If you explore a broker’s trading interface, talk to traders, or even spend some time on a trading subreddit or Discord server, you wouldn’t be alone if you started to feel a little lost. Modern trading is so much more than just buying and selling shares, and options trading is one of the biggest, and most often misunderstood, areas of finance.

In this brief guide, we’ll give you a primer on how options trading works, what the most common types of options are, and even demystify the options Greeks.

Options Explained

An option is nothing more than a contract between two parties for the purchase or sale of an asset at a predetermined price and fixed time in the future. By buying one of one of these options contracts, you give yourself the right to exercise its terms.

The key components of an options contract are the agreed price, known as strike price, the fixed expiration date, and the option premium. The premium is a fee charged by the option’s dealer, and it’s something you can collect as well if you decide to write options rather than just buy them.

You may have heard terms like “in the money” (ITM) and “out of the money” (OTM) being used when options come up in conversation. These terms refer to the price of the stock compared to the strike price. If you’ve got an option to buy a stock for $10 but it’s trading at $15, then you’re very much ITM.

The ITM, OTM, or “at-the-money” status of the option becomes increasingly important as the option’s expiration date draws near. Buying an OTM option when the expiration date is very close is a risky move. It should also have a low premium, since the likelihood of it paying off is also quite low.

The entire point of options trading is that they tend to limit the maximum losses a trader faces. This is because all you need to pay is the option premium, a sum far lower than purchasing the entire lot of underlying assets.

If your option contract expires OTM then you do lose the premium you paid, but that’s a far smaller amount than a “bag” of thousands of fast-depreciating shares if you’d bought them outright instead.

Types of Options

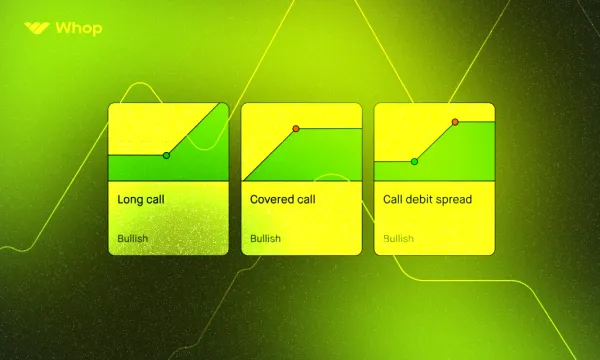

Options trading can get complicated fast given the innumerable strategies available to traders, but everything comes down to two broad options types, the call and the put.

Call Options

If you buy a call option, your hypothesis is that the underlying stock is going to go up. Calls are a powerful tool for investors as well as traders, since it’s possible to look at strikes that expire soon as well as those that are a long way off.

Many investment firms and professional investors use call options with a view to actually exercising them. The analysts at the firm might see a strong possibility of the stock doing well, so the firm puts down the premium on calls. This is, after all, a lot cheaper than actually buying the shares outright.

The calls then give the investor the option to buy at a later date. If the stock does well as predicted, the investor exercises the option, meaning that they pay the cash corresponding to the strike price and take delivery of the shares at a far lower price than they’re trading for.

On the other hand, traders generally don’t exercise their options. Once a call goes ITM, the trader would much rather sell the option to another buyer and take the quick profit rather than the shares themselves.

For example, let’s use a fictional stock that’s trading for $100. If your broker charges you a premium of $3 per share for a strike price of $105, you can buy a call option contract representing 100 shares for $300.

If the stock goes to $110 before the contract expires, you’re $5 ITM per share. However, your call options aren’t just for one share, they’re for a hundred. This means that your gain is actually closer to $500, which isn’t bad on a $300 buy-in. If you’d used the $300 to buy 3 shares, you’d only make a $30 profit. You’d have assets worth $330, while the options trader has $500 cash.

On the other hand, if the share performs purely, the investor still has an asset worth something at the end of the day. The options trader loses his entire premium.

Put Options

Calls let you bet on a stock going up, so puts do the opposite. A put option contract lets you “put” a share to someone for a set strike in the future, essentially allowing you to agree on a price now with a hope that the stock crashes to a much lower point.

Puts aren’t usually as profitable as calls because the potential for a stock to decrease is lower than in the other direction. That said, put options are a safer option than short selling if you want to trade on the bearish side—losses with puts are again limited to your premium, but short selling losses can be infinite.

Options Greeks

Options experts, bonafide or not, tend to talk about far more than just calls and puts. The premium that you’ll pay for options are defined by a set of measures called Greeks which revolve around risk.

The first thing to know in order to understand the Greeks is that option pricing depends heavily upon the volatility of the stock. Simply put, if the market expects the stock to be volatile, there’s more likelihood of its price meeting different strikes. Thus, a rising “implied volatility” tends to increase premium.

Delta

Delta is the Greek that looks at the effect of a change in the stock price. It’s usually expressed on a scale of -100 to 100 or -1.00 to 1.00. Quite simply, an option with a delta of 0.50 will see its premium increase by $0.50 if the stock price goes up $1.

Delta in the 0.50 range is generally seen with “at-the-money” options, while OTM options tend to be close to zero and ITM options range toward the extremes.

A lot of traders regard delta as the probability of an option being ITM at expiration. An OTM call with a delta of 0.60 is generally accepted to have a 60% chance of being ITM when expiration comes around.

Gamma

If you look at delta when deciding on your options trading strategies, you also need to consider gamma, which looks at how delta changes over time. It measures exactly how fast this happens and can give you an idea about future expectations.

High gamma tends to be seen with at-the-money options while deep ITM and OTM options will see low gamma values. If delta refers to the probability of an option being ITM at expiration, gamma can give you an idea of how stable that probability is—high gamma meaning lower stability.

Theta

Given that the chance of an option being profitable decreases with the passage of time, time decay is a factor that is often looked at by traders. This time decay is expressed by the options Greek theta.

Generally good for the seller rather than the buyer, theta can show how much dollar value the option loses on a day to day basis. While appearing linear over the long term, theta slopes get steeper when expiration nears.

Vega

The final major options Greek, vega looks at changes in expectations for future volatility. We’ve already examined the importance of volatility when it comes to options and their premiums, so vega can be quite helpful in assessing the effects of changing implied volatility.

Using all of the four options Greeks together, you can measure an option’s premium quite accurately. Delta looks at how much the premium changes when the underlying asset moves, and then gamma shows delta’s rate of change. Theta then looks at how premium drops closer to expiration, and vega indicates the option’s sensitivity to price changes that trigger volatility.

Risks of Options Trading

As much as your broker might dissuade you from making the comparison, options trading can sometimes feel a lot like betting. One reason for this is that you’re putting down money to pay for an option’s premium, then waiting for the contract to run its race. If it stays OTM throughout and then expires without ever going ITM, it’ll expire worthless and your money’s down the drain.

On the other side of that same coin, options provide a leveraged opportunity to earn a large return with proportionally low investment. A winning options bet of a few hundred dollars can reward you exponentially, while just purchasing the underlying assets and then selling them in the traditional way would result in a comparatively small gain.

It’s also worth noting that, even if options isn’t betting, the counterparties you’re trading against are playing the role of the house. And thanks to trading practices such as Payment For Order Flow, where market makers literally pay brokers for information about your orders, the house always wins. Your broker certainly does, since they collect your premium whether you strike rich or lose it all.

All of that said, options trading is a legitimate strategy to earn off a strong hypothesis or hedge a portfolio. They were created for risk management and can still play that role even though plenty of traders see them purely as a vehicle for speculation. For more on some of these options strategies, check out our in-depth guide to options trading!

Key Takeaways

Options are legally binding contracts between two parties that give the buyer the option to buy or sell an asset for a predetermined price, or strike, at a fixed date in the future. As commonly used in portfolio hedging and risk management as in speculation, options can amplify returns and reduce losses but leave a trader with nothing if they expire out of the money.

👉 If you want to learn more about options or talk over your options strategies with some of the smartest minds in the space, check out Whop’s trading page for all of the top options trading communities!

🏆 Read next: Whop's Top 10 Best Trading Discord Servers

![Top 10 Best Forex Trading Discord Servers [2024]](/blog/content/images/size/w600/2024/05/Top-X-Best-Forex-Discord-Servers.webp)

![Top 30 Best Trading Podcasts [2024]](/blog/content/images/size/w600/2024/06/Top-X-Best-Trading-Podcasts.webp)

![Top 21 Best Trading Discord Servers [July 2024]](/blog/content/images/size/w600/2023/08/trading-discord-servers-large.png)