A payment API or gateway is a set of tools and protocols that allows businesses to integrate payment processing functionality into their websites and mobile applications. Payment APIs enable businesses to create custom payment flows that can be tailored to their specific needs, and process payments directly within their own systems without the need for customers to be redirected to an external website.

How payment APIs work

Payment APIs, or application programming interfaces, allow merchants more control and flexibility over the payments. They also help streamline the checkout process for customers which can, in turn, boost their level of satisfaction. Here’s a quick rundown of how payment APIs work.

Whop Payment API

Step 1: Integration

To kick off the API payment process, the business integrates the payment API into their website or app. This typically involves adding a few lines of code to the website or app to create a payment form where customers can enter their payment information. The API provider will typically offer libraries, SDKs, and guides to help with the integration process.

Step 2: Payment information collection

When a customer initiates a payment, they will enter their payment information into the payment form on the business's website or app. This information is then sent to the payment API.

Step 3: Data encryption

The payment API will encrypt the payment information before sending it to the appropriate payment processor. This is done to protect the sensitive information as it is transmitted over the internet.

Step 4: Transaction request

At this point, the payment processor will contact the customer's card issuer to request authorization for the transaction. This process is known as an "authorization request" and typically involves multiple steps and parties.

Step 5: Authorization

If the transaction is approved, the payment processor will send an "authorization response" to the API. These responses usually include details such as the transaction amount, a unique transaction ID, and the status of the transaction (approved, declined, etc.).

Step 6: The payment API notifies the website

Once the API receives the authorization response, it will send a response back to the company’s website or app. The business can then use this response to update the customer's account and complete the purchase.

Step 7: Capturing the payment

In most cases, the payment is not captured and authorized immediately, but later. This step is known as "capture" and is triggered by the business either through a specific API call, or automatically by the company’s system.

Step 8: Settlement

Once the payment has been captured, the funds will be settled, meaning that they will be transferred from the customer's account to the business's account. The time for the funds to be settled will depend on the payment method and the processor involved.

Step 9: Refunds and disputes

Payment APIs also typically include features to handle refunds and disputes. For example, if a customer needs to return an item or disputes a charge, the business can initiate a refund through the API.

Step 10: Security measures

Finally, because payment APIs handle sensitive data, it’s important that they implement strong security measures to protect against fraud and data breaches. Many APIs evaluate and assess payments once they have gone through to ensure that they maintain a robust security protocol and are keeping customer data safe. These measures include:

- The encryption of data both in transit and at rest

- Two-factor authentication to confirm the identity of the customer

- Fraud detection algorithms to detect and prevent fraudulent transactions

- Regular security audits designed to ensure compliance with industry standards and regulations

Pros and cons of payment APIs

Payment APIs offer numerous advantages to users. Still, there are some things to be aware of before using an API to facilitate payments. Here are some of the top pros and cons of APIs.

Pros

- Convenience: Payment APIs allow customers to make purchases or payments directly within the company's website or application, without having to be redirected to a separate payment gateway.

- Improved user experience: By streamlining the checkout process, payment APIs can help improve the overall user experience and encourage customers to complete their purchases.

- Increased security: Payment APIs can reduce the risk of fraud by securely transmitting sensitive customer data directly to the payment processor rather than requiring customers to enter this information on an external website.

- Greater flexibility: Payment APIs can be customized to meet the specific needs of a business, such as accepting multiple types of payments or implementing recurring billing.

- More control over transaction data: Another good thing about payment APIs is that they enable businesses to access detailed transaction data. This often includes customer information and purchase history, which can be used to improve marketing and customer service.

Cons

- Integration challenges: In many cases, implementing a payment API requires significant technical expertise and resources, which can be a challenge for small businesses or companies that lack dedicated IT teams.

- Potential security issues: If an API is not implemented correctly, it can leave sensitive customer data vulnerable to cyber attacks or fraud. This can not only result in financial loss for businesses, but permanent reputation damage.

- Limited support: Many APIs support a limited number of payment methods, which can limit an organization’s ability to reach a global customer base.

- Additional costs: Some payment APIs require a monthly or annual fee. These costs can really add up over time, especially for businesses with low transaction volumes.

- Limited customization: Some providers may offer a limited set of features or customization options, and that could prevent a business from taking full advantage of the system capabilities. If you plan on modifying or distributing the source code, it’s important to look for an open-source platform.

Things to consider when choosing a payment API for your business

When choosing a payment processing API for their business, merchants should consider several key factors. Here are some of the most important things to think about when making a final decision.

Cost

One of the most important factors to consider when choosing an online payment API is cost. This includes any setup fees, monthly or annual fees, and transaction fees associated with the service. Businesses with low transaction volumes may find that the additional costs associated with a payment API are prohibitive. Merchants should also check to see if there are any additional costs for features such as fraud prevention, recurring payments, or refunds.

Adyen is an example of an affordable payment API. It charges interchange plus 12 cents per transaction for Visa and Mastercard, 3.3% plus 22 cents for American express, and 12 cents plus 3-12& for other payment methods depending on transaction type. Best of all, there are no monthly fees.

Security

Security is a critical concern when it comes to online transactions, and merchants should be sure to choose a payment API that provides robust security features such as encryption, fraud detection, and compliance with industry standards like PCI-DSS. This is particularly important for merchants that handle sensitive customer data like credit card information.

Reliability

Businesses should also consider the reliability of a payment API, including the availability of the service, the time it takes to process transactions, and the API's ability to handle high volumes of transactions.

A reliable payment API is essential to ensuring that customers can complete transactions quickly and easily, which can help to increase sales and improve customer satisfaction. Be sure to check if the API provider offers any kind of SLA or uptime guarantees.

Convenience

Payment APIs should be convenient for both merchants and customers. They should easily integrate with other websites and applications, and support a variety of needs and payment types, such as credit cards and e-wallets. In addition, merchants should choose an API provider that offers a sandbox environment testing the integration before going live.

Flexibility

Some merchants may require additional features such as recurring payments, partial payments, subscriptions, or even the ability to split payments among different parties. Choosing a payment API that is flexible and can adapt to your specific business needs is always helpful. Merchants should also try to choose an API that allows for customization of the checkout process and can support different languages and currencies.

Support

Payment APIs can be complex to set up and manage, which makes customer support an essential factor to consider. Businesses should choose a provider that offers a high level of support, including documentation, tutorials, and a dedicated customer support team. Your provider should offer support for different integration methods like SDKs. They should also have a sample code available for different programming languages. Luckily, if you choose to go with Whop for your payment API you get all of then and then some!

Integration

Ease of integration of the payment API with their website or application is another critical factor merchants should consider. This may require technical expertise and resources. It’s important to evaluate the level of support and documentation provided by the payment API provider. You might also check to see if the provider offers webhooks or other means of real-time notifications to be informed about the status of the transactions in real time.

Compliance

Some businesses require compliance with standards such as GDPR or HIPAA. It is essential to check if the provider is compliant with those regulations and would be able to support the business accordingly. See if they are certified by PCI-DSS or other security standards and if they have a clear security policy and incident response plan in place.

Scalability

Businesses rarely stay in the same spot forever. They may experience rapid growth and an increase in sales over a short period of time. As such, you should choose an API that can scale alongside your organization and equip you with the tools and resources you need, whether you’re just starting out or expanding your offerings after several years in business.

So how do APIs compare to third-party payment systems?

Whereas payment APIs allow two separate software systems to communicate with each other to process payments, third-party, standalone systems provide the infrastructure and technical capabilities to process payments on behalf of merchants and others. It’s important to see how they stack up against each other in order to find the system that’s right for your business.

To start, payment APIs are generally more flexible and customizable than third-party payment systems. Because APIs allow different systems to communicate with each other, they can be integrated into a wide range of different types of software and platforms. Third-party payment systems, by contrast, typically require merchants to redirect customers to their own checkout pages, which can complicate the process.

Also, with payment APIs, merchants and organizations have more control over the customer experience and can design the checkout process to match their brand. Third-party payment systems often have limitations on the design and functionality of the checkout process. While both APIs and third-party gateway systems can be made secure, APIs often provide a higher level of security since they are integrated directly within the software and have access to a robust suite of security features. Third-party systems rely more heavily on their own security measures, which may be insufficient for merchants’ needs.

Setting up your payment process with Whop

Whether you decide to use a payment API, a third-party payment gateway, or something else entirely, it’s important to consider ease of use. The system should be easy to access for both merchants and customers. It should also provide support for a variety of payment options. For example, Whop allows users to accept several different forms of payment when charging access to their Discord. These include:

- Credit and debit payments

- One-time crypto payments

- Renewing crypto payments

With Whop, you can also provide access to your Discord for free. No matter your customers’ preferred method of payment—or lack thereof—you can easily set up payments in a way that’s convenient for you and those that use your Discord.

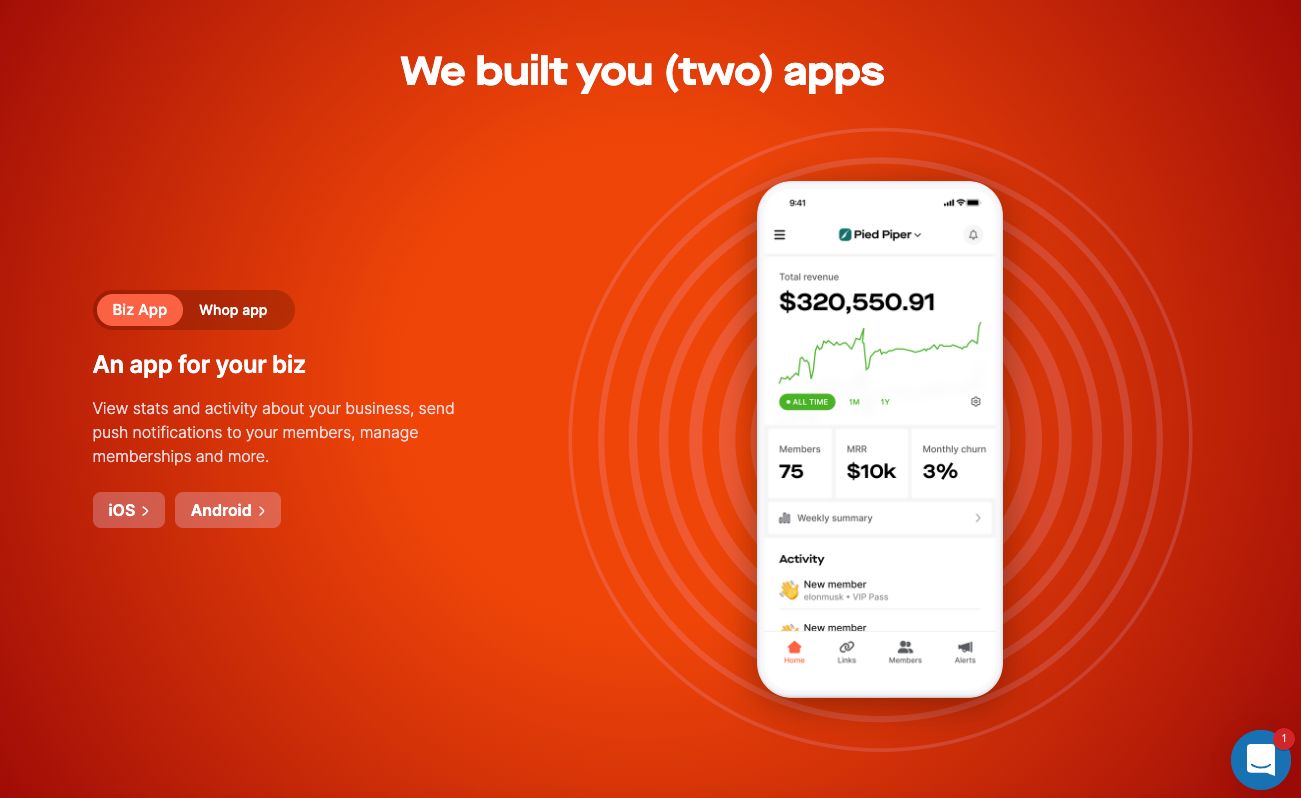

Whop’s powerful API allows users to easily authenticate and interact with your customer base, giving them the options they deserve. Those that are building desktops, webs, and mobile apps, you can benefit from Whop’s seamless payment process, monetizing content including paid memberships, recurring subscriptions, and NFT gaming.

You shouldn’t have to worry about payments—you should be able to focus your time and energy on what actually matters: running your business. Whop’s API handles payments so that you can spend more time interacting with customers and doing what you do best.

Click here to find out more about selling your digital products on Whop.

![Top 23 best dropshipping Discord Servers [July 2025]](/blog/content/images/size/w600/2024/02/Top-Dropshipping-Discord-Servers--1-.webp)

![Top 16 best ecommerce Discord servers [July 2025]](/blog/content/images/size/w600/2023/09/ecommerce-groups.webp)