Offer your customers the payment methods they prefer - from credit and debit cards, digital wallets, and BNPL to crypto, bank transfers, and gift cards. Learn how multiple options reduce cart abandonment, boost conversions, and get you paid faster worldwide.

Key takeaways

- Adding one extra relevant payment method can increase merchant revenue by 12% on average.

- Digital wallets and BNPL reduce cart abandonment and boost order values by offering flexible, frictionless checkout.

- Match payment methods to your audience's preferences—Gen Z favors mobile wallets while B2B clients need bank transfers.

Your customers want choice - from products to delivery, and yes, how they pay.

Accepting credit & debit cards, digital wallets, BNPL, crypto, bank transfers, and local payment methods doesn’t just make checkout easier; it reduces cart abandonment and gets you paid faster, anywhere in the world.

Through thousands of conversations, we’ve learned our customers really only care about two things: getting paid and paying out. Our mission is to be the best in the world at solving those problems.

– Hunter Dickinson, Head of Partnerships at Whop

Here’s the complete list of payment methods to offer in 2026, all designed to help your business move money smarter and faster.

Payment methods to convert every type of customer

From cards to wallets, crypto, and more, these payment methods cover the ways your customers want to pay.

You don’t have to offer every payment method, but Stripe data shows merchants adding just one extra relevant payment method saw an average 12% increase in revenue.

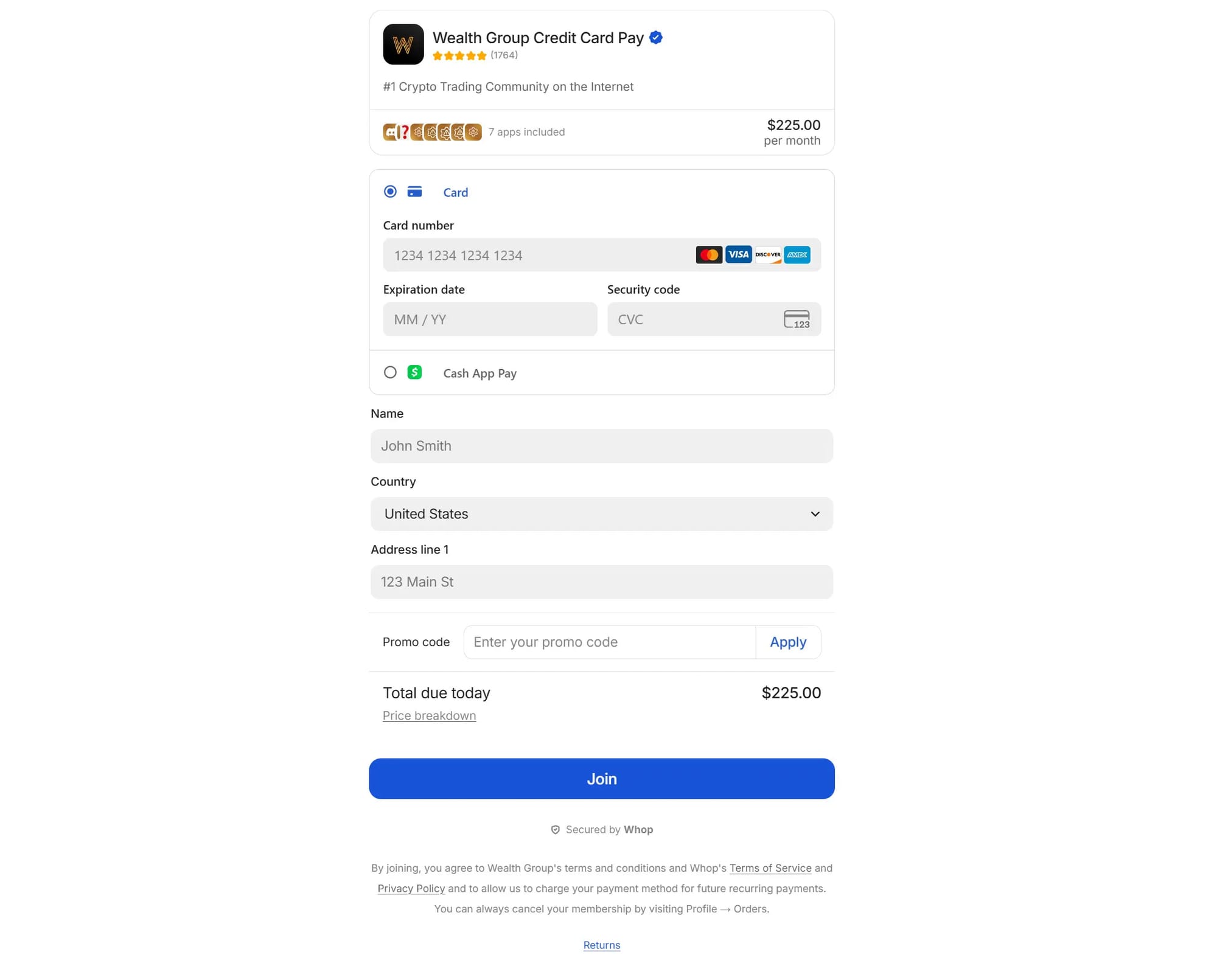

1. Credit & debit cards

Credit and debit cards are the backbone of online payments, used by billions worldwide. From small side-hustle stores to 7-figure platforms, accepting cards is non-negotiable if you want to reach most customers.

How it works:

Customers enter card details at checkout, which are then securely tokenized by your processor (like Stripe, or PayPal). Payments are processed instantly or within a few business days, depending on the gateway and region.

Pros:

- Universally recognized and trusted by buyers

- Instant or near-instant confirmation for most transactions

- Works for recurring subscriptions and one-time payments

- Supports fraud prevention and chargeback management

Cons:

- Standard fees range 2–3% per transaction (may be higher for international cards)

- Requires PCI compliance for secure handling

- Regional card acceptance may vary

Millions of merchants rely on cards. Whop automatically routes card payments through the PSP most likely to approve them, increasing successful charges by up to 11% - helping creators and agencies scale faster without worrying about declines.

2. Digital wallets

Grabbing your physical card each time you want to make an online purchase is a hassle. Thats where digital wallets come in.

Digital wallets store your customers’ payment info - like credit and debit cards, bank accounts, or even BNPL options - so they can pay without typing in card details every time.

Venmo, Apple Pay, Google Pay, Samsung Pay, and PayPal Wallet are the most common, and they’re especially handy for mobile-first shoppers.

How it works:

At checkout, the customer selects their wallet and authenticates via fingerprint, face ID, or password. The wallet securely sends tokenized payment info to your processor, keeping sensitive card data out of your system. This speeds up checkout and reduces friction compared to manually entering card details.

Pros:

- One-tap checkout = faster purchases

- Extra security with device-level authentication

- Supports multiple funding sources (cards, bank accounts, sometimes BNPL)

- Reduces cart abandonment, especially on mobile

Cons:

- Adoption varies by region; not every customer uses wallets

- Some wallets charge additional processing fees

- May need extra integration for web, mobile, and POS

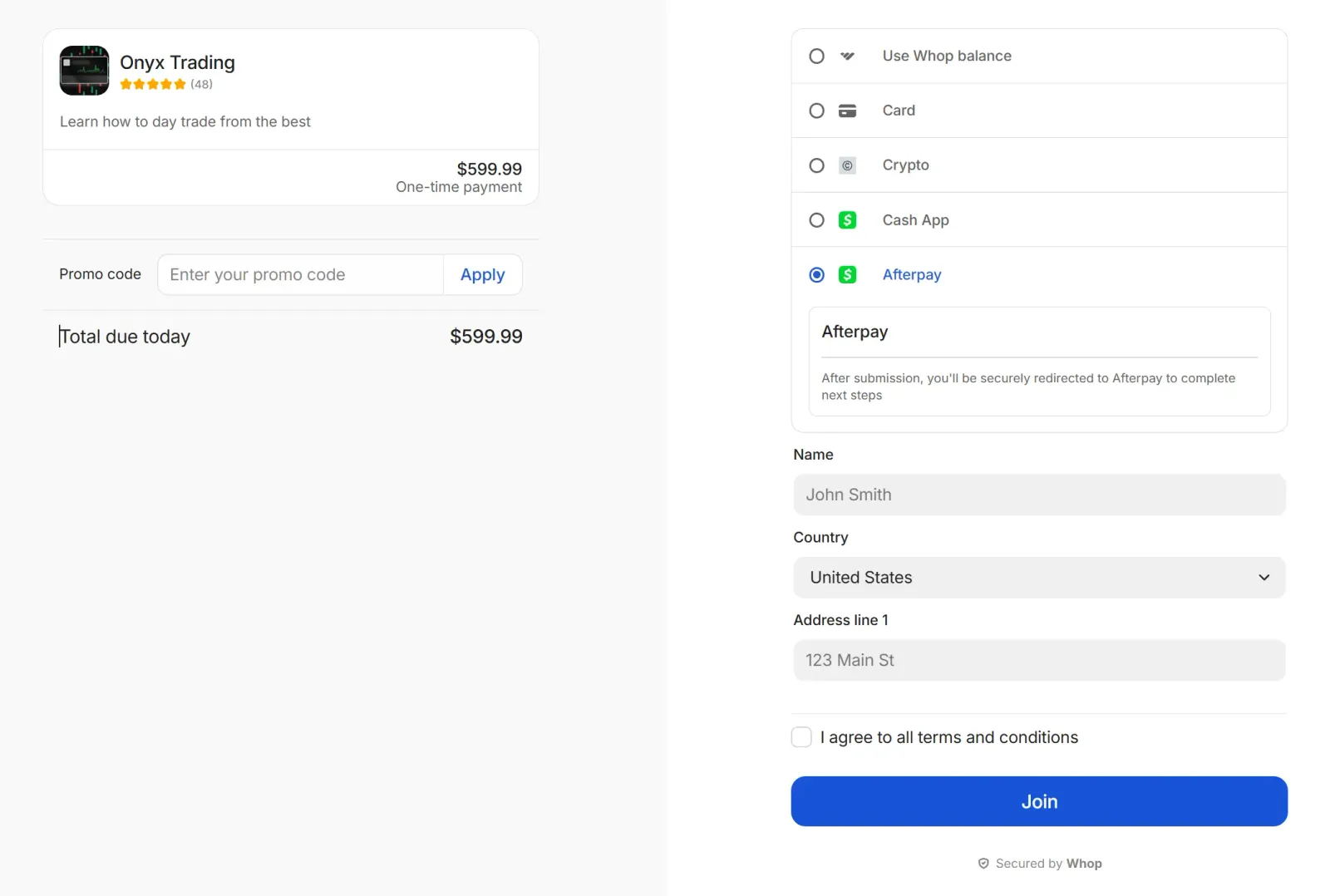

3. Buy Now, Pay Later (BNPL)

BNPL lets customers split purchases into multiple payments over time, often interest-free for a set period. Services like Zip Pay, Klarna, Afterpay, and Affirm are especially popular for higher-ticket items and ecommerce, giving buyers flexibility while you still get paid upfront.

I decided to move over to Whop because they had access to amazing buy now, pay later options, which I just couldn't secure on my previous platform.

I started getting payments that I ordinarily couldn't make because people just couldn't afford my fee up front.

- Carl Parnell, Whop seller (@carlparnell)

How it works:

The customer selects BNPL at checkout. The provider pays you immediately (minus their fee) and collects installments from the customer. Integration is usually via your payment processor or checkout platform.

Pros:

- Increases average order value (AOV) and conversion rates

- Customers can afford higher-ticket items without upfront cost

- You get paid instantly, while the BNPL provider handles repayment

Cons:

- BNPL providers charge higher fees than standard card processing (typically 2.5–6% per transaction)

- Risk of returns or chargebacks is handled differently per provider

- Customers may accumulate debt if not used responsibly

4. Bank transfers / ACH

Bank transfers, also known as ACH payments in the U.S., let customers pay directly from their bank account to yours. This method is especially useful for large orders, subscriptions, or B2B transactions.

How it works:

The customer authorizes a transfer from their bank account, which is securely processed through your payment processor. Depending on the region and bank, settlement can be same-day or take a few business days.

Platforms like Whop make this seamless with multi-rail support and global payouts.

Pros:

- Lower fees compared to credit/debit card transactions (often 0.5–1%)

- Ideal for high-value transactions

- Reduces fraud risk since transactions are authenticated by banks

Cons:

- Slower settlement than instant card or wallet payments (typically 1–3 business days)

- Not all customers are familiar with ACH payments

- Requires proper integration and verification to avoid failed transfers

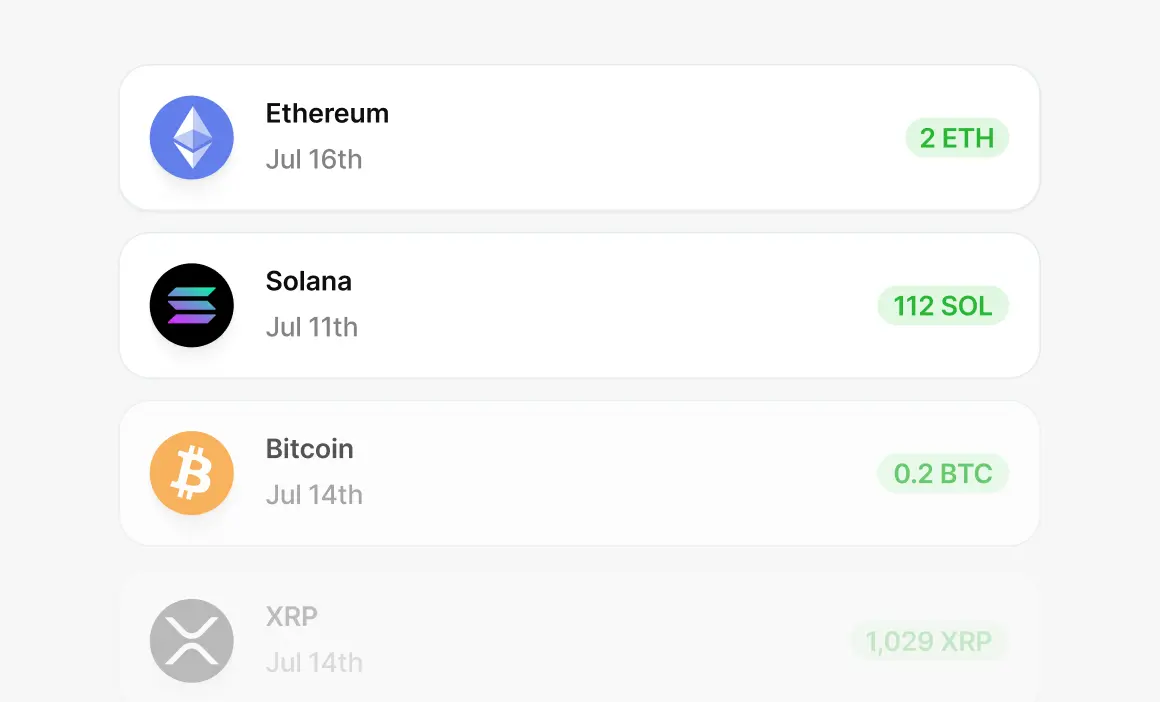

5. Crypto payments

Crypto payments let your customers pay with Bitcoin, Ethereum, stablecoins, and other digital currencies. This method is growing fast among global, tech-savvy buyers and provides instant, 24/7 settlements.

How it works:

Customers select crypto at checkout and send payment to your wallet or through a crypto-enabled processor. You can choose to keep crypto or automatically convert it to fiat to reduce exposure to volatility.

Pros:

- 24/7 instant settlement, even across borders

- Lower transaction fees compared to traditional card processing (often 1–2%)

- Access to a global, digital-native audience

Cons:

- Price volatility if you hold crypto instead of converting to fiat

- Regulatory and tax compliance can be complex

- Smaller customer base compared to traditional payment methods

6. QR Code Payments

QR code payments let customers pay by scanning a code with their smartphone wallet or payment app. They’re popular for social commerce, pop-ups, and in-person events because they make checkout frictionless.

How it works:

The merchant generates a QR code that links to a payment request. Then, customers scan the code with their phone. Finally, they complete the payment using their preferred method (cards, digital wallets, or other supported options).

Pros:

- Simple and fast for customers — no typing or manual entry needed.

- Works across online and in-person sales channels.

- Can support multiple payment methods depending on the provider.

Cons:

- Requires the customer to have a smartphone and compatible app.

- Merchants need a system or gateway that supports QR-based payments.

- Not suitable for all types of transactions (e.g., large corporate invoicing).

7. Payment links / invoices

Payment links and invoices let you request payments from customers without a full ecommerce checkout. They’re perfect for freelancers, agencies, marketplaces, and service providers.

On Whop, you can create an invoice, send it by email, and your client pays without even needing a Whop account.

How it works:

You generate a payment link or invoice from your processor or platform. The link can be sent via email, SMS, or social channels. Customers click the link, enter their payment details, and complete the purchase.

Pros:

- Flexible and easy to send across multiple channels

- Works for one-time or recurring payments

- No need for a full website or checkout integration

Cons:

- May not be suitable for high-volume or large-scale sales

- Customers need internet access to complete the payment

- Some platforms may charge fees per invoice or link

8. Gift cards & store credits

Gift cards and store credits are a powerful way to drive loyalty and boost revenue. Customers can buy them for themselves, gift them to friends, or redeem them later, giving you money upfront and guaranteed sales down the line.

How it works:

A customer buys a gift card or earns store credit. At checkout, they redeem it like cash. Your processor tracks the balance, and you fulfill the order instantly.

Pros:

- Encourages repeat purchases and loyalty

- Great for promotions, holidays, or special events

- Revenue comes in immediately

Cons:

- Only redeemable in your store

- Unused balances need careful tracking

- Refunds can be more complex than standard payments

9. Cash

Cash might feel old-school, but it still works for some markets and in-person sales. COD lets customers pay when they receive your product, making it accessible to those without credit cards or digital wallets (like people on vacation and the older generation).

How it works:

The customer hands over cash at delivery, or pays in-person. You collect payment before or at the time of fulfillment. This is especially useful for local deliveries or physical pop-ups.

Pros:

- No processing fees

- Easy for customers without cards

- Instant revenue in-hand

Cons:

- Higher risk of theft or loss

- Not practical for fully online or digital businesses

- Manual tracking required

10. Alternative / manual payments

Alternative payments cover all the “outside-the-box” methods: checks, money orders, wire transfers, or other manual payments. Perfect for B2B sales, high-ticket products, or industries where standard payment processors might say no.

How it works:

Customers select a manual payment option, and you verify the payment before providing the product or service. It’s flexible but requires oversight.

Pros:

- Works for corporate clients or large transactions

- Lets you accept customers traditional processors might reject

- Adds flexibility for unique business models

Cons:

- Slower than instant online payments

- Manual verification means more admin work

- Not ideal for high-volume ecommerce

How to choose the right payment methods for your business

It can feel overwhelming to decide which payment methods to offer, but the good news is, you don’t have to pick just one.

Most successful businesses accept a mix of payment methods, so customers can pay how they want, you get paid faster, and nobody’s left frustrated at checkout and abandoning carts.

Here’s how to make the choice easier:

Think about where your customers are

Different regions have different habits. Selling in China? Alipay or WeChat Pay are often expected. Germany? Bank transfers are huge. When customers see familiar options, they trust your store more.

Check what’s actually being used

Look at your sales data: which methods are people actually choosing? You might find that only a handful of options cover most orders. Focus on what works, cut the clutter, and keep your checkout simple (and costs lower).

Know your audience

Different generations have different buying habits. Here's a quick rundown:

- Gen Z: Mobile-first, wallets, BNPL. Convenience matters more than anything.

- Millennials: Love digital wallets and installment options for online shopping.

- Gen X: Still rely on cards but slowly adopting wallets for big purchases.

- Boomers: Security is king. Cards are their go-to and digital wallets are rare.

Consider fees

Every payment method has costs. Sometimes paying slightly more for a preferred method is worth it if it reduces friction and keeps sales flowing.

Security matters

Customers expect their info to be safe. Choose methods and processors that handle fraud, encryption, and regulatory compliance so shoppers feel confident.

Prepare for global growth

Selling internationally? Offer region-specific methods like Boleto in Brazil, iDEAL in the Netherlands, or Alipay in China. Meeting customers’ expectations shows you get them.

Platforms like Whop let you offer multiple payment methods and payout globally - so you can give customers options without the headaches of managing multiple processors.

Offer more ways to pay with Whop

Choosing the right payment methods doesn’t have to be complicated. The key is giving your customers the options they want, like cards, wallets, BNPL, crypto, gift cards, and more.

With Whop Payments, you don’t have to pick just one. Our platform supports multiple payment rails, global payouts, and fast settlements so you can meet customers where they shop, get paid on your terms, and scale without limits.

Whether you’re a side-hustle, a 7-figure agency, or running a full platform, Whop makes it simple to accept, manage, and grow with every payment type your audience prefers.

Explore more ways to pay with Whop.

Payment method FAQs

What are the most common payment methods for businesses?

The most widely used payment methods include credit and debit cards, digital wallets (Apple Pay, Google Pay, PayPal), BNPL (Klarna, Afterpay, Affirm), bank transfers/ACH, crypto, gift cards, and alternative/manual payments.

Which payment method is best for online stores?

It depends on your audience. Cards and digital wallets are must-haves for mobile-first shoppers. BNPL works well for higher-ticket items, and bank transfers are ideal for B2B or high-value transactions. Offering multiple options generally boosts conversion.

Are digital wallets more secure than credit cards?

Digital wallets use tokenization and device-level authentication (fingerprint, face ID, PIN), which keeps sensitive card data out of your system. This can reduce fraud risk while speeding up checkout.

How can offering multiple payment methods increase sales?

Shoppers are more likely to complete their purchase if their preferred payment method is available. Businesses that accept multiple methods often see higher conversions, larger average order values, and lower cart abandonment.

Are crypto payments safe for businesses?

Yes, when processed through secure providers. Crypto payments offer instant, 24/7 global settlement. But, holding crypto carries volatility risk, so many businesses auto-convert to fiat to reduce exposure.