Webull offers advanced charting, commission-free trading, and unique features for day traders. Discover its pros, cons, and whether it’s the best platform for you.

Key takeaways

- Webull offers commission-free trading with advanced charting tools ideal for active and day traders.

- The platform provides 3.75% APY on uninvested cash with FDIC insurance and no minimum balance required.

- Withdrawal complaints and poor customer service dominate Webull's 1.5-star Trustpilot rating—a key risk to consider.

If you’re looking to get serious about trading, choosing the right trading platform might be the biggest decision you make.

Webull is one of the first names that’s likely to come up when you start searching the internet for brokerage platforms—they’re one of the newer brokers on the market, but they’ve certainly put their name out there and built a reputation effectively in recent years.

In this in-depth review, we’re going to run the microscope over Webull and take a look at what it offers, what you can do on the platform, what compromises it makes, and whether it’s a good fit for you given your situation and needs as a trader.

What is Webull?

Webull is a mobile-first stock brokerage platform that offers traders an advanced set of tools including charts, indicators, and screeners that make it an appealing proposition for active retail traders and day traders.

It’s one of the wave of neo-brokers alongside the likes of eToro and Robinhood that led the charge for commission-free trading, eliminating fees on popular instruments like ETFs and appealing especially to household traders by using deposit incentives.

Webull is owned by Hunan Fumi Information Technology, a Chinese holding company founded by former Alibaba and Xiaomi executive Wang Anquan.

Despite being owned by a Chinese firm, Webull is registered in the US and other major markets and the platform’s users enjoy SIPC and FDIC protection.

Why traders choose Webull

Webull entered the US market in 2018, making 2026 its eighth year of operation. That still makes it a lot younger than immediate competitors such as Robinhood and eToro, and this fact meant that Webull was always going to market itself aggressively in order to establish a market share quickly.

Incentivized deposits

Right from the get-go, Webull carved out a niche using an aggressive deposit incentive strategy, at one stage offering new depositors a single randomly chosen share.

This helped to entice plenty of new customers since, while the chances of drawing a penny stock worth a few cents or a handful of dollars was extremely high, there were also stocks like $AMZN (at the time) worth thousands up for grabs.

Currently, Webull isn’t quite as generous since new depositors need to come in with a minimum of $500 to qualify for the above promotion, with initial deposits of $2,000 or more netting 40 fractionals and $500 to $1,999 scoring 20 valued between $3 and $3,000.

Joining Webull has been incentivized from the start, much like a betting site, and while the exact offers tend to change, there’s generally some sort of bonus on play if you’re willing to give Webull your money.

Cash management

On the topic of depositing cash with Webull, the prevailing interest rate climate means that Webull has been upping their returns for holding cash. Currently, that rate of return sits at 3.75% APY, which is on the higher end of what’s offered by any legitimate financial institution.

As mentioned previously, your cash under Webull Cash Management is FDIC insured, and it’s worth noting that there’s no need to open any separate account to earn interest—any uninvested cash in your account qualifies, with no fees or minimum balance at play.

It’s also as convenient as can be, given that your Webull account can be managed easily on the go via the Webull mobile app.

Commission-free trading and fractionals

One of Webull’s key features is the fact that US stocks can be bought and sold on the platform without any commission.

This is a far cry from legacy brokerages which made their money on fees, but it’s common among neo brokers which make their money instead by routing user orders to certain market makers such as Virtu and Citadel.

This practice, Payment For Order Flow, constitutes the main source of revenue for some brokers including Webull and its competitor Robinhood, and remains to be backed by US policymakers despite being banned in the UK and the EU.

It must be noted that despite criticism of PFOF affecting order execution, Webull has a stated commitment to execution quality and reviews execution data regularly.

Webull also notes that decisions to route to a market venue are not based on the rebates received from them.

Charting and trading tools

While free trading isn’t necessarily something that sets it apart from the rest, Webull’s charting and selection of tools certainly are.

Featuring some of the best analysis tools among major brokerages, Webull has everything you might want when it comes to charting, plus advanced market data level 2 quotes and NBBO to provide the most detailed insights into price movement possible.

They have over 60 indicators and 20+ drawing tools to make use of if you know what you’re doing, with Trendline and Fibonacci Retracements being just the tip of the iceberg.

They’ve also got 8 different line styles to offer from classic candlesticks to Heikin Ashi, and it’s easy to compare stocks as well by charting multiple assets in a single view.

Furthermore, the user interface deployed by Webull means that you can act quickly whenever your charting gives you anything actionable—you can click anywhere on said chart to bring up buy, sell, and alert buttons which will then let you immediately make your trade.

How to use Webull

What you need to get started

The first thing you need to get started with Webull is an appropriate device.

Luckily with Webull just about anything will do—you can download the Webull mobile app on any sort of handheld device such as your phone or tablet, and desktop users can either use the browser interface or download Webull’s desktop client.

The mobile version will do fine if you need to trade on the go or just want to invest occasionally, but the desktop client is a great idea for day traders who want to put some time into trading and analysis since a bigger screen and the more powerful client can help you get the most out of Webull’s analysis tools.

Once you’ve downloaded the app or client or simply navigated to Webull’s website, you should also get some of your documentation ready—like any brokerage, Webull has to verify your identity when you open an account and collect certain information from you in order to comply with regulatory requirements.

US users need to prove their residency, be at least 18 years old, show a valid US residential address, and provide their Social Security Number or individual Taxpayer Identification Number to get started.

Creating your Webull account

To get started trading on Webull, you’ll need to sign up for an account.

This is done via phone number to begin with, and you’ll get a verification code immediately in order to get the ball rolling.

You can then create your login password, and pick between Webull’s two choices of UI if you’re on the app—there’s the Lite trading platform, or their more sophisticated version.

Then, you’ll need to follow the application prompts to submit an application for your new Webull account. You’ll generally get a reply within 24 hours, either notifying you of approval or that you’ll need to submit further documentation.

It’s worth noting that you can also create a Webull account for your business if you have an LLC, C-Corp, or S-Corp. These “entity accounts” require a minimum initial deposit of $100,000 and have to maintain an ongoing equity balance of $50,000.

How to buy stocks and ETFs on Webull

Webull’s interface is intuitive and easy to use, and you can buy and sell stocks as well as ETFs very easily.

Buttons to do so are signposted clearly and often color-coded, with green representing buy and red for sell. All you need to do is enter a dollar amount or number of shares you want to buy or sell, and hit that button!

With Webull, it’s also possible to buy fractional shares of stocks as well as ETFs.

These are especially important for micro-investors or traders who are starting small, or simply want to add a little bit of exposure to high-value stocks in their portfolios.

Thousand-plus dollar stocks do exist, and fractional shares allow you to, for example, dollar cost average your way into them a few bucks at a time—$5 to be exact, which is Webull’s fractional order minimum.

On the Trade interface, simply enter a dollar amount rather than an amount of shares to trade and Webull will automatically purchase whatever fraction of that share you’re entitled to for that dollar amount. Fractionals can’t be sold short, nor are they eligible for Webull’s stock lending program.

Webull also has a Recurring Investment Program to help you with investing strategies such as the previously mentioned dollar cost averaging technique.

You can simply set a target stock or ETF, click on options to find “Recurring Investment” and then follow the prompts. Again, there’s a minimum of $5 at play here along with a maximum of $25,000.

Lastly, the overnight trading feature that Webull offers could be of interest to many traders. This allows 24 hours per day, 5 days per week trading across selected securities for traders between 8PM and 4AM EST Sunday through Thursday.

Webull users can’t short or trade fractionals during these sessions, and only Limit orders are available.

Other investment options on Webull

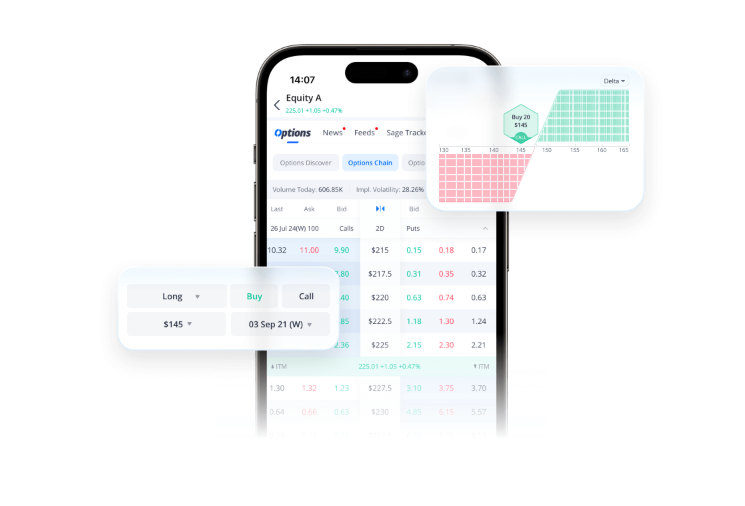

Webull has a selection of vehicles for trading and investment beyond what we’ve already mentioned, one of which is options.

These derivatives are suitable for more advanced traders who have a thorough understanding of how they work, and feature much higher risk than equities due to expiration—the value of an option can go to zero once it expires, as opposed to a stock which always holds value unless it’s delisted.

It could certainly be argued that Webull is one of the best platforms for options trading given the wealth of charting and tools they put at users’ disposal, allowing you to do as much analysis as you need to be sure of your strategy.

Beyond stock options, Webull also allows you to trade index options, futures, money market funds, and offers access to fixed income via US treasures. You can also set up a retirement account (IRA) with Webull.

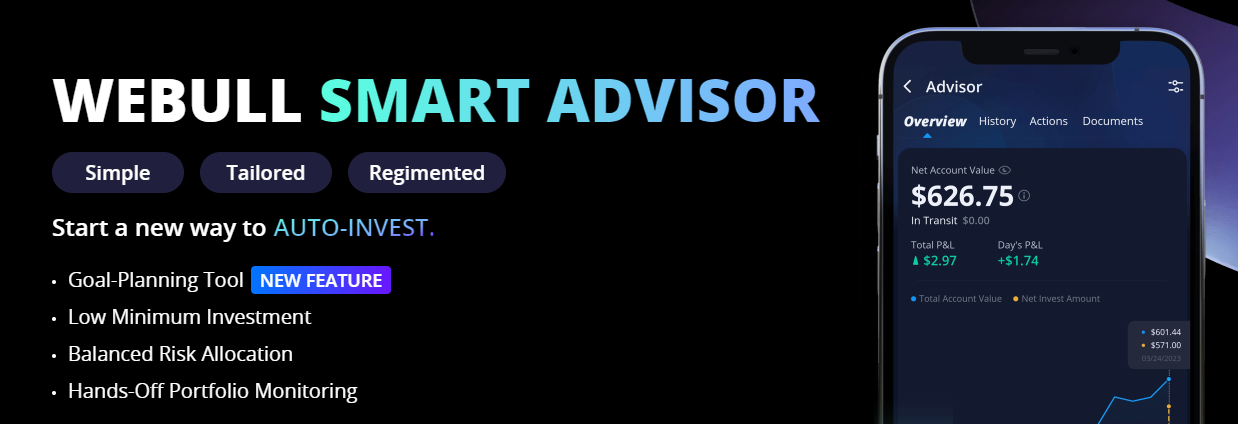

If you’re interested in passive investing rather than active portfolio management or trading, the Webull Smart Advisor could help. First of all, Webull’s robo-advisor will lay down some questions so that you can specify your goals and level of risk.

Then, it’ll automatically invest money that you deposit, building diversified, primarily ETF-based portfolios for you based on your stated goals.

Withdrawing your money from Webull

Withdrawing your money from Webull is easy. All you need to do is select your account, then navigate to Transfers and Transfer Money. From there, you need to indicate that you wish to withdraw, and specify your external bank account.

This sort of ACH withdrawal usually takes a couple of business days, and Webull has a daily limit of $50,000.

However, withdrawal of funds is one of the main sources of online complaints about Webull.

The platform has an extremely poor 1.5 star rating on Trustpilot, and many of those negative reviews have to do with a lack of transparency around the withdrawals of funds and a lack of Webull customer service when it comes to withdrawals and frozen funds.

While negative online reviews ought to be taken with a grain of salt in many cases, they’re worth keeping in mind when you make a decision as to whether or not Webull is to become your trading platform of choice.

Paper trading on Webull

Many trading books and coaches advise that novice traders paper trade before actually putting some skin in the game, and Webull offers a robust paper trading system that can help you if you’re new to the game.

You can paper trade using all products that Webull offers, and it’s completely free to do—there are no fees or commissions for paper trading, and since you’re not using real money, there’s no risk either.

You can also use any amount of virtual cash, thus letting you simulate trading styles such as scalping.

How much does Webull cost?

Webull is one of many brokerages that make keeping costs down central to their unique sale proposition, and its fee schedule reflects that.

Trading in US stocks, options and ETFs is completely free of fees, although regulatory charges do apply. Over the counter trades are subject to fees, while F-stocks (foreign settlement) are subject to $5.00 per trade on the buy side and $0.05 per sell trade.

Perhaps the most significant fee that Webull users may face is the $75 per outgoing stock transfer.

While it might not seem substantial, this fee can impact investors who need to transfer stocks from a brokerage to a transfer agent via the Direct Registration System (DRS) to hold assets in book entry, simplifying participation in corporate actions like voting or receiving dividends.

Since Webull doesn’t facilitate DRS, investors would need to transfer their shares from Webull to a broker like Fidelity or Interactive Brokers that does. This could add up, especially if done on a regular or semi-regular basis.

Is Webull safe to use?

Webull is generally regarded as being safe to use, and they haven’t been subject to any high-profile hacks or breaches unlike several competitors.

However, Webull were fined $3 million by FINRA in 2023 in relation to customer complaints and lacking due diligence when allowing users to trade options.

The firm was also subject to a 2024 probe by 14 state attorneys in relation to data privacy concerns and potential ties to the Chinese Communist Party.

The state of Tennessee went on to ban Webull on all government-issued devices, and in December 2024, the United States House Select Committee on Strategic Competition between the US and the CCP raised concerns over Webull’s ties to China and it's ownership structure.

As previously mentioned, user funds are subject to SIPC and FDIC protection, with up to $500,000 in total coverage and a $250,000 limit for cash. Apex, Webull’s clearing company, also provides a measure of additional insurance on Webull customer transactions.

It’s also important to note that Webull allows users quick access to the app via a passcode system. This Webull login mechanism is a compromise between some brokers that require you to login anew after a few minutes of inactivity, and others that keep you logged in for a lot longer.

The passcode system is convenient, but it’s likely a lot easier to compromise than your full login details if you do misplace your device.

Is Webull worth it?

Webull pros

- Advanced tools and charting. Webull’s advanced charting and analysis tools with 60+ indicators and easy navigation between charting and trading sets it apart from many other brokerages.

- No commissions. Zero commissions is one of Webull’s central features, and although there are fees to do with some operations as well as foreign stock trading, US stocks, options and ETFs are free.

- Hassle-free cash management. Having your uninvested cash automatically deployed toward earning interest without any active management on your part is also a big benefit.

Webull cons

- Separate app for crypto. We haven’t mentioned crypto very much in this review because it isn’t possible to trade on the main Webull app—you’ll have to download the Webull Pay sister app if you want to trade crypto.

- High fee for outbound stock transfers. Transferring positions off of Webull and onto another platform is quite expensive, especially if you need to do it regularly to, for example, DRS the shares you accumulate.

- PFOF. Payment for order flow is what allows Webull to offer commission-free trading, but the fact that it’s banned in other major markets tells the whole story. After all, if something’s free, then there’s a good chance that you’re the product. And that’s definitely the case with neo-brokers since their clients are actually the market makers to whom your order data is sold.

Webull alternatives

If you’re not fully sold on Webull yet, check out our comprehensive guide on the best free stock trading apps to use. Or, if you just want a quick overview, here are three of the best in the business right now.

1. Fidelity

Fidelity is one of the biggest names in finance and could be considered the leading broker in the US given that it’s got over $5 trillion in assets under management and almost triple that in assets under administration.

This certainly suggests that Fidelity is indeed too big to fail, and is as safe and secure as it gets given its role as a traditional brokerage.

That being said, Fidelity more than matches neo-brokers like Webull with commission-free trading in US stocks and ETFs, so if that’s all you’re after then there’s no reason to look past them. However, Fidelity does charge a $0.65 fee on options trades and a spread of 1% on crypto so they’re not entirely free.

Fidelity also doesn’t charge a fee to transfer assets to another platform, and they’ve got a massive selection of assets to invest in, including thousands of mutual funds that Webull doesn’t let you touch.

Read more about Fidelity in our comprehensive review.

2. Interactive Brokers

If you’re not in the US, Interactive Brokers is likely to be very high on your list of brokerage platforms by default—they’re accessible in 200 countries and territories unlike the likes of Robinhood and Webull which are only for US residents.

Like Webull, IBKR (as it’s popularly known) offers some of the most advanced trading tools on the market, and they’ve got access to a wide variety of markets. You can pick up stocks and ETFs from all over the world, with the caveat that you may also have to exchange currencies on the platform and lose a little in forex fees.

There’s zero-commission trading on Interactive Brokers as well, and they’ve got the same fee on options as Fidelity. Also like Fidelity, asset transfer is made very easy, and you can DRS your stocks with minimal fuss.

Discover all you need to know about Interactive Brokers.

3. Robinhood

Robinhood is a neo-broker that’s very much in the same family as Webull, with zero commission trading that’s made possible by their commitment to PFOF.

It’s also known for gamifying the trading experience for better or for worse—trading’s complicated but Robinhood makes it simple, although this means that novice traders may find themselves swimming in waters that are a little too deep.

Robinhood is very similar to Webull from a pricing point of view and is even cheaper when it comes to things like fractional order minimums, but it’s even more expensive for outgoing asset transfers.

The platform also can get expensive if you wire money out or deal with checks, and even monthly paper statements have a cost attached to them.

The platform can’t compete with Webull in terms of charting and analytics tools, but the simplicity of its charting UI is an advantage in another way—if all you want to look at is an extremely basic stock chart or show a particular trend to your followers on socials, a Robinhood screenshot is often the best-looking.

Read more in our in-depth Robinhood review.

Find expert trading tools and education on Whop

Webull’s tools are great, but the real edge comes from learning directly from pros who are already winning. On Whop, you can join communities led by top-performing traders, access their proven systems, and even copy their trade signals.

Some traders are making serious gains simply by following the strategies shared in these awesome trading groups. Whether you’re refining your approach or just starting out, investing in their insights could be your smartest move yet.

Explore Whop’s trading groups today and start learning from the best in the game!