Hundreds of new SaaS (Software as a Service) businesses keep popping up every year. It seems like wherever you look, there’s a new SaaS product promising to solve the world’s problems- and it actually seems to be working! So much so, that the SaaS market size is projected to increase fivefold within the next decade.

In spite of this, the large majority of new SaaS businesses don’t end up making it to the top. Why? They simply aren’t able to maintain their customer base for a long time. And, since they can’t really get a good return on investment from singular purchases, they end up facing constant losses.

That’s where SaaS Customer Lifetime Value (CLV) comes in: an extremely important metric that depicts the total amount of revenue every customer brings to your business while they’re using your product or service.

If you want your SaaS business to grow to its full potential, you must get a grasp on your CLV and look for ways to increase it. Neglect it, and you’ll just bleed money trying to figure out why you can’t hold on to your customers. Master it, and your business will thrive and enjoy healthy profit margins.

That’s why we created this guide to help both brand-new and established SaaS businesses understand more about Customer Lifetime Value. We will go into detail about SaaS CLV means and how it’s affected by other metrics and analytics.

We’ll also go in-depth into why you should really focus on it, how to properly measure it, as well as a few tips and strategies to increase it and help your SaaS business grow even more.

👉 If you have a SaaS business and want a reliable platform to monitor and sell your SaaS products, check out the Whop marketplace. Whop is an all-in-one platform for all your digital products, including SaaS software, and promises to help you launch your product, save time and money, and increase your revenue.

How SaaS Customer Lifetime Value Works

Before we look at the different methods used to calculate Customer Lifetime Value, let’s start with some essentials. Customer Lifetime Value (aka CLV) depicts the total revenue any business can expect from each customer. Despite its name, this metric doesn’t actually reflect the customer’s entire lifetime but rather the lifespan of their relationship with your business.

As you can imagine, CLV is very important for all types of business - physical or digital. Whether you’re selling cups of coffee or Notion templates, you want to know how much “value” each customer brings to your business.

In the case of SaaS businesses, which rely on recurring payments and subscriptions, CLV is an even more significant metric. You see, these types of businesses require huge budgets for marketing to show the value of their product or service. Thus, they need to extract the most from every customer to remain profitable.

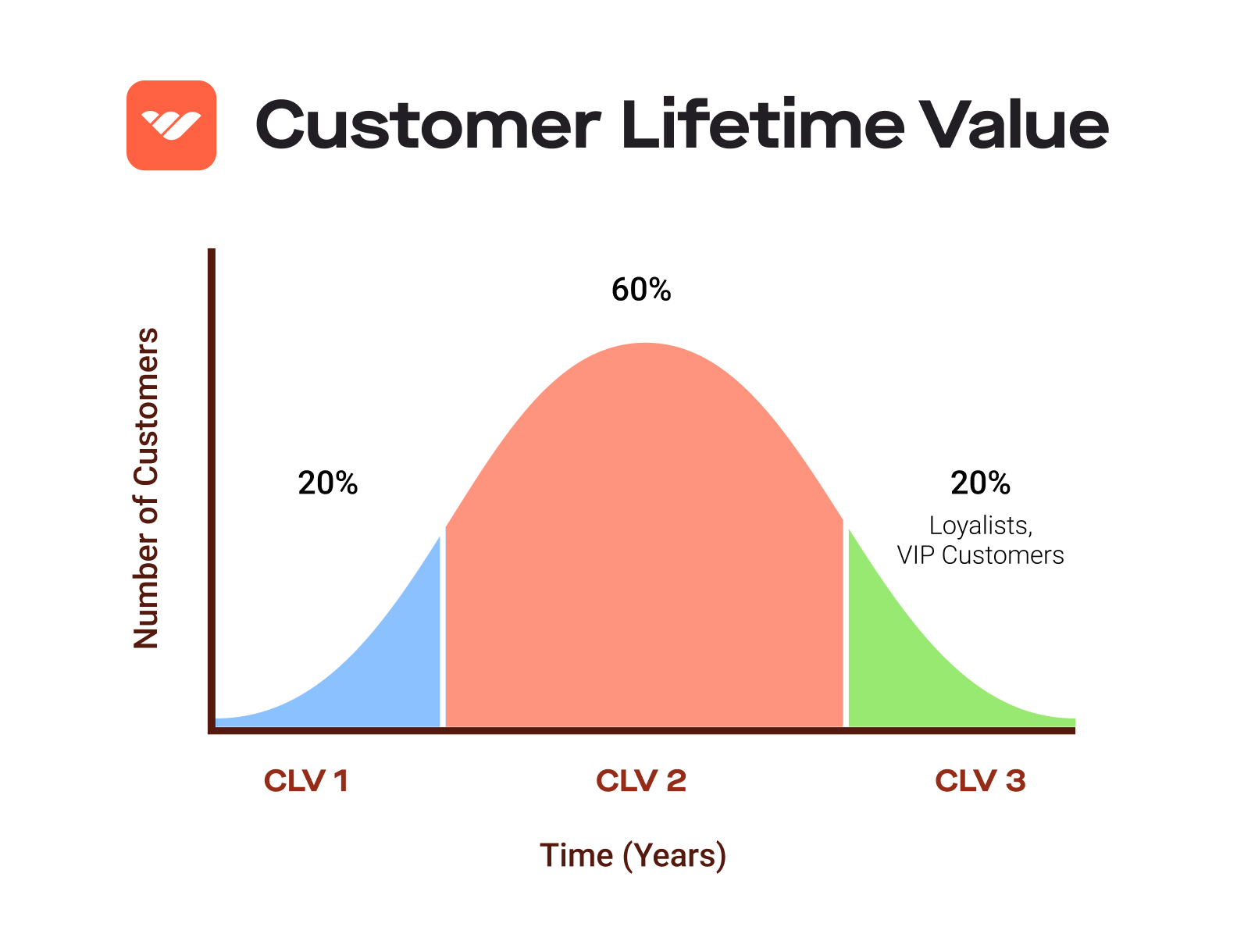

Keep in mind that Customer Lifetime Value is a dynamic metric that changes depending on what stage the business or product sold is in.

SaaS businesses just starting out can’t really expect to have large CLV numbers, as not many customers will find inherent value in their product. These customers will, therefore, be non-profitable.

As the business grows, comes up with new products, and caters to user needs, the number of recurring customers will steadily increase and reach its peak. All these loyal customers will be profitable for the business.

However, just like any digital product, there will come a time when something new will serve the majority of customers better. At that stage, the business CLV will decrease and mainly comprise its VIP and very loyal customers who are inherently unlikely to switch to a new product or service. Those are your precious and profitable customers.

What About LTV?

Before we move on, it’s crucial to distinguish LTV (or Lifetime Value) from CLV. LTV is a pretty similar business indicator that refers to the cumulative business revenue from all customers or other entities combined. Sometimes, the two terms are used interchangeably, but they can vary based on the type of business.

For instance, let’s say you have a traditional manufacturing business; you might be more interested in calculating LTV, as it includes both the value of your customers as well as your actual product lines. On the other hand, a SaaS business that utilizes a subscription-based model solely relies on CLV, as it’s extremely customer-focused.

In any case, you can use both terms to draw conclusions on how much value you get from your customers. In turn, this helps you make educated decisions on how to proceed with things like marketing costs and how to retain more customers.

Metrics Involved in Customer Lifetime Value Calculations

As we already discussed, understanding how Customer Lifetime Value works is key to understanding how to grow your SaaS business. One of the first steps you must take is to calculate your current CLV.

However, before you do so, it’s important to look at some other key business metrics that affect your CLV or LTV numbers. Some of them are even directly used in CLV calculations, so you need to get a grasp on how they operate.

| SaaS Metric | Correlation with CLV |

|---|---|

| Churn Rate | Can significantly lower CLV depending on its percentage and pattern |

| Customer Acquisition Cost (CAC) | A good CLV:CAC ratio (usually 3 to 1) shows a healthy and profitable business |

| Average Revenue Per User (ARPU) | Indicates how much revenue each customer brings and combines with customer lifespan to form a basic CLV formula |

Churn Rate & CLV

Churn is a thorn on any business’ side, as it basically shows how many customers you lose, either actively or passively. As you can imagine, this can have a significant impact on your CLV and also depends on many factors, such as how often you calculate it, what payment model you use, etc.

For example, a SaaS business that offers its products on an annual subscription will naturally see the highest churn during the yearly renewal period.

Some customers will leave because they don’t want to renew their subscriptions, while others will exit passively because their payment got rejected. In any case, the business CLV will take a massive hit for that particular period.

Another good example is a business that offers monthly trial periods. Many customers will sign up for the free trial but won’t continue, so the business will see a huge churn during the first month, leading to a much lower CLV. After that, the churn will stabilize and won’t affect lifetime value too much.

Customer Acquisition Cost (CAC) & CLV

Do you know how much your business spends to get new customers? That’s what the Customer Acquisition Cost (or CAC for short) is all about. It shows you how much money you spend for each new customer and can be calculated by dividing your marketing budget by the number of new customers you receive.

In order for your SaaS business to be healthy and profitable, you need a good CLV:CAC ratio. While it depends on several factors, a good rule of thumb is to have a CLV that’s three times larger than your CAC (basically a 3:1 ratio).

If you’re below a 3, you either lose too many customers or spend more than you should on getting new ones. However, too high of a ratio means you’re probably not spending enough on new customers (who will bring you additional “lifetime value") and restricting your business’ growth potential.

You can also utilize customer segmentation here and sort each client by the channel through which they got their subscription. This shows you where you can get your most “valuable” customers, allowing you to spend your marketing budget more purposefully.

Average Revenue Per User (ARPU) & CLV

The ARPU (aka Average Revenue Per User) essentially gives you a glimpse into how much “value” each customer provides to your business. If you take your total business revenue for a specific period and divide it by the number of users you have, you get your ARPU for that period.

This metric is key in calculating a customer’s lifetime value. However, it only applies to SaaS businesses that follow a subscription-based payment model (either monthly or annual). If you have more than one pricing model or any other forms of revenue, you’ll need to account for them separately.

Depending on how you sort your clients, you may want to consider other similar indicators to ARPU, such as ARPA (Average Revenue Per Account) if several users are affiliated with a single account.

Why You Should Pay Attention to Your SaaS Business CLV

So, why go through all the hassle of calculating your CLV? It’s simple; a high CLV generally means your business is doing great. It also means you have many “high-value” customers. And don’t forget, these are your most important clients; their loyalty and/or spending power are the ticket to your business growing to its full potential.

Another important reason to keep an eye on your CLV has to do with your SaaS business’ profitability. Calculating CLV will allow you to make better predictions for your future revenue, which will drive more responsible decisions. Plus, having a high CLV is a great asset for attracting investors.

As we mentioned above, SaaS businesses need a lot of money to kickstart their customer acquisition. And those with subscription payments can’t possibly expect to make their money back by constantly losing customers and getting new ones. Therefore, these types of businesses must maintain their highest-value customers, so they need to get a grasp of their CLV to find them.

You might even be surprised as to which type of customer provides the highest lifetime value. It may be the case that customers with lower profit margins are more loyal and keep using your product for a longer period. This automatically makes them much more valuable than high-profit margin clients who just leave after a while.

Your best bet is to cater to your high-value customers. Ask them what they enjoy most about your product or service and what would make them stay for even longer. Then, consider making changes to ensure you keep them and attract others like them.

4 Ways to Measure Your SaaS CLV

Now that you properly understand the significance of your Customer Lifetime Value, it’s time to discuss a few different ways you can use to measure it. We’ll start things off with some more simple methods and move on to more advanced formulas further below.

#1. The “Simple” Method

If you’re just looking to get a feel for your SaaS business CLV, you only need a few simple metrics to get started. First, you’ll need to find how much each customer pays on average per transaction. This is easily calculated by dividing the customer revenue by the number of transactions they made. Remember to use figures within a specific time period.

Next, you’ll need to learn how often the customer completes a transaction on average. This is easy to find through the purchase history or calculate by dividing your total transactions with the number of unique customers.

The final piece of the puzzle is the average customer lifespan, a metric that shows how long the relationship between your business and the customer lasts on average. This indicator will be very useful for almost all methods further below.

Once you have your figures, all you need to do is multiply them together to get your CLV. This comes out to the following formula:

CLV = Average Transaction Value * Average Transaction Rate * Average Customer LifespanKeep in mind that this method is only a rough estimate and doesn’t take into account more advanced metrics and parameters. Still, it’s a good start to get a hold of your CLV, see where you are, and figure out how to make it better.

#2. An Alternative Using Total Customer Revenue

A slightly more advanced calculation method includes the total revenue you can expect to earn on average from a customer throughout their relationship with your business.

For this, you’ll need to calculate your ARPU (Average Revenue Per User) or ARPA (Average Revenue Per Account) depending on whether you have single users with several accounts or multiple users within the same account.

To calculate your ARPU, you can just divide your MRR (Monthly Recurring Revenue) by the number of active users or accounts. Then, you’ll need to multiply your ARPU by your average customer lifespan, which we calculated above. The final formula is:

CLV = ARPU Average * Customer LifespanCLV = ARPU Average Customer Lifespan

This formula also has a few variations depending on which parameters you want to use. For example, you can also introduce your CAC (Customer Acquisition Cost) into the mix. This will allow you to get a better understanding of what net value each customer brings considering how much it costs to get them to hop on board. Your formula would then transform into:

CLV = (ARPU Average Customer Lifespan) - CACRemember that all these formulas work specifically for SaaS businesses that utilize subscription billing for their Monthly Recurring Revenue. If your company has additional revenue through other SaaS billing methods, like usage-based billing, you need to find a way to incorporate them into your calculations.

#3. Introducing Churn Rate

We’ve already discussed the importance of the Churn Rate in your CLV calculations. But how can you actually go about integrating it into the formula?

First, start by calculating your business’ Churn Rate. It’s pretty simple; just divide your revenue losses during a particular time period (usually one month) by the revenue amount you had at the start of that period.

Then, all it takes is to divide your ARPU (which we’ve calculated above) by your Churn Rate to get your CLV. The formula for this is shown below:

CLV = ARPU / Churn RateThe biggest issue with this formula (and the integration of churn rate in CLV calculations in general) is the lack of consistency. This formula assumes that churn rates are the same for each time period (each month in most cases) as well as for each customer. Also, it doesn’t consider any potential changes in the business’ offerings.

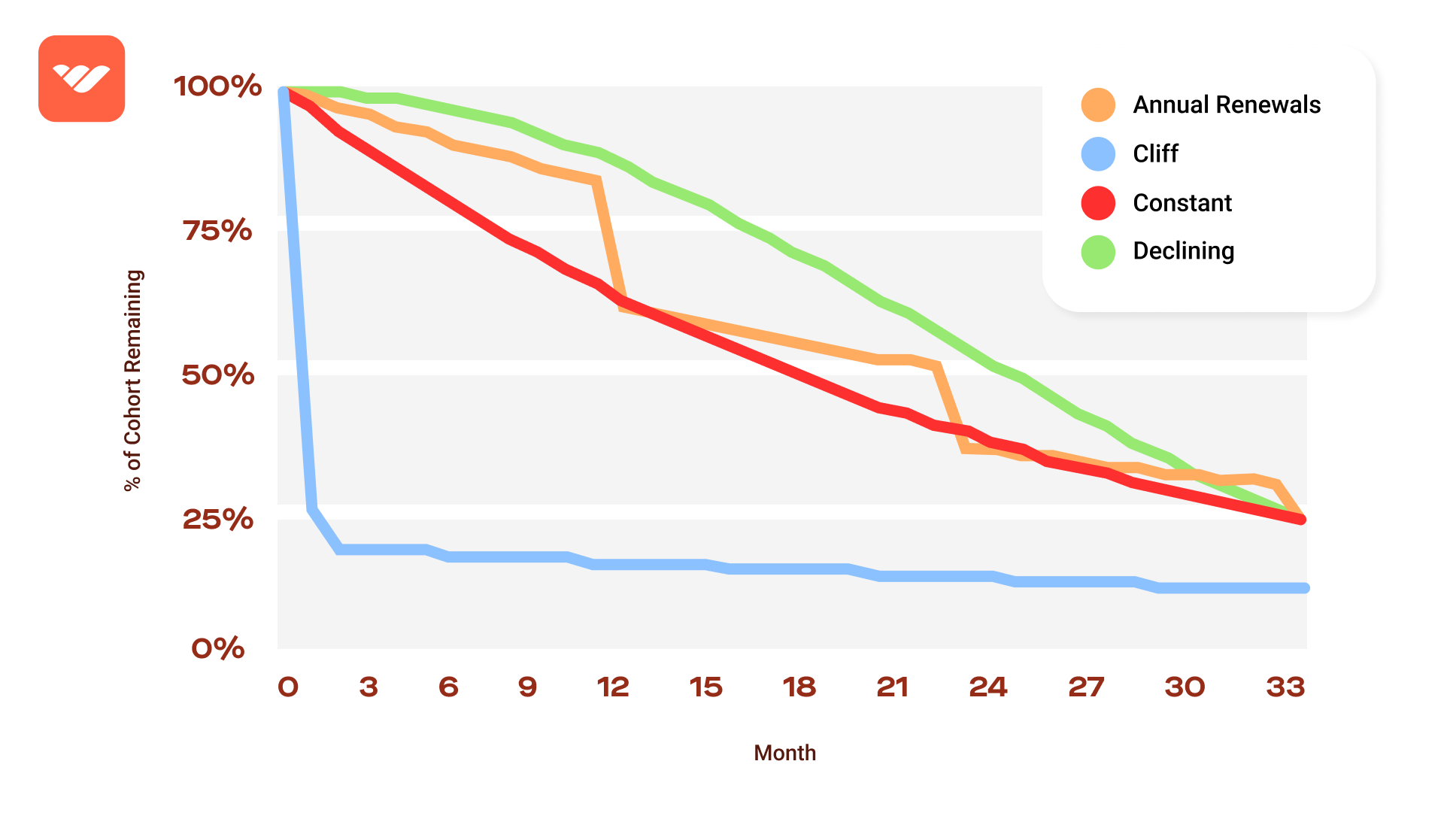

In actuality, the churn rate follows several different patterns and is not necessarily linear. Tomasz Tunguz has split the churn rate into four distinct patterns presented below:

| Churn Rate Pattern | Effect |

|---|---|

| Constant | Closest to a linear churn rate progression, depicted as a 3.5% monthly churn rate here |

| Annual Renewals | Consistent churn every month, with large dips every 12th month when the annual subscription renewals happen |

| Declining | Churn here starts off at zero and rises consistently by 0.25% every month |

| Cliff | Huge amounts of churn for the first few months, which stabilizes to a standard churn rate every month. |

What’s impressive about these findings is that the customer lifetime value was not significantly affected by most Churn Rate patterns - except for the last one, which showed a huge 75% reduction.

Therefore, if you’re looking to properly integrate churn rate into your CLV calculations, it’s better to go for a more conservative approach. You can do this by multiplying the result from the formula above by 0.75 to account for any potential issues with different churn rate patterns.

#4. Utilizing Gross Margin Percentage

Using your gross margin percent in your calculations is the best way to approach CLV from the scope of profitability. After all, your end goal is to have a healthy and profitable business, right? Your Gross Margin Percentage is just your total revenue minus your cost of goods, divided by the total revenue and then multiplied by 100%. The equation is:

Gross Margin Percentage = Total Revenue - Cost of GoodsTotal Revenue 100%

You’ll also need to calculate your Net Revenue Churn Rate, which is basically your revenue lost during a time period minus any potential upsells during that period. For the final CLV calculation, you just multiply the ARPU by the Gross Margin Percentage and divide them by the Net Revenue Churn Rate, as seen below:

CLV = (ARPU Gross Margin Percentage) / Net Revenue Churn RateThis will give you a better understanding of how your business works in terms of profits. It may also show you some weak areas, which you can improve to increase your CLV and profitability.

For example, you may find that your cost of goods is higher than it should be, thus affecting your CLV negatively. Or, you could discover that several account upsells during a specific period have actually lowered your overall churn rate, even though you lost a good chunk of customers.

What to Do to Improve Your Customer Lifetime Value Numbers

So, now you’ve learned the importance of CLV and how to calculate it. But the number you came up with is not high enough. What can you do to increase it? There are plenty of improvements you can implement to increase your Customer Lifetime Value, and all of them revolve around increasing one of the parameters of the CLV formulas described above.

| Improvement | How to do |

|---|---|

| Increase Transaction Value |

|

| Increase Transaction Frequency |

|

| Increase Customer Lifespan |

|

| Minimize Churn Rate |

|

Get More from Each Customer

The first and simplest parameter you can look to improve is the average transaction value. After all, if you get considerable revenue from every customer, it will inevitably raise your CLV.

You can do this through different means, with the simplest one being increasing the price of your products or services. However, you’ll also need to provide the necessary value so your customer doesn’t just think you’re trying to milk them for their money.

Alternatively, you can let your customers know about the benefits of opting for a higher pricing tier (also known as upselling). Or you can show them different products or additional features they can purchase separately, which will help them solve their issues better (known as cross-selling).

Encourage Frequent Purchases

The next parameter you’ll want to look at is the transaction rate or, simply put, how often your customers purchase your products or services. Remember, we’re not talking about new customers here; we want already-established clients to buy as often as possible.

To achieve this, you’ll need to inform them through different channels, like email or social media, about new and upcoming product releases they may be interested in. Also, don’t forget to “nudge” customers into purchasing complementary products and services, but do it gently to avoid frustration.

Finally, always push any product discounts or sales you may have going on at the moment, as it’ll serve a dual purpose. Existing customers will see them and might want to make additional purchases, and you’ll also attract some new customers altogether.

Make Sure Customers Stay For Longer

We’ve already talked about how having a high customer lifespan is key for your SaaS businesses. Long-standing customers will usually offer you a lot more value in the long run compared to high-spenders who just leave after a while.

If you want to retain your customers for longer, you need to offer them a lot of value and make your products “stick”. What do we mean by this? Offer them unique features and customization tools that help them solve a very difficult issue, so they depend on your product and are less likely to choose a competitor.

Additionally, overall customer experience is key in this one. Make your platform user-friendly and educate your customers on how to use it properly. Also, don’t forget to invest in a high-quality customer support team; your customers will definitely appreciate having access to friendly, responsive and effective customer support in case they run into any issues.

Don’t Lose Customers to Churn

Churn (and particularly the passive kind) is the number one enemy of all SaaS businesses. If you want to have a high CLV, you need to lose as few customers to churn as possible.

For those who cancel actively, try offering them a discount on their plan to entice them to stay. Or, if they still want to leave, give them a short survey to complete, asking the reason for leaving, if there was any dissatisfaction, etc. This will allow you to understand customer issues and prevent them in the future.

Finally, to avoid passive churn, you need proper software to handle your SaaS billing. And Whop is the perfect solution to your problem.

Whop.com offers an excellent tool for managing your SaaS subscriptions effortlessly. Plus, the platform emphasizes on preventing passive churn through different means, such as discount codes and cancellation offers.

Increase Your Customer Lifetime Value Through Whop

As you can clearly see, having a high customer lifetime value is paramount to running a successful and profitable business. Hopefully, by now, you should have understood the importance of CLV, how to measure it, and tips you can follow to improve it.

If you want to take your SaaS business to the next level, consider Whop.com to handle your SaaS subscriptions and memberships. You’ll only need a few minutes to sign up, and the platform is very easy to integrate into your established business through its user-friendly interface and simple API.

Also, Whop is one of the largest online marketplaces out there, so your products and software will be seen by millions of users around the world.

👉 Join Whop today and let us help you make your business profitable in no time!

![The Best SaaS Subscription Management Software [2024]](/blog/content/images/size/w600/2023/11/SaaS-management.webp)