When it comes to online commerce, chances are you’re looking to provide your clients and customers with a great experience. Whether you’re selling in-person goods through an online interface or selling digital products online, there’s a lot that goes into that–from providing a smooth shopping experience and making it clear what you have to offer all the way to checkout.

You probably want to provide a seamless and easy-to-use checkout and payment experience as well. What’s more, security is a top priority; the last thing you want to do is forget about security when you’re dealing with customers and clients’ payment information and personal data.

That’s where payment processing APIs come in. With the right payment processing API, engaging with clients and customers online can be a breeze. But how do you choose the right payment processing API? What exactly does a payment processor API do? What is there to look for? And, what are some of the popular payment APIs that online merchants are utilizing to create a seamless customer experience?

Let's talk about some of the best payment processor APIs available right now and how you can level up with the best payment processor APIs.

What is a payment processor API?

To understand what payment processing APIs are, it’s important to first understand what an API is. You can think of an API as a tool for making different software and hardware systems work together. API stands for an application programming interface. It’s like the common ground that different software needs to communicate properly. APIs are often used to integrate different types of software to work well together.

A payment processor API is an API designed specifically to help developers integrate payment options into their software. Payment processing APIs allow online businesses to utilize payment gateways to enable payments from online customers. So, for example, let’s say that you’re creating an online marketplace where customers can purchase shoes online.

You want to give them a seamless customer experience, where they can browse, order, and pay online. Maybe you’ve built an app already where customers can easily browse what you have to offer from their mobile devices. To add payment functionality to your app, you might use a payment processor API to integrate payment options into your app.

Depending on which payment processor API you use, however, your options in terms of which payments you can accept, how easy integration is, what services are available, and how much you’ll pay in fees to use this service will vary. That’s why we’re exploring the top payment processor APIs right now so that you can level up your payments.

What To Look For in a Payment Processing API:

Depending on what your needs are, what you’re looking for in payment processor APIs might vary. Some of the things to be aware of, though, are how much business you expect to do, how the payment service charges fees, whether they offer customer support around the clock, what types of payments you want to be able to accept from customers or clients, and other services offered. Here are some factors to consider when looking at different payment processing APIs:

- Software documentation: can you find documentation for integrations easily?

- Payments accepted: Consider which payments you’ll be able to accept and which ones you’ll need to accept for your business to be successful

- Domestic or international: Are you a domestic business? Accepting domestic cards may be your only concern. However, to international merchants, it might be important to work with payment processing APIs that enable you to accept foreign credit cards or foreign currency.

Stripe

Stripe has been around for over a decade and provides online payment services, mostly to online merchants. Stripe offers a range of solutions for ecommerce merchants to integrate payment into their website or app, as well as extensive software documentation and SDKs that software engineers can use to integrate Stripe payments seamlessly into existing software. Stripe is touted as highly customizable and offers around-the-clock customer service.

Stripe offers payment integrations that range from simple card payments and digital wallets to bank transfers and additional payment methods. Additionally, Stripe touts the ability to process even international credit cards. Stripe also boasts highly robust security features, including encryption to ensure that transactions are secure.

Stripe offers different pricing schemes depending on your needs and size, making them versatile in terms of the sizes of businesses that they service. With pay-as-you-go pricing, Stripe is suitable for both small and large businesses, regardless of their volume of transitions. For larger businesses Stripe also offers custom pricing so that you can find an optimal pricing solution based on the size and needs of your online business.

Stripe combines a merchant account with a payment gateway, meaning that rather than setting up a merchant account and integrating Stripe’s payment platform, you can do both at once.

Paypal

Paypal has been around in the world of online commerce for a while. Many people recognize Paypal as a sort of digital wallet. Still, Paypal’s payment processor API is a robust online tool that online merchants can use to process payments and engage with their customers and clients as well.

One thing that Paypal has going for it is name recognition. Paypal has been ubiquitous in the online commerce space for years now, and it’s considered, by many, a trusted name in e-commerce.

Like Stripe, through Paypal, online merchants can accept major credit cards from customers and clients, as well as Venmo payments and cryptocurrency payments. Paypal also offers extensive documentation for their payment processing API and makes it fairly simple for software engineers to integrate their services.

Braintree

Braintree is owned by Paypal but offers distinctive services that make it a contender in the online commerce space as a great payment processor API. As a full-stack platform, Braintree offers a one-stop solution to obtaining a merchant account and integrating a payment platform–much like Stripe.

Braintree also offers online merchants the ability to accept a wide range of payment options–including, but not limited to Paypal, Apple Pay, Google Pay, Venmo, Visa, Mastercard, American Express, Discover, and more.

Like Stripe’s payment API, Braintree is a pay-as-you-go system by default, but there are custom pricing schemes available to businesses that have unique pricing needs, either due to sales volume or other factors.

Like many other online payment processing APIs, Braintree also offers extensive fraud protection and other vital online security features. Customer service is available mostly only during the workweek, Monday through Friday, but Braintree does boast emergency support through email around the clock.

Square

Square’s logo, which you might recognize from brick-and-mortar establishments. That’s because, unlike many other online payment solutions, Square doesn’t only operate online. They also offer services to brick-and-mortar establishments and offer hardware, such as card readers, on top of the software that they offer.

Square’s online payment systems are anything but an afterthought, however. Square’s robust payment processing API offers integrations that enable software engineers to easily work Square payments into their existing website or app. Square also offers hardware that makes it easy for brick and mortar locations to accept digital payments in person.

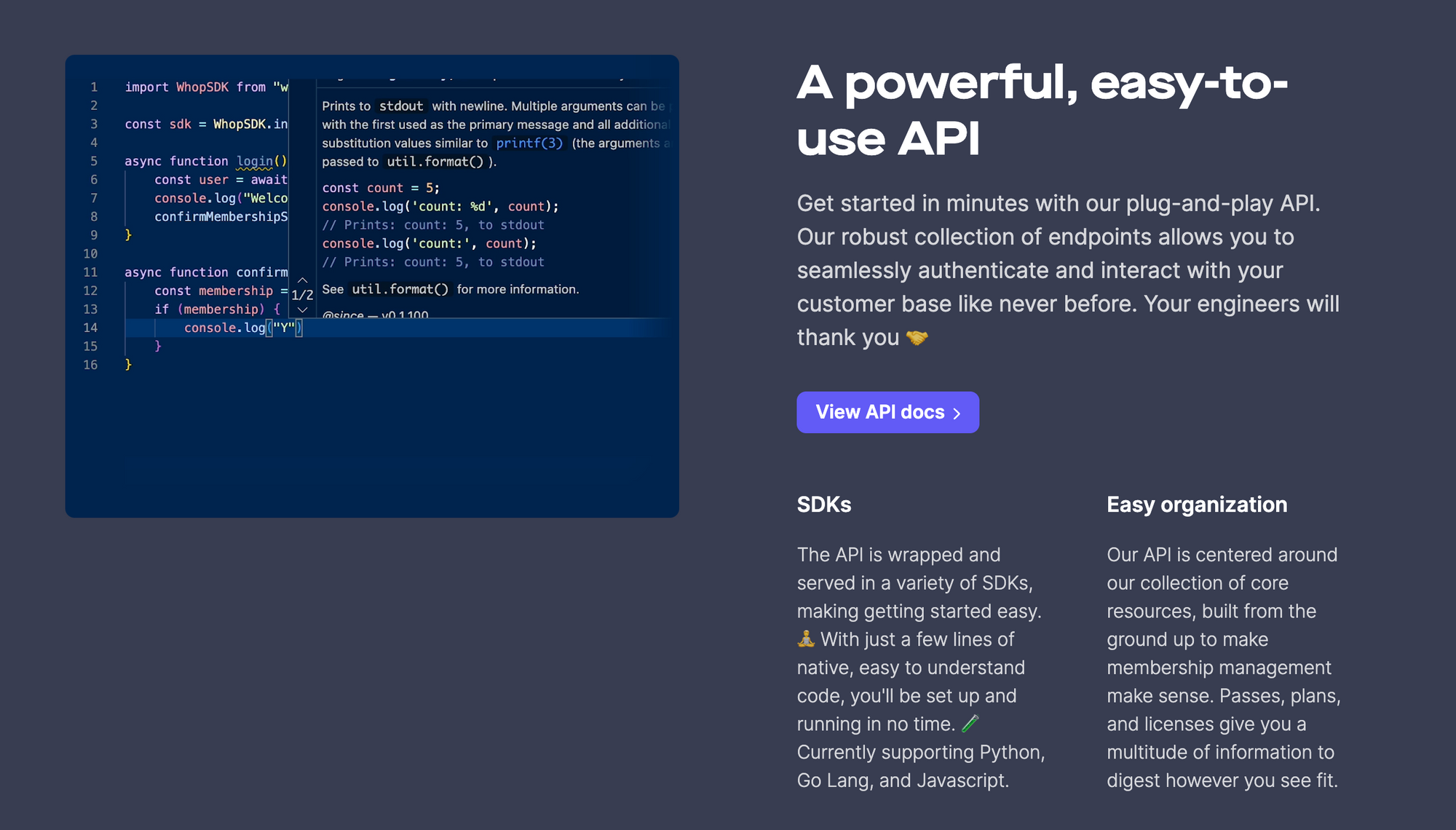

Whop Payments

Whop has partnered with Stripe to bring the best of Whop’s ecosystem and the best of Stripe’s seamless payment API integrations into one place. We’ve talked about how Stripe offers merchants the ability to accept a wide range of payment types, as well as Stripe’s robust security and easy software integration. These are just a couple of the reasons we’ve partnered with Stripe to bring you a seamless payment experience for your customers.

Through Whop pay, you can decide how often you want to be paid and when you want to be paid. We offer Stripe-integrated payment options that enable you to receive payments from your customers through ACH direct deposit in whatever currency they pay with.

What’s more, if you or your company already uses Stripe, you can easily connect using your existing account and easily get started on Whop with Whop pay.

Easily Accept Crypto

With Whop pay, you can easily accept crypto payments in the form of Ethereum from your customers and clients. Simply set up an Ethereum payment Gateway through Whop and connect your crypto wallet. Moreover, you can also be paid out in Ethereum using your same crypto wallet.

Payout Alternatives

What if the country I’m located in doesn’t allow me to use Stripe? Not to worry: with Whop Pay, you can use our Tipalti integration to accept payments and be paid out through Paypal, ACH or even eCheck.

The Bottom Line

If you’re looking to change how you engage with customers and make online payments a breeze, it’s worth taking the time to learn more about different payment processor APIs! Using the right payment processing integrations, you can create a seamless experience for your customers and make running an online business much simpler.

Remember that it’s important to consider what types of payments you need to accept, how robust customer support is, whether APIs can be easily integrated into existing software, and how you can create the most seamless experience for your customers.

👉 To learn more about how Whop pay makes it easy to accept payments and get paid on your terms, you can learn more about it here.