Learn how payment APIs and gateways work, the pros and cons, and why Whop Payments makes getting paid online faster, simpler, and more secure.

Key takeaways

- Payment APIs give you control over checkout experience but require developer resources and proper implementation to avoid failures.

- Payment gateways securely encrypt and transmit card data between customers and banks, often working alongside APIs for best results.

- When choosing a payment API, prioritize security compliance, reliability, multi-method support, and scalability for your business model.

Payment APIs (Application Programming Interface) are software that connects your website or app to payment processors, allowing you to accept payments directly within your platform.

Payment gateways are secure tunnels that encrypt and transmit customer payment data between your business, the payment processor, and the customer's bank.

If you’re running a business online, getting paid is non-negotiable. But unfortunately, payments are often where things break.

Keep reading to learn how APIs and gateways really work for online payments.

How does a payment API work?

When a customer checks out, a payment API collects their card details on your site.

1. Integration

The business connects the API to its site or app — usually by dropping in code or using the provider’s SDKs and libraries. This creates a payment form where customers enter their details.

2. Collecting payment info

A customer starts checkout and adds their card, wallet, or bank details. The API takes that information and prepares it for secure transmission.

3. Encrypting the data

Before anything is sent, the API encrypts the customer’s payment info to keep it safe as it travels over the internet.

4. Sending a transaction request

The encrypted data is passed to the payment processor, which contacts the customer’s bank (the issuer) to ask if the payment can go through.

5. Authorization

The bank checks the customer’s balance and risk signals, then replies with an authorization response — approved or declined — plus details like a transaction ID.

6. Updating the website or app

The API relays that response back to the business. If approved, the site shows a confirmation; if declined, the customer is prompted to try another method.

7. Capturing the payment

In many setups, authorization happens first and the actual payment “capture” happens later — triggered automatically or via another API call.

8. Settlement

Funds move from the customer’s bank to the business’s account. Depending on the processor and method, this can take anywhere from instant to a few days.

9. Refunds and disputes

Most payment APIs include endpoints to issue refunds or manage disputes, giving businesses tools to handle customer service and chargebacks.

10. Security checks

Payment APIs layer on fraud detection, two-factor authentication, data encryption (in transit and at rest), and regular security audits to meet industry standards and keep both businesses and customers safe.

APIs give you more power, but they also put more responsibility on your shoulders. If the setup isn’t done right, you’ll feel it in failed payments, frustrated customers, and wasted time.

How does a payment gateway work?

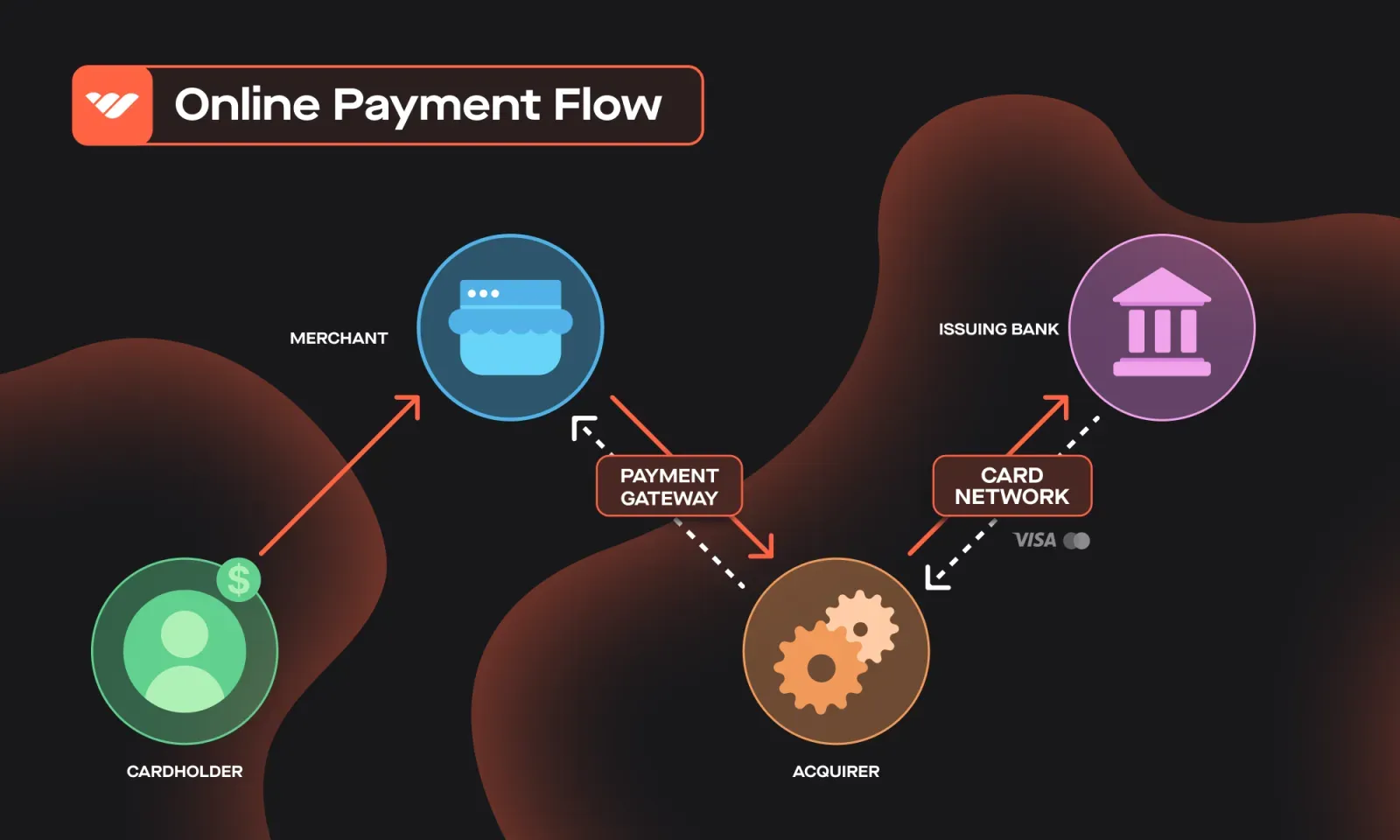

If a payment API is the messenger, a payment gateway is the secure tunnel. It’s the technology that moves sensitive card details between your website, the payment processor, and the customer’s bank — and then brings back the yes/no answer in just a few seconds.

Here’s how it goes:

1. Customer enters details

At checkout, the customer types in their card or wallet info.

2. Gateway encrypts the data

The payment gateway immediately encrypts those details so they can’t be intercepted or stolen.

3. Secure transmission to processor

The encrypted data is sent to the payment processor, which passes the request through the card network (Visa, Mastercard, etc.) to the customer’s issuing bank.

4. Bank checks funds & risk

The bank verifies the customer has enough balance and isn’t flagged for fraud.

5. Approval or decline

The response travels back through the network → to the processor → to the gateway → to the website or app. The customer sees either a success confirmation or an error message.

6. Settlement later

If approved, the payment is captured and settled — funds move from the customer’s account to the merchant’s account.

Payment gateways make online transactions possible, but they’re not always flexible. Most modern businesses combine a gateway with an API to balance security, control, and customer experience.

The pros and cons of using APIS for payments

Payment APIs can unlock a lot of value for your business, but they also come with trade-offs. Here’s a clear look at both sides.

Pros

- Seamless checkout: Customers pay directly on your site or app, without being redirected elsewhere.

- Better user experience: Fewer clicks = fewer drop-offs, which means higher conversion rates.

- Strong security: Sensitive data is transmitted directly to the processor, reducing fraud risk.

- Flexibility: APIs can handle multiple payment types, recurring billing, and advanced logic.

- Rich data access: Businesses can analyze detailed transaction data to improve marketing and customer support.

Cons

- Integration can be complex: Most APIs require developer resources, which may be tough for small teams.

- Security risks if misused: Poor implementation leaves room for fraud or breaches.

- Limited payment options with some providers: Not every API supports global or local payment methods.

- Added costs: Monthly fees or per-feature charges can stack up, especially for low-volume merchants.

- Customization limits: Some APIs are closed systems, making it hard to adapt or extend beyond what’s provided.

Payment APIs give you full control over checkout and customer data — but they also come with strings attached.

If you don’t have the technical resources, they can quickly turn into extra costs, delays, and complexity that pull you away from actually growing your business. That’s why Whop Payments offers both: deep APIs for custom setups, and no-code tools that anyone can use.

Things to consider when choosing a payment API for your business

Not all payment APIs are created equal. The right one can help your business grow seamlessly; the wrong one can add cost, complexity, or even turn customers away at checkout.

Here are the key factors to keep in mind:

- Cost: Factor in setup fees, monthly/annual charges, and hidden costs for essentials like fraud prevention, recurring billing, or refunds.

- Security: Your payment API should meet PCI-DSS standards, encrypt data in transit and at rest, and include built-in fraud detection.

- Reliability: Downtime = lost sales. Choose a provider with high availability, fast processing, and uptime guarantees (SLAs).

- Convenience: Look for APIs that support multiple payment types (cards, wallets, local methods), sandbox testing, and easy plug-ins for your platform.

- Flexibility: Choose an API that can adapt to your model. Flexibility also means support for multiple currencies and languages.

- Support: Strong documentation, SDKs, sample code, and responsive customer support make a big difference.

- Integration: Check whether the API supports webhooks, real-time notifications, and modern frameworks to reduce dev headaches and give you better visibility into transaction status.

- Compliance: Make sure your provider is compliant and can back it up with certifications. Ask about their security policies and incident response plans.

- Scalability: Look for APIs that can scale with you, supporting higher transaction volumes and new markets without disruption.

Whop Payments checks all these boxes — with flat 2.7% + 30¢ fees, orchestration that reduces declines, PCI Level 1 security, payouts in 241+ territories, and support for 100+ payment methods (including crypto).

“My first month on Whop, I made $12.5k all from organic traffic, with 0 failed payments lol. Thanks Whop!”

- Whop seller @0xroas

Process your payments with Whop

Payments should be simple for you and seamless for your customers. That’s why Whop gives you multiple ways to start collecting money — without unnecessary friction.

With Whop Payments, you can:

- Accept credit and debit cards, buy now pay later, and 100+ local payment methods worldwide.

- Offer crypto payments (Bitcoin, ETH, stablecoins) for one-time or recurring transactions.

- Get paid out globally in over 241 territories, straight to your local bank, Venmo, CashApp, or crypto wallet.

If you’re technical, Whop’s powerful API makes setup easy:

- Create a charge on your server with a single API call.

- Confirm the payment on the client with Whop’s iFrame SDK — open a payment modal inside your app or redirect users to a secure checkout page.

- Automate payouts with another API call — send funds to your users by Whop username, ID, or wallet, straight from your ledger account.

And if you’re not technical? We still have you covered:

- Share checkout links in seconds.

- Embed Whop’s checkout widget directly into your site.

- Or launch a full storefront with Whop’s no-code builder.

Get extras baked in at no extra cost: dispute handling, free trials, affiliate tools, mobile management, and orchestration that boosts revenue by up to 11% by routing every charge through the best provider.

Sign up for Whop Payments and supercharge your online sales with higher success rates, lower fees, and more flexibility.

FAQs about payment APIs, gateways, and Whop Payments

What’s the difference between a payment API and a payment gateway?

A payment API is the tool that connects your website or app to a payment processor, giving you control over how checkout looks and works. A gateway is the secure tunnel that moves your customer’s card details to their bank and brings back the yes/no response. Most businesses use both.

Do I need developers to use a payment API?

With most providers, yes. Payment APIs usually require coding knowledge to integrate. With Whop, you can go either way: use the full API if you want control, or skip the dev work with checkout links, embeddable modals, and no-code storefronts.

What payment methods should I offer customers?

The more payment methods you give, the higher your conversion. Beyond credit and debit cards, you’ll want local payment methods (like iDEAL in the Netherlands), Buy Now Pay Later (BNPL), and even crypto. Whop Payments supports 100+ global methods plus Bitcoin, ETH, and stablecoins out of the box.

How long does it take to get paid?

Some providers hold funds for days before releasing them. With Whop, payouts are faster and more flexible. You can get paid in 241+ territories via local bank transfer, Venmo, CashApp, or crypto — whichever works best for you.