One of the most common pieces of advice young people receive is to invest early and often. Planning for retirement sounds boring, but what if retiring at 50 or even 40 becomes a reality as a result of it? Compound interest can help you do just that.

This article is going to break it all down for you, explaining how compound interest works and how to match it with your investment goals, followed by some of the best ways to actually put this theory into practice.

What is Compound Interest

Compound interest is a concept treated with reverence by many, and there’s even a myth going around that Albert Einstein himself called it the most powerful force in the universe. True or not, compound interest is certainly worth harnessing, but luckily, it’s also very simple.

If you live in a developed country, you might only just be getting accustomed (or reaccustomed) to receiving a small rate of interest when you save money in a bank account. This rate may not be more than one or two percent, but that’s better than nothing given the years of zero interest that followed the global financial crisis of ‘08.

Even a 1% interest rate can demonstrate how compound interest works. Payout policies may differ from bank to bank, but in the worst case, if you deposit $100, you should have $101 in your account a year later.

You now have two options. You can take that $1 out and use it, or you can leave it in the account for another year. If you let it stay, at the end of year two, your account will now have $102.01.

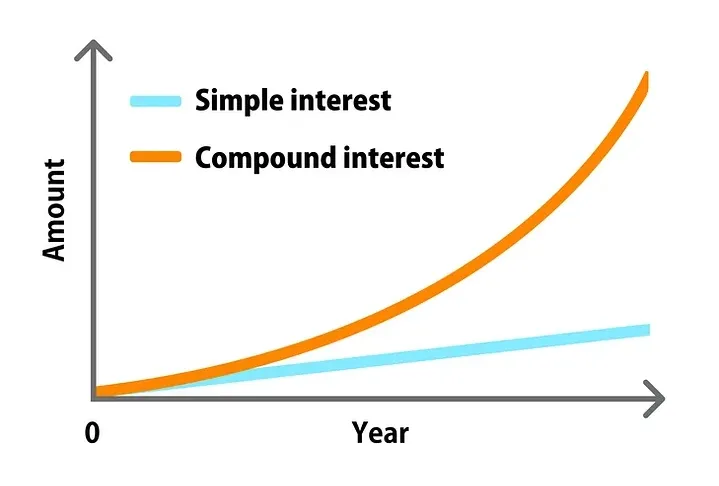

That extra cent doesn’t sound like much, but if we take this compounding example ten years into the future, you’d have $110.46. That’s $0.46 more than you’d have if you keep withdrawing the interest that you earn, and it amounts to almost 5% of your total interest earned over ten years.

Where compound interest really shines is when you start to get higher interest rates, and keep adding to your principal deposit as well. $100 a month invested into a 5% interest account compounded monthly for ten years means that you’d put in a total of $12,000 but end up with over $15,500.

Finding safe investments that still provide a decent return and contributing to them as consistently as possible is the key to maximizing compound interest and growing your wealth over time.

Early Investment Goals

One of the main things to do when figuring out your investment strategy and incorporating compound interest is to set clear goals. The advantage of starting early is that you’re giving yourself a time horizon that helps make your goals achievable.

If you’re just entering the workforce in your late teens or early twenties, setting a goal of retiring on your investments at the age of 35 or 40 might be entirely realistic and achievable. Even if you don’t have too much money to put down as a principal, a monthly contribution of a few hundred bucks can go a long way.

The importance of setting goals is that you can devise a strategy to accomplish them more easily. Those goals need to be realistic, though. If you want to retire by the end of next week and aren’t positioned for it, your only options are to buy a bunch of lottery tickets or throw your life savings at some risky out-of-the-money call options. In both cases, you’re far more likely to end up going broke than quitting your day job.

The traditional view of retirement is that you’d need $1 million so that you can live off an annual 5% interest. This belief may change due to the current cost of living crisis, but assuming that it still holds, a target of $1 million and a time horizon of 30 years could be quite reasonable for most young people.

You can use a compound interest calculator to do the math yourself, but that target is achievable with zero principal if you can put around $500 a month into an investment that yields 10%, compounded annually. $500 sounds like a lot, but remember, a 30 year horizon starting at 20 means retiring at just 50.

How to Earn Interest

The above example does make two things clear. First is that the frequency of compounding matters. The more often interest is paid out and can be reinvested, the faster your wealth grows—so in that same example, you’d have $150,000 more with monthly compounding than you would with annual compounding.

Secondly, but even more importantly, you need to find investments or asset classes that you’re comfortable with but still provide enough return. Let’s take a look at some common asset classes used for compounding:

Dividend Stocks

One of the most common ways to activate the benefits of compounding, dividend stocks are an easily accessible asset class although not without risks. The best stocks can always drop either because of the company’s performance or that of the economy as a whole, but the reverse is also true.

The added benefit here is that stocks that pay dividends tend to be established, profitable companies. That makes them relatively safe as far as stocks go, and there’s also the potential capital gains which can boost your wealth in a way that many other assets can’t compete with.

Dividends can be paid out annually, but some companies make a point of paying out on a quarterly basis. This means that you might be able to compound your dividends by reinvesting them every three months with the right dividend stock selection.

Dividend ETFs

Stock-picking can be quite risky unless you spend a lot of time researching the market, and even the best stock-pickers can get things very badly wrong. This can make dividend stocks a tricky strategy for some, but dividend ETFs can offer an alternative.

ETFs are a popular class of investment because they allow you to diversify without having to get out there and buy lots of different dividend-paying stocks. The ETF sponsor does the legwork, and you can simply buy shares of the ETF and receive the dividends that the underlying stocks pay out.

Bonds

Bonds are a classic form of investment and some advisors still believe that they should contribute to any long-term investment portfolio. The interesting thing about bonds from a compounding perspective is that the coupon rate of a bond is essentially the interest rate that the borrower pays the lender. By holding the bond, you’re the lender, and you receive (and can reinvest) that interest.

Savings Accounts and CDs

We’ve touched on savings accounts already, and while interest rates offered by banks for savings do tend to be low, you may occasionally see rates that might allow you to compound effectively.

If you reside in a country with higher interest rates, this might be an effective way to go about it since there’s an element of safety in being able to withdraw your money and exit the investment immediately if need be.

On the other hand, Certificates of Deposit (CDs) are also offered by banks but represent a deposit that can’t be withdrawn before their term is up. Since the bank doesn’t have to worry about your withdrawing the money early, they are happy to offer a higher interest rate on these products.

It’s not impossible to get out of a CD (also known as term deposits or fixed deposits) before maturity, but you might lose the interest you have accrued or pay a penalty. There’s also the risk of the interest rate rising after you lock in a long-term CD. On the plus side, CD’s (and savings accounts) tend to be federally insured.

One other notable factor when it comes to CDs is that the initial principal is fixed, and you can’t keep adding to it on a monthly basis like you can with most other instruments.

Cryptocurrencies

A relatively new class of assets that many financial advisors would advocate strongly against, cryptocurrencies are still relatively untested when it comes to their worth in the longer term or in strategies such as compounding.

Bitcoin, the cryptocurrency that most people have heard of, doesn’t really work for compounding on a protocol level. The only way you can compound BTC is by storing them with a custodian who pays you interest. Unfortunately, several of these custodians crashed in 2022, taking depositor funds with them.

If you do want to try and put crypto to work for you, you may have to look for proof-of-stake cryptos like Ethereum. These can be deposited to the protocol itself and generate returns that you can use to compound your gains, often on a daily basis. Just watch out for “gas” fees when you make transactions on a blockchain!

Risk vs. Reward

Risk and reward go hand in hand, and market forces work in such a manner that higher interest rates tend to come with higher risk investments. You can see this in traditional vehicles such as bonds, where loans to stable economies such as Germany might return at a far lower rate than to a developing or struggling nation.

One way to keep yourself and your money safe if you notice an investment product offering above-market returns is to always ask where that money comes from. There’s always a catch if you can’t see how returns are generated, and that’s one way to spot a marketing tool operated by a predatory business.

An unfortunate reality of finance is that very few Wall Street fraudsters ever see jail time, despite millions or, in the case of 2008’s GFC, billions being affected by their crimes. Household investors and professional money managers alike can be lured by high returns, so it always pays to do your due diligence on an investment or provider.

Key Takeaways

Compound interest can help you grow your wealth over the long term by reinvesting the earnings you receive from an investment. This allows you to collect more earnings with each iteration, letting you hit your investment goals without having to rely solely on savings and capital gains.

The key elements of compounding for growth are the rate you receive, and how often you can reinvest. Frequent reinvestment can grow your wealth even faster, but always remember to keep an eye on the risks—chasing returns without doing your due diligence can undo years of hard work in a flash.

👉 If you’d like to learn more about compound interest and discuss investment strategies, check out Whop.com’s trading page for all of the best communities in the business!

🏆 Check out: Whop's Top 10 Best Trading Discord Servers

![Top 10 Best Forex Trading Discord Servers [2024]](/blog/content/images/size/w600/2024/05/Top-X-Best-Forex-Discord-Servers.webp)

![Top 30 Best Trading Podcasts [2024]](/blog/content/images/size/w600/2024/06/Top-X-Best-Trading-Podcasts.webp)

![Top 21 Best Trading Discord Servers [July 2024]](/blog/content/images/size/w600/2023/08/trading-discord-servers-large.png)