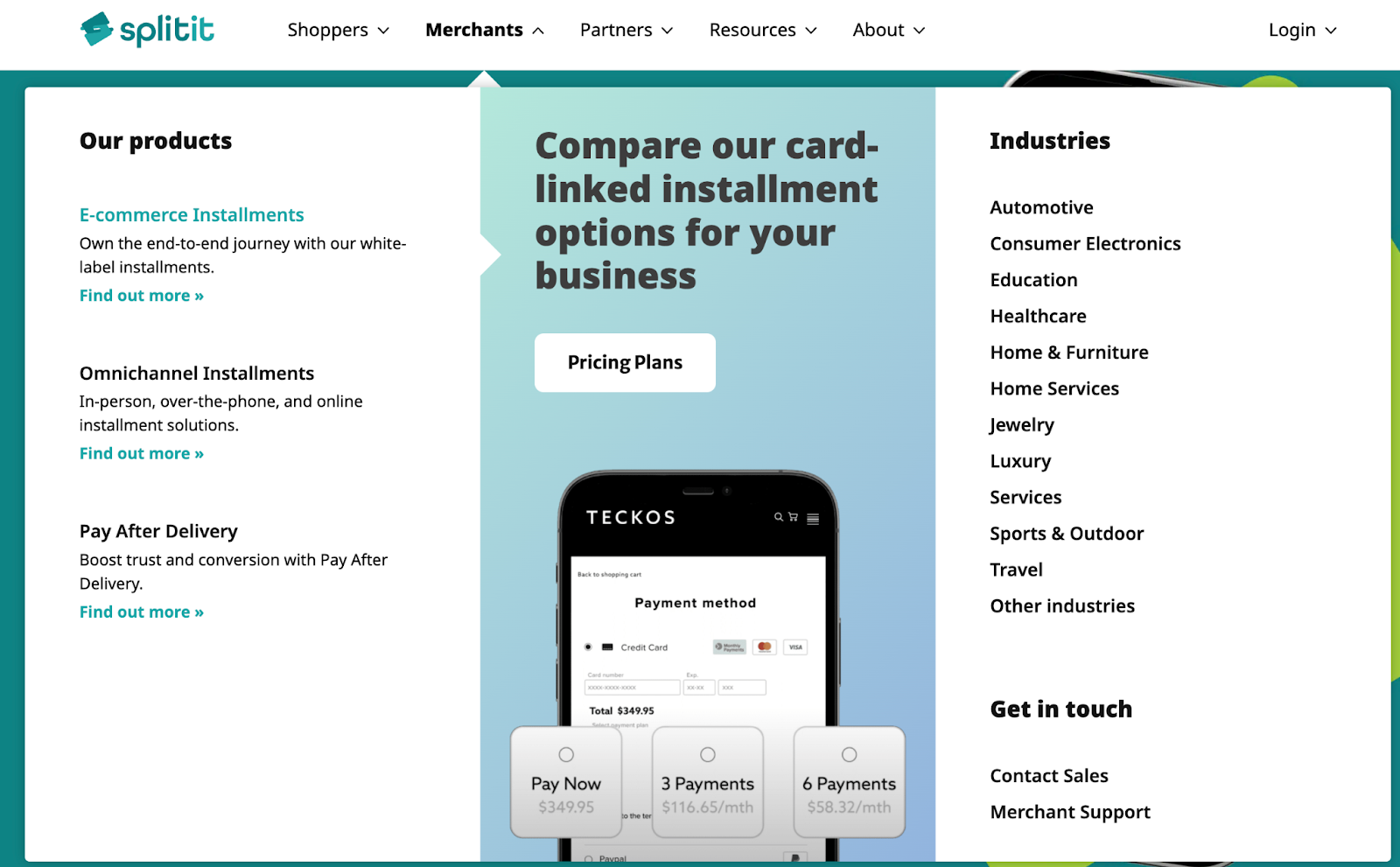

Splitit is a buy now, pay later (BNPL) provider that gives shoppers flexible installments, reduces cart abandonment, and grows your online business. Read this review to see if Splitit suits your needs.

Key takeaways

- Splitit lets customers pay in installments using existing credit cards without new loans, credit checks, or separate accounts.

- Merchants receive full payment upfront with zero default risk while Splitit handles installment collection automatically.

- The service requires customers to have sufficient available credit, as the full purchase amount is held throughout the payment plan.

Splitit is a buy now, pay later (BNPL) service that lets customers split purchases into installments using their existing credit card with no new loans, no credit checks, and no extra accounts.

In this review, we'll dig into how Splitit works, its standout features, pricing, and why it's worth considering as your BNPL partner.

What is Splitit?

TL;DR:

- Splitit is a BNPL service that lets customers pay in installments using their existing credit card (no new loans or credit checks).

- It's for merchants selling high-ticket items ($500+) and shoppers who want payment flexibility without opening new accounts.

- Sellers get paid upfront while customers spread payments over time.

Splitit is a buy now, pay later service that lets customers split purchases into smaller payments using the credit card they already have.

Unlike most BNPL providers, Splitit uses the available credit you already have, making it easier for shoppers to manage cash flow and for merchants to offer flexible payment options.

It isn't a payment processor on its own; it works alongside your existing processor or gateway, integrating smoothly with platforms like Whop, Shopify, and WooCommerce.

Splitit offers two plan types:

- Retail plans: interest-free installments funded by the merchant.

- Splitit financing: monthly payments with finance charges of up to 35.99% APR, depending on state and federal rules.

Who can use Splitit?

Splitit has strict eligibility rules and a detailed prohibited-business list. If your business falls into any of the following categories, you cannot use Splitit at all.

Prohibited categories include:

- Adult entertainment and related products

- Counterfeit goods

- Firearms, ammunition, or weapons

- Gambling and betting services

- Magazine subscription services

- Pseudo-pharmaceuticals or health products with unverified claims

- Online auction sites

- Pay-per-click, parked, or speculative websites

- Payroll providers

- Precious metal sales

- Real estate brokerage services

- SEO service providers

- Social networking platforms

Splitit is typically used by ecommerce retailers with low-risk physical goods and strong card-authorization success rates.

If you sell regulated products, subscription-based content, or anything involving financial or reputational risk, Splitit probably won't approve your business.

How Splitit works

At checkout, Splitit places an authorization hold for the full purchase amount on the customer’s Visa or Mastercard, and the shopper’s card is charged automatically each month as installments come due.

A key detail is how the authorization works: Splitit renews the full authorization hold every 18–21 days, which means the shopper’s available credit stays reduced for the entire duration of the payment plan.

Even though they aren’t paying that full amount upfront, the credit limit remains tied up until the plan is complete.

For merchants, Splitit offers multiple funding models, from receiving installment payments month by month to getting the full amount upfront through Splitit’s accelerated payout options.

Your pricing depends heavily on which model you choose.

Pros and cons of Splitit

Splitit brings clear benefits to both shoppers and businesses, with only a few limitations to keep in mind.

Pros:

- Interest-free options: With Retail Plans, shoppers can split payments over time without extra fees or interest beyond their card's standard terms.

- No credit checks: Customers use the credit they already have, so there are no new applications, no delays, and no hit to credit scores.

- Customer-friendly: Shoppers still earn their usual card rewards—points, miles, cashback—while spreading out payments.

- Boosts sales for merchants: Offering installments increases conversion rates, reduces cart abandonment, and often raises average order value.

Cons:

- Credit limits matter: Customers need enough available credit for the full purchase amount, which is held on their card while installments are paid down.

- Card acceptance varies: Visa and Mastercard are widely supported, but acceptance of Amex, Discover, and UnionPay depends on the merchant.

- Financing availability: Splitit Financing is only offered in the U.S. and not in every state.

Splitit pricing

Splitit doesn’t publish a simple flat rate because merchant fees depend on your business model, volume, and risk category.

But here’s what a seller can realistically expect:

- 3%–6.5% per transaction, plus

- a small flat fee (varies by agreement)

Merchants in lower-risk retail categories generally sit toward the lower end of that range, while higher-risk verticals will see rates at the higher end.

Splitit key features

For buyers, Splitit offers flexible payment solutions for purchasing expensive products. For sellers, the service offers some key features for businesses:

Ecommerce platforms integrations

Splitit plugs straight into the major ecommerce platforms, making it easy for merchants to offer installment payments without extra friction. It’s built for flexibility, with out-of-the-box integrations and support for custom setups when needed.

The ecommerce platform partners include:

Splitit was able to provide a solution that addressed our needs to deliver a modern pay-after-delivery option for AliExpress consumers.

Splitit’s white-label approach allows us to easily customise and integrate the service into our platform while delivering a positive experience for sellers and shoppers.

- Topp Gary Paul, AliExpress European commercial director

Installments

Splitit lets shoppers split online purchases into monthly installments right at checkout. For ecommerce businesses, that means a smoother experience and fewer drop-offs, since customers never have to leave the site.

Merchants can choose how installments work—either interest-free Retail Plans or Financing with monthly charges—depending on their setup and the customer’s eligibility.

Omnichannel installments

Splitit works across every sales channel—online stores, mobile apps, and even in-store—so businesses can deliver a consistent payment experience no matter where customers shop.

In-store, sales associates can set up a payment plan on the spot and send a QR code or payment link by email or SMS, making it just as seamless as checking out online.

Pay after delivery

Splitit gives customers the option to start paying only after their order has been delivered. The full purchase amount is placed on hold, and once the product arrives, payments are broken into installments.

For shoppers, this builds trust—they don’t start paying until they’ve got the item in hand. For sellers, there’s no downside since they still receive the full payment upfront.

Guaranteed full transaction amount

With Splitit, merchants get paid in full right away, no matter how long the customer takes to pay off their installments. Splitit collects each payment directly from the shopper’s credit card and manages the schedule behind the scenes.

Because the full purchase amount is authorized up front, merchants don’t carry the risk of defaults—payment is guaranteed.

Global payment acceptance

Splitit works across multiple countries and currencies, giving ecommerce businesses the flexibility to reach new markets.

While Splitit Financing is currently limited to the U.S., Retail Plans are widely available. The service supports Visa and Mastercard globally, with American Express, Discover, and UnionPay accepted depending on the merchant.

Automated reconciliation

Accounting doesn’t have to be a headache. Splitit automatically reconciles customer payments with business records, cutting down on manual work and making life easier for teams managing high transaction volumes.

Fraud detection and prevention

Security is built in. Splitit uses industry-standard fraud prevention tools so merchants can offer installment payments with confidence and customers can shop without worry.

Who uses Splitit?

Three distinct groups use Splitit:

- Businesses and merchants: to boost conversions on higher-ticket items.

- Shoppers: for more flexibility to spread out payments.

- Credit card holders: to manage cash flow without juggling new accounts.

Each group gets a clear win: more sales for merchants, more breathing room for shoppers, and more control for cardholders.

Businesses and merchants

High-ticket retailers often turn to Splitit to make their products feel more accessible and to reduce hesitation at checkout. It's especially common in industries like luxury goods, jewelry, travel, healthcare, home appliances, and furniture.

When a customer chooses Splitit, the merchant gets paid up front while Splitit manages the installments directly with the card issuer.

Some merchants may set purchase minimums—luxury retailers may start at $10,000+—or restrict which payment plans are available. But overall, Splitit is designed to make expensive products easier to buy and easier to sell.

Consumers

Splitit provides shoppers flexibility without the hassle of new credit checks or accounts. Big purchases can be divided into manageable monthly payments on an existing credit card.

We noticed customers were leaving behind custom orthotics in their carts, likely due to the higher price point.

We introduced flexible payment options, allowing people to split up payments without adding any extra cost. It was a game-changer.

– Matt Behnke, CEO, Orthotic Shop

With Splitit Financing, finance charges may apply, but the process is still streamlined and simple. This makes Splitit appealing for budget-conscious consumers or anyone who doesn't want to tie up cash all at once.

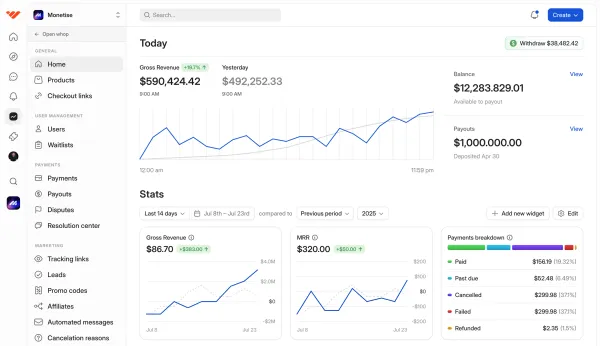

Scale your sales with Whop Payments

Want to give your customers more ways to pay?

With Whop, you can offer Splitit right alongside credit cards, Apple Pay, Google Pay, and even crypto. That means you’re not just adding BNPL flexibility—you’re giving buyers the freedom to pay how they want, across every channel.

Whop Payments is fully built into the platform, so whether you’re selling coaching sessions, ebooks, online courses, or private communities, you get a seamless checkout experience with all the tools you need to run your business.

From solo creators just starting out to established brands scaling fast, Whop makes it simple: one platform, multiple payment methods, and more ways to win customers.

Splitit review FAQs

The frequently asked questions about Splitit.

How does Splitit benefit my business?

Splitit helps you close more sales by giving customers the option to pay over time. Retail Plans let shoppers split payments into manageable installments with no extra interest, while Splitit Financing offers extended terms with finance charges.

High-ticket items feel more affordable, cart abandonment drops, and conversions go up. Best of all, you get paid in full upfront while Splitit manages the installments.

Is there any financial risk for using Splitit as a seller?

No. You're paid in full at the time of purchase, even though your customer is paying in installments. Splitit secures the transaction with an authorization hold on the customer's credit card, so there's no default risk for your business. If a payment fails, Splitit charges the remaining balance against that hold.

Can I use Splitit for both online and in-store sales?

Yes. Splitit is built for omnichannel selling—online stores, mobile apps, and physical locations. In-store, sales associates can create a plan and send the customer a QR code or payment link via email or SMS, making the process just as smooth as shopping online.

What are the requirements for customers?

Customers need a valid credit card (Visa, Mastercard, or, depending on your setup, Amex, Discover, or UnionPay) with enough available credit to cover the full purchase amount. The total is placed on hold and renewed every 18–21 days until the plan is complete. No credit checks or applications required.

Are there different types of Splitit plans?

Yes. Splitit offers two options:

- Retail Plans: interest-free installments funded by the merchant.

- Splitit Financing: monthly payments with finance charges up to 35.99% APR, available in the U.S. (excluding 25+ states).

The plan your customer sees depends on your setup and their location.