Durango Merchant Services is a great independent sales organization that specializes in high-risk businesses and provides features like virtual terminals, shopping cart integrations, and a powerful gateway. Find out if its the right ISO to use for your business.

Key takeaways

- Durango Merchant Services specializes in getting merchant accounts approved for high-risk businesses that traditional processors reject.

- High-risk merchants should expect rolling reserves of 5-10% held for months, impacting cash flow even though funds are eventually returned.

- High-volume businesses processing over $100,000 monthly can negotiate significantly lower transaction fees with Durango.

Durango Merchant Services is a financial services company built specifically for high-risk businesses that operate in fields like insurance, fine jewelry, digital downloads, subscriptions, and supplements.

It also works with low and medium-risk businesses as well.

Durango helps you open a merchant account with transparent pricing, multi-currency support, virtual terminals, shopping cart integrations, and protected payment gateways.

Accepted payment methods include Visa, MasterCard, Discover, American Express, Google Pay, and Apple Pay.

I dug into Durango Merchant services so you don't have to. Here's what I found on Durango's services, pricing, and features.

How Durango Merchant Services works for sellers

Durango Merchant Services is an Independent Sales Organization. They don't process payments themselves - instead, the services connect businesses to bank networks that actually process payments.

Here's how the payment flow works:

- Customer enters their payment details on the business' website or virtual terminal

- Payment goes through the Durango Pay Gateway and checks with the processor (Fifth Third Bank) if the funds are available or not

- The processor connects to the customer's bank to approve or decline the payment

- Money moves from your customer's account to yours

Durango, you can accept credit card payments, digital wallet payments (via Google and Apple Pay), ACH (e-check), and even cryptocurrencies.

Who is Durango Merchant Services for?

Durango Merchant Services is for all businesses, but it's specifically built for high-risk merchants.

A high-risk business is one with higher chances of chargebacks, unpredictable revenue, fraud exposure, or a business model and product that banks see as risky.

For example, if a business is selling subscriptions, high-ticket items, supplements, or nutraceuticals, traditional processors like Stripe or Square might reject their application - or worse, hold your funds.

For example, Derek Wilmer from Whop learned this the hard way - "December 2nd, 2019, PayPal took $264,000 from me for elevated risk, and never returned it".

But Durango isn't just for high-risk merchants.

From what I found, they also work with low and medium-risk businesses, businesses with high volume ($100,000+ per month for lower rates), B2B (business-to-business) and B2G (business-to-government) businesses (for lower interchange rates), and international vendors.

What industries does Durango Merchant Services support?

Durango Merchant Services support all kinds of industries from high-risk ones to regular, low-risk industries. They're especially good at helping businesses get merchant accounts in sectors that other processors and ISOs often avoid.

Durango Merchant Services specifically list over 25 industries that commonly require a high-risk merchant account, and it includes:

- High ticket items

- Travel companies

- Supplements

- Memberships sites

- Bad credit

- Health & beauty

- Luxury goods

How much does Durango Merchant Services cost?

Durango uses interchange-plus pricing, which I appreciate for its transparency.

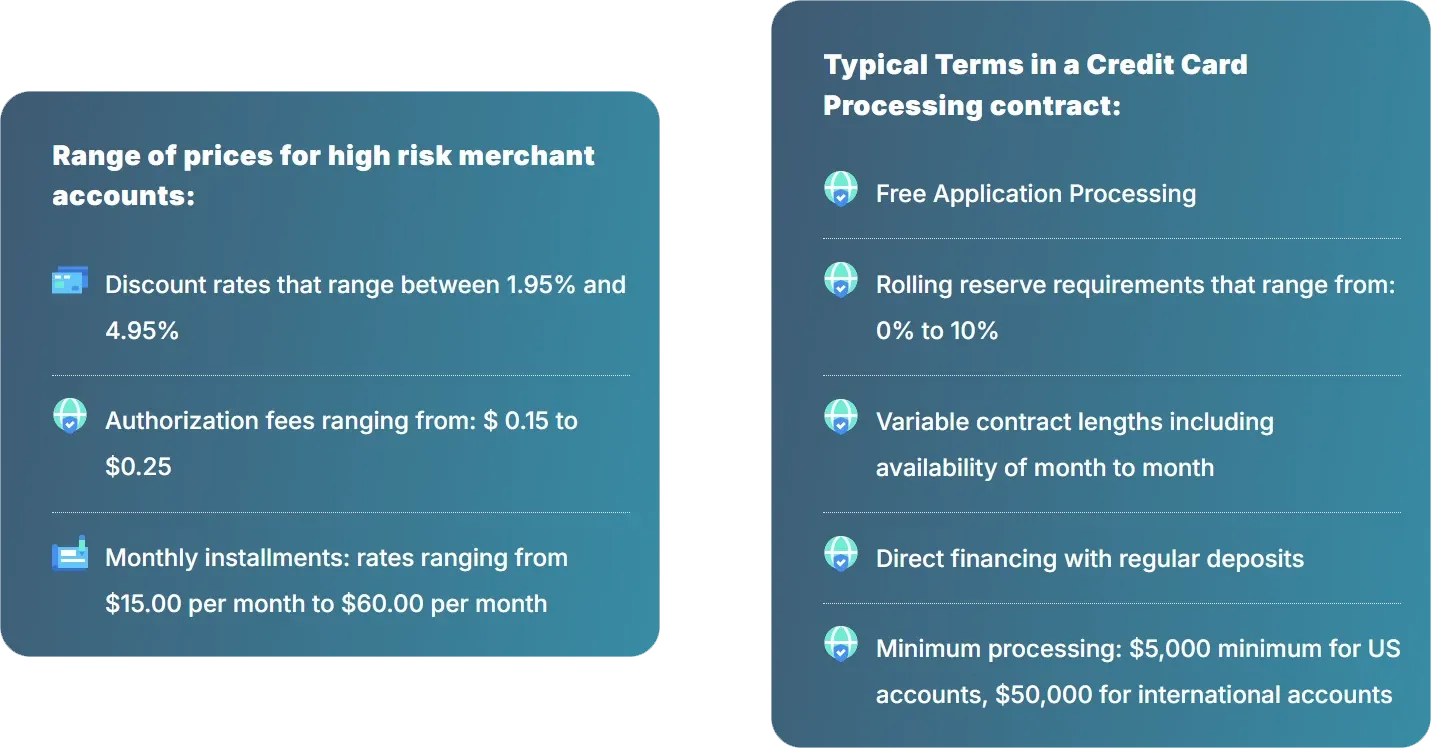

Your exact fees will depend on your business type, payment method, and what you sell - here's the typical range I found:

| Fee type | Range |

|---|---|

| Processing fee | 1.95% – 4.95% |

| Authorization fee (per transaction) | $0.15 – $0.25 |

| Monthly subscription | $15 – $60 |

| ACH return fee | $2 – $10 |

| Chargeback fee | $20 – $100 |

| Rolling reserve | 5% – 10% (held for 3 to 6 months) |

An important chunk of the fees are set by card networks like Visa and MasterCard. These rates differ based on the risk profile of the business, and the amount that's being processed.

High-risk merchants should also expect a rolling reserve, meaning that Durango Merchant Services will hold 5% to 10% of daily sales for 3 to 6 months to cover potential chargebacks.

This isn't really a fee since you eventually get your money back, but it still affects operations.

If the merchant is providing B2B or B2G services, they can qualify for lower interchange rates, and if you're processing over $100,000 per month, you can negotiate lower transaction fees.

How to get started with Durango Merchant Services

You can start working with Durango Merchant Services by either using the application form on the website, or directly getting in contact with the Durango Merchant Services sales team by calling or sending an email to them.

Once you apply, an account manager will contact you within 24 hours (usually) and guide you through the full application and approval system.

During the application, you'll be asked to submit three (more in some cases) documents as a standard procedure:

- A copy of your drivers license or passport

- A voided business check or bank reference letter

- Proof of business (business license, articles of incorporation or articles of organization)

Once Durango Merchant Services has all the information it needs from you and your business, the approval period starts, which usually takes 4 to 6 business days.

In some cases, approval can be within a day or can go up to 2 to 4 weeks.

Key features of Durango Merchant Services

Durango Merchant Services offers a lot of services and features to businesses that work with them. Some of the key features that stood out to me were:

High-risk merchant accounts

High-risk approvals are Durango Merchant Services' speciality. They individually review businesses and understand your industry's risk profile, lowering the chances of future declines.

Credit card, crypto, and large ticket processing

Durango Merchant Services supports a wide range of payment methods from credit card to crypto.

The thing that stood out to me the most is crypto payments are automatically converted to the local currency of the business and deposited to the bank.

If you're processing large B2B or B2G transactions, you can even qualify for lower interchange rates.

Virtual terminals

DMS' virtual terminals are built into their payment gateway, so you can take payments without hardware.

This is especially useful for phone orders, invoices, and other payment methods where card readers are not present.

Recurring billing

If you're using a recurring billing pricing system, DMS can help you with it, allowing you to take payments without collecting card details each time.

Integrations

DMS' payment gateway can be integrated into over 150 shopping carts (like WooCommerce and Shopify) and you can even do custom integrations with their API.

Dedicated account managers

When you work with DMS, you get a real dedicated account manager assigned to you.

All accounts managers at DMS are experts in their industries and they will walk you through application, approval, and other operations moving forward.

Powerful payment gateway

DMS' payment gateway is what called an "omni-channel platform" - it works online, in-person, mobile, and over the phone.

I'm most impressed with the security features the gateway offers: AI-powered fraud detection, 3D Secure 2.0, tokenization, and more. Their security is tight.

Pros & cons of Durango Merchant Services

As with all sales organizations, Durango Merchant Services also has its own pros and cons.

Let's break them down.

Pros

- Ability to lower processing fees for high-volume businesses ($100,000+/month)

- Dedicated account managers

- Multiple payment method support

- Strong security and fraud protection

Cons

- High processing fees (1.95% to 4.95%)

- No standard pricing

- Can hold back 5% to 10% of sales for 3 to 6 months of high-risk businesses

Durango Merchant Services alternatives

Durango is solid for high-risk businesses, but it's not your only option. Here are the alternatives I'd consider:

1. Whop

Whop is an all-in-one platform that works for all business types.

With a 2.7% + $0.30 processing fee and no monthly costs, Whop routes payments through multiple providers to prevent declines. Plus, you can run an entire business on the platform or use it as just a payment service.

Whop works whether you're high-risk or not, so you won't need to switch providers as you scale your business.

You also get built-in tools to handle recurring billing, sending invoices, selling courses, community memberships, and more.

2. PayWorld

PayWorld is a high-risk payment processor that accepts most high-risk businesses that traditional processors would reject, like forex, nutraceuticals, and e-wallets. Their virtual terminal allows merchants to accept payments without advanced hardware.

They also support subscription and recurring billing models, which are usually considered high-risk by other traditional processors and is a common decline reason.

Plus, they offer international banking options to businesses that need it.

3. Payline

Payline is a merchant services provider that offers interchange-plus pricing (interchange + 0.4% + $0.10 per transaction) with no hidden and other fees like PCI compliance, cancellation, or application.

Businesses get a dedicated account manager when working with Payline.

Parting with over 20 banks makes it easy for businesses that work with Payline to get merchant accounts for their high-risk businesses. They also offer same-day approvals if you apply online.

4. PaymentCloud

PaymentCloud is another high-risk merchant provider with a high approval rate. Its fast approval times (48 hours) also makes it stand out. Businesses that work with PaymentCloud get their own account managers and 24/7 support.

PaymentCloud works with many payment gateways so you won't need to switch your payment setup.

They also have their own tool called Paysley for accepting multiple payment methods from credit card to bank transfers.

Why I recommend Whop instead

If you're not specifically a high-risk business, Durango Merchant Services might not be the best choice for you, especially due to high fees.

No matter what kind of a business you're running, I recommend Whop.

Whop is built for all types of businesses, whether you're selling digital products or in-house services - plus, no hidden fees or monthly subscriptions needed. This is why major creators like TJR and Frugal Season work with Whop.

When you use Whop, you:

- Pay a 2.7% + $0.30 for each transaction

- Can accept credit cards, cryptocurrencies, BNPL options, and ACH

- Can build your entire business on Whop - no more juggling between tools and platforms

- Get lower declines because the payments you receive goes through multiple payment service providers

Whop helps tens of thousands of businesses to both run their entire operation on Whop, or just process their payments using its API or embedded checkouts.

Signing up to Whop and creating your business takes less than 10 minutes - join us today.

FAQs

Is Durango Merchant Services a payment processor?

No, Durango Merchant Services isn't a payment processor - it's an ISO (independent sales organization). Rather than directly processing payments, they connect businesses to banks and processors worldwide and help them get approved for merchant accounts.

Can I accept multiple currencies with Durango Merchant Services?

Yes, Durango Merchant Services' payment gateway supports multi-currency payments including USD, EUR, JPY, GBP, and more.

Which industries are considered high-risk?

Industries with higher chances of chargeback rates and complex regulations are considered high-risk. Some examples are online gaming, nutraceuticals, supplements, and CBD products.

Does Durango Merchant Services have monthly fees?

Yes, Durango Merchant Services have monthly fees ranging from $5 to $60 depending on your business type and risk level.

Can I integrate Durango Merchant Services payments to my shopping cart system?

Yes, Durango Merchant Services offers shopping cart integration through their payment gateway which connects to major platforms like WooCommerce and Shopify.