The best low-fee payment platforms and processors in 2026 are Whop, Stripe, Helcim, Square, and PayPal. Explore 30 providers and see which one fits your business best.

Key takeaways

- High-volume businesses can save significantly by choosing subscription-based processors over percentage-only pricing models.

- Zero-fee processors like Nadapayments legally pass costs to customers through surcharges, eliminating merchant fees entirely.

- The best low-fee processor depends on your business type—creators benefit from all-in-one platforms while retailers need strong POS features.

In my experience, platforms like Whop, Stripe, Helcim, Square, and PayPal are some of the most reliable low-fee options for accepting payments.

Each has its differences - some are cheaper, some offer extra features - but all can work really well depending on your setup.

I’ve put together a list of 30 of the best low-fee payment platforms and processors you should consider in 2026, based on real-world usability, fees, and flexibility.

30 best low fee payment processors and platforms

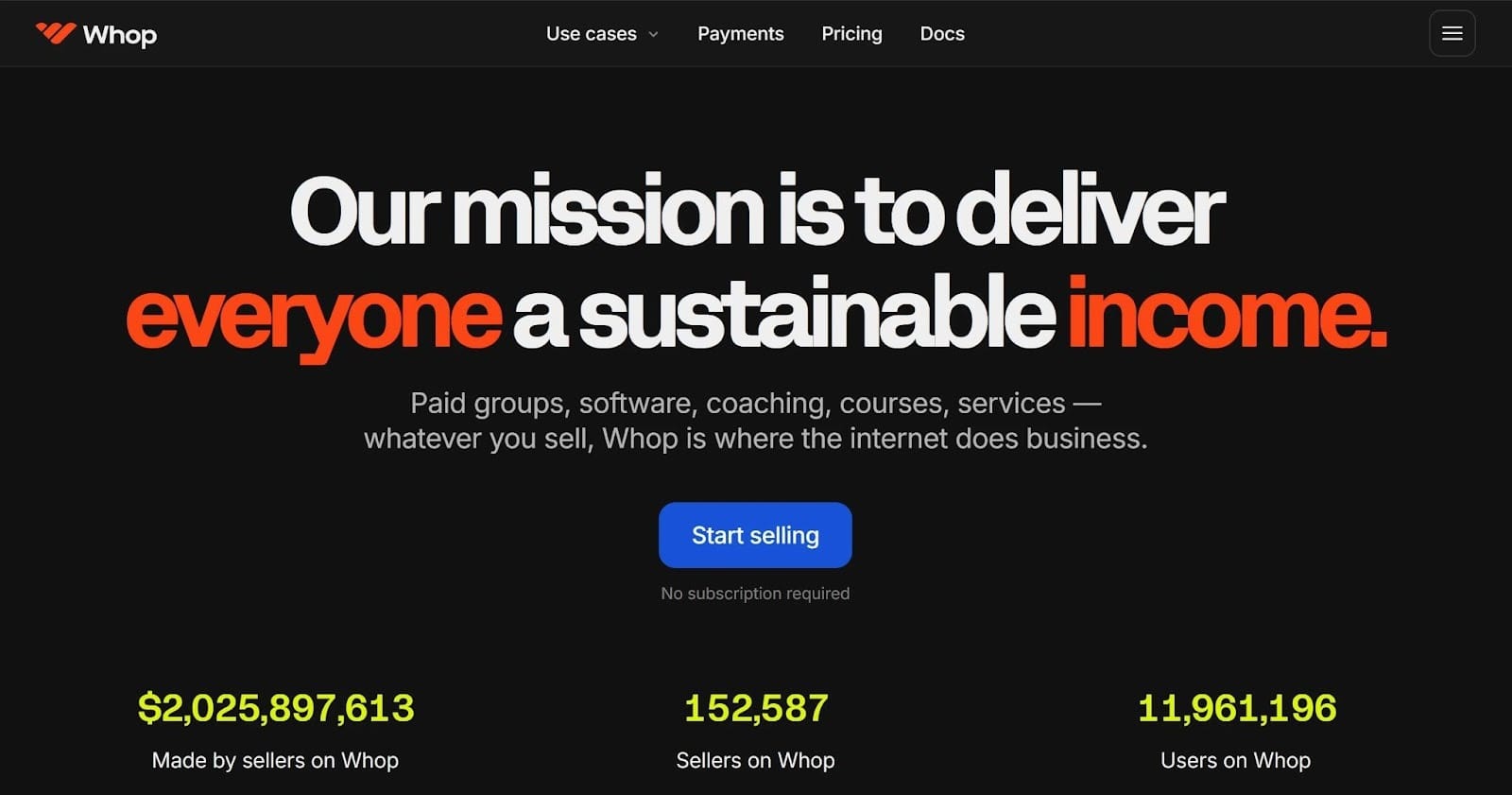

1. Whop

I’ve used Whop myself (no surprise there!), and what I love about it is that it’s truly an all-in-one platform for creators and small businesses. You can start, manage, and grow your online business entirely on Whop - payments included - or just use it as a standalone payment solution.

There are no monthly fees, the processing rates are low, and you can sell in multiple ways: credit cards, PayPal, crypto, BNPL, and more. Here’s a quick breakdown:

- Online payment fee: 2.7% + $0.30 (domestic cards), +1.5% for international cards, +1% for currency conversion

- In-person payment fee: 2.7% + $0.30

- Monthly membership fee(s): $0

- Best for: Creators or small businesses who want a single platform to run their business and handle payments without using multiple tools

2. Stripe

Stripe is one of the most widely recognized payment platforms, trusted by businesses around the world.

It allows merchants to accept credit cards, debit cards, BNPL, bank transfers, and other forms of payment, giving your customers plenty of options at checkout.

Stripe isn’t just about accepting payments. It comes with a suite of features designed to make managing your business easier: subscription management, automated invoicing, multi-currency support, and global payment processing.

- Online payment fee: 2.9% + $0.30 (domestic), +1.5% international, +1% currency conversion

- In-person payment fee: 2.7% + $0.05

- Monthly membership fee(s): $0

- Best for: Stripe is a solid choice if you want a payment platform that grows with your business and can handle multiple payment types seamlessly

3. Helcim

Helcim is a Canada-based payment platform designed with small and medium businesses in mind. It allows merchants to accept both online and in-person payments.

One of Helcim’s standout features is its competitive fees. Online payments average 2.49% + $0.25, though the exact rate can vary based on card type and transaction volume. For in-person payments, fees average 1.93% + $0.08.

On top of that, Helcim charges no monthly membership fees, making it straightforward and predictable for businesses managing tight budgets.

Other tools, like the Helcim Smart Terminal, make taking payments in person easier and more professional. All in all, Helcim is a popular option for small and medium businesses looking for low-fee payment processing both online and offline.

- Online payment fee: 2.49% + $0.25 on average, varying by card type and other factors like transaction type

- In-person payment fee: 1.93% (avg) + $0.08

- Monthly membership fee(s): $0

- Best for: Small and medium businesses that want both online and in-person payment processing with low fees

4. Square

Square let merchants accept credit cards, digital wallets, and contactless payments both online and in-person.

The platform includes a free POS service with features like inventory management, employee scheduling, customer directories, and sales analytics.

Square’s 2.6% + $0.10 in-person processing fee is one of the reasons many businesses prefer working with Square. Signing up for the Plus plan ($89 per month) lets merchants access features like custom reports and next-day deposits.

- Online payment fee: 2.9% + $0.30

- In-person payment fee: 2.6% + $0.10-$0.15

- Monthly membership fee(s): $0 (basic), $89 (Plus plan)

- Best for: Small and medium businesses that want free extensive POS systems to handle both online and in-person payments

5. PayPal

PayPal is one of the most popular payment processing solutions in the world. With PayPal, merchants can take credit card, debit card, PayPal balance, and Venmo payments. The platform works for online stores with digital checkout pages and in-person sales with QR code and invoice payments.

While PayPal’s 2.99% + $0.30 online processing fee sits at the higher-end of most payment processors, it’s one of the most secure and powerful processors in the market.

If you’re accepting in-person payments with QR codes, the fee goes down to 2.29% + $0.09.

- Online payment fee: 2.99% + $0.30 (standard), 3.49% + $0.30 (other commercial transactions)

- In-person payment fee: 2.29% + $0.09 (with QR codes)

- Monthly membership fee(s): $0

- Best for: Businesses who want to process payments with a global processor with checkout pages, QR codes, and in-person processes

6. Stax

Stax is a subscription-based payment processor that charges a monthly fee plus a processing fee instead of most other processors which charge percentage-based fees.

Merchants using Stax pay the interchange (the fee that card networks charge) + $0.07-$0.15 per transaction depending on the payment type.

Stax can be integrated with more than 200 business apps including QuickBooks, Salesforce, and most POS systems. The platform includes features like invoicing, recurring billing, advanced analytics, and surcharging capabilities.

- Online payment fee: Interchange + $0.08-$0.15 per transaction

- In-person payment fee: $0.08-$0.15 per transaction

- Monthly membership fee(s): $99-$199+ (based on volume)

- Best for: Businesses with a high monthly volume that prefer monthly membership fees instead of percentage-based fees

7. Payment Depot

Payment Depot is a membership-based payment processor that offers two pricing models: The interchange-plus plan charges 0.2-1.95% in fees with no monthly fees. The subscription plans ($59-199/month) charge only $0.05-0.15 per transaction plus interchange.

Merchants pay a monthly subscription ($59-$99 per month based on volume), designed to scale with the merchant’s growth.

The platform also offers features like virtual terminals, ACH processing, and is compatible with most POS hardware.

- Online payment fee: Interchange + 0.2-1.95% (no monthly fee plan) or interchange + $0.05-0.15 per transaction (with subscription plans)

- In-person payment fee: Same as online payment fee

- Monthly membership fee(s): $0 (interchange-plus) or $59-199 (subscription plans based on volume)

- Best for: Businesses that want a payment processor that helps them scale and adapt their processing fees accordingly

8. Dharma Merchant Services

Dharma Merchant Services is a payment processor offering interchange plus low processing fees to merchants. The company charges interchange plus 0.15% + $0.08 for in-person Visa/Mastercard/Discover transactions and 0.20% + $0.11 for online payments, with slightly higher rates for American Express cards.

One thing you should keep in mind is that Dharma Merchant Services only work with businesses that process at least $10,000 per month.

The $20 monthly membership fee includes access to their payment platform which lets users process online payments, send invoices, accept over-the-phone payments, and more.

- Online payment fee: Interchange + 0.20% + $0.11 (for Visa, MasterCard, and Discover), +0.30% + $0.11 (Amex)

- In-person payment fee: Interchange + 0.15% + $0.08 (for Visa, MasterCard, and Discover), +0.25% + $0.08 (Amex)

- Monthly membership fee(s): $20

- Best for: Businesses that process over $10,000 per month that want transparent interchange-plus pricing

9. Nadapayments

Nadapayments is a zero-fee payment processor that passes the processing costs to customers through surcharging. Merchants don’t pay any fees for credit card transactions while customers see a 3.5% surcharge at the checkout page. Debit card payments cost merchants 1% + $0.25.

Merchants can rent terminals for $35 per month or virtual terminal access for $29 per month which allows them to process payments from any web browser, generate payment links, send invoices, set up recurring billing, and store customer cards on file.

Both options include automatic surcharge calculations and signage to meet state and card network regulations.

- Online payment fee: 0% for credit cards (customer pays 3.5% surcharge) and 1% + $0.25 for debit cards

- In-person payment fee: Same as online payment fee

- Monthly membership fee(s): $35 (smart terminal rental) or $29 for virtual terminal access

- Best for: Merchants who want to eliminate their processing fees by legally passing them onto customers via surcharge

10. CardX

CardX is a surcharging payment processor owned by Stax that lets merchants accept credit cards and pay zero processing fees by passing them to the customer at around 3% - however, with debit card payments, merchants pay 1.25% + $0.25 per transaction.

CardX handles all surcharging compliance automatically and shares them with the customers transparently at the checkout. CardX helps merchants by allowing them to take payments online and in-person.

Depending on your preferred payment method, like with virtual or physical terminals, monthly memberships start at $29 per month and have two types: in-person and in-person and online.

- Online payment fee: $0 (customer pays around 3% surcharge) for credit cards and 1.25% + $0.25 per transaction for debit cards

- In-person payment fee: Same as online payment fee

- Monthly membership fee(s): $29-35/month for terminal or virtual terminal access

- Best for: Small businesses that want to eliminate credit-card processing costs via surcharge

11. GoDaddy Payments

GoDaddy Payments is the payment processing service that can be integrated directly into GoDaddy websites, online stores, and POS systems. GoDaddy lets merchants accept credit cards, debit cards, Apple Pay, ACH, and other payment methods both online and in-person.

The platform includes free features like Pay Links, mobile virtual terminals, Tap to Pay on mobile devices, and more.

Merchants can also use the Rate Saver, a surcharging option that passes processing fees to the customer.

- Online payment fee: 2.7% + $0.30 (e-commerce), 2.8% + $0.30 (invoicing/pay links)

- In-person payment fee: 2.5% + $0.00 (card-present via POS or mobile app)

- Monthly membership fee(s): $0 (standalone), $99-499 (with POS Plus plans that include Rate Saver)

- Best for: Small businesses that already use GoDaddy’s website or POS tools, wanting integrated payments and predictable flat-rate pricing

12. Host Merchant Services

Host Merchant Services is a payment processor that offers interchange-plus pricing. The online payment fee is interchange + 0.35% + $0.10 and in-person fee is interchange + 0.25% + $0.10, plus a $14.99 monthly membership fee. While the platform requires a monthly membership, its processing fees are competitive.

Host Merchant Services specialized in working with high-risk businesses - like sports betting.

- Online payment fee: Interchange + 0.35% + $0.10

- In-person payment fee: Interchange + 0.25% + $0.10

- Monthly membership fee(s): $14.99

- Best for: Small businesses that want transparent interchange-plus pricing

13. Chase Payment Solutions

Chase Payment Solutions is a payment processor from Chase Bank, offering flat rate processing fees for both online (2.9% + $0.25) in-person transactions (2.6% + $0.10). The platform can be used for $0 but high-volume or multi-currency businesses might have to pay monthly fees.

While you can process payments through the platform’s mobile apps or virtual terminal, you can also get wireless and countertop Case Terminals.

- Online payment fee: 2.9% + $0.25 for ecommerce, 3.5% + $0.10 for key in or payment link transactions

- In-person payment fee: 2.6% + $0.10

- Monthly membership fee(s): $15 but can be waived if you’ll be maintaining a linked personal Chase account, meeting military banking requirements, keeping a $2,000 daily balance, depositing $2,000 through eligible Chase Payment Solutions, or spending $2,000 on a Chase Ink Business card (can change for high-volume or multi-currency businesses)

- Best for: Businesses that use Chase Bank and/or want fast deposits, advanced support, and advanced analytics features

14. PaymentCloud

PaymentCloud is a payment processor that specializes in high-risk businesses like travel and pharmaceuticals. Processing fees of PaymentCloud are customized per business, but typically start at 2.4% + $0.10 for low-risk and 2.8% + $0.25 for high risk businesses.

The platform’s monthly fees range from $0 to $50 based on your business’ risk profile and processing needs.

- Online payment fee: 2.8% + $0.25 (medium-risk)

- In-person payment fee: 2.4% + $0.10 (low-risk retail)

- Monthly membership fee(s): $0-$50 (quote-based)

- Best for: High-risk businesses that require a specialized payment processor

15. National Processing

National Processing is a flat-rate and interchange-plus based payment processor. The standard payment processing fees of the platform is 2.4-2.5% + $0.10 for in-person and 2.9% + $0.30 for online payments.

The platform has three membership tiers: Basic in-person for card reader solutions with 2.5% + $0.10 processing fee for $14.95 per month, Basic Online for online payments with 2.9% + $0.30 processing fee for $14.95 per month, and Premium for POS systems with 2.41% + $0.10 processing fee for $19+ per month.

- Online payment fee: 2.9% + $0.30

- In-person payment fee: 2.4-2.5% + $0.10

- Monthly membership fee(s): $14.95-$19+

- Best for: Small and medium businesses that need flexible plans

Read next: What is payment acceptance, and how do you increase it?

16. Clover

Clover is an all-in-one POS system and payment processor that offers industry-specific solutions with different monthly subscriptions for restaurant, retail shops, professional services, personal services, and home & field services.

Clover stands out from the rest with its powerful hardware POS system options with features like inventory tracking and employee management tools.

The standard in-person processing fee of Clover is 2.3%-2.6% + $0.10 (varies by plan) and the online processing fee is 3.5% + $0.10.

- Online payment fee: 3.5% + $0.10

- In-person payment fee: 2.3%-2.6% + $0.10 (varies by plan)

- Monthly membership fee(s): Clover offers six business categories with varying subscriptions for each: Full service dining, quick-service restaurant, retail shops, professional services, personal services, and home & field services

- Best for: Businesses that want an all-in-one POS solution for online and in-person payments

17. Shopify Payments

Shopify Payments is a payment processing system for online stores built-into the Shopify ecosystem. As with many processors that have tiered membership plans, the processing fees go down as the tier goes up: 2.9% + $0.30 on Basic ($39/month), 2.6% + $0.30 on Grow ($105/month), and 2.4% + $0.30 on Advanced ($399/month).

In-person payments you process through Shopify POS doesn’t have flat processing fees, but only percentage based charges. The processor supports over 100 currencies and includes tools like fraud analysis and advanced analytics.

- Online payment fee: 2.9% + $0.30 (Basic), 2.6% + $0.30 (Grow), 2.4% + $0.30 (Advanced)

- In-person payment fee: 2.7% + $0.00 (Basic), 2.5% + $0.00 (Grow), 2.4% + $0.00 (Advanced)

- Monthly membership fee(s): $39 (Basic), $105 (Grow), $399 (Advanced), $2,300 (Plus)

- Best for: Businesses that already sell on Shopify and need a built-in, easy to set up payment processor

18. PayPal Enterprise Payments (formerly Braintree)

PayPal Enterprise Payments (formerly Braintree) is a PayPal owned payment processor that specifically works for online and mobile businesses. The platform allows merchants to accept PayPal, Venmo (at 3.49% + $0.49), Apple Pay, Google Pay, and BNPL options at a flat rate of 2.89% + $0.29.

The platform usually caters to tech-savvy businesses and can be integrated into already built systems with its API - it also offers tools like recurring billing and advanced analytics.

- Online payment fee: 2.89% + $0.29 (standard merchants)

- In-person payment fee: 2.89% + $0.29

- Monthly membership fee(s): $0

- Best for: Tech-savvy businesses who want to integrate a trustworthy payment processor into their current systems

19. Adyen

Adyen is a payment processor that’s designed to work with medium to large businesses. The platform charges $0.13 plus processing fees that vary depending on the payment method used per transaction. For example, Afterpay payments in the US have a fee of 4.99% + $0.30 and Mastercard payments have a fee of interchange + 0.60%.

There are no setup or monthly fees on Adyen, but there are minimum invoices depending on the industry and the business model, which merchants can learn by getting in touch with Adyen’s sales team.

With Adyen, merchants can offer all preferred payment methods of their customers with just a single integration.

- Online payment fee: $0.13 (Adyen processing fee) + varying payment method fees

- In-person payment fee: Same as online payments

- Monthly membership fee(s): No monthly fee (volume minimums may apply)

- Best for: Medium to large businesses that need a payment processor that’s flexible enough to support a very large variety of payment methods

20. Finix

Finix is a payment processing platform that offers interchange-plus pricing that scales with volume. Depending on the merchant’s monthly processing volume, their fees range around interchange + $0.08 per transaction (direct merchants) or interchange + 0.3% + $0.30 (platforms).

If you’re a direct merchant selling products, there’s a monthly membership fee starting at $250. The platform also offers in-person payment terminals for you to accept payments in-person

Finix is one of the payment processors that stand out with their API, which they claim to have 99.999% update 365 days a year. The platform accepts many payment methods including debit, credit, and business cards, ACH, Apple and Google Pay, and a variety of in-person payment terminals.

- Online payment fee: Interchange + $0.08 per transaction (direct merchants) or interchange + 0.3% + $0.30 (platforms)

- In-person payment fee: Interchange + $0.08 per transaction

- Monthly membership fee(s): Starting at $250/month for direct merchants

- Best for: Businesses that want to integrate technical payment processing with low fees into their existing systems with a powerful processing API

21. Payline Data

Payline data is a payment processor that specializes in getting approvals with high-risk industries where other payment processors wouldn’t. With a volume based processing fee system, Payline Data splits their processing fees into two categories:

- Card present: Ranges from interchange + 0.35% + $0.10 for under $50,000 to interchange + 0.15% + $0.08 for $1M+ volume

- Card not present: Ranges from interchange + 0.50% + $0.20 for under $50,000 to interchange + 0.10% + $0.12 for $1M+ volume

The platform also offers many terminal and POS systems that can be rented, starting from $10 per month to $45+, including virtual terminals for merchants who want to operate hardware-free.

- Online payment fee: Depending on monthly volume, interchange + 0.15-0.35% + $0.08-0.10 if card is present, and 0.10-0.50% + $0.12-$0.20 if card is not present

- In-person payment fee: Same as online payment fee

- Monthly membership fee(s): $10-$40 per month for terminals and custom pricing for POS

- Best for: Merchants in high-risk or specialized industries looking for flexible processing fees

22. Merchant One

Merchant One is a payment processor that offers interchange-plus pricing with processing fees that range from 0.29% to 1.99% for online and 0.29% to 1.55% for in-person payments.

The processor specifically advertises itself to target small businesses that need a fast turnaround (set up within 24 hours), 98% approval rate even though the merchant’s credit isn’t perfect, and dedicated account managers.

Merchant One supports hardware terminals, mobile payment processors (app or card swiper add-on), and card-not-present POS solutions.

- Online payment fee: Interchange + 0.29%-1.99%

- In-person payment fee: Interchange + 0.29%-1.55%

- Monthly membership fee(s): $13.95

- Best for: Small businesses that need low interchange-plus processing fees and can commit to a 3-year contract

23. Authorize.net

Authorize.net is a payment processor that merchants can use to process payments online and in-person. By using the Authorize.net API, partner integrations like Adobe Commerce and Shopify, and simple one-time payment buttons that can be integrated to any website, merchants can start processing online payments with a 2.9% + $0.30 processing fee.

For in-person payments, merchants have to pay a $25 monthly gateway fee and 2.9% + $0.30 processing fee to accept in-person payments with compatible card readers and the official Authorize.net mobile app.

The platform also offers virtual POS systems on their computers, card readers, and virtual terminals for phone payments.

- Online payment fee: 2.9% + $0.30 (all-in-one)

- In-person payment fee: 2.6% + $0.10

- Monthly membership fee(s): $25 (gateway fee)

- Best for: Businesses of all sizes that want an industry standard processing fee with reliable online and in-person payment systems

24. Amazon Pay

Amazon Pay is a payment processor that lets merchants accept payments from Amazon customers using their Amazon accounts. While Amazon Pay doesn’t support in-person payments, the online processing fee is 2.7%-3.4% + $0.25-$0.35 (varies by region and volume).

Customers don’t have to enter their card information on your checkout when you use Amazon Pay, instead, they can just log in via Amazon and use their saved checkout preferences.

This both makes it easier for the customer to complete a purchase and makes them feel secure since they’re using the card information saved in Amazon, which they most likely trust.

- Online payment fee: 2.7%-3.4% + $0.25-$0.35 (varies by region and volume)

- In-person payment fee: Not available

- Monthly membership fee(s): $0

- Best for: Online businesses that want to take advantage of Amazon’s checkout experience

25. Elavon

Elavon is a payment processor owned by the US Bank that offers interchange-plus payment processing to merchants. The processing fees vary depending on the business type, risk profile, and monthly sales volume of the merchant, starting at 2.90% + $0.30 for online and 2.60% + $0.10 for in-person payments.

- Online payment fee: Starting at 2.90% + $0.30

- In-person payment fee: Starting at 2.60% + $0.10

- Monthly membership fee(s): Quote-based

- Best for: Businesses of all sizes that want transparent pricing and effective online and in-person processing solutions

If your business processes in-person payments, Elavon has a variety of countertop, mobile, and hospitality POS solutions with transparent pricing and 24/7 customer support.

If your business is processing online payments, Elavon offers three subscription models:

- Core, $15 per month: Send payment links and invoices for one-time or recurring payments

- Plus, $30 per month: Get a branded storefront and process online payments

- Pro, $40 per month: Get a storefront and manage complex shipping, automated taxes, marketing, and analytics

26. Worldpay

Worldpay is a payment processor that has varying processing fees for UK and US merchants - it also provides custom rates for high volume online sales. It’s an international payment processor with multi-currency support and local payment methods in over 140 countries.

But, it requires 18 month long contracts and charges various monthly fees for services like PCI compliance and terminals.

- Online payment fee: 1.3% + 20p (UK plan) or 2.55% + $0.10 (US) or custom rates for high volume

- In-person payment fee: 0.75% + 4.5p (UK, high volume) or 1.5% (UK, low volume) or 2.55% + $0.10 (US)

- Monthly membership fee(s): £19-35/month (varies by plan and services)

- Best for: Large businesses with a high sales volume that want custom pricing and global reach

27. GoCardless

GoCardless is a payment processor that supports direct debit and ACH payment methods. The platform doesn’t support in-person card payments and only processes bank-to-bank payments.

The platform specializes in recurring payments like subscriptions, memberships, and invoices.

It allows merchants to take one-off payments, subscriptions, payments in installments, take international payments, and send payments to others from your account to others, whether that’s customers, suppliers, or other people.

GoCardless offers three pricing tiers for merchants: Standard, Advanced, and Pro, starting at 1% + £0.20 per domestic transaction, capped at £4. Both fees and benefits (like fraud protection, bank detail verification, etc.) increase as tiers go up.

- Online payment fee: 1%-1.4% + £0.20 (domestic), capped at £4-£5.60 depending on plan

- In-person payment fee: Not available

- Monthly membership fee(s): $0 (no monthly fees, pricing is pay-as-you-go across tiers)

- Best for: Businesses that collect recurring payments or invoices and want a low-cost bank-to-bank alternative

28. PayTrace

PayTrace is a specialized B2B payment processor that allows merchants to accept payments via virtual terminals, mobile apps, POS systems, ACH payments, ecommerce checkout integrations, digital invoicing, and more.

Based on the data merchants provide at the time of the transaction, which PayTrace helps with enhanced forms, the interchange fee will vary from 1.90% to 3%.

- Online payment fee: Interchange + $0.10-0.20 per transaction (varies qualification level via PayTrace Interchange Optimization)

- In-person payment fee: Interchange + around $0.10 per transaction for virtual terminal + supported card reader

- Monthly membership fee(s): Varies

- Best for: Businesses that want to process B2B payments

29. Moneris

Moneris is one of the largest payment processors in Canada and is backed by major Canadian banks. The processor is best for merchants looking for a reliable processor with an extensive POS solution ecosystem, which includes basic terminals to slim card readers.

Moneris offers both flat rate (2.85% + $0.30) and interchange-plus (interchange + 0.30%-0.50%) processing fee options for small, medium, and large businesses.

On top of this, merchant’s industry and specific needs might require monthly subscriptions - like Moneris Online plans that start from $19 and go up to $105 per month, offering a basic marketing suite, shipping, ecommerce, integration with hardware POS, and more.

- Online payment fee: 2.85% + $0.30 or interchange + 0.30%-0.50% (simplified pricing system)

- In-person payment fee: 2.65% + $0.10 or interchange + 0.30%-0.50% (simplified pricing system)

- Monthly membership fee(s): Varies (subscription tiers and software/hardware fees based on the industry of the merchant)

- Best for: Medium to large businesses that want a reliable payment processor backed by major banks (in Canada) and access a large ecosystem of POS solutions

30. SumUp

SumUp is a mobile payment processor especially popular in Europe and the UK. The platform lets merchants accept both online (plus invoices) and in-person payments, but the processing fee differs based on where the merchant is located.

If the merchant is in the UK, for example, they pay 1.69% processing fee with the Pay-as-you-go plan for in-person payments (goes down to 0.99% with Payments Plus, £19 per month) - if the merchant is located in the US, however, they pay 2.6% + $0.10 per in-person transaction.

SumUp targets small to medium businesses with simple and easy to use POS solutions for $99 (Connect Lite), 199 (Connect Plus), or $289 (Connect Pro) per month, each tier offering advanced benefits like customer databases, dedicated installation and training, customer rewards, and SMS/email promotions.

- Online payment fee: 3.5% + $0.15 for online and manually entered payments or 2.9% + $0.15 for invoice payments for US merchants

- In-person payment fee: 2.6% + $0.10 for US merchants

- Monthly membership fee(s): £0 per month (pay-as-you-go), £19 per month (Payments Plus, requires £3,000+ monthly volume), or custom (Tailored, requires £10,000+ monthly volume)

- Best for: Small to medium businesses that wants a simple and low cost POS solutions

How to choose the right payment processor for you

Picking the right payment solution isn’t just about finding the lowest fees - it’s about finding the right fit for your business.

You’ll want to consider:

- Fees: Look beyond just the headline rate. For example, Helcim’s in-person processing fee averages 1.93% + $0.08 with no monthly cost, which is great - but if you need a built-in POS system for a restaurant, another processor or platform might make more sense.

- Features: Make sure the payment system supports the tools your business actually needs, whether that’s subscription management, recurring billing, or integrated POS systems.

- Sales volume: Many processors adjust fees based on your monthly volume. Payline Data, for example, offers different rates depending on how much you process each month.

- Transaction type: The type of payments you take can affect costs. Adyen, for example, charges a flat $0.13 per payment plus a variable fee based on transaction type - 4.99% + $0.30 for Afterpay & Clearpay, or interchange + 0.60% for Mastercard.

I decided to move over to Whop because they had access to more Buy Now, Pay Later options – which I just couldn't secure on the previous platform.

I’m now taking payments that I couldn't previously accept, because people just couldn't afford my fee up-front. In the last couple of months, I've done $124,000 in sales.

- Coach Carl Parnell

One more thing: low advertised fees don’t always mean your customers won’t see extra charges. CardX, for instance, advertises $0 processing fees for credit cards, but customers pay a 3.5% surcharge at checkout, and unexpected extra costs are the number one reason shoppers abandon carts, according to Shopify.

Start processing payments with Whop

I've covered 30 low-fee payment platforms and processors that businesses of all sizes can use to start accepting payments in 2026. From small startups with low monthly volume to larger enterprises handling thousands of transactions, there’s a solution for nearly every scenario.

“Through thousands of conversations, we’ve learned our customers really only care about two things: getting paid and paying out. Our mission is to be the best in the world at solving those problems.”

- Hunter Dickinson, Head of Partnerships at Whop

Whop stands out as a platform that combines business management and payment processing in one place, with low fees, multiple payment options, and no monthly membership cost. Setting up an account is simple, and you can get started in just a few minutes.

Start taking payments with Whop today.

Low fee payment processors FAQs

Which payment processors have the lowest payment processing fees in 2026?

NadaPayments and CardX allows merchants to avoid paying processing fees by passing it to their customers via surcharging.

Is it legal to pass the processing fees to the customer?

Yes, passing the processing fees to the customer, known as surcharging, is legal when done compliantly.

What is the best payment processor for selling digital products and communities?

Whop is the best option if you want to sell digital products, community memberships, downloadables, coaching services, and more. Whop is an all-in-one platform where users can create and run their businesses.

Plus, Whop doesn’t have a monthly membership fee and its processing fee is just 2.7% + $0.30.

Which payment processor is best for small businesses?

There are many payment processors that target small businesses and some of the best ones are:

- GoDaddy Payments

- Helcim

- Square

- SumUp

- Whop

Which payment processor is best for medium businesses?

Some of the best payment processors for medium businesses are:

- Adyen

- Helcim

- Moneris

- National Processing

- Stripe

- Whop

Which payment processor is best for large businesses?

If your business has a high processing volume per month, the processors are some of the best ones to use:

- Adyen

- Payline Data

- Stripe

- Whop

- Worldpay

Which payment processors let merchants pass the processing fee to the customer?

Passing the processing fee to the customer can help merchants avoid dealing with additional costs per transaction. Some processors who have this feature are:

- Nadapayments

- CardX

- GoDaddy Payments

- Stax

Do I have to pay monthly membership fees to use a payment processor?

Many payment processors don’t have monthly membership fees and only charge you per transaction.

- Platforms that don’t have monthly fees: Whop, Stripe, Helcim, Square (basic plan), PayPal, Braintree, Amazon Pay, and GoCardless

- Platforms with monthly fees: Stax ($99+), Payment Depot ($59+), Dharma ($20), and Chase Payment Solutions ($15, waivable)

What’s the average payment processing fee in 2026?

The average payment processing fee in 2026 is 2.9% + $0.30, which is equivalent to Stripe’s.