Did Stripe close your account? Find out why it happened and the best steps to reopen your account and keep your payments flowing.

Key takeaways

- Stripe closes accounts for restricted businesses, suspicious activity, inactivity over 90 days, or verification issues.

- Providing complete and accurate documentation during signup prevents most account restrictions and closures.

- If restricted, follow Stripe's verification steps and allow 3-5 business days for document review and restoration.

If your Stripe account has been closed, it usually happens because the platform flagged an issue with your business, your transactions, or compliance with its terms of service.

Common triggers include unusual payment activity, prohibited products or services, or verification problems.

The good news? Most closures can be resolved. In this guide, we'll break down the main reasons Stripe shuts down accounts and walk you through practical steps to get your account reinstated.

Reasons why your Stripe account has been closed

If your Stripe account was shut down, it usually comes down to one of several common causes:

- Restricted Business List: Some industries can’t use Stripe, including adult content, gambling, debt relief, government services, and identity verification businesses.

- Suspicious or fraudulent activity: Any unusual transaction patterns can trigger a suspension while Stripe investigates.

- Inactivity: Accounts that haven’t processed payments for 90 consecutive days may be closed automatically.

- Insufficient funds: Overdrawn accounts or failed transactions can result in closure.

- Policy violations: Breaking Stripe’s Terms of Service, Acceptable Use Policy, or other rules can get your account shut down.

- Verification issues: Missing or inaccurate documentation during account setup may cause Stripe to disable your account.

Understanding why your account was closed is the first step to getting it back up and running.

Check out our full Stripe guide that tells you everything you need to know, including how it works and whether or not it’s the best option for your business.

How to prevent your Stripe account from being restricted

To prevent your Stripe account from being restricted, it's essential to provide the appropriate documentation while signing up.

This means the platform can confirm your business is really what it claims to be.

Documents you'll need to supply include:

- Home address verification: So that Stripe can confirm where you live

- Identity verification: This might include a driver's license, state ID card, or passport.

- Business verification: This could include a certificate of incorporation, partnership agreement, certificate of nonprofit registration, or company constitution.

What happens if my Stripe account is restricted?

If you've not supplied Stripe with these items, Stripe may apply one or two different types of restrictions on your account.

- Charges disabled: Stripe prevents you from processing customer payments.

- Payouts disabled: Stripe prevents payouts from your Stripe account from being linked to your bank account.

5 Steps to fix a restricted Stripe account

If your Stripe account has been restricted, there are a few steps you can follow to get it up and running again.

1. Log in to your Stripe account

To begin the process of restoring your account, sign in to your Stripe account via the dashboard. After you’ve done this, navigate to the 'View Stripe Payments Dashboard' button located in the Online Booking and Payments section.

2. Examine the reason for suspension

On the online booking and payments section, you’ll find a Restricted icon. Click on this, and it will tell you the reason why your account has been closed.

If it’s because of unsupplied documentation, Stripe will simply state ‘Identity documentation required’ under ‘Information needed.’

It won’t, however, tell you the exact documentation you need.

3. Provide the required documentation

To supply Stripe with the proper documents, navigate to the Settings page on your dashboard. Scroll down to find ‘Business settings,’ and click on Verifications.

You’ll find a button named ‘Review details,’ which you can click on to continue the verification process. This will ask you to fill in your personal details, including name, address, and social security number.

Click ‘Update Person’ at the bottom of the screen to confirm your details.

Stripe Connect: how it works, what it costs, and top alternatives

4. Check your emails

When Stripe requires more information, they'll send an email asking for further documentation.

If this is the case, return to the Business settings page and click ‘Review details,’ where you’ll be prompted to upload the required information.

Bear in mind that your documents will need to meet some specific requirements in order to be accepted. These include:

- Clarity: The documents must be large and clear enough to read easily.

- Validity: All documents must be valid and up to date according to your business’s registration.

- Matching information: Make sure the information supplied in the form, for example, company registration number, VAT number, business address, business name, etc, all match the information you’ve supplied on your Stripe account.

- Comprehensive documentation: If the documents you supply consist of PDFs with multiple pages, make sure you include all of the relevant pages.

5. Wait for confirmation

Allow Stripe 3-5 business days to review your documents.

Stripe has a support team that you can contact via support.stripe.com/contact, so if you want to check on the status of your application, you can reach out here.

Once your details have been checked, Stripe support will email you to notify you about the outcome of your review.

Want a comprehensive list of the best payment processing solutions for ecommerce? We’ve got the low-down.

Advantages and disadvantages of using Stripe as your PSP

Stripe is one of the top payment service providers out there, but that doesn’t mean it doesn’t have disadvantages.

Here are the main pros and cons:

| Pros | Cons |

|---|---|

| ✅ Well-established in over 45 countries, supporting 135+ currencies | ❌ Might not be ideal for physical stores |

| ✅ Developer-friendly with extensive customization options | ❌ Only available in 135 countries, so some businesses can't use it |

| ✅ Strong security measures for both businesses and customers | ❌ Non-developers won't get the full benefits of the platform |

Top 5 Stripe alternatives

The table below gives a quick side-by-side view of five Stripe alternatives, comparing their key strengths and limitations.

Click any provider name to jump straight to its detailed overview.

| Provider: | Why it works: | Worth noting: |

|---|---|---|

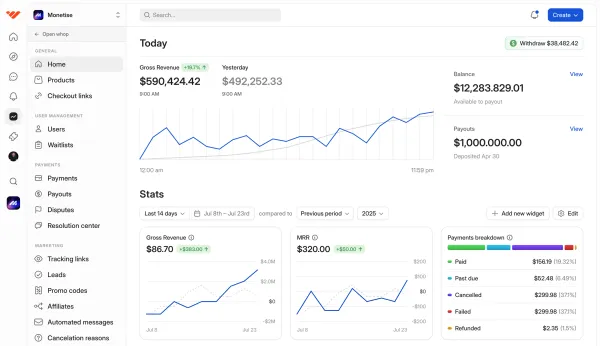

| Whop Payments | Multi-PSP orchestration; 100 + methods (cards, BNPL, crypto); instant payouts; built-in affiliates, analytics, and full mobile app. | Built to eliminate the usual pain points: no setup fees, no waiting, no coding required. |

| PayPal | Global coverage, trusted by consumers, easy setup with recurring billing and Pay Later options. | High fees (4.99 % + $0.49), reserves, and limited customization for advanced use cases. |

| Square | Excellent POS hardware, transparent pricing, and built-in tools for hybrid retail and services. | Limited international support and weaker online-first or subscription features. |

| Adyen | Enterprise-grade platform offering unified commerce, advanced risk tools, and real-time analytics. | Complex onboarding, high volume thresholds, and developer-heavy integration. |

| Paddle | Handles global taxes and compliance as Merchant of Record; ideal for SaaS and software businesses. | Less control over pricing and customer data; slower payouts. |

1. Whop Payments

Looking for a modern Stripe alternative? Whop Payments combines reliability and security with features built for today’s online businesses. Run your store, process payments, pay your team, and create a community – all in one place. Ultimate flexibility, 24/7 support, and low fees.

Why it works:

- Multi-PSP orchestration: Maximizes successful payments by automatically retrying declined transactions.

- Global payment support: 100+ methods including BNPL, crypto, and region-specific options.

- Worldwide payouts: Send money to 190+ countries via ACH, Venmo, CashApp, crypto, and more.

- Flexible checkout: Embed on your site, use checkout links, or Whop’s no-code store builder.

- Business toolkit included: Affiliates, free trials, dispute handling, and a full mobile app.

- Developer-friendly: APIs allow programmatic charging, embedded checkout, and membership management.

Whop isn’t just a payment processor. It’s a whole ecosystem for scaling your digital business globally with minimal hassle.

2. PayPal

PayPal remains one of the most recognized names in online payments, with global coverage and a reputation for buyer trust. It’s simple to set up, supports 200+ countries, and integrates easily into most ecommerce platforms.

Why it works:

- Global presence in 200+ countries

- Trusted brand with strong buyer protection

- Easy setup, ideal for small teams

- Built-in invoicing and recurring billing tools

Limitations:

- PayPal’s processing fees are high (typically 4.99% + $0.49 for BNPL and digital goods)

- Account freezes and rolling reserves are notorious

- Payouts can take several days

- Customization is limited

3. Square

Square is a top choice for physical stores and service businesses that need POS hardware and in-person payments. It integrates easily with its ecosystem of terminals, readers, and retail tools while also offering online checkout.

Why it works:

- Strong in-person payment suite

- Transparent pricing (2.6% + 10¢ per swipe)

- Good for hybrid retail and ecommerce setups

- Includes invoicing, payroll, and staff management

Limitations:

- Square is built around physical transactions, not digital-first businesses

- Its online payment tools lack flexibility

- Global availability is limited (mostly North America, UK, Australia, and Japan)

4. Ayden

Adyen powers payments for global enterprises like Spotify, Uber, and eBay. It’s built for scale, offering direct-to-network card processing, unified commerce, and real-time analytics across 200+ payment methods and 120+ currencies.

Why it works:

- Enterprise-grade global coverage

- Unified system for online and offline payments

- Transparent Interchange++ pricing

- Advanced fraud and risk tools

Limitations:

- Complexity and volume requirements make it impractical for smaller businesses or creators

- Setup requires developer resources, contracts, and sometimes months of onboarding

5. Paddle

Paddle is an all-in-one payments and billing platform designed primarily for SaaS and software businesses. Paddle handles global tax compliance, invoicing, subscriptions, and customer billing, so you don’t have to. It’s popular with startups and mid-size software companies that sell internationally and want to simplify VAT, GST, and sales tax management.

Why it works:

- Fully compliant MoR setup handles VAT, GST, and digital tax automatically

- Streamlined checkout and subscription management tools

- Ideal for SaaS and B2B software businesses with recurring revenue

- Supports multiple currencies and global invoicing out of the box

Limitations:

- Less control over customer relationships, pricing flexibility, and refunds

- Payouts are slower

- Custom integrations can be limited

Whop Payments: The #1 payment processor for online business

If your Stripe account got shut down, don’t panic. Whop Payments has your back with the smoothest setup, insane payout options (yes, including crypto), and 24/7 support that actually responds fast.

No more waiting around for approvals or wondering if your account will vanish.

Get your biz back on track, start selling digital products, SaaS, or coaching material, and get paid without the Stripe drama.

Stop stressing. Get paid. Use Whop. Sign up now and turn your digital hustle into real cash.

FAQ

What payments do Stripe support?

Stripe supports a variety of different payment methods to make each transaction as easy as possible for you and your customers. These include:

- Debit cards

- Google Pay

- Apple Pay

- Buy now, pay later

- Credit cards

- Bank transfers

Bear in mind that the first payout on new Stripe accounts can take up to 7 days. So, if you’re still waiting for this to be processed, don’t worry - this is completely normal and your account hasn’t been closed.

Will Stripe reactivate my account?

If your Stripe account has been closed for reasons other than missing documentation, it won’t usually be reactivated. This is because you don’t have much control over how Stripe views your business and the products you’re offering.

According to the official terms of service, "Stripe may terminate this Agreement (or any part of it) or close your Stripe Account at any time for any or no reason (including if any event listed in Sections 6.2(a)-(i) of these General Terms occurs)."

So basically, Stripe doesn't need to provide you with a reason why your account has been suspended.

If it’s due to fraudulent activity, or selling restricted products, then you won’t be able to create any future accounts on the platform. If it’s simply due to inactivity, Stripe will usually allow you to make a new account.

What are some of the limitations of Stripe?

Despite its popularity, Stripe does have its limitations. With a 2.9% + $0.30 per transaction fee, plus the monthly costs and some hidden fees, Stripe can be a very expensive option for new and smaller businesses.

Can Stripe legally hold your money?

Depending on your situation, it can be difficult to get money back from Stripe. Oftentimes, you won’t be given any information on why your funds have been held, or when you’ll get them back. However, legally, Stripe is only able to hold funds for a total of 180 days.

Is Stripe 100% safe?

Stripe has some of the best security features out there. With EMVCo Level 1 and Level 2 certifications, it meets the highest standards in the industry.

- Level 1: Covers the physical security between the credit cards and terminals

- Level 2: ensures the software processes EMV transactions safely and smoothly

What are the differences between Stripe and PayPal?

Stripe and PayPal share many similarities. They’re both payment processing platforms that allow businesses to accept payments in person, via social media, or in an app.

However, there are also some key differences between the two. While PayPal is customizable to a certain degree, Stripe has almost unlimited scalability when it comes to customization features.

The checkout experience also differs. With PayPal, users are redirected to PayPal to complete their payment, which can create a more time-consuming shopping experience. Stripe, on the other hand, directly integrates payments into the web store.

Who uses Stripe?

Stripe is one of the top payment processing platforms in the industry, used by big brands such as Amazon, Shopify, Lyft, Pinterest, and FreshBooks. The company even attests that almost 90% of all personal credit cards have been processed via the Stripe software.

Some of the most popular businesses that use Stripe include:

- Nonprofits and fundraisers

- Software as a service

- Retail online stores

- eCommerce sites

- B2B Platforms

- B2C Marketplaces