Cross-border payments are what allow businesses to move money internationally. Find out how cross-border payments work, the top cross-border payment methods, and the best global payment providers.

Key takeaways

- Integrated global payment platforms eliminate complexity by combining checkout, currency conversion, compliance, and payouts into one system.

- Cross-border payments pass through multiple intermediaries that each add fees, delays, and opacity before funds reach recipients.

- Businesses should choose payment rails based on transaction size, speed needs, and corridor coverage rather than defaulting to traditional banks.

Selling worldwide sounds simple, until money actually has to move.

For platforms, marketplaces, SaaS products, or any high-level global business, cross-border payments are what let you charge customers in one country, pay partners in another, and scale without limits.

B2B cross-border payments are projected to reach $47.8 trillion by 2032. Why? Because businesses are expanding internationally faster than traditional banking systems can keep up with.

Currency conversions, settlement delays, and compliance requirements still make global money movement one of the toughest battles businesses face.

So, this guide will explain what cross-border payments are, how different cross-border payment methods work, the fees you can expect, and how to avoid common issues.

I’ll also list the top platforms for cross-border payment services.

What are cross-border payments?

Cross-border payments are transactions where money moves between parties in different countries.

For merchants, this usually involves moving funds through international banking systems (requiring currency conversion, FX exchange processing, and compliance in multiple jurisdictions).

These payments allow businesses to use global invoicing, multi-currency checkout, international payroll, contractor payments, and marketplace payouts.

TL;DR: When a company charges a customer in one country or pays a supplier in another, a cross-border payment is taking place.

Cross-border payments can be processed through banks, payment processors, card networks, digital wallets, or specialized global payment platforms.

Each method has different costs, settlement times, and infrastructure requirements (we’ll go through these in detail soon).

Typical business cross-border payments:

- B2B supplier payments: Payments made between businesses across borders, such as paying overseas manufacturers, vendors, or service providers.

- International customer payments: When businesses charge customers in other countries, often involving multi-currency pricing and FX conversion.

- Global payroll and contractor payments: Paying employees, affiliates, freelancers, or contractors located in different territories.

- Marketplace and platform payouts: Platforms that need to pay merchants in their local currencies.

- Intercompany transfers: Moving funds between subsidiaries or entities within the same organization across countries (a USA to UK branch, for example).

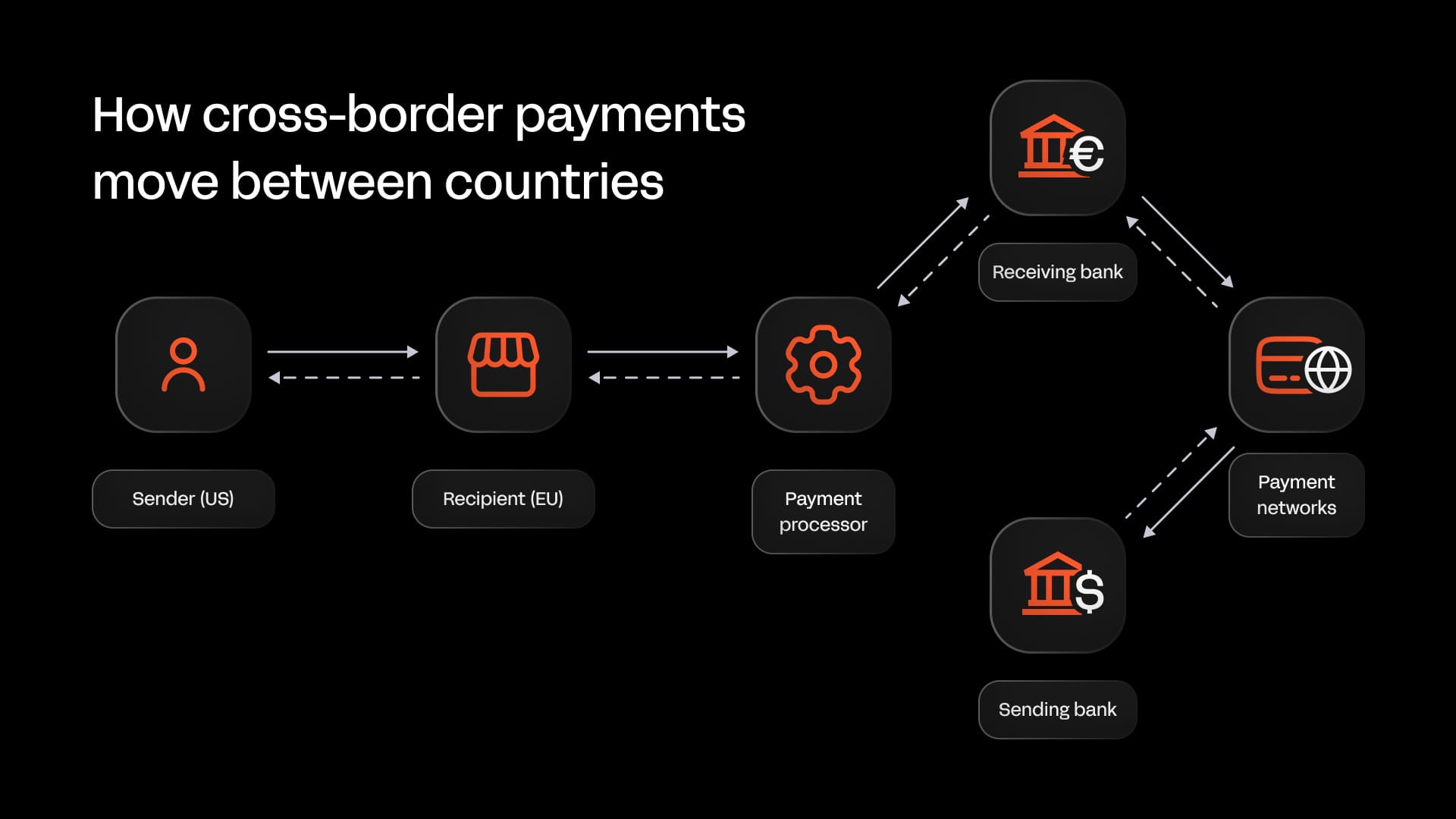

How cross-border payments actually move

Cross-border payments have to move between multiple parties before they successfully payout. Here's a simplified flow from initiation to completion, taking into account the intermediaries along the way.

1. A payment is initiated

A business triggers a payment: either a customer paying you (pay-in) or you paying a seller, supplier, or contractor (payout). At this point, the platform captures the amount, currency, and recipient details.

2. The funds are authorized and debited

The sender’s bank, card network, or payment provider confirms the funds are available and locks or withdraws the money.

If it’s a card payment, the card network authorizes it. If it’s a bank transfer, the bank processes the debit. You get the idea.

3. The money enters a payment network

The funds then move through a card network, banking network, or local payment rail in the sender's country. Platforms and orchestration providers (like Whop, Stripe, Airwallex, etc.) help manage the flow and routing between these systems.

4. Currency conversion happens (if needed)

If the sender and receiver use different currencies, FX conversion occurs.

This can happen at the sender’s bank, within the payment processor, or inside the receiving platform. An exchange rate is applied, and an FX fee is typically added.

5. Settlement occurs

The funds are settled, meaning they officially move from the sender’s financial institution to the receiver’s provider or platform balance.

For marketplaces and platforms, this may land in:

- A platform master account

- A wallet

- A connected sub-account

Settlement timing depends on rails used (instant, same day, or several days).

6. Funds are allocated (platform logic, if applicable)

For platforms and marketplaces, the system used for cross-border payments will then split funds between seller and platform. Funds may be held escrow, fees may be deducted, and compliance checks may be applied.

This is where revenue share and payout logic is applied if applicable.

7. Payout to the recipient

If it’s a payout flow, the platform sends funds to the final recipient via one of the methods listed below. More cross-border fees and FX may apply during this stage, depending on the platform used and the orchestration route the money follows.

8. Funds arrive and become usable

The recipient’s bank credits the account. At this point, the money is available for withdrawal or spending.

Different cross-border payment methods

There isn’t one single way to move money internationally; businesses can move money through several types of payment rails.

Payment methods differs in cost, settlement speed, currency support, compliance requirements, and scalability; so let’s explore the most popular.

International wire transfers (SWIFT)

International wire transfers are bank-to-bank transfers sent through the SWIFT messaging network.

When a business initiates a cross-border wire, its bank communicates payment instructions through SWIFT to the recipient’s bank, often via one or more intermediary correspondent banks.

This method is commonly used for large B2B supplier payments, intercompany transfers, or high-value transactions where traditional banking relationships are already in place.

The process is layered, though. Funds can pass through multiple banks before reaching the final recipient, and each one can deduct fees, apply FX markups, or delay settlement, meaning businesses often don’t see the full cost until reconciliation.

Pros:

- Globally standardized and widely accepted

- Suitable for large, one-off B2B payments

- High transaction limits

- Strong institutional trust

Cons:

- Multiple fee layers (sending, receiving, intermediary)

- FX spreads applied by banks

- Settlement can take several business days

- Limited transparency into where funds are during transfer

Card payments (credit and debit networks)

Cross-border card payments occur when a customer uses a credit or debit card issued in one country to pay a business in another.

Transactions route through networks like Visa and Mastercard, are converted into the merchant’s settlement currency, and deposited into the merchant account.

This is the main method for international ecommerce and SaaS subscription billing, as it supports instant authorization and global consumer familiarity.

The downside? Cross-border card transactions typically trigger additional fees beyond domestic processing rates. Think international assessment fees, currency conversion markups, and higher fraud risk categorization.

Pros:

- Instant payment authorization

- High customer trust and familiarity

- Built-in fraud tooling via networks

- Supports recurring billing models

Cons:

- Higher processing fees for cross-border transactions

- FX markups applied by issuers or acquirers

- Exposure to chargebacks

- Less suitable for large B2B invoice payments

International ACH and local bank rails

Instead of sending funds through SWIFT, you can also use local clearing systems in specific regions.

Examples include SEPA in Europe, ACH in the United States, and BACS in the UK.

To use these rails cross-border, businesses typically need local bank accounts or a payment provider with access to those domestic systems, which the right partner can provide automatically.

For example, Whop allows you to reach customers worldwide with region specific payment method routes. Derek Wilmer explains how, saying "When we route a payment through a local entity, everything improves, approval rates, fees, even chargeback outcomes. It just looks ‘right’ to the customer’s bank."

Funds are processed as local transfers within the recipient’s country, reducing fees compared to international wires.

This method is widely used for global payroll, contractor payments, and recurring vendor payouts.

Coverage depends on corridor access and infrastructure. Not all countries offer easily accessible domestic rails to foreign businesses.

Pros:

- Lower fees than SWIFT wires

- Suitable for recurring payouts (payroll, contractors)

- More predictable settlement costs

- Reduced intermediary banking layers

Cons:

- Slower settlement than card payments

- Requires local accounts or payment partners

- Not universally available across all corridors

- FX conversion still required if currencies differ

Digital wallets and PSPs

Business-focused digital wallets and payment service providers allow companies to hold, send, receive, and convert funds across multiple currencies without relying solely on traditional banking.

They’re commonly used by businesses, freelancers, and marketplaces that want to accept online payments globally (without setting up foreign bank accounts).

Pros:

- Faster onboarding than traditional banks

- Multi-currency balances in one dashboard

- Transparent fee structures (varies by provider)

- Good coverage for common global corridors

Cons:

- FX spreads still apply

- Withdrawal limits or payout delays may exist

- Regulatory restrictions vary by country

- May not offer full treasury control for large enterprises

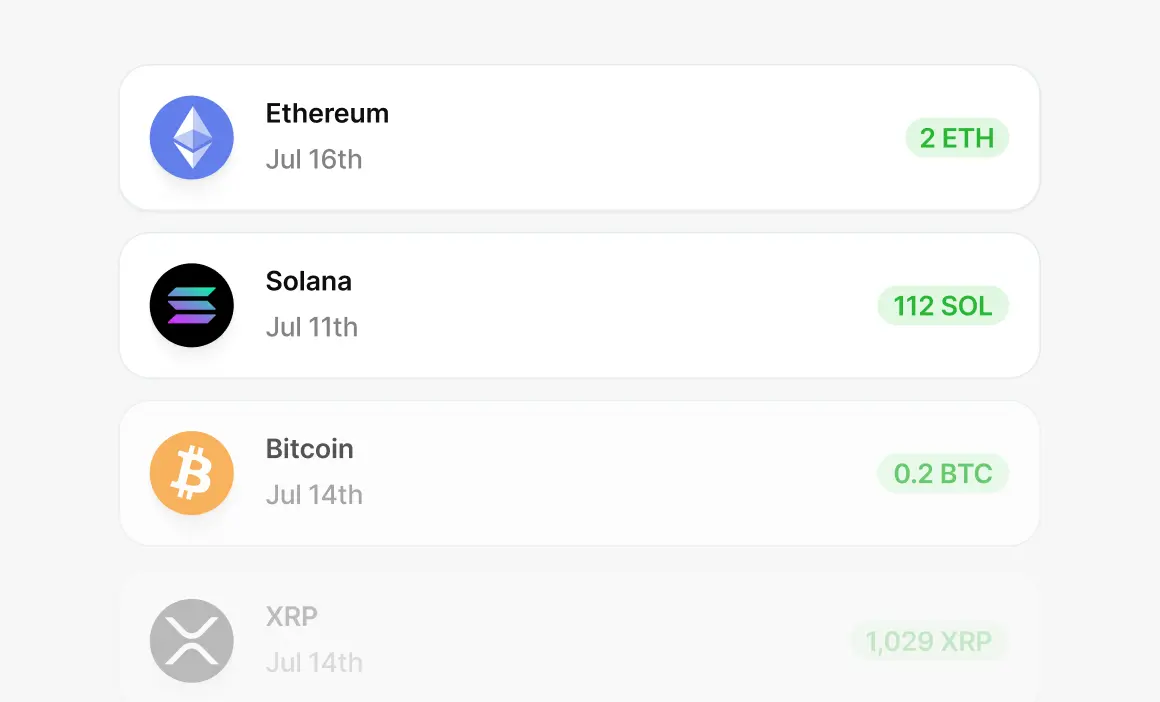

Cryptocurrencies and stablecoins

Crypto payments allow businesses to send cross-border funds over blockchain networks instead of traditional banking rails.

In practice, most business use cases rely on stablecoins like USDC or USDT, because they’re tied to fiat currencies, reducing risk.

Crypto rails are typically used by online companies, global contractor networks, or businesses operating in regions with limited or slow banking infrastructure.

Settlement is often near-instant, and funds can move without correspondent banks or intermediary fees.

I spoke to Dr. Ignacio E. Carballo, Director at the Center of Alternative Finance, about how stablecoins can increase cross-border payment success rates:

The main benefit of stablecoins is that they turn cross‑border into something much closer to a real‑time, domestic transfer: settlement in seconds or minutes, 24/7, with significantly lower fees and fewer intermediaries than traditional correspondent banking.

Pros:

- Fast settlement (often minutes)

- Lower fees in some corridors

- No reliance on traditional banking networks

- Useful in underbanked or high-friction markets

Cons:

- Regulatory uncertainty in some regions

- Volatility risk for non-stablecoins

- Requires wallet infrastructure and custody management

- Not universally accepted by vendors or employees

Integrated global payment platforms

Integrated payment platforms combine checkout, currency conversion, compliance handling, and payout infrastructure into a single system.

Instead of you having to stitch together banks, FX providers, tax tools, and payout systems, you can use one platform to manage revenue operations and payment flows from a single dashboard.

Examples include Stripe, Whop, and Adyen. These platforms provide infrastructure to manage complex payment operations and revenue flows, and can include:

- Managing multi-currency pricing

- Automating global payout workflows

- Managing KYC and compliance processes

- Issuing invoices

- Supporting marketplace or affiliate distribution

- Offering access to virtual cards or spending controls

For platforms, SaaS companies, and marketplaces, integrated platforms hugely reduce operational load.

Derek Wilmer, head of Payments at Whop says, "Whop offers a significant advantage to merchants by holding funds in multiple regions, which circumvents the need for platforms to establish their own entities, taxes, regulatory review, and licensing in various regions."

Pros:

- Merchants can accept payments from customers worldwide and manage revenue distribution and multi-currency pricing in one system.

- Built-in compliance, onboarding, and reporting tools

- Supports marketplace and multi-sided business models

- Reduces reliance on multiple banking relationships

Cons:

- Pricing and features vary by platform

- Can be less flexibility than fully custom in-house treasury setups

Most high-volume businesses will see the most benefit (smoother payments, lower fees, easier compliance) using an integrated global payments platform, so let’s take a look at the top options.

Top cross-border payment platforms

The solutions below help you accept international payments, handle currency conversion, and pay out users globally.

Fees vary by region, payment method, and volume, but this comparison highlights how each typically prices cross-border transactions.

Whop

Whop is built for businesses that want to simplify managing global payments and revenue operations without juggling multiple tools. There’s no monthly fee to get started - you just pay per transaction.

Merchants can access checkout, marketplace distribution, affiliate management, revenue sharing, tax handling, and payment orchestration all in one platform.

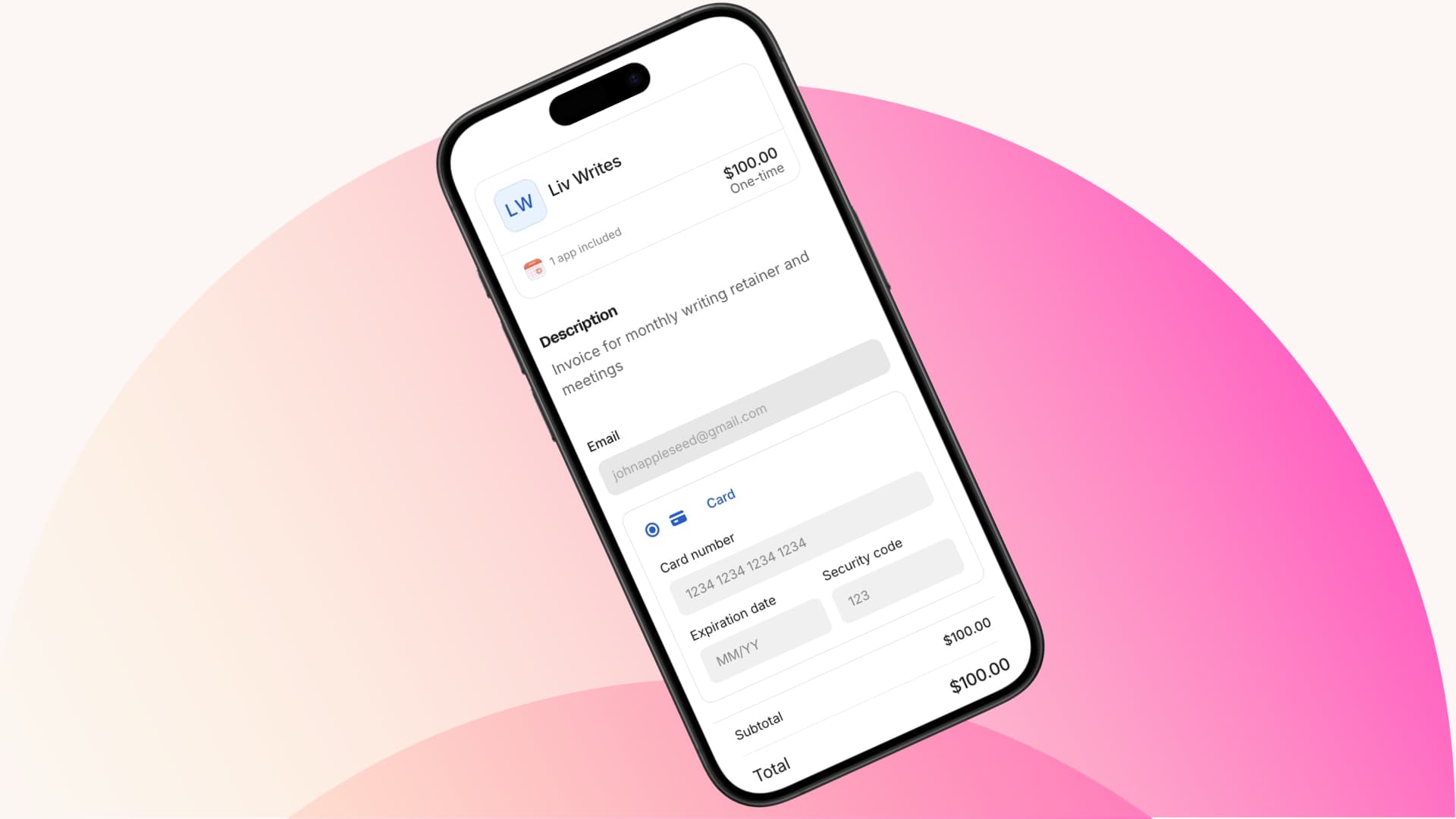

You can embed Whop’s checkout into your own environment, share checkout links with customers, or use the store builder as your website.

Basically? Instead of managing multiple tools for billing, compliance, and revenue workflows, everything can be coordinated in one system.

"Whop gives me peace of mind - I don't have to worry about our payment stack working. Our team has gotten back so much time." – Nick Lawton, CEO of SideShift

Oh, and Whop’s system is designed to optimize payment routing to improve authorization rates - especially important for international cards that are more likely to be declined.

Cross-border coverage matters, and Whop makes it easier for merchants to reach customers and partners worldwide with support for 100+ payment methods, crypto payments, and payouts in 241+ territories.

- Payments acceptance: Merchants can accept payments from customers worldwide using checkout links, embedded checkout, invoicing, automated billing, and 100+ local payment methods.

- Revenue management: Merchants can manage multi-currency pricing, revenue allocation, and payout logic for partners or sellers in 241+ territories.

- Conversion fee: +1% when applicable

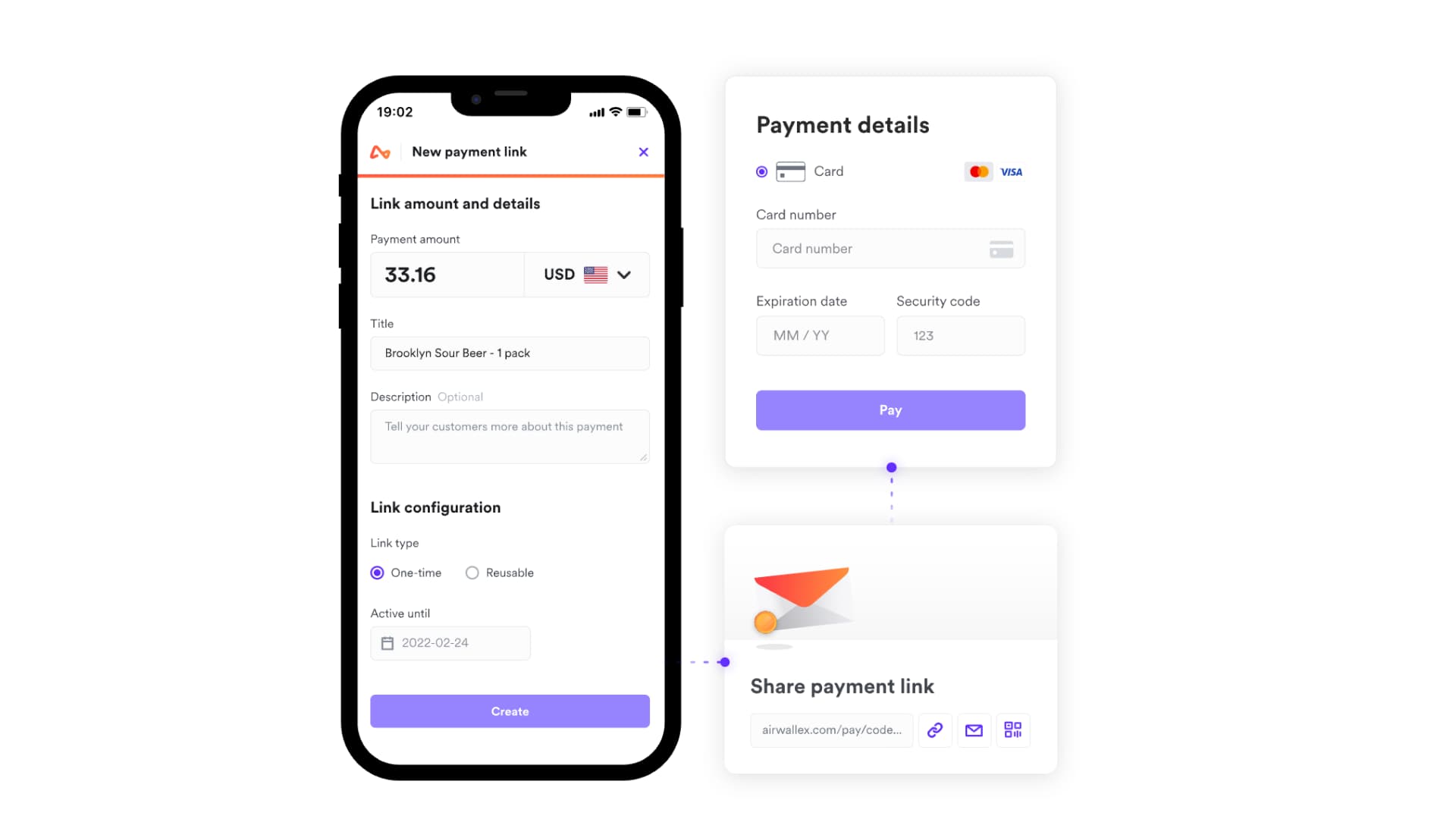

Airwallex

Airwallex helps marketplaces, SaaS platforms, and on-demand service providers.

Through 'Connected Accounts', platforms can onboard sellers, accept payments in 170+ currencies, split funds automatically, and trigger global payouts to 150+ countries.

You can use Airwallex to process payments directly (including cards and 160+ local payment methods), or keep your existing payment provider and use Airwallex just for wallets, FX, and payouts.

Airwallex is a solid financial infrastructure, providing accounts, currency management, onboarding, and global disbursement tools.

But, you won’t get a built-in marketplace, audience distribution, or an all-in-one commerce layer.

- Send: Global payouts via local bank rails and SWIFT to 150+ countries

- Receive: Card payments, 160+ local payment methods, account funding via bank transfer

- Conversion fee: 0.5% above interbank for major currencies, 1% above interbank for others

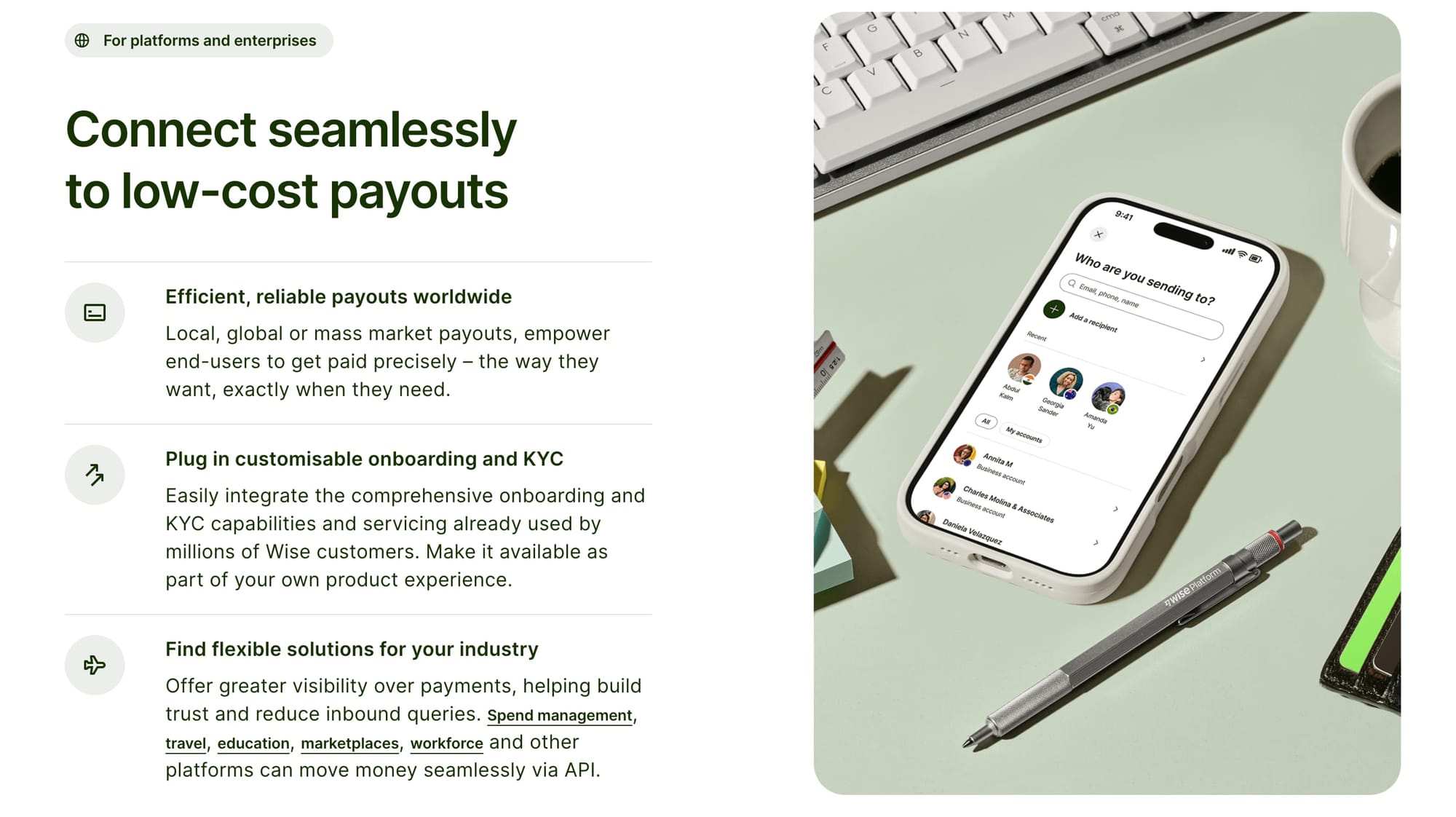

Wise Business

Wise Business gives merchants a multi-currency account built for sending, holding, converting, and spending money internationally at transparent rates.

It’s typically designed for startups and growing companies that need to move money across borders without traditional bank markups.

Wise positions itself around mid-market exchange rates and upfront pricing, no FX spread hidden inside inflated rates, but it isn’t a merchant of record or a built-in marketplace solution.

You can hold balances in multiple currencies, get local account details (like USD routing numbers, GBP account numbers, EU IBANs), send international transfers, batch pay up to 1,000 recipients, issue debit cards to your team, and sync with accounting software.

Wise doesn’t handle revenue sharing between sellers, automate commission splits, or provide a distribution layer. It’s just designed for holding, converting, and transferring money.

- Send: International transfers to 170+ countries (bank transfers)

- Receive: Local account details in GBP, EUR, USD, AUD, CAD, etc. (with local receipts)

- Conversion fee: From 0.57% (mid-market rate, varies by currency)

Payoneer

Payoneer is widely used by marketplaces and global businesses that need to move money between large numbers of sellers, partners, or contractors across borders.

Its main strength is in mass payouts, as Payoneer allows platforms to distribute funds to recipients in 190+ countries and 70 currencies from a single account.

However, currency conversion costs can add up at scale, particularly when regularly converting between currencies. It functions primarily as a global payout and receiving account provider.

- Send: Mass payouts to 190+ countries in 70 currencies

- Receive: Local receiving accounts in major currencies; marketplace integrations

- Conversion fee: Up to 3-3.5% on currency conversion (varies by region and route)

Stripe

Stripe is a global payments infrastructure provider used by ecommerce businesses, SaaS companies, and marketplaces to accept payments internationally and manage multi-party flows.

It supports 100+ payment methods and operates across all 195 countries, making it strong for businesses with broad global pay-in requirements.

For platforms and marketplaces specifically, Stripe Connect enables onboarding, fund routing, and payouts to third parties.

Stripe also supports multi-currency settlement and international payouts, though cross-border and conversion costs apply when processing or settling outside your domestic currency.

- Send: Bank accounts and debit cards in 50+ countries via local rails or wire with Global Payouts; multi-currency platform payouts via Stripe Connect

- Receive: Card payments, wallets, stablecoins, ACH, and 100+ local payment methods via checkout and payment links

- Conversion fee: 0.5%-2%, depending on product and corridor (e.g., receiving card payments vs sending Global Payouts)

Using platforms like those listed above helps your business or platform avoid most of the common pitfalls associated with cross-border payments: processing times, fragmented foreign systems, and high fees.

Common issues with cross-border payments (and how to avoid them)

1. FX volatility and hidden conversion costs

Exchange rates move, margins shrink, and some providers quietly bake markups into the rate, which is really frustrating.

Dr. Ignacio E. Carballo explains that for businesses with less budget to spare, these hidden costs can cause big headaches.

"Multiple intermediaries, FX mark‑ups and compliance overhead make cross‑border payments materially more expensive than domestic ones, which is painful for SMEs and platforms working with thin margins."

And for platforms operating at scale? Even small swings compound fast across thousands of transactions.

How to avoid them:

- Hold funds in multiple currencies instead of auto-converting

- Use providers that show the FX margin clearly

- Separate conversion timing from payout timing where possible

- Negotiate FX tiers if processing large volume

Whop makes cross-currency pricing transparent, with a flat +1% fee applied whenever a currency conversion occurs.

2. High and layered transaction fees

Cross-border payments rarely mean one fee. You’re often paying processing fees, cross-border uplifts, FX fees, intermediate bank charges, and even payout fees.

When you can't see those numbers clearly, costs stack quickly.

Whop combines payment collection, automated billing, and revenue allocation in one system, reducing complexity and the need for multiple tools.

How to avoid them:

- Use a single provider that controls the full flow (from payments to payouts)

- Avoid correspondent banking chains where possible

- Model total cost per transaction, not headline rate

- Consolidate volumes to unlock lower tiers

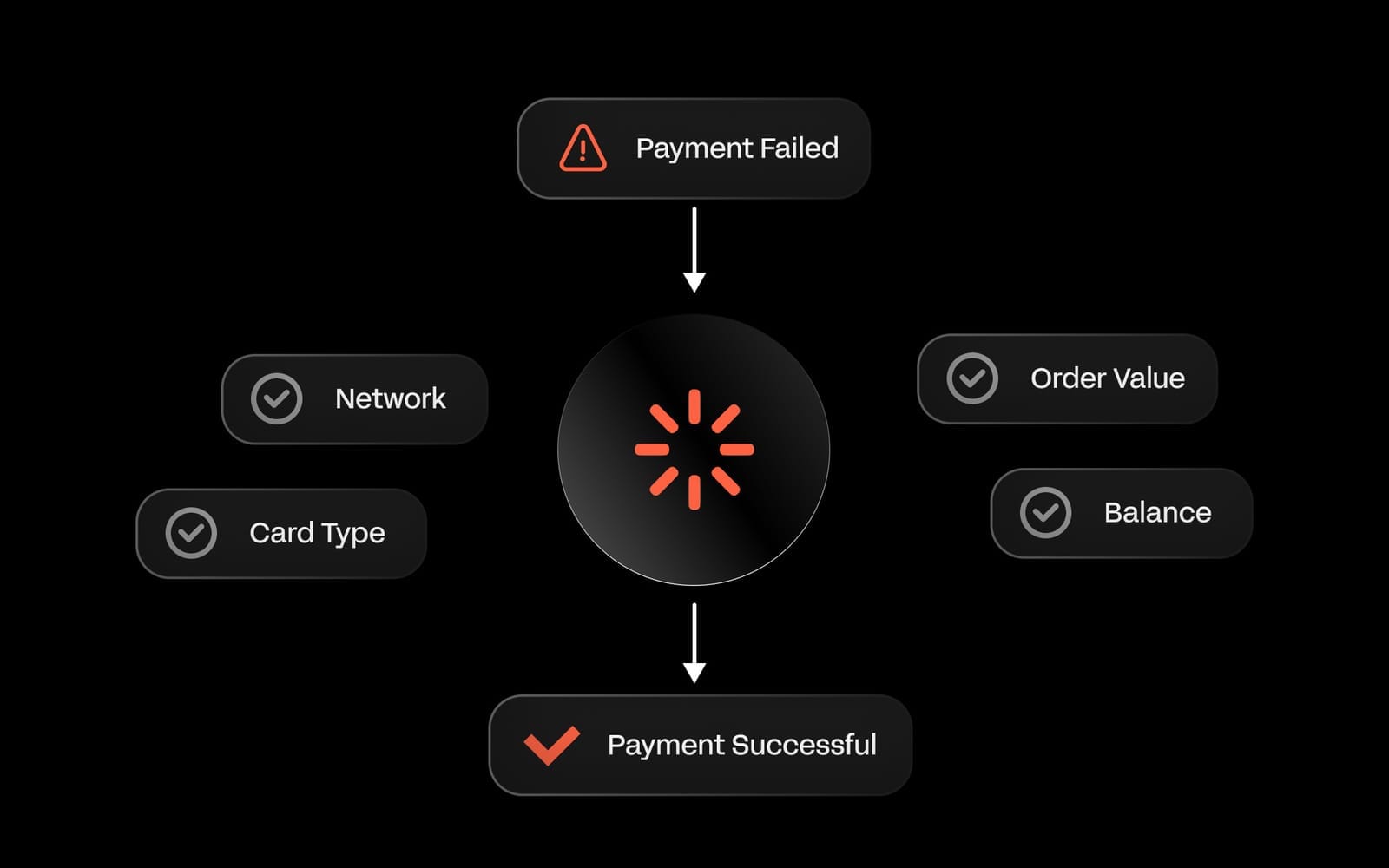

3. Fraud and cross-border risk exposure

Cross-border flows introduce more variables, like new jurisdictions, identity verification challenges, and higher chargeback risk. Platforms are especially exposed because they move money on behalf of others.

I asked Maddie Cohen, head of Trust at Whop, how businesses can balance security and fraud checks with good customer experience:

You have the best customer and user experience when there are really seamless fraud checks. When fraud checks are working properly, you hardly even know they're there, and you're only going to catch the bad actors.

How to avoid it:

- Use built-in adaptive risk and fraud detection tools

- Apply dynamic authentication when required

- Automate sanctions screening

- Separate platform funds from seller funds

4. Regulatory and compliance complexity

Every country has its own KYC rules, AML obligations, sanctions lists, reporting frameworks, and tax withholding rules. It's a lot to be across.

If you’re running a marketplace or platform, you don’t just comply for yourself, you carry the obligations for your sellers too.

How to avoid it:

- Use infrastructure providers with built-in KYC and AML tooling

- Automate onboarding and identity verification

- Choose partners licensed in the jurisdictions you operate in

- Centralize reporting

Whop provides KYC and compliance tools and orchestrates payment workflows within its platform, so merchants don’t have to build their own compliance stack.

5. Settlement delays and unpredictable timing

Traditional cross-border transfers can involve multiple intermediary banks. That means delays, opaque tracking, and confused recipients. For platforms especially, slow payouts damage trust.

One way to increase customer trust is by making transactions appear local, as Dr. Ignacio E. Carballo explains:

"Approval rates improve most when transactions look ‘local’: local acquiring, local currency, familiar payment methods, and richer data all matter."

How to avoid it:

- Use providers connected to local payment rails (Whop supports fast global payouts across ACH, crypto, PayPal, Venmo, and more)

- Prefer local bank transfers over SWIFT where possible

- Offer instant or same-day payout options

- Provide real-time payout tracking

6. Fragmented systems and manual workflows

Running one provider for pay-ins and another for payouts creates friction, fast. More systems lead to more issues, and more accounting work.

How to avoid them:

- Use unified infrastructure for pay-in and payout

- Automate fund allocation and fee deduction

- Integrate directly via API

- Centralize reporting across currencies

The best global payment stacks aren’t just connected, they’re automated by APIs. Real-time routing, fund splitting, compliance checks, FX logic, and payout scheduling all depend on API-level control.

7. Tax and withholding complications

Different countries have vastly different tax laws surrounding VAT, GST, withholding and reporting requirements. Understanding your responsibilities are key to avoid landing in hot water.

How to navigate it:

- Use automated tax calculation and reporting tools

- Monitor thresholds by jurisdiction

- Work with providers that support tax automation

- Keep transaction-level audit data

Why businesses choose Whop for cross-border payments

Cross-border payments mean complexity. You’re dealing with multiple currencies, layered fees, compliance requirements, payout logistics, and reporting across varying jurisdictions.

And as volume increases, that complexity only grows. Whop swaps multiple moving parts for one smooth system.

"Giving partners an account‑like experience (balances, history, status, fees) via a clean API or dashboard tends to build a lot of trust and dramatically reduce support tickets," – Dr. Ignacio Carballo.

Accept international payments, manage revenue distribution, and automate cross-border workflows - all from a single dashboard, without juggling multiple tools.

Clearer total costs, faster settlement, and better control over your global cash flow.

Cross-border payments FAQs

What are cross-border payments?

Cross-border payments are transactions where the payer and recipient are in different countries. They typically involve currency conversion, international payment networks, regulatory compliance, and sometimes intermediary banks.

How do cross-border payments work?

Cross-border payments move through several steps:

- The payer initiates a payment.

- The payment is processed through a network (card network, local rail, or SWIFT).

- Currency conversion happens if needed.

- Funds settle in the recipient’s country and are deposited into their account.

Speed and cost depend on the payment method and infrastructure used.

Why are cross-border payments more expensive?

Cross-border payments often include multiple cost layers like processing fees, currency conversion (FX) fee, intermediary bank charges, and payout fees.

How long do cross-border payments take?

Card payments often have near-instant authorization, while local bank rails can take 0-2 business days. SWIFT wires typically take the longest, an average of 2-5 business days. Delays usually occur when intermediary banks or manual reviews are involved.

What are cross-border payment fees?

Cross-border payment fees are an additional charge applied when a transaction involves two different countries. They can include international card uplifts, cross-border payout percentages, or foreign exchange margins.

How can businesses reduce cross-border costs?

Businesses can reduce costs by holding funds in multiple currencies, using local payment rails instead of SWIFT, and using unified payments systems to avoid layered fees.

What is the best way to manage cross-border payments for a marketplace or SaaS platform?

The most effective approach is using unified infrastructure that handles global pay-ins, currency conversion, automated fund allocation, cross-border payouts, and your compliance and reporting.