Vanguard is one of the most popular trading platforms, but is it the right choice for you? Find out in this guide.

Key takeaways

- Vanguard's unique investor-owned structure allows it to offer some of the lowest expense ratios in the industry, maximizing long-term returns.

- Index fund investing through Vanguard provides broad market exposure at minimal cost, ideal for passive wealth-building strategies.

- Vanguard excels for long-term investors with tools like target-date funds, but may lack advanced features active traders need.

If you’re getting serious about wealth-building, you’ve probably heard of Vanguard. You may have heard of Vanguard from its variety of investment funds or as a brokerage and financial services platform - either way, it is extremely well known in the world of investment.

So, if you want to know more about Vanguard and see if it’s where you should park your own hard-earned cash, you’ve come to the right place. This review will look at the ins and outs of Vanguard, help you understand where it shines as well as what its drawbacks are, and ultimately decide whether or not Vanguard is for you.

What is Vanguard?

Vanguard was founded in 1975 by legendary business magnate and investor John C. Bogle, considered by many to have popularized the index fund. Bogle’s preferred investing style of buying into funds representing the entire market, reinvesting dividends, and holding over as long a term as possible is still considered one of the best strategies for investors of all levels.

Now in its 50th year of operation, Bogle’s Vanguard Group is one of the largest investment management companies in the world, with upwards of $8 trillion in assets under management.

The company is considered unique for its ownership structure, since rather than following traditional corporate structure via shareholder ownership, Vanguard is in fact owned by its many investors via its mutual funds.

Thanks to this ownership structure and not being beholden to external shareholders clamoring for profits, Vanguard is able to keep costs low and prioritize the financial interests of its owners and clients. This business model makes Vanguard an attractive choice as far as wealth-building platforms are concerned, and has contributed to its stellar reputation in an industry where many brokers now consider users as their products rather than their clients.

Why traders choose Vanguard

Vanguard has been a leader in financial services for half a century, and their commitment to low cost investing has made them a household name thanks to the savings generated for some 50 million clients across the world.

Low costs

Thanks to its ownership structure, Vanguard is able to lower costs significantly, which translates to much more favorable expense ratios on Vanguard funds compared to industry averages. Given that these funds are designed for long-term investing, the savings will add up—and we’re talking expense ratios as low as three or four cents on the dollar compared to many actively managed mutual funds, and this sort of saving can really compound over the years.

Beyond its funds, Vanguard also keeps costs low across all of its brokerage services, which extends to zero commission trading for US stocks and ETFs, with over 3000 no-transaction-fee mutual funds also available on the platform. In fact, all you’ll need to pay in order to invest in stocks and ETFs on Vanguard with a brokerage account is a $25 fee, and even that can be waived if you sign up for e-delivery of all documentation.

Index investing

Vanguard and its founder John Bogle were the OG’s of the index fund, and Vanguard has retained its expertise in this regard, focusing very strongly on passive investing. Index funds are designed to track the performance of a specific market index, such as the S&P 500 which covers the top 500 listed companies in the US.

Buying into a fund like this gives you broad market exposure to the entire index, essentially letting you bet on the continuous growth of the market over time—and reinvesting dividends you earn along the way for even stronger performance.

Crucially, these index funds allow investors like you to execute such a strategy at a low cost, the alternative being to manually allocate and accumulate shares of these companies yourself—a time-consuming and extremely expensive endeavor. Index fund investing makes this easy to do, and as we’ve already mentioned, Vanguard gives you access to a lot of funds at a far lower cost than anywhere else.

Vanguard offers a selection of index funds covering different asset classes and sectors that can help you build more specific investing strategies while sticking to this passive style. This way, you can also adjust your investments to fit your individual risk tolerance and financial goals, while taking advantage of Vanguard’s low costs and expertise.

Long-term focus

If you’re looking to build your wealth over a longer term and want to invest rather than just trade, Vanguard might be ideal for you given that just about every tool, resource, and feature available on the platform is geared towards this end. Whether it’s retirement planning or starting investing early, Vanguard gives you every chance to take advantage of principles like compounding returns and diversification.

Vanguard also offers investment products that can play out extremely specific strategies, such as target-date funds which automatically adjust their allocation to reduce risk as the target date approaches—essentially, serving as an automated retirement investment tool. This and other tools that Vanguard deploys can help you take a hands-off approach when it comes to investment, with constant portfolio adjustment becoming a thing of the past.

Broad asset selection

Vanguard’s stock in trade are its mutual funds, and it offers hundreds of those, amounting to one of the most extensive line-ups going. However, mutual funds are just the tip of the iceberg when it comes to investment assets at Vanguard—you’ve got a wide variety of stocks and ETFs to put your money into, as well as bonds if you want to mix in more traditional elements of portfolio-building.

If you want to make the most of your cash there are also money market funds and certificates of deposit (CDs) to look at depending on the time horizon you’re interested in. That being said, many assets can be found within the funds Vanguard has to offer. For instance, Vanguard’s all-in-one funds give you a way to build a broadly diversified portfolio with reduced risk while investing in a single fund—this sort of solution is elegant, efficient, and very convenient to manage.

You can also find funds that cover assets that can be tricky to invest in, such as bond funds—meaning that you can get all the benefits and exposure to bonds that a traditional investment portfolio dictates, without the hassle of actually dealing with the bonds themselves.

Investing tools

One area of Vanguard’s platform that may lag behind the competition in is advanced trading tools, although there are several interesting features that could help newer investors. The investor quick-start tool, for example, makes it simple to narrow down your preferences and investment goals and presents you with a shortlist of investment options that fit you well.

There’s also the investor questionnaire, which digs even deeper into your investment preferences to help create the ideal asset mix for your portfolio.

Vanguard also provides you with a selection of market insights and frequently updated market data alongside breaking financial news, helping you to stay plugged in as you trade. Plus, you get access to a number of curated research reports from Vanguard analysts, letting you base your investment decisions on the strongest possible data and insights.

How to use Vanguard

What you need to get started

Before you get started with Vanguard, you’ll need to decide whether you want to use their services on your desktop or mobile device. You don’t have every single function on the mobile app as you do on desktop, but mobile’s fine for monitoring your account activity and making trades, as well as depositing and withdrawing funds—so, the essentials are covered.

In order not to miss out on the full experience, we’d recommend that you at least sign up using a desktop computer, and just about any hardware will do as long as you’ve got a stable, working internet connection.

Beyond that, you’ll also need to get your financial documents in order, as with any other financial services firm. First and foremost, you’ll need to provide either your Social Security Number (SSN) or Taxpayer Identification Number (TIN) to go along with your name, address, and contact details—note that address refers to a permanent US residence, in the case of Vanguard’s main US platform, although services are available in other countries via the respective regional websites.

You may also need to provide information about your employer and disclose your income depending on the type of account you choose to create. And lastly, you’ll need to be ready to make a bank transfer in order to fund your account—be aware that many funds require a minimum investment of $1,000 or more, but a brokerage account is basically good to go if you just fund it with at least $1.

Creating your Vanguard account

Funding an account is critical to getting started, and as you can see from the image above, there are several ways to do so and ensure your account goes live. The first option is likely what’s going to be most applicable to the majority of new Vanguard users, and as mentioned earlier, you’ll need to transfer at least $1 to get going.

However, the other funding options can be completed after you open your account, since in some cases there’s a little bit of work to do. It’s worth noting, as well, that Vanguard accepts transfers from almost all IRAs, individual and joint accounts, trusts, and custodial accounts, though it’s worth checking with them if you aren’t sure.

Opening a new Vanguard account will only take you five to ten minutes in all, and beyond providing all of the information we mentioned earlier and completing funding, the only thing you need to do is choose an account type. This choice isn’t too nuanced, and Vanguard’s account creation wizard will guide you through the process.

If you’re just investing generally on an individual basis, you’ll probably land on an individual brokerage account—although it’s worth looking at the other accounts available in case there’s something else you’d rather do, such as cash management, so you can come back later and add another account type.

How to buy stocks and ETFs on Vanguard

Vanguard’s platform is easy to use, and even though it’s very much considered a traditional brokerage, isn’t going to overwhelm you with an abundance of options or features.

That being said, you can execute whatever trading strategy you need to, with every standard order type being very much available to you as a brokerage client.

All you need to do once your brokerage account is open and funded is to click on the “Transact” tab to open up the trading interface. Then go to “Buy & Sell” to open up the order ticket, where you can enter the ticker symbol and quantity of whatever asset you wish to purchase or sell. Then, just choose your order type and finalize the purchase.

On top of simple purchases and sales of stock and ETF shares, more sophisticated trading techniques are also possible with Vanguard. It’s possible to trade on margin if you apply for it and get approved, and the same goes for options. These permissions ensure that beginner investors aren’t getting access to instruments that could cause outsize losses.

When trading options on Vanguard, you have four different choices, namely buy to open, sell to open, buy to close, and sell to close. However, you must have enough cash in your settlement account to fund your options trade, and exercising options needs to be done on the phone. This is relatively standard practice, since most non-institutional traders tend to take profits on their options rather than use them to acquire the underlying shares.

Navigating the Vanguard platform

Vanguard’s platform offers all of the features you need for portfolio management, but you might consider it a step behind many of its competitors when it comes to sleekness of design or feature selection. Options like Interactive Brokers are loaded with features and information, while Webull has lots of bells and whistles that many traders look for.

However, the lack of ostentation and straightforward presentation of Vanguard’s system does get plenty of appreciation from experienced investors, who are happy to do their charting elsewhere and just need a trading platform that gets the job done—platforms that promote features like gamification aren’t really meant for serious traders, after all.

When you use Vanguard, you’ll find a simple if perhaps somewhat traditional interface but all of the relevant information close at hand, such as performance charts, research reports, and calculators that make it easy to forecast different possibilities and simplify your decision-making process.

How much does Vanguard cost?

Cost is central to what has set Vanguard apart for decades, and it’s right up there as one of the most economical platforms to use no matter what sort of investing style or strategy you plan on executing. Vanguard mutual funds and ETFs being free to trade is a huge benefit, since they’re one of the market leaders when it comes to those products to begin with.

Vanguard’s extremely low expense ratios help too, allowing you to reap maximum benefits across the long term from these proven assets, even benefiting from the compounding effects of increasing returns thanks to these low fees.

The brokerage even waives the account fee that you’d usually have to pay if you agree to e-delivery of different documents, meaning that there aren’t any hidden fees to catch you unawares—neo-brokers tend to charge high fees for many paper deliveries, making them far more expensive to use.

Vanguard charges no fees on any stock or ETF trading if you do it via their online platform, although there’s a small fee for options trading—we’re talking about a flat $1-per-contract fee, so it won’t really add up unless you’re going deep out of the money or doing a lot of contracts on penny stocks. Again, Vanguard is all about long-term investing and wealth building, not speculation.

Given Vanguard’s more traditional profile, one charge you may want to keep in mind is the $100 processing fee per CUISP for the deposit of physical certificates. These aren’t common anymore, but your older relatives may be in possession of physical stock, and depositing these certificates can come into play when it comes to gifting or inheritance.

Is Vanguard safe?

As far as brokerage services and financial services firms go, Vanguard is as safe as houses. There have been no reported large-scale security breaches or anything of the sort, meaning that there isn’t a negative track record of any kind to worry about.

Like many financial services firms, however, Vanguard has seen its share of regulatory action. One of the most recent instances was an A$12.9 million ($8.89 million) fine levied against Vanguard’s Australian unit for making misleading claims about its ethical and green investment options, or “greenwashing”.

The Australian federal court stated that 74% of the securities in the fund by market value were not researched or screened against applicable environmental, social, and governance criteria, and that Vanguard benefited from this misleading conduct. The incident dates back to 2021, with penalties being imposed in late 2024.

Vanguard also agreed to pay $40 million in November 2024 to settle a class action lawsuit in the federal court of Philadelphia claiming that it hit ordinary investors in target-date retirement funds with surprisingly large tax bills.

According to claimants, Vanguard’s decision to reduce the minimum investment in lower-cost funds meant for institutional clients from $100 million to $5 million caused a “stampede” into these funds. This in turn allegedly forced higher-cost retail funds to sell assets to meet redemptions, meaning large capital gains for the clients who didn’t qualify for the lower-cost funds.

In 2022, Vanguard agreed to pay $6.25 million to resolve very similar claims by the then-Massachusetts Secretary of State.

Is Vanguard worth it?

Vanguard pros

- Low costs. Vanguard’s lowered costs across not just its fund selection but also its brokerage services can help amplify your gains as you build your wealth and investment portfolio across the long term.

- Ownership model. Vanguard is owned by its fund investors rather than shareholders, and aside from allowing the company to keep costs down, this structure means that clients are always going to be stakeholder number one.

- Investment options. Vanguard offers a wide variety of investment options at low cost, including a number of interesting fund options that can fulfil a variety of investment strategies with minimum effort.

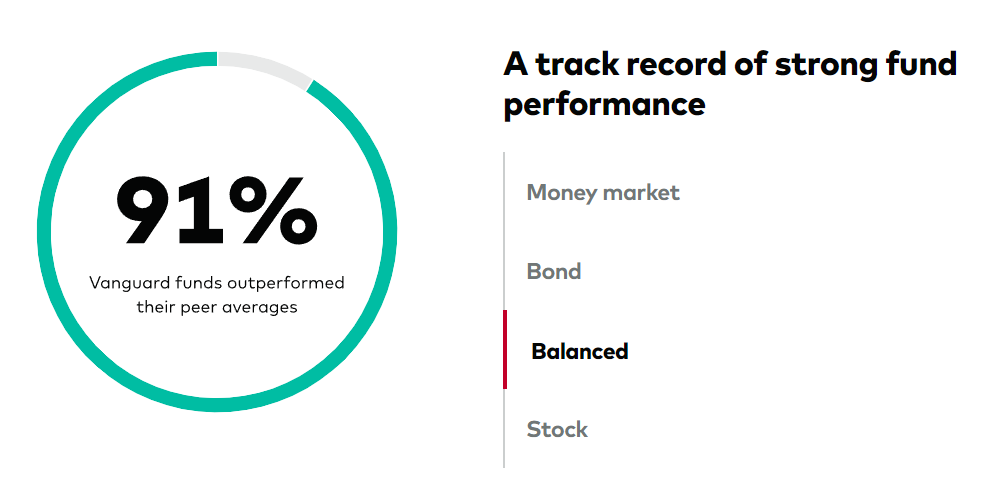

- Track record. Vanguard is as proven as any, and is one of the pioneers of the index fund. They’ve been experts in the financial world for a long time, and are a highly respected provider of financial services.

Vanguard cons

- Traditional interface. Vanguard’s user interface and trading system is neither as sophisticated or as slick as some of its competitors, so if this is a deal-breaker for you, look elsewhere.

- High fund minimums. While you can use Vanguard’s brokerage to trade stocks, ETFs and options as normal, investing in mutual funds will require a four-figure minimum investment in most cases.

- Limited features for traders. Active trading isn’t what Vanguard is for, so there aren’t as many features for that sort of trading. There’s charting and research, but you’ll not get as many indicators or other trading tools as on other platforms.

Vanguard alternatives

For a full list of alternatives to trade on if you feel Vanguard isn’t quite up to snuff, check our guide to the best free stock trading apps on the internet. If you’d rather not click away, though, here are a few options at a glance:

1. Interactive Brokers

Interactive Brokers (IBKR) is another top trading platform known across the globe, and it’s been around for almost as long as Vanguard. While Vanguard founder John C. Bogle was pioneering index fund investing, in fact, Interactive Brokers founder Thomas Peterffy went on to introduce handheld computers onto the trading floor.

IBKR is considered one of the top global brokerages, and it could be a great alternative if you’re in a geographical region that Vanguard doesn’t serve. It’s also a top option when it comes to advanced trading, providing you with all of the tools and trading options you need to execute whatever strategies you have in mind.

Interactive Brokers offers access to perhaps even more assets than Vanguard given its global reach, with stocks and ETFs from a variety of markets. Vanguard does so through its funds, but with IBKR, you can buy a whole host of individual foreign stocks and build your own portfolio however you want to.

2. Fidelity

Fidelity is one of the few financial firms that are in the same league as Vanguard in terms of sheer volume of assets under management, and both are considered serious juggernauts in the world of investing—but for different reasons. Vanguard’s great for funds and well as advisory services, but as far as brokerages go, Fidelity might be a cut above.

With a slick user interface and all of the trading and investing options you need, Fidelity makes it possible to invest in all sorts of assets while also opening up every trading style—so while Vanguard leans toward long-term investing, Fidelity does that just as well but also keeps the door open for active trading.

Fidelity is a traditional brokerage too, yet fees and commissions are kept low, allowing them to compete with neo-brokers as well as low-cost brokerages like Vanguard. In fact, as a US client of Fidelity, you’re not going to be paying any fees on stock or ETF purchases, and options are similarly economical to trade.

3. Webull

We’ve referenced neo-brokers a few times up to this point, and Webull is an example of one. However, it’s as suitable a venue for active trading as any, especially because of the number of advanced trading tools available on the platform—Webull’s target market is a lot more sophisticated than those of other neo-brokers, and it’s a feature-rich platform with plenty of functions.

In fact, Webull’s got so many indicators and charting tools to play with that you probably won’t even need to incorporate additional research venues like TradingView—which you almost assuredly would if you were to trade on Vanguard.

One of the main criticisms of Webull comes in regard to its Chinese ownership and therefore concerns over data privacy, especially given the recent bans on social media platform TikTok. That being said, Webull is fully regulated in the US, and by nature of being a financial services firm is subject to much tighter restrictions than most other websites and apps.

Trade better with Whop

Vanguard is one of the biggest names in finance today, and has been since its inception at the hands of its founder, a veritable legend in the world of investing whose philosophies are still being preached today. So, linking up with them in order to build your own wealth is a perfectly logical move, especially since they can offer so many advantages in terms of fund investing.

However, you’ll need to add a few different types of arrows to your quiver if you want to trade actively on Vanguard. The platform doesn’t natively offer the sort of indicators or advanced trading tools you need to make good decisions when it comes to entering and exiting positions, and its stock information and market insights also leave a little bit to be desired.

That’s where Whop comes in. In Whop’s trading section, you’ll find plenty of groups dedicated to helping traders set up the ideal systems and giving them the tools and indicators they need to make the right trading decisions. They also have a wealth of resources to help you learn how to trade and build a portfolio, including some incredible stock trading courses designed to skill you up fast.

So, to take full advantage of the safety and stability of a platform like Vanguard while powering up your own research capabilities and trading knowledge, check out what Whop has to offer today.