Are you ready to get serious about investing? Discover what Robinhood all about, how you use it, and whether it is worth trying out if you’re looking to make some money? This in-depth review aims to find out!

Key takeaways

- Robinhood offers commission-free trading ideal for beginners and micro-investors, but hidden costs exist in withdrawals and transfers.

- Robinhood's payment-for-order-flow business model has resulted in SEC fines for providing customers inferior execution prices.

- Multiple regulatory actions reveal significant platform issues including crypto withdrawal restrictions and misleading customer information.

Online trading has been the rage for a few years now, and if you’re looking to join the party or get serious about investing, Robinhood is likely to come up. It’s one of the biggest names in financial services today and has often been on the tip of people’s tongues for the right and wrong reasons alike.

So, what’s Robinhood all about, how do you use it, and is it worth trying out if you’re looking to make some money? This in-depth review aims to find out!

Why investors choose Robinhood

Robinhood is a major U.S. stockbroker and trading platform and is often considered the leading neo-broker as it pioneered the concept of free, commission-less trading in the U.S. markets. The broker is also well known for its gamification of trading, simplifying the complexities of financial instruments, and engaging novice traders.

How to use Robinhood

What you need to get started

When it comes to stockbrokers and trading platforms, the most important thing is your geographical location and residency. You can only use Robinhood if you’re in the U.S., meaning you also need a valid social security number, a legal U.S. residential address, and either citizenship, permanent residency, or a valid U.S. visa.

Robinhood also has an age limit of 18, meaning you can’t sign up for a normal account if you’re younger. Beyond that, there aren’t any further restrictions when using Robinhood—all you’ll need is a device that meets the platform’s tech requirements (iOS 15/Android v7 or newer).

Creating your Robinhood account

To get started with Robinhood, you first need to download the app using one of your devices. Once that’s done, simply fire it up and submit an application for a Robinhood account through it—this is a pretty simple process since you can’t get any use out of the app without an account, and everything’s signposted clearly.

Robinhood can take up to 5 or even 7 days to respond to applications, so you’ll need to be patient after submission. Once things are moving, you’ll get an email from the platform to either confirm the success of your application or to request more information. If more info is needed, Robinhood will include instructions for you to securely upload your documents.

Most documents can be sent via the app by taking a photo—this includes your State ID, passport photo page, driving license, bank statements, social security card, PR card, and 3210 letter.

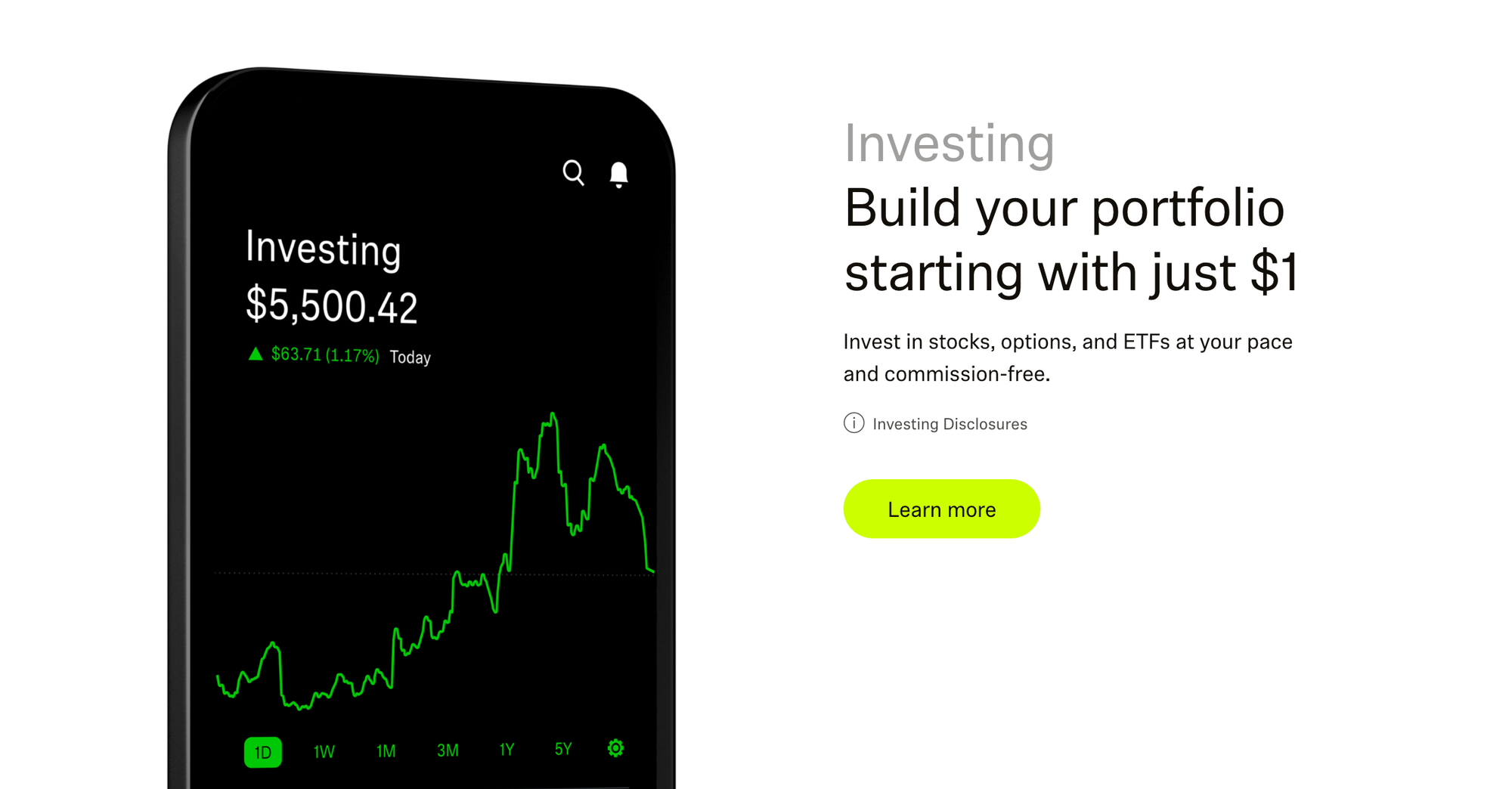

Buying stocks and ETFs on Robinhood

When you navigate the Robinhood app and attempt to place a buy order, the default option is to purchase either several shares or dollar amounts of a particular stock. Stock trading is the main reason that most people sign up for services like Robinhood, and the platform also offers ready access to exchange-traded funds.

In fact, Robinhood goes a little bit further with both instruments since, using a dollar-based buy order, you can purchase fractional shares of both stocks and ETFs. Fractionals aren’t offered by every broker, but those that do allow you to gain exposure to stocks that may otherwise be difficult to purchase. The best example here is Warren Buffet’s Berkshire Hathaway Inc., a single share of which is currently trading at over $600,000.

Fractionals on Robinhood can actually be as small as a millionth of a share, so yes, you can buy $1 worth of BRK.A if you wanted to!

It’s also important to note that Robinhood offers the option of dividend reinvestment (DRIP) for anyone wanting to use it as a platform for long-term investment and harness the power of compounding. If you want to enable DRIP, go to your Account Menu, select Investing, and Enable Dividend Reinvestment. You’ll then see a list of your holdings that are eligible for DRIP and can select which ones to reinvest cash dividends in by selecting the circle or checkmark.

How to trade crypto on Robinhood

Unlike many of the top traditional brokers, Robinhood gives users the ability to buy and sell cryptocurrencies. In order to trade crypto, you simply need to select Crypto in your Robinhood app, then search and select the coin or token you want to trade. It’s possible to place one-time orders through this interface and to have the order set as recurring if you plan on accumulating the asset regularly over the long term.

It’s worth noting that if you’re placing a market order on a cryptocurrency, Robinhood executes them as limit orders collared to 1% for buys and 5% for sells. This is a measure of protection since the crypto markets can be so volatile—double-digit percentage moves within seconds are all too common, and these collared orders prevent execution in case there is price movement outside of the mentioned ranges.

How to trade options on Robinhood

Robinhood is often considered one of the foremost platforms for options trading because of how simple the process is on the platform. This is a critical component of Robinhood thanks to the revenue it brings the platform (we’ll get into that in more detail later) and trading options is extremely easy—just use the app’s search bar for the underlying stock or ETF whose options you’d like to trade.

Now, select the name of the stock or ETF, and its detail page will come up. Click on Trade, and then choose Trade Options. You should see a list of expirations for available options contracts now, along with strike prices listed from high to low. Premiums and percentage changes should be listed to the right of the screen.

Withdrawing your money from Robinhood

In order to withdraw money from Robinhood, you need to navigate to your Account Menu, select Transfers, and then Transfer Money. You can now select the Robinhood account you want to draw money from, and then select a linked account you want to withdraw to. Instant transfers are possible if the relevant label is shown next to that account.

There’s no fee to withdraw money if you’re doing so via a bank transfer. Instant withdrawals to a debit card or a bank account however can incur a fee of up to 1.75%. There are daily withdrawal limits on all outgoing transfers, and you can check your limits from the Transfers page by going to Transfer Limits.

It’s also possible to withdraw your securities from Robinhood in a limited manner—the ACATS system is used to transfer whole, settled shares of securities to other brokerages for a fee of $100. However, Robinhood doesn’t allow the direct registration of shares, nor does it currently allow you to transfer fractional shares or crypto off the platform.

How much does Robinhood cost?

Cost is the main selling point of the Robinhood platform because they don’t charge fees on purchases of stocks, ETF shares, options, or crypto. Buying all of these assets for free is a big advantage, especially for micro-investing—fees, especially flat fees, can add up if you’re only throwing ten or fifteen bucks at a trade. This is Robinhood’s wheelhouse, allowing people to sink small amounts of money into different assets for free.

However, we’ve already mentioned the steep cost for outgoing asset transfers at $100, and the percentage-based fee can hit hard if you want to withdraw your funds from the platform for immediate use. Furthermore, Robinhood also takes back the corresponding amount of the 1% match on your Robinhood IRA if you withdraw after less than five years.

Per Robinhood’s fee schedule, outgoing wires and returned checks for IRA rollovers cost $25 each, and domestic overnight mail or check delivery will set you back $20. International overnight mail costs $50, and monthly paper statements cost $2.

Robinhood Gold is a premium plan that gives you more interest on the uninvested cast, research reports from Morningstar, and Level II market data from Nasdaq. If these benefits interest you, Gold costs just $5 per month.

Is Robinhood safe?

When it comes to the relative stability of its platform (outside of a major hack in November 2021) and pledges made by the company to reimburse all losses due to unauthorized account activity that aren’t the customer’s fault, Robinhood would appear safe on the surface. However, there have been multiple high-profile incidents and lawsuits that you should at least be aware of before signing up to the platform.

Crypto withdrawals (DOJ)

We mentioned that you can’t withdraw your crypto from Robinhood, and for anyone who knows their way around cryptocurrency, that’s a red flag. It’s also a sticking point for the California Attorney General, who in early September 2024 announced a landmark settlement in the first public action by the DOJ against a cryptocurrency company.

By failing to allow the transfer of crypto from user accounts between 2018 and 2022 and for failing to disclose aspects of its trading and order handling arrangements fully, Robinhood has violated the California Commodities Law. The Attorney General also stated that Robinhood misled customers by advertising it would connect to multiple trading venues to ensure that customers would receive the most competitive price.

The conclusion of the case included a $3.9 million penalty and strong conduct requirements. These conduct requirements include permitting customers to withdraw crypto from the platform.

Misleading customers (SEC)

The U.S. Securities and Exchange Commission (SEC) charged Robinhood in December 2020 for misleading customers by executing orders at prices inferior to other brokers’ prices, depriving customers of over $34 million even after factoring in savings from Robinhood’s commission-free trading. Robinhood agreed to pay $65 million to settle these charges.

On its website and annual report, Robinhood confirms they send user orders to market makers who pay them for it. This sale of user traders is a key revenue stream for Robinhood, and it’s how they can offer free trading to users.

Misleading customers (FINRA)

Robinhood was also taken to task by the self-regulating Financial Industry Regulatory Authority (FINRA) in June 2021, accused of feeding false or misleading information to customers who suffered “significant harm”. FINRA fined Robinhood $57 million and ordered the platform to pay $12.6 million to affected customers.

Included within the scope of this complaint were the approvals given to customers for advanced trading permissions by algorithmic bots on behalf of Robinhood. These issues combined tragically in the case of Alex Kearns, a college student who used Robinhood to trade options. His Robinhood trading account reflected a negative cash balance to the tune of $730,000, and according to his family, Kearns’ repeated attempts to reach out to Robinhood representatives seeking an explanation were unsuccessful.

Unaware that the negative balance in his account would have been erased by the exercise and settlement of options he held, Kearns took his own life.

Trading restrictions (GameStop)

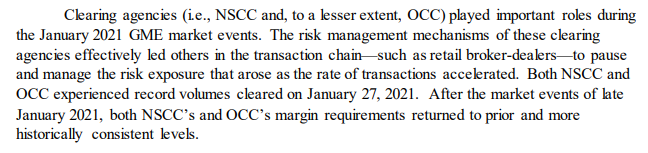

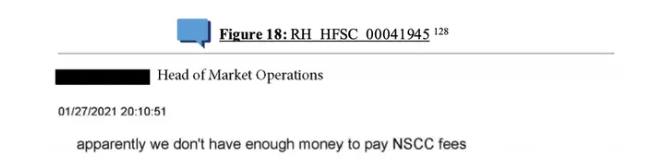

January 2021 is now famous among investors for the extraordinary market movements on the 27th and 28th of that month. According to the SEC report into the events that occurred, the number of shorted shares for GameStop Corp exceeded the float of the company, and trader interest and positive sentiment in the stock (code: GME) saw it rise to a high of $483 on the 28th. Then, the SEC notes that GME’s decline coincided with several brokerages’ decision to restrict trading.

On the 27th, the National Securities Clearing Corporation and the Options Clearing Corporation made billions of dollars worth of margin calls and NSCC waived charges that would have been levied on broker-dealers. One unnamed broker has even waived a charge of double its margin requirement of $1.4 billion.

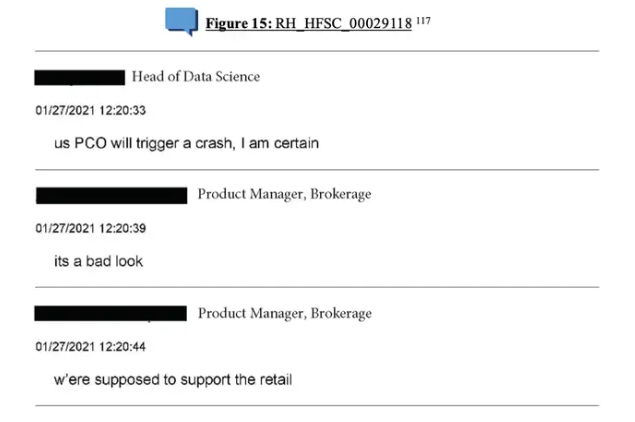

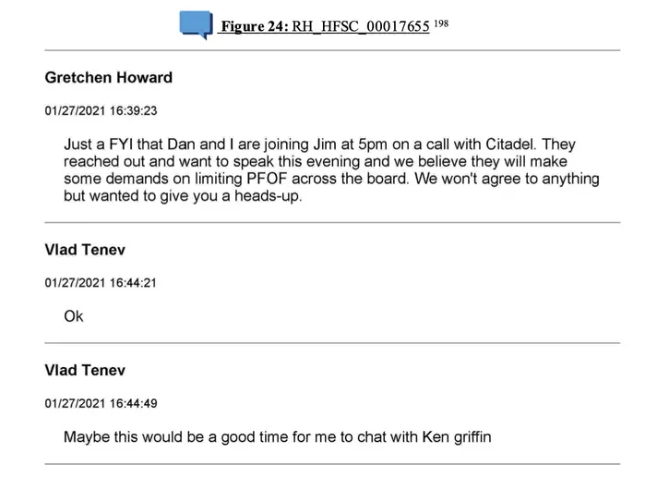

Several brokers restricted trading in GameStop. Robinhood was notable for this because internal communications on the decision to place GME on “PCO” (or “position close only”) went public. PCO sounds like a normal abbreviation, but stopping traders from buying a stock and only allowing them to sell is anything but benign.

Robinhood founder and CEO Vlad Tenev, Citadel Securities founder and CEO Ken Griffin, and DTCC CEO Michael Bodson were all grilled by the House Financial Services Committee about these events; however, the story of January 2021 remains unfinished.

Is Robinhood worth it?

So, should you consider Robinhood if you’re in the market for a stockbroker, trading platform, or even a crypto exchange? Let’s take a summarized look at some of the pros and cons of using Robinhood.

Robinhood pros

- No trading commissions. Robinhood is the OG neo-broker and offers commission-free trading, so it makes sense especially if you’re micro-investing. It’s hard to put money aside in the high cost of living environment that’s prevalent today, but on no-fee platforms like Robinhood, you actually can build out a bespoke diversified portfolio with $100 or even $50 a month split among many assets.

- Simple interface. Traditional broker platforms can be quite clunky and difficult to navigate, and in some cases, even the sheer quantity of information they provide can be too much for novice brokers. Robinhood is very easy to use.

- Charting. Robinhood offers candlestick, line, and volume charting as well as indicators for volume, moving averages, and RSI. Combined with its clean interface, Robinhood is often considered one of the best platforms for charting—you’ll see lots of social media posters claiming that they sign up for Robinhood only to use charting, and don’t even trade on the platform.

- Retail-focused assets. Robinhood offers access to stocks, ETFs, options, and crypto. These are the most popular assets for retail investors, and along with fractional shares, give people access to the most in-demand instruments.

Robinhood cons

- Controversies. See above for more details. Individually, some of these instances could be deal-breakers for many potential users. Together, they paint a picture of a trading platform that’s no stranger to controversy.

- Asset transfer. There’s a little bit of Hotel California where it pertains to Robinhood not allowing you to withdraw your crypto or directly register your shares, and charging such a steep fee for ACATS transfers to another broker. The easiest way to withdraw is to close your positions, which benefits Robinhood one last time since it counts for order flow that they get paid for.

- Asset selection. You don’t get access to bonds or mutual funds with Robinhood. Not every modern investor wants to include these in their portfolio, but they’re a big part of classic investing strategies.

Robinhood alternatives

If the arguments against Robinhood are simply too strong or you just want to see how Robinhood measures up against its competitors, here are three alternative brokers that are well worth checking out:

1. Fidelity

Fidelity is a titan in the financial services world with $5.4 trillion in assets under management and $14.1 trillion in assets under administration. The sheer size and financial clout it has makes Fidelity one of the safest and most secure brokers out there. It’s considered one of, if not the most trusted name among stockbrokers.

Very much considered a traditional broker, Fidelity has nonetheless moved with the times. They offer commission-free trading in stocks and ETFs just like Robinhood, but although there aren’t commissions on options and crypto trades, they do levy a $0.65 fee per options contract and a spread of 1% on crypto trades.

Fidelity also offers one of the widest selections of traditional instruments out there, with over 10,000 mutual funds to choose from compared to Robinhood’s zero. Access to crypto is more limited, though, with only Bitcoin and Ethereum currently on offer.

Fidelity also doesn’t charge any fee to transfer assets to another brokerage, and it very much offers crucial access to the DRS (Direct Registration System) which allows you to register your stocks in your own name rather than that of your broker.

2. Webull

If you’d prefer an alternative similar to Robinhood rather than a traditional broker, Webull is another top name among the neobroker set. Often considered Robinhood’s main competitor, it matches a lot of key benefits including $0 account minimums and trading commissions.

Webull does charge a $0.55 fee for options contracts, but on the flip side of that doesn’t have any other fees to speak of. It also doesn’t strictly charge a transfer fee, but its clearing agent does levy a fee of $75 for outbound securities.

The charting tools on offer at Webull might also be considered more advanced than those provided by Robinhood, along with the intel provided by Level 2 Quotes and NBBO. You can also paper trade on Webull before investing any real money, so it’s a good platform to learn the basics.

3. Interactive Brokers

Robinhood, Fidelity, and Webull are all brokers you can only use if you’re in the U.S. Interactive Brokers is the global answer, offering trading in 27 currencies and service in 200 countries and territories.

IBKR is a rock-solid trading platform and, on top of its global reach, is considered one of the most advanced broking platforms available. You’ll have to get permission (and the requirements are pretty stringent) for more advanced trading strategies, and even access to options is gated behind a certain level of wealth as well as trading knowledge.

US residents also get zero-commission stock and ETF trades, with options coming in at $0.65 just like Fidelity. It’s also possible to invest in assets all across the world, so you can diversify your portfolio on IBKR however you want to—including with metals and crypto.

Read our review on Acorns vs Robinhood.

Find expert trading and investing advice and education on Whop

Trading and investing are complicated, and platforms like Robinhood simply provide you with the tools to get the job done. You can trade and invest successfully using any trading platform, whether it’s Robinhood, Webull, IBKR, Schwab, Fidelity, Degiro, Etoro, or any combination of the hundreds and thousands of online broking apps out there.

What really matters is the knowledge you apply to the job. Educating yourself about the markets and how they work, and working to find the trading assets and styles that most appeal to you will give you the best chance of reaching your financial goals.

So, do yourself a favor and check out the trading courses and communities on Whop. Whether you learn better by taking courses, working with a coach or mentor, or even discussing concepts as well as market movements with like-minded traders, Whop’s trading groups are where it’s at. You’ll also find plenty of others who’ve tried Robinhood and many other trading platforms, so we’ve even got you covered even if it’s just a new broker you’re after.

Check out Whop today and find expert trading and investing advice.

FAQs

Is Robinhood a good beginner broker?

Yes, because Robinhood simplifies trading and makes it easy to carry out trades on their platform. However, the gamification elements of the platform make it risky, and it’s either impossible or costly to transfer your assets off the platform when you want to graduate to a better alternative.

How old do you have to be to use Robinhood?

You have to be at least 18 years old and a resident of the U.S. to use Robinhood.

How do I close my Robinhood account?

You can easily deactivate your Robinhood account through the app. You can then transfer whole shares of stocks and ETFs to another brokerage for $100, but fractionals and crypto are stuck unless you liquidate.