Find the right SaaS billing solution by prioritizing automation, payment flexibility, security, and analytics to reduce failed payments and boost growth.

Key takeaways

- Choose a SaaS billing platform that matches your business stage—indie founders need simplicity while enterprises require compliance and scalability.

- Smart dunning workflows automatically recover failed payments, reducing involuntary churn and protecting recurring revenue.

- The best billing solutions combine flexible pricing models, global payment options, and seamless integrations to scale with your growth.

Choose the right SaaS billing solution by focusing on automation, flexible subscription models, secure payment processing, and compliance tools. The right platform keeps revenue predictable, reduces churn, and scales with your business. In this guide, we break down key features, challenges, and top platforms for SaaS billing.

In this guide, we’ll break down what makes a great SaaS billing system, the challenges it should solve, and how to pick the right platform for your business model – whether you’re just starting out or managing thousands of active subscribers.

What are SaaS billing solutions?

SaaS businesses generate recurring revenue through subscriptions or pay-as-you-go pricing.

Managing these recurring payments, invoices, and renewals can quickly get complex — especially when handling hundreds (or thousands) of customers.

That’s where SaaS billing solutions come in. These platforms automate and centralise your billing processes so you can:

- Accept global payments across multiple currencies

- Automate invoicing and renewals

- Track usage and revenue in real time

- Stay compliant with tax and data regulations

In short, SaaS billing platforms let you focus on building your product while they handle the operational heavy lifting.

Examples of SaaS billing solutions on the market

There’s no shortage of billing platforms built for SaaS — each offering different levels of automation, flexibility, and global reach.

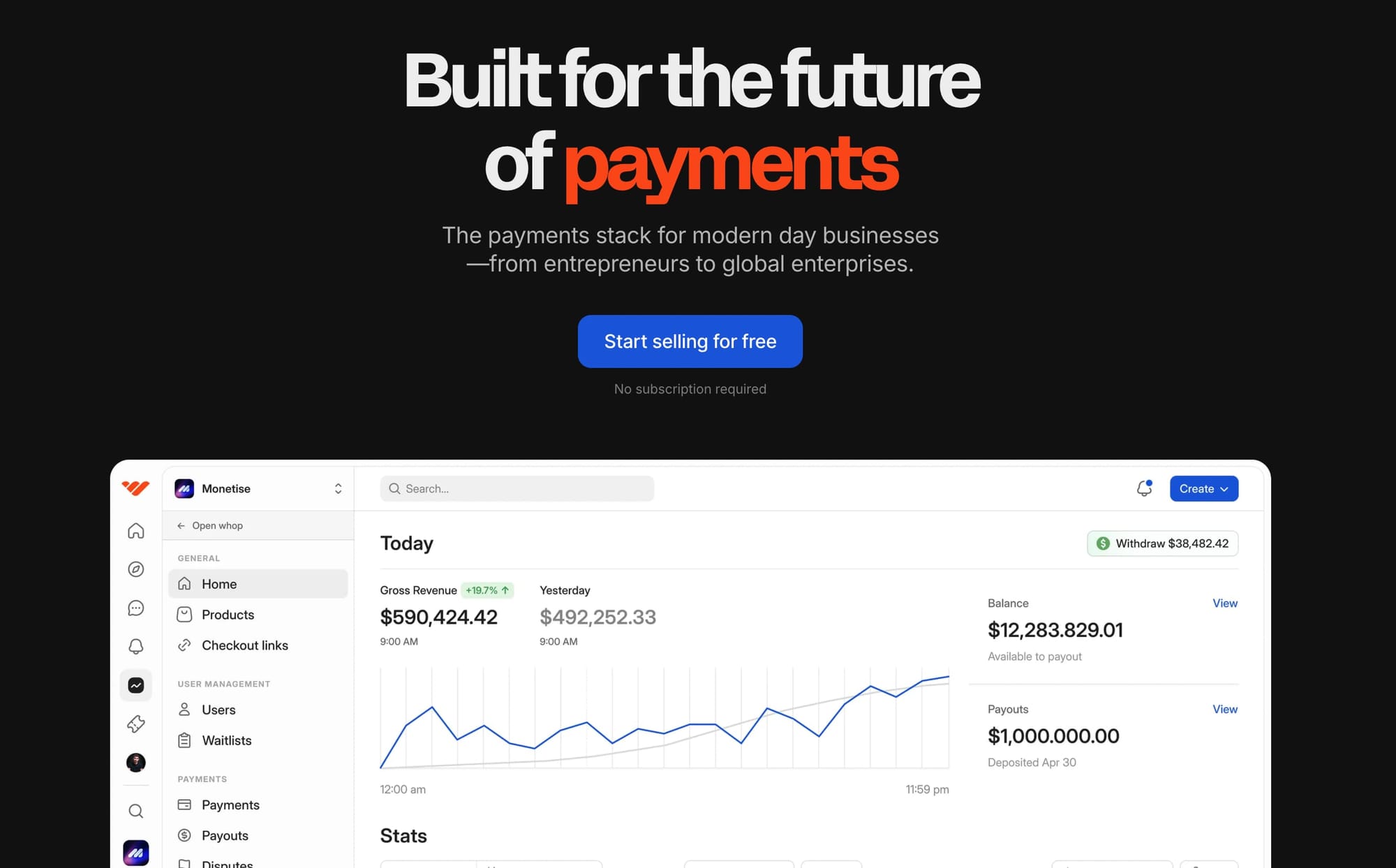

A clear standout is Whop Payments – a full Merchant of Record (MoR) platform built for modern SaaS and digital businesses.

It handles payments, subscriptions, tax compliance, and chargeback protection automatically, so you can scale globally without worrying about financial infrastructure.

With 100+ payment methods, global payouts in 190+ countries, and built-in BNPL options, Whop Payments lets you grow revenue while staying compliant everywhere you operate.

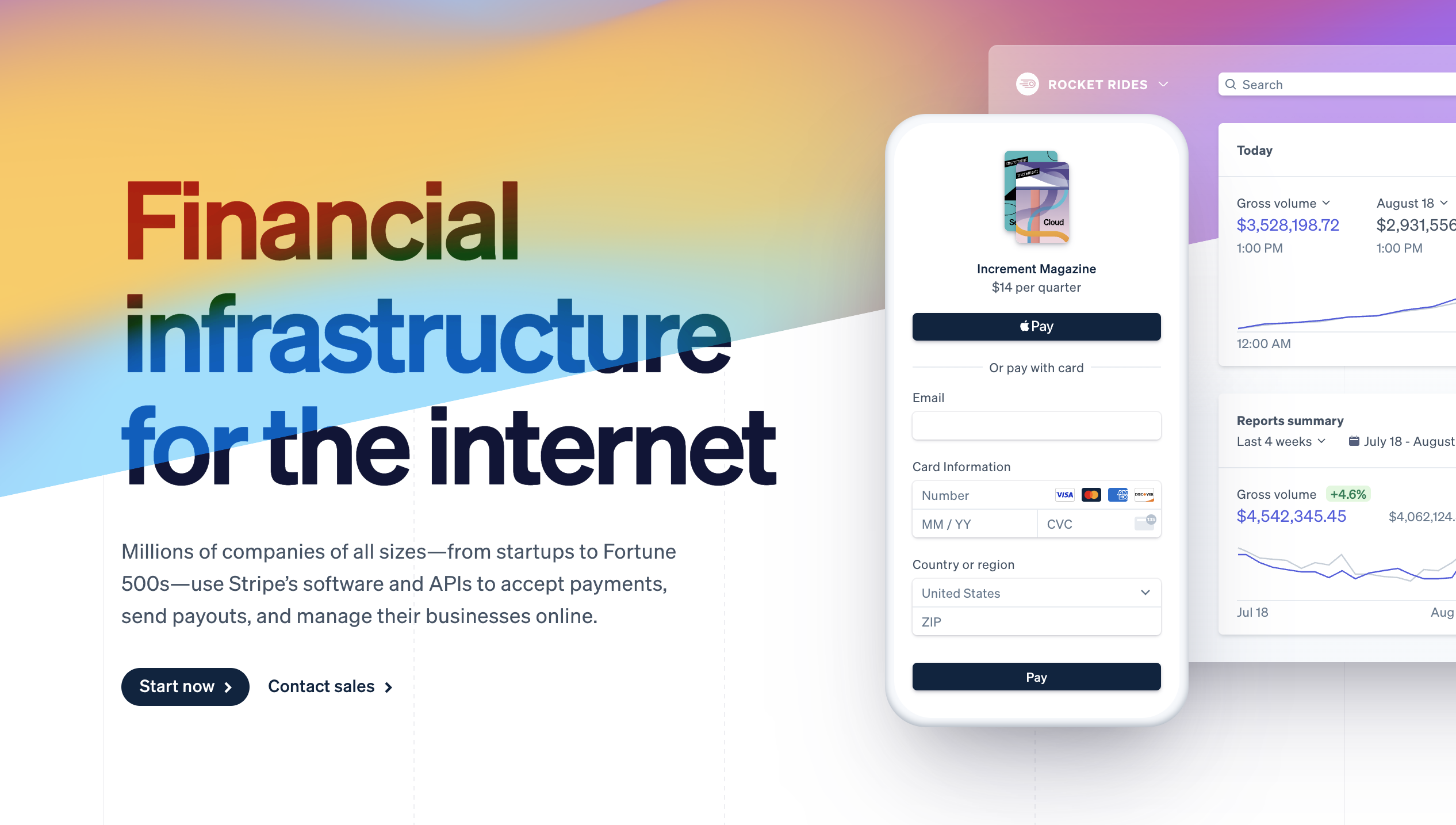

Other established solutions include Recurly, Stripe, and Chargebee – each with its own strengths in analytics, billing logic, or gateway flexibility.

Top features of SaaS billing platforms

To choose the right SaaS billing solution, focus on the features that directly impact revenue, customer experience, and scalability.

Here are the essential capabilities every platform should offer:

1. Pricing models

The pricing model you choose for your SaaS billing solution directly impacts your revenue and customer retention. Common models include:

- Pay-as-you-go: Best for flexible or usage-based pricing.

- Subscriptions: Ideal for recurring access and predictable revenue.

- One-time payments: Great for fixed, non-renewing digital goods or licenses.

- Freemium tiers: Let users try before they buy, then upgrade for premium features.

Choose a billing system that supports multiple models so you can experiment and adapt over time.

2. Payment gateways

A billing system is only as strong as its payment gateway integrations. Look for platforms that support:

- Major gateways like Stripe, PayPal, and Adyen

- Alternative methods such as Apple Pay, Google Pay, ACH, or crypto

- Global checkout options for different currencies and languages

More options mean more completed checkouts, especially for international audiences.

3. Scalability

Your billing solution should grow with you. A scalable platform can handle spikes in traffic, integrate with CRMs and analytics tools, and support global expansion without downtime.

Look for APIs and modular integrations that allow your developers to plug billing directly into your existing stack.

4. Customer support

Billing is mission-critical. When something goes wrong, you need fast help.

Choose a provider with 24/7 live support, ideally through multiple channels (chat, email, and phone).

Bonus points for platforms that offer self-service portals, FAQs, and onboarding guides to reduce dependency on support tickets.

5. Security

Security and compliance are non-negotiable. Your billing provider should offer:

- PCI-DSS compliance

- Two-factor authentication

- Advanced fraud detection

- Data encryption at rest and in transit

These safeguards protect both your revenue and your users’ trust.

6. Integrations

The best SaaS billing tools fit seamlessly into your workflow.

Prioritise platforms with robust APIs and integrations for CRMs, analytics, email tools, and accounting systems.

The more connected your systems are, the easier it is to manage customer data and automate reporting.

How to choose a subscription billing platform

Not every SaaS billing solution fits every business. Your ideal platform depends on your company size, subscription model, and global ambitions. Use this framework to guide your choice:

1. Indie SaaS / Early-stage

- Focus: Simplicity, low cost, fast setup

- Key Features: Easy API integration, basic subscription management, no monthly fees or complex contracts

- Why: You want to start collecting recurring revenue quickly without overhead, and flexibility is more important than advanced analytics.

2. Mid-Market / Scaling SaaS

- Focus: Automation, multi-currency support, analytics

- Key Features: Automated billing & dunning, global payment methods, detailed reporting, and subscription lifecycle management

- Why: You’re managing hundreds or thousands of subscribers, so automation reduces errors, improves retention, and provides data to optimize revenue.

3. Enterprise / Large SaaS

- Focus: Full compliance, high scalability, advanced orchestration

- Key Features: Multi-gateway routing, tax and regulatory compliance, advanced fraud detection, API access for complex workflows

- Why: Large businesses need platforms that can handle high transaction volumes, multiple payment methods globally, and strict compliance requirements without downtime.

By matching your business stage with the right platform features, you can choose a SaaS billing solution that scales with your growth while minimizing churn and revenue risk.

Whop Payments for SaaS billing

If you’re looking for an all-in-one billing infrastructure built for modern SaaS? You need Whop Payments.

It’s a full Merchant of Record (MoR) platform that handles payment processing, subscriptions, tax compliance, and global payouts, all under one roof.

Instead of managing multiple tools or worrying about payment failures, fraud, or compliance issues, Whop lets you focus entirely on building and scaling your product:

- Full Merchant of Record coverage: Whop handles taxes, chargebacks, and compliance across 100+ jurisdictions.

- Global payouts: Get paid in over 241+ territories, via ACH, crypto, CashApp, or local bank rails.

- Multiple payment methods: Accept 100+ options, including cards, wallets, crypto, and Buy Now Pay Later (BNPL).

- Advanced payment orchestration: Each checkout is automatically routed to the provider most likely to approve the transaction—boosting conversion rates by up to 11%.

- Built-in analytics and insights: Track churn, MRR, and customer lifetime value in real time.

- No monthly fees: Just 2.7% + $0.30 per transaction, with zero setup costs or hidden extras.

We take care of the messy parts of billing and let you scale globally without friction.

Seamlessly scale SaaS subscriptions with Whop Payments

The best SaaS billing platforms automate recurring payments, handle tax and compliance seamlessly, and give you the flexibility to adapt as your business grows.

Whop Payments manages everything from subscription billing and chargeback protection to global payouts and compliance. Accept 100+ payment methods, expand into new markets, and monitor your revenue — all from one dashboard.

Whether you’re an indie SaaS founder or a fast-scaling team, Whop Payments gives you the infrastructure to grow without the complexity.

Start selling with Whop Payments today and turn your billing system into a growth engine.

SaaS billing FAQs

How do I migrate my existing subscriptions to a new billing platform?

Migration involves exporting customer and payment data, mapping it to the new platform, and testing billing cycles in a sandbox. Many platforms provide migration tools or dedicated support to simplify the process.

What hidden costs should I watch for in a SaaS billing platform?

Beyond transaction fees, check for setup fees, monthly minimums, currency conversion costs, chargeback handling, and add-ons for analytics or advanced integrations.

How do billing platforms recover failed payments without upsetting customers?

Smart dunning workflows retry failed payments at optimal times, send automated reminders, and let customers update payment details easily, reducing involuntary churn while maintaining trust.

Can SaaS billing platforms handle complex revenue recognition?

Yes. Advanced platforms automate revenue recognition for GAAP or IFRS compliance, which is especially useful for multi-component subscriptions or deferred revenue.

How can I measure the ROI of my SaaS billing system?

Track metrics like recovered failed payments, reduction in involuntary churn, time saved on manual invoicing, payment success rates, and growth in MRR/ARR. Dashboards often provide LTV and churn insights by customer segment.