Sezzle is a Buy Now, Pay Later service that lets customers split purchases into interest-free installments while you get paid upfront. Offering it can boost sales, increase conversions, and give shoppers flexible payment options, especially when paired with Whop for a seamless checkout experience.

Key takeaways

- Sezzle lets customers pay in installments while merchants receive full payment upfront, protecting cash flow.

- Adding Sezzle reduces cart abandonment and increases conversions by removing price friction at checkout.

- Sezzle integrates easily with major ecommerce platforms and can work alongside other payment methods.

Sezzle is a Buy Now, Pay Later (BNPL) service that lets your customers split purchases into interest-free installments, while you, the merchant, get paid upfront.

With Sezzle you can give shoppers flexible payment options without holding up your cash flow (a win for everyone!).

Let's take a closer look at what Sezzle is, how it works, the benefits of adding it to your store, its key features, and how to get started - plus, why pairing it with Whop can give your customers the ultimate checkout experience.

What is Sezzle?

Sezzle is a Buy Now, Pay Later (BNPL) option that lets your customers split their purchases into interest-free payments. You get paid in full upfront, and your shoppers get the flexibility to pay on their own schedule.

But, Sezzle is more than just BNPL at checkout. With Sezzle Spend, customers can use a Sezzle card anywhere, and Sezzle Anywhere lets them convert purchases into installments across participating stores.

And yes, it plays nicely alongside the other payment options you already offer.

How Sezzle works (for shoppers and sellers)

When a shopper chooses Sezzle at checkout, they can split their purchase into interest-free installments - either four payments over six weeks, or two payments for smaller purchases.

Payments are split for the customer but not for you - you get paid in full, upfront, by Sezzle. Sezzle handles the credit approval, payment tracking, and reminders for your customers, while you focus on running your store.

Sezzle cares about stores no matter the size. …unlike other partners we’ve worked with, they make you feel like you’re an actual person instead of a number.

- Director of Education, Retail

For sellers, it’s all integrated into your checkout experience. You don’t need extra apps or complicated setups. Once it’s activated, Sezzle just works, giving your customers a flexible way to pay and giving you peace of mind that you’ll receive the full amount for every sale.

You need payments, you need to accept payments, and you need to pay out payments. And if you can't do that, you can't run a business.

- Hunter Dickinson, Head of Partnerships at Whop

Benefits of adding Sezzle as a payment method

Offering Sezzle can give your store a serious boost.

Sezzle removes the friction at checkout. Same product, easier decision, better revenue. It turns ‘maybe later’ into ‘buy now’ by smoothing sticker shock, so you see fewer abandoned carts and more clean, predictable cash flow.

- Nick Wood, Whop

Customers love the flexibility to pay over time, which can lead to higher conversion rates and bigger orders. And, shoppers are more likely to complete their purchase when they can break it into smaller, manageable payments - especially when it comes to high-spend periods, like holidays.

This in turn means that Sezzle reduces cart abandonment and brings in new buyers who might otherwise hesitate at checkout.

It isn't only about affordability - Sezzle is also a trust signal. Showing a BNPL option at checkout tells your customers that your business is trusted by financial institutions.

Sezzle's top features for merchants

It's clear to see that Sezzle makes buy now, pay later simple for both you and your customers.

Here’s what it offers:

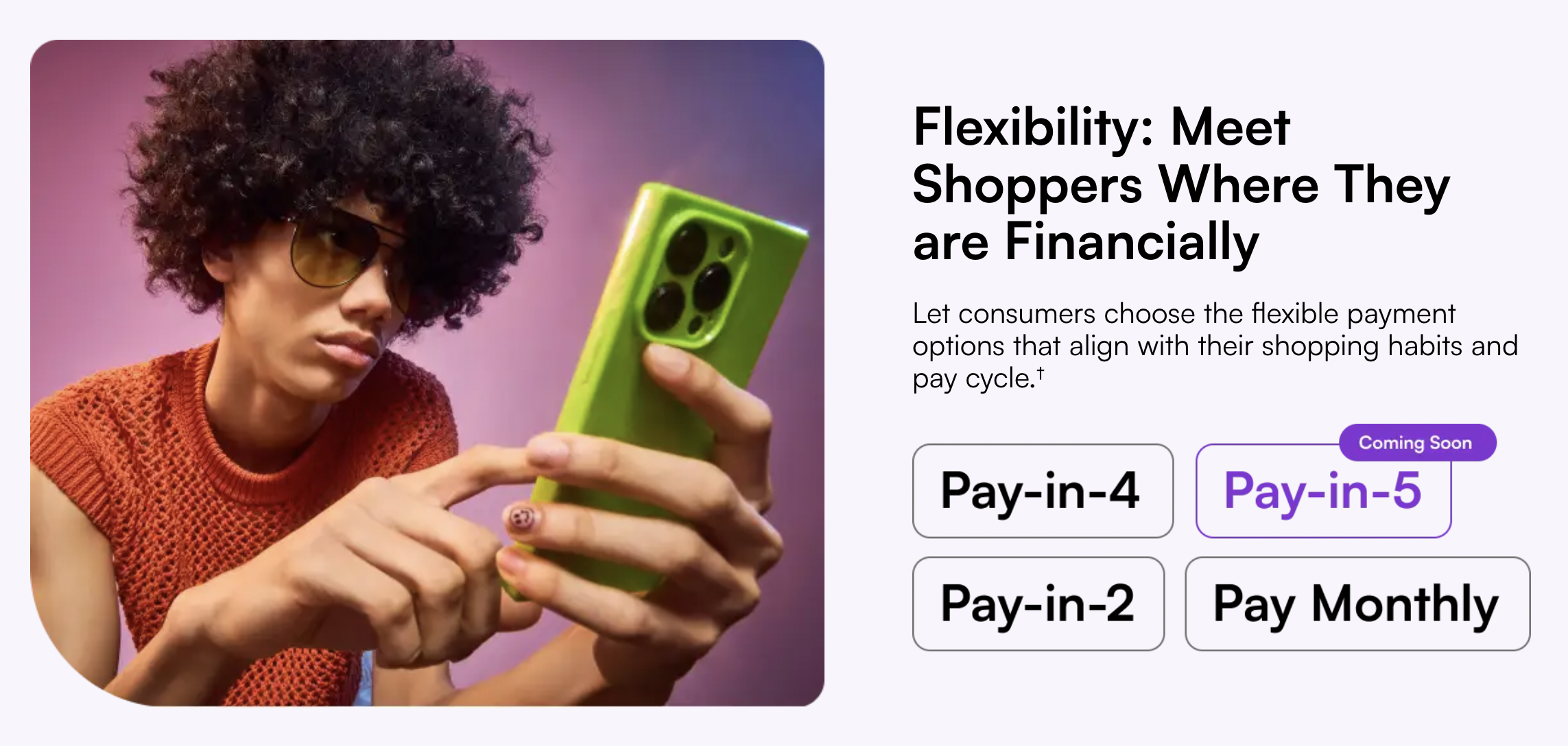

Sezzle-it online

When shopping online, customers can split payments into flexible installments pay in 4 or pay monthly, without interest on eligible transactions.

Pay in 2

For smaller purchases, this option splits the total into two equal payments. The first is paid at checkout, the second two weeks later.

Pay in 4

Perhaps the most popular option, customers pay in four equal payments over six weeks. Payments are automatic and interest-free, helping customers manage spending without surprises.

Pay monthly

For higher-ticket items, customers can spread payments across 3 to 48 months, depending on approval and purchase amount.

Sezzle-it in-store

Sezzle isn't only for online transactions. With a virtual Visa card, Sezzle works at any physical store that accepts Visa. Customers can use pay in 4 (or other installment options) approved for their purchase.

How to set up Sezzle for your store

1. Sign up for a Sezzle merchant account

Head to Sezzle’s website and register as a merchant. You’ll need to provide your business information, bank account details, and tax identification (like an EIN or SSN in the US).

2. Integrate Sezzle with your ecommerce platform

Sezzle supports most major platforms, including Shopify, WooCommerce, BigCommerce, and more. Integration usually involves installing the Sezzle plugin or app, connecting your merchant account, and enabling it as a payment option at checkout.

From the business owner standpoint, (Sezzle) integrates with any platform that they’re on. It’s plug and play, and it’s that easy.

- Director of Partnerships, Retail

With Whop, you can also offer Sezzle alongside other payment methods directly through your store or checkout links, giving your customers more ways to pay while keeping all transactions and payouts in one unified dashboard.

3. Customize how Sezzle appears on your site

You can control how Sezzle shows up at checkout, including messaging, badges, and promotional banners.

4. Set your payout preferences

Sezzle pays merchants in full upfront, typically within a few business days. Set up your payout schedule and preferred notifications to stay on top of incoming funds.

5. Tell your customers

Let shoppers know they can pay over time. Highlight Sezzle on product pages, shopping carts, and during checkout.

6. Track performance and insights

Sezzle provides dashboards with real-time insights on orders, approvals, and payments. Use these tools to track adoption, spot trends, and optimize your checkout experience.

Once everything is set up, Sezzle handles approvals, payment reminders, and installment tracking for your customers — while you enjoy the benefits of upfront payments and reduced cart abandonment slowing down your operations.

Sezzle fees: how much does it cost merchants?

As a merchant, you don’t pay a setup fee or monthly subscription with Sezzle - but you do cover transaction and account maintenance fees, which are as follows:

Order processing fee: Sezzle applies a percentage‑based fee plus a small flat fee per transaction. The exact rate is customized based on your store’s volume, products, and risk profile, but several sources indicate a typical rate around 6% + $0.30 per transaction.

Monthly minimum account management fee: If your store processes less than roughly $300 USD in order volume in a 30‑day billing period, a monthly minimum fee (for example, $15 USD) may apply.

Refund fee: If Sezzle cannot issue a refund from your refund reserve account and instead uses a card on file, a refund‑processing fee may be applied.

Don’t just stop at Sezzle – offer more payment options with Whop

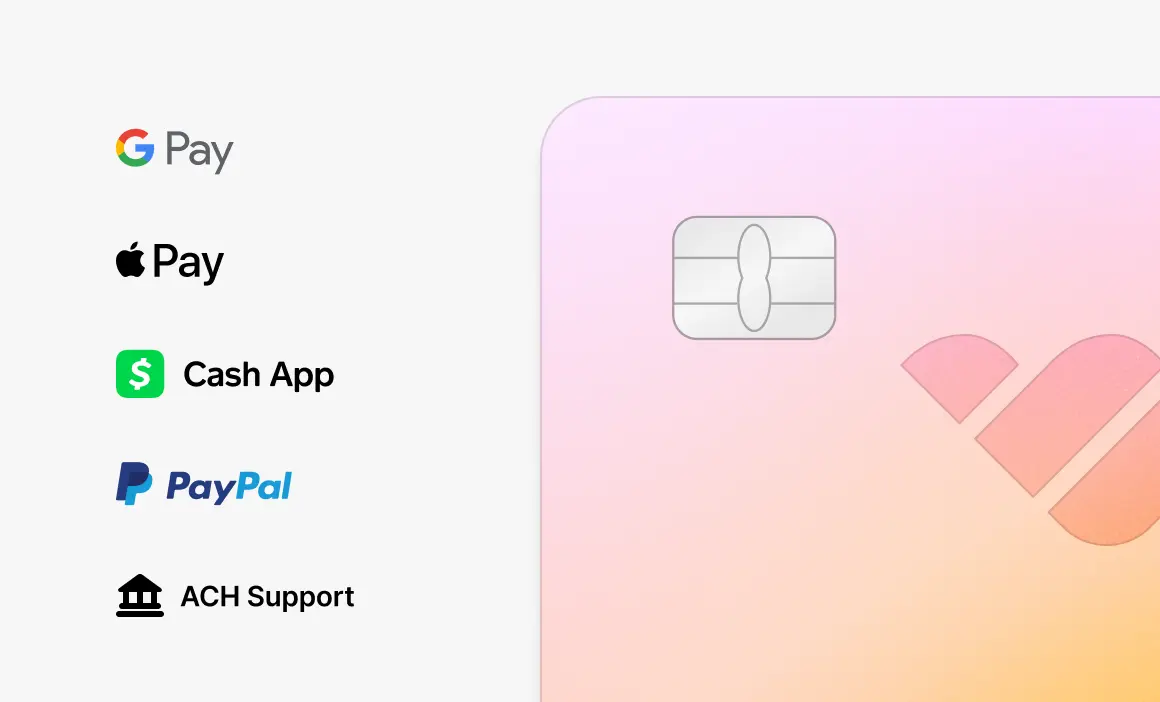

Sezzle is a powerful way to boost conversions and give shoppers the flexibility they love. With Whop Payments, you can easily apply for Sezzle (alongside other BNPL options like Zip and Splitit), activate it at checkout, and manage everything in one place - alongside cards, wallets, crypto, and more.

Through thousands of conversations, we’ve learned our customers really only care about two things: getting paid and paying out. Our mission is to be the best in the world at solving those problems.

- Hunter Dickinson, Head of Partnerships at Whop

Whop handles routing, payouts, and reporting behind the scenes so you can stay focused on growing your business. And your customers get a seamless checkout experience with all the payment options they expect - including Sezzle.

Basically, it’s the easiest way to make checkout a win-win for everyone.

Give your customers every way to pay, with Whop

Sezzle boosts conversions, and with Whop Payments, you can offer it right beside every other way your customers want to pay. Cards, wallets, crypto, BNPL… all in one seamless checkout.

This means faster payments, bigger carts, and happier shoppers.

Turn on Sezzle through Whop and level up your entire checkout.

Sezzle FAQs

Can I use Sezzle with my existing store?

Yes, Sezzle works with many major ecommerce platforms like Shopify, WooCommerce and BigCommerce. Sezzle can also be integrated through Whop.

Does using Sezzle delay my payouts?

No - with Sezzle, you get paid upfront for every sale. While customers pay in installments, you get the full amount in one go.

Are there fees for me as a merchant?

Sezzle charges a small processing fee per transaction, similar to credit card fees.

Can my customers use Sezzle in-store?

Yes - with the Sezzle virtual card, shoppers can pay in installments anywhere Visa is accepted.

Does Sezzle affect my checkout experience?

Not at all. Once integrated, Sezzle shows up as a payment option just like any other method..

Can I offer Sezzle alongside other BNPL or payment options

Absolutely. Pairing Sezzle with Whop means you can offer BNPL, crypto, wallets, and traditional card payments all in one place, giving your customers total flexibility.