You’ve probably heard a lot of talk about investing and the stock market. But how do you get started? Investing in stocks can be a great way to learn more about the market and economy, and support companies that you believe in. You may be wondering how to trade stocks. Before investing in stocks, though, it’s important to understand what they are, how they work, and how you can invest in them. In order to get started, it’s important to have some foundational knowledge. We’ll discuss some ways investors invest in stocks, the basics of what stocks are, what brokers and brokerages are, and how you can find some great courses to take to learn more.

Decide What You Want Out Of Investing

To get started, you’ll want to think about what you hope to get from investing in stocks. Are you hoping to build long term growth? Maybe you want to learn how investing in the stock market works. Maybe you’re just interested in investing because you want to help grow companies with values that you believe in. Maybe you’re just looking for a side hustle. Whatever your reason...this is a good place to start.

It’s also important to remember that investing in stocks comes with risks, and it can be helpful to seek out financial education that can help you make more informed decisions as an investor. Before you begin investing, it’s important to have a solid knowledge of what you hope to gain from your investments. This can shape everything else you do, moving forward.

Understand The Basics of Stocks

You might have a pretty good idea about what stocks are already. You may be a total beginner, eager to learn more. Whatever the case, it doesn’t hurt to learn a little bit more about how stock trading works. We’ll discuss what stocks are, how people invest in stocks, some ways investors might categorize stocks, and a few other basic concepts.

It’s also a great idea to find financial education resources that can help you become a more informed investor. Whether you take a class or join a course for learning more about stocks and investing, learning more can help you make more informed decisions about investing in stocks. You can find courses online on a variety of subjects through online marketplaces like Whop.

The Basics: What a Stock Is

Stocks are, essentially, a part of a company. Investor.gov defines them as “a type of security that gives stockholders a share of ownership in a company.”

In essence, when an investor buys a share in a company, they are purchasing a part of the company. There are many reasons why an investor might do this. They may be interested in what that company does and want to financially contribute. They may be interested in dividends that the company pays share owners, or they may buy a stock hoping that the value of the company is going to increase so that they can sell the stock later, for a profit.

As with many, if not all, forms of investing, this carries some inherent risks. It’s important to remember that any company can go out of business, no matter how well-established they are. Earnings can also drop over time, rather than growing–meaning that stocks that shareholders own can drop in value over time. Just as stock can help investors grow wealth, they can lose money too. It’s important to conduct independent research on any company that you consider investing in.

While we’ll talk about some basic concepts here, it’s also important to seek out financial education resources, which can help you thoroughly understand important financial concepts. Learning more about how stocks work can help you more effectively navigate the complex world of investing in stocks. Whether you take a class in person at your local college or university, or you find an online course that helps you learn more about stocks and investing, learning more about investing can help you make more informed decisions.

So, stocks are a way through which investors can support companies and hold a stake in their growth, development, and success. Now, how do people invest in stocks?

Brokers and Brokerages: How People Buy Stocks

There are a few ways investors can invest in stocks. Though it is possible to buy stocks directly from a company, people often go through a broker or brokerage. There are a few reasons for this. For one, not every company offers stocks directly to investors. Through a broker or brokerage, investors also may be able to purchase certain stocks they might not be able to buy directly from the companies. So, what are brokers and brokerages? Essentially, they help investors trade. Investor.gov defines a broker as “firm or individual that engages in the business of buying and selling securities – stocks, bonds, mutual funds, exchange-traded funds (ETFs), and certain other investment products – on behalf of its customer (as broker), for its own account (dealer), or both.”

Brokers act as a sort of go-between for investors and the stocks or other securities they want to trade. Different brokers may offer different services, and they may enable investors to trade different types of securities.

Growth Vs. Value Stocks

Some traders like to think of and classify stocks as either growth or value stocks. Some investors may be interested in one type over the other, depending on their investment strategy and how these stocks might fit into it. Investor.gov outlines a few stock categories, and defines growth stocks as those with “earnings growing at a faster rate than the market average,” and value stocks as those with a “low price-to-earnings (PE) ratio.” A price-to-earnings ratio helps investors understand the relationship between how much a stock costs and how much a company is earning with relation to how many shares are issued.

The two values you need to calculate a PE ratio are the current stock price, as well as the earnings per share of that stock. Many brokerage services will list price-to-earnings ratios of stocks so that investors can make informed decisions about trading them.

Dividends and Equity Growth

We’ve discussed how investors invest in different stocks for different reasons, and one of those reasons may be dividends. Not all stocks pay dividends, but some companies offer shareholders payments in the form of dividends.

These are payments that investors receive as a shareholder just for owning a stock. These come from a company’s profits. Some investors like to focus on stocks which pay dividends, while other investors are not interested in dividends at all.

Other stocks don’t pay dividends at all, yet investors are still interested in them. Investors who buy stocks that don’t pay dividends may be hoping that as the value of the company they’re invested in grows, so will the price of its stocks. Should the value of stocks go up, so should their equity as a shareholder. Stocks can be sold for a profit later if their value rises enough. They can also be sold for a loss if their value drops instead.

Find Some Ways To Learn More About Stocks

We’ve discussed a few basic concepts, but it can be extremely helpful to learn more about stocks and investing before you get started. Consider seeking out financial education and resources to sharpen your knowledge of investing. Financial education services can help you understand more about investing and give you helpful knowledge that will help you develop and flesh out an investment strategy that you’re happy with.

The world of investing is vast and the more knowledge you can accumulate before you start making investments, the better. While we can discuss some basic stock investing concepts, it’s helpful to seek out classes and courses that will help you understand the specifics of the type of stock investing you’re interested in.

Consider Taking a Class

There are many classes available, both online, and in-person, which offer financial education to students. You may be able to find some amazing classes where you can learn about investment strategies, investing knowledge, more about how stocks work and what they are, and much more. If you’re a college student, your school or university may offer financial literacy classes, resources, or materials. You may also be able to attend financial literacy classes at a local college.

Consider Finding Online Courses

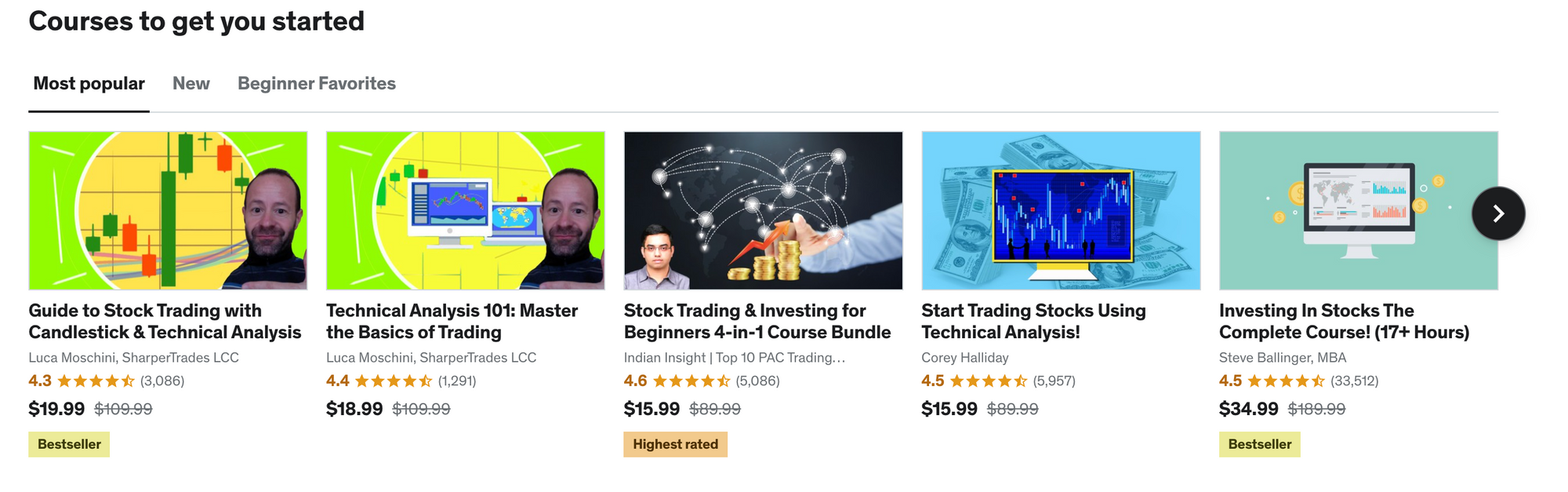

There are some excellent courses available online, where interested individuals can learn about a myriad of topics, including investing in stocks. Finding an online course can be a way for beginners to learn more about investing in stocks.

Before looking for an online course, consider what you’re hoping to learn. Do you want to learn about how the stock market works in general? Maybe you’re interested in a specific type of stock, or investment strategies. Think about what you might gain from taking online courses and how ones you find might work for you or not work for you.

There are even online marketplaces which can help you connect with others and find useful courses on a variety of subjects. Online marketplaces, like Whop, allow you to find and even offer everything from group membership to courses on useful topics. Through marketplaces like this, you may be able to find courses about all many types of subjects like investing in the stock market.

Here are some other places you can find online investing courses:

- Udemy: Udemy offers investing courses that you can find here.

- edX: You can find more information here.

There are also some free resources you can access online. It can be extremely helpful to find paid education content, but it doesn’t hurt to start with free resources. These are some places where you can find free financial education resources and learn about investing:

- TD AMeritrade: TD Ameritrade offers education resources here.

- Fidelity: Fidelity offers education resources here.

Remember that learning about anything is an ongoing process, and there will always be more to learn about the stock market, so it’s important to seek out continuing financial education resources as you begin investing. Even once you feel like you have a solid grasp of the stock market and investing, there will probably still be things you can learn to help you make more informed decisions.

Think about Your Potential Investing Strategies

As you come to understand more about investing in stocks, it can be useful to consider how what you hope to gain out of investing in stocks might inform how you invest. Consider how long your investment strategy is; do you plan to invest for the near future or are you planning long-term? Consider which types of stocks you might be the most interested in.

Are you hoping to invest in stocks in companies you want to see grow, or are you more interested in companies that have already grown significantly? Consider what sectors you might be interested in investing in. Are you passionate about healthcare, electric vehicles, or the food industry? Maybe you’re interested in automobile manufacturing or pharmaceuticals. Depending on your interests, some companies may be more appealing to invest in than others.

You may also be interested in stocks from a numbers perspective, and you may not care what industry a company is in, only how well you think it might perform. Whatever the case, it’s helpful to understand your own interests as you begin to develop ideas about your own trading strategy. This may also help you find the best broker or brokerage services, as it can help you understand your own needs in investing. Understanding your goals in investing can also help you find courses and other resources that will help you specifically in your investing journey.

Consider Financial Advising

Your investing strategy is something you can discuss with an investing advisor. It’s also important to consider how much risk you’re comfortable taking, investing in stocks. Since investing in stocks always comes with some risk, consider how much you’re comfortable spending investing in stocks, and how that might shape your investing strategy. You can seek out the services of a financial advisor in order to gain a better understanding of risks that come with investing in the stock market, and they may be able to help you develop a strategy that you’re comfortable with. Investors seek the services of financial advisors for many reasons. You can find more information about investment advisors here at investor.gov.

Finding a Broker: Decide How You Want To Trade Stocks

There are many brokerage services available today. Many of them are available completely online, while some people prefer the personal touch that comes with meeting with a broker in person. Consider which route you may be more attracted to. When you’re looking for brokerage services, there are some criteria you may want to consider, including what services they offer, what limitations there are, how they may or may not fit well with your trading strategy and if they’re a good personal fit for you.

Services To Consider

Depending on what type of trading you’re interested in, you might be attracted to certain brokers or brokerages. Consider if they charge trading fees or commission, what types of securities they allow you to trade, whether or not they offer fractional or only whole shares to be traded. Other services and attributes you might consider include:

- Financial Education: Do they offer you support in the form of financial education materials?

- Minimums: How little will a broker or brokerage service allow you to invest? Some brokers require account minimums to get started.

- Trading Fees: brokers and brokerage services may or may not charge fees for trading.

- Trading securities besides stocks: Some brokerage services will also allow you to buy and sell other securities, such as bonds or ETFs. Some also allow you to trade cryptocurrency and other assets.

Whatever you’re looking for in a broker or brokerage service, it’s important to consider what you’re looking for, and how that relates to the services that a potential broker or brokerage firm offers. The more you learn about them, the easier it will become to decide if they’re a good fit for you. Many brokerage services have information about their offerings and services available online.

Though there are many online brokerage firms available, you may also be interested in finding a full-service broker who can help you with more than just executing trades in the stock market. If you opt to find an in-person brokerage with extra services, be sure to consider carefully what you expect out of a brokerage service, and how their offerings line up with your needs and expectations. Asking questions and doing independent research can help you make more informed decisions about the broker or brokerage firm that you opt to invest with.

Consider Finding An Investing Community To Pool Knowledge

Many investors form or join groups of like-minded investors where they can discuss what they’ve learned about investing in stocks. After you begin investing, you may be interested in joining a community of other investors in order to discuss trading with one another. You can find investing communities online, through marketplaces like Whop–a marketplace for communities. Be sure to check out Whop to learn more.

Putting Everything Together

Once you’ve learned about what stocks are, and how they can be traded, and once you’ve decided which broker or brokerage firm you’d like to trade with, it’s time to get started. Consider potential investment strategies, what types of stocks you might be interested in investing in, and what your expectations are. Remember to always consider the risk involved with investing, and seek out financial education to learn more about investing. You can always learn more about investing, so remember that even after you start investing, your learning journey isn’t over. It’s important to do research on any investments you make, and keep up with developments.

Don’t Forget To Check Out Whop

No matter what type of investment strategy you choose to pursue, don’t forget to check out Whop, where you can find not only a marketplace full of great communities to join and courses to take, but you can also list services yourself.

![Top 10 Best Forex Trading Discord Servers [2024]](/blog/content/images/size/w600/2024/05/Top-X-Best-Forex-Discord-Servers.webp)

![Top 30 Best Trading Podcasts [2024]](/blog/content/images/size/w600/2024/06/Top-X-Best-Trading-Podcasts.webp)

![Top 21 Best Trading Discord Servers [July 2024]](/blog/content/images/size/w600/2023/08/trading-discord-servers-large.png)