In the entrepreneurial world, one of the holy grails of all business models is one that includes monthly recurring revenue, or MRR. But what is MRR, and how is it different from ARR?

Keeping on top of business metrics can be confusing, but these metrics are key to your success. MRR is one such metric, and this figure helps you to evaluate the performance of your business, staff, and more. So, let’s see exactly what MRR is, how it can help your business, and how you can begin using the MRR metric today.

Jump to:

- What is MRR?

- Types of MRR

- MRR vs ARR - What is the Difference?

- Different types of MRR Business Models

- How to Calculate MRR

- Advantages of the Subscription Business Model

- Growth Strategies for MRR

- Using Whop to Start and Scale a Subscription Business

- MRR FAQs

What is MRR?

The simple definition of MRR is a metric of a revenue model in which a product is sold on a monthly basis. MRR as a metric is a way to average various pricing plans and billing periods into a single, consistent number that can be tracked over time.

When making the initial purchase, the customer knowingly agrees to be billed again, agreeing to the terms of a subscription model, which can vary in length of time, from monthly to annually and semi-annually.

Monthly recurring revenue refers to the metric used in financial reporting in which revenue is calculated or projected on a monthly basis, regardless of how often the customer is paying.

Types of MRR

MRR metrics can get more nuanced, including specific types that you can use to track the growth or shrinkage of your business and its products. These different types are most applicable to business owners who have an established brand that is selling multiple products with a suite of features and functionality.

Basic MRR

The average monthly income of your business is categorized as MRR, and does not consider any growth or loss on its own unless compared to other periods.

New MRR

Whenever you gain new customers over time, your MRR will increase. This increase is called New MRR. However, new MRR can still occur if there is stagnation or negative growth if previous customers are leaving.

Net New MRR

If you want to track the metric that considers how much your revenue is growing, you will need to calculate the overall growth on a monthly basis compared to past periods. This is called Net New MRR. Net New MRR can be either positive or negative and is calculated by subtracting any churned revenue from the gained revenue.

Churned MRR

Losing customers on a monthly basis is called churning. Your Churned MRR is quite similar to Churn Rate, except that it is always averaged on a monthly basis, and is a dollar amount instead of a percentage. For example, if in the last month you have lost 10 customers who each paid $40 per month for you private community, your churned MRR for last month is $400.

Upgrade MRR

For business owners that have a tiered subscription model, you will want to track and report Upgrade MRR, which shows how much revenue comes from members who have upgraded to a pricier plan on a monthly basis.

Downgrade MRR

Downgrade MRR is simply the opposite of Upgrade MRR and shows how much lost revenue is from your customers from higher-tiered plans that have downgraded to cheaper plans. If your downgrade MRR is too high, especially if your churn rate is low, you may want to consider the more expensive features that you have added and if they are worth the price that you are charging.

Expansion MRR

If you are focused on growing the overall revenue of your current customer base, the main metric you will focus on is Expansion MRR.

The Expansion MRR is calculated by tracking the revenue that is generated through additional payments from existing customers, which can happen in the form of upselling, cross-selling, and add-ons or purchases of any other or new products. For example, if your current customer base during a monthly period has 5 new monthly upgrades for a membership that costs an additional $100 per month, and 10 customers purchase a $25 add-on, your Expansion MRR for the month is $750.

Contraction MRR

The opposite of Expansion MRR is called Contraction MRR. If customers are downgrading subscriptions to cheaper plans and spending less, the dollar amount at which this is happening on a monthly basis is the Contraction MRR. It is reported as a positive number even though it indicates negative growth. For example, if in one month you have 10 customers downgrading subscriptions to a plan that is $25 less, your Contraction MRR for that month is $250.

Reactivation MRR

Winning back lost customers is a great way to improve the health of your business because not only will it lower your overall churn rate, you will likely have made improvements that will increase the conversion rate of new customers.

The metric used to calculate how much of the monthly revenue is from old customers that have come back is called Reactivation MRR. While it is possible to use email marketing and some sweet talking and perhaps a discount to get an old customer back, it is most effective to add a new feature or improve an existing one before reaching back to churned customers for reactivation.

MRR vs ARR - What is the Difference?

One quick distinction to make between recurring revenue business models and reports is that between monthly recurring revenue and annual recurring revenue.

Annual recurring revenue will be used typically only with a subscription-based business that is already established, as it requires a full year of data to calculate, so it is most useful for a business that has been generating somewhat substantial revenue for at least one full year.

ARR is almost always compared to MRR in order to calculate a projected growth rate. If you are a newer entrepreneur selling a membership or SaaS, you will only really need to worry about MRR at first, which also is best interpreted after several months of revenue.

| MRR | ARR |

|---|---|

| Total amount of recurring revenue generated each month | Total amount of recurring revenue generated in a year |

| Precise, detailed view | Overall snapshot |

| Monthly growth of the business | Yearly growth of the business |

| MRR = ARPU x MS (monthly subscribers) | ARR = MRR x 12 |

Different types of MRR Business Models

Monthly recurring revenue can be had in several different business models, which we will go over in this section.

MRR in Ecommerce

Ecommerce entrepreneurs whose businesses produce monthly recurring revenue fall into the category of a subscription business model. One common type of subscription owner for physical product owners is a subscription box, which can include a variety of helpful products in a certain niche like healthcare or beauty. Another common subscription-based business model is for those that sell supplements, which are often taken daily, so the business owner would be wise to ask to sell to the customer on a monthly recurring basis, perhaps for a discount.

MRR in SaaS

In the world of digital products, subscription-based business models often exist in the form of a software-as-a-service, or SaaS business. Although SaaS is sometimes sold in a one-time or lifetime membership, it is more often sold on a recurring basis, the most common being a monthly subscription.

The monthly revenue should be reinvested into further development and maintenance of your software so that you remain relevant in the competitive world of SaaS, where there is rarely a truly original idea but rather better variations of existing ideas.

How to Calculate MRR

Calculating MRR is fairly simple. All that is required is a revenue-generated subscription-based business and a period of time of sales, ideally a year or more.

Once you have met the prerequisites, you can calculate MRR.

The simplest way to calculate MRR is to multiply the total number of paying customers by the average revenue per user (ARPU) per month.

MRR = Total number of active customers x Average billed amount

For example, if you have 100 paying customers spending an average of $40 per month, your MRR is $4000.

Even if you have tiered subscriptions with different prices and payment period terms, your MRR number will be the same.

To calculate MRR, start by totaling the monthly subscription values of each of your current customers. If you have customers on multi-month or yearly subscriptions, simply take those contract values and divide them by the number of months in the subscription period.

Advantages of the Subscription Business Model

The monthly recurring revenue that comes with a subscription-based model presents several advantages, which we will go over here:

- Higher customer lifetime value

Whenever a customer signs up for a subscription, they are often worth more than one time purchasers, even those that pay a more expensive price. - Potential for greater customer loyalty

Customers who agree to pay on an ongoing monthly basis and are happy with the service offered are likely to remain loyal over time and might even spread the business with word of mouth. - More predictable financial projections

MRR is a helpful metric to understand particularly for making financial projections in order to forecast decisions related to budget, hiring, or raising money effectively. The more data you have with MRR, the more you’ll be able to make accurate predictions regarding financial projections. - Can scale without needing to add to the team or process

Some businesses such as traditional physical products businesses need to worry about the logistics of both supply and fulfillment in order to effectively scale, which can prove both costly and complicated. With a subscription-based business of a digital product such as SaaS or another software, scaling the fulfillment is often no more complicated with 1000 subscribers than 100 subscribers, save for maybe expanded customer service. - Increased valuation for investors

As much as a business owner might like predictable revenue coming in every month, an investor might like this even more. Steady recurring revenue, especially if there is a strong history and signs of growth, will increase the valuation of a business compared to the typical market rate whether it is to raise money or to sell. - Easier to generate passive income

Since a subscription brings in steady revenue, it is easier to create and manage a budget for a team that can have work delegated to them. Once these systems and processes have been set up and the revenue is coming in steadily, it is possible for the owner to sit back and bring in income that is largely passive, in the same way that a real estate owner can collect checks every month without being obligated to trade time directly for money in order to do so.

Growth Strategies for MRR

If you want longevity and growing MRR in your subscription business, you need to utilize strategies such as the following:

- Quality product

The biggest driver of growth is increased customer adoption and retention, which makes for a reduced churn rate, and the easiest way for people to adopt and keep a product is for yours to be better than the competition. Ensure that you have sufficient features, especially compared to competing businesses. - Superior customer experience

People like to do business with those that they like, so make sure to give your customers a great experience. Some customers leave a business that may be technically superior but is lacking in customer experience, so don’t neglect this just because you think your product is good enough to not need good customer service. Offer support that is responsive and knowledgeable, with as many options as possible to talk to a human. - Trial period or Freemium offering

Just about every SaaS or subscription business will offer a free trial, whether it’s for a few days or a month. The biggest reason to offer a free trial is because it allows someone who is currently paying for another competing service to try yours without having to pay for two services at once. You can consider doing a Freemium, or toned-down version of your software as well. Although this sometimes attracts freeloaders, if they like your product enough and have enough incentive to use the full version, it’s a great way to continue to recruit new customers. - Effective upselling

The easiest customers to sell to are those who have already bought a product of yours, especially if you’ve followed the previously mentioned practices of having a solid product and great customer experience. Upselling is a great way to increase average customer value, and when done tastefully, actually gives the customer more of what they want as well. Make sure to reserve certain features for upsells, and always pay attention to feedback regarding what features you can make an upsell in the future if they don’t already exist. - Split test

Once you have a certain level of traction, you should be paying attention to the conversion rates. Compare these to the industry standards, and if you are falling short, you need to be able to reach the bar. The most effective way to compare your performance to its potential is to A/B or split test. You can split test landing page design, the checkout process, pricing, and which features to include for paying users in different tiers. It is best to utilize existing split testing software in order to do this effectively and gather actionable data to make changes when there is strong evidence to do so.

Using Whop to Start and Scale a Subscription Business

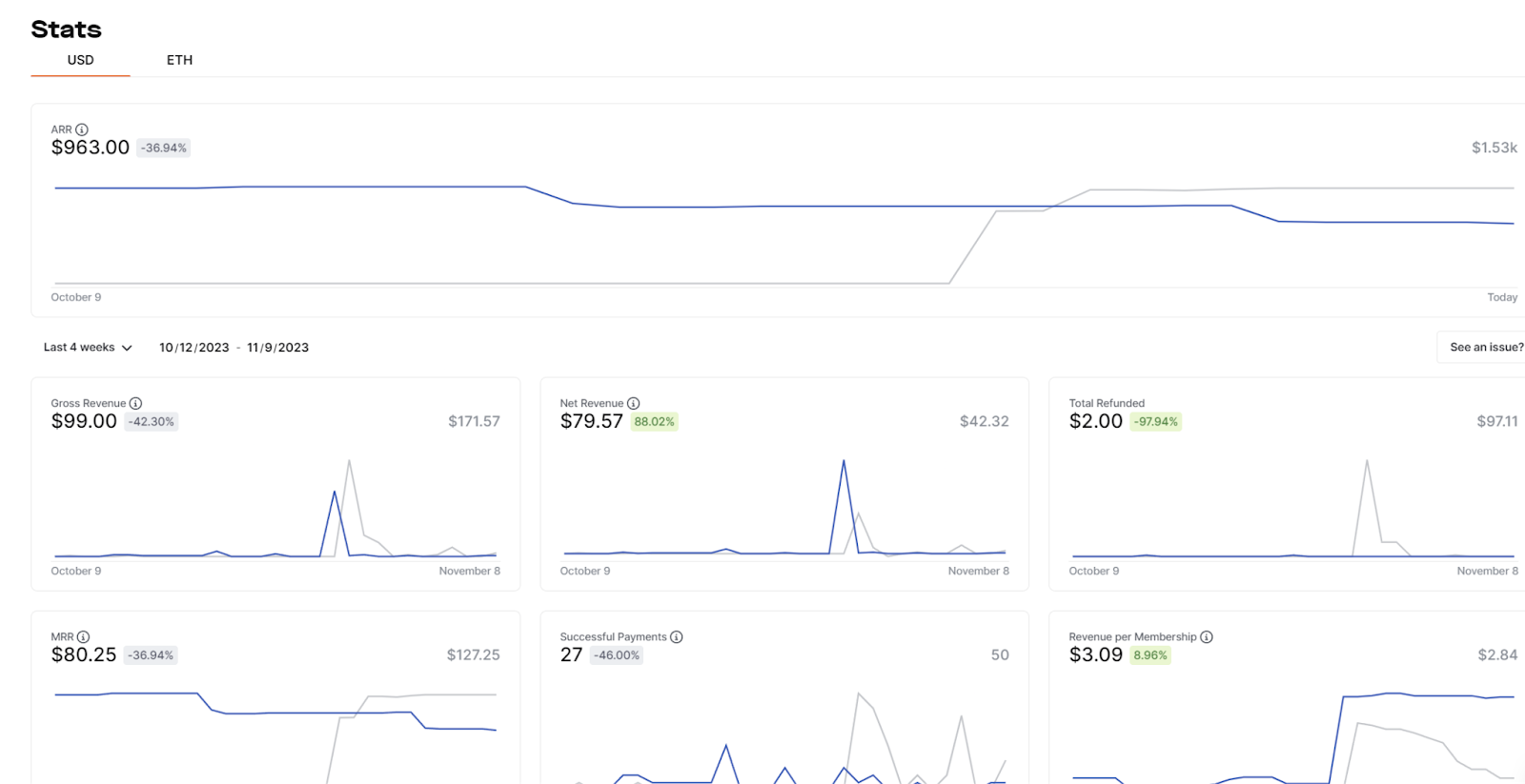

Whop’s powerful dashboard will give you numerous insights into metrics in an easy-to-read report, including MRR.

Other statistics with easy-to-read charts that you’ll see in the dash will include ARR, Gross Revenue, Successful Payments, Revenue per Customer, and more.

These reports get better as you scale, and will allow you to make effective data-driven decisions that can drive your business growth.

Even though you’ll have to wait to get live data and revenue numbers to populate your reports, with Whop, it shouldn’t take too long to do so! We have extensive customer support who will help you along any step of the way in your digital products selling journey so that you can find success as early as possible.

👉 With a sign-up process that takes less than 10 minutes and support for numerous subscription-based businesses including SaaS and private memberships run on Discord, Telegram, and more, you will be able to launch your business quickly with Whop. Sign up here to get started!

MRR FAQs

What is MRR Churn?

MRR churn is a metric that measures a company's total MRR losses over a set period of time. It is calculated by adding up all recurring revenue losses due to customer churn and subtracting any revenue gains due to upgrades, cross-sells, and new customer acquisition. The MRR churn is calculated as a percentage and is the churn rate on a monthly basis.

What is Net MRR Growth?

Net MRR Growth is basically the opposite of MRR churn and refers to the overall growth over a certain period. It is also calculated as a percentage, and it should always be the goal of a subscription-based business to have positive Net MRR Growth, particularly when new, so as to give incentive as well as funding to allow for continued business growth.

Which Types of Businesses Calculate MRR?

MRR is a metric that is only applicable to subscription-based businesses. These can include physical products such as subscription boxes or supplements, or digital products like private community memberships or SaaS.

When Should I Calculate MRR?

Although MRR can be calculated after even a few months of having a live product with revenue and active users, in terms of having actionable data for making worthy decisions, business owners should wait at least a year to accurately reflect and project. If your subscription-based business is not achieving a positive MRR after several months in business, it may be time to reassess the offering or market, or it may be time to cut your losses. On the other hand, early growth that continues throughout the first year of business is a great sign that you have established a business that can compete and thrive.