going to depend on a few factors, including which features are most important to you and the person you’re sending money to (or receiving it from).

Let’s take a look at Western Union’s main pros and cons:

Pros:

- Services available in 200+ countries and territories

- Cash pickup option, really useful for recipients without bank access

- Multiple ways to send and receive money (online, app, in-person)

- Solid track record and good brand trust

- Reliable for urgent international transfers

Cons:

- Higher fees compared to newer, digital-first money transfer services

- Weaker exchange rates, which can quietly increase the total cost (adds a markup on exchange rate to make money on transfers, unlike other options which use the mid-market rate with no markup)

- Online and in-app experiences can feel dated, especially compared to newer competitors

- Fees and delivery times vary widely depending on route and payout method

- Less transparent pricing than other alternatives, and fees stack up

I know the fee structure might sound a little confusing (and honestly, that’s because it is), so let’s break it down bit by bit together.

Western Union fees and costs

Unlike modern P2P money transfer services, Western Union transfers can incur pretty loaded fees and (if transferring internationally) conversion costs, too.

I used the Price Estimator tool they provide to look at the potential fees for a dummy transaction from the US to Australia, for the value of $500 USD.

As you can see, you’re looking at pretty different funds reaching the receiver depending on a bunch of variables: how your recipient wants the money, which payment method you want to use, and obviously, the global conversion rate.

I chose to send funds to the recipient's bank account, and as you can see in the video above, each card (debit, Visa, credit) incurred widely different fees.

Oh, and choosing to send the recipient cash? Yeah, that took even higher fees again:

Let’s take at each of the different fees in a little more detail.

Transfer fees

It goes without saying that, like any money service, Western Union charges you a transfer fee, however, like we discovered above, the actual amount depends on how you fund the transfer and how the recipient receives it.

For a typical international transfer of $500 USD, fees generally fall around:

- Bank transfer or debit card: Often $0 to $10, depending on speed and route

- Credit card payments: Commonly $15 to $40+

- Cash-funded or cash pickup transfers: This is always the most expensive option, with fees stacking higher again, and dependent on your recipient’s location and the exchange rate

Things you might take for granted on other payment platforms (faster delivery, card payments, transfers to wallets) can cost more with Western Union.

Exchange rates

This is where you really need to pay attention, as this is where Western Union becomes more expensive than at first glance.

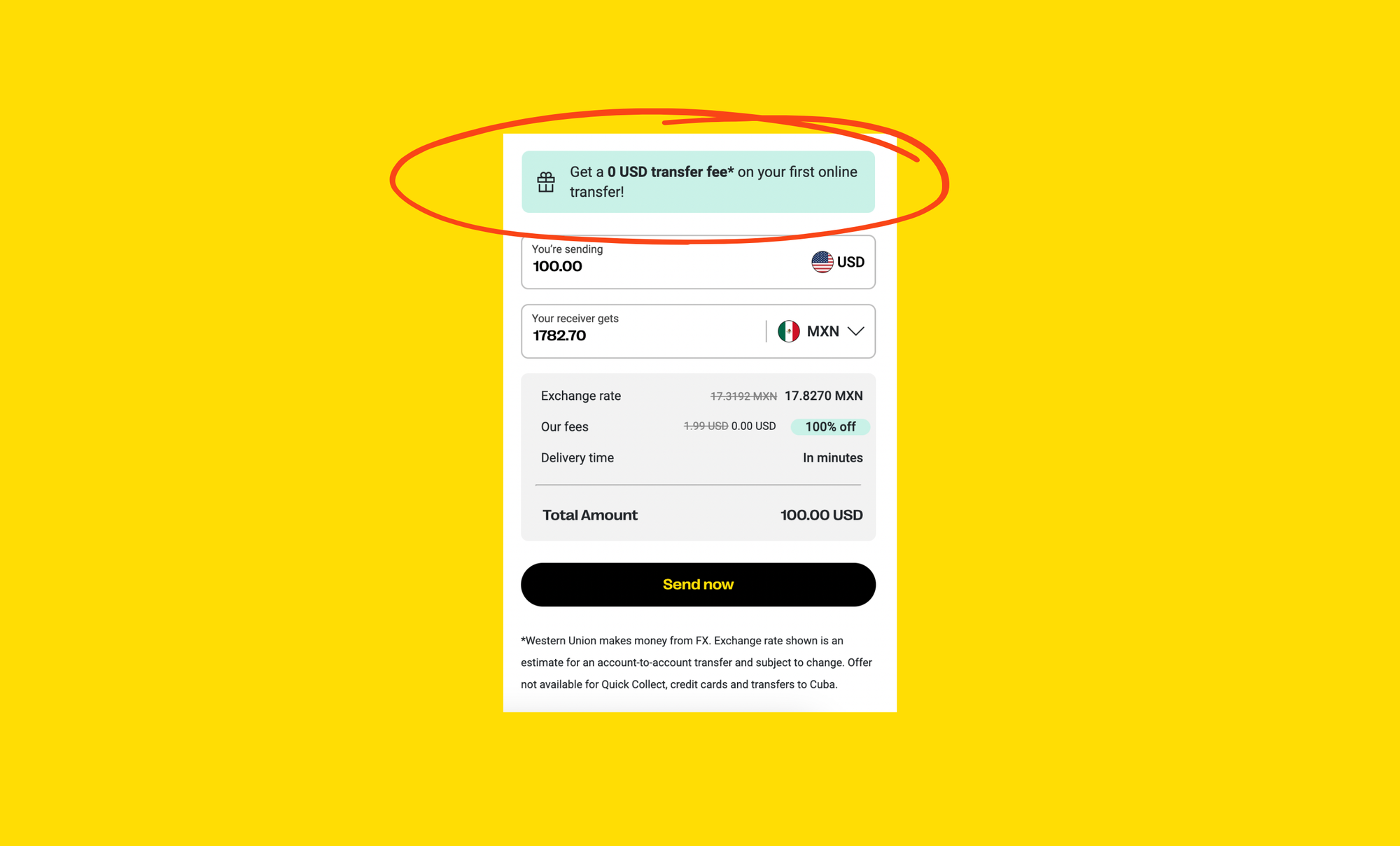

When you send money internationally, Western Union applies a markup to the exchange rate, rather than offering the mid-market rate you see on Google (again, using their Price Estimator tool is helpful here for accuracy).

Things to remember:

- The exchange rate offered by Western Union is usually worse than the mid-market rate

- That difference effectively acts as an additional fee, even if the listed transfer fee looks low

- The recipient often ends up receiving less in their currency compared to services that use real exchange rates

This is one of the biggest differences compared to digital-first platforms, which tend to separate fees from exchange rates and use the mid-market rate by default.

So even when Western Union advertises “low” or “$0” transfer fees, part of the cost is often baked into the conversion.

Banking and SWIFT fees

Depending on how the money is delivered, there may also be third-party fees involved (especially for international bank deposits).

These can include:

- SWIFT or intermediary bank fees deducted before funds reach the recipient

- Receiving bank fees charged by the recipient’s bank for international transfers

- Delays caused by correspondent banks along the transfer route

Western Union doesn’t always show these fees clearly upfront, because they’re charged by intermediary institutions, not Western Union itself.

This means the final amount received can sometimes be slightly lower than what the estimator initially suggests, particularly for international bank transfers.

Western Union’s best features

Western Union’s biggest strength is reach: you can send money to 200+ countries and territories, either online or in person, and your recipient doesn’t need to be particularly tech-savvy to get paid.

That's why it's still widely used today, especially by older generations who have more first-hand experience and comfort with using it (and don’t use digital wallets or mobile apps).

Still, reach isn’t so much a defining strength in 2026 where most competitors offer the same (if not more) coverage.

Below are the features that, in my mind, can actually make Western Union useful in practice.

In-person cash transfers

This is where Western Union still stands apart, to be frank.

You can send money online or in-store, and the recipient can collect it as cash from a Western Union agent location. For people without reliable bank access (or in regions where cash is still king) this is a genuine advantage.

I spoke to Keisha, our blog editor here at Whop, who used Western Union when traveling South America:

Actually getting money from Western Union was complicated. I had to be there at a certain time, I had to take paperwork, I had to take my ID, then I had to take the money out in cash.

– Keisha Singleton, Whop Editor

Cash pickup is especially useful when:

- The recipient doesn’t have a bank account (my grandad lived internationally to me as a kid and would send me money for gifts via Western Union pickup at cash agents)

- Funds are needed urgently

- Digital payment options aren’t practical

But again, the trade-off is cost: Cash transfers usually come with higher fees than bank deposits.

International bank transfers

Western Union lets you send money directly to bank accounts in a large number of its supported countries, making it a solid option when you want funds deposited rather than picked up in cash.

Think situations where:

- Your recipient prefers money landing straight in their bank account

- You’re sending funds internationally and don’t want them handling cash

- Speed matters, but instant delivery isn’t essential

Delivery times vary by country and bank, but many international bank transfers arrive within 1 to 5 business days.

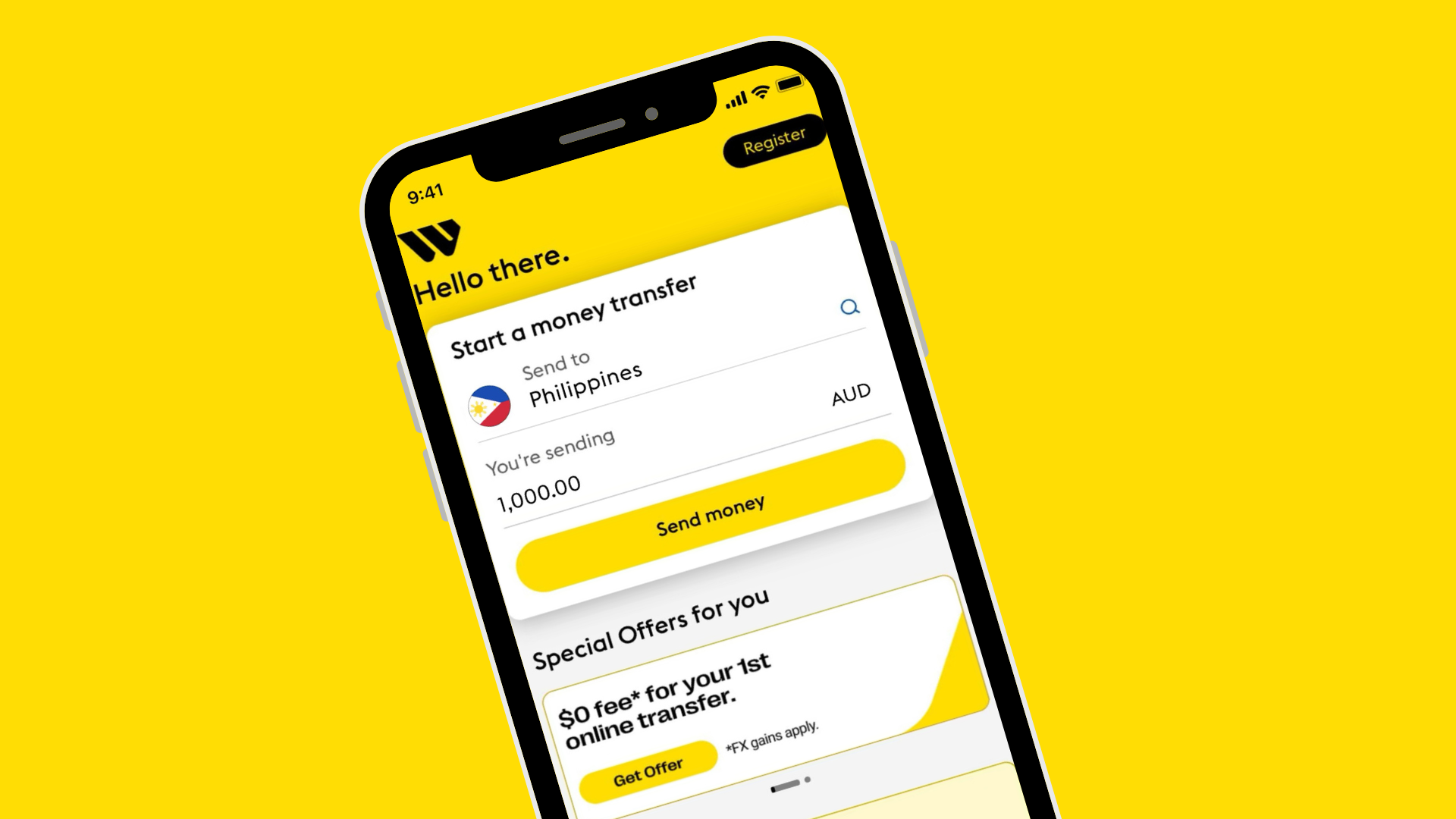

The Western Union app

Western Union’s mobile app lets you send money, track transfers, manage recipients, and check exchange rates without visiting a physical location.

The app supports:

- Bank transfers and card-funded payments

- Transfer tracking in real time

- Saved recipients for repeat payments

While it works reliably, the experience feels more functional than modern.

What I mean to say is yes, it gets the job done, but it’s not as clean or transparent as newer, app-first platforms. *cough*

Western Union Prepaid Visa card

Western Union also offers a prepaid Visa card in some regions, which can be used to receive funds and spend them like a regular debit card.

That’s actually pretty cool, and can come in handy in a lot of situations:

- Your recipient wants card access without a traditional bank account

- When the funds need to be spent online or in-store

- You just want an alternative to cash pickup that isn’t through the recipient’s bank

Availability and features vary by country, so it’s not a universal option, but it adds another layer of flexibility to how money can be received.

I mentioned earlier Western Union has a Trustpilot rating of 4.2 stars (i.e., 'Great'), but does that mean it’s secure?

Let’s find out.

Is Western Union safe to use?

Western Union is safe to use; it’s a legitimate company with an extremely long-standing record (we’re talking 150+ years as an international money transfer service).

It was the world's first wire money transfer service, meaning it was trusted by generations before this article was written.

The biggest genuine issues people have with it are long wait times, high fees, and a slow, outdated mobile app.

However, there are some concerns surrounding Western Union, namely, scams.

Scams using Western Union aren't a fault with Western Union’s security itself, though.

It’s to do with the fact that scammers can take advantage of things like cash pickup, where it’s much harder to get your money back than it is with say, banking transfers.

But as far as genuine transfers and collections go? Western Union is safe, well regarded, and trustworthy.

How to use Western Union

While Western Union might not be as user-friendly and modern as its competitors, it’s still pretty easy to use, whether you’re sending funds out or receiving money.

Sending money with Western Union (US)

If you’re in the US, Western Union gives you flexibility in how you send money (online, using an app, or walking into a physical location).

You can choose the option that best matches how fast you need the money delivered and how your recipient wants to receive it.

- Send online: Use the Western Union website to send money from your bank account, debit card, or credit card. This is the most common option for international transfers and lets you compare delivery methods and costs before checking out.

- Send with the app: The Western Union app lets you send money, track transfers, save recipients, and check exchange rates on the go, pretty convenient if you’re making repeat transfers and want to avoid visiting an agent location.

- Send in person: You can visit a Western Union agent location in the US to send money with cash or card. Some people don’t want to use online banking or need help completing the transfer, but it usually comes with higher fees.

Receiving money with Western Union (US)

Receiving money is also pretty straightforward, and you don’t need to use the same method the sender used.

Here are the main ways to receive money:

- Bank account: Funds can be deposited directly into your US bank account. This is typically the cheapest and most practical option, though delivery times can range from same-day to a few business days depending on the transfer.

- Cash pickup: You can collect cash from a Western Union agent location by presenting a valid ID and the transfer’s tracking number (MTCN).

- Mobile wallet: In some cases, money can be received into a supported mobile wallet instead of a bank account or cash (but availability depends on the recipient’s wallet and the wire transfer route).

The sender always has to enter how the recipient will receive the money, so make sure you’re on the same page before sending funds or arranging payment.

Best alternatives to Western Union

If Western Union’s fees, exchange rates, or delivery options are making you shudder, I’ve lined up a few alternatives worth considering, depending on whether you’re sending money casually, internationally, or as part of a business.

If I was travelling South America again today, I don't think that I would use Western Union. I'd probably use a more modern way to receive and send money internationally, whether that was something like Wise or Paypal or Whop. You can instantly see how much you need to send, how much you're going to receive, and they don't have those hidden fees.

– Keisha Singleton, Whop Editor

Whop

Whop is built for modern online businesses that need to accept, route, and receive payments globally without stitching together multiple tools.

We’ve combined payments, payouts, checkout orchestration, and monetization into a single platform, with no monthly subscription and clear transaction-based pricing.

So what about international payments? Glad you asked.

You get access to 100+ global payment methods (including cards, BNPL, crypto, and region-specific options), and global payouts across 240+ territories via ACH, crypto, Venmo, Cash App, and more.

Oh, and pricing is simple: free to start, and 2.7% + $0.30 per transaction.

Best for: Creators, coaches, and online businesses that want to accept payments globally, improve conversion, and manage international payouts with low fees and fast processing.

PayPal

PayPal is one of the most recognisable names in online payments, and it’s often used for quick, familiar transfers, especially within the US or between people who already have PayPal accounts.

It’s easy to use, widely accepted by merchants, and convenient for small or occasional transfers.

That said, PayPal’s international fees and currency conversion markups can add up quickly, and it’s not always the cheapest option for cross-border payments.

It also doesn’t support crypto payments or wallet payments, and recipients have to withdraw from PayPal to their own bank account, incurring more fees.

PayPal works best when both sender and recipient are already in the PayPal ecosystem, but it offers less transparency and flexibility compared to newer platforms.

Best for: Casual domestic transfers and paying online where PayPal is a supported method.

Wise

Wise is a digital-first money transfer service known for transparent pricing and real exchange rates. It’s especially handy for travellers and people moving around globally who need fast and accurate currency conversion.

Users get the mid-market exchange rate and can clearly separates fees from currency conversion, so you can see exactly how much your recipient will receive before sending.

Fees are typically percentage-based and consistent across routes, which makes Wise popular for international bank transfers.

Unlike Western Union, though, Wise doesn’t support cash pickup. Still, it’s one of the most cost-effective options for bank-to-bank international payments.

Best for: International transfers where low fees, real exchange rates, and bank deposits matter more than cash access.

Fast, secure, and flexible global payments with Whop

When you’re comparing services like Western Union and Wise, it usually comes down to the same core needs: getting paid quickly, avoiding unnecessary fees, and having flexibility in how you receive and move your money.

Whop does all of that, plus more. Instead of acting as a single-purpose transfer tool, Whop is built to handle global payments and payouts end to end, with more flexibility and lower fees.

Accept payments from customers worldwide, route checkouts through the providers most likely to succeed, and receive funds instantly in many cases, rather than waiting days for international settlements.

Plus, withdraw your transfers to bank accounts, digital wallets, or crypto wallets.

If you’re sending or receiving money internationally, creating a Whop account gives you more control, better conversion, and far fewer hoops to jump through.