The best payment processor APIs make it easy to accept payments, manage subscriptions, and scale globally. Compare top APIs like Stripe, PayPal, Square, and Whop Payments to find the right fit for your business.

Key takeaways

- Payment processor APIs let you embed checkout, automate billing, and accept multiple payment methods directly in your app.

- Merchant of Record platforms like Whop handle taxes, compliance, and chargebacks so you can focus on growth.

- Smart payment orchestration routes transactions to providers most likely to approve them, reducing declines and boosting revenue.

Payment processor APIs let businesses accept payments online, automate billing, and build custom checkout experiences that fit their brand.

The right API can streamline subscriptions, boost conversion rates, and keep transactions secure; all without adding manual overhead.

In this guide, we’ll break down what payment processor APIs do, what to look for in a good one, and which platforms (like Stripe, PayPal, Adyen, and Whop Payments) offer the best mix of flexibility, global coverage, and developer support.

What is a payment processor API?

A payment processor API lets developers embed payment functionality directly into apps, websites, or software. It connects your product to payment gateways so customers can pay with cards, digital wallets, crypto, or buy-now-pay-later options — all without leaving your platform.

In simple terms, an API is the bridge between your checkout and the financial networks that move money.

With the right API, you can securely process transactions, automate billing, manage subscriptions, and handle refunds — all from within your own system.

What to look for in a payment processing API:

Not every payment API is built the same. The right choice depends on how you sell, where your customers are, and how much control you want over the checkout experience.

Here's what to look for when choosing a payment processor API:

- Integration and documentation: Look for clean, well-documented APIs that make it easy for developers to set up payments and test transactions quickly.

- Supported payment methods: Check which options are available (credit cards, wallets, crypto, BNPL, ACH, etc.) and which are essential for your audience.

- Global coverage: If you sell internationally, you’ll want multi-currency support, localized checkouts, and global tax handling.

- Fees and pricing model: Compare transaction fees, currency conversion costs, and whether there are monthly minimums or hidden surcharges.

- Security and compliance: Make sure the provider is PCI-DSS compliant and offers built-in fraud detection and chargeback protection.

- Reliability and uptime: Payments are mission-critical. Choose an API with 99.9%+ uptime and strong error handling.

- Support and scalability: Round-the-clock support, sandbox environments, and multi-PSP routing can make a huge difference as your business grows.

Top 5 payment processor APIs for online businesses

The best payment processor APIs handle subscriptions, compliance, fraud, and even alternative payments like BNPL and crypto.

Here are the top platforms leading the way, each offering different strengths depending on your size, stack, and growth stage.

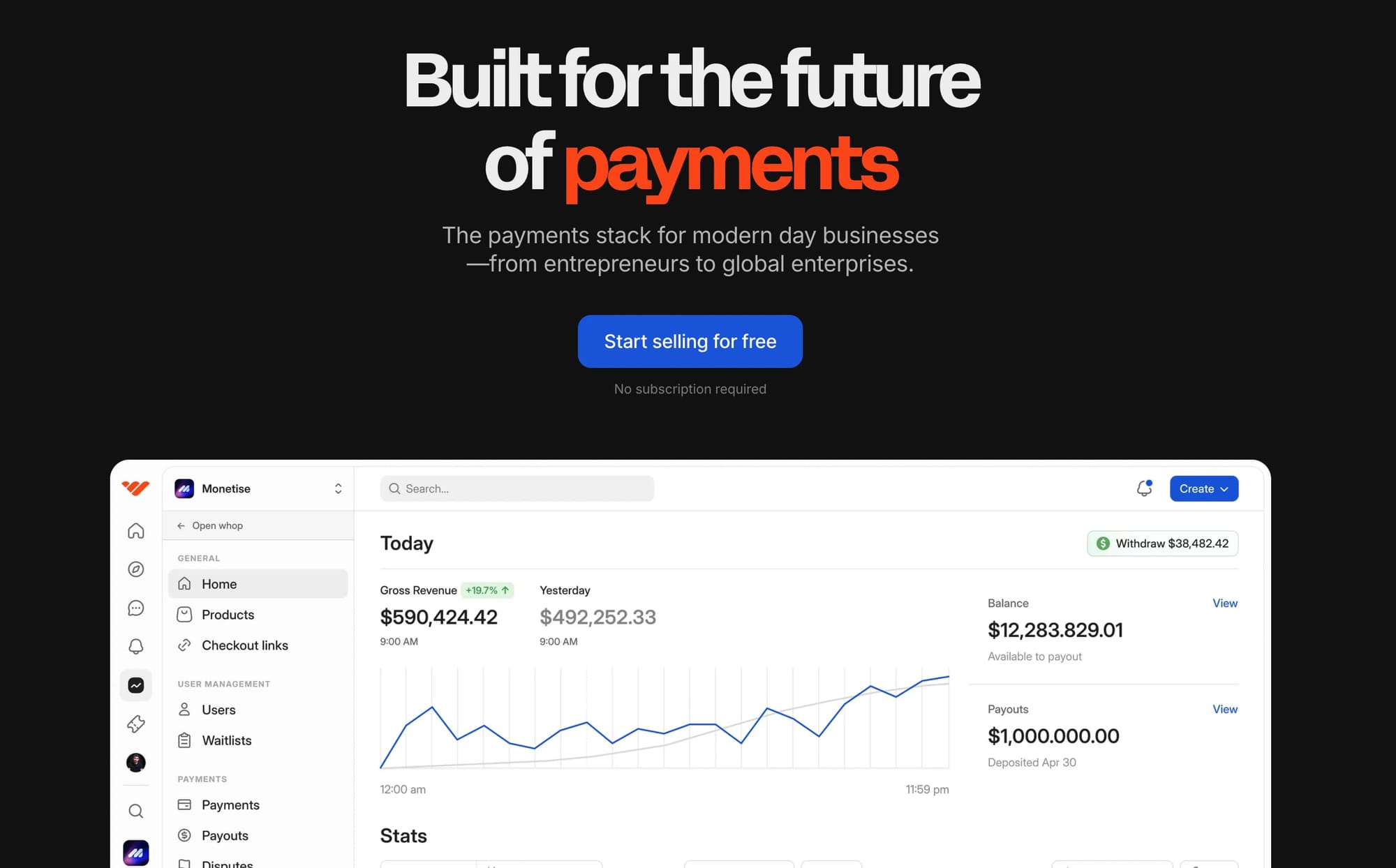

1. Whop Payments

Whop Payments is a full Merchant of Record (MoR) for creators, SaaS founders, and digital entrepreneurs.

It’s more than just a payment API: it’s the entire infrastructure that sits between your business and your buyers.

That means Whop handles payment routing, tax compliance, and fraud risk automatically so you can focus on growth.

The API integrates seamlessly into your product or store, while Whop’s checkout links and embeddable components let you sell subscriptions, digital products, or memberships without writing a line of code.

You also get access to 100+ payment methods (including debit and credit cards, wallets, crypto, and BNPL), automated retries to reduce failed payments, and global payouts to 190+ countries.

“Through thousands of conversations, we’ve learned our customers really only care about two things: getting paid and paying out. Our mission is to be the best in the world at solving those problems.”

- Hunter Dickinson, Head of Partnerships at Whop

Pricing: Flat 2.7% + $0.30 USD per transaction, with no monthly or setup fees.

Pros:

- Handles taxes, compliance, and chargebacks for you (MoR model)

- 100+ payment methods and global payouts in 240+ countries

- Built-in BNPL, embedded checkout, and marketplace visibility

- No monthly fees, predictable costs, and fast onboarding

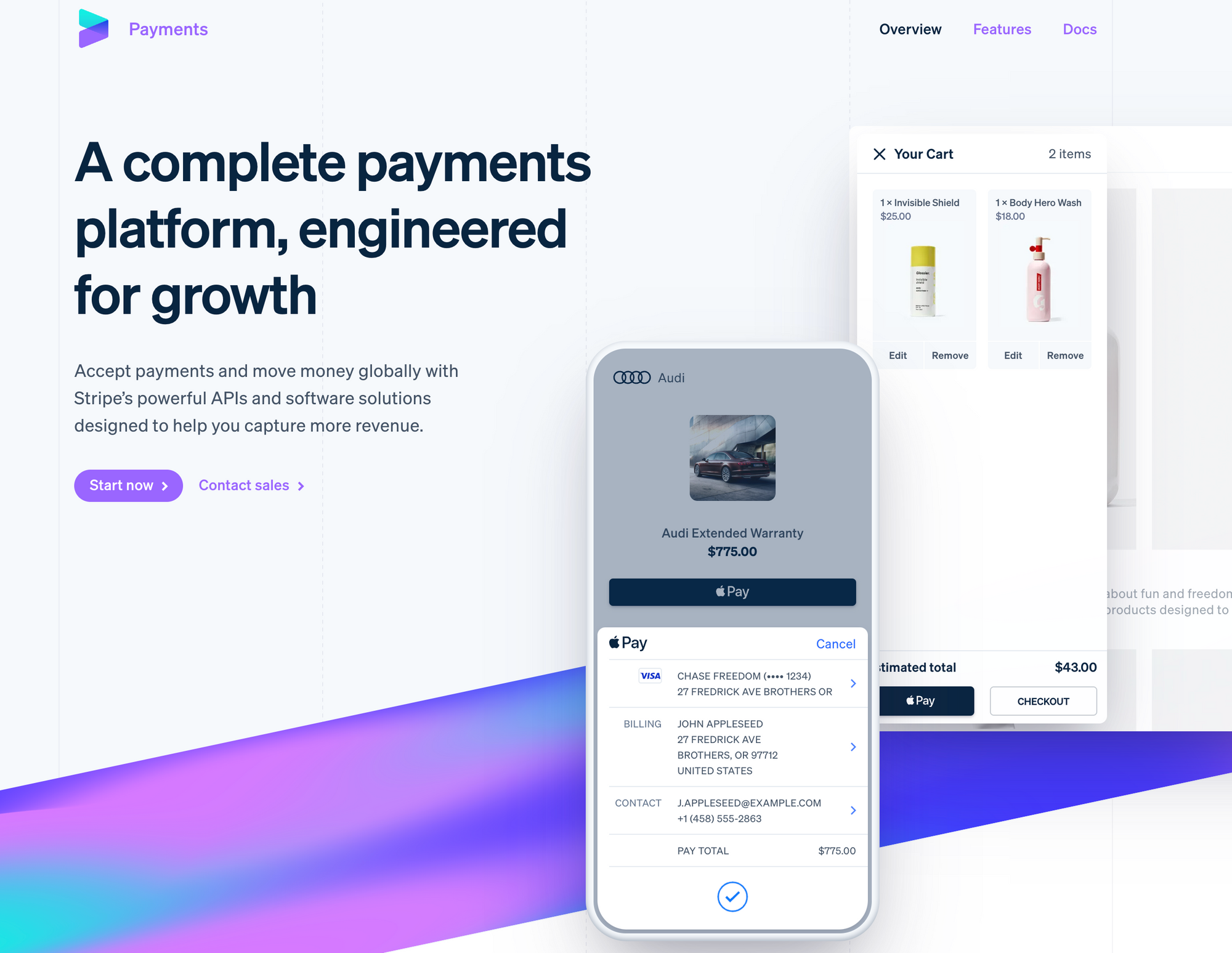

2. Stripe

Stripe is a popular payment API for developers and startups. It’s built for flexibility, allowing you to embed payment flows directly into your app, handle subscriptions, and automate invoices with just a few lines of code.

The Stripe API also supports advanced use cases, like metered billing, marketplace payouts, and platform-level revenue sharing, which makes it popular with fast-growing SaaS and creator platforms.

You’ll find SDKs for almost every stack, a generous sandbox environment, and native extensions for major frameworks like React, Django, and Node.js.

Pricing: 2.9% + $0.30 USD per successful domestic transaction (with higher rates for international or currency-converted payments).

Pros:

- Excellent developer tools, SDKs, and API reliability

- Global reach and a wide range of payment methods

- Advanced billing, subscription, and payout features

Cons:

- Taxes, compliance, and chargebacks remain your responsibility

- International and cross-border fees add up fast

3. PayPal

PayPal remains one of the most recognizable names in online payments. It’s a solid choice if you want to accept cards, PayPal balances, Venmo (in the U.S.), or even crypto payments without reinventing your checkout.

The REST-based PayPal API allows developers to embed PayPal directly into sites or apps, and you can combine it with PayPal Checkout or PayPal Commerce Platform for full-stack integration.

Its biggest strengths are consumer trust and reach: PayPal operates in 200+ markets and supports 25+ currencies.

However, for developers, it’s slightly less flexible than Stripe or Adyen, especially when it comes to advanced automation or granular subscription control.

Pricing: Typically 2.9% + $0.30 USD per domestic transaction (plus cross-border and currency fees).

Pros:

- Universal brand trust and easy customer adoption

- Accepts PayPal, Venmo, and crypto payments

- Strong buyer/seller protection systems

Cons:

- Developer experience and API depth lag behind newer platforms

- Fees for cross-border payments are relatively high

4. Ayden

Adyen is a powerhouse for global enterprise payments. Its single-integration API supports cards, wallets, BNPL, and local payment methods in over 200 markets.

It’s designed for scale, offering features like dynamic routing (sending each transaction to the gateway most likely to approve it), risk management powered by machine learning, and advanced reporting for finance teams.

Adyen’s API is highly configurable, which makes it perfect for established companies that want complete control over payment flows, reconciliation, and compliance.

Its marketplace and platform tools also let you split payments, manage multi-party payouts, and integrate financial services natively into your product.

Pricing: No setup or monthly fees. Transactions are billed on an interchange++ structure that varies by card type and region.

Pros:

- Handles complex, high-volume international payments

- Strong compliance, fraud prevention, and analytics tools

- Transparent per-method pricing for large-scale merchants

Cons:

- Setup can be complex for smaller teams

- Custom pricing makes cost comparisons less straightforward

5. Square

Square is one of the most versatile payment processor APIs for businesses that operate both online and offline.

Initially known for its sleek POS readers, Square has evolved into a fully integrated payment platform that supports e-commerce sites, apps, and in-person checkout.

Square’s API lets developers embed payments directly into custom websites, mobile apps, or online stores, with full support for cards, digital wallets (like Apple Pay and Google Pay), ACH payments, and even BNPL via Afterpay (which Square owns).

However, for global SaaS or enterprise setups, its limited international coverage and lack of full Merchant of Record functionality can be restrictive.

Pricing: 2.9% + $0.30 USD per online transaction (domestic); 2.6% + $0.10–$0.15 for in-person sales, depending on plan and hardware.

Pros:

- Unified online and in-person payments ecosystem

- Built-in BNPL via Afterpay, plus invoicing and CRM tools

- Flat, transparent pricing with no monthly fees

Cons:

- Limited international support and customization compared to Adyen or Whop

- Doesn’t handle tax compliance or chargebacks on your behalf

5 reasons why Whop is the best payment processor API

Whop isn’t just another payment processor API — it’s the only one built for modern creators, SaaS founders, and digital entrepreneurs who want payments, subscriptions, and compliance handled in one place.

1. Merchant of Record: You sell, Whop handles the rest

Unlike most APIs that make you manage taxes, compliance, and chargebacks, Whop acts as your Merchant of Record.

That means Whop legally processes transactions on your behalf — handling VAT, GST, and sales tax collection in over 100 jurisdictions.

If a chargeback happens, Whop’s built-in Dispute Fighter automatically responds using real transaction evidence. You keep selling while Whop takes care of the red tape.

2. 100+ payment methods, 190+ payout countries

Global audiences expect global payment options. Whop’s API supports over 100 methods out of the box, including credit/debit cards, Apple Pay, Google Pay, PayPal, BNPL (Afterpay, Klarna, Zip, Sezzle, Splitit), and even major cryptocurrencies.

"You can now get paid out in Bitcoin or Stablecoin, and in basically every single country in the world, which are things that Stripe doesn't really support.”

- Steven Schwartz, Whop CEO

Sellers get paid out in over 241 territories via ACH, crypto, CashApp, or local bank rails. You can scale internationally without opening local bank accounts or juggling multiple payment gateways.

3. Built-in fraud protection and orchestration

Every transaction on Whop Payments passes through smart orchestration — routing payments to the provider most likely to approve them, and retrying failed attempts automatically.

The result? Fewer declines, higher conversions, and more revenue.

Combined with fraud scoring, velocity limits, and machine-learning risk detection, Whop protects both you and your buyers from payment abuse without slowing checkout.

4. Developer-first API with no monthly fees

Whop’s API gives developers complete control with simple, modern endpoints — all documented at docs.whop.com.

You can embed checkout flows, manage memberships, automate billing, and trigger payouts with a few lines of code.

There are no monthly fees or minimums; you only pay when you make money (2.7% + $0.30 per transaction).

For teams that want to build custom experiences without enterprise overhead, Whop offers scalability and simplicity in one package.

5. All-in-one business ecosystem

Payments are just the beginning. Whop lets you sell courses, communities, memberships, and digital downloads in the same ecosystem — complete with analytics, affiliate tracking, and automated email tools.

Host your store, embed checkout on your website, or distribute products through Whop’s marketplace for added exposure.

It’s an entire business stack powered by one API, built to help creators and SaaS founders grow faster.

The future of payments runs on Whop

Most payment APIs still make you do the heavy lifting — managing taxes, handling chargebacks, and juggling multiple integrations just to stay compliant.

Whop Payments changes that.

By combining powerful APIs with total Merchant-of-Record protection, Whop makes it simple to sell anywhere, accept any payment method, and get paid instantly.

“Payments are just one part of the stack. It doesn't stop there.”

- Steven Schwartz, Whop CEO

Scaling a SaaS, launching a digital product, or building a creator business, Whop gives you everything you need to process payments, manage customers, and expand globally.

Start selling smarter. Build your business on Whop today.

FAQs

1. What is a payment processor API and why do I need one?

A payment processor API lets you embed payment functionality directly into your app, website, or software. It connects your platform to gateways so customers can pay with cards, wallets, crypto, or BNPL without leaving your product.

Using one automates billing, manages subscriptions, and reduces manual overhead, all while keeping transactions secure.

2. How do I choose the best payment processor API for my business?

Look for APIs with strong documentation, global payment method support, high uptime, PCI compliance, and scalable developer tools. Consider fees, multi-currency support, and fraud prevention features.

3. Can a payment processor API improve subscription billing and recurring revenue?

Yes. A good API automates recurring billing, invoicing, and retries for failed payments, which reduces churn and ensures predictable revenue. It also handles payment updates and refunds without manual intervention, keeping your subscription business running smoothly.

4. What are the advantages of using Whop Payments over other APIs?

Whop Payments acts as a full Merchant of Record, handling taxes, compliance, chargebacks, and global payouts automatically. It supports 100+ payment methods, built-in fraud protection, and smart payment routing to reduce declines. Developers get a modern, flexible API with no monthly fees, making it easy to integrate and scale.

5. Do payment processor APIs support global payments and alternative methods like crypto or BNPL?

Many modern APIs, including Whop, Stripe, PayPal, and Adyen, support global payments, multi-currency transactions, and alternative methods like Apple Pay, Google Pay, Afterpay, Klarna, and even cryptocurrencies. Choosing an API with wide coverage ensures you maximize acceptance rates and reach international customers.