Discover how to start a small business at home with these steps to success. Explore various home business ideas, including ecommerce, freelancing, dropshipping, online courses, content creation, and affiliate marketing.

Key takeaways

- Starting a home business requires choosing the right model—ecommerce, freelancing, dropshipping, or content creation—based on your skills and goals.

- Careful planning through market research, a solid business plan, and proper legal structure significantly reduces the 25% small business failure rate.

- Small business owners can earn significantly more than average workers, but success depends on identifying market gaps and leveraging your expertise.

Starting a small business at home could change your life, allowing you to become your own boss and dictate your income. That’s the dream, right? But as around 25% of small businesses in the U.S. fail, careful planning and research are critical.

In this guide, we’ll walk you through the steps to starting your own business, looking at what’s needed to get it off the ground logistically and legally.

How much money can I make from starting a small business?

Small businesses are the backbone of the U.S. economy. There are 33 million in the U.S. today, providing over 62 million jobs. They vary in size from sole proprietorships to corporations with many employees. How much money you could make will vary depending on your success and niche. But here’s a general overview:

- The average small business owner in the U.S. earns around $99,000 per year (compared to the average American wage of $66,795).

- The top 90% of all small business owners earn at least $94,000.

- The bottom 10% earn under $27,000.

Highest-earning states for small business owners

| State | Average annual salary |

|---|---|

| New York | $126,515 |

| Vermont | $114,198 |

| Maine | $113,885 |

| Massachusetts | $111,458 |

| Nevada | $111,324 |

Source: ZipRecruiter

Types of small businesses you can start at home

The internet allows small businesses to exist entirely in the digital space, so there’s no need to open and manage a physical store. That not only slashes your workload but also your expenses.

In the U.S., small businesses can be found in five categories:

- Service industry: 55% of small businesses in the U.S.

- Retail: 13% of small businesses in the U.S.

- Construction: 12% of small businesses in the U.S.

- Professional: 9.3% of small businesses (SBA).

- Healthcare and social assistance: 8.8% of small businesses in the U.S.

With that in mind, here’s a look at some home business ideas you can choose from:

Ecommerce

Around 80% of Americans shop online, making ecommerce a great option for starting a small business from home. Your role will be to sell products online and navigate supply chains, cash flow, orders, and customer support. If you make products, clothing, art, or digital products, it gives you a chance to sell your creations without a brick-and-mortar location.

Many ecommerce platforms allow you to start selling immediately, taking care of payment processing. But you can also start your own site, tailoring the user experience to your vision.

Freelancing

Freelancing has long been a popular remote work option. With no strings attached, you can work for as many clients as you like and determine your prices. The schedule is up to you and can fit your own pace and vision.

With an estimated 76.4 million freelancers in the U.S., freelancing is popular in digital careers such as web development, accounting, translation, photography, arts, and writing. But it could cover anything that you could provide a service online with.

You’ll need to decide on the extent of your services. For example, if you’re a photographer, will you be providing retouches and prints? Or if you’re a web developer, will it also include all the content writing alongside the coding?

Dropshipping

Dropshipping allows you to start a business from home with minimal outgoing costs or product development. The task is to market an existing product (made by someone else) with delivery and packaging managed by a third party. You can create your own site or join huge platforms like AliExpress.

An estimated 27% of businesses now use dropshipping as their way to fulfill orders, so it's becoming more and more popular. These dropshipping services often have very large warehouses, so you can handle large quantities of orders without worrying about where the stock is stored. However, profit margins are typically lower than in traditional ecommerce.

Online courses

Teaching online is a low-cost business opportunity that you can do without moving from your home desk. Although you’ll need to put in significant time and effort, the outgoing costs are very low.

The industry is also surging in popularity, with 57 million people predicted to take online courses by 2027. As such, a course could result in passive income for years to come, as subscribers will purchase your pre-made content. Selling courses can also help you form a community to sell digital products, tools, and apps to a pre-existing audience.

Content creation

Content creation can be an extremely lucrative career, but only 50% of content creators make money. However, with such minimal outgoing costs, it’s easy to get started and many success stories are genuinely life-changing. Income is typically made via ad revenue, affiliate marketing, and sponsorship. You could consider being a blogger, vlogger, podcaster, or social media influencer.

- How to Become a Content Creator and Earn Money With Social Media, Podcasts, and Blogs

- How to Become a YouTuber and Earn Money With Online Video Content

Affiliate marketing

Affiliate marketing is when you get paid a commission for helping make another person a sale. It’s responsible for 16% of all online orders in the U.S. Typically, you'll share a link to a sales page via your blog, social media, email, or website.

Being just an affiliate marketer isn’t a thing - instead, you’ll need to create some sort of outlet that brings relevant viewers or readers in. This ties in closely with content creators. Creating a blog is one of the most popular and accessible routes to making affiliate marketing money and can eventually lead to other revenue streams such as sponsorship and merch.

In-person businesses from home

Running a business from home doesn’t have to restrict you to the online world. Real-life interactions still have their place, particularly when providing a service. You may be required to travel to perform your service or allow your clients to visit you. For example, massage therapists, dog care, consultancy, teaching, haircuts, instrument lessons, or cleaning.

Whatever your chosen niche, you’ll still want to be active online to market yourself and grow an audience. It may also be wise to combine revenue streams, such as a fitness instructor who provides real-world training but also has an online blog with affiliate marketing links and even a paid community with exclusive content.

Step one: Develop your business idea

Your small business idea is your most important asset at this stage. It will determine the direction you’re set to go in. If you don’t already have an idea, here’s some advice:

Use your expertise

74% of small business owners have a bachelor’s degree at least, with many taking their expertise into business. So think about what you’re good at or what you know tons about. A good starting place is to think about your hobbies or any expertise you’ve gained from previous job roles.

Solve problems

If you can find a solution to a problem you’d like solved, you’ll have a unique business idea ready. You can also analyze your competitors to see if they’re leaving gaps in the market with weaknesses in their products or if they’re ignoring a hungry demographic. On the other hand, take the time to consider where their strengths and domination might leave you lacking!

Find inspiration

Has someone inspired you to start a small business? Or are there businesses you’re a fan of? Perhaps you can put your spin on things. Don’t be afraid to take ideas from others, providing you put your own spin on things.

Examine local opportunities

There may be business opportunities for you to exploit locally. For example, is there an accountant in your town or a wedding photographer? If there’s a gap, then you could immediately be valued in your community with some good service and marketing.

Step two: Conduct market research

Market research can reveal if your business idea can realistically become a success. Your findings will reduce risks and allow you to shape your business optimally.

To conduct market research, you’ll first need to gather information on the type of people you’ll be targeting. This should include age, gender, interests, wealth, and location. Then you can determine if there’s enough demand in those areas for your product or service, how much money they can spend, and the number of competitors there are. The U.S. Small Business Administration has a wide range of free small business data available on its site to help.

To take things one step further, you can also ask consumers directly for their opinions. Consider using surveys, questionnaires, focus groups, or interviews. You should also research the latest industry trends, to gain a sense of what’s hot and what’s not.

Step three: Create a business plan

You need to create a business plan to help guide you on your journey and use it to convince lenders for small business loans and investments.

A strong business plan should include:

- Cover page and table of contents

- It should look professional and include your business name and contact information.

- Executive summary

- The key takeaways of the document, or the ‘TL;DR’ of a business plan.

- Company description

- Describe your legal structure and members, alongside a mission statement.

- Market analysis

- Include a competitive analysis of your market, its audience, and its qualities.

- Organization and management

- Describe each management position, their responsibilities, and their qualifications.

- Service or product

- Describe your service or product in detail, including your business model, needs, trademarks, patents, and pricing.

- Marketing and sales

- A review of how customers will find your business, what your sales channels will be, and your growth strategy.

- Financing analysis

- Financial projections for three to five years.

Step four: Choose a business entity

In the U.S., you can’t just start making cash without some legal structure (unless you want to face some difficult questions and fines down the line). There are four business structures for small businesses:

Sole proprietorship

A sole proprietorship is an unincorporated business with one owner. That means there is no legal separation between your business and you (the owner). You’ll receive all the profits directly but also be liable for debts and losses. Your revenues are reflected on your tax return - which means far less paperwork, but your assets are accessible if you go into debt.

LLC

A limited liability company (LLC) is a private limited company. LLCs can have more than one member and protect personal assets from business liability and debts. They also offer pass-through taxation, so taxes are paid by the owners of the business on their personal income taxes.

Partnerships

Partnerships are formal arrangements made by two or more parties. They also allow for pass-through taxation. But, owners are responsible for business assets and liabilities.

Corporations

Corporations are separate legal entities from their owners. They possess many of the same rights as individuals. Corporations can enter contracts, borrow money, get sued, hire employees, and pay taxes. They also offer limited liability, where shareholders profit through dividends but are not liable for company debts.

Step five: Register your business

Register your business name

It’s time to decide on a business name. Some people go for something utterly unique, like ‘Whop’; while others go for something direct and self-explanatory, like ‘Dave’s DJ Courses’ (yes, we made that one up). Have a search online before you commit, as taking someone else’s business name will lead to all sorts of trouble later.

You’ll then need to register it, officially. You must do this in the state within which you’ll do business (so your primary residence), by submitting a form to your local government. The requirements will vary depending on the type of business structure you have.

Make your business official

After you’ve registered your business name, you’ll also need to register the business with the Secretary of State. You’ll be required to meet the following:

- Have a physical presence in the state (which is easy if you live where you’ll operate from).

- Receiving a significant portion of the company’s revenue within the state.

- Have employees work in the state.

If you want to do sales outside of your home state, you may need to get foreign qualification by filing a Certificate of Authority with the state and obtaining a Certificate of Good Standing from your home state. You can skip this step if your business is a sole proprietorship.

You can also consider trademarking your business name, goods, and services to prevent others from stealing any following you build up. But, this might be a task for later on.

Get bank accounts

It’s also wise to set up a business account, so you can separate your personal finances from your business ones. You should also record receipts for all business purchases, as you may be able to deduct them from your taxes. Keep records of all your sales and consider getting an accountant on board when you’re starting to make some serious money. They can help you avoid nasty surprises and claim all the deductions you’re entitled to.

Step six: Budget and project

Financial projections

Before launch, you need to know if you’ll make enough revenue for it to be worthwhile. That means determining your expenses and pricing. Then make a financial projection of how much money you could earn and spend over the first 1-2 years. You’ll also be able to recognize your limits and see whether you need some financial help.

Expenses may include upfront investments such as a new laptop, microphone, camera, or desk, or ongoing costs, such as materials, tools, and marketing.

Cash flow

Focusing on cash flow is critical for a small business owner. Around 82% of small businesses fail due to a lack of cash. Create a business model that reflects the ability to plan for delays in payments and market fluctuations. If you’re looking to make a living from the business, you’ll also need to determine how many sales that objective would require.

Make sure you consider:

- The money you expect to have at the start of each month.

- The money coming into your business.

- The money going out every month.

How to finance your business

When starting a business at home, it's a good idea to have some cash set aside in case of unexpected events like recessions, pandemics, or personal emergencies. Many entrepreneurs rely on their savings, but you should consider adding to your resources with:

- Support from friends and family: If you’re in the fortunate position to have wealthy family or friends, consider asking them.

- Personal loans: 21% of small business owners turn to personal loans, but be warned that you will personally be liable should you not pay it back.

- Crowdfunding: If you have a following who are keen to see the business become a reality, they may be willing to help get it off the ground.

- Venture capital: Experts with high net worth may be willing to finance your business dreams in exchange for a share of the business.

- Merchant cash advance: This is a type of loan where you pay it back as a percentage of your sales.

- Small business loans: The U.S. Small Business Administration may provide a loan to qualifying business owners.

- Business credit cards: Credit cards can significantly help you with cash flow issues and the ability to invest in getting things moving. Just be sure that you have a plan to repay them on time.

Step seven: Get your permits and licenses

Creating a business in the U.S. requires that you have a general business license and Federal and State Tax ID numbers. If you’re working in a certain industry, your business may also require a specific permit (such as in food or construction-related fields).

Sole proprietors won’t need an Employer Identification Number (EIN), but if you create a business entity, then you will need one.

Step eight: Establish your business online

Establishing yourself online will enable you to get your products and services seen. Of course, this will vary with each type of industry. But here’s our essential advice:

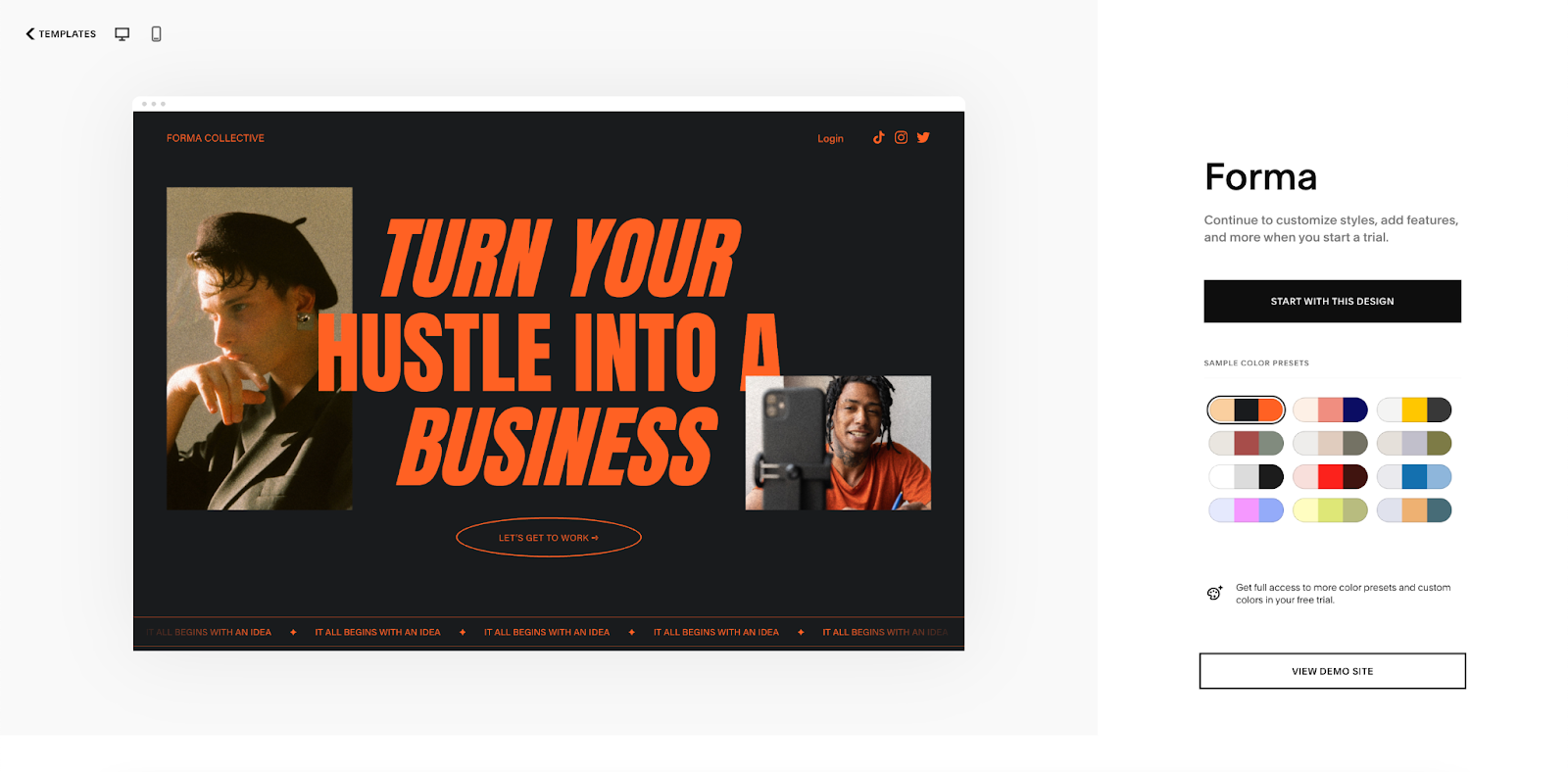

Start a website

From selling products to being a content creator, having a website gives you a professional appearance and a place where people can come to learn about you. You can also use it as a portfolio to highlight your best achievements.

There are dozens of popular site creators to choose from, such as the super easy Squarespace and WordPress to the more complex Webflow or Framer. If you’re looking to run an online store, you might need some web developer help here.

We recommend that you make sure your website is ADA-compliant. That means making it accessible for all users, including those with disabilities. Without this, your business could face a lawsuit in the future.

Sign up to ecommerce platforms

If you’re selling a product, you may also want to choose a popular platform such as Etsy, Shopify, and Wix. You can also sell your digital products and services on sites like Whop to audiences who are ready to spend. These platforms provide the tools to list items and process payments.

Start your social media accounts

Social media is important in any small business, from freelancers to dropshipping empires. You’ll use it to keep customers hooked and notified about the latest releases. With around 5.17 billion global social media users, you can showcase your work to new eyes and engage with customers via comments and DMs.

If you want to get creative, you can also use social media to create reels and join in with trends that could further promote your product.

Step nine: Set up your home office

Whatever your business niche is, you’ll need a workspace. When working from home, we advise you to try to keep it as separate as possible from your relaxation space; otherwise, you’ll never be able to escape the pressures.

Here are some things you might need to invest in:

- A desk/chair

- A new computer

- Microphone and/or camera

- Filing cabinet

- Printer

- Lighting equipment

- Materials and tools

Step ten: Promote your business

Next, it’s time to get your business seen by a wider audience. You’ve got several promotion options:

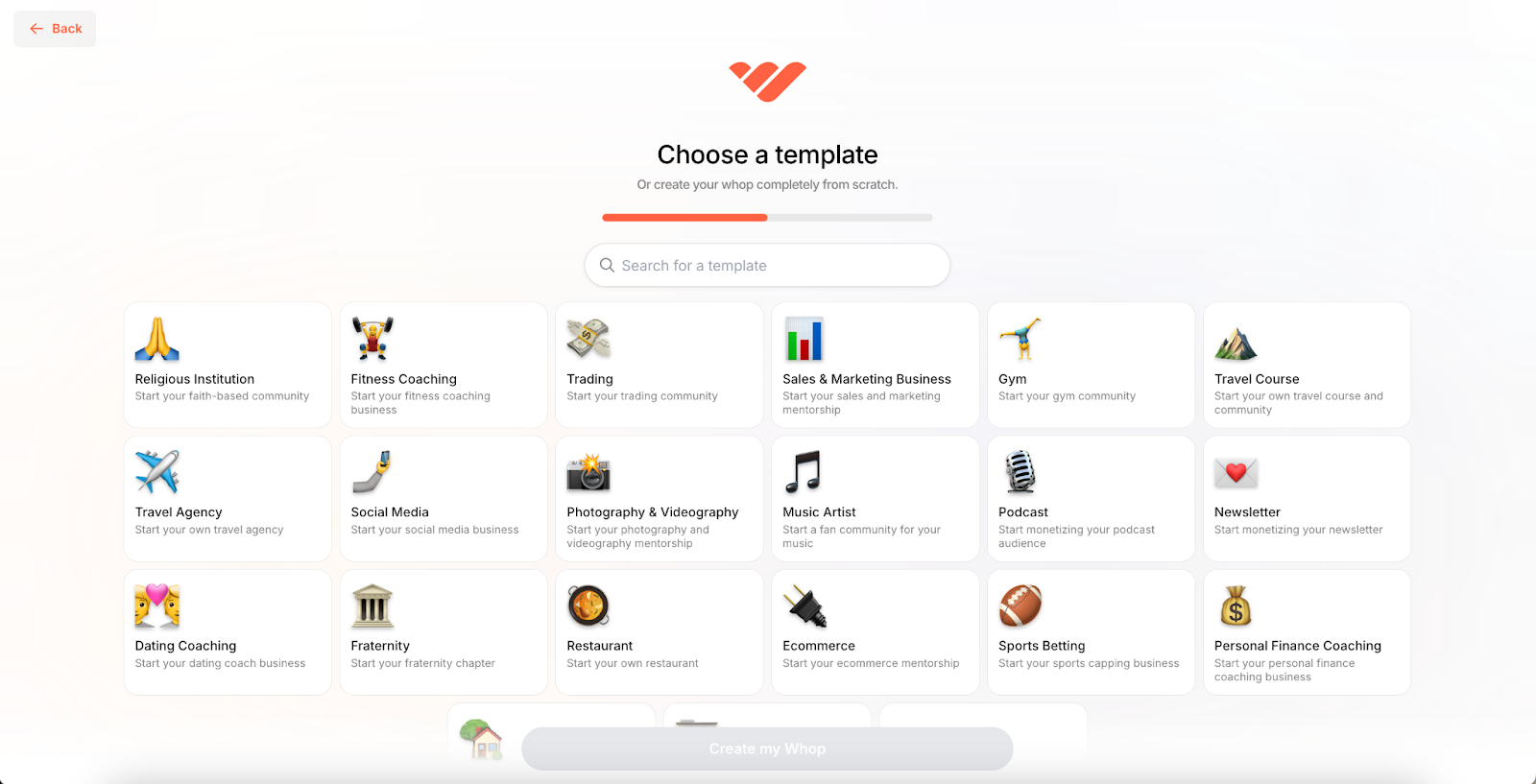

Start a community

Joining platforms where you can sell your services and products is a great way to expand beyond your site. These sites, such as Whop, allow you to build a community around your business, where ‘fans’ and loyal customers can engage with you and other members, creating a long-term environment to sell your products. You’ll also be able to gain feedback and directly ask what people are interested in.

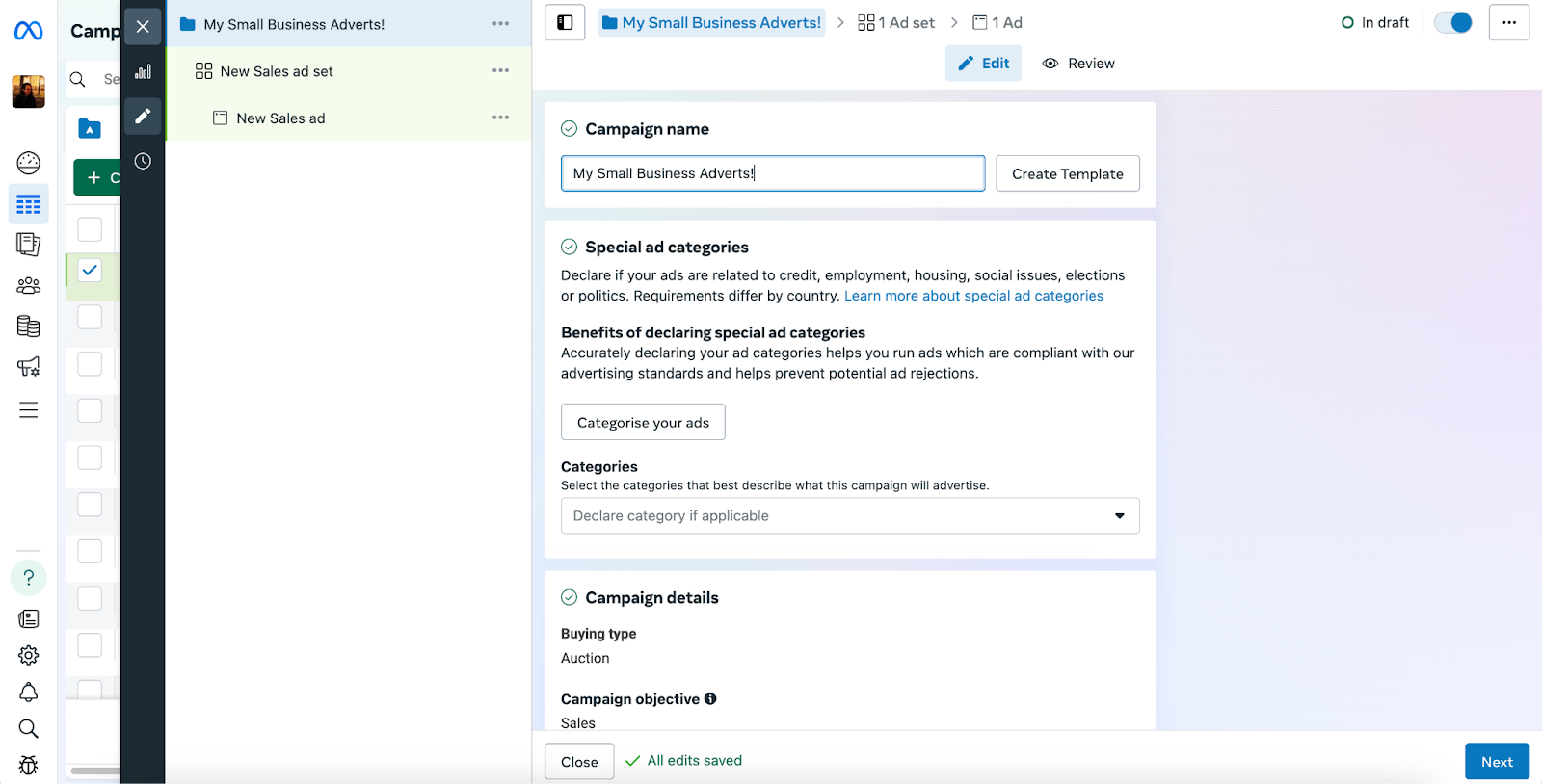

Paid ads

Paid adverts are a guaranteed way to get your business seen online. They even allow you to specifically target certain demographics, by things like age, gender, interests, and location. There are various platforms to choose from including Google Ad campaigns, Facebook ads, Instagram ads, and TikTok. Signing up for these platforms is easy, but you’ll need to pay to run the campaigns.

SEO

Search engine optimization (a.k.a SEO) is the tactic of bringing in web traffic for free. There are no paid ads involved here, instead, it’s about setting up your site so that it appears in relevant search engine results. By strategically using headlines, keywords, and search terms across your site, you’ll boost your organic traffic.

Although free, it can pose a learning curve for newbies. The good news is there are countless guides and courses to help you out. We suggest using tools like Keywords Forever, SEMRush, or Ahrefs to give you a clearer outlook.

Cold-emailing

Cold-emailing is the old-school approach to spreading your services, but it still works. You’ll need to find the contact information of potential clients and send them a short yet attractive email in an attempt to convince them. The average cold email response rate is 8.5%, so be prepared for a lack of replies.

There’s also the ‘warm-emailing’ approach, which is more about opening the door to potential collaboration rather than direct advertisement.

Pro tip: Your subject line will convince them to open the email and the content will convince them to reply.

Business cards and flyers

Making an impact in the physical world can also be useful if your business is serving the local community. Even the likes of web developers can be attractive to locals who want to work with someone close by. Consider printing business cards or flyers that you can leave in local establishments and promote your business within your community.

Network

Creating connections in your industry will also help you secure long-term growth. Connections can lead to referrals, collaborations, and credibility. Plus, having people to talk to about your work will be helpful for your mental health.

Consider attending networking events and conferences in your industry. The business networking site LinkedIn is also recommended, as you’ll be able to rapidly connect without leaving the comfort of your own home. Read this guide for small business networking tips.

Newsletters

Emailing customers the latest product ranges and news via newsletters is as impactful as ever. 99% of email users check their email every day and 60% of consumers say they’ve purchased something as a result of a newsletter. Your job is to make these newsletters entertaining or worth their time; so think about discount codes and exclusive content.

Running a giveaway is a great way to get people signed up to your mailing list, as you can’t just add random emails without permission.

Common problems facing small businesses

Any small business owner will face hurdles. Being prepared for these can help you recover and understand it’s a normal part of business life:

- Cash flow: Be sure you have the funds to start and fail. You don’t want to end up unable to pay rent. If this is an issue, consider taking a loan or partnering with someone. In the U.S., you may qualify for a small business loan.

- Administration: Ensure you factor admin into your working hours. From emails to taxes and customer support, you’ll be taking on the task of several employees all by yourself.

- Boundaries: Set boundaries with your friends and family so that you’re not interrupted or expect to clean the kitchen while you’re on business hours. Alternatively, remember to not let your office take over your home life.

- Isolation: It’s really easy to get isolated when working from home alone. There’s no one to vent to and no one to relate to. Join online groups, network with other small businesses, or even follow mentors who can support you.

Learn how to build a successful business with Whop

So, here’s a quick recap. Find an idea that fits your interests and skills, then decide the best type of format and business structure to take you forward. Once you’ve got that far, take care of the legal paperwork and ensure your financial projections are solid. Then, it’s time to have fun and get selling. You can use social media, ads, and communities to build a customer base. Don’t be put off by slow progress or adjustments, it’s all part of the game.

If all of this sounds overwhelming, don't worry. Whop's Marketplace has resources that can help you navigate the whirlwind of opening your own business. You can join communities run by industry-leading experts or take courses in marketing, ecommerce, and social media to learn the secrets of success.

Join Whop to set your business on the right track.

FAQs:

How much does it cost to start a small home business?

The costs of starting a business vary dramatically depending on the industry and business. However, here is a breakdown of where the average budget is spent:

- Operating costs: 11%

- Marketing: 10.3%

- Online costs: 9%

- Product: 31.6%

- Shipping: 8.7%

- Team and employees: 18.8%

- Offline costs: 10.5%

Can I start a small business at home by myself?

Yes. However, you may want to ask for help or add team members to expand your productivity in the future. Businesses with higher first-year revenues typically spend more on team costs.

Do I need a lawyer or accountant to start a small business at home?

There is no requirement to have an accountant or lawyer when starting a business, as with some research you can handle finances and paperwork alone. However, it is advised that you consider hiring a Certified Public Accountant when possible. Doing so will let you focus on the business, instead of taxes, and potentially even save money in the long term.

Do I need insurance to start a business at home?

Many new business owners use their homeowner's insurance policies. If you’re not planning on having customers visit your premises, this is fine. But, it will only cover up to $2,500 of business equipment. In the long term, you may want to consider buying home-based business insurance policies to increase your coverage and protect your business from liabilities, sick employees, interruptions, and customer injuries.